Executive summary:

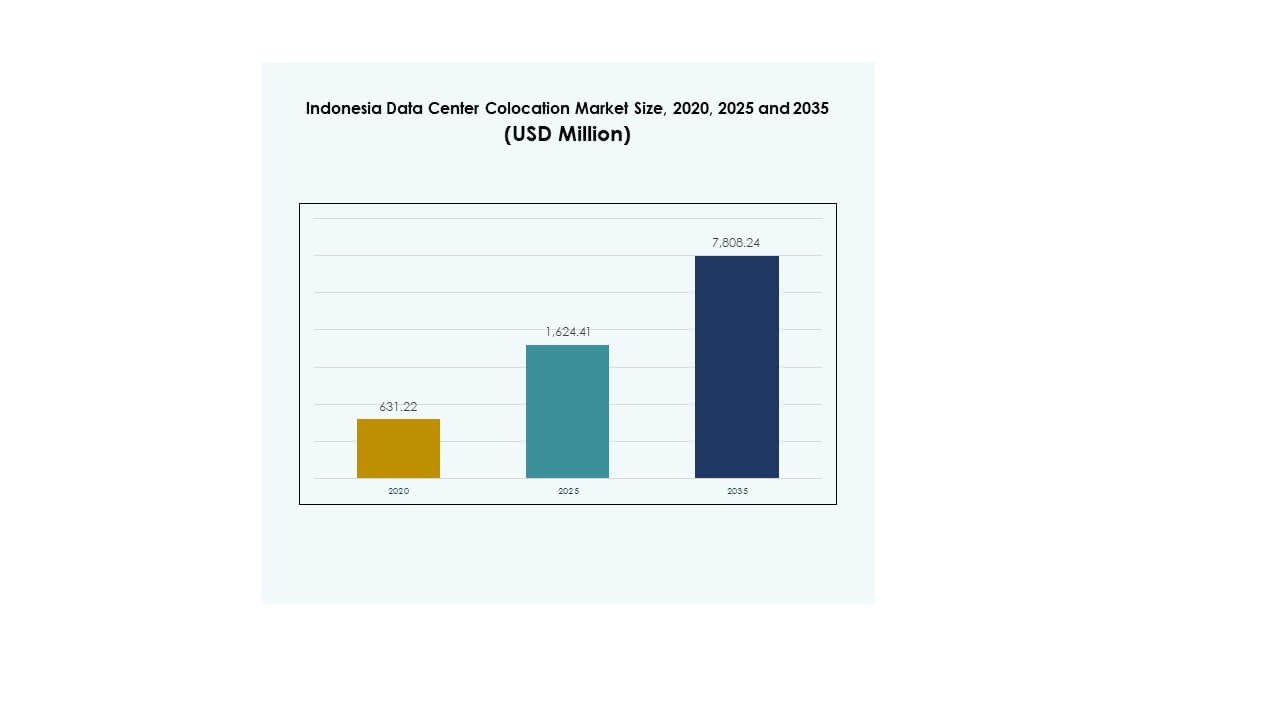

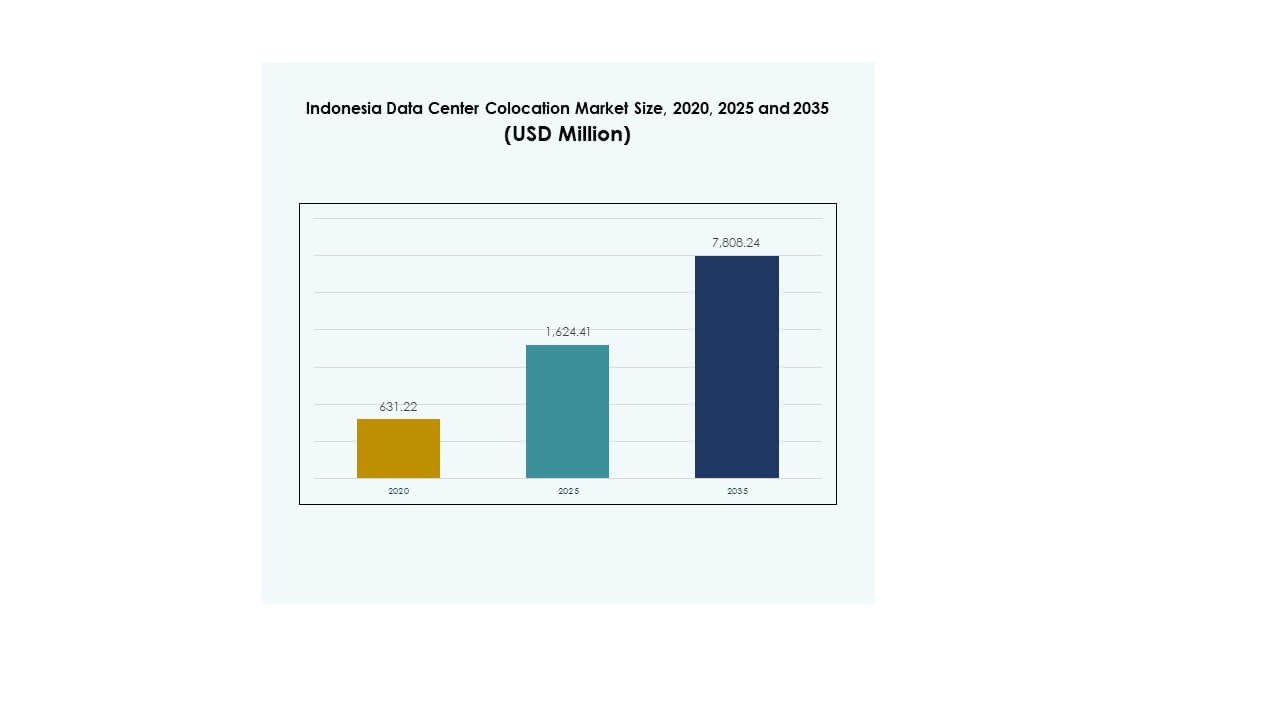

The Indonesia Data Center Colocation Market size was valued at USD 631.22 million in 2020, reached USD 1,624.41 million in 2025, and is anticipated to reach USD 7,808.24 million by 2035, at a CAGR of 16.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Indonesia Data Center Colocation Market Size 2025 |

USD 1,624.41 Million |

| Indonesia Data Center Colocation Market, CAGR |

16.90% |

| Indonesia Data Center Colocation Market Size 2035 |

USD 7,808.24 Million |

Strong demand for cloud services, AI workloads, and edge computing is driving the Indonesia Data Center Colocation Market. Enterprises are adopting colocation facilities to increase flexibility, improve operational efficiency, and scale digital services. Expanding hyperscale infrastructure and sustainable design strategies are attracting major investments. The market is becoming a key enabler of national digital transformation, offering strategic value for both domestic and international investors.

Jakarta leads the market due to strong connectivity and a well-developed digital ecosystem. Batam and Surabaya are emerging as strategic hubs supported by their proximity to international routes and government-backed digital programs. These regions are gaining attention from hyperscale operators and cloud providers, strengthening Indonesia’s role as a central hub in Southeast Asia’s digital infrastructure network.

Market Drivers

Rapid Digital Transformation and Surge in Cloud Adoption

Indonesia is undergoing strong digital transformation across industries. Enterprises are migrating their critical workloads to colocation facilities to improve agility, security, and cost efficiency. Rapid expansion of e-commerce, fintech, and content delivery platforms is accelerating the need for scalable infrastructure. It is enabling faster deployment of edge and cloud services to serve a growing digital user base. Investors are seeing long-term value in high-capacity data centers that support hyperscale and AI workloads. Strong government initiatives are further strengthening the country’s digital backbone. The Indonesia Data Center Colocation Market is becoming a core pillar of the national digital economy.

Expansion of Hyperscale Infrastructure and Edge Computing Ecosystems

Hyperscale providers are driving rapid capacity buildouts to support rising AI and data-intensive workloads. Edge computing deployment is improving latency and enabling better user experience in high-demand regions. Enterprises are preferring colocation models over on-premises infrastructure due to scalability and performance benefits. This expansion is supporting strategic partnerships between local and global players. The ecosystem is attracting large capital investments to meet long-term digital infrastructure needs. It is unlocking new revenue streams for operators and service providers. The Indonesia Data Center Colocation Market is gaining strategic importance for regional connectivity.

Strong Demand from Data-Intensive Sectors and Digital Service Providers

The financial services, healthcare, telecommunications, and e-commerce sectors are leading the surge in data demand. These industries are prioritizing secure, low-latency environments for critical workloads. Advanced colocation facilities are meeting compliance standards and supporting AI-driven innovations. This demand is encouraging operators to deploy advanced cooling and high-density compute solutions. Strategic investments are enabling enterprises to optimize IT resources and scale faster. It is reshaping the competitive landscape by driving advanced infrastructure design. The Indonesia Data Center Colocation Market is benefiting from sustained enterprise cloud migration.

- For instance, in November 2024, DCI Indonesia topped out its 36 MW JK6 facility at the H1 Campus in Cibitung. The expansion brought the campus’s total capacity to 73 MW. The facility is scheduled to become operational in Q1 2025, further strengthening Indonesia’s colocation infrastructure.

Government Support, Connectivity Growth, and Regulatory Clarity

Policy reforms and strong investment incentives are fueling digital infrastructure expansion. The government is promoting data localization, cybersecurity compliance, and fiber network modernization. Strategic projects like submarine cable systems and green data center zones are creating new growth corridors. Investors are finding regulatory stability and infrastructure readiness appealing. Expanding 5G coverage and smart city programs are further supporting infrastructure scaling. It is reinforcing Indonesia’s role as a critical digital hub in Southeast Asia. The Indonesia Data Center Colocation Market is positioned for sustained high-growth investment activity.

- For instance, in 2024, BDx Indonesia launched its CGK4 AI campus, a sovereign AI data center powered by renewable energy through its joint venture with Indosat Ooredoo Hutchison and Lintasarta. The facility incorporates NVIDIA accelerated computing and supports Indonesia’s AI ambitions under local data sovereignty mandates.

Market Trends

Rising Adoption of AI-Ready and High-Density Colocation Infrastructure

Global cloud providers and local operators are introducing AI-ready colocation designs to meet the surge in compute demand. High-density racks and advanced power systems are enabling higher performance per square foot. Enterprises are adopting GPU-based solutions for data-heavy applications. Advanced cooling technologies like liquid cooling are enhancing operational efficiency. It is leading to improved PUE levels and sustainability targets. Operators are focusing on modular and scalable infrastructure to support future upgrades. The Indonesia Data Center Colocation Market is becoming a preferred location for AI infrastructure deployment.

Integration of Renewable Energy and Green Data Center Design

Sustainability is emerging as a central focus in the market’s evolution. Operators are integrating solar and hybrid renewable energy to lower carbon emissions. Green building certifications are becoming standard for new hyperscale and colocation facilities. Energy-efficient power systems are reducing operational costs while supporting ESG commitments. It is aligning national energy strategies with global sustainability goals. Operators are prioritizing cooling innovations to minimize energy consumption. The Indonesia Data Center Colocation Market is shifting toward low-carbon, future-proof infrastructure.

Strengthening Interconnection Ecosystems and Carrier-Neutral Platforms

Carrier-neutral colocation models are growing rapidly to support cross-industry collaboration. Interconnection hubs are improving latency, network resilience, and multi-cloud deployment capabilities. Strategic alliances between telecom operators and data center providers are creating new business ecosystems. It is enabling faster adoption of hybrid and multi-cloud architectures. Enterprises are leveraging these ecosystems to scale digital services nationwide. Interconnection growth is making Indonesia more attractive for global network providers. The Indonesia Data Center Colocation Market is evolving into a key regional connectivity node.

Growing Focus on Security, Compliance, and Data Sovereignty

Enterprises are prioritizing facilities that comply with national data protection regulations and global security standards. ISO, PCI-DSS, and Tier certifications are shaping market competitiveness. Operators are investing in advanced cybersecurity frameworks to attract regulated industries like BFSI and healthcare. Secure colocation environments are supporting mission-critical operations with minimal downtime. It is reinforcing enterprise confidence and supporting long-term digital strategies. Demand for sovereign data solutions is rising among public sector entities. The Indonesia Data Center Colocation Market is advancing toward a more regulated, trust-driven ecosystem.

Market Challenges

High Energy Costs, Infrastructure Gaps, and Power Reliability Risks

Energy represents one of the largest operational costs in colocation facilities. Limited renewable integration and grid stability issues are creating significant cost pressures. Power supply gaps in secondary cities restrict large-scale facility deployment. It is challenging operators to maintain efficient cost structures and meet demand growth. Infrastructure disparities between Jakarta and emerging hubs slow balanced expansion. High dependency on diesel backup raises operational risks and environmental concerns. Regulatory complexity around power procurement creates further delays in capacity planning. The Indonesia Data Center Colocation Market faces constraints in energy optimization and grid readiness.

Talent Shortage, Security Concerns, and Complex Compliance Landscape

Shortage of skilled professionals in facility management, network engineering, and security is increasing operational risks. Evolving cybersecurity threats require continuous upgrades and proactive risk mitigation. Enterprises are facing challenges in aligning with strict data protection and localization rules. It is raising compliance costs and slowing expansion for smaller operators. Lack of standardized frameworks complicates cross-border data flow management. Security investments are growing but remain uneven across regions. The Indonesia Data Center Colocation Market is navigating a complex operational and regulatory environment.

Market Opportunities

Emergence of New Colocation Hubs and Edge Infrastructure Expansion

Rapid demand growth outside Jakarta is creating opportunities in secondary cities. Batam, Surabaya, and Medan are emerging as strategic edge locations due to their proximity to key routes. Operators can capitalize on government-backed connectivity and green energy initiatives. It is opening new revenue streams for regional players and hyperscalers. Strong investment interest supports localized capacity buildouts. The Indonesia Data Center Colocation Market is entering a diversification phase driven by geographic expansion.

Growing Demand from AI, 5G, and Industry-Specific Cloud Solutions

AI workloads, 5G networks, and industry-specific cloud solutions are creating strong demand for colocation capacity. Enterprises are seeking low-latency, secure environments to support critical workloads. Telecom, manufacturing, and media sectors are expected to play a key role. It is encouraging operators to build AI-ready infrastructure tailored to these verticals. The Indonesia Data Center Colocation Market is well-positioned to benefit from next-generation digital solutions.

Market Segmentation

By Type

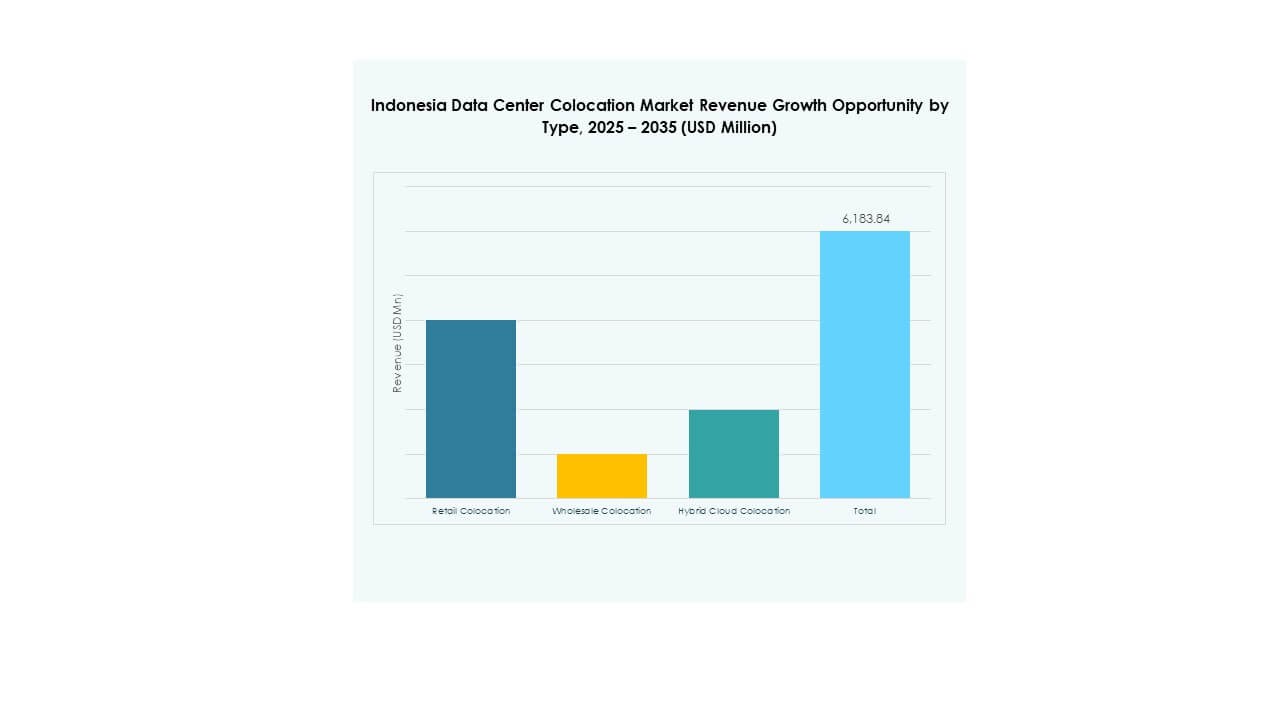

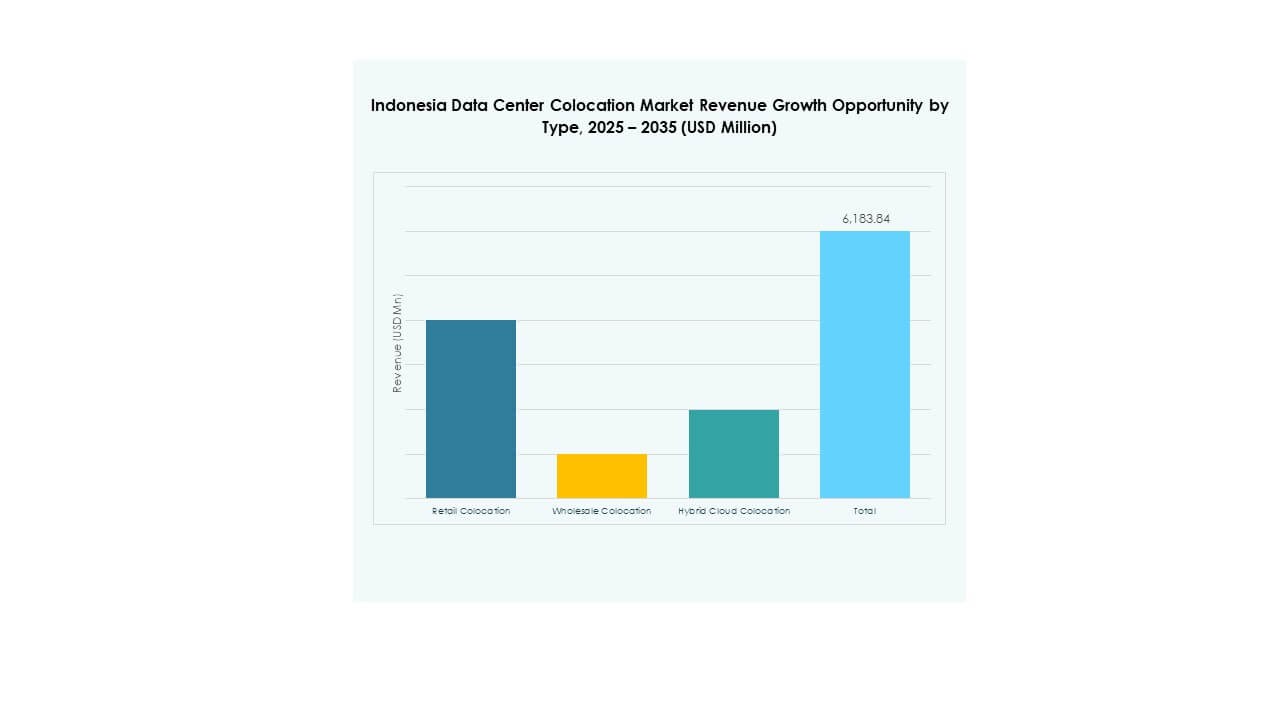

Retail colocation holds the dominant share due to strong demand from SMEs and enterprises seeking flexible capacity and faster deployment. It offers cost-efficient scaling and secure infrastructure for diverse applications. Wholesale colocation is gaining traction with hyperscalers focused on AI and cloud services. Hybrid cloud colocation supports multi-cloud strategies and enhances interoperability. The Indonesia Data Center Colocation Market is being shaped by the balance between flexibility, scale, and hybrid adoption.

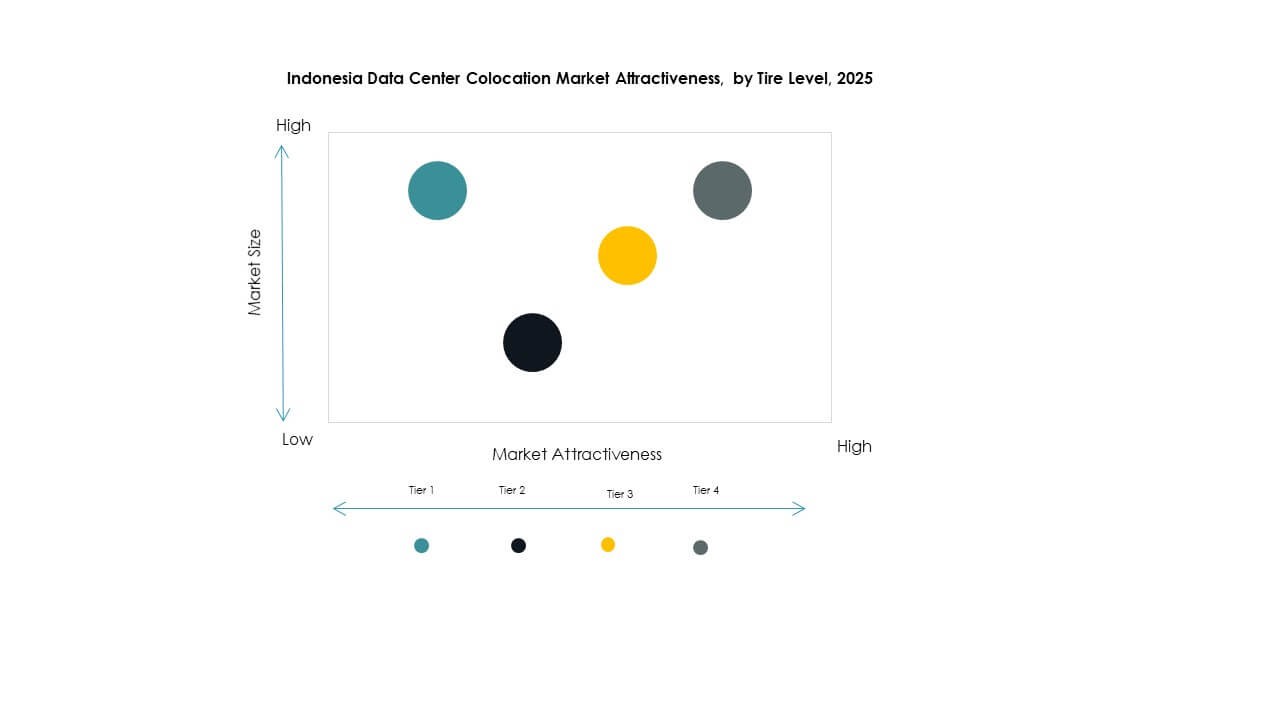

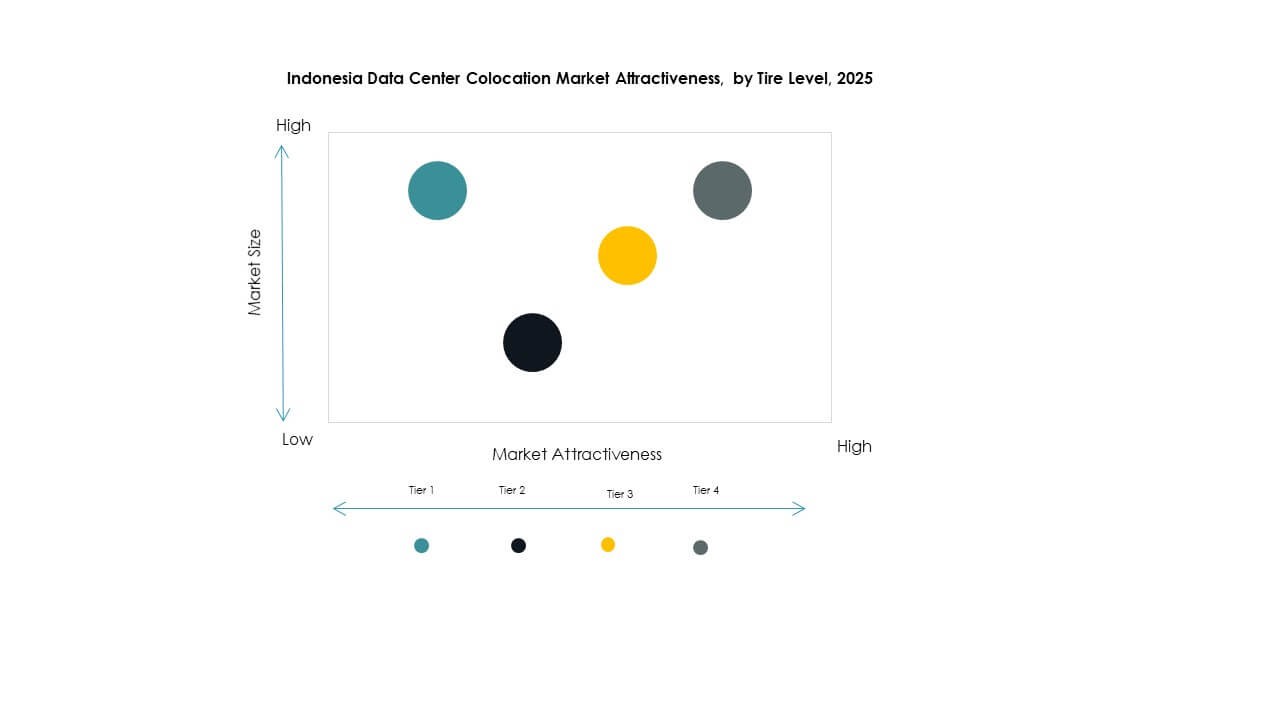

By Tier Level

Tier 3 facilities lead the market due to their balance between performance, availability, and cost. They provide the redundancy and reliability needed for critical workloads. Tier 4 is gaining investment attention from hyperscale providers seeking fault tolerance. Tier 1 and Tier 2 serve niche applications with lower uptime requirements. It is strengthening infrastructure diversity and enabling tiered service offerings in the Indonesia Data Center Colocation Market.

By Enterprise Size

Large enterprises dominate the market due to higher IT spending and demand for scalable infrastructure. These organizations prioritize secure, high-density colocation facilities for mission-critical workloads. SMEs are increasingly adopting retail colocation to avoid capital investments in on-premises infrastructure. It is broadening the customer base and encouraging providers to offer flexible pricing models. The Indonesia Data Center Colocation Market benefits from strong enterprise participation across segments.

By End User Industry

The IT & telecom sector holds the largest share due to rapid digitization and 5G deployment. BFSI is expanding colocation usage to strengthen security and regulatory compliance. Media and entertainment players are leveraging low-latency infrastructure for streaming and gaming. Retail and healthcare sectors are adopting advanced colocation for digital services and patient data management. It is diversifying demand sources and supporting steady growth in the Indonesia Data Center Colocation Market.

Regional Insights

Jakarta: Core Hub with Strong Infrastructure and Market Leadership

Jakarta dominates the Indonesia Data Center Colocation Market with 62% share due to its advanced connectivity and concentration of financial and enterprise activity. Strong network backbones and multiple carrier-neutral facilities make the city a preferred choice for global and local operators. It is home to major cloud and content delivery players. Robust demand from BFSI and e-commerce accelerates investment. Proximity to international submarine cables ensures high-speed connectivity and redundancy. Jakarta’s strategic location reinforces its position as the nation’s primary digital infrastructure hub.

- For instance, in May 2025, Equinix officially launched its first International Business Exchange (IBX) data center “JK1” in Jakarta through a joint venture with Astra International Tbk. The eight-story facility started operations with 550 cabinets, with plans to expand to 1,600 cabinets and 5,300 sqm of colocation space. The site is AI-ready and designed for an average PUE of 1.41 at full load.

Batam: Strategic Edge Location with High Investment Potential

Batam holds 23% share and is emerging as a critical connectivity and edge hub. Its location near Singapore makes it ideal for cross-border traffic routing and disaster recovery setups. Investors are drawn by favorable government policies and submarine cable landing points. It is gaining importance as enterprises look to distribute workloads beyond Jakarta. Batam’s development supports network resilience and capacity diversification. The region’s rapid transformation positions it as a key node in Indonesia’s data center network.

- For instance, in August 2025, Princeton Digital Group announced plans to build a 96 MW multi-phase data center campus at Nongsa Digital Park in Batam. The project is part of its SG+ regional expansion strategy aimed at strengthening digital infrastructure between Indonesia and Singapore.

Surabaya and Other Secondary Cities: Emerging Regional Growth Clusters

Surabaya and other cities account for 15% share, reflecting growing edge and regional expansion. Infrastructure modernization and rising enterprise demand are supporting steady facility development. It is enabling operators to build low-latency networks that reach underserved regions. These areas benefit from increased local content consumption, cloud adoption, and industrial digitization. Government support for digital zones further boosts their attractiveness. These regional hubs are shaping a more distributed and resilient national data center landscape.

Competitive Insights:

- DCI Indonesia

- PT Telkom Indonesia

- Indosat Ooredoo

- NTT Indonesia Nexcenter

- Amazon Web Services (AWS)

- Google Cloud

- Indonesia Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The competitive landscape of the Indonesia Data Center Colocation Market is defined by strong participation from global hyperscale operators and leading domestic providers. Local players are expanding capacity to meet growing enterprise demand, while international companies are investing to build strategic regional hubs. It is creating a hybrid ecosystem that blends localized service delivery with global connectivity. Operators are focusing on green data center development, modular builds, and high-density rack solutions. Strategic partnerships with telecom carriers and cloud providers are strengthening market positioning. Pricing models, service reliability, and technological innovation remain key competitive differentiators among leading firms.

Recent Developments:

- In July 2025, DCI Indonesialaunched its AI-ready JK6 data center in Cibitung, a 36 MW facility claimed to be the largest single data center ever built in Indonesia. It represents a major expansion of the company’s H1 Campus, increasing its total capacity to 73 MW and further establishing DCI as a leader in the national digital infrastructure space.

- In August 2025, PT Telkom Indonesia, through its subsidiary NeutraDC, announced a partnership with Sembcorp Development Ltdto develop sustainable data centers across Southeast Asia. The collaboration will initially focus on Indonesia and Singapore, targeting low-carbon and high-efficiency operations supported by renewable energy integration.

- In August 2025, Indosat Ooredoo Hutchison, in collaboration with Cisco Systems, launched Indonesia’s first sovereign Security Operations Center (SOC). The initiative aims to strengthen the country’s national cybersecurity posture by utilizing advanced monitoring and response technologies within the domestic digital ecosystem.

- In August 2025, Digital Realty Trust, through its joint venture with Telin under Digital Realty Bersama, partnered to strengthen data center interconnection infrastructures in Indonesia. This collaboration aims to establish Indonesia as a major digital hub connected to international markets with high-speed data transit.