Executive summary:

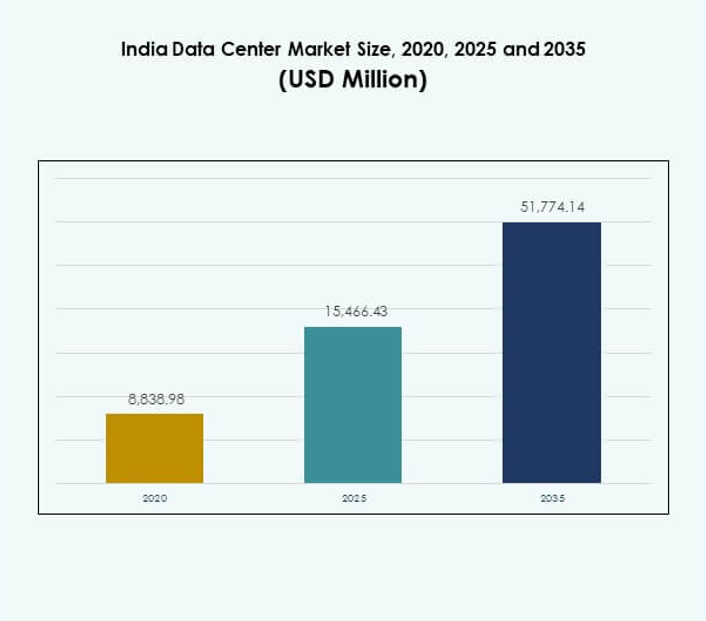

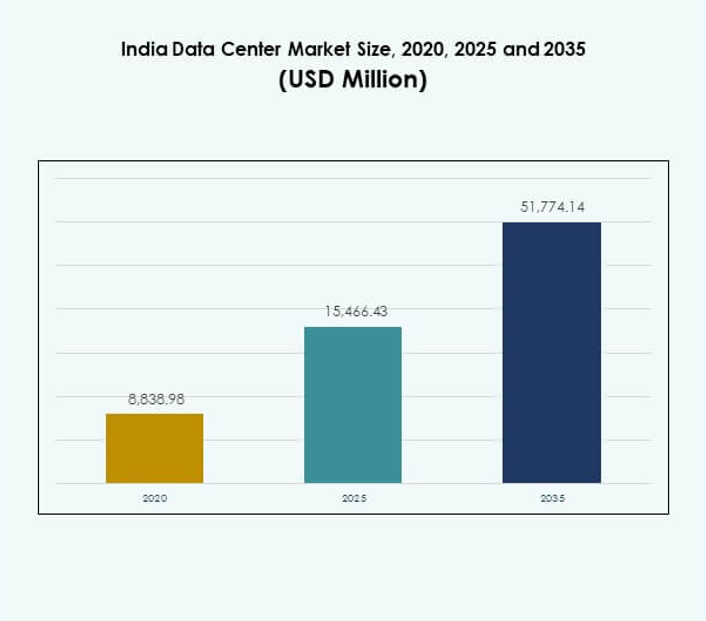

The India Data Center Market size was valued at USD 8,838.98 million in 2020 to USD 15,466.43 million in 2025 and is anticipated to reach USD 51,774.14 million by 2035, at a CAGR of 12.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| India Data Center Market Size 2025 |

USD 15,466.43 Million |

| India Data Center Market, CAGR |

12.81% |

| India Data Center Market Size 2035 |

USD 51,774.14 Million |

Market growth is driven by expanding cloud adoption, strong demand for AI and IoT applications, and increasing reliance on hybrid infrastructure models. Enterprises focus on scalability, automation, and compliance to enhance efficiency. It strengthens India’s position as a key hub for digital transformation. For businesses and investors, the market offers significant opportunities supported by policy-driven initiatives, technological innovation, and enterprise adoption of data-driven models.

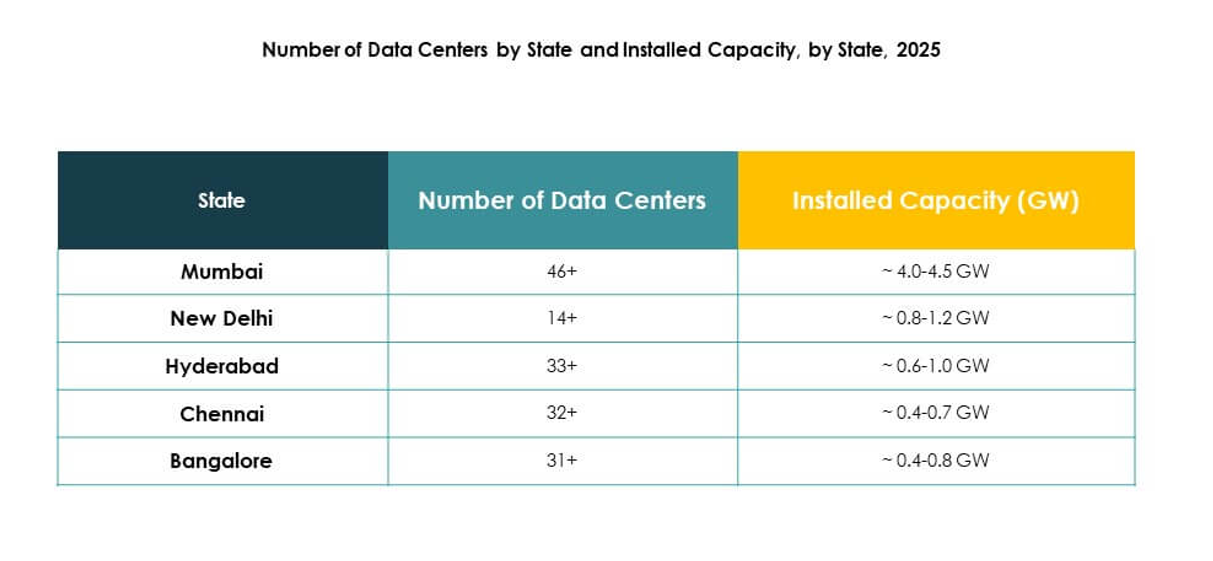

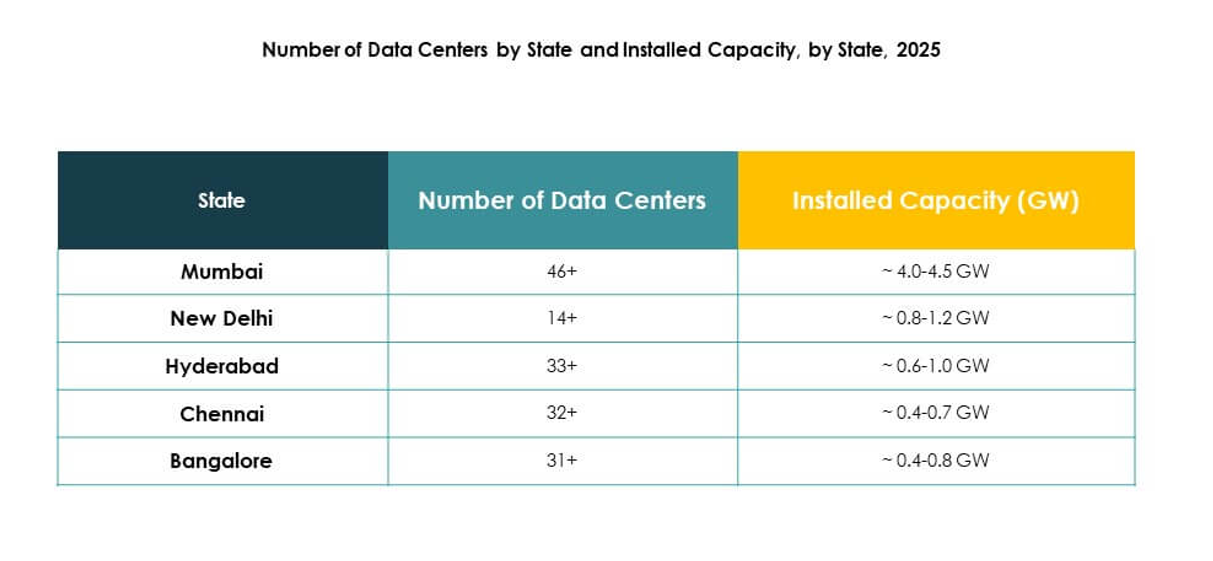

Western India leads the market with strong hubs like Mumbai and Pune, supported by subsea cable connectivity and financial sector demand. Southern cities such as Chennai, Hyderabad, and Bengaluru are emerging as major growth centers due to IT clusters and startup ecosystems. Northern and Eastern regions also show rising potential with government projects and enterprise adoption. This geographic spread ensures a balanced and resilient market expansion.

Market Drivers

Growing Demand for Cloud Adoption and Digital Transformation Across Industries

The India Data Center Market is expanding due to rapid cloud adoption and digital transformation across diverse sectors. Businesses migrate workloads to scalable cloud platforms to improve operational agility and cost efficiency. Demand for data localization policies also drives investments in new facilities. Enterprises rely on advanced computing models to support real-time analytics and artificial intelligence. It supports business continuity by ensuring secure data storage and seamless access. Investors identify strong returns in building hyperscale and colocation facilities. The sector attracts global technology players to strengthen digital infrastructure. This driver reinforces India’s role as a digital-first economy.

- For instance, in November 2022, Amazon Web Services (AWS) launched the Asia Pacific (Hyderabad) Region in India, featuring three Availability Zones designed to deliver low-latency, high-availability workloads for enterprises, as confirmed in official AWS and government releases.

Rising Integration of IoT, 5G, and Artificial Intelligence in Core Infrastructure

IoT devices, 5G rollout, and AI integration contribute significantly to infrastructure growth. Businesses adopt data-heavy applications requiring robust storage and faster processing. It accelerates demand for advanced networking and high-density server racks. Telecom operators invest heavily in new facilities to manage growing mobile data traffic. Enterprises leverage AI-driven automation for predictive analytics, enhancing efficiency. The India Data Center Market benefits from cross-sector innovation, making it a strategic growth hub. It ensures enterprises gain scalability for advanced services. This momentum pushes demand for resilient and future-ready facilities.

Expansion of E-Governance Programs and Public Sector Digital Initiatives

Government initiatives enhance digital infrastructure by supporting e-governance, smart cities, and public service digitization. Public agencies push investments in secure, compliant, and efficient facilities to handle sensitive data. It builds resilience in areas such as defense, healthcare, and finance. Digital India programs accelerate adoption of cloud platforms across state institutions. The India Data Center Market benefits from favorable regulations for data localization and security. Enterprises partner with government-backed projects to ensure compliance and capacity expansion. The sector strengthens investor confidence through regulatory clarity. This creates long-term opportunities for infrastructure modernization.

- For instance, the National Informatics Centre (NIC) operates National Data Centres in Delhi, Pune, Bhubaneswar, and Hyderabad, with nearly 100 petabytes of storage capacity and around 5,000 servers dedicated to government cloud applications, as confirmed in official NIC and government infrastructure releases.

Increased Enterprise Investments in Hybrid and Multi-Cloud Architectures

Hybrid and multi-cloud deployments are gaining traction across enterprises seeking flexibility and resilience. Businesses diversify workloads across public and private platforms for efficiency. It reduces risks related to downtime while optimizing costs. Enterprises adopt virtualization and orchestration software to enhance IT performance. The India Data Center Market gains from rising demand for hybrid infrastructure among financial services and IT firms. Enterprises focus on cloud-native applications that require robust back-end infrastructure. Investors view this driver as a path to scalable returns. Hybrid architectures strengthen India’s position in the global digital economy.

Market Trends

Rapid Growth of Renewable-Powered Data Centers and Green Energy Adoption

The India Data Center Market is witnessing a strong shift toward renewable-powered operations. Operators deploy solar, wind, and hybrid solutions to reduce operational costs and align with ESG goals. It enables global companies to meet sustainability commitments. Colocation providers advertise green credentials to attract environmentally conscious clients. Energy efficiency measures, such as liquid cooling and heat reuse, gain importance. Regulatory focus on emissions strengthens this trend. The industry positions itself as a low-carbon hub. Sustainable operations secure investor confidence in long-term profitability.

Rising Demand for Edge Data Centers to Support Real-Time Applications

Edge data centers emerge as a key trend with demand for low-latency applications. It supports industries like autonomous mobility, manufacturing automation, and remote healthcare. Enterprises prefer edge infrastructure to minimize downtime and ensure real-time decision-making. Telecom companies expand modular facilities near urban clusters. The India Data Center Market benefits from a growing 5G rollout that complements edge adoption. Regional players invest in micro data centers for localized services. Edge growth accelerates innovation in smart cities. This trend ensures rapid scalability for advanced technologies.

Adoption of Advanced Cooling Technologies to Manage High-Density Infrastructure

Cooling solutions are transforming as facilities host high-density racks and power-intensive applications. Operators deploy liquid cooling, immersion cooling, and AI-driven optimization to control energy use. It reduces costs and supports long-term sustainability goals. Colocation facilities adopt modular cooling to ensure flexible deployment. The India Data Center Market gains strength as technology suppliers bring localized innovations. Enterprises prioritize efficient cooling systems to handle AI and big data workloads. Advanced cooling technologies improve system uptime. This trend strengthens operational reliability in competitive environments.

Increased Focus on Cybersecurity and Regulatory Compliance in Operations

Rising digital threats push demand for advanced cybersecurity systems in facilities. Enterprises prioritize compliance with GDPR, India’s data localization rules, and global frameworks. It enhances trust among international clients managing critical workloads. Operators invest in AI-based monitoring and multi-layered firewalls. The India Data Center Market attracts multinational firms due to compliance-ready infrastructure. Cloud providers establish SOCs and disaster recovery capabilities for resilience. Cybersecurity maturity becomes a competitive differentiator. This trend enhances investor confidence and enterprise adoption.

Market Challenges

High Capital Investment Requirements and Rising Energy Costs in Infrastructure Expansion

Building and maintaining advanced data centers requires heavy upfront capital and continuous operational costs. Investors face challenges in balancing high investment with long-term profitability. It becomes more complex due to rising electricity tariffs and dependence on stable energy supply. The India Data Center Market faces difficulties in managing margins for operators competing on cost. Smaller players struggle to expand without external funding. Long lead times for return on investment also slow expansion plans. Energy availability and costs impact scalability. These factors create barriers for new entrants.

Regulatory Complexity and Land Acquisition Issues Across Key Urban Hubs

Regulatory hurdles and complex approval processes delay project timelines across major cities. Land acquisition costs rise significantly in metros, making expansion challenging. It forces developers to look for alternatives in secondary cities. The India Data Center Market faces delays in construction permits and compliance requirements. Power and fiber connectivity permissions also slow progress. Investors often factor risks into project valuations. Lack of uniform regulations across states creates uncertainty. These challenges restrict faster deployment of new facilities.

Market Opportunities

Emerging Potential of Secondary Cities and Renewable Energy-Backed Infrastructure

Secondary cities like Pune, Kochi, and Jaipur emerge as attractive destinations for facility development. Land availability and lower costs provide strong growth opportunities. It creates distributed capacity beyond saturated metro hubs. Operators explore renewable-backed campuses to reduce expenses. The India Data Center Market benefits from government support for regional development. These opportunities attract mid-sized enterprises and global players. Investors gain from diversified geographic footprints. Expansion into secondary hubs ensures long-term competitiveness.

Rising Demand from Digital Services, OTT Platforms, and Global Cloud Providers

OTT platforms, fintech startups, and gaming firms drive exponential storage and processing needs. Enterprises require scalable back-end infrastructure to manage user growth. It boosts demand for colocation and hyperscale investments. Global cloud providers expand Indian footprints to capture demand. The India Data Center Market supports large-scale deployment of streaming and e-commerce platforms. Growth opportunities favor providers offering scalability and redundancy. Strategic partnerships create faster routes to market. These opportunities reinforce India’s global digital integration.

Market Segmentation

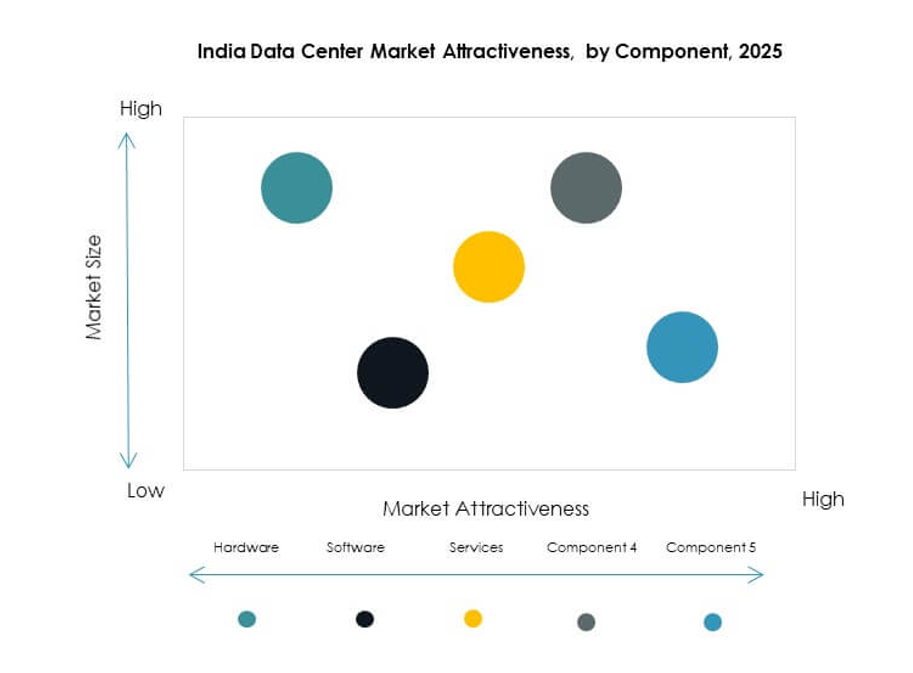

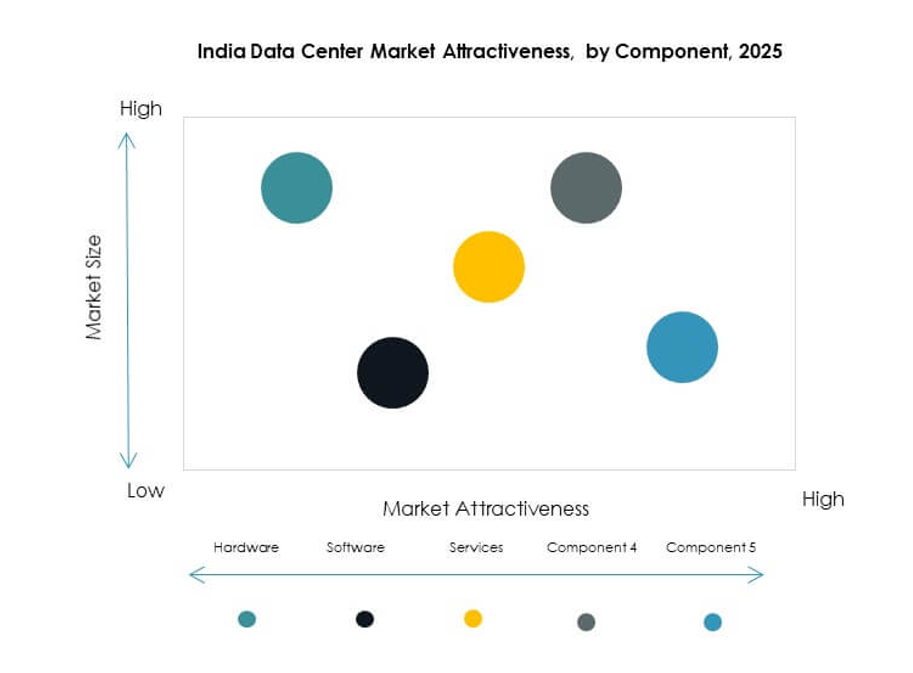

By Component

The India Data Center Market shows hardware as the dominant segment, led by servers, networking, and storage solutions that account for major investments. Strong demand for high-density servers and liquid-cooled racks drives growth. Software, including DCIM and automation, gains adoption for efficiency. Services such as consulting and managed offerings complement infrastructure expansion. Hardware maintains the highest share due to essential role in operations. Enterprises increasingly combine advanced hardware with cloud-native software. Services contribute recurring revenue streams. This balance strengthens overall market performance.

By Data Center Type

Hyperscale facilities dominate the India Data Center Market, driven by global cloud players investing in capacity expansion. Colocation centers also see rapid growth with SMEs outsourcing IT needs. Edge and modular facilities gain traction in Tier-II cities to support localized services. Enterprise facilities focus on secure data hosting. Mega data centers and internet data centers serve global traffic needs. It reflects diverse demand across business scales. Hyperscale dominance continues due to scalability advantages. Growth in colocation and edge creates balanced industry momentum.

By Deployment Model

Hybrid deployment holds significant growth due to enterprises balancing cost, security, and flexibility. Cloud-based adoption grows with digital transformation initiatives. On-premises deployment continues among government and defense clients due to compliance. The India Data Center Market sees hybrid as the leading model due to its adaptability. Enterprises diversify workloads across models to reduce risks. Cloud-based adoption aligns with the surge in SaaS and digital services. On-premises maintains importance for critical workloads. Deployment choices reflect strategic enterprise goals.

By Enterprise Size

Large enterprises dominate demand due to heavy reliance on advanced IT infrastructure. SMEs adopt colocation and cloud services to minimize costs. It allows smaller firms to scale operations efficiently. The India Data Center Market shows strong adoption among SMEs in retail, fintech, and e-commerce. Large enterprises invest in hyperscale and hybrid facilities. SMEs benefit from modular and subscription-based services. Both segments contribute significantly to overall growth. Market players design tailored offerings for each size group.

By Application / Use Case

BFSI holds a leading share with strong demand for secure, compliant, and scalable facilities. IT and telecom drive continuous expansion due to data-intensive applications. Government and defense prioritize sovereignty and control. Healthcare, retail, and media sectors show rapid adoption driven by digital services. The India Data Center Market also gains traction from manufacturing and education use cases. Applications reflect diverse demand patterns. BFSI continues leading due to mission-critical needs. Retail and healthcare emerge as high-growth verticals.

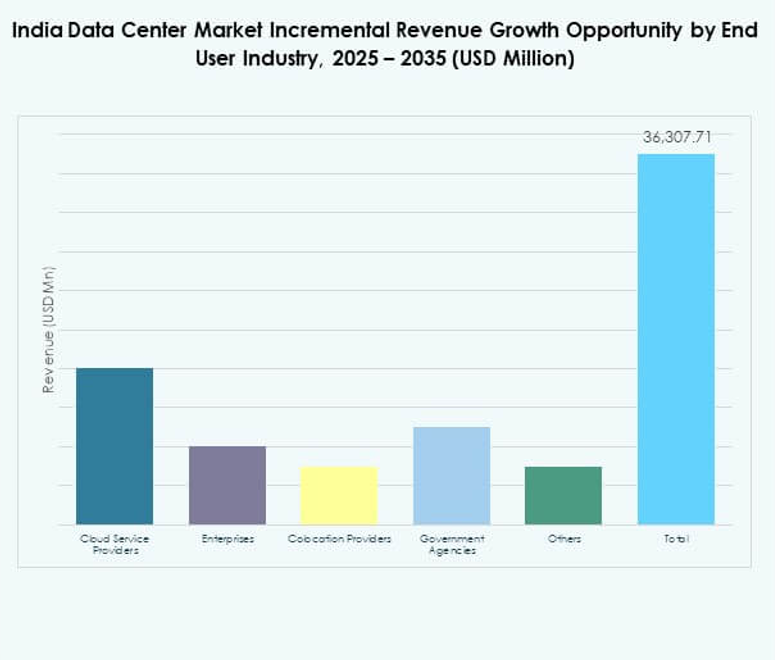

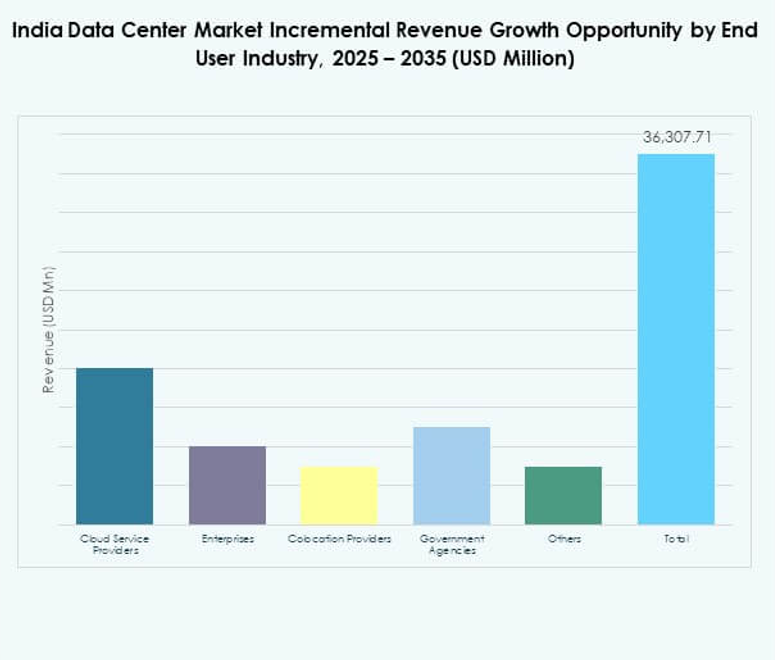

By End User Industry

Cloud service providers dominate the India Data Center Market, driven by large-scale global players expanding footprints. Enterprises adopt hybrid and colocation facilities for flexible needs. Government agencies demand compliant solutions aligned with localization rules. Colocation providers support SMEs and growing digital services. Other industries expand presence with customized deployments. It reflects diverse end-user demands across the ecosystem. Cloud providers maintain leadership due to scale. Strong collaboration between enterprises and providers fuels long-term industry growth.

Regional Insights

Western India Leading With Strongest Market Share

Western India holds 38% share of the India Data Center Market, driven by hubs in Mumbai and Pune. The region benefits from subsea cable connectivity, strong financial sector demand, and availability of renewable energy. It attracts hyperscale and colocation investments. It is the leading region due to strong infrastructure readiness. Enterprises expand operations here for global connectivity. Western India continues to consolidate leadership in large-scale deployments. The region strengthens India’s role as a global digital hub.

- For instance, Sify’s Rabale AI-ready data center campus in Navi Mumbai is designed for up to 377+ MW IT capacity and includes 99 MW of solar and wind power support.

Southern India Expanding With Growing Market Share

Southern India accounts for 32% of the India Data Center Market, supported by growth in Chennai, Hyderabad, and Bengaluru. It benefits from IT services, startups, and smart city projects. Proximity to undersea cable landings makes Chennai a strategic hub. It attracts investments in colocation and edge facilities. Enterprises prefer southern cities for scalability and innovation potential. It establishes itself as the second-largest subregion. Southern India positions as a rising growth center.

- For instance, in February 2025, CtrlS Datacenters inaugurated a data center park in Chennai with two buildings offering a combined IT load capacity of 72 MW, engineered to withstand earthquakes up to magnitude 7.5 on the Richter scale, secured by a nine-zone security system and four fiber entry paths, and planned to pursue LEED Platinum certification for sustainable operations.

Northern and Eastern India Emerging With Future Growth Potential

Northern and Eastern India together hold 30% share of the India Data Center Market. Delhi NCR drives northern demand through government and enterprise adoption. Eastern cities like Kolkata and Bhubaneswar show potential for edge and modular facilities. It creates distributed opportunities across emerging hubs. Market growth in these subregions is led by smaller enterprises and public sector demand. It strengthens geographic diversity across the market. Both subregions add resilience to India’s digital expansion.

Competitive Insights:

- Sify Technologies

- Yotta Infrastructure

- CtrlS Data Centers

- Nxtra Data (Bharti)

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC (Alphabet Inc.)

- Others

The India Data Center Market reflects strong competition between domestic operators and global hyperscale players. Local providers such as Sify, CtrlS, and Yotta expand capacity through modular campuses and renewable-powered facilities. International leaders including AWS, Microsoft, and Google strengthen presence with cloud-driven investments and strategic alliances. It benefits from hybrid partnerships, mergers, and technology-focused upgrades that enhance scalability and resilience. Nxtra Data and Digital Realty expand colocation footprints to capture demand from enterprises and SMEs. NTT enhances global connectivity through network-integrated solutions. Competitive strategies emphasize innovation, compliance, and sustainability. This rivalry strengthens India’s positioning as a critical digital hub in Asia.

Recent Developments:

- In July 2025, Google announced plans to invest $6 billion to construct a 1-gigawatt data center with integrated renewable power infrastructure in Visakhapatnam, Andhra Pradesh. Of this investment, $2 billion is specifically earmarked for renewable energy.

- In August 2025, CtrlS Data Centers activated the first phase of its new data center campus in Kolkata, delivering 16MW of capacity to support the burgeoning demand for high-density data solutions in eastern India. This marks a significant step in CtrlS’s ongoing expansion, targeting key metros and emerging regions and enhancing their nationwide data center footprint.

- In April 2025, Sify Technologies inaugurated its new AI-ready data center in Noida, which represents its largest facility in northern India and is designed to offer advanced security, reliability, and performance for the rapidly evolving digital landscape. This center features next-generation infrastructure, emphasizing scalability and sustainable operations to attract businesses aiming for secure and efficient cloud and AI solutions.

- In November 2024, Yotta Infrastructure made headlines by acquiring IndiQus Technologies, the parent company of the cloud platform Apiculus. The acquisition aims to bolster Yotta’s sovereign AI and cloud capabilities, supporting their ambition for leadership in India’s digital infrastructure. This move is expected to accelerate digital transformation and innovation by providing a comprehensive AI and cloud platform for enterprises.