Executive summary:

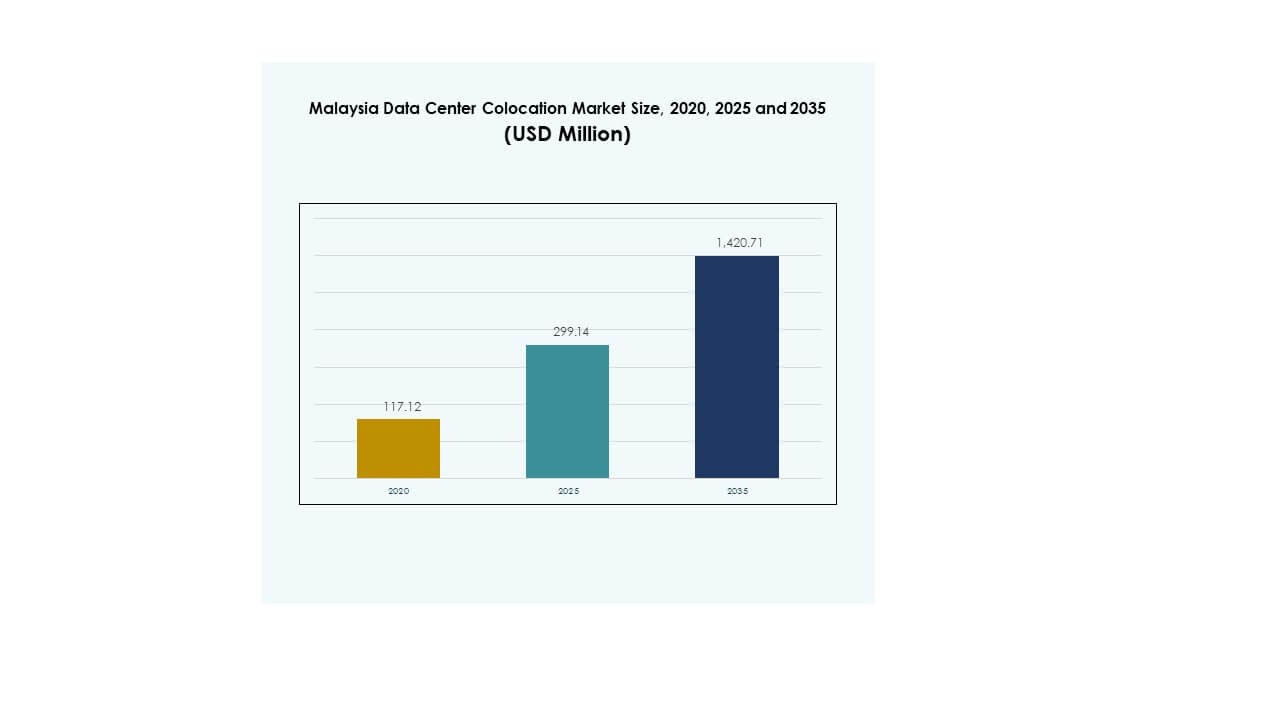

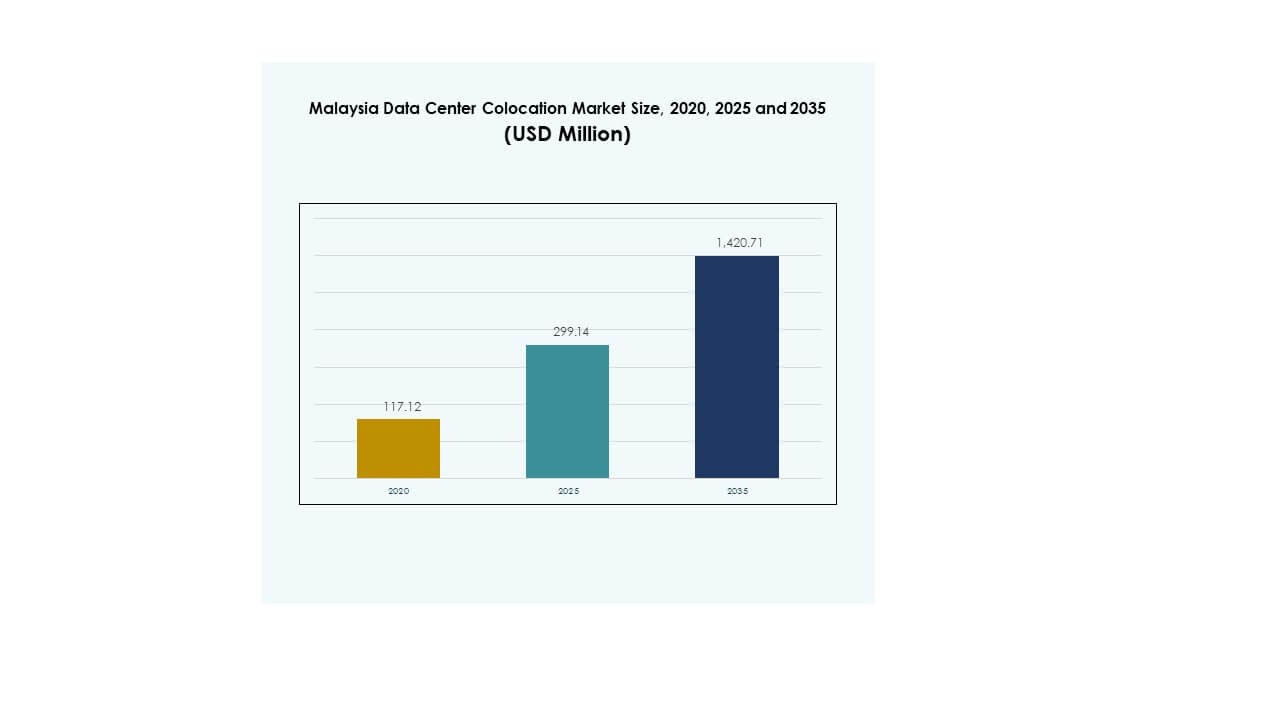

The Malaysia Data Center Colocation Market size was valued at USD 117.12 million in 2020 to USD 299.14 million in 2025 and is anticipated to reach USD 1,420.71 million by 2035, at a CAGR of 16.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Malaysia Data Center Colocation Market Size 2025 |

USD 299.14 Million |

| Malaysia Data Center Colocation Market, CAGR |

16.76% |

| Malaysia Data Center Colocation Market Size 2035 |

USD 1,420.71 Million |

Strong digital transformation initiatives, rapid cloud adoption, and increasing AI integration are driving demand for modern colocation facilities. Enterprises are shifting from on-premise models to scalable, secure, and energy-efficient data center environments. The market plays a critical role in supporting business continuity, reducing infrastructure costs, and enabling high-performance computing. Investors view it as a strategic entry point to tap into Southeast Asia’s expanding digital ecosystem.

Kuala Lumpur leads the market due to advanced infrastructure and robust enterprise connectivity. Johor and Penang are emerging as key hubs driven by geographic advantages and supportive government policies. Strong connectivity, power availability, and cross-border investment make these regions central to Malaysia’s data center growth strategy.

Market Drivers

Rising Enterprise Digital Transformation and Demand for High-Capacity Colocation Infrastructure

Growing digital transformation across industries is driving the expansion of the Malaysia Data Center Colocation Market. Enterprises are increasing investments in cloud services, edge computing, and hybrid IT frameworks to scale operations. Colocation facilities support faster deployment, advanced redundancy, and secure data hosting. It is becoming a core enabler for companies seeking cost optimization and better agility. Businesses are migrating from on-premise to colocation due to power efficiency and operational flexibility. Demand from BFSI, e-commerce, and telecom players is accelerating growth. Investors see colocation hubs as critical infrastructure. This shift positions Malaysia as a prime regional data center hub.

- For instance, AIMS Data Centre inaugurated its expanded Cyberjaya Block 2 facility in April 2024, adding 8 MW of IT load with Tier III infrastructure. The project strengthens the company’s capacity to support financial, telecom, and digital enterprise migration across Malaysia. This expansion reflects the company’s continued investment in critical digital infrastructure.

Strategic Government Support and Regulatory Initiatives Driving Infrastructure Growth

Government initiatives and regulatory reforms are strengthening investor confidence in colocation infrastructure. Policies promoting digital economy growth and energy-efficient infrastructure are attracting hyperscalers and cloud service providers. It is enabling faster project approvals and creating favorable tax structures. Strategic programs like MyDIGITAL are fostering digital competitiveness and infrastructure modernization. This alignment of public and private investment accelerates data center expansion. Long-term commitments to digital policies offer predictability and stability. Companies view Malaysia as a strategic colocation hub due to transparent policies. This policy-driven environment fuels innovation and infrastructure development.

Rapid Adoption of Advanced Technologies Across Core and Edge Environments

Growing integration of AI, IoT, and 5G technologies is reshaping infrastructure requirements. Companies need facilities that offer high-density racks, low latency, and seamless connectivity. It encourages investment in scalable and modular colocation facilities. Automation and intelligent monitoring improve operational efficiency and uptime. This shift supports businesses with real-time data applications and complex workloads. Colocation enables rapid deployment without the burden of infrastructure ownership. Technology-driven innovation is expanding use cases in financial services, manufacturing, and media. These advancements increase strategic value for investors and technology providers.

- For instance, in December 2023, EdgeConneX announced plans to develop nearly 300 MW of data center capacity across Kuala Lumpur, Bukit Jalil, and Cyberjaya. The facilities are designed to support high-density workloads and scalable power configurations. This initiative targets advanced AI, cloud, and content delivery applications.

Expanding Hyperscale Demand and Strong Connectivity Ecosystem

The strong presence of submarine cables and IXPs supports the development of hyperscale-ready data center hubs. Global cloud providers and hyperscalers are expanding footprints to serve growing digital ecosystems. It enhances network resiliency, improves performance, and supports hybrid deployments. Malaysia’s location between major APAC connectivity routes strengthens its role in regional traffic exchange. Companies are choosing colocation for faster market access and service delivery. Hyperscale demand boosts multi-tenant developments and energy-efficient architecture. Strategic infrastructure expansion strengthens investor interest. This creates a competitive ecosystem that drives sustained market growth.

Market Trends

Shift Toward Sustainable and Energy-Efficient Colocation Infrastructure

Sustainability is becoming a defining trend in the Malaysia Data Center Colocation Market. Operators are integrating renewable energy sources and advanced cooling systems to reduce carbon impact. Green building certifications are gaining importance in new developments. It reflects customer demand for responsible operations and regulatory compliance. Energy-efficient designs lower operational costs while improving reliability. Companies view green data centers as strategic assets. The trend aligns with global environmental goals and local energy policies. These changes redefine investment priorities for hyperscalers and enterprises.

Emergence of AI-Ready Data Centers and High-Density Deployments

Rising AI and HPC workloads are driving the evolution of colocation designs. Facilities are incorporating liquid cooling, high rack power density, and intelligent capacity planning. It supports advanced compute requirements for AI, analytics, and automation. This trend is pushing operators to adopt flexible architecture and modular growth models. The emergence of AI-ready infrastructure increases efficiency and performance. Businesses see these facilities as critical to future-proofing digital operations. AI integration also creates opportunities for new revenue models. The trend strengthens Malaysia’s position in the APAC data center network.

Rising Edge Data Center Deployments to Support Low-Latency Applications

Edge deployments are becoming an integral part of colocation strategies. Operators are establishing distributed sites to deliver low-latency services for industries such as gaming, telecom, and financial services. It enables data processing closer to end-users and reduces network congestion. These deployments enhance user experience and application performance. Edge expansion increases flexibility for businesses seeking local presence. This trend also supports critical infrastructure for IoT and 5G applications. The demand for localized capacity strengthens investor confidence. It positions Malaysia as a scalable edge ecosystem in Southeast Asia.

Integration of Automation, AI, and DCIM for Operational Optimization

Automation and AI are transforming how colocation facilities are managed. Operators are using DCIM platforms to optimize power usage, cooling, and asset management. It enhances visibility, reduces downtime, and improves energy utilization. Predictive maintenance minimizes operational risks and improves service reliability. AI-driven monitoring strengthens security and compliance management. This digital shift supports data-driven decisions and faster scaling. Businesses view automated colocation as a strategic advantage. The trend sets a strong foundation for future infrastructure resilience and growth.

Market Challenges

Power Supply Constraints and Rising Energy Consumption Costs

Rising energy consumption creates operational and financial challenges in the Malaysia Data Center Colocation Market. High-density deployments demand stable power infrastructure, but supply limitations persist in some regions. It increases dependency on backup power systems and drives operational costs upward. Energy tariffs and infrastructure upgrade costs impact colocation pricing strategies. Balancing performance with energy efficiency requires significant investment. Operators must optimize cooling and power utilization to maintain competitiveness. Grid limitations slow hyperscale expansion timelines. These power challenges require strong utility partnerships and efficient technology adoption.

Complex Regulatory Landscape and Land Availability Issues

Operators face challenges from complex regulatory frameworks and limited suitable land for large-scale developments. Regulatory approvals often involve multiple agencies and extend project timelines. It affects speed-to-market and raises development costs. Land scarcity in prime locations such as Kuala Lumpur restricts expansion capacity. Companies must secure land with favorable zoning and infrastructure access. Strict environmental regulations demand compliance investment. Market entrants face high barriers to securing permits and suitable sites. These challenges increase the need for strategic planning and government collaboration.

Market Opportunities

Strategic Expansion Through Hyperscaler Partnerships and Regional Connectivity

Strong demand from global cloud service providers creates opportunities for strategic partnerships. Operators can expand capacity through joint ventures and cross-border infrastructure investments. It enhances network reach and strengthens Malaysia’s role as a regional digital hub. Expanding connectivity through submarine cables attracts enterprise and hyperscale customers. These partnerships accelerate buildout and improve market competitiveness. Investors find this environment favorable for long-term returns. Hyperscaler collaboration enhances innovation and operational efficiency.

Accelerating Growth of Edge and AI-Driven Infrastructure Solutions

Edge and AI integration offers new opportunities for colocation operators. The increasing need for low-latency applications drives distributed deployments in key regions. It allows operators to target industries with localized processing needs. AI-ready infrastructure attracts data-intensive industries like manufacturing and financial services. The combination of edge and AI increases strategic importance for investors. Operators can differentiate through specialized solutions. This creates new revenue models and strengthens ecosystem resilience.

Market Segmentation

By Type

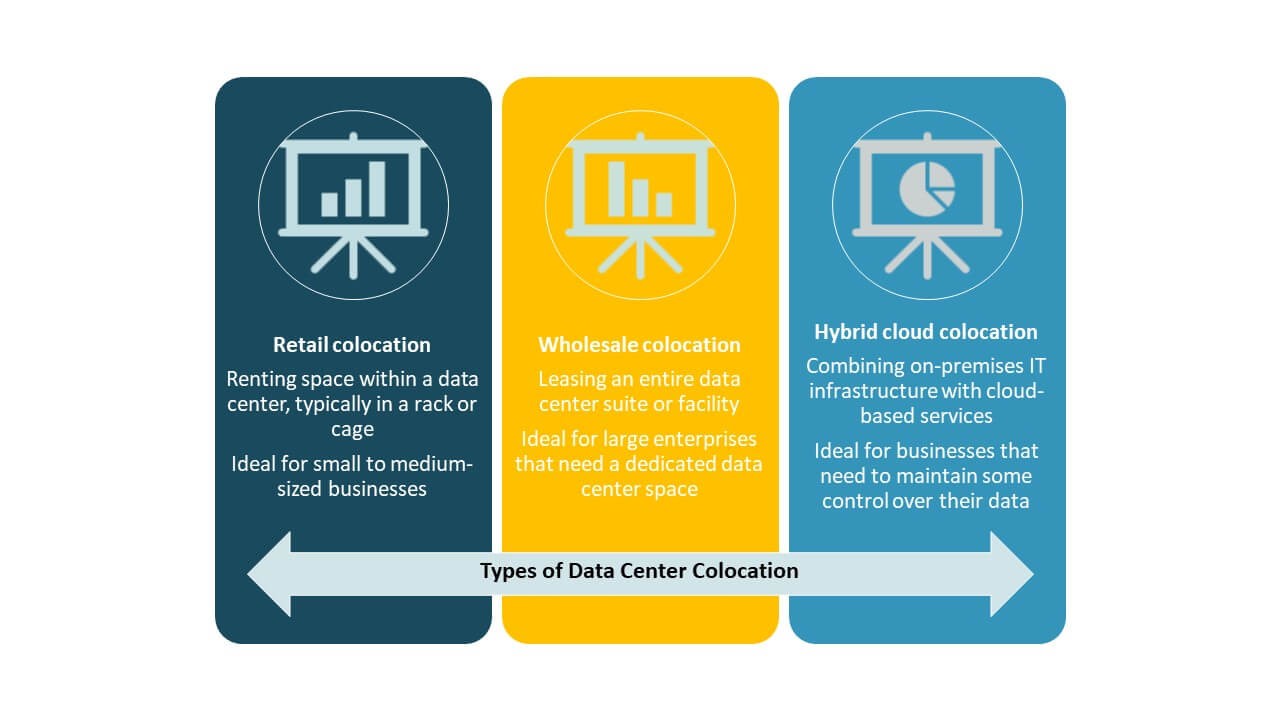

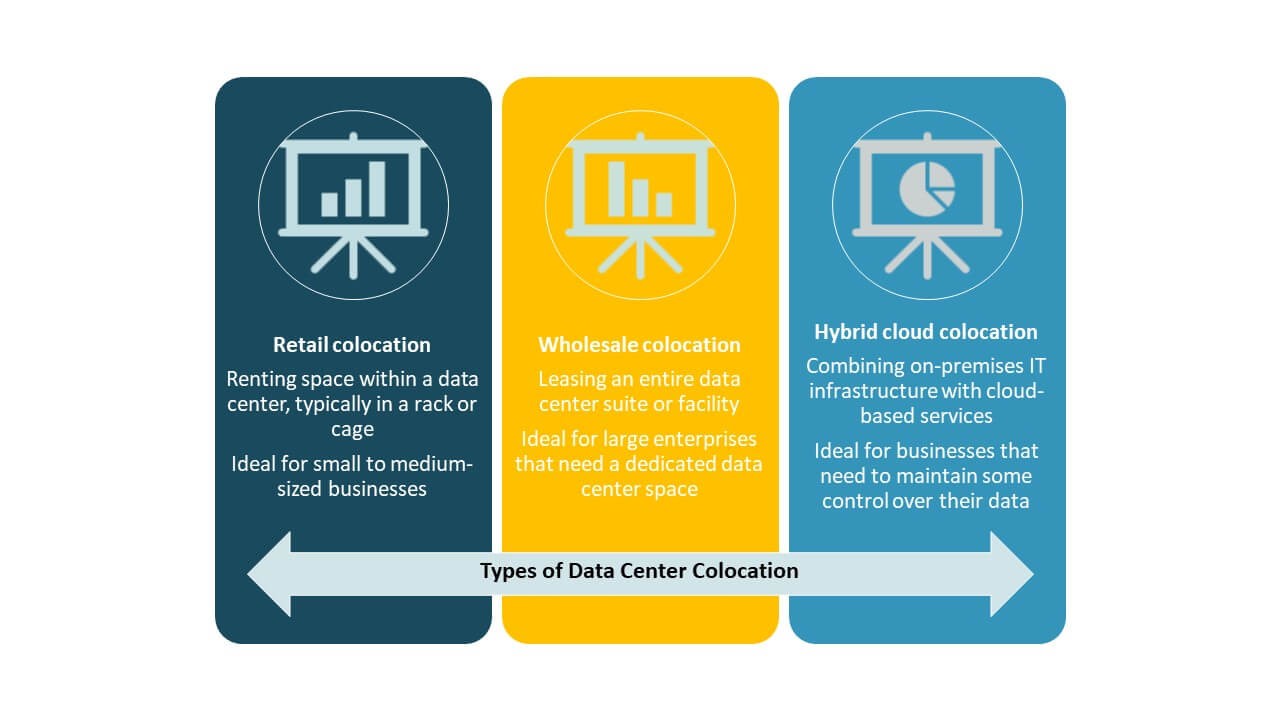

Retail colocation holds a dominant share in the Malaysia Data Center Colocation Market due to strong demand from SMEs and enterprises seeking cost-effective and scalable solutions. Wholesale colocation is gaining momentum with hyperscalers and large enterprises expanding capacity. Hybrid cloud colocation is also rising as businesses adopt multi-cloud strategies. Retail colocation offers flexible pricing, faster deployment, and operational control. These benefits make it the preferred choice for enterprise workloads, driving market expansion.

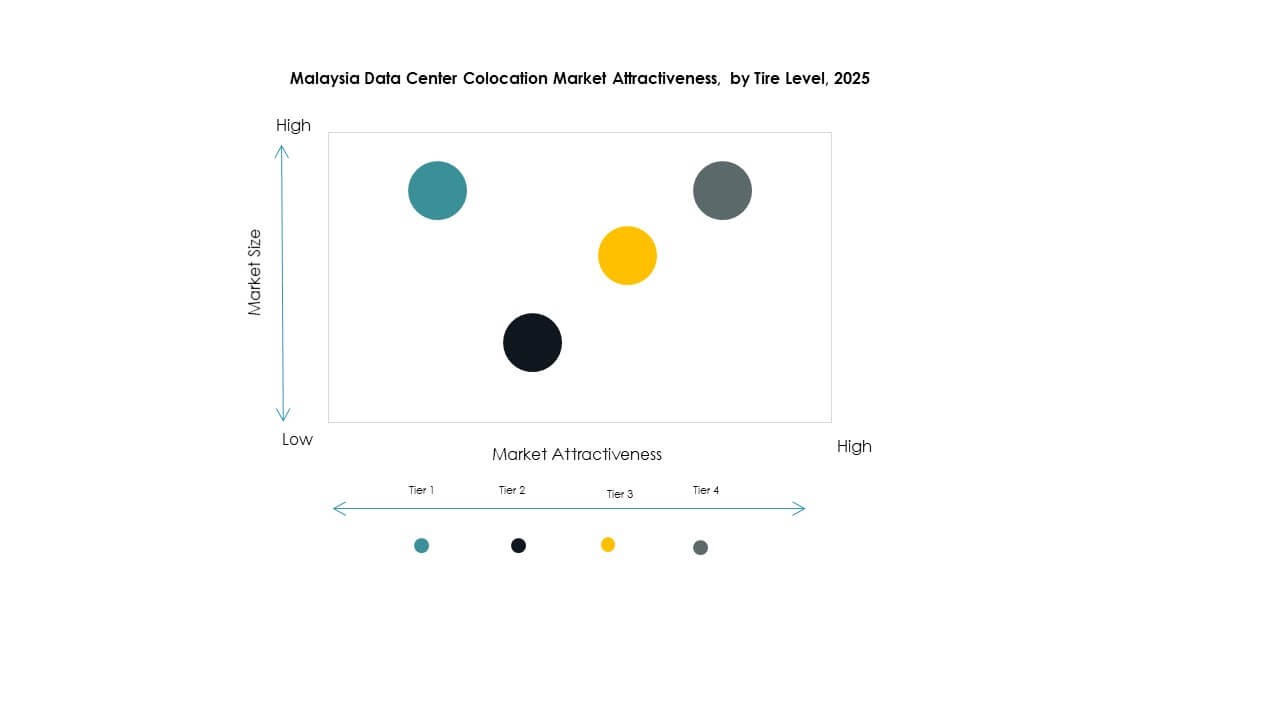

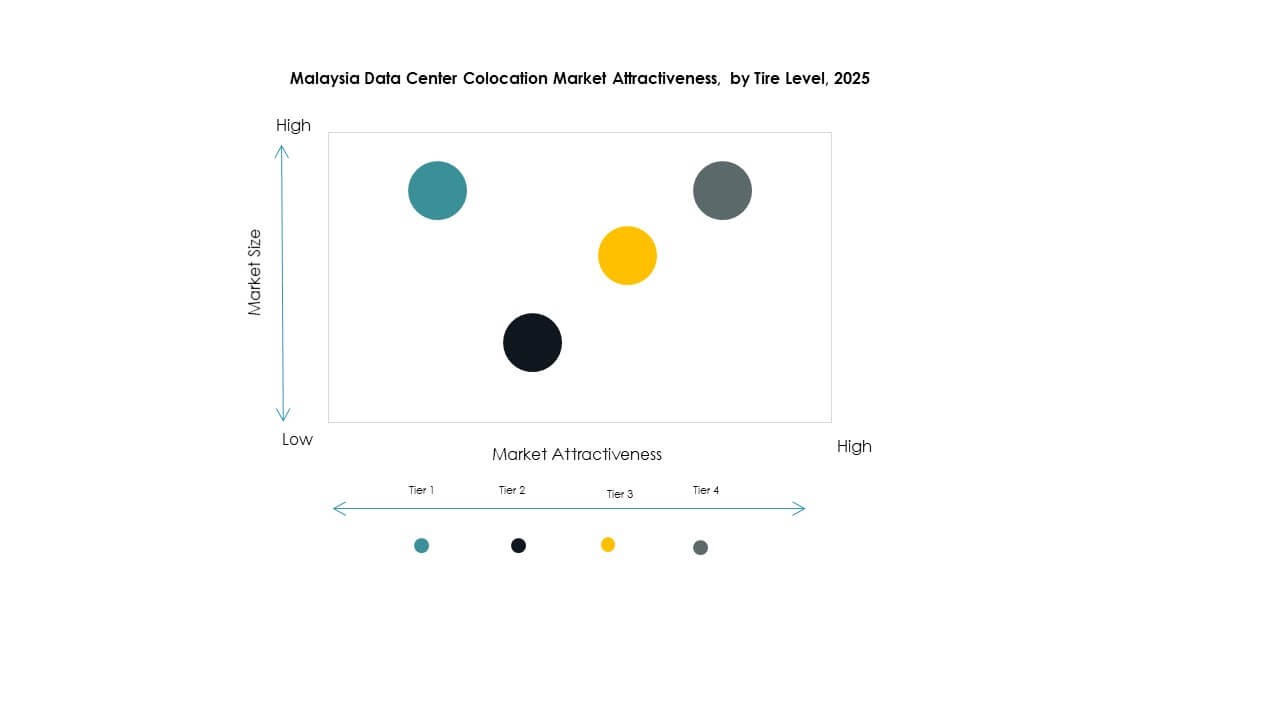

By Tier Level

Tier 3 facilities dominate the Malaysia Data Center Colocation Market due to their strong balance of reliability, energy efficiency, and operational cost. These facilities offer redundant capacity and high uptime standards, which attract enterprises across sectors. Tier 4 infrastructure is expanding to meet hyperscale demands for advanced performance. Tier 1 and Tier 2 remain relevant for smaller workloads. The focus on Tier 3 aligns with global best practices in reliability and cost optimization.

By Enterprise Size

Large enterprises account for the major share of the Malaysia Data Center Colocation Market. They drive demand through high-capacity workloads and advanced IT infrastructure needs. SMEs are adopting colocation to reduce capital expenditure and improve scalability. Large enterprises prioritize uptime, security, and connectivity, which colocation providers deliver effectively. Their strong investment capacity strengthens long-term contracts and revenue stability for operators. SME adoption is expected to grow with digitalization initiatives.

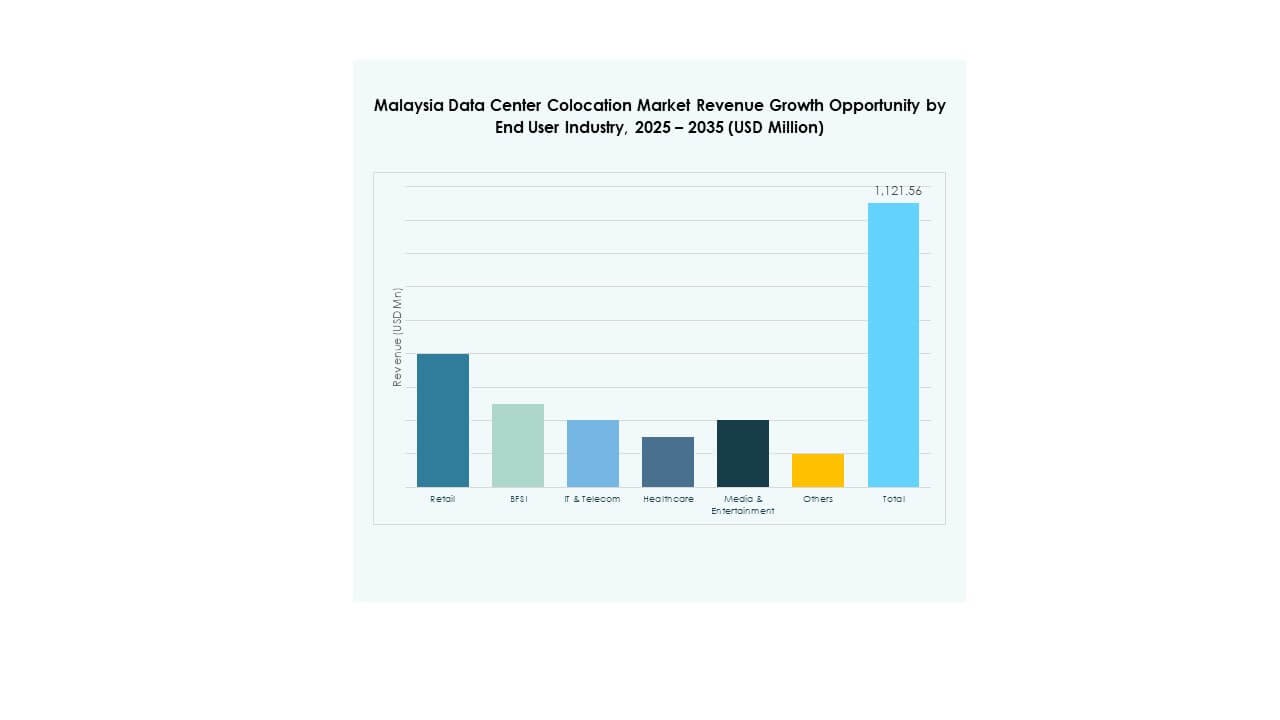

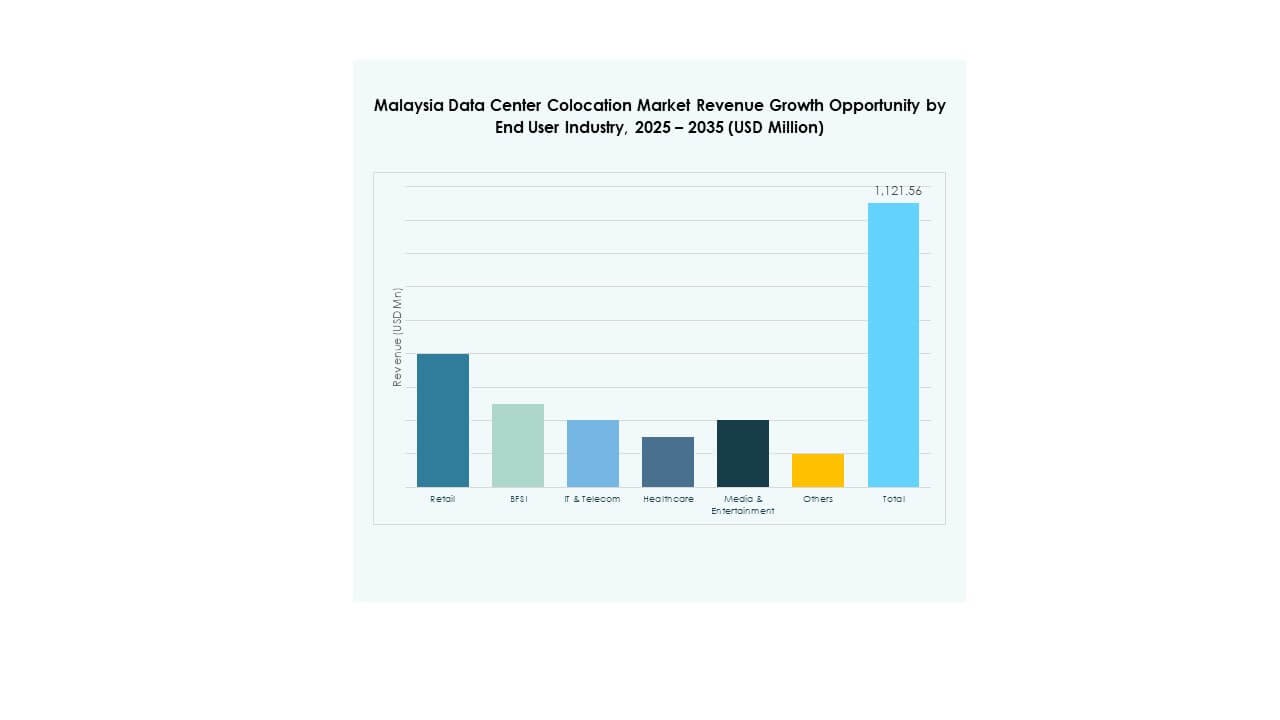

By End User Industry

The IT & telecom sector leads the Malaysia Data Center Colocation Market, supported by cloud service providers, telecom operators, and digital platforms. BFSI follows due to its reliance on secure, high-availability infrastructure. Retail, healthcare, and media sectors are expanding usage driven by e-commerce growth, digital health, and streaming services. IT & telecom’s demand for latency-sensitive and scalable infrastructure makes it the largest segment. Strong sectoral adoption drives ongoing capacity expansion and investment.

Regional Insights

Central Malaysia Leads with 52% Market Share Due to Strong Infrastructure

Central Malaysia, particularly Kuala Lumpur and Selangor, holds 52% of the Malaysia Data Center Colocation Market. This dominance stems from advanced connectivity, fiber networks, and proximity to major enterprises. High power availability and strong policy support attract hyperscalers and large enterprises. The concentration of financial institutions and tech companies boosts demand. Central Malaysia remains the strategic core of colocation development. It also supports hybrid cloud deployments and edge expansion.

- For instance, Microsoft is launching its first Malaysia West cloud region in Greater Kuala Lumpur by Q2 2025. The US$2.2 billion investment will establish three hyperscale data centers and create over 37,000 jobs, including 5,700 skilled IT positions. This project marks one of the largest digital infrastructure investments in the country.

Southern Malaysia Emerges as a Growth Hub with 31% Market Share

Southern Malaysia, including Johor, represents 31% of the Malaysia Data Center Colocation Market. Its location near Singapore and competitive operational costs attract cross-border deployments. Johor is becoming a preferred alternative for hyperscalers seeking capacity diversification. Expanding cable landing stations and renewable energy integration enhance its appeal. Government support for data center zones further drives investment. Southern Malaysia’s growth reflects its strategic geographic advantage.

Northern and Eastern Malaysia Show Rising Potential with 17% Market Share

Northern and Eastern Malaysia together account for 17% of the Malaysia Data Center Colocation Market. Emerging developments in Penang and other industrial zones drive localized colocation demand. These regions benefit from increasing digitalization in manufacturing and logistics. Infrastructure projects are expanding network connectivity and energy availability. Lower costs and proximity to trade hubs support edge deployments. These subregions hold strong potential for future capacity expansion and diversification.

- For example, Open DC officially launched PE2, Penang’s largest next-generation data center, in April 2025 at the Bayan Lepas Technology Park. The facility began with 10 MW IT capacity and is scalable to 30 MW. It achieves a PUE below 1.5 and integrates DE-CIX Malaysia’s Penang Internet Exchange for low-latency connectivity to support AI and cloud workloads.

Competitive Insights:

- Malaysia Posts and Telecommunications (VNPT)

- AIMS Data Centre

- TM ONE

- Bridge Data Centres

- Strateq

- Google Cloud

- Malaysia Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Malaysia Data Center Colocation Market is highly competitive, with strong participation from regional operators and global hyperscale providers. It is shaped by capacity expansion, strategic alliances, and network modernization. Local companies like TM ONE and AIMS strengthen domestic connectivity, while global leaders such as Equinix, NTT, and Digital Realty focus on hyperscale-ready infrastructure. Strategic investments target energy-efficient architecture, AI integration, and high-density deployments. Global cloud providers are enhancing service portfolios to support hybrid and edge environments. Intense competition drives innovation in cooling technologies, security systems, and operational automation. This competitive structure accelerates infrastructure development and strengthens the market’s role as a regional hub.

Recent Developments:

- In October 2025, Colt Data Centre Services announced a joint venture with ESR to develop a 130MW hyperscale data center campus in Osaka, Japan. The partnership combines Colt’s operational expertise with ESR’s development capabilities, marking an ongoing expansion of Colt’s presence in the Asia-Pacific region, complementing its network and service offerings for customers in Malaysia.

- In September 2025, Vantage Data Centers announced a major acquisition deal involving Yondr Group’s Malaysia data center campus located in Johor Bahru. The acquisition, valued at approximately $1.6 billion, marked a strategic move by Vantage to strengthen its presence in Southeast Asia. The campus, which spans 72.5 acres in Sedenak Tech Park, features a 300MW capacity and is among Malaysia’s largest colocation developments.

- In August 2025, NTT DATA partnered globally with Google Cloud to enhance agentic AI and cloud modernization for enterprises. The collaboration combines NTT’s deep industry expertise with Google Cloud’s analytics and AI tools to deliver scalable AI-driven enterprise solutions. This global partnership underpins NTT’s broader expansion strategy in the Asia-Pacific region, including Malaysia.

- In August 2025, Vietnam Posts and Telecommunications Group (VNPT) entered a partnership with South Korean IT firm LG CNS to develop a hyperscale artificial intelligence data center in Vietnam. Under this collaboration, LG CNS will provide AI and cloud technology as well as data center design expertise, with future expansion plans including Malaysia and Singapore.

- In July 2025, AIMS Data Centre completed the construction of Cyberjaya Block 3 ahead of schedule, strengthening Malaysia’s position as Southeast Asia’s leading data center hub. Following its partnership with DigitalBridge, AIMS secured over RM2 billion in capital to support Malaysia’s digital infrastructure, helping attract foreign investment and global cloud service providers to the country.