Executive summary:

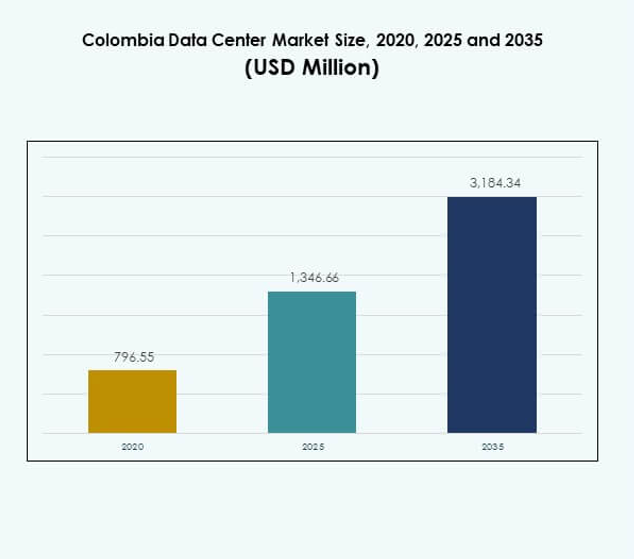

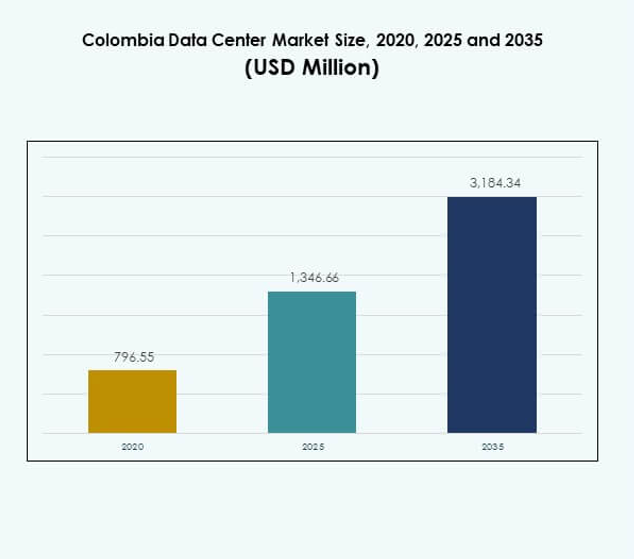

The Colombia Data Center Market size was valued at USD 796.55 million in 2020 to USD 1,346.66 million in 2025 and is anticipated to reach USD 3,184.34 million by 2035, at a CAGR of 8.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Colombia Data Center Market Size 2025 |

USD 1,346.66 Million |

| Colombia Data Center Market, CAGR |

8.95% |

| Colombia Data Center Market Size 2035 |

USD 3,184.34 Million |

Growth is driven by rising cloud adoption, AI integration, and automation shaping operational models. Enterprises focus on scalable, energy-efficient infrastructure to support digital transformation across industries. The market reflects strong innovation, with hybrid and edge solutions gaining traction. Its strategic importance lies in enabling business continuity, security, and global competitiveness, making it attractive for both investors and multinational corporations.

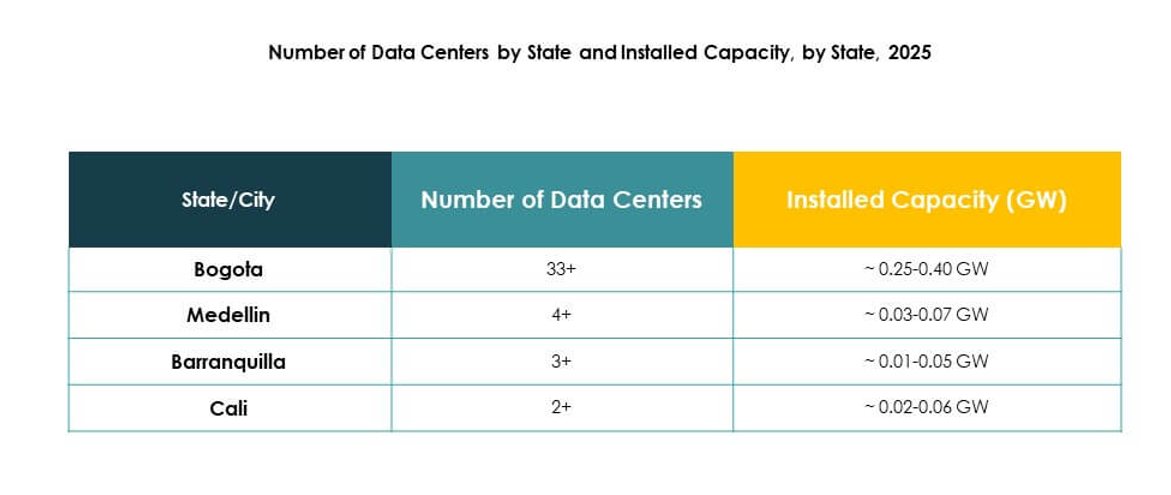

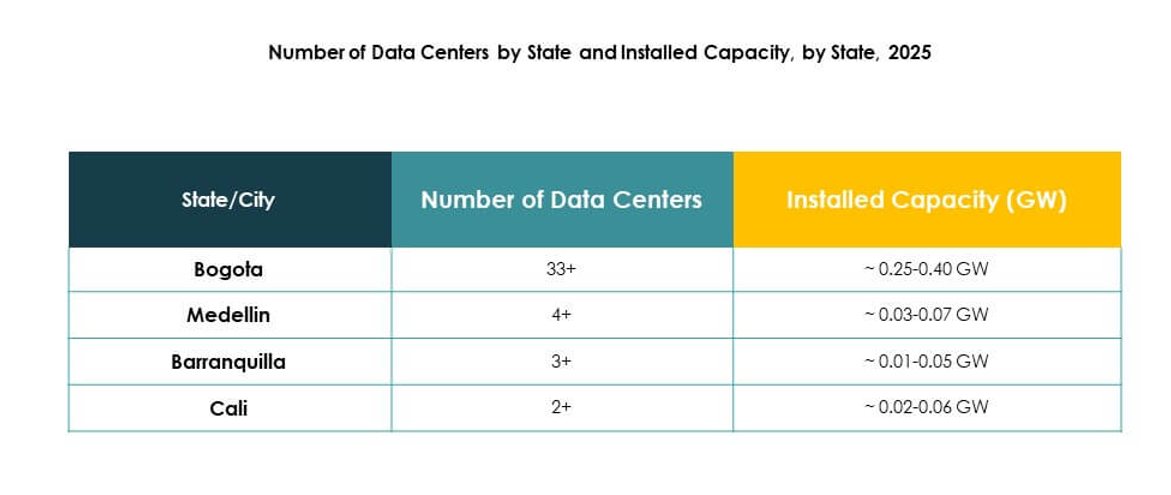

Regionally, Central Colombia leads with its strong connectivity and concentration of infrastructure in Bogotá, making it the digital hub. Northern regions are emerging due to submarine cable access, boosting international connectivity. Southern and western areas record steady adoption through edge deployments and government-led modernization projects. This regional balance enhances resilience and ensures broader digital inclusion nationwide.

Market Drivers

Rising Digital Transformation and Cloud Computing Acceleration

The Colombia Data Center Market benefits from strong digital transformation across financial services, telecom, and retail. Businesses demand cloud-first strategies, driving large-scale infrastructure expansion. Enterprises prioritize agility and operational efficiency, which creates continuous investments in next-generation data centers. Adoption of SaaS and hybrid solutions enhances the role of colocation providers. Technology vendors focus on building secure and flexible models for long-term use. Growing cloud reliance establishes strategic opportunities for both global hyperscale operators and regional firms. Investors recognize it as a sector with resilience and scalability. This environment fuels consistent revenue growth and infrastructure upgrades.

Growing Role of Artificial Intelligence and Automation in Operations

Artificial intelligence and automation influence operational strategies in the Colombia Data Center Market. AI-driven systems optimize cooling, energy management, and predictive maintenance. Automation reduces operational risks while ensuring faster deployment of IT resources. Enterprises rely on advanced algorithms to reduce downtime and strengthen business continuity. Automation tools also improve resource utilization and overall cost efficiency. Service providers position themselves with strong automation capabilities to attract multinational corporations. Businesses view automation as critical to maintaining performance under higher workloads. It strengthens competitiveness and ensures readiness for future workloads. Investors support expansion projects that embed automation at scale.

- For instance, EdgeConneX is developing a purpose-built Tier 3 designed data center in Bogotá, with a planned 28 megawatt (MW) capacity, including 9.6MW of core and shell ready-for-service in Q3 2025, and this facility will enable advanced automation, interconnection, and multi-cloud integration for Colombian enterprises.

Increasing Demand for Edge Data Centers and Emerging Hybrid Models

Edge data centers are gaining traction in the Colombia Data Center Market, enabling faster data processing closer to end users. They support low-latency applications across e-commerce, healthcare, and smart city projects. Hybrid models gain popularity, balancing cost efficiency with scalability. Enterprises choose a combination of on-premises and cloud-based deployments to optimize flexibility. Colocation providers integrate edge solutions into service portfolios to meet regional demand. This adoption strengthens digital ecosystems and supports real-time workloads. Enterprises value hybrid approaches for balancing security, compliance, and innovation. Investors view it as a vital evolution in the national infrastructure landscape.

- For instance, AWS announced the launch of a Local Zone in Bogotá, expanding cloud infrastructure closer to end users and enabling Colombian companies to run latency-sensitive applications with improved performance.

Expansion of Strategic Investments and Partnerships Across Industries

Strategic investments from cloud giants and telecom operators shape the Colombia Data Center Market. Partnerships accelerate infrastructure rollouts in urban hubs and regional clusters. Global firms collaborate with local companies to improve connectivity and network resilience. Investment in submarine cables and fiber links further strengthens cross-border data flows. Enterprises seek providers offering multi-location redundancy and disaster recovery. Partnerships provide a pathway for small operators to access advanced technology and expertise. These alliances build investor confidence and encourage further capital inflows. It creates a sustainable foundation for Colombia’s long-term role in the Latin American digital economy.

Market Trends

Sustainable Infrastructure and Green Energy Deployment in Data Centers

Sustainability defines the Colombia Data Center Market, with operators adopting renewable energy and energy-efficient cooling. Providers focus on reducing carbon footprints through solar and wind integration. Companies deploy liquid cooling and AI-based systems to lower power usage effectiveness (PUE). Green certifications such as LEED become benchmarks for global clients. Enterprises prefer facilities committed to sustainability when outsourcing workloads. Government policies supporting renewable adoption accelerate green infrastructure. It drives stronger alignment between business priorities and environmental responsibility. This trend sets the foundation for long-term competitiveness in the region.

Adoption of High-Density Racks and Modular Design Approaches

High-density racks gain adoption in the Colombia Data Center Market, supporting applications like AI, IoT, and analytics. Modular data centers rise as a preferred solution due to speed and flexibility. Enterprises select modular builds for faster deployment in urban areas. Colocation providers expand modular facilities to serve cloud service providers. High-density environments require specialized power and cooling infrastructure. Providers invest in advanced rack designs to manage higher workloads. It supports innovation while maintaining operational efficiency. This trend creates new revenue channels for infrastructure vendors and service operators.

Expansion of Submarine Cable Connectivity and Regional Network Integration

Submarine cables strengthen connectivity in the Colombia Data Center Market, linking global hubs with regional nodes. New routes increase bandwidth capacity and reduce latency across Latin America. Enterprises leverage improved connectivity for multinational operations. Cloud providers view Colombia as a strong gateway to expand services regionally. Telecom firms invest in fiber backbones to support growing digital demand. Better integration enhances resilience and disaster recovery capabilities. It positions Colombia as a competitive market within Latin America’s data infrastructure ecosystem. These investments transform the nation into a strategic connectivity hub.

Adoption of Advanced Security and Compliance-Oriented Infrastructure

Cybersecurity gains critical importance in the Colombia Data Center Market as businesses face evolving threats. Providers embed advanced firewalls, intrusion detection, and encryption protocols. Compliance with global standards like ISO 27001 builds client trust. Enterprises prioritize service providers that guarantee data protection and regulatory adherence. Banks, healthcare, and government agencies demand strong compliance measures. Investments in physical and digital security systems remain consistent. It builds confidence among multinational firms deploying workloads in Colombia. Security becomes a defining differentiator in competitive service offerings.

Market Challenges

Energy Supply Constraints and High Infrastructure Costs

The Colombia Data Center Market faces challenges from limited energy supply and rising electricity costs. Reliable power delivery remains critical for continuous operations, yet local grids face strain. Operators spend heavily on backup systems, impacting profitability. Cooling infrastructure adds further capital and operational expense. These costs reduce competitiveness against larger regional hubs. Smaller firms struggle to balance energy efficiency with affordability. It affects expansion timelines and overall service pricing. Sustaining long-term investments requires coordinated efforts between industry and government.

Regulatory Complexities and Shortage of Specialized Workforce

The Colombia Data Center Market experiences challenges related to regulatory compliance and workforce availability. Complex licensing and data localization rules increase project timelines. Investors face barriers in navigating tax and import duties. A shortage of skilled engineers and IT professionals creates operational risks. Companies invest in training programs but talent gaps remain significant. This limits the pace of technology deployment and advanced service adoption. It also slows expansion plans for hyperscale providers. Industry growth depends on effective regulatory frameworks and talent development strategies.

Market Opportunities

Expansion Through Cloud-Driven Services and Digital Ecosystem Development

The Colombia Data Center Market creates opportunities by expanding cloud-driven services across industries. Enterprises accelerate migration to cloud platforms for agility and scalability. Digital ecosystems grow as e-commerce, fintech, and healthcare demand stronger infrastructure. Providers capture opportunities through managed services and edge solutions. Cloud adoption supports long-term resilience and competitive growth. It also enables investors to support projects aligned with high-value applications. Partnerships between global and local providers expand access to advanced capabilities. This dynamic fuels broader opportunities for service diversification.

Innovation Through AI Integration and Renewable Infrastructure Adoption

The Colombia Data Center Market gains opportunities from innovation in AI integration and renewable infrastructure. AI-powered data centers enable predictive maintenance and resource optimization. Renewable energy adoption reduces operational costs while enhancing sustainability profiles. These advancements attract multinational firms seeking eco-friendly and innovative solutions. Providers investing in smart infrastructure position themselves as regional leaders. It ensures stronger market penetration and customer loyalty. These opportunities reinforce Colombia’s relevance in the evolving digital economy. Investors recognize significant value in such sustainable and technology-focused projects.

Market Segmentation

By Component

Hardware dominates the Colombia Data Center Market due to demand for servers, networking, and cooling. Enterprises rely on advanced storage and racks for scalable workloads. Software adoption grows with DCIM and orchestration tools ensuring efficiency. Services gain traction with consulting and managed services supporting transformation. Hardware remains the largest contributor to market revenues, driven by data growth. Enterprises prioritize secure and high-performing infrastructure. It makes hardware investment central for providers seeking reliable long-term contracts.

By Data Center Type

Hyperscale data centers lead the Colombia Data Center Market with large investments from global cloud firms. Colocation centers follow with strong adoption among enterprises seeking cost efficiency. Edge and modular centers record rising demand for latency-sensitive applications. Enterprise data centers retain relevance in regulated industries. Mega data centers strengthen international connectivity and service redundancy. Cloud internet data centers expand with SaaS and PaaS growth. It drives further adoption across industries with scalable solutions.

By Deployment Model

Cloud-based deployment leads the Colombia Data Center Market, reflecting digital-first strategies. Enterprises adopt hybrid models for flexibility and risk management. On-premises retains value in government and sensitive sectors. Cloud dominance is fueled by SaaS, IaaS, and PaaS adoption. Hybrid integration grows with enterprises balancing workloads. SMEs rely on cloud for scalability while large firms combine models. It creates diverse growth paths for providers across sectors.

By Enterprise Size

Large enterprises dominate the Colombia Data Center Market through higher budgets and complex needs. SMEs adopt cloud and colocation for scalability and cost management. Demand from SMEs accelerates digital transformation in retail, fintech, and healthcare. Large enterprises maintain strong focus on resilience and compliance. SMEs adopt edge solutions for agility. This dual adoption strengthens the ecosystem across enterprise sizes. It ensures sustainable demand across providers.

By Application / Use Case

BFSI dominates the Colombia Data Center Market due to compliance, security, and transaction volumes. IT and telecom represent strong demand through cloud and network services. Healthcare grows with digital records and telemedicine. Retail and e-commerce accelerate demand for scalable platforms. Media and entertainment adopt infrastructure for streaming growth. Manufacturing requires reliable systems for automation and analytics. Government and defense emphasize compliance and secure platforms. Education and utilities add to steady growth.

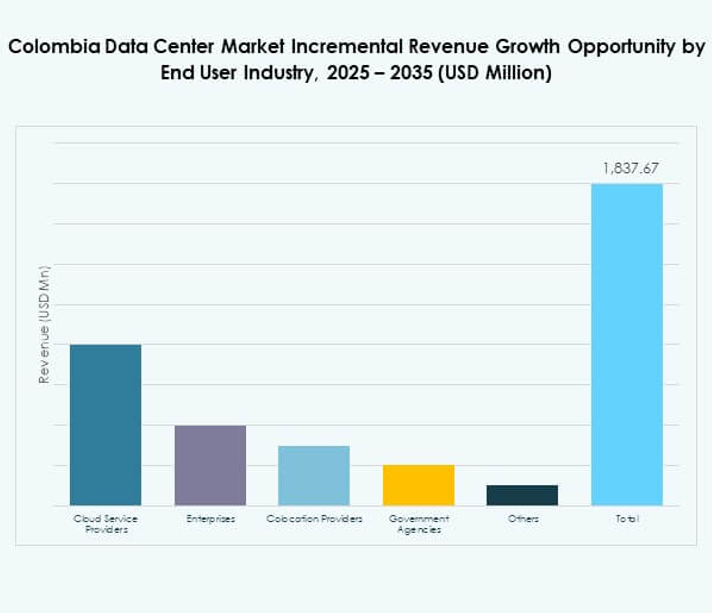

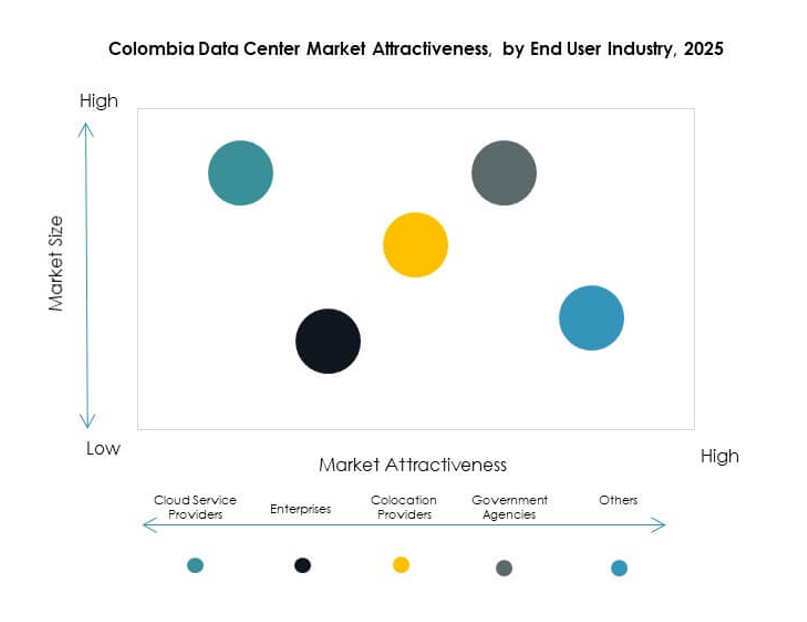

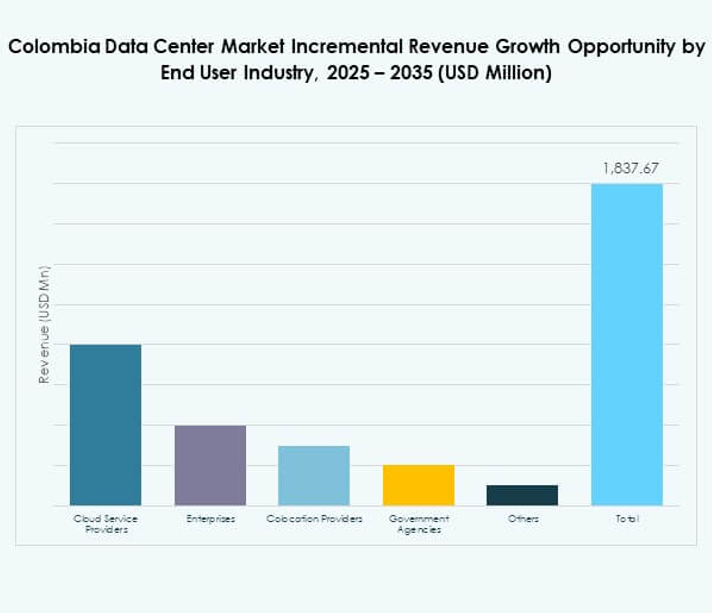

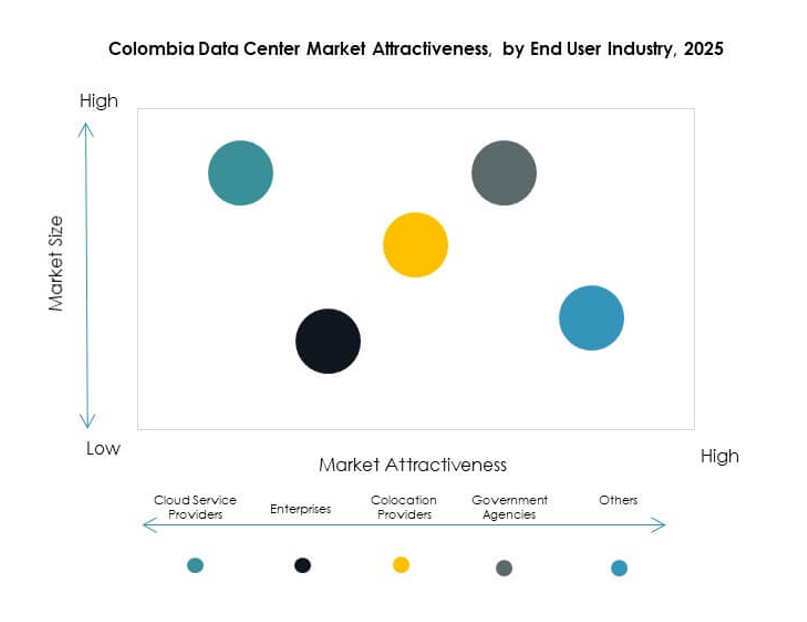

By End User Industry

Cloud service providers lead the Colombia Data Center Market, fueling hyperscale investments. Enterprises remain strong contributors with hybrid and colocation demand. Colocation providers grow with SMEs outsourcing infrastructure. Government agencies demand secure, localized storage. Other industries like utilities and education also strengthen adoption. Cloud firms remain the dominant force in shaping infrastructure strategy. It establishes long-term dominance across the ecosystem.

Regional Insights

Dominance of Central Colombia with Bogotá as the Core Hub

Central Colombia leads the Colombia Data Center Market with 52% share, centered in Bogotá. The region benefits from robust connectivity and access to skilled workforce. Cloud providers and enterprises select Bogotá for scalability and security. Infrastructure investment flows into the city due to its established ecosystem. Colocation and hyperscale deployments dominate expansion. It sets the standard for service delivery in the country. This dominance makes Bogotá the digital core of Colombia’s economy.

- For instance, the Equinix BG1 Bogotá Data Center provides 21,570 square feet of raised floor colocation space and is certified for ISO 27001, PCI DSS, SOC 1 Type 2, and SOC 2 Type 2 compliance, ranking #1 in Colombia’s market according to Equinix’s official data center listing.

Emerging Growth in Northern Colombia with Strategic Coastal Advantage

Northern Colombia holds 28% share in the Colombia Data Center Market, supported by coastal cities. Access to submarine cables strengthens international connectivity. Enterprises benefit from lower latency in global data flows. The region gains attention from colocation providers targeting multinational clients. Growth is supported by e-commerce and logistics industries. It positions northern cities as emerging alternatives for hyperscale deployments. The coastal advantage creates sustained relevance for future expansion.

- For instance, in July 2025, InterNexa announced an investment of more than 8 billion Colombian pesos for the deployment of 25 new connectivity nodes in over 20 strategic municipalities including coastal northern sites with connectivity reaching up to 100 Gbps per location and a 900% increase in installed capacity compared to earlier years, as officially confirmed by InterNexa.

Southern and Western Colombia Strengthening Niche Growth Areas

Southern and western Colombia account for 20% share in the Colombia Data Center Market. The regions attract healthcare, education, and government-focused deployments. Providers expand smaller facilities to address localized demand. These regions prioritize edge infrastructure to support rural digitalization. Growth opportunities remain steady through regional modernization programs. It adds diversification beyond major hubs. The distribution of investments supports nationwide infrastructure balance.

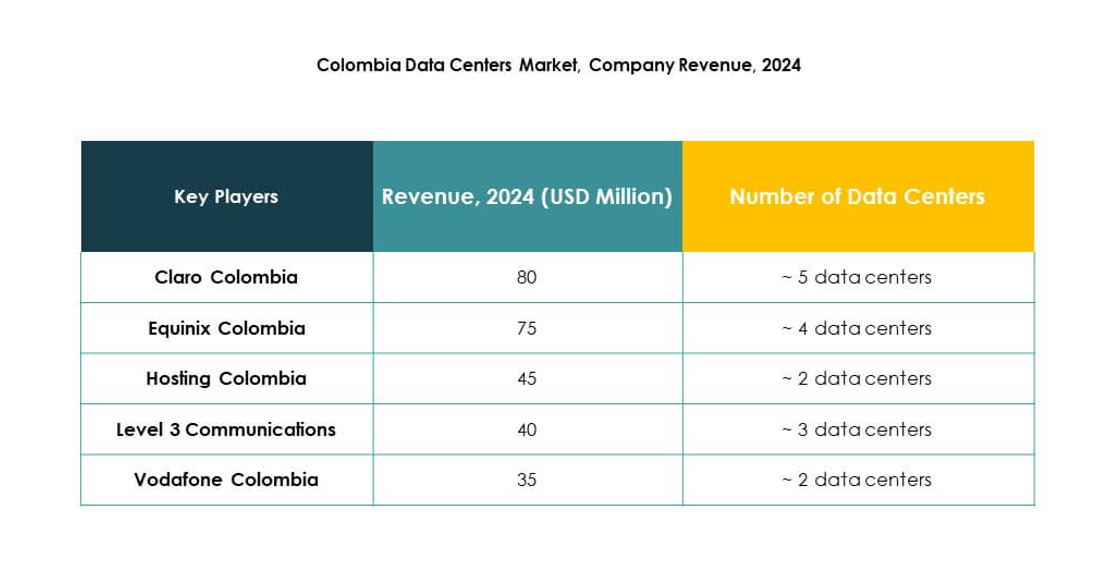

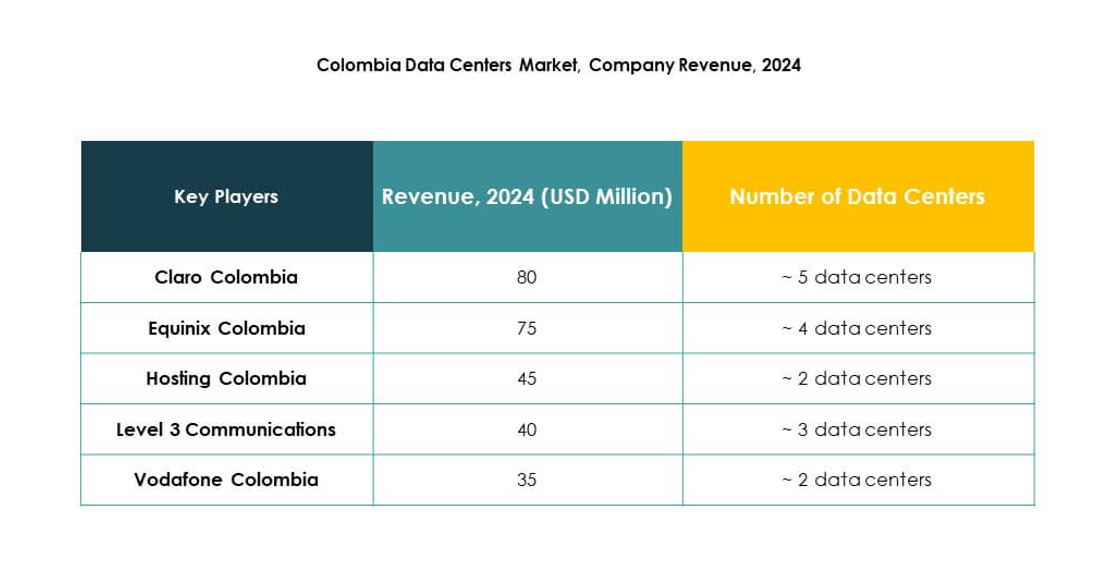

Competitive Insights:

- Claro Colombia

- Equinix Colombia

- Hosting Colombia

- Vodafone Colombia

- Level 3 Communications

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Colombia Data Center Market features a mix of global hyperscale players, regional telecom operators, and specialized colocation providers. Global leaders like AWS, Microsoft, and Google expand through large-scale investments, strengthening cloud adoption and enterprise solutions. Telecom operators such as Claro and Vodafone integrate connectivity with data center services, securing local dominance. Equinix and Digital Realty drive colocation and interconnection growth, supported by advanced global platforms. NTT and Level 3 enhance international connectivity, while Hosting Colombia caters to regional enterprises with tailored solutions. It demonstrates increasing competition, with players focusing on hybrid offerings, energy efficiency, and security-driven infrastructure. Strategic alliances, technology innovation, and infrastructure scalability remain critical differentiators shaping long-term positioning.

Recent Developments:

- In August 2025, the Colombian Association of Data Centers (ACOLDC) was established through a partnership aimed at boosting the nation’s technological innovation, with Vertiv joining as a key technical partner to provide training and support for mission-critical infrastructure, beginning in September 2025.

- In October 2024, ODATA (Aligned Data Centers) announced a significant expansion plan in Colombia, committing USD 1.3 billion for the construction of two new data centers BG02 and BG03 in Bogotá. The first phases of these advanced facilities are expected to be completed by the end of 2026, expanding the company’s footprint and reinforcing Bogotá’s role as the core hub for data center infrastructure in the country.