Executive summary:

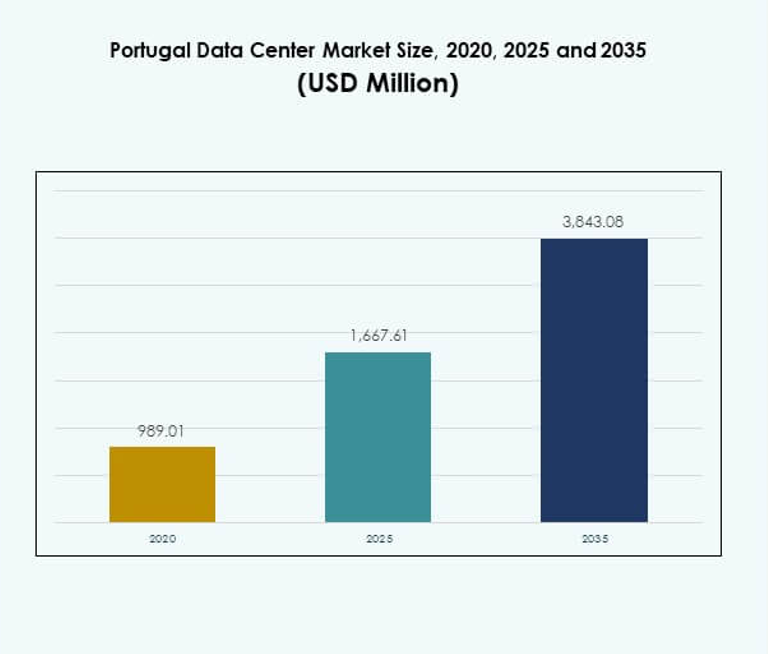

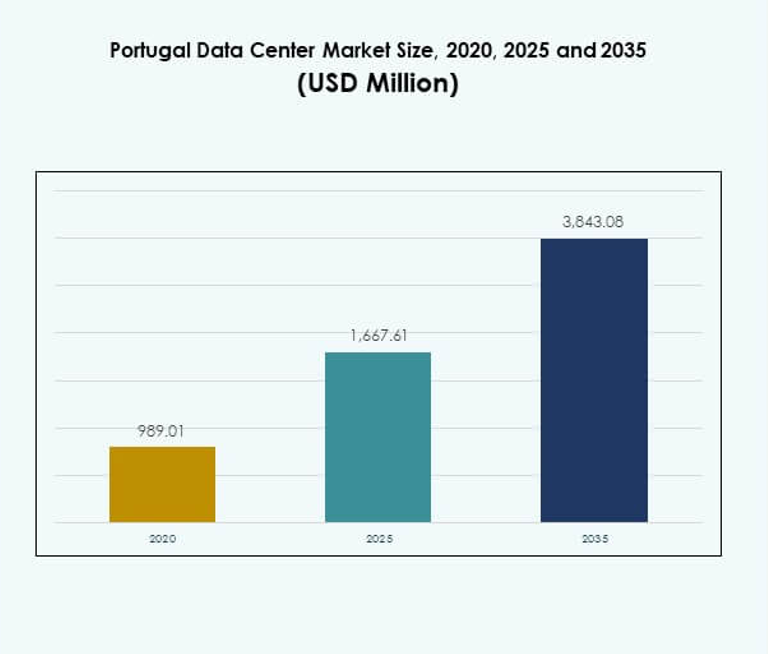

The Portugal Data Center Market size was valued at USD 989.01 million in 2020 to USD 1,667.61 million in 2025 and is anticipated to reach USD 3,843.08 million by 2035, at a CAGR of 8.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Portugal Data Center Market Size 2025 |

USD 1,667.61 Million |

| Portugal Data Center Market, CAGR |

8.67% |

| Portugal Data Center Market Size 2035 |

USD 3,843.08 Million |

The market is driven by digital transformation across industries, rising adoption of cloud services, and strong demand for hyperscale facilities. Enterprises increasingly rely on AI, IoT, and edge computing, pushing investments in modern and energy-efficient infrastructure. Innovation in automation and renewable-powered operations positions Portugal as a strategic hub for global connectivity, attracting businesses and investors seeking sustainable and scalable solutions.

Regionally, Western Europe leads with strong digital adoption and advanced infrastructure, making it the most influential subregion. Southern Europe is emerging with Portugal gaining importance due to its transatlantic connectivity and renewable energy integration. Northern and Eastern Europe also show growth potential, supported by modernization and investments in sustainable data infrastructure.

Market Drivers

Rapid Technology Adoption Driving Digital Transformation and Infrastructure Expansion

The Portugal Data Center Market is supported by strong momentum in digital adoption. Enterprises demand advanced storage and computing capabilities to handle rising volumes of structured and unstructured data. Cloud migration strategies are creating demand for scalable and flexible infrastructure. Edge and IoT deployment across industries accelerates adoption of advanced hardware and networking solutions. Businesses prioritize energy-efficient systems to meet operational and regulatory goals. Government initiatives encouraging digital transformation strengthen the investment environment. It strengthens Portugal’s position as a key hub in Europe.

- For example, Equinix launched its second Lisbon IBX data center (LS2) in June 2024, featuring an initial investment of €50 million, and providing 2,050 sqm of co-location space with an initial 625 rack capacity. The LS2 facility is positioned to meet growing enterprise demand, offering adjacency to high-capacity subsea connectivity and driving Portugal’s strategic digital hub status.

Innovation in Data Center Design and Efficiency Enhancing Competitiveness

Energy-efficient infrastructure design is becoming a priority to reduce operational costs and environmental footprint. New cooling solutions, renewable energy integration, and modular systems are reshaping facilities. Enterprises focus on automation to optimize resources and achieve higher operational efficiency. Integration of AI-enabled monitoring ensures predictive maintenance and resilience. The Portugal Data Center Market benefits from companies emphasizing green initiatives. Investors value Portugal’s access to renewable power sources to support sustainable growth. It helps enterprises align operations with international environmental standards.

- For example, Start Campus, in partnership with Schneider Electric, launched the SIN01 data center in Sines, Portugal with an initial capacity of 26 MW, scalable to a 1.2 GW campus. The facility uses seawater cooling and operates on 100% renewable energy, supported by Schneider Electric’s EcoStruxure platform for real-time energy management.

Shifts Toward Cloud-Based and Hybrid Models Creating Strategic Opportunities

Businesses are accelerating transition from legacy systems to cloud-based and hybrid infrastructure. Growing reliance on SaaS platforms fuels storage and security investments. Hyperscale data centers attract large technology players seeking reliable infrastructure in Western Europe. Enterprises aim to balance scalability, security, and cost-effectiveness through hybrid deployment. Rising digital payments and e-commerce increase demand for low-latency systems. The Portugal Data Center Market gains relevance in global digital supply chains. It offers investors strategic entry into Europe’s expanding digital economy.

Strategic Importance of Portugal’s Position in Transatlantic Connectivity

Portugal’s location makes it a vital gateway for transatlantic data traffic. Submarine cables connect Europe with Africa and the Americas, strengthening connectivity. Enterprises benefit from low-latency links and access to global markets. Investments in high-speed networks attract global service providers. The Portugal Data Center Market leverages geographic strengths for regional dominance. It helps businesses position infrastructure strategically for scalability. Portugal’s rising role enhances investor confidence and long-term stability.

Market Trends

Growth of Hyperscale Facilities and Increasing Investment by Global Providers

Global cloud service providers are expanding hyperscale infrastructure across Portugal. Rising demand for large-scale storage and compute capacity drives this trend. Enterprises require high-bandwidth, low-latency connections for AI, IoT, and analytics workloads. Hyperscale centers deliver cost efficiency and operational flexibility. The Portugal Data Center Market reflects growing foreign investment interest. It creates opportunities for colocation and managed services providers. Portugal emerges as an attractive destination for multinational digital expansion.

Adoption of Artificial Intelligence and Machine Learning for Operations Optimization

AI and ML are increasingly used for predictive analytics and automated monitoring. Enterprises deploy these tools to reduce downtime and optimize cooling and power usage. Smart systems enable predictive maintenance, lowering operational risk. AI-driven workload allocation enhances energy efficiency. The Portugal Data Center Market integrates automation as a standard feature. It makes operations more resilient and cost-effective. Industry players prioritize AI adoption to stay competitive in global markets.

Sustainability Initiatives and Green Data Centers Setting a Competitive Benchmark

Enterprises commit to renewable energy sourcing for powering infrastructure. Solar, wind, and hydro resources support cleaner data center operations. Providers develop green-certified facilities to meet regulatory compliance and investor expectations. Sustainable cooling solutions gain adoption for environmental and cost benefits. The Portugal Data Center Market is becoming aligned with Europe’s carbon neutrality targets. It enhances brand value and customer trust. Green innovation sets Portugal apart from less sustainable regional markets.

Expansion of Edge and Modular Data Centers for Localized Needs

Edge data centers grow in importance for latency-sensitive applications. Enterprises demand faster processing for 5G, IoT, and real-time analytics. Modular facilities support flexible deployment in urban and regional locations. These solutions enable scaling without high upfront investments. The Portugal Data Center Market sees rising interest from SMEs seeking affordable solutions. It supports distributed computing strategies for modern industries. Edge facilities enhance competitiveness across multiple sectors including retail and healthcare.

Market Challenges

High Energy Costs and Infrastructure Limitations Creating Barriers for Growth

The Portugal Data Center Market faces rising concerns over high energy expenses. Operators need significant investment to maintain competitive efficiency standards. Limited availability of advanced grid infrastructure delays renewable energy integration. It challenges small players unable to bear long-term operational costs. Enterprises face difficulties in balancing sustainability with profit margins. Delays in permitting and construction timelines restrict capacity expansion. Investors consider cost structures carefully before entering Portugal.

Talent Shortages and Cybersecurity Concerns Impacting Operational Readiness

Data center operators require specialized skills for AI integration, automation, and cloud orchestration. Portugal faces a limited pool of trained professionals, slowing adoption. Enterprises must invest heavily in workforce training programs. The Portugal Data Center Market also encounters rising cybersecurity threats. It raises concerns over data protection for regulated industries like BFSI and healthcare. Increasing sophistication of cyberattacks drives demand for advanced security. Compliance with strict data regulations adds operational challenges.

Market Opportunities

Expansion of Renewable Energy Integration and Green Data Center Growth

Portugal’s renewable energy potential strengthens investment opportunities in sustainable infrastructure. Operators can leverage solar and wind power to reduce carbon footprint. The Portugal Data Center Market aligns with EU sustainability frameworks. It positions Portugal as a regional leader in green hosting services. Global enterprises seek low-carbon operations, making Portugal an attractive destination. Demand for sustainable colocation services supports steady growth. Investors benefit from long-term energy cost savings.

Rising Role of Edge Computing and Regional Data Traffic Expansion

Edge infrastructure enables faster services for industries requiring low latency. Portugal’s strategic location supports high data traffic from transatlantic cables. The Portugal Data Center Market leverages geographic strength for global demand. It enhances opportunities for SMEs to access affordable modular facilities. Edge expansion supports healthcare, retail, and fintech sectors. Enterprises capitalize on distributed computing to improve performance. Regional connectivity enhances Portugal’s competitiveness in the European market.

Market Segmentation

By Component

Hardware dominates the Portugal Data Center Market, driven by demand for servers, storage, and cooling. It accounts for the largest share due to scalability requirements in hyperscale and colocation facilities. Strong investment in power and security systems enhances resilience. Software, including DCIM and virtualization tools, grows steadily with automation adoption. Services such as consulting and managed offerings add value for SMEs. Hardware remains the critical backbone ensuring operational performance and efficiency.

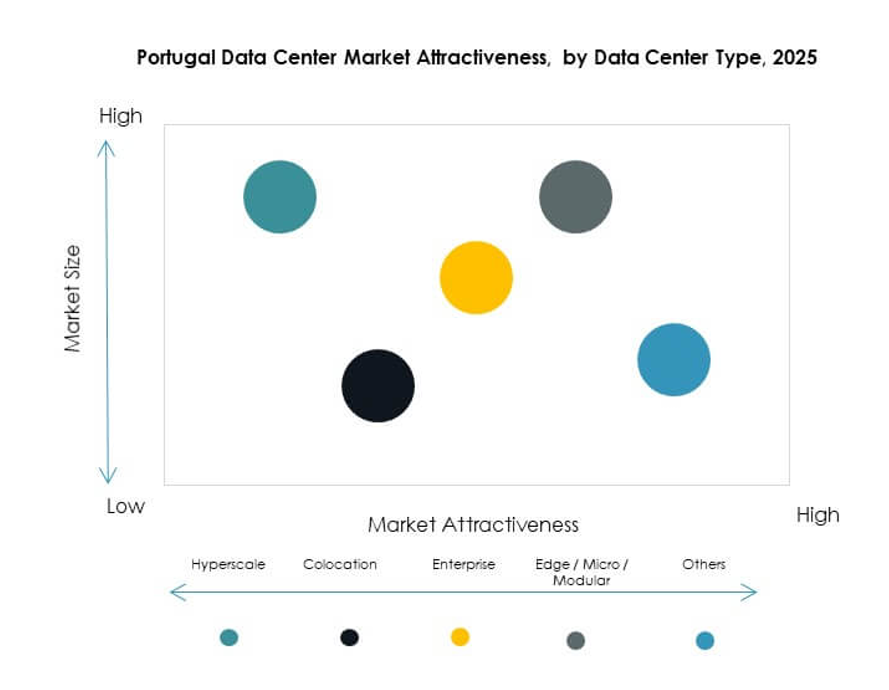

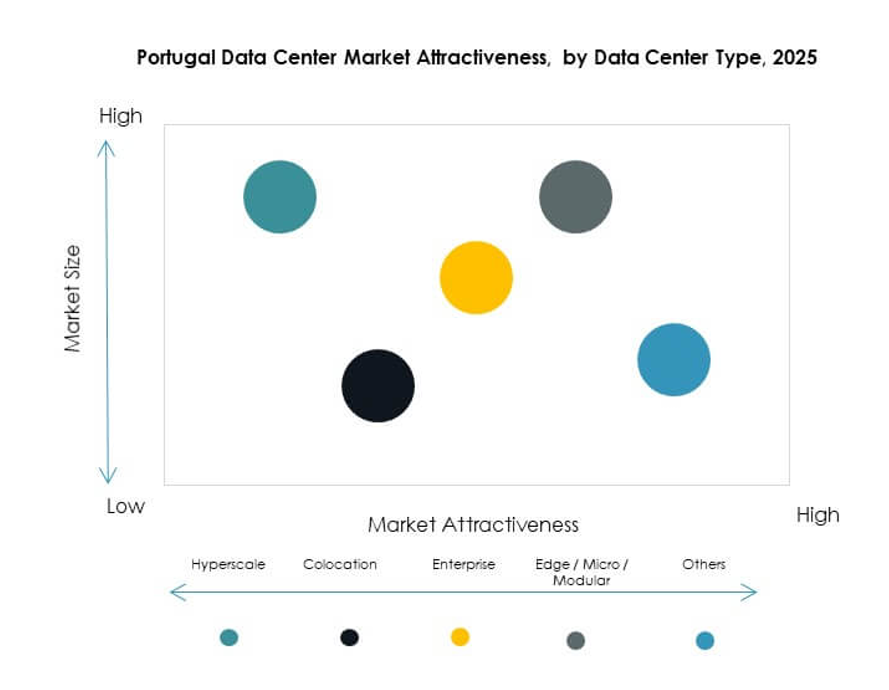

By Data Center Type

Hyperscale facilities lead the Portugal Data Center Market due to strong cloud provider investments. Colocation centers also expand rapidly, serving enterprises with cost-effective hosting solutions. Edge and modular centers grow in response to low-latency requirements. Enterprise data centers retain importance but see slower growth. Mega centers are fewer but influential in supporting large-scale international traffic. Cloud and internet data centers represent strong demand across industries.

By Deployment Model

Cloud-based deployments dominate with enterprises migrating workloads to scalable platforms. The Portugal Data Center Market benefits from hybrid adoption offering flexibility and resilience. On-premises models retain use in highly regulated industries. Hybrid models attract businesses balancing security with scalability. Cloud adoption rises across BFSI, retail, and telecom. It reflects Portugal’s growing maturity in digital infrastructure.

By Enterprise Size

Large enterprises dominate demand with complex data storage and processing requirements. The Portugal Data Center Market also experiences growth from SMEs. SMEs adopt modular and colocation services to reduce costs. Large organizations drive hyperscale expansion and hybrid deployments. SMEs embrace cloud-based solutions for flexibility. Both groups contribute to broad market growth across sectors.

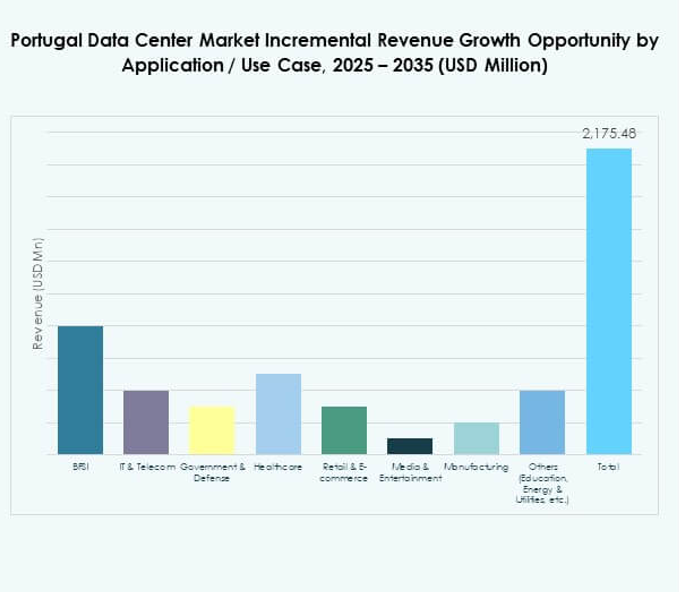

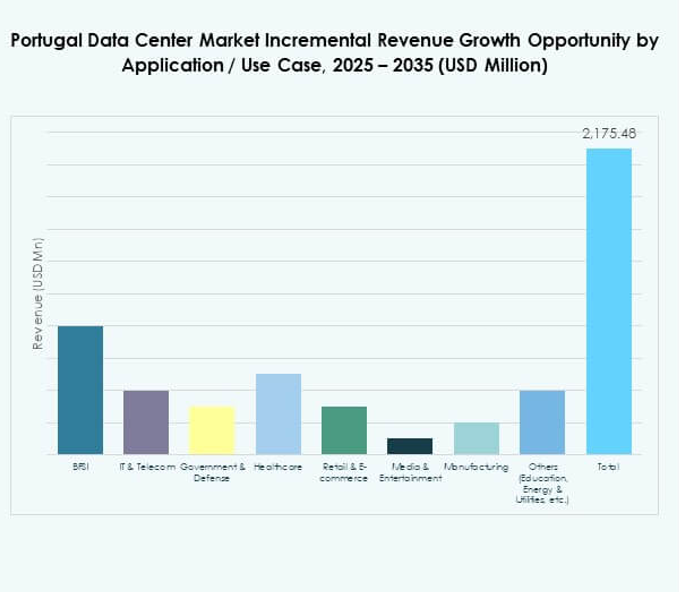

By Application / Use Case

IT and telecom lead applications, supported by connectivity growth and digital adoption. BFSI invests heavily in secure data hosting to manage critical information. The Portugal Data Center Market expands with demand from retail, healthcare, and e-commerce. Media and entertainment adopt solutions for streaming and content delivery. Manufacturing integrates IoT and analytics support from robust data infrastructure. Education and utilities also expand usage for digital transformation.

By End User Industry

Cloud service providers dominate the Portugal Data Center Market. Enterprises adopt colocation and hybrid solutions for operational flexibility. Colocation providers attract demand from SMEs seeking affordable infrastructure. Government agencies strengthen demand for secure data hosting and compliance. The diverse user base strengthens resilience across industries.

Regional Insights

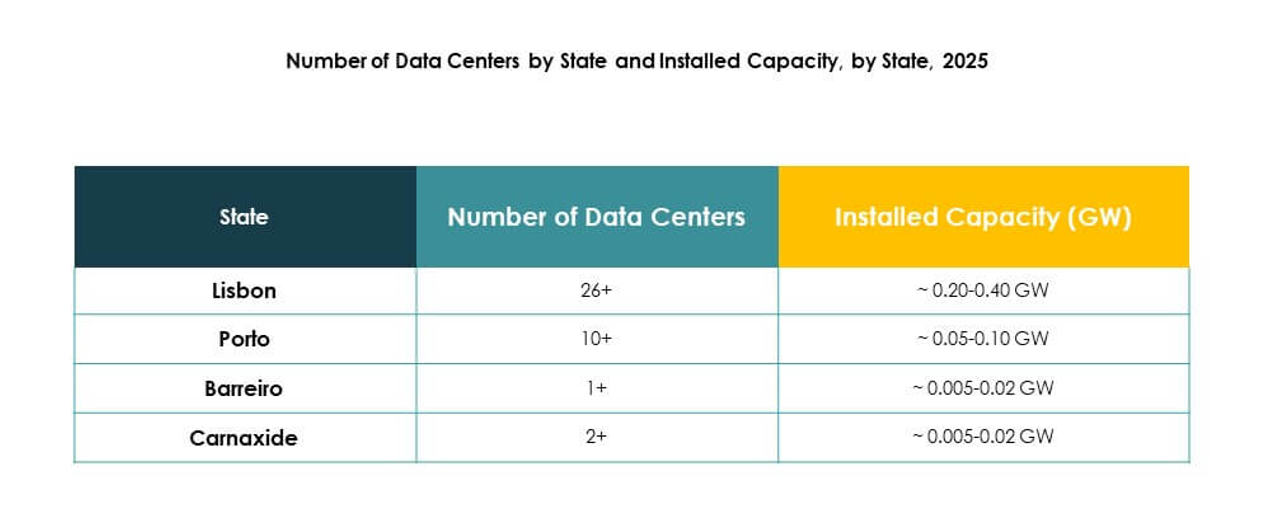

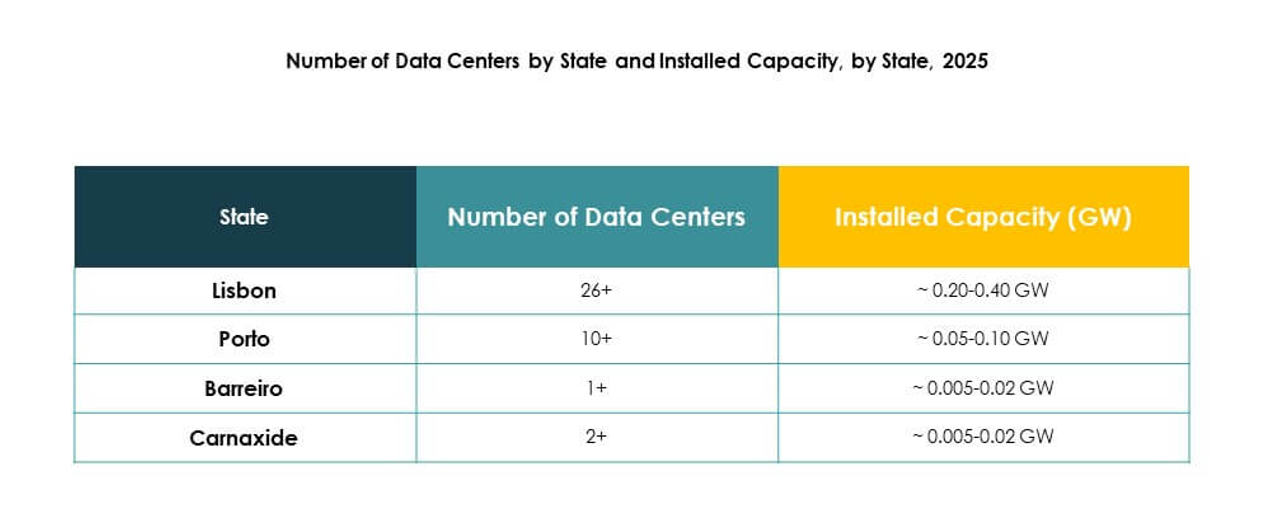

Western Europe Leading With Advanced Infrastructure and Market Share Dominance

Western Europe holds 47% share of the Portugal Data Center Market. Strong digital adoption and advanced IT systems drive growth. Enterprises leverage Portugal’s role as a gateway for transatlantic connectivity. It enhances competitiveness of regional service providers. Western Europe remains the largest market due to advanced cloud and edge ecosystems. Portugal’s position ensures sustained demand for scalable facilities.

- For example, in 2024, AtlasEdge entered the Portuguese market with major investments in Lisbon, committing over €500 million to develop data center campuses delivering more than 20 MW of IT capacity, powered by 100% renewable energy and designed to support AI and hyperscale workloads.

Southern Europe Emerging With Rising Investment and Infrastructure Expansion

Southern Europe captures 33% share of the Portugal Data Center Market. It benefits from strong investments in renewable energy and digital projects. Portugal emerges as a strategic hub connecting global regions. Enterprises invest in modular and colocation facilities to improve accessibility. It helps smaller economies attract international players. Southern Europe continues to strengthen its position in the data economy.

- For example, in 2025, Start Campus, in partnership with Schneider Electric, inaugurated the SIN01 data center in Sines with an initial 26 MW capacity, as the first phase of its planned 1.2 GW campus, powered entirely by renewable energy and supported by seawater cooling and Schneider’s EcoStruxure platform.

Northern and Eastern Europe Gaining Ground With Targeted Growth Strategies

Northern and Eastern Europe together account for 20% of the Portugal Data Center Market. Northern Europe maintains leadership in green initiatives and hyperscale deployment. Eastern Europe shows steady growth supported by digital modernization. Portugal gains importance by bridging multiple subregions. It strengthens regional collaboration through connectivity and transatlantic networks. The combined share reflects a balanced expansion strategy.

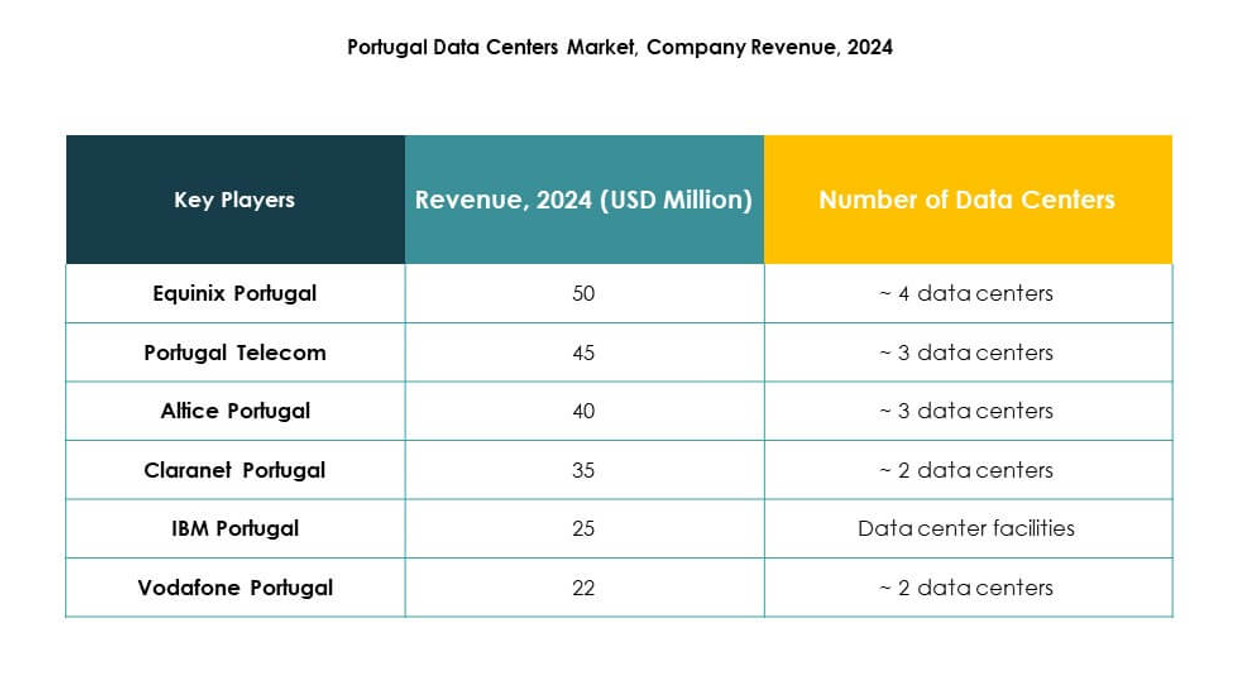

Competitive Insights:

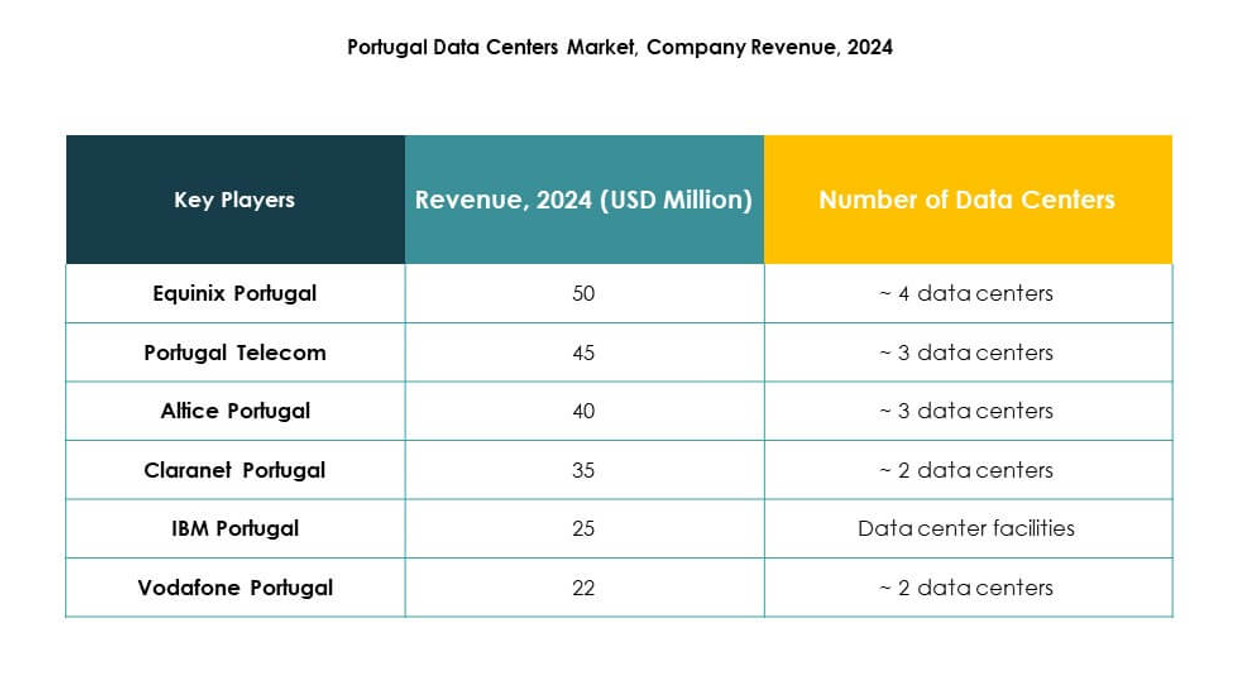

- Equinix Portugal

- Portugal Telecom

- Altice Portugal

- Claranet Portugal

- IBM Portugal

- Vodafone Portugal

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Portugal Data Center Market demonstrates strong competition shaped by global hyperscale providers and established domestic players. Equinix and Digital Realty strengthen their positions through extensive colocation and interconnection services. Portugal Telecom and Altice leverage national telecom networks to support enterprise clients and government projects. Vodafone and Claranet focus on hybrid solutions, cloud connectivity, and managed services. Global technology leaders such as Microsoft, AWS, and Google expand capacity to meet cloud adoption demand. NTT Communications and IBM enhance competitiveness with enterprise-focused digital transformation solutions. It encourages innovation in sustainability, security, and automation, making Portugal a key destination for investors and enterprises seeking robust and scalable digital infrastructure.

Recent Developments:

- In July 2025, Legrand announced the acquisition of Quitérios, a Portuguese company, as part of its ongoing push to expand its data center capabilities in Europe. This move strengthens Legrand’s footprint in the Portugal data center market and supports its strategy to provide advanced solutions for hyperscale and colocation data centers.

- In March 2025, AtlasEdge revealed a strategic partnership with Colt Technology Services, focusing on Portugal’s digital infrastructure. This collaboration merges AtlasEdge’s 100% renewable data center campus in Lisbon with Colt’s high-bandwidth, low-latency connectivity solutions, aiming to power thousands of local businesses with dependable and sustainable IT ecosystem.