Executive summary:

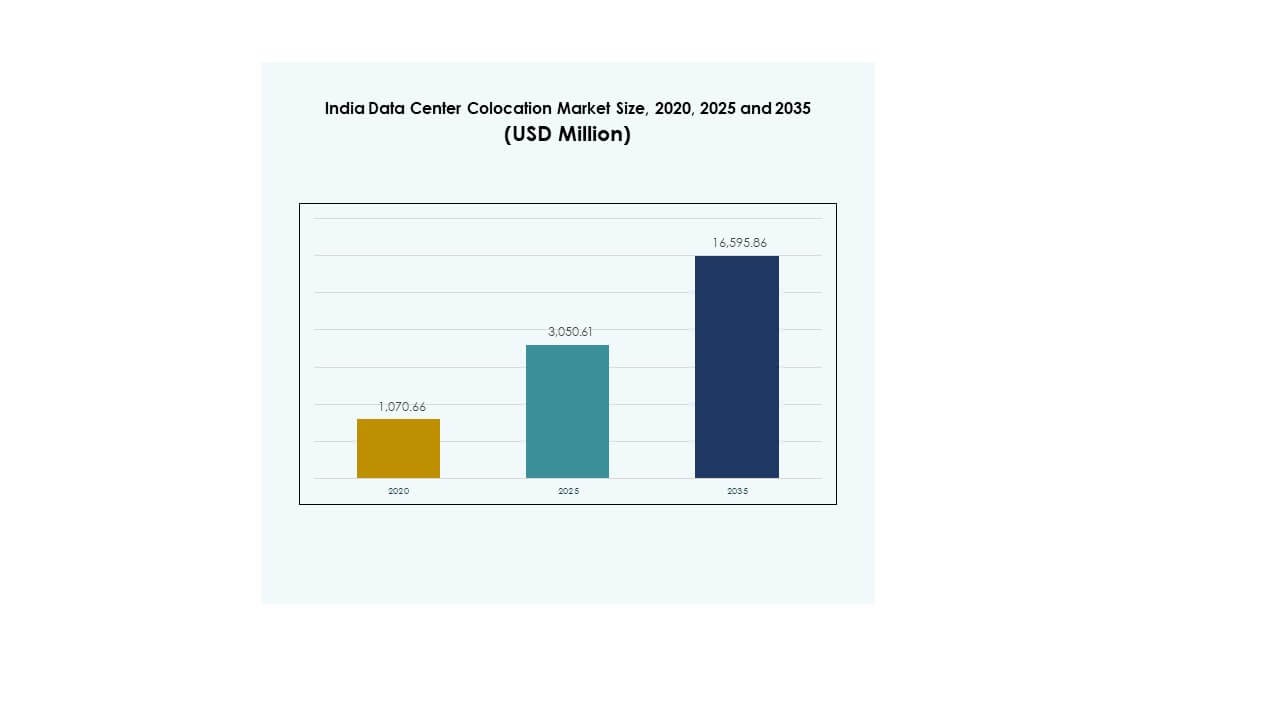

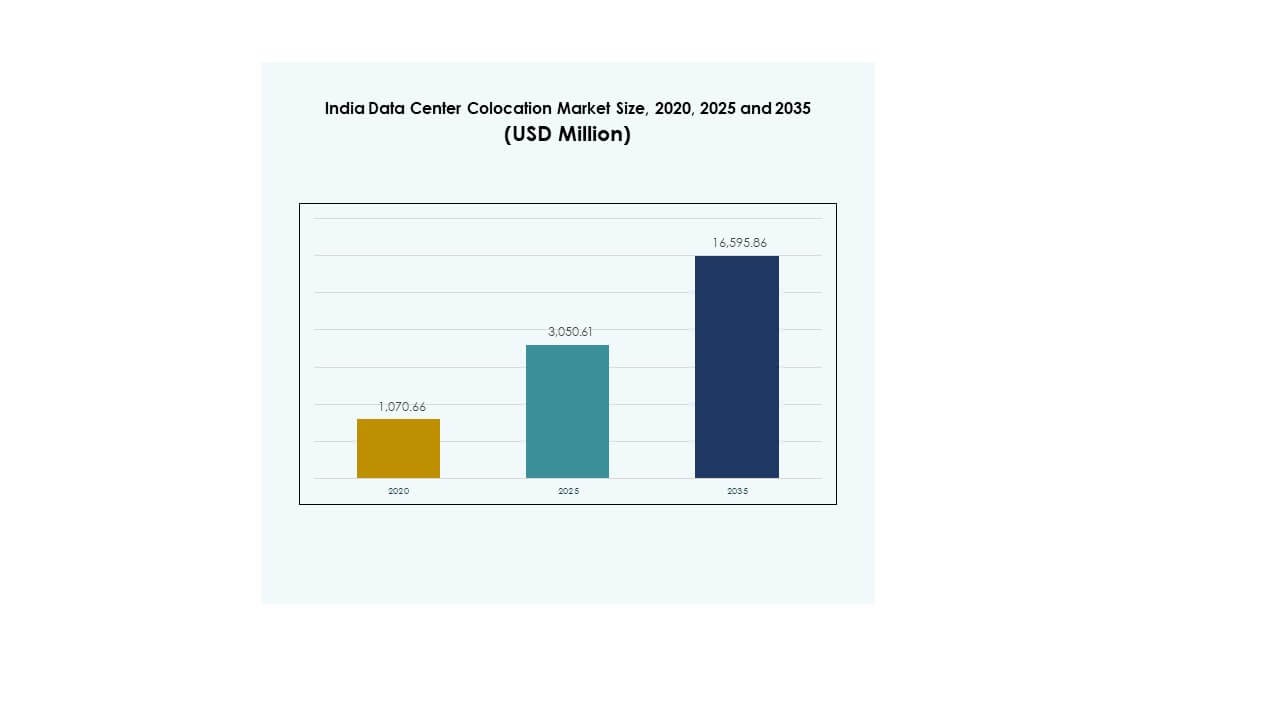

The India Data Center Colocation Market size was valued at USD 1,070.66 million in 2020 to USD 3,050.61 million in 2025 and is anticipated to reach USD 16,595.86 million by 2035, at a CAGR of 18.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| India Data Center Colocation Market Size 2025 |

USD 3,050.61 Million |

| India Data Center Colocation Market, CAGR |

18.40% |

| India Data Center Colocation Market Size 2035 |

USD 16,595.86 Million |

Technology adoption, cloud migration, and AI-driven workloads are major factors driving strong market momentum. Enterprises are shifting from legacy infrastructure to scalable colocation facilities to support high-density computing. Strategic investments in digital transformation are accelerating demand for secure, flexible, and sustainable hosting environments. The market is becoming critical for businesses and investors focused on expanding digital infrastructure and enabling low-latency services.

The western region leads the market due to its strong connectivity, mature ecosystem, and cable landing stations. Southern states are fast-emerging hubs supported by expanding edge infrastructure and tech talent. Northern and eastern regions are developing rapidly, driven by smart city initiatives and regulatory support. This geographic distribution strengthens the country’s position as a regional digital infrastructure hub.

Market Drivers

Rising Demand for Hyperscale and Cloud Infrastructure Driving Large-Scale Data Center Expansion

The India Data Center Colocation Market is experiencing rapid growth due to strong demand from hyperscale and cloud operators. Digital transformation across industries is pushing enterprises to shift from on-premises infrastructure to scalable colocation models. Growing AI, IoT, and edge computing applications are increasing power density and rack space requirements. Investors are targeting hyperscale deployments for long-term revenue stability. It supports multi-cloud strategies and ensures lower latency for end-users. Cloud-native applications and real-time services need resilient infrastructure. It enhances digital competitiveness and attracts foreign investment. This structural shift establishes a critical foundation for advanced workloads.

- For instance, CtrlS Datacenters is developing a hyperscale data center campus in Navi Mumbai with a planned IT load of 140 MW. The facility is Tier-4 rated and designed to support large cloud and enterprise workloads, reinforcing Mumbai’s position as a key digital infrastructure hub.

Accelerating Digital Transformation and Enterprise Modernization Driving Strong Colocation Demand

Enterprise modernization programs are creating a major wave of colocation adoption. The rapid digitization of retail, banking, telecom, and healthcare sectors is boosting infrastructure needs. CIOs and CTOs are prioritizing secure, high-availability environments over legacy setups. It supports predictable operating costs and better data governance. Companies are also focusing on deploying hybrid strategies to increase agility and security. The growing use of digital platforms and online services requires reliable network backbone. Enterprises see colocation as a way to expand quickly without heavy capital investment. This technology-led shift enhances business resilience and scalability.

Rising Policy Support and Infrastructure Investments Strengthening the National Digital Backbone

Government programs are creating a strong push for infrastructure investments across key cities. Digital India initiatives, data localization rules, and fiscal incentives are encouraging private investments. The establishment of data center parks and renewable energy corridors supports large-scale deployments. It enables fast project clearances and grid reliability for operators. Improved connectivity through submarine cables and 5G expansion boosts data flow efficiency. Investors find the regulatory environment increasingly stable for long-term commitments. Policy-driven infrastructure upgrades enhance operational certainty. This structured environment fuels confidence in strategic capital deployment.

- For instance, the government-backed Digital India initiative has helped expand submarine cable routes and improve power grid reliability around data center clusters like Mumbai. In September 2025, STT GDC India acquired 24.34 acres in Mumbai’s Palava region to build part of its expanded campus under state incentives, targeting greenfield capacity growth in a region with strong digital infrastructure.

Technological Innovation Enhancing Data Efficiency and Operational Resilience

The market is witnessing advanced innovations in power, cooling, and connectivity layers. Liquid cooling, AI-enabled monitoring, and modular builds are improving operational performance. Operators are integrating renewable energy sources to reduce costs and meet ESG goals. It drives efficiency while ensuring grid stability for intensive workloads. Next-generation facilities support AI training, edge computing, and real-time analytics. Interconnection ecosystems are becoming more open and vendor-neutral. These innovations enable lower operational risk, higher scalability, and improved service levels. Strong technological maturity creates a solid base for future infrastructure expansion.

Market Trends

Increased Edge Deployments and Distributed Infrastructure Models Reshaping Network Topology

The India Data Center Colocation Market is moving toward edge-based architecture for better latency control. Enterprises are distributing workloads closer to end-users to support time-sensitive applications. Telecom operators and OTT players are deploying regional nodes across multiple cities. It improves application performance and reduces backbone congestion. The rise of autonomous systems, 5G, and smart cities accelerates this trend. Infrastructure models are becoming more decentralized to support real-time decision-making. Regional availability zones are being developed to complement core hubs. This shift marks a strategic transition from traditional centralized hosting.

Integration of Sustainable Energy and Advanced Cooling to Support ESG Commitments

Sustainability has become a key strategic pillar across new data center builds. Operators are investing in renewable energy, on-site solar, and green grid sourcing. Cooling systems are shifting toward liquid and hybrid models to lower energy usage. It enhances operational efficiency and aligns with corporate sustainability goals. Energy-efficient designs reduce long-term costs and help meet global standards. Regulatory pressures are increasing focus on emissions reduction. Companies are adopting circular water systems and energy reuse technologies. Sustainability integration shapes future market positioning and operational strategies.

Growing Role of AI and Automation in Enhancing Facility Operations and Performance

Automation and AI are transforming data center management practices across the country. Predictive analytics enables better power and cooling load balancing. Intelligent systems detect faults faster and minimize downtime risks. It creates more reliable and scalable operational environments. Automated maintenance enhances uptime and reduces operational costs. AI-based forecasting improves capacity planning and resource allocation. Companies are adopting software-defined infrastructure for flexible service delivery. This shift strengthens operational excellence and improves service continuity for enterprises.

Strategic Expansion by Global Colocation Providers to Strengthen Market Competitiveness

Global colocation players are expanding their presence through greenfield investments and joint ventures. Operators from the U.S., Europe, and Asia-Pacific are entering key Indian metros. It intensifies competition and improves service diversity for customers. New entrants are introducing advanced designs, better interconnection, and value-added services. The growth of international traffic and content distribution is driving facility expansion. Strategic partnerships with telcos and hyperscalers support ecosystem maturity. Competitive intensity improves pricing efficiency and innovation velocity. This trend signals deeper integration with global digital infrastructure networks.

Market Challenges

Regulatory, Land Acquisition, and Power Availability Constraints Delaying Infrastructure Execution

The India Data Center Colocation Market faces critical hurdles in project execution due to regulatory and power-related issues. Land acquisition involves multiple clearances, slowing construction timelines. Grid stability remains uneven in several emerging cities, impacting operator confidence. It creates higher operational risk for large-scale deployments. Local approvals often lack standardization, complicating investment planning. Power tariffs fluctuate, increasing uncertainty in long-term cost structures. Delays in infrastructure approvals affect return on investment timelines. Addressing these challenges is essential to maintain investor trust and ensure predictable growth.

Skilled Workforce Gaps and Cybersecurity Vulnerabilities Increasing Operational Complexity

The talent gap in advanced data center engineering and cybersecurity remains significant. Specialized expertise in liquid cooling, automation, and hybrid cloud integration is limited. It raises operational costs and restricts rapid scalability for operators. Cyber threats are increasing with the growth of digital traffic and cloud services. Breach risks and compliance gaps create strategic vulnerabilities. Regulatory demands on data protection are becoming stricter, increasing compliance complexity. Maintaining operational resilience requires large-scale investment in skills and defense frameworks. Workforce development and security modernization remain strategic priorities.

Market Opportunities

Strong Investment Momentum Creating Scope for High-Capacity Data Center Development

The India Data Center Colocation Market is attracting major investments from domestic and international players. Rapid digitalization and hyperscale demand are enabling large greenfield projects. It creates strong opportunities for scalable infrastructure in metro and emerging cities. Investments are focusing on AI-ready and edge-integrated facilities. Strategic partnerships between global operators and Indian telecom firms are growing. This trend sets a strong base for accelerating capacity deployment.

Emerging Tier-II and Tier-III Cities Offering Untapped Growth Potential

Emerging cities are becoming attractive destinations for expansion due to improved fiber and power infrastructure. It supports lower land costs and balanced load distribution. Government incentives for infrastructure development strengthen this momentum. Local enterprises and BFSI segments are driving new colocation requirements. Edge deployments in these regions create strategic advantages. This geographic diversification supports inclusive market expansion.

Market Segmentation

By Type

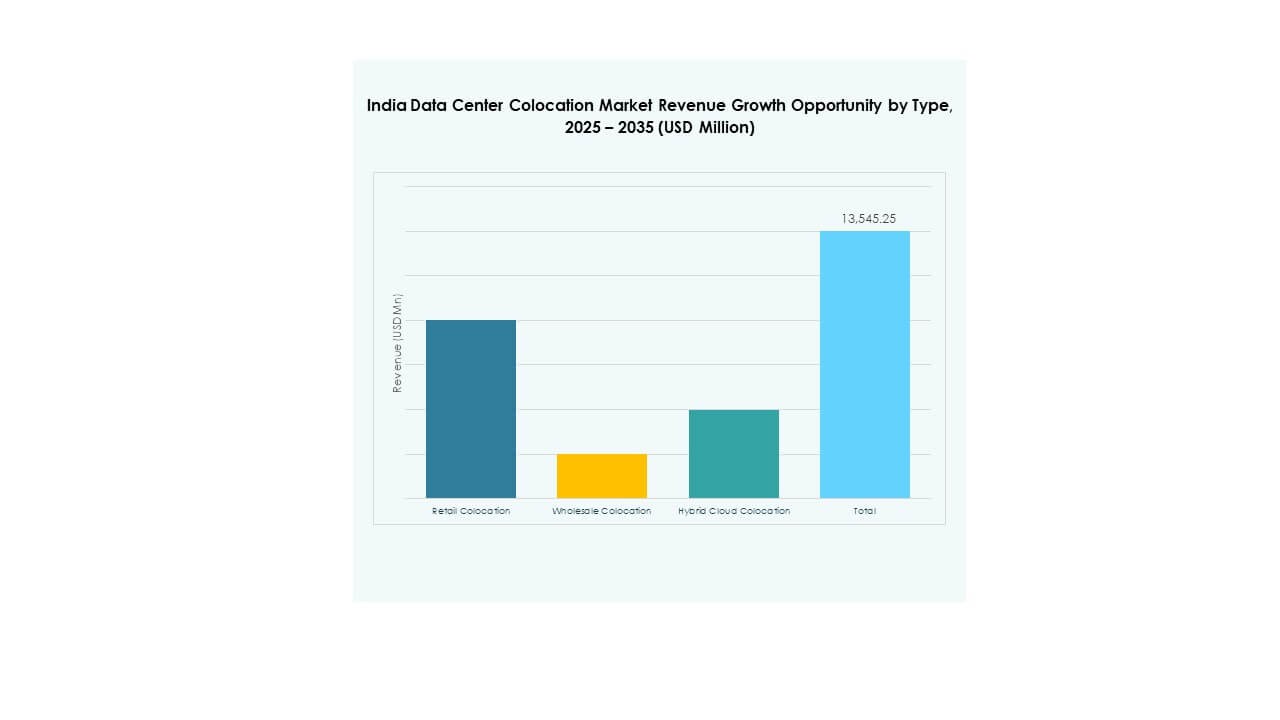

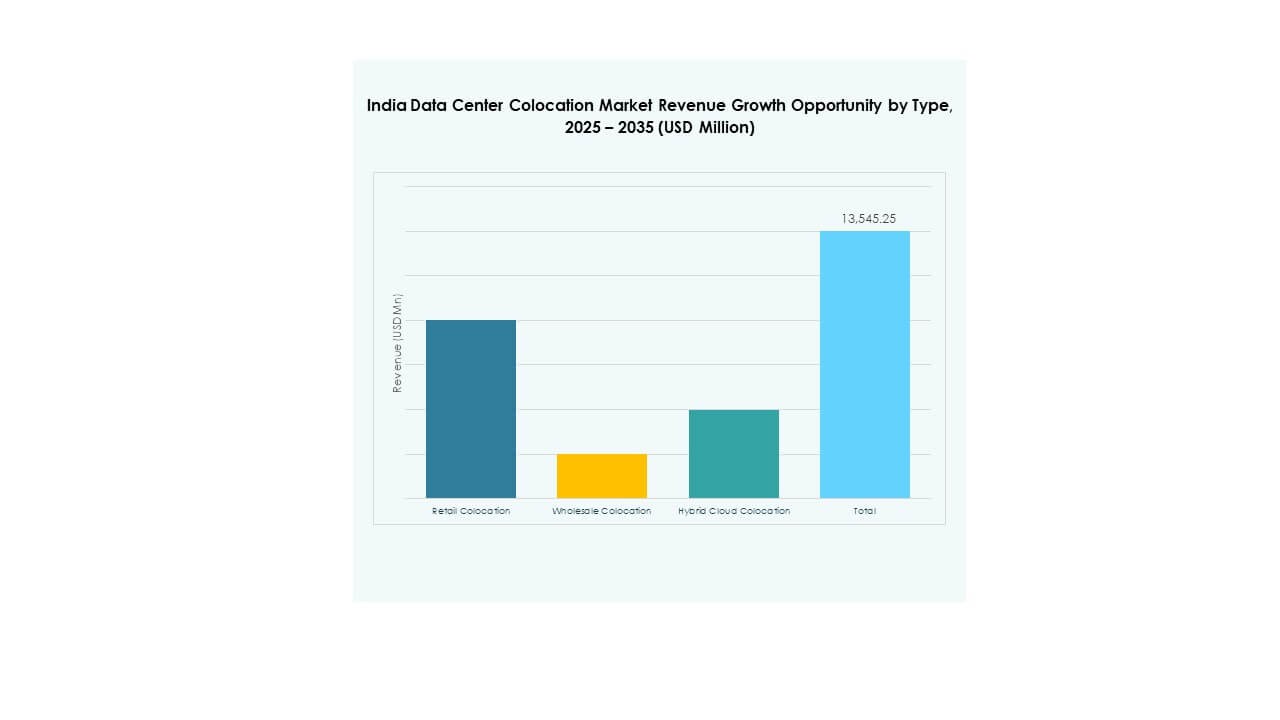

Retail colocation dominates the India Data Center Colocation Market with a strong customer base from BFSI, IT, and media firms. Enterprises prefer retail models for flexibility and managed services. Wholesale colocation is expanding through hyperscale contracts and global partnerships. Hybrid cloud colocation is gaining traction for hybrid workload deployments and cloud integration. Growing demand for low-latency connectivity and regulatory compliance supports retail leadership in the segment.

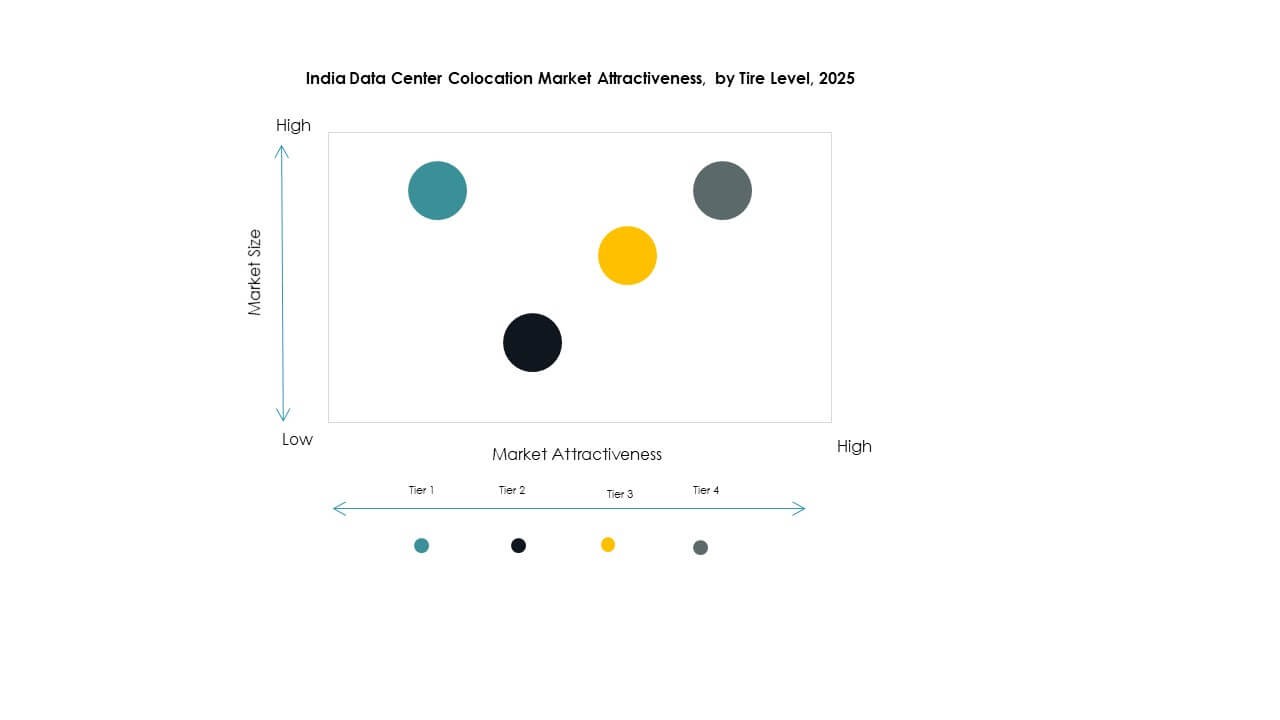

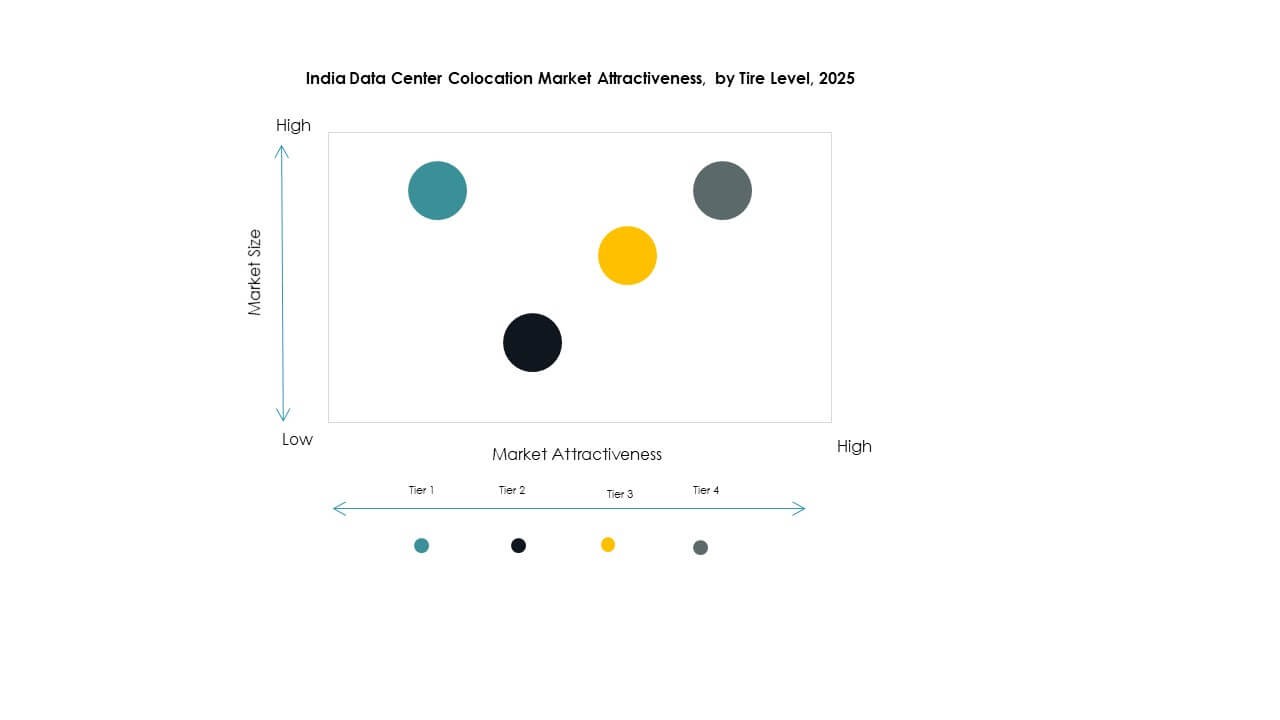

By Tier Level

Tier 3 holds the dominant market share in the India Data Center Colocation Market. Operators prefer Tier 3 for its strong balance between uptime assurance and cost efficiency. Tier 4 is growing steadily with hyperscale and critical infrastructure deployments. Tier 1 and Tier 2 maintain niche use cases for low-cost operations. High demand for reliable power and cooling is driving investments into Tier 3-certified facilities across metros.

By Enterprise Size

Large enterprises lead the India Data Center Colocation Market, contributing the highest share. These companies prioritize advanced security, scalability, and global interconnection. SMEs are increasingly adopting colocation to reduce infrastructure costs and speed up digital transformation. Growing SaaS and fintech segments are pushing SME demand. Service providers are tailoring flexible and cost-efficient colocation packages to capture this segment.

By End User Industry

The IT and Telecom sector dominates the India Data Center Colocation Market with significant traffic volumes and infrastructure needs. BFSI follows with high compliance and security requirements. Media and entertainment drive growth through streaming platforms and content delivery. Retail and healthcare contribute through e-commerce expansion and digital health records. Other sectors are gradually increasing their presence with enterprise modernization initiatives.

Regional Insights

Western Region Holding Strong Leadership Through High Connectivity and Industrial Base

The western region accounts for 36% of the India Data Center Colocation Market. Maharashtra leads with Mumbai as a prime colocation hub supported by international cable landing stations. The region offers strong grid connectivity, skilled talent, and a mature ecosystem. It attracts global hyperscalers and OTT players seeking low-latency infrastructure. High demand from BFSI and media drives continuous capacity expansions. Policy and infrastructure alignment make this region a strategic anchor for national deployments.

Southern Region Growing Rapidly Due to Technology Hubs and Expanding Edge Deployments

The southern region holds 31% of the India Data Center Colocation Market. Tamil Nadu and Karnataka are leading with strong IT and telecom activity. Bengaluru and Chennai serve as prime locations for edge and cloud expansion. The region benefits from reliable grid infrastructure and a large tech workforce. Growing hyperscale investments and 5G rollouts strengthen its ecosystem. Strategic coastal positioning supports international connectivity and content distribution networks.

- For instance, in September 2025, Equinix inaugurated its CN1 data center in Chennai with an initial capacity of 800 cabinets and plans to scale up to 4,250 cabinets. The facility is designed for 99.999% uptime, supports direct liquid cooling, and is interconnected with Equinix’s three data centers in Mumbai.

Northern and Eastern Regions Emerging as Key Growth Frontiers for Distributed Infrastructure

The northern region holds 20%, while the eastern region holds 13% of the India Data Center Colocation Market. Delhi-NCR leads in the north with strong enterprise demand and connectivity improvements. Kolkata is emerging in the east with growing telecom and BFSI activities. Lower land costs and government incentives attract new operators. Edge deployments in these regions support traffic decentralization. These zones are expected to play a critical role in balancing national load distribution.

- For instance, in October 2025, TCS bolstered India’s sovereign cloud strategy by signing a landmark MoU with C-DAC to co-develop indigenous cloud infrastructure. The plan targets expansion of data center deployments beyond Mumbai and Hyderabad to Delhi and Kolkata, supporting a distributed and sovereign digital infrastructure for enterprises and government.

Competitive Insights:

- Nxtra (Bharti Airtel)

- Sify Technologies

- CtrlS Datacenters

- Web Werks

- Amazon Web Services (AWS)

- Google Cloud

- India Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The India Data Center Colocation Market features a strong mix of domestic and global players competing on infrastructure quality, geographic reach, and service innovation. Nxtra, Sify, and CtrlS dominate domestic operations with large facilities and nationwide network integration. Equinix, Digital Realty, and NTT are expanding through strategic partnerships and hyperscale capacity builds. It benefits from foreign capital inflow and advanced design expertise. Cloud providers like AWS and Google strengthen interconnection ecosystems. Operators differentiate through sustainability commitments, Tier certifications, and carrier-neutral models. Competitive intensity remains high due to growing enterprise demand, regulatory shifts, and expanding AI and edge deployments. This dynamic landscape drives rapid capacity growth and continuous service upgrades.

Recent Developments:

- In October 2025, Adani Enterprises announced a major partnership with Google to build India’s largest AI data center and green energy infrastructure in Visakhapatnam, Andhra Pradesh. The project, valued at approximately USD 15 billion, will span from 2026 to 2030 and is being developed through Adani Group’s joint venture, AdaniConneX, along with Alphabet’s subsidiary, Raiden Info Tech.

- In September 2025, BSNL unveiled plans to establish five strategic data centers across India, with Guwahati selected as the anchor facility for the Northeast region. The new data centers are part of BSNL’s initiative to support India’s national data localization and digital infrastructure objectives. The facilities are designed to provide high‑availability colocation services and will also support government cloud workloads to improve regional connectivity and latency performance.