Executive summary:

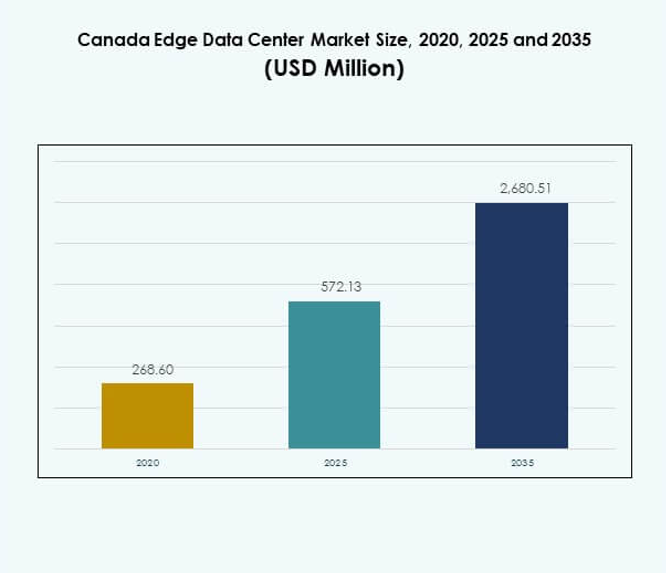

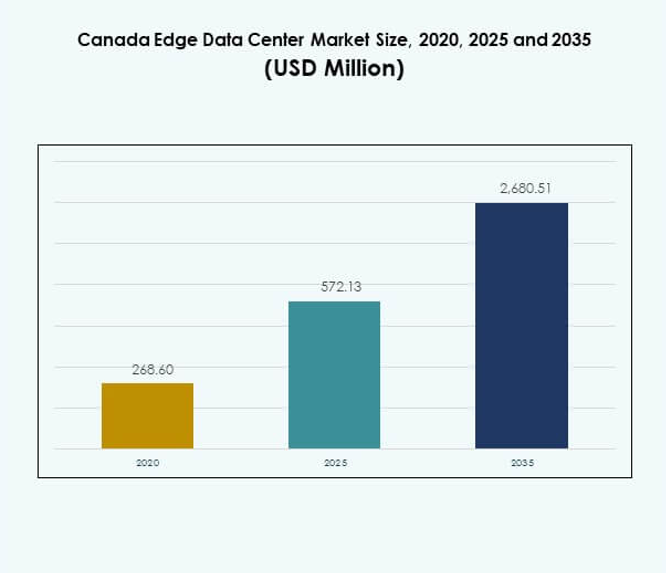

The Canada Edge Data Center Market size was valued at USD 268.60 million in 2020, reached USD 572.13 million in 2025, and is anticipated to reach USD 2,680.51 million by 2035, at a CAGR of 16.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Canada Edge Data Center Market Size 2025 |

USD 572.13 Million |

| Canada Edge Data Center Market, CAGR |

16.56% |

| Canada Edge Data Center Market Size 2035 |

USD 2,680.51 Million |

Strong demand for low-latency computing, cloud adoption, and AI-driven workloads is propelling market expansion. Telecom operators, hyperscalers, and infrastructure providers are investing in modular, sustainable, and energy-efficient facilities to handle distributed data traffic. It supports industrial automation, 5G network deployment, and data localization efforts. The market holds strategic value for investors due to its scalability, digital innovation potential, and alignment with Canada’s growing AI and smart infrastructure ecosystem.

Ontario and Quebec lead due to robust connectivity, renewable power access, and high enterprise concentration. Western provinces, including British Columbia and Alberta, are rapidly emerging with data-intensive industries and smart city initiatives. Northern and Atlantic regions show rising activity as improved broadband and renewable integration enable regional deployments. This geographic diversification strengthens Canada’s overall edge computing network.

Market Drivers

Rising Adoption of Edge Computing and Low-Latency Demand Across Industries

The Canada Edge Data Center Market is driven by rapid expansion of connected devices and the increasing need for ultra-low-latency data processing. Enterprises rely on edge infrastructure to process data closer to end users, reducing congestion on central networks. It supports real-time applications in manufacturing, healthcare, and retail. The growing use of 5G, AI, and IoT intensifies the need for distributed computing resources. Businesses implement localized data centers to ensure faster service delivery and compliance with data residency laws. This transition improves network reliability and scalability. Investors view edge computing as a strategic enabler of digital transformation across industries.

Technological Innovation and Deployment of Energy-Efficient Infrastructure

Continuous advancements in modular and scalable edge facility designs enhance operational flexibility. Companies deploy liquid cooling, renewable energy integration, and intelligent power management to cut energy costs. It strengthens sustainability performance and aligns with national carbon neutrality goals. The adoption of advanced analytics and remote monitoring systems enables predictive maintenance and performance optimization. Cloud service providers and telecom operators collaborate to build edge-ready zones supporting hybrid cloud models. These facilities host workloads that demand real-time analytics. Innovation drives competitiveness, helping Canada attract global hyperscale investments. Technological progress ensures long-term growth and efficiency for operators and end users.

- For instance, Rogers entered a five‑year strategic alliance with Microsoft to leverage Azure for 5G multi‑access edge computing and to modernize workloads, combining network and cloud to optimize performance and efficiency in production environments.

Expansion of 5G Networks Supporting Distributed Data Ecosystems

The national 5G rollout accelerates edge infrastructure deployment across major cities and remote regions. Telecom companies leverage small cells and micro-edge data centers to enhance coverage and performance. It facilitates data-intensive services such as autonomous vehicles, AR/VR platforms, and industrial automation. The integration of 5G with edge computing boosts bandwidth utilization and supports intelligent traffic routing. Government-backed digital policies encourage investments in high-speed connectivity. This shift empowers enterprises to develop decentralized applications with near-zero latency. Businesses benefit from enhanced reliability and improved consumer experiences. Strategic 5G-edge convergence reinforces Canada’s leadership in advanced communication technologies.

- For instance, Bell’s Public MEC service embeds AWS compute and storage at the edge of its 5G network starting in Toronto, with expansion to other Canadian markets planned, supporting real‑time visual processing, AR/VR, AI/ML, and advanced robotics that require low latency and high throughput.

Strategic Importance for Businesses and Long-Term Investment Value

Enterprises view the edge ecosystem as essential for optimizing operations and delivering digital services. It supports cloud-native solutions and ensures faster deployment of customer-facing applications. Regional businesses gain competitive advantage through localized compute environments. Data sovereignty and security compliance elevate investor confidence. Infrastructure partnerships between technology providers and real estate firms accelerate regional expansion. Increasing demand for intelligent logistics, smart retail, and telemedicine strengthens the case for edge deployments. Investors recognize the market’s long-term value due to recurring revenue models. The ecosystem offers scalable opportunities aligned with Canada’s digital economy vision.

Market Trends

Integration of Artificial Intelligence and Automation in Edge Operations

AI-driven automation is transforming facility management in the Canada Edge Data Center Market. Intelligent monitoring tools manage temperature, workload distribution, and predictive maintenance. Automation reduces downtime and increases asset lifespan. It enhances efficiency by enabling self-correcting systems and resource optimization. Operators use AI analytics to forecast demand patterns and balance workloads. These technologies improve sustainability metrics and cost predictability. The convergence of AI and edge computing supports intelligent networks. Automation strengthens operational resilience and enables faster response to fluctuating data loads.

Emergence of Modular and Prefabricated Edge Data Centers

Modular construction is a growing trend due to flexibility and faster deployment cycles. Prefabricated edge facilities reduce construction time and operational complexity. It helps service providers scale operations rapidly in distributed environments. The approach improves standardization, making maintenance easier and more cost-effective. Vendors design plug-and-play units compatible with renewable energy sources. This trend enhances energy efficiency and enables quick response to regional data demand. Modular architecture supports incremental capacity expansion and reduces total cost of ownership. Canada’s climate and geography further drive adoption of scalable modular designs.

Shift Toward Green Data Centers and Renewable Energy Integration

Sustainability is shaping investment strategies across the market. Operators integrate hydro, solar, and wind energy to reduce dependence on fossil fuels. It aligns with Canada’s carbon reduction commitments. Data centers use free cooling and energy recovery technologies to minimize emissions. Investors favor projects demonstrating environmental accountability and efficiency. The adoption of LEED-certified designs improves brand reputation and cost efficiency. Renewable integration strengthens operational stability during grid fluctuations. Sustainability-focused investments attract global interest and enhance long-term competitiveness.

Growth of Edge-as-a-Service and Multi-Cloud Deployments

Enterprises increasingly adopt Edge-as-a-Service models for flexibility and cost control. Service providers offer managed infrastructure that supports real-time analytics and AI workloads. It enables businesses to deploy resources dynamically near user locations. The multi-cloud strategy allows workload balancing across multiple environments. Companies benefit from enhanced redundancy and security compliance. The trend accelerates hybrid cloud adoption among SMEs and large enterprises. Edge-as-a-Service reduces capital expenses while ensuring scalability. The approach positions Canada as a regional hub for cloud-native applications.

Market Challenges

High Infrastructure Costs and Limited Standardization

High capital expenditure and lack of uniform standards pose barriers in the Canada Edge Data Center Market. Building edge facilities across multiple regions demands significant investment in power, connectivity, and hardware. It increases operational costs for smaller enterprises. The absence of common regulatory guidelines complicates deployment. Interoperability challenges arise when integrating multi-vendor systems. Operators face difficulties aligning with data protection and environmental laws. Limited standardization impacts scalability and performance optimization. Overcoming these challenges requires collaboration among telecom operators, cloud vendors, and policymakers.

Talent Shortages and Power Availability Constraints

The shortage of skilled professionals in edge computing, network design, and cybersecurity impacts growth. It slows innovation and affects service quality. Limited access to sustainable power sources in remote areas also creates operational hurdles. It forces operators to depend on diesel generators, which raise emissions. Training programs and digital workforce development are vital to bridge skill gaps. Utility modernization can stabilize electricity supply for data-heavy regions. Companies must prioritize workforce readiness and green energy transition. Sustainable expansion depends on aligning resource availability with long-term digital strategies.

Market Opportunities

Expansion of Smart Cities and IoT Ecosystems Across Canada

The expansion of smart cities creates major opportunities for the Canada Edge Data Center Market. Edge infrastructure supports connected streetlights, transportation systems, and surveillance networks. It enhances real-time analytics and automation for public services. Governments invest heavily in digital modernization projects, driving edge adoption. Private players collaborate to deliver scalable solutions for data-intensive applications. This expansion strengthens national digital capacity and supports local innovation ecosystems. Enterprises gain value through faster response times and improved data localization. The shift to smart urban ecosystems amplifies edge investment prospects.

Rising Collaboration Between Telecom Operators and Cloud Service Providers

Telecom firms and hyperscale providers form alliances to deploy distributed edge nodes. It accelerates 5G network rollout and hybrid cloud service delivery. Partnerships support low-latency applications such as gaming, video streaming, and AI workloads. Joint investments create localized infrastructure that enhances customer experience. Collaboration lowers entry barriers for new market participants. Strategic integration of networks and cloud strengthens competitiveness. These partnerships drive future-ready infrastructure capable of supporting national digital transformation goals.

Market Segmentation

By Data Center Size

Micro data centers dominate the Canada Edge Data Center Market due to their flexibility and quick deployment. These compact units are ideal for edge applications supporting remote and enterprise sites. Hyperscale and enterprise data centers follow, serving regional content delivery and AI workloads. It enables low-latency services across industrial and commercial applications. The “Others” segment covers specialized installations for research and telecom applications, contributing steadily to market revenue.

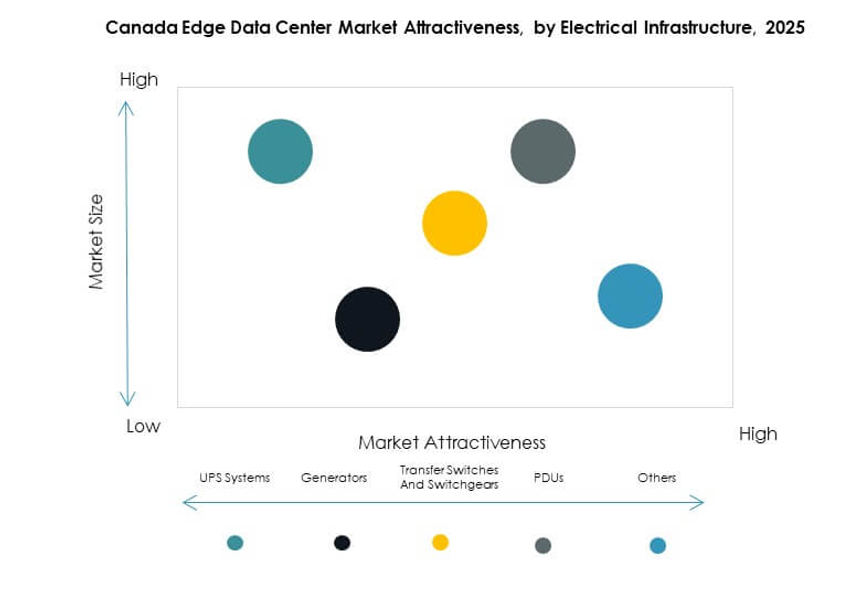

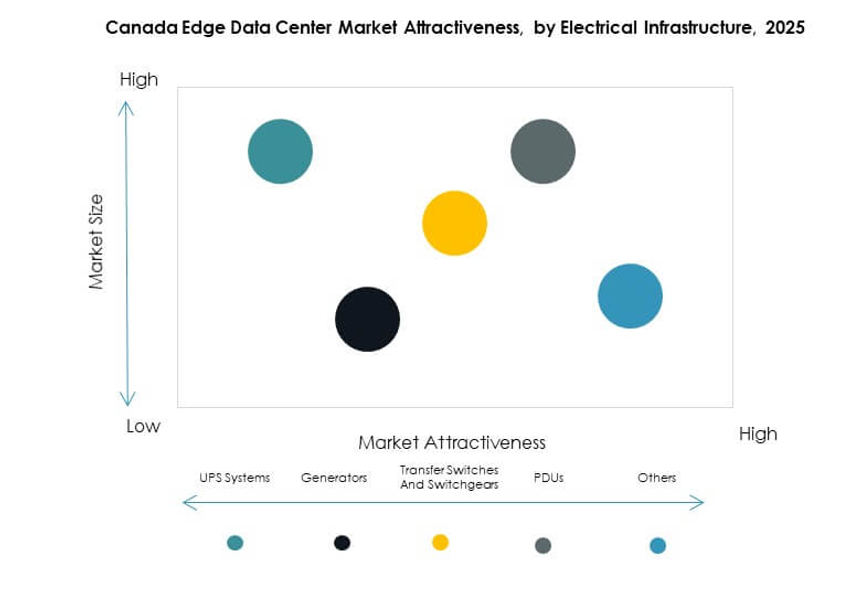

By Electrical Infrastructure

UPS systems hold the largest share due to their critical role in ensuring uninterrupted operations. Reliable power backup is essential for maintaining uptime in distributed networks. PDUs and switchgears gain traction for efficient power distribution and fault management. It helps operators reduce downtime and enhance performance. Generators support remote locations with inconsistent grid access. The “Others” category includes renewable-based systems integrating sustainable energy for edge deployments.

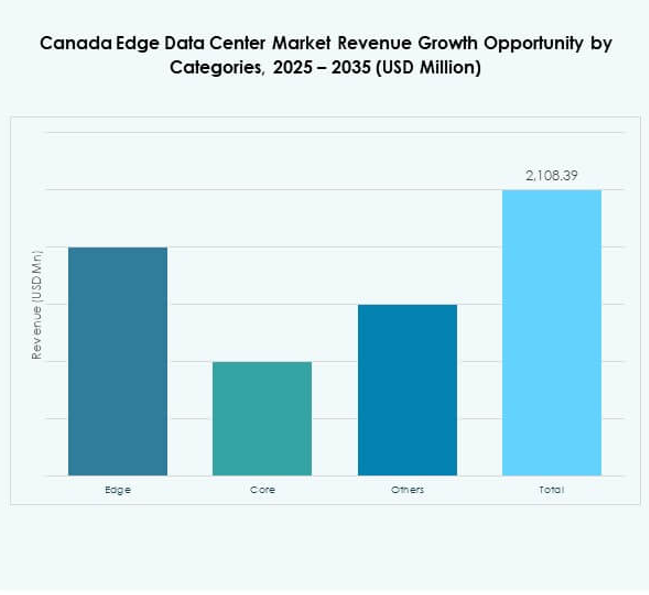

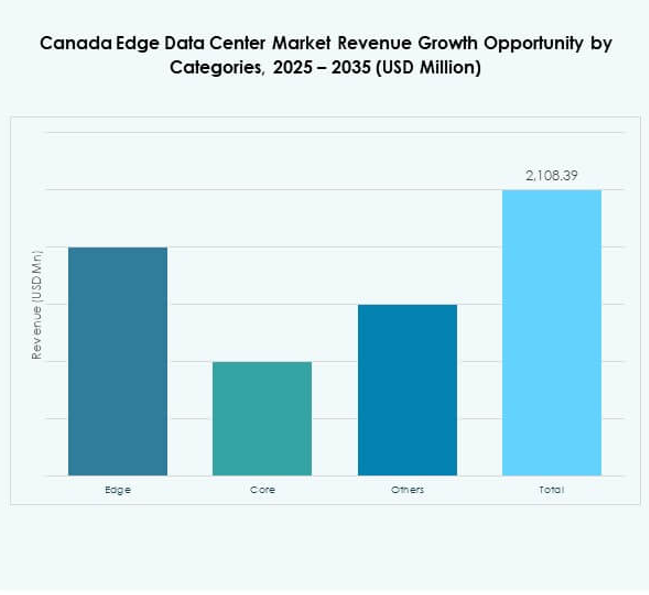

By Category

Edge category leads the market share due to rapid decentralization of computing resources. Businesses demand proximity-based data processing to improve service quality. Core category follows, hosting centralized workloads that support national-scale applications. It contributes to cloud network stability and hybrid architectures. The “Others” segment includes intermediate computing models balancing latency and cost. The adoption of distributed frameworks reinforces regional infrastructure efficiency.

By End User Industry

IT and Telecom sector dominates due to rapid digitalization and 5G rollout. BFSI industry follows with growing use of secure, low-latency systems for financial transactions. It helps institutions improve compliance and operational speed. Government and defense sectors expand digital infrastructure for critical operations. Retail, healthcare, and manufacturing sectors rely on real-time analytics to enhance customer experiences. Media and entertainment industry benefits from low-latency content delivery networks. The “Others” segment includes research and academic institutions adopting advanced computing solutions.

Regional Insights

Eastern Canada – Ontario and Quebec Leading with 48% Market Share

Eastern Canada holds the largest share in the Canada Edge Data Center Market due to strong connectivity and dense enterprise concentration. Ontario’s Toronto corridor hosts multiple carrier-neutral facilities supporting hyperscale and financial sectors. Quebec benefits from renewable energy supply and government incentives for green IT infrastructure. It attracts large-scale investments from cloud and telecom players. Regional partnerships promote cross-border data exchange with northeastern U.S. markets. The eastern subregion anchors national edge expansion and serves as the primary innovation hub.

- For instance, in September 2025, Cologix acquired full ownership of TOR4 and also acquired the adjacent TOR5 data center in Markham, Toronto’s corridor, adding a combined 14 MW and 90,000+ square feet of capacity to support hyperscale and financial-sector workloads, reinforcing carrier‑neutral interconnection and cloud on‑ramps in Ontario’s core edge cluster.

Western Canada – British Columbia and Alberta Emerging with 31% Market Share

Western Canada experiences rapid growth driven by industrial digitization and smart city projects. British Columbia’s proximity to U.S. West Coast data routes enhances its appeal. Alberta’s technology ecosystem encourages enterprise data decentralization and IoT adoption. It supports 5G-driven applications in logistics, manufacturing, and energy. Investments in sustainable infrastructure strengthen regional competitiveness. Western provinces continue to emerge as preferred destinations for edge and colocation deployments.

- For instance, EdgeConneX reported tripling global capacity since EQT’s 2020 acquisition and operating 80+ data centers across 50+ markets, underlining sustained build‑to‑density and sustainability leadership relevant to Vancouver‑anchored West Coast connectivity; in 2024 it received Datacloud’s Global Data Centre of the Year award recognizing rapid expansion and sustainable innovation, a pattern that supports Western Canada edge deployments tied to U.S. West Coast routes.

Northern and Atlantic Canada – Developing Regions with 21% Market Share

Northern and Atlantic regions are developing segments of the Canada Edge Data Center Market. Infrastructure investments focus on improving broadband access and network reliability. It supports mining, defense, and rural community connectivity. Renewable energy potential in Newfoundland and Labrador promotes sustainable operations. Emerging initiatives for localized edge computing improve service delivery in remote areas. The expansion of digital inclusion programs fosters long-term market participation and national resilience.

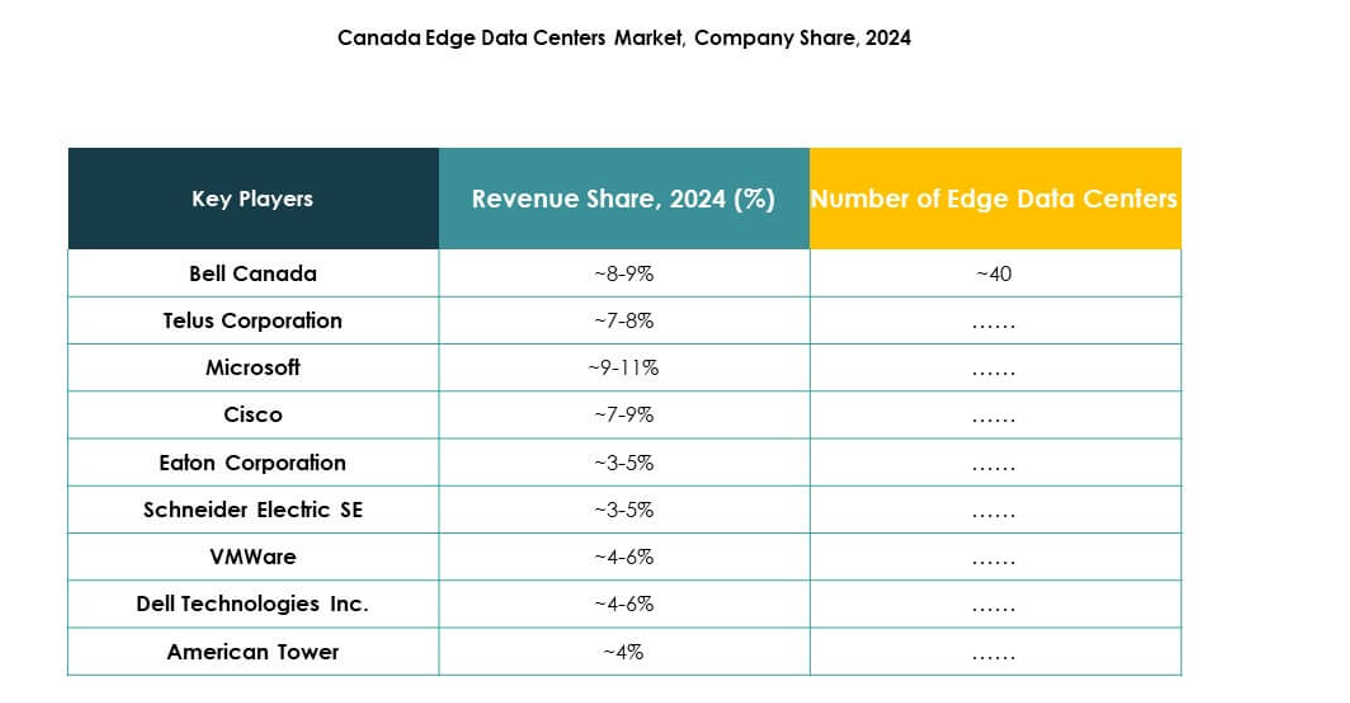

Competitive Insights:

- Bell Canada

- Telus Corporation

- Rogers Communications

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- American Tower

- Cisco

- SixSq

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

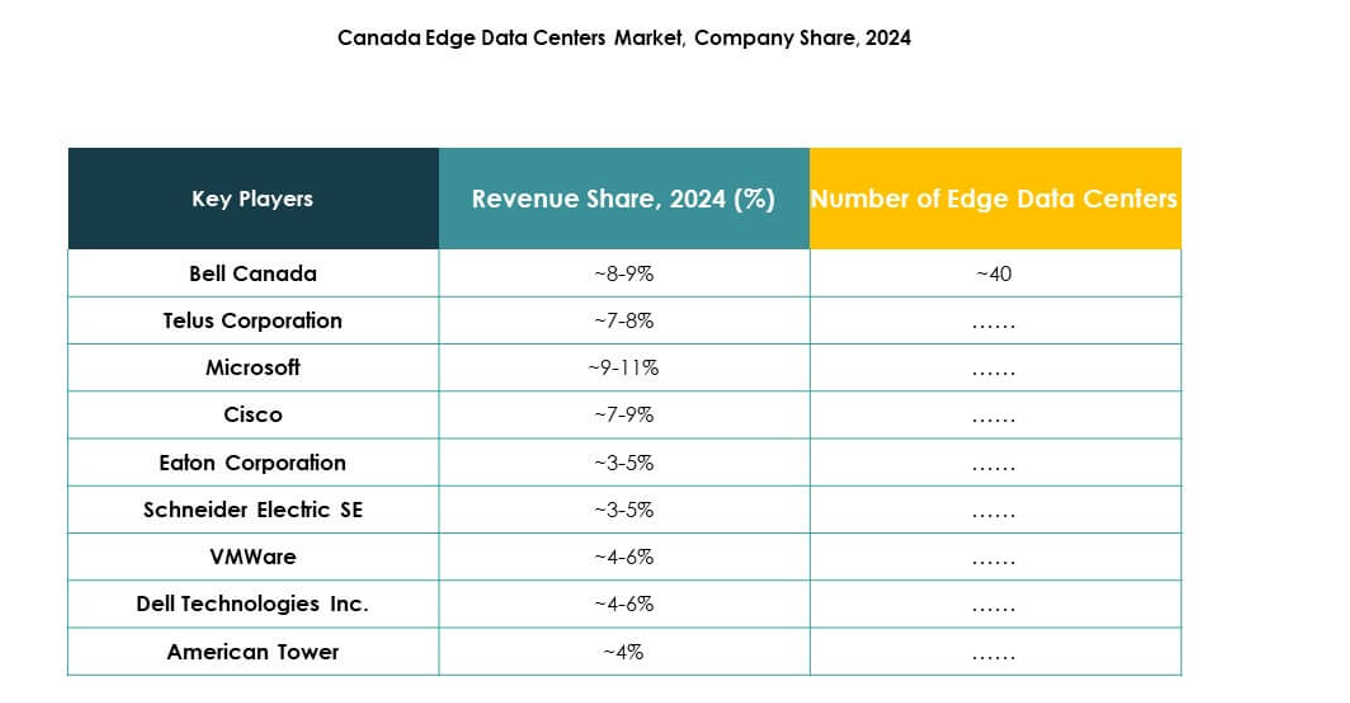

The Canada Edge Data Center Market features strong competition among telecom operators, global technology firms, and infrastructure providers. It focuses on developing energy-efficient, modular, and AI-integrated facilities to meet data localization and low-latency demands. Telecom giants such as Bell, Telus, and Rogers strengthen nationwide connectivity through regional expansion and 5G integration. Technology leaders including Cisco, Dell, Microsoft, and VMware enhance edge platforms through automation and hybrid cloud capabilities. Equipment manufacturers such as Eaton, Schneider Electric, and Rittal support sustainability through advanced power and cooling systems. Strategic collaborations, acquisitions, and partnerships define the competitive direction and accelerate digital infrastructure modernization across the country.

Recent Developments:

- In September 2025, Eaton announced edge‑focused power innovations to mitigate AI “power bursting,” advancing its grid‑to‑chip strategy including collaborations with NVIDIA on 800 VDC architectures for 1MW‑plus racks and Siemens Energy for fast‑track integrated onsite power, building on its April 2024 launch of SmartRack modular data centers for rapid edge deployments.

- In September 2025, TELUS announced a collaboration with NVIDIA to build a Sovereign AI Factory at TELUS data centres in Quebec and British Columbia, deploying NVIDIA’s latest GPUs and AI software stack to deliver AI-as-a-Service over its low-latency PureFibre network powered by 99% renewable energy.

- In August 2025, Buzz HPC and Bell Canada formed a partnership for NVIDIA AI deployments tied to new Canadian facilities, including a 7MW data center in Merritt, British Columbia expected to go live by year-end 2025, aligning with expanded AI and edge compute demand in Canada.

- In August 2025, EdgeConneX partnered with Lambda to build an AI Factory leveraging EdgeConneX’s Ingenuity next‑generation data center solution supporting densities exceeding 600kW per rack, as part of Lambda’s multi‑gigawatt GPU expansion roadmap across North America, following earlier Canadian market entry via a Toronto edge data center in 2017.