Executive summary:

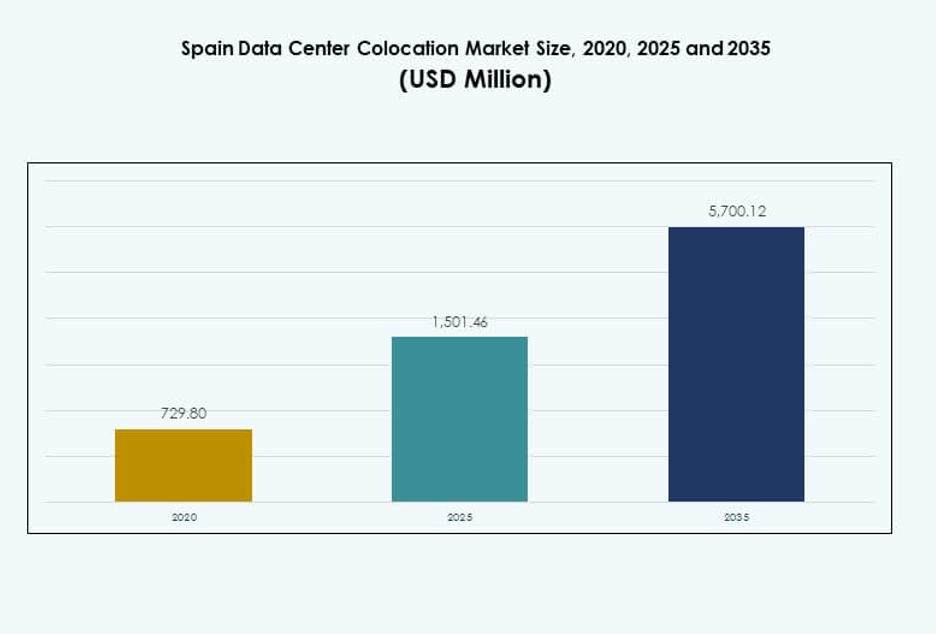

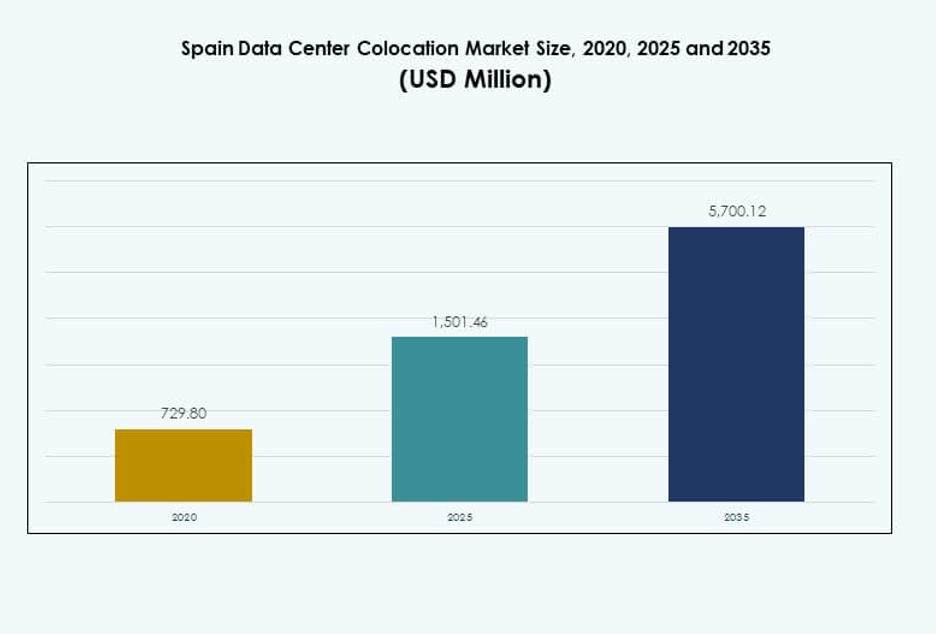

The Spain Data Center Colocation Market size was valued at USD 729.80 million in 2020 to USD 1,501.46 million in 2025 and is anticipated to reach USD 5,700.12 million by 2035, at a CAGR of 14.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Spain Data Center Colocation Market Size 2025 |

USD 1,501.46 Million |

| Spain Data Center Colocation Market, CAGR |

14.21% |

| Spain Data Center Colocation Market Size 2035 |

USD 5,700.12 Million |

The rising demand for scalable IT infrastructure and high-capacity connectivity is driving investments across both hyperscale and enterprise colocation segments, making Spain a key digital infrastructure hub in Southern Europe. Strong cloud adoption, growing submarine cable connectivity, and rising edge deployments are fueling market growth. Companies are adopting colocation to enhance operational agility, reduce latency, and support AI-driven workloads. Hyperscalers, telecom operators, and enterprises are investing in high-efficiency facilities that deliver security, reliability, and sustainable power usage. The market’s strategic role in supporting cross-border data flows is attracting global and regional investors seeking long-term infrastructure opportunities.

Madrid leads the market due to its strong connectivity, developed power infrastructure, and growing hyperscale ecosystem. Barcelona is emerging as a strategic hub supported by new subsea cables and expanding digital infrastructure. Coastal cities and industrial zones are gaining importance through distributed colocation deployments. These regional developments are strengthening Spain’s position as a leading gateway for data traffic in Southern Europe.

Market Drivers

Accelerating Adoption of Digital Infrastructure and Strategic Enterprise Modernization

The Spain Data Center Colocation Market is driven by rapid digital transformation across multiple industries. Businesses are adopting cloud-native applications, AI workloads, and edge computing to increase operational agility. Strong enterprise demand is pushing colocation providers to upgrade power capacity, cooling systems, and network infrastructure. Investments in advanced IT infrastructure are enabling companies to support mission-critical workloads with higher resilience and scalability. Telecom operators and cloud hyperscalers are expanding their presence to address rising compute and storage needs. Enterprises view colocation as a cost-efficient alternative to building private data centers. It is becoming a core element of Spain’s digital economy, enabling flexible, secure, and energy-efficient operations. Investors are identifying colocation facilities as strategic assets for long-term infrastructure portfolios.

- For instance, Equinix launched its MD6 data center in Madrid with 4.8 MW of IT power capacity and 1,466 square meters of colocation space. The facility is designed to meet growing enterprise demand for high-performance, cloud-connected infrastructure in Spain.

Expansion of Submarine Cable Landings Strengthening International Connectivity

Global connectivity is expanding through strategic submarine cable deployments linking Spain to North Africa, North America, and other European hubs. These cables provide high-capacity, low-latency routes essential for hyperscale cloud providers, content delivery networks, and financial services. Spain’s coastal regions, including Barcelona and Bilbao, are becoming prime landing points for new cable systems. This development supports rapid data traffic growth and international interconnection, positioning the country as a gateway for cross-regional data flows. Colocation facilities located near cable landing stations are gaining higher strategic importance. It is benefiting from increased global data exchange and interconnection-driven workloads. Enhanced connectivity creates new opportunities for technology service providers and enterprises. These infrastructure improvements support sustainable growth and competitive positioning.

- For instance, the 2Africa submarine cable consortium, backed by Meta, Vodafone, and China Mobile, landed in Barcelona in October 2022 at the AFR-IX Telecom cable landing station. The system has a design capacity of 180 Tbps, enhancing international connectivity between Europe, North Africa, and the Middle East.

Rising Focus on Sustainability and Energy-Efficient Infrastructure Solutions

Environmental regulations and corporate sustainability targets are accelerating demand for energy-efficient colocation solutions. Operators are integrating liquid cooling systems, renewable power sources, and smart energy management platforms. These technologies lower energy consumption and reduce carbon emissions. Green building certifications and efficient PUE levels are becoming major selection criteria for enterprises choosing colocation providers. Sustainability initiatives are shaping facility design, power sourcing, and operational frameworks. It is strengthening the country’s position as a hub for environmentally responsible infrastructure. Global cloud providers are partnering with renewable energy developers to support sustainable growth. Regulatory support for green infrastructure is encouraging large-scale investment in low-carbon data centers.

Strong Cloud and Edge Ecosystem Development Enhancing Market Competitiveness

Spain is witnessing accelerated deployment of hybrid and multi-cloud strategies supported by hyperscale operators. Enterprises are migrating workloads to colocation facilities that offer proximity to cloud on-ramps and edge nodes. Edge computing infrastructure is enabling faster response times for applications in AI, IoT, and content delivery. Major technology providers are collaborating with colocation operators to create integrated digital ecosystems. This convergence of cloud and edge technologies enhances network performance and service reliability. It is driving higher demand for strategically located colocation capacity. Enterprises are gaining improved operational flexibility and optimized cost structures. The expansion of this ecosystem is making Spain a competitive digital infrastructure destination in Europe.

Market Trends

Integration of AI and Automation in Facility Operations for Enhanced Efficiency

AI and automation are transforming data center colocation operations in Spain. Operators are adopting predictive maintenance, real-time monitoring, and autonomous energy optimization to reduce downtime and improve efficiency. AI-driven workload management enables better capacity utilization and resource allocation. Intelligent building management systems are lowering operational costs and improving sustainability metrics. Automated controls support compliance with energy and security regulations. It is enabling faster response to infrastructure changes and minimizing manual intervention. The adoption of these technologies is improving service reliability and operational resilience. Colocation providers are gaining a competitive edge through intelligent automation strategies.

Increasing Adoption of Modular and Scalable Facility Designs for Flexibility

Colocation operators are investing in modular data center designs to meet fluctuating enterprise demand. Prefabricated modules and scalable capacity blocks enable faster deployment and optimized resource utilization. Modular designs allow flexible expansions while maintaining operational continuity. This approach reduces construction time and capital expenditure. Enterprises benefit from the ability to scale infrastructure in alignment with workload growth. It is improving operational agility and supporting a diverse customer base. The trend is reinforcing Spain’s position as an attractive location for global and regional infrastructure investments. Scalability and flexibility are becoming key differentiators in the market.

Growing Importance of Network Edge and Distributed Computing Models

Edge computing is gaining strong traction across Spain’s colocation landscape. Distributed data centers located near urban and industrial zones enable low-latency processing for real-time applications. Enterprises are deploying edge nodes to support AI-driven analytics, IoT devices, and critical industrial systems. This infrastructure reduces backhaul costs and improves response times. Telecom and hyperscale operators are collaborating to integrate edge nodes with backbone colocation sites. It is reshaping the way data is processed and delivered across industries. The adoption of distributed computing enhances Spain’s digital capabilities and market competitiveness. Edge infrastructure is becoming central to next-generation digital services.

Rising Investments from Global Hyperscalers and Strategic Collaborations

Global hyperscale operators are investing heavily in Spain’s colocation ecosystem. Strategic partnerships with local providers are driving network expansions and facility upgrades. Hyperscalers are integrating AI-ready infrastructure and sustainable energy solutions to meet global standards. These investments are stimulating demand for advanced colocation capacity and interconnected campuses. It is positioning the market as a critical node for regional and international cloud traffic. Collaborative development models are enhancing service portfolios and market depth. Hyperscaler involvement is accelerating innovation, operational maturity, and long-term capacity growth. This trend is setting a new benchmark for infrastructure modernization in Spain.

Market Challenges

High Infrastructure and Energy Costs Affecting Market Profitability

The Spain Data Center Colocation Market faces rising infrastructure and power costs that impact profitability. Building and maintaining high-tier data centers demand significant capital investment and specialized technology integration. Energy expenses remain one of the largest operational cost components for operators. Fluctuating energy prices create financial pressure, especially for facilities relying on non-renewable sources. Regulatory requirements for energy efficiency increase the need for costly upgrades. It is forcing operators to balance operational excellence with financial viability. These challenges limit smaller providers’ ability to compete with global players. Strategic cost management and renewable energy adoption are becoming critical priorities.

Complex Regulatory Environment and Land Availability Constraints

Complex permitting procedures and land scarcity near key connectivity hubs are slowing data center developments. Securing suitable land for large-scale facilities near urban and cable landing points is increasingly difficult. Regulatory approval timelines add delays to expansion plans and increase project costs. Strict environmental and energy compliance frameworks require advanced technical planning and higher capital commitments. It is creating entry barriers for new market participants. These limitations affect deployment speed and capacity scalability. Operators must navigate these regulatory complexities with strategic planning and strong stakeholder engagement. Policy alignment and streamlined approval processes are essential for sustaining growth.

Market Opportunities

Rising Role of Spain as a Strategic Connectivity Gateway for Global Data Flows

Spain’s geographic location between Europe, Africa, and the Americas is unlocking major connectivity opportunities. Submarine cable landings are boosting international data capacity and positioning the country as a regional hub. Enterprises and hyperscalers view Spain as a strategic point for interconnection expansion. It is driving demand for large-scale colocation campuses near cable stations. This development supports growing traffic from AI, cloud, and content services. Strong infrastructure investments are increasing foreign participation and innovation.

Expanding Ecosystem for Edge, AI, and Cloud Convergence

Edge and AI-driven infrastructure expansion is creating new growth avenues for colocation providers. Enterprises are deploying workloads closer to end users to improve performance and reduce latency. Colocation sites offering AI-ready power density and connectivity are gaining higher strategic value. It is creating strong incentives for both domestic and international investors. Convergence of edge and cloud ecosystems supports the development of next-generation services. Spain’s digital infrastructure ecosystem is evolving into a regional technology powerhouse.

Market Segmentation

By Type

Retail colocation holds the largest share in the Spain Data Center Colocation Market due to its flexible deployment models and service customization. Enterprises prefer retail colocation for scalable rack deployments and managed service options. Wholesale colocation is expanding, driven by hyperscale cloud providers seeking dedicated capacity. Hybrid cloud colocation is emerging as a strong growth segment as enterprises adopt hybrid architectures. It is benefiting from rising digital transformation initiatives and increasing demand for secure, scalable infrastructure across multiple industries.

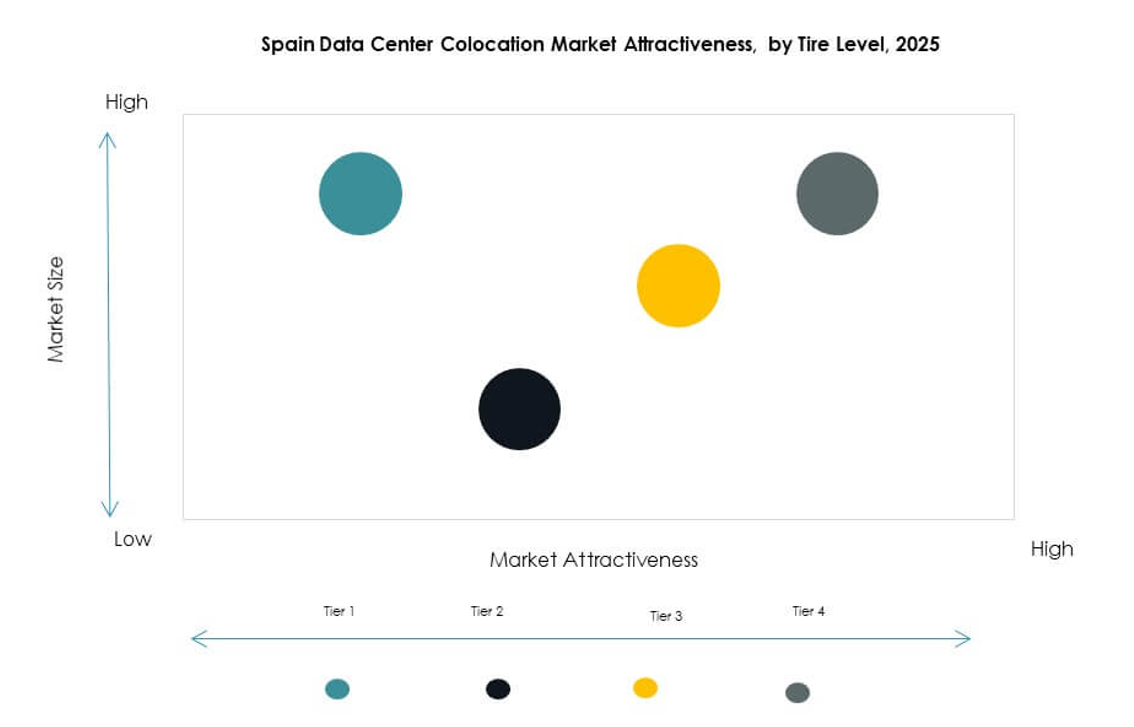

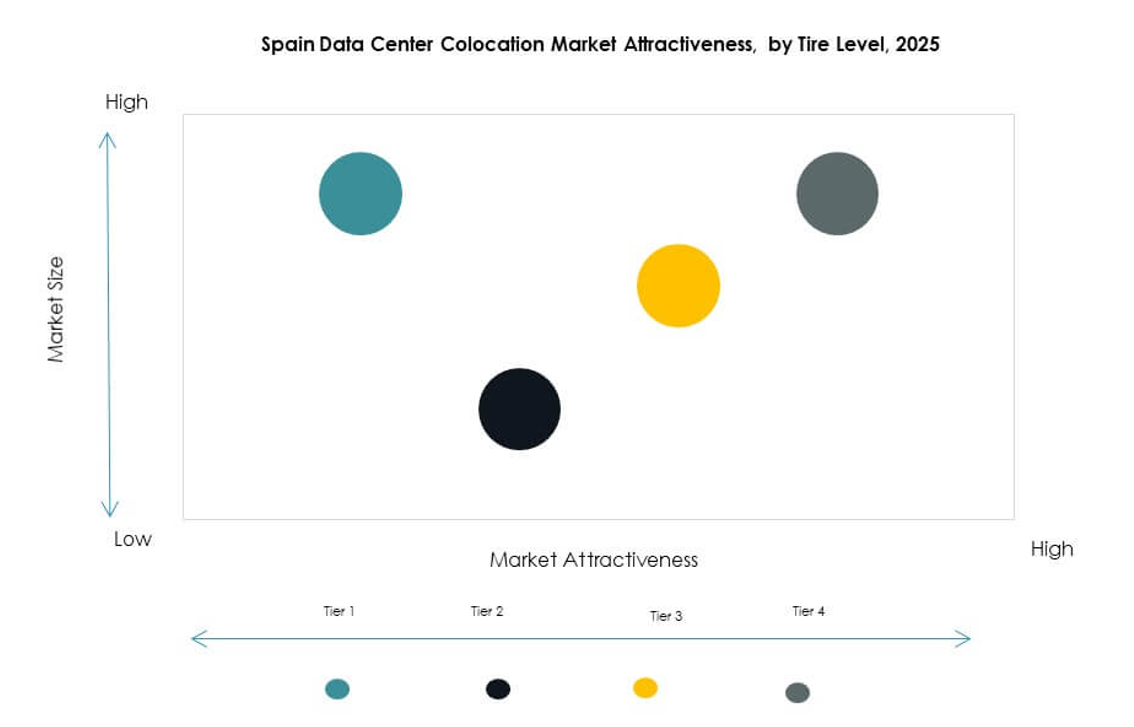

By Tier Level

Tier 3 facilities dominate the Spain Data Center Colocation Market due to their strong balance between operational efficiency and cost-effectiveness. These facilities provide high availability and redundancy suitable for most enterprise workloads. Tier 4 data centers are growing rapidly as hyperscale and AI-driven deployments demand ultra-reliable infrastructure. Tier 1 and Tier 2 sites serve niche and edge applications in less urbanized regions. It is supporting diversified infrastructure development aligned with business continuity goals.

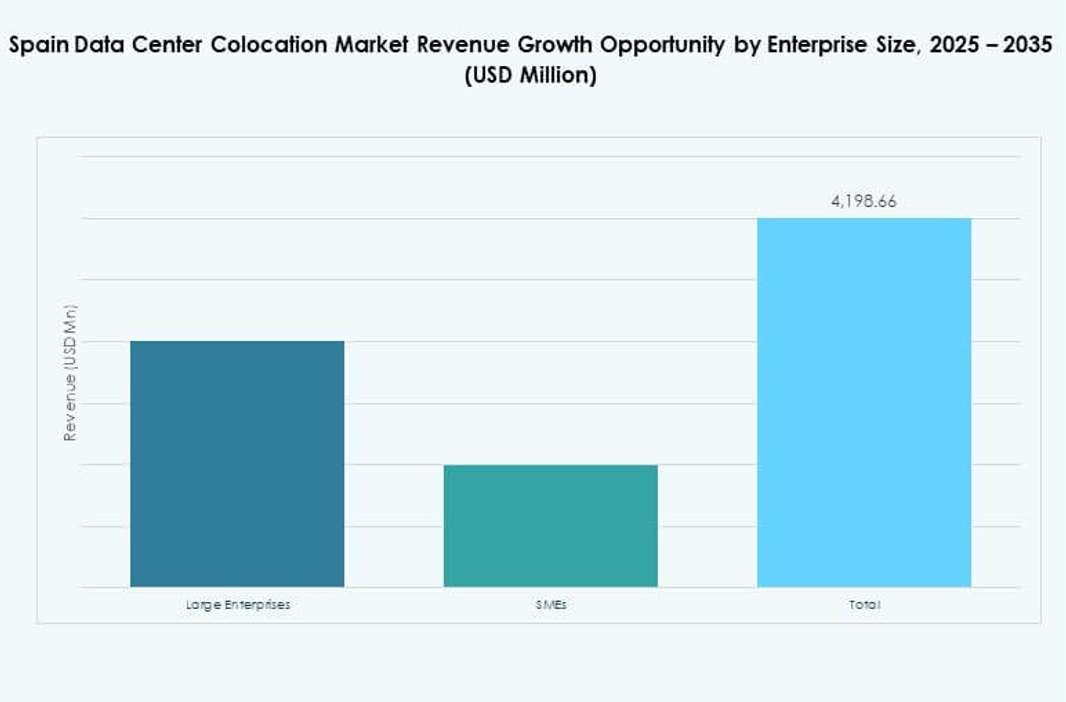

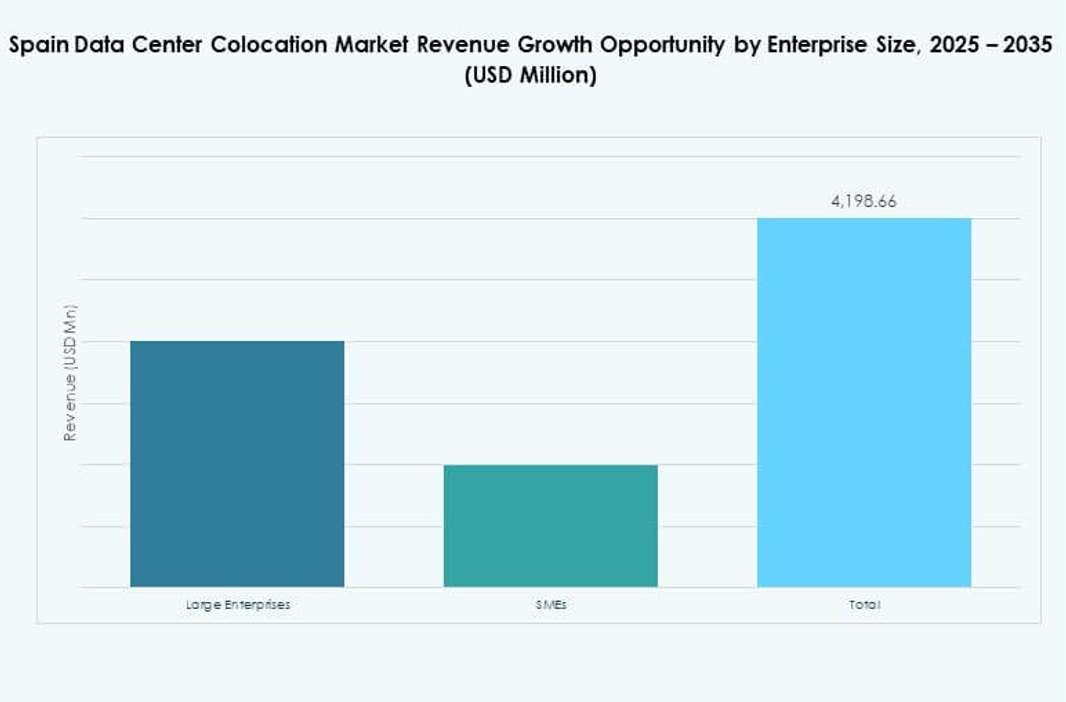

By Enterprise Size

Large enterprises account for the majority share of the Spain Data Center Colocation Market. Their focus on security, reliability, and scalable capacity drives strong adoption of colocation facilities. SMEs are increasing their participation through retail colocation and hybrid solutions. Rising digital adoption and cloud-native strategies are enabling smaller businesses to access advanced infrastructure. It is expanding the addressable customer base and supporting overall market growth.

By End User Industry

The IT & Telecom sector dominates the Spain Data Center Colocation Market, driven by rapid 5G deployments, edge computing, and AI adoption. BFSI follows closely, focusing on secure infrastructure for critical workloads. Healthcare is expanding its footprint with advanced data hosting for telemedicine and patient management systems. Media and entertainment industries leverage colocation for content delivery and streaming services. It is driving diversification and deeper integration of colocation solutions across verticals.

Regional Insights

Madrid – Leading Digital Infrastructure Hub with 48% Market Share

Madrid holds the largest share of the Spain Data Center Colocation Market at 48%. Its central location, advanced connectivity, and strong energy infrastructure make it the country’s primary colocation hub. Hyperscalers and cloud providers are concentrating deployments in Madrid to leverage its high-capacity network backbone. It is also a preferred location for interconnection due to proximity to major enterprises and government networks. Strong investment inflows are supporting large-scale expansions. Madrid’s ecosystem is driving national capacity growth and shaping Spain’s competitive position in Europe.

- For instance, Interxion (Digital Realty) expanded its Madrid campus with the MAD3 facility at Calle de Emilio Muñoz 49-51. The site is integrated with other Interxion data centers through a dedicated fiber ring, enhancing connectivity and supporting Madrid’s position as a key digital hub in Spain.

Barcelona – Emerging Coastal Connectivity and Hyperscale Expansion Zone with 32% Market Share

Barcelona holds 32% of the market share and is gaining rapid momentum through its strategic position on the Mediterranean coast. Submarine cable landings and international connectivity are attracting hyperscale operators. The city’s focus on smart infrastructure and innovation clusters supports colocation growth. It is becoming a critical node for AI, cloud, and content delivery workloads. Barcelona’s infrastructure investments are enhancing Spain’s role as a gateway for global data flows. Strong international interest is accelerating facility development in the region.

Other Regions – Strategic Coastal and Industrial Developments with 20% Market Share

Other regions contribute 20% of the Spain Data Center Colocation Market. Bilbao, Valencia, and Malaga are witnessing steady growth with investments near cable landing points and industrial clusters. These locations are supporting distributed computing and edge deployments. It is improving national coverage and reducing network congestion in primary hubs. Energy availability and strategic positioning are encouraging enterprises to expand workloads. The spread of colocation infrastructure across these regions strengthens Spain’s digital resilience and network diversity.

- For instance, Spanish ISP Sarenet announced a new data center outside Bilbao, scheduled for completion in 2025. The facility spans 1,000 square meters and provides 3 MW of IT power capacity for up to 340 racks, strategically positioned to serve industrial and cable landing clusters in the region.

Competitive Insights:

- Interxion (Digital Realty)

- Acens

- Telefónica

- Iberdrola Data Center

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Spain Data Center Colocation Market features strong competition among global hyperscalers and regional infrastructure providers. It is witnessing accelerated expansion through strategic alliances, facility upgrades, and investments in energy-efficient infrastructure. Leading players are building large-scale campuses near submarine cable landing points and urban hubs to support high interconnection demand. Global firms like AWS, Equinix, and Digital Realty are strengthening their presence through capacity expansions and hybrid solutions. Local operators such as Telefónica and Acens maintain a competitive edge with tailored enterprise services. Partnerships between energy firms and data center providers are supporting sustainability goals. The market shows a clear shift toward integrated ecosystems combining colocation, cloud, and edge infrastructure.

Recent Developments:

- In September 2025, Digital Realty announced a significant investment of nearly €500 million in Spain to develop two new data centers in Madrid and Barcelona, reinforcing the company’s continued expansion in the Spanish market. The new facilities are intended to support growing demand for colocation and cloud-neutral services in Southern Europe, solidifying Digital Realty’s position as a major player in the region.

- In July 2025, Iberdrola announced a strategic joint venture with Echelon Data Centres to create what is being described as the largest binding agreement of its kind in Europe between an energy utility and a data center operator. Iberdrola will hold a 20% stake, provide land and supply 24/7 electricity, while Echelon will handle development and operations. The partnership’s first project is a 144 MW data center in Spain, with a secured 230 MW grid connection.