Executive summary:

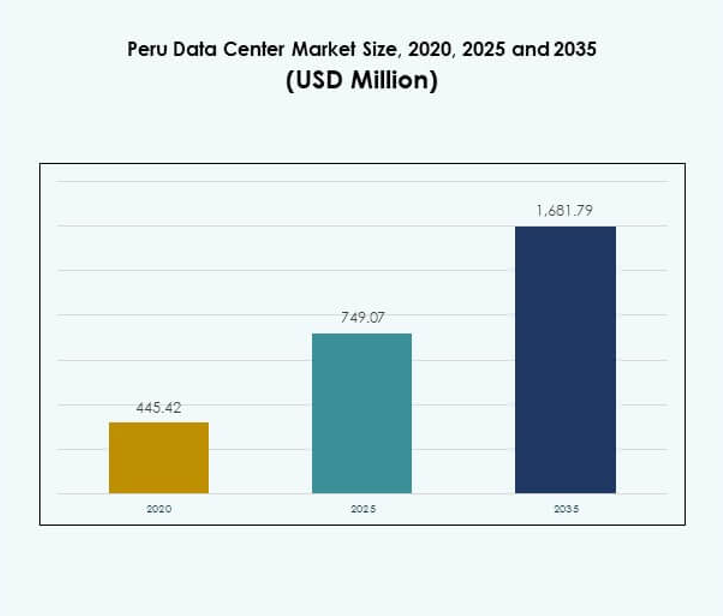

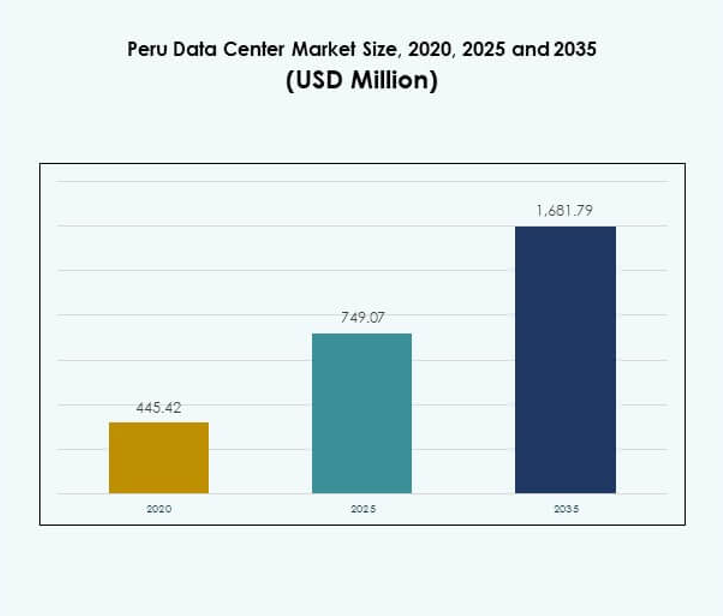

The Peru Data Center Market size was valued at USD 445.42 million in 2020 to USD 749.07 million in 2025 and is anticipated to reach USD 1,681.79 million by 2035, at a CAGR of 8.39% during the forecast period. Strong demand for cloud services, enterprise digital transformation, and regulatory initiatives are shaping the expansion of modern facilities across the country.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Peru Data Center Market Size 2025 |

USD 749.07 Million |

| Peru Data Center Market, CAGR |

8.39% |

| Peru Data Center Market Size 2035 |

USD 1,681.79 Million |

Growth is driven by increased technology adoption, innovation in infrastructure, and a rising shift toward hybrid and edge computing. Enterprises are prioritizing scalability, data security, and compliance, which strengthens the role of local facilities. The Peru Data Center Market supports digital industries such as fintech, healthcare, and e-commerce, offering secure and efficient platforms. It is strategically important for businesses and investors seeking long-term opportunities in Latin America’s evolving digital economy.

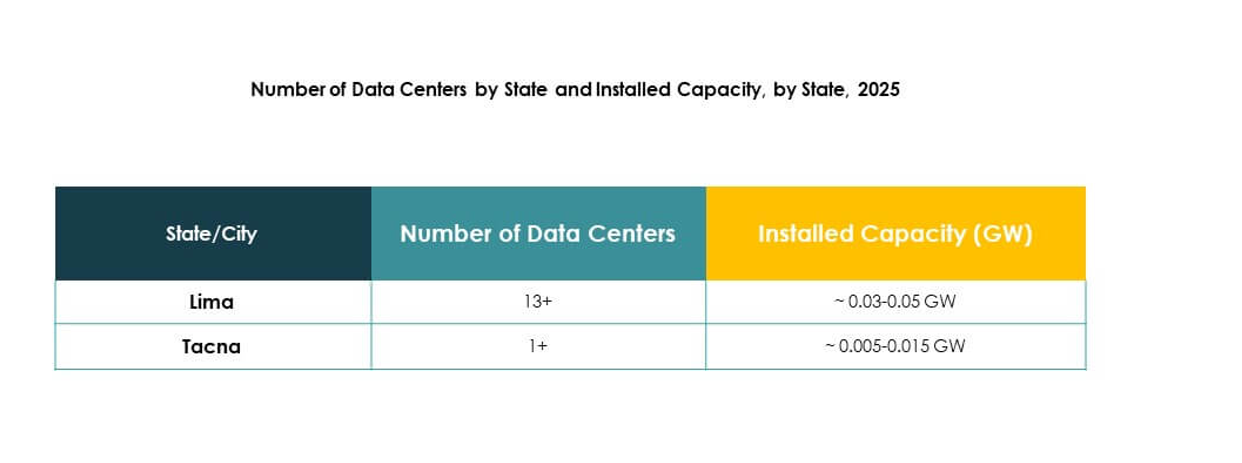

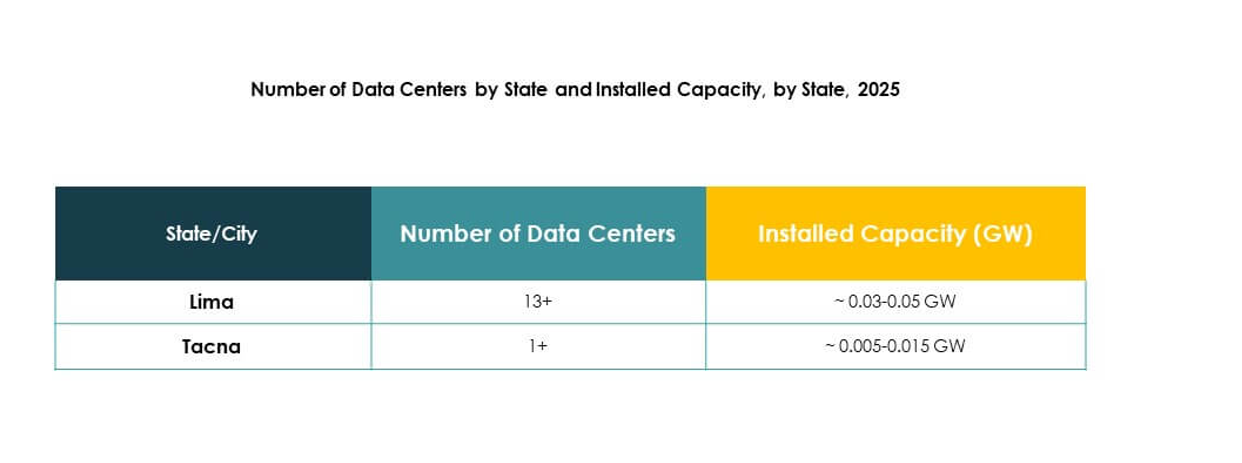

Regionally, Lima and coastal areas lead the market due to high enterprise density and reliable connectivity, serving as the primary hub for international infrastructure. Central Highlands are emerging with growing demand from manufacturing and telecom, supported by modular deployments. Northern and southern regions are gaining relevance, fueled by mining, energy, and education sectors. The Peru Data Center Market reflects a balanced geographic expansion that strengthens national digital resilience.

Market Drivers

Growing Digital Transformation Initiatives Across Key Industries

The Peru Data Center Market is benefiting from rapid digital transformation across finance, healthcare, retail, and public sectors. Enterprises are adopting cloud and hybrid infrastructure to improve efficiency and scalability. Government-backed digital strategies are pushing demand for secure and scalable facilities. Strong internet penetration and higher data consumption are reinforcing adoption. Organizations are focusing on data sovereignty and compliance, which makes local data centers vital. It supports mission-critical applications with enhanced reliability. Investors recognize the market’s growing strategic role in enabling Peru’s digital economy.

- For instance, GTD Perú launched a 20MW Tier III-certified data center in Lurín, near Lima, in October 2024. The $50 million facility certified by Uptime Institute offers 960 cabinets and provides services to major Peruvian enterprises, supporting national initiatives for digital infrastructure.

Rising Adoption of Cloud, AI, and Edge Solutions

The adoption of cloud platforms and artificial intelligence is reshaping enterprise IT strategies. Businesses demand scalable environments that can handle predictive analytics, automation, and AI-driven workloads. Edge and modular data centers are being deployed to meet latency-sensitive applications. It offers enhanced flexibility for industries like telecom, manufacturing, and retail. The Peru Data Center Market is becoming critical for enterprises seeking agility in digital operations. Technology adoption is creating new competitive advantages for local and regional firms. This driver is pushing infrastructure providers to expand service portfolios.

Increased Investments From Global and Regional Players

International colocation and hyperscale providers are entering Peru to meet rising demand. They are deploying capital to develop facilities equipped with advanced power, cooling, and security solutions. It helps bridge the gap between local needs and international standards. Regional enterprises are also upgrading existing infrastructures to match global benchmarks. The Peru Data Center Market is attracting interest due to Peru’s strategic location and strong connectivity routes. Cross-border collaborations are improving technology integration. This investment momentum strengthens business continuity and disaster recovery solutions for enterprises.

- For instance, Claro Peru inaugurated a $50 million Uptime Tier III-certified data center in Lima in December 2023, providing capacity for 104 cabinets and fully renewable energy certification. The facility is part of América Móvil’s global network, expanding international colocation options for enterprise clients in Peru.

Regulatory Support and Data Localization Policies

Government policies supporting data sovereignty and privacy compliance are shaping the industry. Enterprises are aligning strategies with evolving regulatory frameworks. Data localization drives demand for in-country facilities. The Peru Data Center Market is supported by favorable tax policies and regulatory clarity. It gives businesses confidence in investing in local infrastructure. Strategic collaborations between government and private sector enhance digital readiness. This environment supports long-term investments and boosts resilience of national IT infrastructure. Investors see Peru as a stable market for regional digital expansion.

Market Trends

Expansion of Green and Sustainable Data Centers

Sustainability is shaping investment decisions in the Peru Data Center Market. Operators are adopting renewable energy and advanced cooling technologies to reduce carbon footprints. Green certifications are becoming essential to attract multinational clients. It drives demand for energy-efficient systems that reduce operational costs. Enterprises are increasingly prioritizing ESG compliance when choosing service providers. This trend highlights Peru’s alignment with global sustainability commitments. Providers are innovating with modular renewable integration to improve efficiency. These efforts position Peru as a sustainable hub for future digital growth.

Adoption of High-Density and Modular Infrastructure

The shift toward high-density computing drives deployment of modular solutions. Businesses are seeking scalable facilities capable of handling workloads from AI and big data. Modular and micro data centers support edge computing and regional service delivery. It enhances flexibility for industries requiring rapid deployment and localized processing. The Peru Data Center Market is evolving with prefabricated designs to lower deployment time. These solutions help optimize space while maintaining cost efficiency. Providers use modular builds to adapt to varying enterprise demand. This trend strengthens the resilience of Peru’s infrastructure.

Integration of Automation and AI in Data Center Management

Automation tools and AI-driven monitoring are transforming data center operations. Operators implement DCIM and predictive maintenance systems to optimize uptime. AI enables dynamic power and cooling adjustments, improving efficiency. It also helps reduce downtime and operational risks. The Peru Data Center Market is shifting toward intelligent systems that minimize manual oversight. Enterprises benefit from streamlined management of hybrid workloads. Providers invest in automation to enhance competitiveness and customer experience. The trend underscores a clear shift toward intelligent, self-optimizing facilities in Peru.

Growing Adoption of Edge and Hybrid Deployments

Businesses increasingly demand low-latency solutions to support real-time applications. Edge facilities are being deployed closer to end-users to reduce delays. Hybrid models combine on-premises, colocation, and cloud for flexibility. The Peru Data Center Market is responding with solutions that meet varied enterprise needs. It is becoming important for industries like telecom, e-commerce, and financial services. The expansion of 5G further strengthens edge adoption. Enterprises see hybrid infrastructure as critical for digital transformation. This trend shapes Peru’s role in enabling regional data connectivity.

Market Challenges

High Capital Expenditure and Infrastructure Barriers

Building advanced facilities requires significant upfront investment in power, cooling, and security systems. Smaller enterprises face challenges in funding infrastructure upgrades. Limited access to renewable energy sources raises operational costs. The Peru Data Center Market is constrained by high deployment costs, which delay expansion. It creates entry barriers for local firms competing with global providers. Regulatory delays in construction approvals add further complexity. Infrastructure limitations slow adoption of hyperscale models. This financial burden challenges long-term scalability and innovation efforts in the country.

Skilled Workforce Shortages and Cybersecurity Risks

A lack of trained IT and data management professionals poses operational challenges. It impacts the efficiency of running modernized facilities. The Peru Data Center Market faces risks from rising cyberattacks and data breaches. Enterprises demand stronger security frameworks, increasing cost pressures on providers. Limited awareness of cybersecurity standards among SMEs exacerbates the issue. The shortage of skilled technicians delays adoption of automation and AI tools. Providers must invest in talent development and training programs. These workforce and security gaps remain significant barriers to sustainable growth.

Market Opportunities

Emergence of Peru as a Regional Connectivity Hub

The Peru Data Center Market is positioned to become a regional hub due to growing connectivity. Enterprises seek facilities with strong network infrastructure to support cross-border operations. It allows Peru to attract international cloud service providers. Local industries benefit from lower latency and reliable connectivity. Strategic location enhances the role of Peru in regional data flows. Investments in submarine cable projects strengthen this positioning. Providers can capitalize on this opportunity to expand service portfolios. The market offers strong potential for regional growth leadership.

Rising Demand From SMEs and Digital Startups

The growing digital economy in Peru fuels demand for scalable and cost-effective infrastructure. SMEs and startups are embracing cloud and colocation to expand operations. The Peru Data Center Market supports their need for flexibility and affordability. It helps smaller businesses access enterprise-level IT services. Growth in fintech, e-commerce, and digital media industries creates new opportunities. Providers offering modular and hybrid solutions gain a competitive edge. This opportunity aligns with Peru’s digital innovation ecosystem. Rising adoption among SMEs enhances overall market expansion prospects.

Market Segmentation

By Component

Hardware dominates the Peru Data Center Market due to demand for servers, storage, and networking solutions. Power and cooling systems are critical for maintaining uptime and performance. Software segments such as DCIM and automation are growing rapidly. Services like consulting and managed support strengthen overall adoption. Hardware accounts for a leading share because enterprises prioritize performance and reliability. It ensures operational continuity in mission-critical applications. The hardware-led structure supports scaling of large and small facilities. Investments in advanced infrastructure drive its long-term growth potential.

By Data Center Type

Colocation facilities lead the Peru Data Center Market due to enterprise demand for scalability and cost efficiency. Hyperscale projects are expanding with international providers entering the region. Edge and modular data centers are gaining adoption for real-time applications. Enterprise-owned facilities remain relevant for sensitive data operations. Cloud and internet data centers are strengthening their role with rising digital services. Mega data centers are at early stages but gaining interest from global investors. It shows diverse adoption across multiple types. Colocation remains the most influential driver of demand.

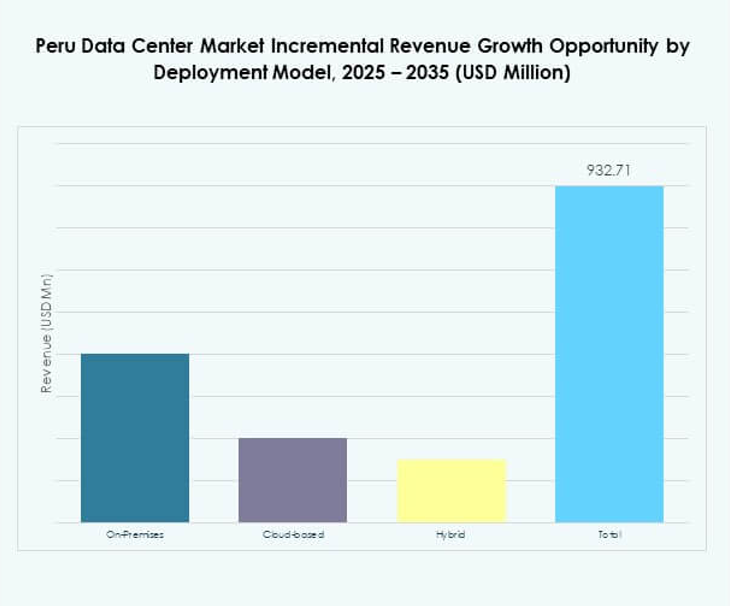

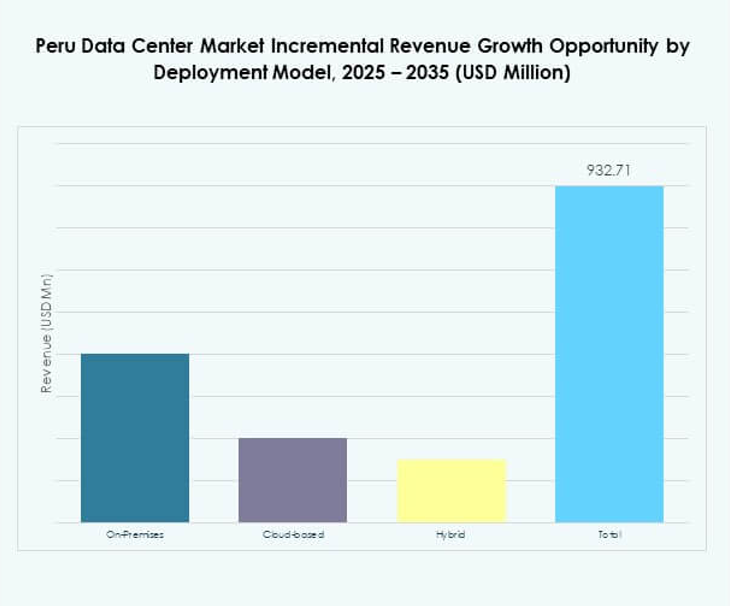

By Deployment Model

Hybrid deployment dominates the Peru Data Center Market as enterprises seek flexibility between cloud and on-premises models. Cloud-based models are expanding with rapid SaaS adoption. On-premises infrastructure remains critical for industries with high regulatory demands. Hybrid approaches offer optimized workloads for enterprises managing complex applications. It enables companies to balance security with cost-efficiency. Demand for hybrid is driven by the need for scalability and control. This model has become the preferred choice for large and mid-sized firms. Its adoption reinforces infrastructure resilience across Peru.

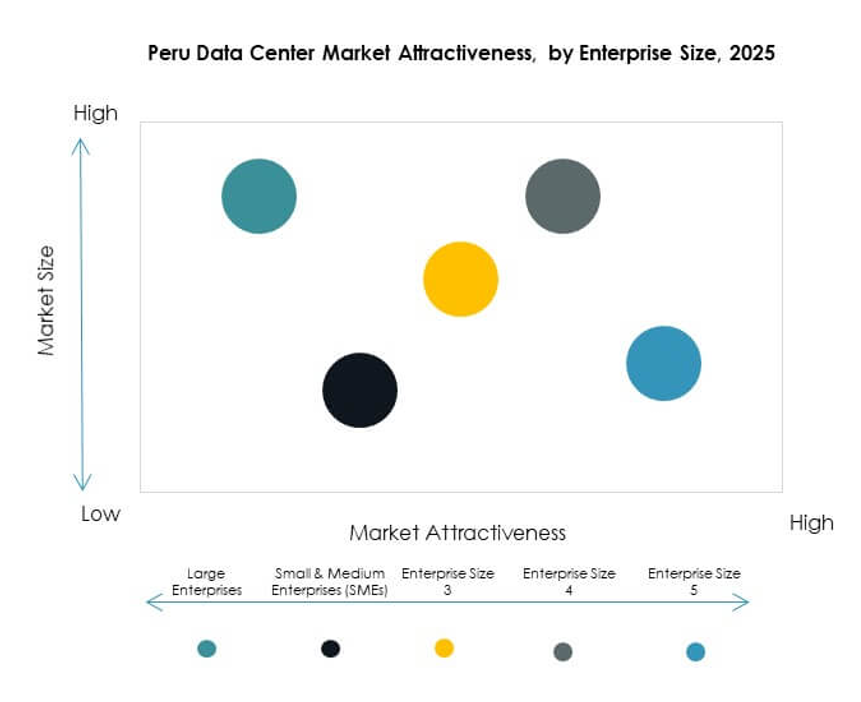

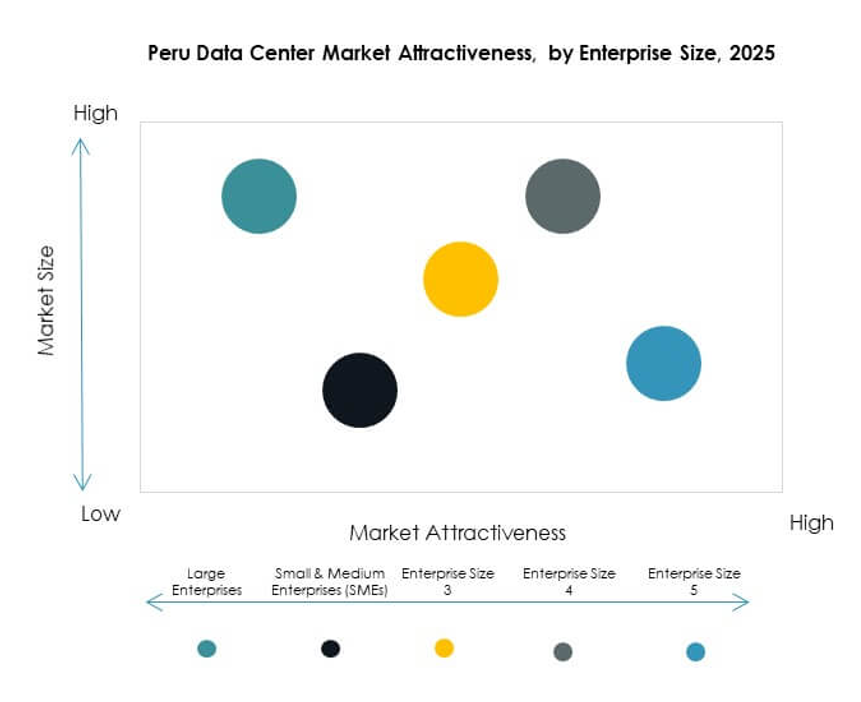

By Enterprise Size

Large enterprises dominate the Peru Data Center Market with their capacity to invest in advanced solutions. They demand high-performance colocation and hybrid models for complex IT operations. SMEs are emerging contributors with growing adoption of cloud-based services. It allows smaller players to compete with digital-native strategies. Large firms account for a leading share due to scale of digital operations. Their adoption drives service expansion for providers. SMEs represent a growing segment offering untapped potential. Providers are tailoring cost-efficient solutions for this emerging customer base.

By Application / Use Case

IT and telecom applications hold the largest share in the Peru Data Center Market. Rising demand for connectivity, 5G networks, and data services drive this dominance. BFSI and government sectors follow closely with secure infrastructure requirements. Healthcare and retail are expanding their adoption through digital transformation. Media and entertainment benefit from rising streaming and digital content. Manufacturing is exploring industrial IoT integration. Other industries like education and energy are contributing steadily. IT and telecom remain the core demand driver for ongoing expansion.

By End User Industry

Cloud service providers lead the Peru Data Center Market as global and regional firms expand. Enterprises follow with demand for hybrid and colocation facilities. Colocation providers maintain a strong footprint with scalable solutions. Government agencies drive growth through national digitalization projects. It reflects diverse adoption across industries and public sector initiatives. Cloud players benefit from demand for SaaS, PaaS, and IaaS services. Enterprises sustain consistent growth with tailored solutions. This dynamic mix highlights the market’s broad customer base and multi-industry reliance.

Regional Insights

Dominance of Lima and Coastal Regions

Lima and nearby coastal regions lead the Peru Data Center Market with a 46% share. The concentration of enterprises, government offices, and strong connectivity fuels this dominance. It supports large-scale colocation and cloud facilities. Lima acts as the primary hub for international connectivity through submarine cables. Investors prioritize this region due to infrastructure readiness and customer density. It creates a strategic advantage for providers expanding services. Coastal dominance highlights the importance of concentrated urban demand in shaping Peru’s market.

- For instance, in August 2024, Win Empresas announced the construction of its sixth data center in La Molina, near Lima, with capacity for over 600 cabinets and an initial investment of $12 million, supporting advanced infrastructure for enterprise clients.

Emergence of Central Highlands

The Central Highlands contribute 29% of the Peru Data Center Market, showing strong potential for growth. Increasing digital penetration and enterprise expansion in secondary cities fuel adoption. It is driven by local manufacturing, retail, and telecom industries seeking secure infrastructure. Providers invest in modular and edge facilities to meet regional demand. The highlands are becoming an attractive alternative to reduce reliance on Lima. Growth opportunities are strong in mid-tier cities with rising digital economies. This reflects the growing geographic diversity in Peru’s market.

- For instance, Telefónica del Perú kicked off inland region upgrades in January 2025, starting in Trujillo and scheduled for rollout in other cities including Huancayo, indicating its plan to renew over 5,000 base stations with state-of-the-art Massive MIMO technology to support enhanced data capacity.

Developing Presence in Southern and Northern Regions

Southern and northern regions account for 25% of the Peru Data Center Market. Industrial growth and government initiatives to expand digital coverage drive adoption. It is supported by mining, energy, and education sectors demanding localized infrastructure. Edge and micro data centers are increasingly relevant here. Providers see these regions as future growth corridors. The focus is on extending connectivity to underserved areas. Regional balance enhances Peru’s digital resilience and ensures equitable infrastructure development across the country.

Competitive Insights:

- Claro Peru

- Alestra Peru

- Movistar Peru

- Entel Peru

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Peru Data Center Market features strong competition between domestic telecom operators and global hyperscale providers. Claro Peru, Movistar Peru, Entel Peru, and Alestra Peru dominate local infrastructure and connectivity services, while Digital Realty and NTT strengthen international colocation and facility standards. Global leaders such as Microsoft, AWS, and Google drive adoption of cloud and hybrid models, offering advanced services that elevate market expectations. It demonstrates a balance between regional incumbents ensuring network reliability and multinational corporations introducing cutting-edge technologies. Competitive strategies focus on expanding data center capacity, integrating renewable energy, and offering managed services. This landscape positions Peru as a rising hub for digital infrastructure in Latin America, with investments aligning with enterprise cloud migration, fintech growth, and government-led digitalization efforts.

Recent Developments:

- In March 2023, Actis, a UK-based private equity company, acquired 11 data center assets from Nabiax for $500 million. Among these, two data centers are located in Peru, contributing significantly to the country’s expanding digital infrastructure landscape.