Executive summary:

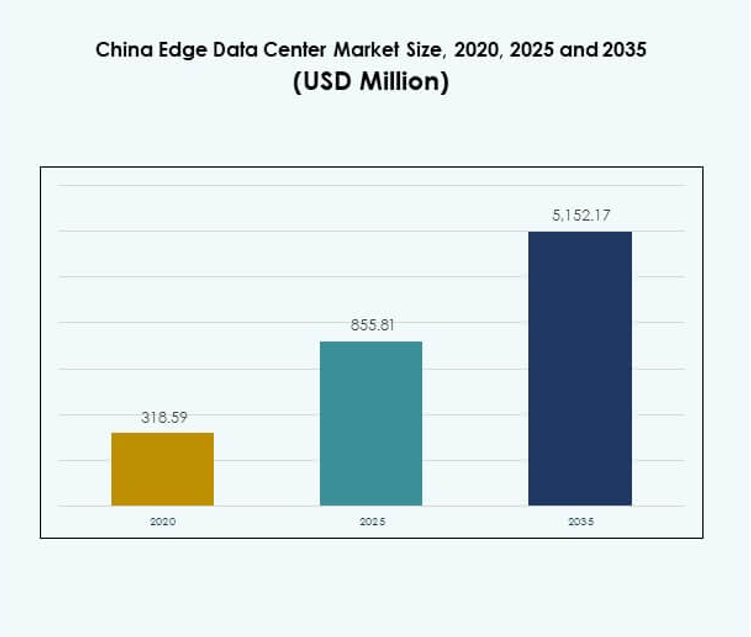

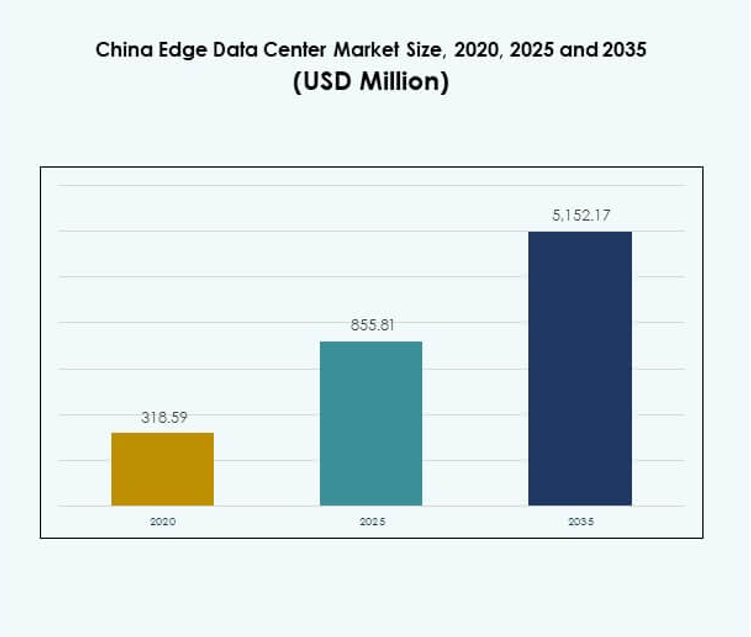

The China Edge Data Center Market size was valued at USD 318.59 million in 2020, growing to USD 855.81 million in 2025, and is anticipated to reach USD 5,152.17 million by 2035, at a CAGR of 19.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| China Edge Data Center Market Size 2025 |

USD 855.81 Million |

| China Edge Data Center Market, CAGR |

19.41% |

| China Edge Data Center Market Size 2035 |

USD 5,152.17 Million |

The market is driven by the integration of 5G, IoT, and artificial intelligence technologies that demand low-latency computing and localized data processing. Enterprises are investing in modular edge facilities to improve operational efficiency and enable real-time analytics. Government-backed digital infrastructure projects and cloud-edge hybrid solutions enhance scalability. The market’s strategic importance lies in its ability to support automation, data sovereignty, and smart city development, attracting strong investor interest.

Eastern and southern China lead the market, supported by robust industrial bases, high data consumption, and strong connectivity ecosystems. Cities such as Shanghai, Shenzhen, and Guangzhou attract heavy investments due to advanced network infrastructure and supportive government policies. Northern and western regions are emerging growth areas driven by renewable energy access and regional digitalization programs, expanding China’s nationwide edge network capacity.

Market Drivers

Rising Integration of 5G, IoT, and Artificial Intelligence in Data Infrastructure

The China Edge Data Center Market is expanding due to the large-scale deployment of 5G networks, IoT devices, and AI-driven applications. These technologies require low-latency computing, which edge data centers provide efficiently. Telecom operators such as China Mobile and China Unicom are increasing investments in localized infrastructure to enhance service delivery and reduce congestion. AI adoption in industrial automation and smart cities strengthens computational demand near endpoints. The growing need for real-time analytics supports the establishment of micro data centers in urban zones. It enhances data processing efficiency and enables quick decision-making for enterprises. The combination of national policies and private investments accelerates digital infrastructure upgrades. Businesses are prioritizing decentralized computing to meet evolving data management needs across the country.

- For instance, by mid-2025, China Mobile’s total 5G base stations reached nearly 2.8 million, supporting advanced edge computing with coverage in over 300 cities—these 5G-Advanced networks deliver 10-times faster peak speeds and are validated in official MIIT reports and latest company press releases.

Government Support and Digital Infrastructure Investments Enhancing Market Growth

China’s strong policy focus on digital transformation drives market development. The government’s “New Infrastructure Plan” promotes next-generation data center construction to support industrial digitization and AI innovation. Investments in data parks across Beijing, Shanghai, and Guangdong are accelerating capacity expansion. Local governments are offering tax incentives and power subsidies to attract edge data center projects. These efforts aim to decentralize data storage and optimize connectivity between regional networks. It ensures efficient resource allocation and boosts regional economies through digital inclusion. Public-private partnerships are enabling broader coverage of edge computing capabilities. The increasing alignment between policy frameworks and enterprise strategies underpins long-term market sustainability.

Increased Demand from Smart City and Industrial Automation Initiatives

Smart city programs in China are creating new demand for localized computing infrastructure. Edge data centers are vital for supporting intelligent transport systems, public safety, and utility management. The integration of IoT sensors with real-time processing reduces delays and enhances operational efficiency. Industrial automation, supported by AI-based predictive analytics, requires reliable local computing environments. It enhances manufacturing productivity and supports the development of autonomous systems. The ongoing expansion of 5G coverage strengthens industrial edge networks. Leading enterprises are deploying edge solutions to monitor and control distributed assets effectively. This transformation positions the edge infrastructure segment as a core enabler of digital industrial ecosystems.

Technological Innovation and Energy-Efficient Designs Strengthening Market Competitiveness

Innovation in data center design is promoting sustainable growth in the market. Companies are developing modular and prefabricated data centers to improve scalability and reduce installation time. Advanced liquid and immersion cooling systems are being adopted to minimize power usage. The shift toward green energy sources, including solar and hydroelectric power, enhances operational efficiency. It also aligns with national goals to reduce carbon emissions. Hybrid architecture combining cloud and edge infrastructure provides flexibility for diverse workloads. These developments are driving the adoption of eco-friendly and cost-efficient solutions. Businesses and investors recognize the strategic potential of this transformation in boosting profitability and energy optimization.

- For instance, in August 2025, Chinese enterprises trialed underwater edge data centers near Shanghai, delivering up to 90% reduction in cooling energy consumption versus conventional setups this approach is being implemented for clients such as China Telecom, substantiated by direct company statements to AFP and leading tech journals.

Market Trends

Expansion of Decentralized Edge Networks Supporting Real-Time Data Processing

The China Edge Data Center Market is witnessing strong momentum toward decentralized network architectures. Enterprises are deploying localized edge facilities to process data closer to users and devices. This shift reduces bandwidth congestion and improves latency performance across distributed applications. The trend aligns with China’s rapid digitalization across manufacturing, transport, and public administration. It enhances cloud interoperability and improves end-user experience. The deployment of micro data centers in urban zones strengthens service reliability for critical sectors. It fosters resilience in digital ecosystems and enhances business continuity. This evolution highlights the strategic transition toward distributed computing infrastructure.

Adoption of Renewable Energy and Sustainable Cooling Solutions

Growing emphasis on sustainability is transforming operational models in edge infrastructure. Companies are adopting renewable energy sources such as wind and solar to power edge facilities. Energy-efficient cooling systems like direct liquid and evaporative cooling are gaining traction. These innovations reduce power consumption and align with China’s carbon neutrality goals for 2060. It promotes long-term operational savings and compliance with environmental standards. Developers are implementing AI-based energy management tools to optimize workloads dynamically. Partnerships with renewable energy providers are expanding green capacity in data-intensive zones. Sustainability has become a decisive factor in attracting new investments across the market.

Emergence of AI-Oriented Edge Platforms for Intelligent Workloads

AI integration across edge platforms is reshaping the digital landscape in China. Enterprises are leveraging AI-driven processing at the edge to manage large datasets securely and efficiently. It improves decision-making and enables real-time automation across sectors like healthcare, retail, and logistics. Vendors are developing AI-optimized chips and frameworks for localized inference processing. The trend enhances predictive maintenance, visual analytics, and anomaly detection capabilities. Cloud providers are offering AI-edge hybrid models for scalable deployment. This evolution strengthens China’s position in global AI infrastructure competitiveness. It reflects a growing synergy between intelligent computing and next-generation connectivity solutions.

Growing Role of Edge Data Centers in National Security and Data Sovereignty

National security regulations and data localization policies are reinforcing domestic data infrastructure growth. Edge data centers are critical in maintaining sovereignty over sensitive industrial and consumer information. It enables compliance with China’s cybersecurity law and enhances digital autonomy. Government-backed organizations are expanding secure regional data zones to host critical information systems. Enterprises are investing in advanced encryption and compliance frameworks. The trend promotes trust in digital operations and strengthens the resilience of national networks. Domestic technology vendors are playing a larger role in ensuring secure data processing ecosystems. This focus enhances China’s technological independence and infrastructure robustness.

Market Challenges

High Capital Costs and Infrastructure Scalability Constraints

The China Edge Data Center Market faces financial and technical barriers to large-scale expansion. High capital requirements for network upgrades, power provisioning, and real estate limit new market entrants. Infrastructure scalability is constrained by regional disparities in energy access and land availability. It increases the overall cost per deployment, especially in Tier-2 and Tier-3 cities. Power shortages and grid instability affect long-term sustainability for rural deployments. Companies must balance capacity growth with operational efficiency and environmental compliance. Rapid technological evolution also demands continuous reinvestment in updated hardware. This cost-intensive cycle poses a significant challenge to maintaining profitability across the sector.

Regulatory Complexity and Shortage of Skilled Workforce

Strict government regulations regarding data sovereignty and cybersecurity introduce operational challenges. Companies must comply with multiple regional standards for data storage and transmission. It slows project execution and increases administrative costs for cross-provincial operations. The shortage of skilled IT and cooling system professionals further complicates market expansion. Enterprises face difficulty maintaining advanced infrastructure in compliance with evolving energy standards. Talent gaps in AI, edge computing, and network engineering hinder innovation. Coordination between national and provincial authorities often delays project approval timelines. These factors collectively restrain consistent deployment and operational performance in the market.

Market Opportunities

Rising Investments in Smart Manufacturing and Digital Transformation

The ongoing industrial digitalization creates major opportunities for the China Edge Data Center Market. Smart factories and logistics networks require localized data processing for automation and predictive analytics. Edge computing supports real-time control systems, enhancing manufacturing precision and efficiency. It also enables improved decision-making in connected industrial environments. Government-backed initiatives like “Made in China 2025” promote integration of intelligent technologies. Partnerships between equipment manufacturers and IT service providers are accelerating innovation. This industrial focus enhances long-term growth opportunities for infrastructure and service providers. Investors benefit from growing demand across industrial clusters and emerging digital zones.

Integration of AI-Driven Edge Solutions in Public and Private Sectors

AI-driven analytics and machine learning models are creating new demand for localized processing. The China Edge Data Center Market benefits from adoption in public services, healthcare, and financial institutions. Edge infrastructure supports faster data handling and regulatory compliance. It improves service quality, data security, and operational continuity. Cloud providers and telecom companies are launching hybrid edge models to serve diverse needs. This integration enhances scalability for emerging smart applications. It drives sustainable revenue opportunities for both domestic and international technology investors.

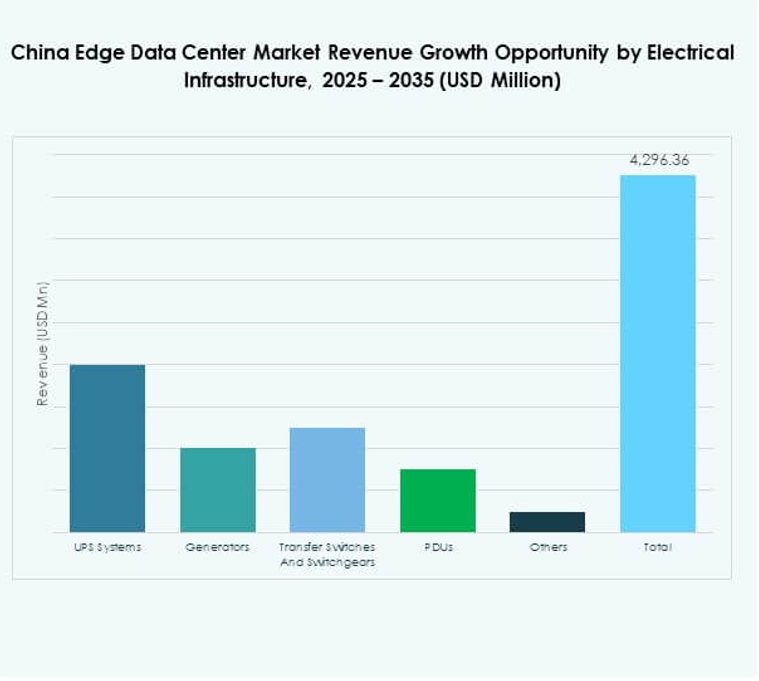

Market Segmentation

By Component

The solution segment dominates the China Edge Data Center Market due to rising demand for hardware, networking, and storage systems. It captures a significant share as enterprises deploy modular infrastructure for scalability and efficiency. Services including installation, maintenance, and consulting are growing with expanding deployments. It ensures reliability and performance optimization across diverse operating environments. Vendors are offering end-to-end solutions combining hardware and software integration. Growing need for operational continuity boosts service-based contracts. Hardware modernization initiatives across industries reinforce market leadership of the solution segment.

By Data Center Type

Colocation edge data centers hold a leading position, offering scalable capacity and cost efficiency. Enterprises rely on colocation providers for shared infrastructure and secure connectivity. Managed and cloud-edge facilities are gaining traction with increasing enterprise digitization. It enables flexible resource allocation and hybrid deployment models. Enterprise-owned centers support mission-critical workloads requiring enhanced data control. Cloud-edge hybrid models support seamless workload distribution across multiple environments. The segment’s diversification supports business continuity and operational resilience.

By Deployment Model

Hybrid deployment models dominate the market due to their flexibility and scalability. They integrate the advantages of cloud and on-premises infrastructure for better workload management. It allows enterprises to balance latency and security requirements efficiently. Cloud-based models are expanding in industries prioritizing agility and cost efficiency. On-premises systems remain essential for organizations handling confidential data. The hybrid model supports unified orchestration across distributed systems. Growing preference for customized solutions enhances adoption across large enterprises and SMEs.

By Enterprise Size

Large enterprises hold a major share of the China Edge Data Center Market due to higher capital capacity and technology adoption. They deploy edge solutions to enhance performance, data governance, and user experience. SMEs are also adopting scalable cloud-edge infrastructure to improve competitiveness. It enables faster response times and efficient data utilization. Tailored service models attract small businesses seeking affordable edge solutions. Growing awareness of IoT-driven efficiency drives new adoption across industrial SMEs. The convergence of cloud and edge platforms enhances enterprise-wide digital performance.

By Application / Use Case

Power monitoring and asset management applications dominate due to the critical need for real-time energy oversight. These functions help reduce operational costs and improve system reliability. Environmental monitoring and capacity management are expanding with smart facility initiatives. BI and analytics applications support informed decision-making and process optimization. It enhances efficiency across IT and manufacturing operations. Rapid adoption in retail and healthcare supports remote monitoring and predictive analytics. The diversification of applications fosters innovation and service differentiation among providers.

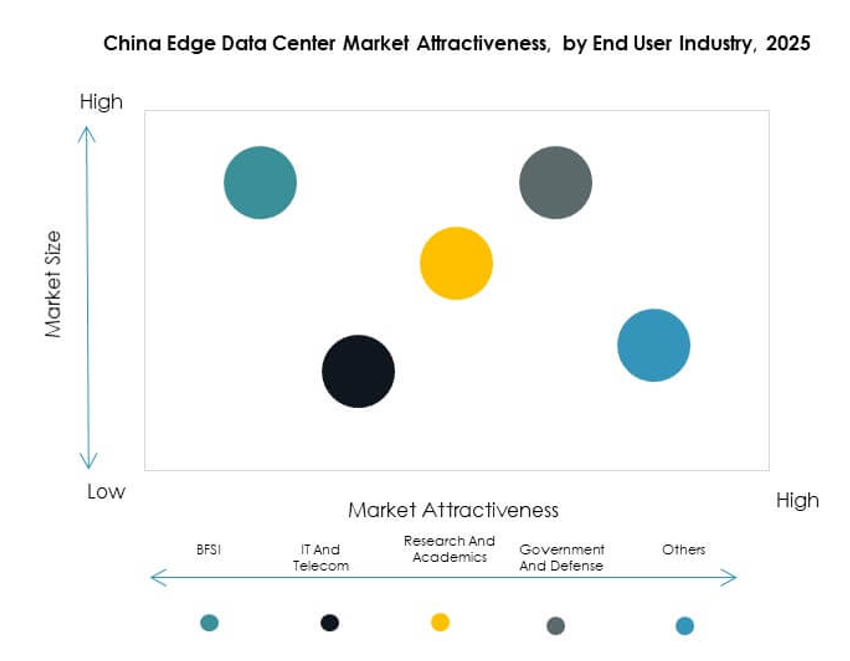

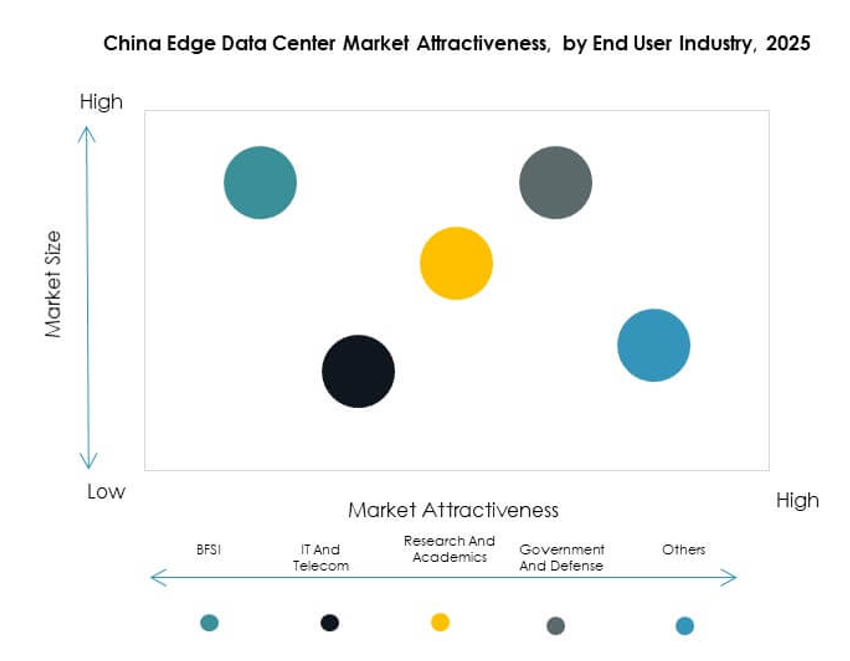

By End User Industry

The IT and telecommunications sector leads with the largest share of deployments. It benefits from strong network infrastructure and continuous 5G rollouts. BFSI and healthcare sectors are increasing adoption for secure and efficient data processing. Retail and e-commerce use edge infrastructure for enhancing real-time transactions and logistics. Aerospace, defense, and energy sectors rely on low-latency solutions for mission-critical operations. It strengthens national industries and digital competitiveness. Expanding demand across diverse sectors drives robust multi-industry integration.

Regional Insights

Eastern China Dominating the National Landscape with 38% Share

Eastern China remains the leading subregion in the China Edge Data Center Market, holding a 38% share. Cities like Shanghai, Hangzhou, and Nanjing host dense digital infrastructure and strong enterprise clusters. It benefits from high data traffic, government support, and availability of skilled talent. Telecom operators and hyperscale providers are expanding capacity to serve industrial and commercial hubs. The proximity to financial and e-commerce sectors fuels continuous growth. Advanced connectivity infrastructure supports smart city initiatives and data-intensive industries.

- For instance, in August 2025, the Shanghai Communications Administration announced plans to build five new large-scale data centers to expand the city’s AI computing capacity beyond 100 exaflops, reinforcing Shanghai’s leadership in China’s national digital infrastructure development.

Southern China Emerging as a High-Growth Digital Zone with 33% Share

Southern China accounts for 33% of the market, driven by innovation ecosystems in Shenzhen, Guangzhou, and Hong Kong. Strong industrial presence and government-backed digital economy projects are accelerating deployments. It attracts investment from global and domestic data center operators seeking cross-border connectivity. Integration of renewable power sources enhances energy efficiency in local data parks. Enterprises are establishing edge facilities near major logistics corridors and ports. This region is becoming a preferred hub for AI-enabled and cloud-linked services.

- For instance, at the International Digital Energy Expo in Shenzhen in September 2025, the city released its “2025 Shenzhen Digital Energy White Paper,” highlighting flagship initiatives including a cloud-based virtual power plant management platform and integrated charging-storage-discharge networks, and showcasing over 300 new digital energy technologies from more than 2,000 enterprises worldwide.

Northern and Western China Gaining Momentum with 29% Combined Share

Northern and western provinces are experiencing strong growth due to supportive regional policies. Cities such as Beijing, Chengdu, and Chongqing are expanding their edge infrastructure. The availability of affordable land and renewable power sources encourages large-scale data park development. It strengthens capacity for emerging industries in manufacturing and cloud computing. Strategic investments are linking remote regions with national networks. These developments enhance national data distribution, driving balanced regional growth across China.

Competitive Insights:

- China Mobile

• China Telecom

• China Unicom

• Alibaba Group

• EdgeConneX

• Eaton Corporation

• Dell Technologies Inc.

• Fujitsu

• Cisco Systems, Inc.

• SixSq

• Microsoft Corporation

• VMware, Inc.

• Schneider Electric SE

• Rittal GmbH & Co. KG

The China Edge Data Center Market is highly competitive, with domestic and global firms investing in large-scale edge deployments and energy-efficient infrastructure. Telecom leaders such as China Mobile, China Telecom, and China Unicom are expanding 5G-enabled data networks to support real-time processing and localized connectivity. Technology providers like Alibaba Group, Microsoft, and VMware are integrating hybrid cloud and AI-driven edge platforms. Equipment suppliers including Schneider Electric, Eaton, and Rittal focus on modular power and cooling systems for sustainable operations. It is evolving toward ecosystem partnerships combining telecom, cloud, and hardware expertise to meet rising enterprise and industrial demand across China.

Recent Developments:

- In September 2025, Guangdong Hec Technology Holding Co Ltd agreed to acquire the China business of a major data center operator for $3.9 billion. This significant acquisition expands Guangdong Hec’s footprint in the edge data center market and strengthens its positioning for both cloud and AI business growth. The deal highlights ongoing consolidation and investment activity among Chinese technology firms aiming for nimble regional data center deployment.

- In August 2025, China Telecom partnered with ZTE and other industrial players to deploy a 5G-Advanced EasyOn·Robot private network at the World Artificial Intelligence Conference (WAIC) in Shanghai. The solution demonstrated advanced low-latency connectivity for coordinated AI robotics, contributing significantly to the evolution of intelligent edge data center applications in China.

- In July 2025, China Mobile International activated the Southeast Asia–Japan Cable 2 (SJC2) to enhance seamless regional connectivity. This deployment reflects a strategic advancement in the company’s regional edge connectivity footprint, supporting robust capacity needs for enterprise and data center clients in China’s edge data center market.

- In March 2025, China Unicom, in collaboration with ZTE, launched a new range of AI-powered home terminals including an AI-enabled home companion camera and smart home screens at MWC Barcelona. This move showcases China Unicom’s ongoing innovation in leveraging edge technology for smart home ecosystems in China’s edge data center sphere.