Executive summary:

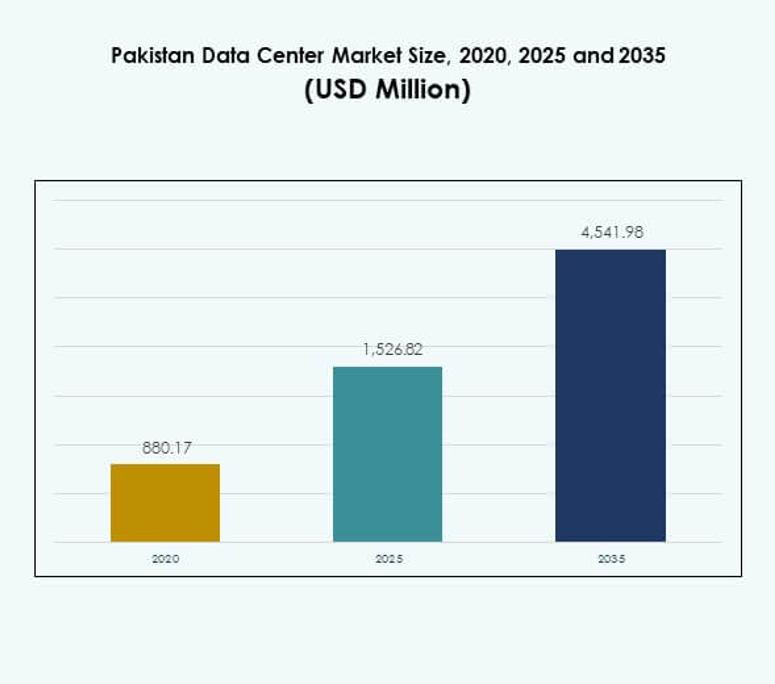

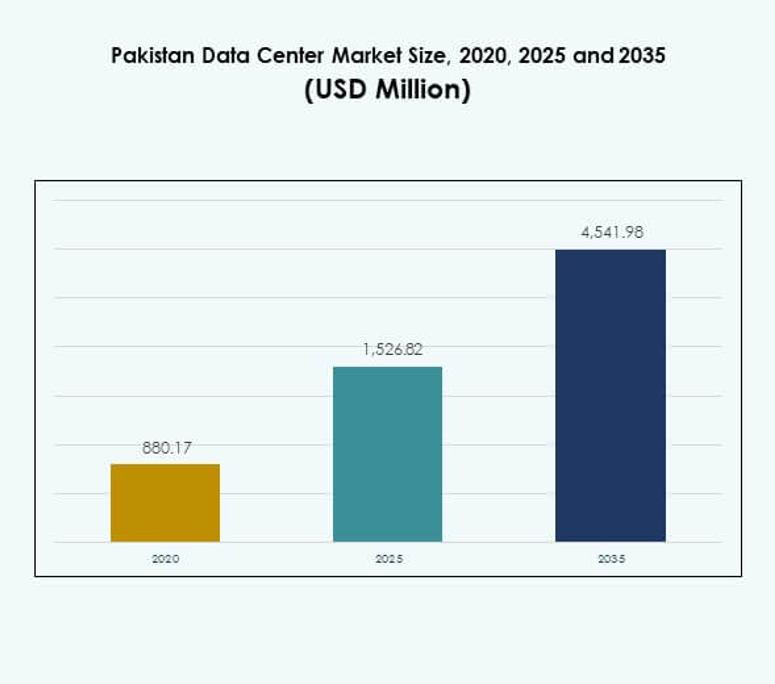

The Pakistan Data Center Market size was valued at USD 880.17 million in 2020 to USD 1,526.82 million in 2025 and is anticipated to reach USD 4,541.98 million by 2035, at a CAGR of 11.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Pakistan Data Center Market Size 2025 |

USD 1,526.82 Million |

| Pakistan Data Center Market, CAGR |

11.44% |

| Pakistan Data Center Market Size 2035 |

USD 4,541.98 Million |

Market growth is being fueled by rapid digital transformation, rising cloud adoption, and increasing reliance on AI and IoT applications. Businesses across telecom, banking, and retail are investing in localized hosting for compliance and efficiency. Investors are focusing on colocation and hybrid models to balance cost optimization with scalability. The market holds strategic importance as it enables data sovereignty, drives operational resilience, and strengthens competitiveness for both enterprises and government organizations.

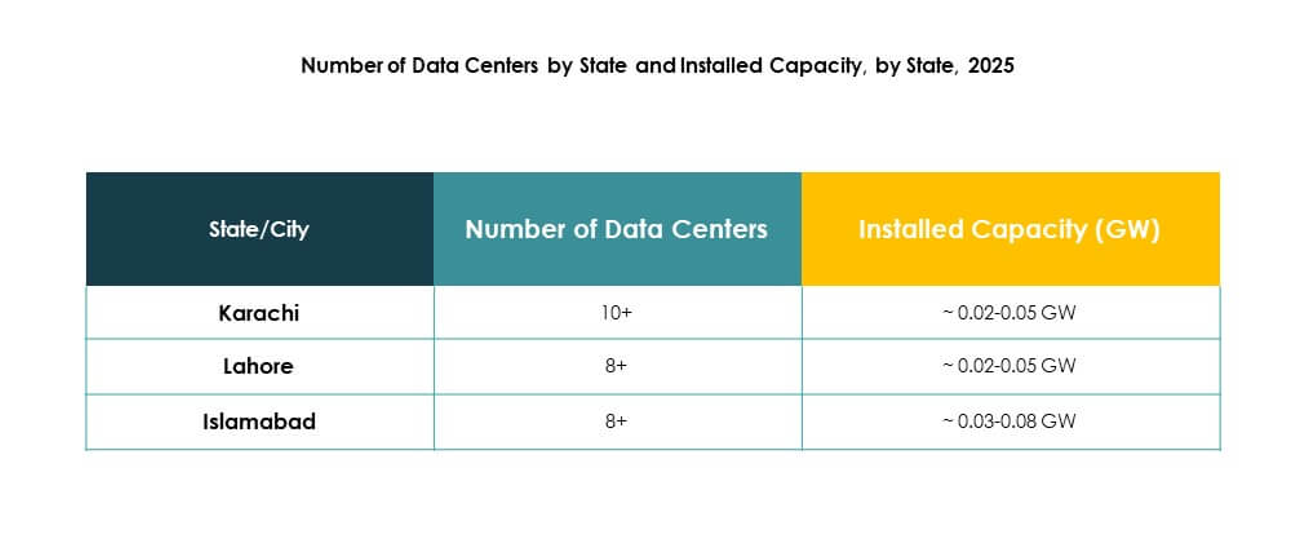

Regionally, North Pakistan leads due to strong adoption in telecom and banking, supported by IT hubs in Islamabad and Lahore. Central Pakistan is emerging with growth in e-commerce and SME digitalization, creating demand for flexible hosting. South Pakistan is developing into a regional hub with Karachi attracting international investments through its port connectivity. These dynamics position the market for strong regional and cross-border opportunities.

Market Drivers

Rising Digital Transformation and Accelerated Demand for Secure IT Infrastructure

The Pakistan Data Center Market is expanding due to rising digital transformation initiatives and rapid growth in internet penetration. Enterprises in banking, telecom, and retail require secure infrastructure to handle increasing volumes of customer and transactional data. Government-backed digitalization programs are creating demand for high-capacity centers with advanced security protocols. Businesses are focusing on localized storage to enhance compliance and data sovereignty. Multinational firms see opportunities in managed services and localized hosting. Cloud adoption across industries supports scaling without heavy upfront investments. It strengthens resilience and operational efficiency for organizations. Investors find this shift attractive for long-term growth and market penetration.

- For instance, Jazz invested Rs37 billion in 2023 to expand digital infrastructure, added nearly 1,000 new 4G sites, and increased its overall subscriber base to 70.6 million, supporting secure IT growth for fintech, cloud, and data services in Pakistan.

Adoption of Cloud Computing and Hybrid Deployment Models Among Enterprises

Cloud computing adoption is driving the need for advanced facilities, where enterprises combine on-premises, cloud-based, and hybrid deployment models. The Pakistan Data Center Market benefits from this shift, with firms leveraging hybrid setups for cost optimization and flexibility. Financial institutions and government agencies demand high-performance and compliant storage systems. Healthcare and education sectors also expand usage with strong digital application growth. Investors are channeling capital toward colocation and cloud providers to capture scaling demand. It ensures strong connectivity across regions, enhancing productivity and service delivery. Cloud-native solutions and microservices architecture increase efficiency of IT ecosystems. Businesses recognize the strategic importance of localized centers for data security and customer trust.

Integration of Advanced Technologies Driving Innovation in Facility Design

The integration of artificial intelligence, big data analytics, and IoT technologies is reshaping facility requirements across the country. The Pakistan Data Center Market is witnessing investments in intelligent monitoring, automation, and predictive analytics for energy optimization. AI-enabled platforms enhance cooling efficiency and reduce operating costs. IoT applications require edge and micro data centers to provide low-latency performance. Enterprises deploying advanced analytics seek higher processing capacity, fueling demand for hyperscale centers. It provides scalability, agility, and innovation opportunities for businesses managing large data workloads. Strategic investors favor companies deploying automation-driven models. This innovation ensures cost savings, operational resilience, and long-term sustainability.

Government Policies and Strategic Importance for National Digital Economy

Government-driven policies, such as incentives for IT parks and data protection regulations, create favorable conditions for investments. The Pakistan Data Center Market benefits from legal frameworks ensuring compliance and data sovereignty. Enterprises gain confidence in local hosting for critical workloads. Public-private partnerships are supporting the creation of large-scale hyperscale facilities. It enhances the country’s role as a regional hub for digital infrastructure. Strategic positioning between South Asia and the Middle East adds cross-border opportunities. Strong policies on cybersecurity strengthen investor confidence. Businesses see the sector as vital for digital economy growth and innovation. The regulatory clarity attracts both domestic and international investments.

- For instance, Khazana Cloud partnered with the National Aerospace Science and Technology Park (NASTP) in 2024 to launch Pakistan’s first hyperscale data center, powered by Huawei, providing secure AI and cloud solutions with assured data residency within Pakistan.

Market Trends

Growth of Colocation Facilities to Support Flexible and Scalable IT Solutions

Colocation facilities are gaining traction among enterprises looking for cost-efficient scalability. The Pakistan Data Center Market reflects growing adoption of shared infrastructure, where businesses avoid large upfront investments. Telecom operators and e-commerce firms prefer colocation for agility and operational reliability. Data security standards in these facilities ensure compliance with industry regulations. It offers scalability for companies shifting from traditional hosting models. Investors are supporting the development of regional colocation hubs. Demand for disaster recovery and business continuity solutions enhances the attractiveness of colocation. Organizations value its cost predictability, which supports long-term operational strategies.

Edge and Micro Data Centers Emerging as Key Enablers of Low-Latency Applications

The increasing demand for real-time data processing has accelerated interest in edge and micro facilities. The Pakistan Data Center Market sees strong growth in localized facilities supporting IoT, smart cities, and mobile applications. Industries require low-latency solutions for better performance and customer experience. Enterprises are deploying edge setups closer to users to enhance connectivity and efficiency. It drives investment in modular and containerized designs for faster deployment. The rise of 5G technology supports edge computing demand. Regional connectivity also improves application responsiveness. Edge facilities align with evolving user needs in gaming, healthcare, and retail ecosystems.

Energy-Efficient Infrastructure and Green Data Centers Shaping Investments

Energy efficiency is a major trend influencing investment decisions in new facilities. The Pakistan Data Center Market is aligning with sustainable practices by adopting advanced cooling systems, renewable integration, and low-power hardware. Businesses demand eco-friendly solutions to meet ESG goals. Investors are funding projects that emphasize carbon reduction and sustainable power sourcing. It reduces long-term costs and enhances environmental performance. Green building certifications drive credibility and attract global clients. Enterprises are focusing on energy optimization through AI-driven facility management. Sustainable designs also enhance resilience during energy shortages. The market sees green adoption as a competitive differentiator.

Increased Focus on Cybersecurity and Regulatory Compliance in Facility Management

Cybersecurity standards are becoming central to facility operations in the country. The Pakistan Data Center Market reflects rising demand for advanced firewalls, threat detection, and compliance-driven solutions. Enterprises in banking and telecom prioritize regulatory adherence with data protection measures. Security-driven infrastructure gains importance with increasing cyber threats and ransomware attacks. It builds trust among users relying on digital services. Investors consider cybersecurity measures a critical factor before funding new projects. Regulatory mandates encourage higher adoption of managed security services. Businesses see data protection as a vital part of customer experience. This focus ensures resilience in digital transformation.

Market Challenges

High Capital Expenditure and Infrastructure Barriers Limiting Large-Scale Expansion

The Pakistan Data Center Market faces challenges due to high capital expenditure requirements for building advanced facilities. Infrastructure such as power supply, cooling systems, and high-speed connectivity demands significant investment. Smaller enterprises hesitate to invest heavily, limiting overall capacity growth. It slows down the adoption of hyperscale facilities in emerging regions. Energy shortages and inconsistent grid supply increase operational costs. Land acquisition issues in urban areas further create delays. Investors evaluate long-term returns cautiously before funding. High costs remain a barrier for broad expansion across multiple cities.

Skilled Workforce Shortage and Regulatory Uncertainty Affecting Operational Efficiency

Operational challenges also arise from a shortage of skilled professionals in cloud engineering, cybersecurity, and data management. The Pakistan Data Center Market experiences delays in advanced deployment due to limited expertise. It creates dependency on international consultants, raising costs and project timelines. Regulatory uncertainty in data protection laws affects investor confidence. Businesses hesitate to migrate sensitive data without strong legal assurance. Complex compliance requirements demand specialized teams that are not easily available. Security risks also grow with limited talent availability. These barriers hinder smooth adoption of next-generation infrastructure in the market.

Market Opportunities

Rising Demand for Cloud-Based and Hybrid Models in Emerging Enterprises

The Pakistan Data Center Market presents opportunities with the rising adoption of cloud and hybrid models among SMEs and large enterprises. Organizations are seeking cost-efficient setups with scalability and flexible deployment. Cloud-native startups require managed hosting services to enhance operational agility. It creates demand for consulting, integration, and monitoring services. Colocation providers also benefit by offering hybrid capabilities. This opportunity allows investors to capture growth from expanding cloud penetration. Enterprises see hybrid adoption as vital for efficiency and innovation. Demand will expand further with increasing digitalization in government and private sectors.

Strategic Role of Pakistan as a Regional Hub for Cross-Border Connectivity

The country’s geographic position between South Asia and the Middle East creates strong opportunities for regional hosting. The Pakistan Data Center Market can serve as a hub for data transit and cross-border integration. Investors see potential in developing hyperscale facilities to attract international clients. It strengthens connectivity for regional e-commerce, telecom, and digital service providers. Strategic initiatives encourage partnerships with Gulf-based companies. Businesses benefit from reduced latency and lower cross-border hosting costs. This regional role enhances investor confidence in long-term expansion.

Market Segmentation

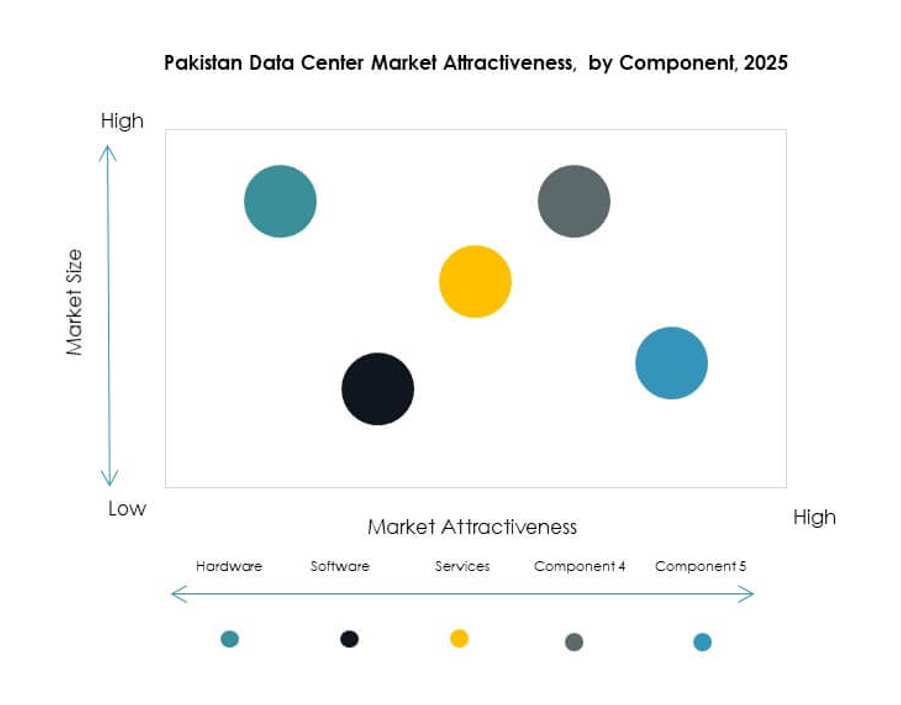

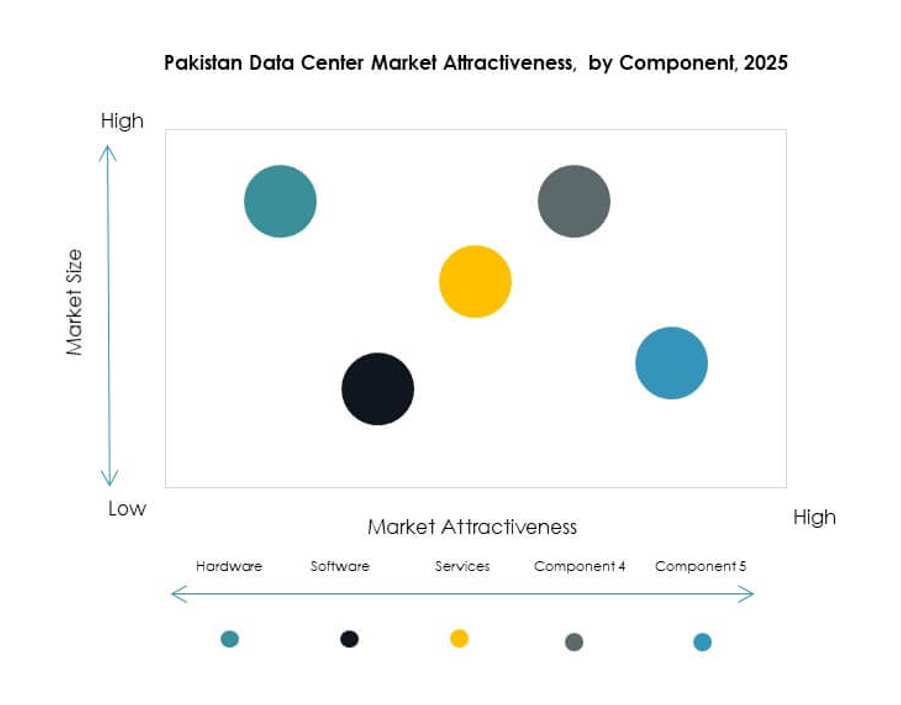

By Component

Hardware holds the dominant share in the Pakistan Data Center Market, driven by demand for servers, storage, networking, and cooling systems. Increasing data traffic requires high-performance infrastructure with efficient power usage. Cooling and security systems gain importance as enterprises prioritize energy efficiency and compliance. Software solutions such as DCIM and virtualization also see growth but remain secondary. Services including consulting and managed offerings expand with cloud adoption. It highlights the market’s reliance on physical infrastructure as the backbone for growth and reliability.

By Data Center Type

Colocation leads the Pakistan Data Center Market due to cost benefits and flexibility for enterprises. Shared facilities allow businesses to scale operations without large capital expenditure. Hyperscale facilities are expanding, driven by cloud providers and global investors. Enterprise and edge setups see rising demand with localized storage needs. Modular centers provide scalability for mid-sized firms. Cloud/Internet data centers support digital businesses, while mega data centers are still in early stages. It positions colocation as the most adopted model for cost control and agility.

By Deployment Model

Cloud-based deployment dominates the Pakistan Data Center Market as businesses move workloads away from traditional setups. Cloud adoption enables scalability, security, and operational efficiency. On-premises deployment continues in regulated sectors such as BFSI and government. Hybrid deployment also sees momentum, offering flexibility between local control and cloud scalability. It supports diverse industry requirements with strong compliance. The shift toward digital business operations accelerates adoption of cloud-first strategies. Enterprises see hybrid setups as essential for long-term sustainability.

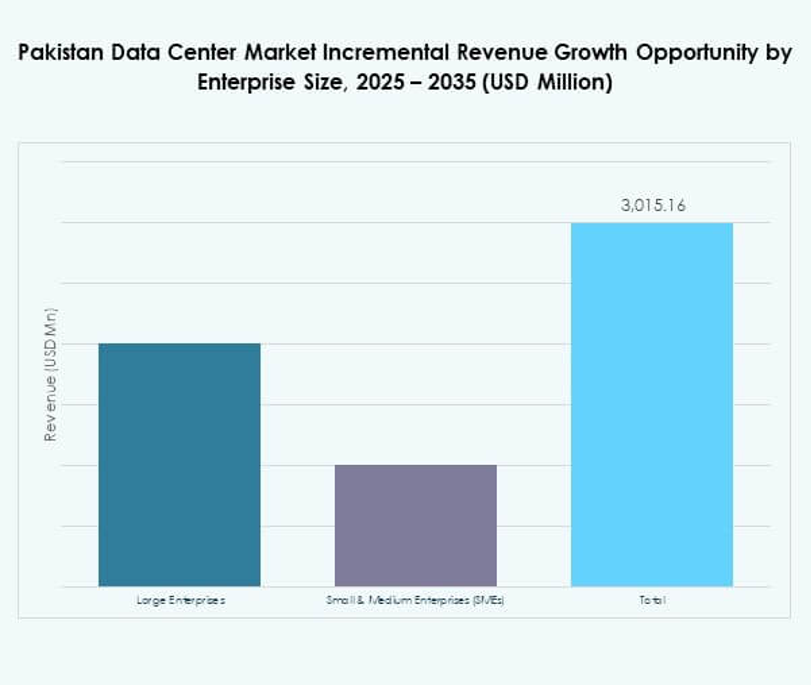

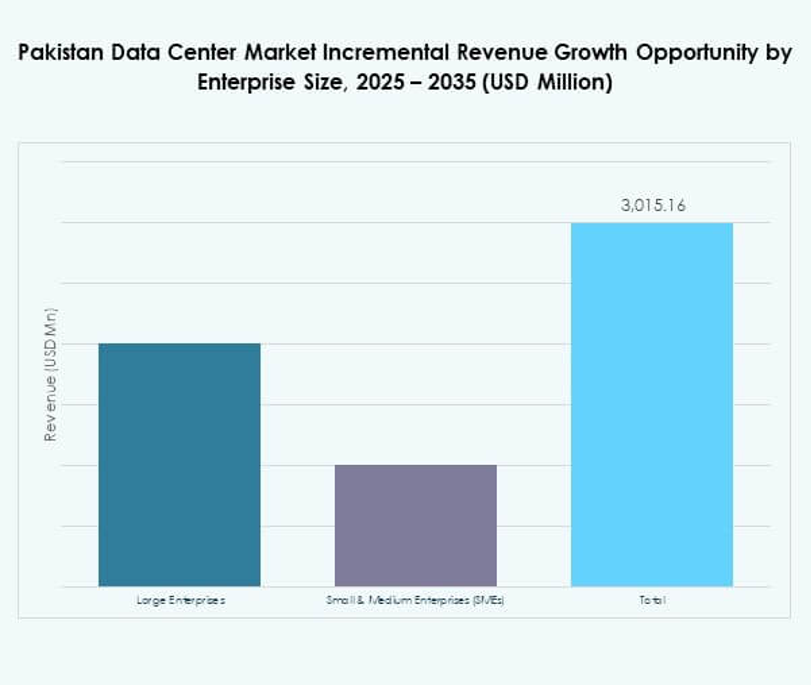

By Enterprise Size

Large enterprises dominate the Pakistan Data Center Market with high adoption of managed hosting, hybrid models, and colocation. These firms require strong performance and compliance for critical operations. SMEs are rapidly increasing their adoption due to affordable cloud-based services. It creates demand for flexible subscription-based pricing. Both groups contribute significantly, but large enterprises hold the highest market share. The expansion of digital services in banking and telecom supports their strong dominance. SMEs remain an important growth driver with untapped opportunities.

By Application / Use Case

IT and telecom dominate the Pakistan Data Center Market with significant share due to heavy reliance on digital services and high-speed networks. BFSI follows closely, driven by secure transactions and compliance requirements. Healthcare and retail sectors are expanding their reliance on cloud and colocation facilities. Media and entertainment demand grows with streaming and gaming. Government and defense invest in secure infrastructure for mission-critical operations. It highlights IT and telecom as the leading vertical due to heavy infrastructure demand.

By End User Industry

Cloud service providers lead the Pakistan Data Center Market with major share, driven by rising demand for cloud hosting. Enterprises also contribute significantly through hybrid and colocation adoption. Government agencies are expanding investments in secure local hosting to ensure compliance. Colocation providers continue to capture mid-sized enterprises seeking cost-effective solutions. It positions cloud service providers as the strongest end users in driving growth. Strategic collaborations between enterprises and hosting providers fuel expansion across industries.

Regional Insights

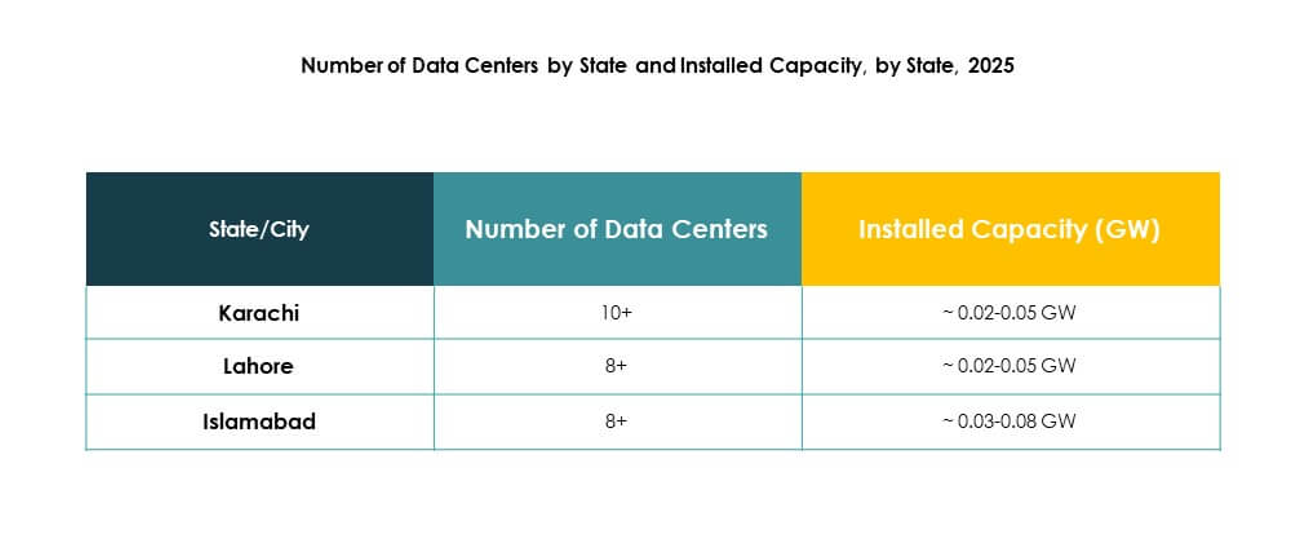

North Pakistan Leading with High Market Share from Telecom and Banking Growth

North Pakistan dominates the Pakistan Data Center Market with a 41% share, driven by strong presence of telecom and banking institutions. Urban hubs like Islamabad and Lahore are central to IT infrastructure expansion. Enterprises in these regions demand advanced facilities for secure hosting. It strengthens local ecosystems with reliable connectivity. Investor confidence remains high in northern hubs due to skilled workforce availability. Regional clustering of enterprises creates economies of scale. The northern subregion continues to hold the strongest share in the market.

Central Pakistan Emerging with Strong Growth in E-commerce and SME Adoption

Central Pakistan holds 34% share of the Pakistan Data Center Market, with growth fueled by e-commerce expansion and SME digital adoption. Cities like Multan and Faisalabad see increasing deployment of colocation and cloud-based services. Local businesses prefer hybrid setups to balance compliance and scalability. It drives demand for flexible hosting solutions across industries. Central regions benefit from strategic connectivity with both north and south. This emerging subregion contributes significantly to new investments in localized infrastructure.

- For example, PTCL’s enterprise business recorded 18.8% year-on-year growth in 2022, driven by expansion in ICT, cloud, and data center services. The company also strengthened its portfolio through managed infrastructure solutions and continued rollout of premium FTTH services.

South Pakistan Developing into a Growing Hub with International Investment Focus

South Pakistan accounts for 25% share of the Pakistan Data Center Market, with Karachi leading as a hub for international investments. Strong port connectivity attracts global enterprises seeking low-latency hosting. Cloud providers and colocation facilities expand in the south to meet demand. It supports industries like trade, logistics, and financial services. International investors view Karachi as a gateway for regional expansion. The south is expected to grow steadily, strengthening its role in the country’s digital economy.

- For example, in June 2025, Data Vault Pakistan launched the country’s first AI-focused data center in Karachi. The solar-powered facility offers GPU-as-a-Service and secure cloud infrastructure to support enterprises and digital innovation initiatives.

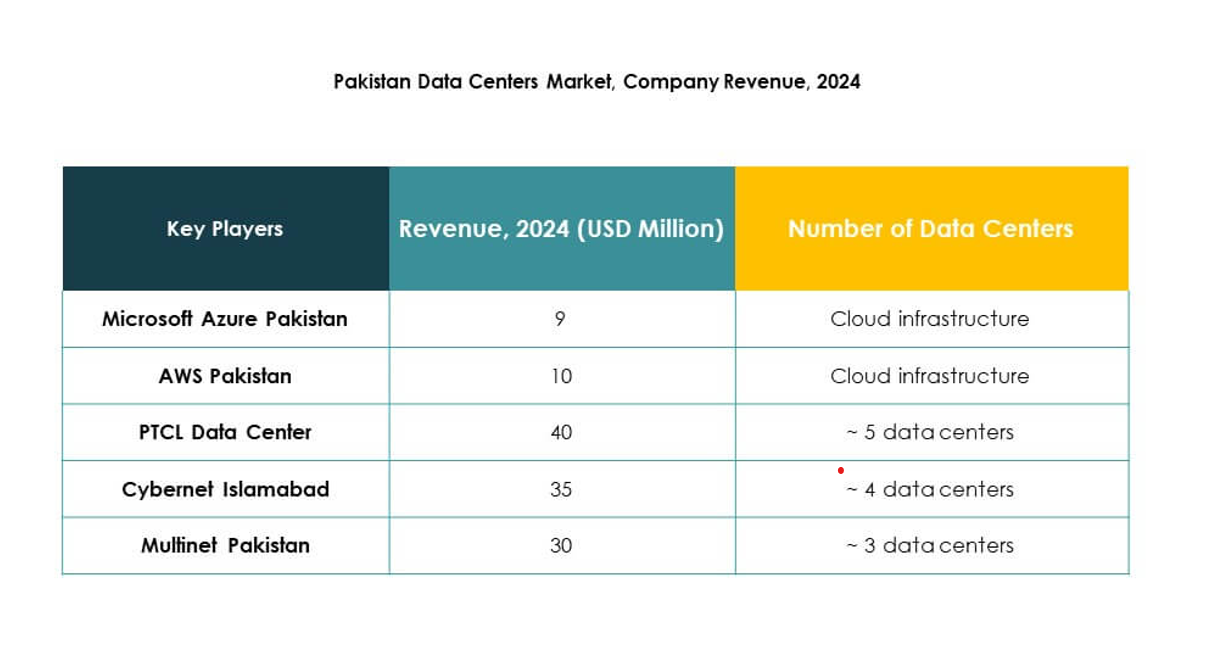

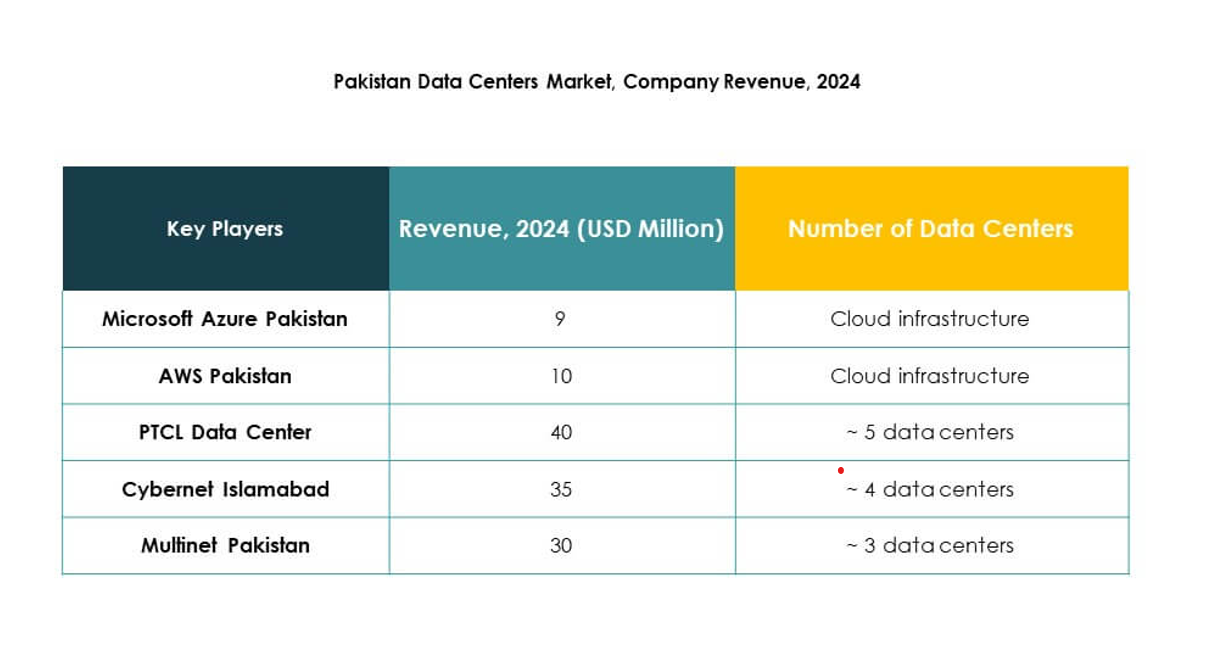

Competitive Insights:

- Jazz (Mobilink)

- Zong 4G (CMPak)

- Nayatel

- Multinet Pakistan

- Cybernet Islamabad

- Microsoft Azure Pakistan

- AWS Pakistan

- PTCL Data Center

The Pakistan Data Center Market is shaped by a mix of telecom operators, global cloud giants, and regional service providers. Local firms like Jazz, Zong, Nayatel, Multinet, and Cybernet focus on colocation, connectivity, and enterprise hosting, leveraging strong domestic networks. PTCL plays a pivotal role with government-backed infrastructure serving public and private sectors. International players such as Microsoft Azure and AWS strengthen the market by introducing hyperscale and hybrid models, raising competitive benchmarks. It fosters innovation through partnerships, managed services, and expansion of green facilities. Market competition centers on scalability, compliance, and energy efficiency, driving differentiation. Companies are aligning strategies to capture demand from SMEs, large enterprises, and government agencies while positioning themselves for long-term digital growth.

Recent Developments:

- In September 2025, Mari Energies announced it is advancing its presence in the technology sector by planning the completion of a new 5MW data center in Islamabad by next year. This initiative marks significant progress in local data infrastructure, promising to support a broader range of cloud and digital services for businesses in the region.

- In August 2025, Indus Cloud, a subsidiary of Master Group of Industries, entered a strategic partnership with Huawei to launch a next-generation cloud data center in Pakistan. This collaboration integrates Huawei’s PowerPod 3.0 technology, which cuts space requirements by 40% and reduces energy consumption by 70%. The project is designed to expand the nation’s cloud ecosystem and align with Pakistan’s Digital Pakistan initiative by enhancing digital infrastructure for enterprises and government users alike.

- In August 2025, Mari Petroleum Company Limited (MPCL) revealed the launch of a new digital infrastructure subsidiary with an equity investment of approximately $36 million. The subsidiary’s focus includes constructing Tier III and Tier IV-certified data centers across Pakistan, starting with a flagship data center in Karachi, to deliver advanced cloud and colocation services for both public and private institutions.

- In June 2025, Jazz completed a major infrastructure partnership with Engro Corporation Limited, strengthening its data center capabilities and enhancing digital transformation for businesses across Pakistan. In April 2025, Jazz entered into a partnership with Nothing smartphones, introducing Nothing’s latest devices to Pakistani consumers exclusively through Jazz, which signals further expansion into digital services and IT infrastructure.