Executive summary:

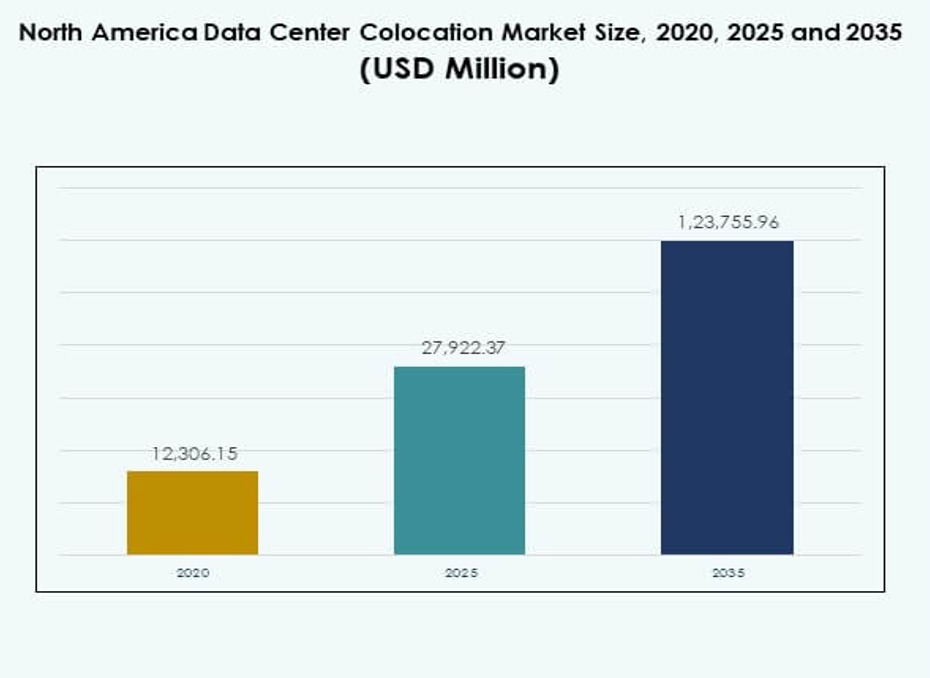

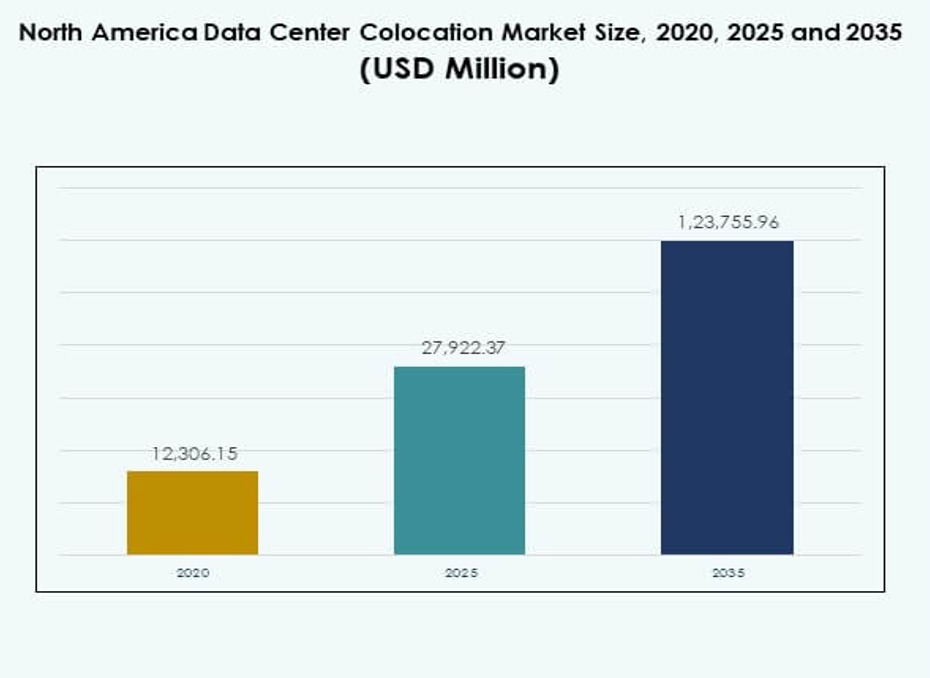

The North America Data Center Colocation Market size was valued at USD 12,306.15 million in 2020 to USD 27,922.37 million in 2025 and is anticipated to reach USD 1,23,755.96 million by 2035, at a CAGR of 15.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| North America Data Center Colocation Market Size 2025 |

USD 27,922.37 Million |

| North America Data Center Colocation Market, CAGR |

15.98% |

| North America Data Center Colocation Market Size 2035 |

USD 1,23,755.96 Million |

The market is driven by rapid cloud adoption, AI integration, and edge infrastructure development. Enterprises are investing in scalable colocation facilities to support digital transformation. It plays a strategic role in reducing capital expenditure, improving operational efficiency, and ensuring compliance with data sovereignty regulations. Innovation in high-density computing, advanced cooling, and interconnection ecosystems enhances competitiveness and attracts strong institutional investment.

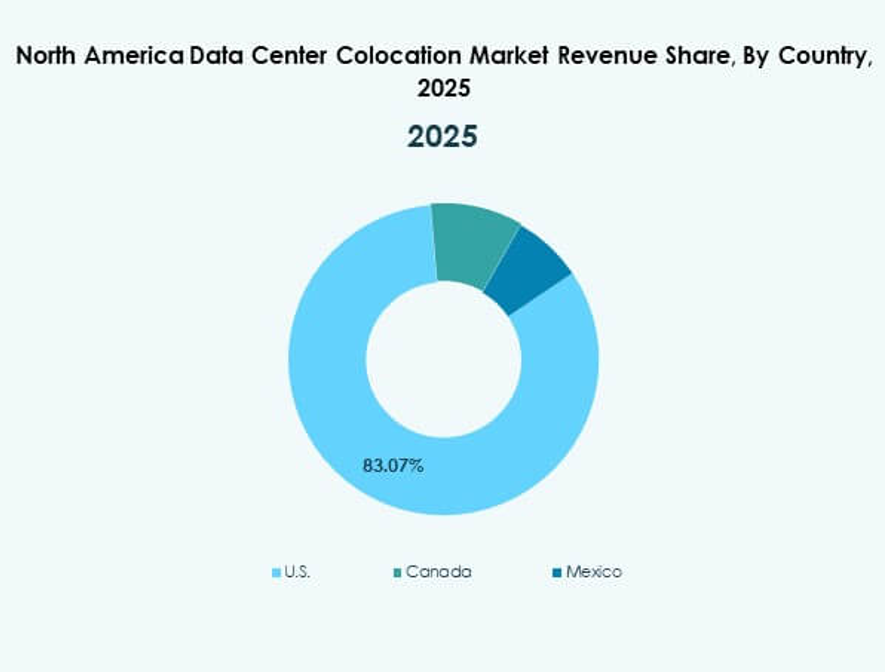

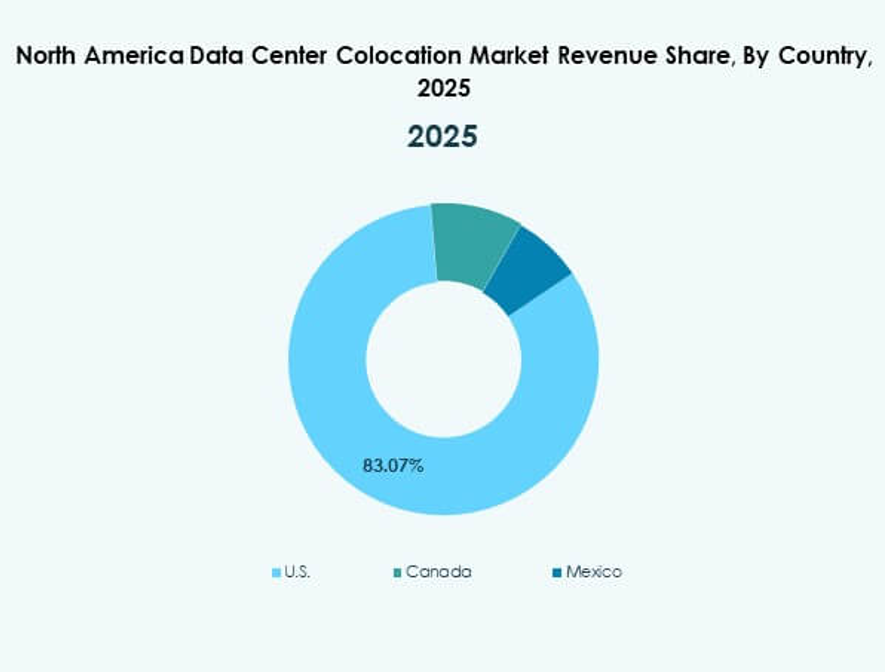

The U.S. leads the market with major hyperscale activity and robust enterprise demand. Canada is emerging as a sustainable data center hub supported by renewable energy resources and favorable regulations. Mexico is witnessing steady growth through telecom expansion and urban infrastructure development. These factors create a strong regional balance and strengthen North America’s leadership in the global colocation landscape.

Market Drivers

Strong Acceleration in Cloud Adoption and AI-Driven Infrastructure Expansion

Rapid cloud adoption and AI workloads drive large-scale colocation demand across North America. Businesses prioritize low-latency networks and reliable hosting to support mission-critical workloads. It enables enterprises to expand without heavy capital investment in owned infrastructure. Edge computing and 5G rollouts increase the requirement for scalable capacity. Investors view these facilities as stable assets that deliver predictable returns. Digital transformation in banking, e-commerce, and manufacturing accelerates deployment. Hybrid cloud strategies push enterprises toward flexible colocation models. AI-powered platforms and high-performance compute nodes strengthen operational efficiency.

- For instance, Equinix has enabled Block (formerly Square) to deploy the NVIDIA DGX SuperPOD, equipped with DGX GB200 systems, inside Equinix’s interconnected colocation centers in 2025. This supports distributed AI workloads and provides secure, multi-cloud connectivity for large-scale financial data, evidenced by Uber’s transfer of 6.5 petabytes via Equinix Fabric Cloud Router for cost-efficient data movement between clouds.

Rising Focus on Renewable Energy Integration and Energy-Efficient Operations

Growing sustainability mandates reshape energy procurement strategies within data centers. Operators adopt renewable sources like wind, hydro, and solar to meet emission targets. It improves operational cost structure while enhancing brand credibility among enterprise clients. Hyperscalers set long-term carbon neutrality goals that favor efficient colocation models. Modular design, efficient cooling, and liquid immersion solutions reduce energy use. Data center operators attract ESG-driven investments through measurable emission reductions. Power purchase agreements ensure predictable energy costs. Advanced monitoring systems enable better resource allocation and capacity planning.

Rapid Adoption of Digital Infrastructure Modernization Across Industries

Digital infrastructure modernization drives large investments in automation and software-defined architectures. Enterprises demand interconnected ecosystems with minimal downtime and strong security frameworks. It allows businesses to maintain agility while reducing IT overheads. Migration from on-premise to colocation environments improves network resilience. Automated provisioning and intelligent workload management increase operational speed. Enterprises require platforms that support multi-cloud deployments with integrated security. Colocation providers align strategies with evolving compliance requirements. Infrastructure upgrades create scalable environments that support next-generation applications.

Strategic Investments from Hyperscale Players and Institutional Funds

Global hyperscalers and investment funds inject capital to expand colocation footprints. Their involvement accelerates capacity buildouts and enhances market competitiveness. It increases the availability of Tier 3 and Tier 4 facilities that support high-performance computing. Real estate investment trusts and infrastructure funds identify data centers as resilient asset classes. Hyperscalers pursue joint ventures to control network connectivity and energy efficiency. Investors prioritize facilities located near high-demand enterprise clusters. Strategic alliances enhance financial stability and accelerate digital transformation. Long-term lease agreements provide predictable revenue streams.

- For instance, Google signed a $3 billion, 20-year agreement with Brookfield Renewable Partners in July 2025 to secure up to 3 gigawatts (GW) of hydropower capacity for its U.S. data centers, starting with 670 megawatts (MW) from Pennsylvania dams at Holtwood and Safe Harbor. This is the world’s largest corporate hydropower deal to date, supporting Google’s rapidly growing AI-driven operations and continuous carbon-free energy supply on the PJM grid.

Market Trends

Integration of AI-Driven Automation and Intelligent Resource Management

AI-based monitoring platforms optimize power, cooling, and bandwidth allocation in colocation facilities. Predictive analytics enhances system reliability and lowers operational risk. It allows operators to maintain high uptime levels with less manual intervention. Advanced automation accelerates provisioning for enterprise clients. AI-enabled demand forecasting helps prevent capacity shortages. Integrated management platforms reduce complexity and cost for operators. This shift positions colocation facilities as smarter, leaner infrastructure hubs. The adoption of autonomous systems redefines traditional operations and service delivery models.

Expansion of Edge Data Centers Supporting Decentralized Architectures

Edge facilities are expanding rapidly to support distributed computing ecosystems. Enterprises need infrastructure closer to users to improve application performance. It reduces latency and enhances real-time data processing. Edge expansion supports applications in AI, AR, and IoT. Smaller but strategically located facilities enable flexible deployment. Telecom operators and cloud providers invest in micro data centers to meet growing demand. Edge adoption strengthens hybrid strategies that balance core and distributed networks. This trend reshapes network topology across major and secondary cities.

Growing Role of Sustainability Certifications and Green Standards

Sustainability certifications like LEED and ENERGY STAR influence data center design. Operators prioritize renewable energy sources to meet green compliance goals. It drives investment toward facilities with low PUE and strong ESG credentials. Customers select providers that align with their carbon reduction commitments. Utility providers and governments offer incentives for sustainable construction. Energy-efficient cooling and power optimization strengthen competitive positioning. Green standards help secure long-term enterprise contracts. This trend reinforces the strategic role of environmental responsibility in infrastructure planning.

Rising Adoption of Hybrid and Multi-Cloud Deployment Models

Hybrid and multi-cloud architectures reshape enterprise infrastructure strategies. Businesses favor colocation for better control and flexibility. It supports seamless integration of private and public cloud platforms. Interconnection-rich facilities allow faster, secure data exchange. Enterprises reduce vendor lock-in and optimize performance. Cloud service providers partner with colocation operators to deliver advanced connectivity solutions. This shift increases traffic volumes through carrier-neutral facilities. Market participants enhance network fabrics to support this hybrid connectivity evolution.

Market Challenges

High Energy Costs and Power Supply Constraints Across Key Markets

Energy consumption remains one of the most critical operational concerns for colocation providers. Power prices fluctuate across North American regions, increasing operational risk. It places pressure on margins and limits flexibility in pricing models. Power grid limitations slow down expansion in energy-intensive areas. Integrating renewable sources involves infrastructure upgrades and grid stability measures. Energy contracts need long-term commitments that reduce adaptability. Operators must manage rising costs while meeting sustainability targets. The North America Data Center Colocation Market faces added complexity in securing reliable, low-carbon power sources.

Rising Data Security Risks and Regulatory Compliance Complexity

Cybersecurity threats grow in scale and sophistication, targeting interconnected colocation environments. Compliance with data privacy regulations across states and industries adds cost and complexity. It demands robust security frameworks, frequent audits, and advanced threat monitoring. Multi-tenant environments face higher risks due to shared infrastructure. Strict requirements in sectors like finance and healthcare increase compliance burden. Regulatory variations between the U.S., Canada, and Mexico complicate operations. Operators must balance scalability with security obligations. Failure to address these risks impacts customer trust and market positioning.

Market Opportunities

Expanding Demand from Emerging Industries and Enterprise Cloud Shifts

New sectors like autonomous mobility, digital health, and fintech boost colocation demand. Enterprises prioritize low-latency infrastructure to support data-intensive applications. It creates expansion opportunities for providers in urban and secondary hubs. Advanced analytics and edge solutions enhance service differentiation. Partnerships with AI and IoT companies increase network diversity. Businesses prefer flexible leasing models to avoid heavy capital outlay. This structural shift opens long-term revenue streams for operators. Market growth aligns with enterprise digital transformation goals.

Government Incentives and Infrastructure Modernization Programs

Federal and state-level programs promote renewable energy use and digital infrastructure investment. Energy-efficient projects attract funding through tax incentives and grants. It encourages the development of advanced Tier 3 and Tier 4 facilities. Public-private partnerships strengthen connectivity in underserved areas. Regulatory support improves business confidence in capacity expansion. Colocation operators leverage policy alignment to scale operations. Long-term infrastructure planning supports faster deployment cycles. Favorable policies enhance the attractiveness of investments in this sector.

Market Segmentation

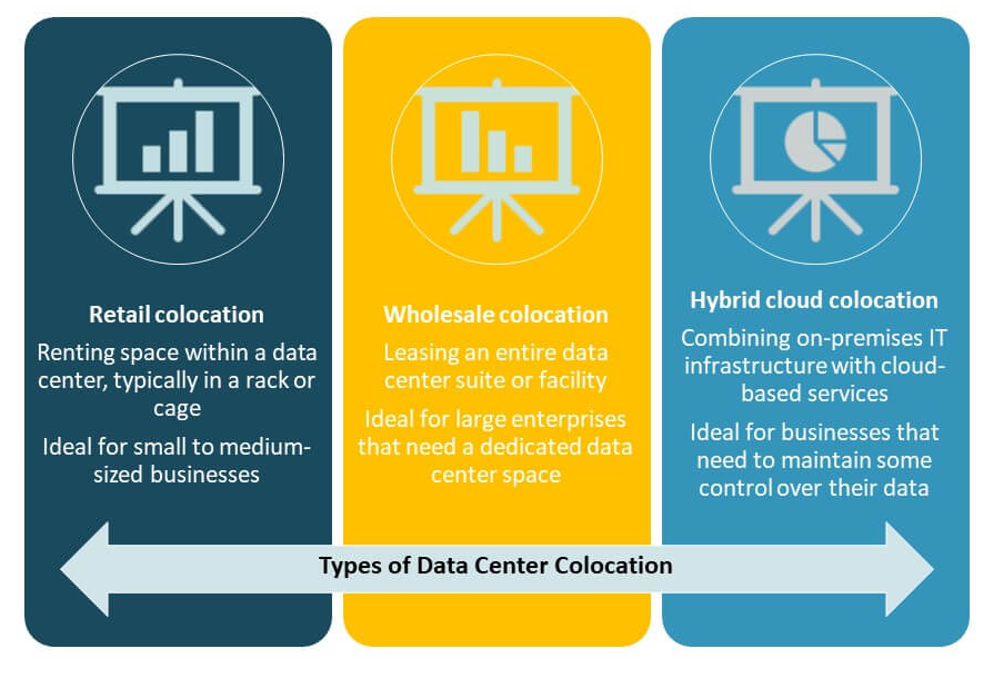

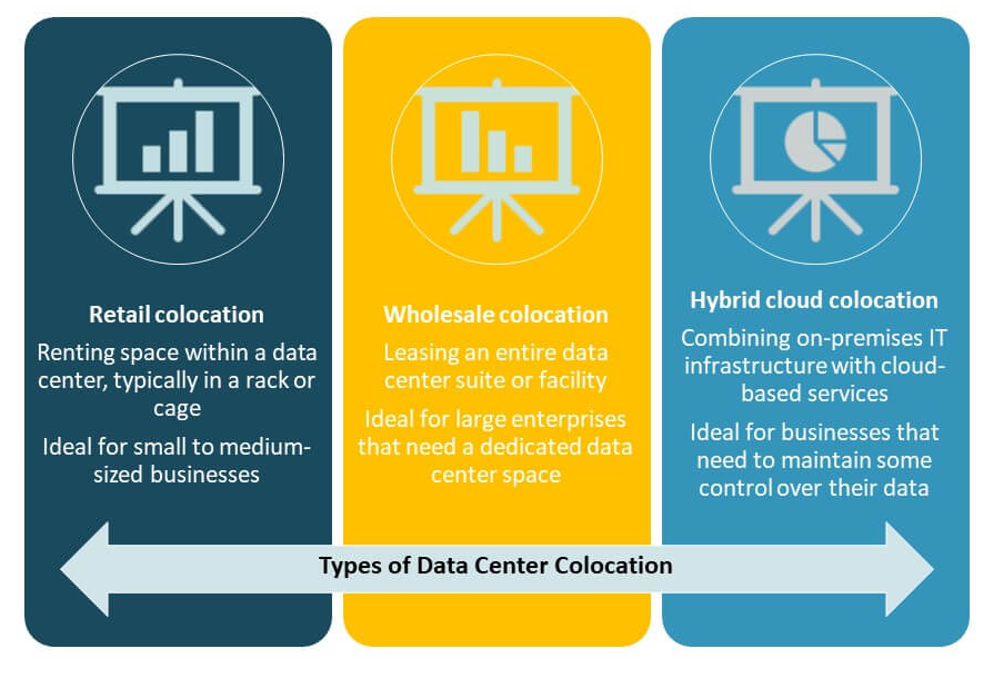

By Type

Retail colocation holds the dominant share in the North America Data Center Colocation Market due to its flexibility and lower entry cost for enterprises. It supports rapid deployment for small and mid-sized businesses. Wholesale colocation is gaining traction from hyperscale customers seeking dedicated space and power. Hybrid cloud colocation is expanding with growing multi-cloud strategies. Strong interconnection services and scalable capacity drive adoption. Demand for retail colocation remains highest among BFSI, healthcare, and IT enterprises.

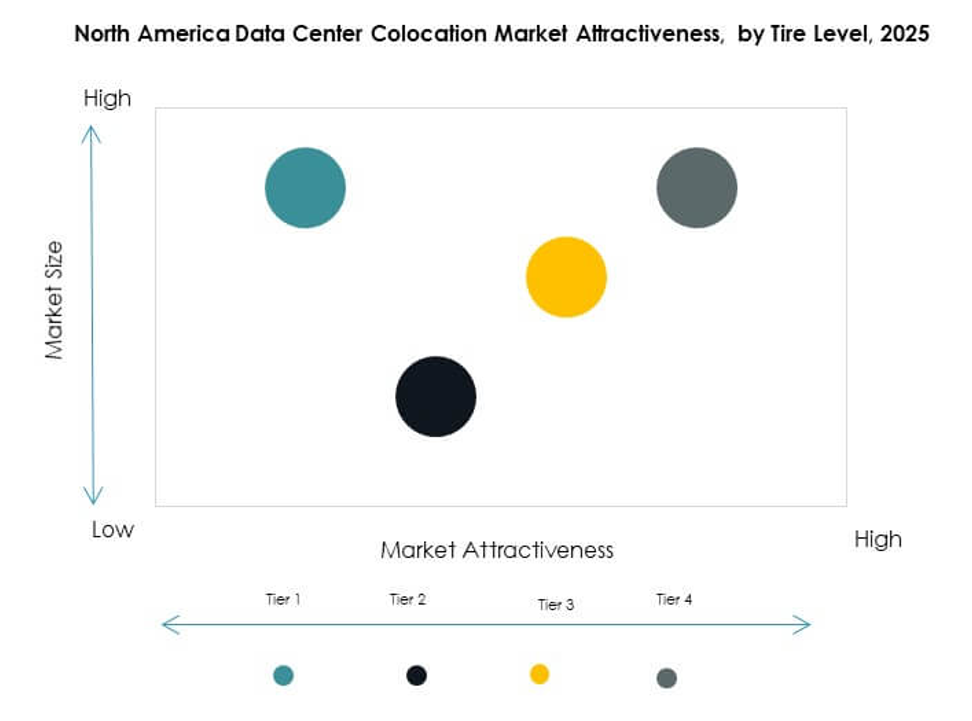

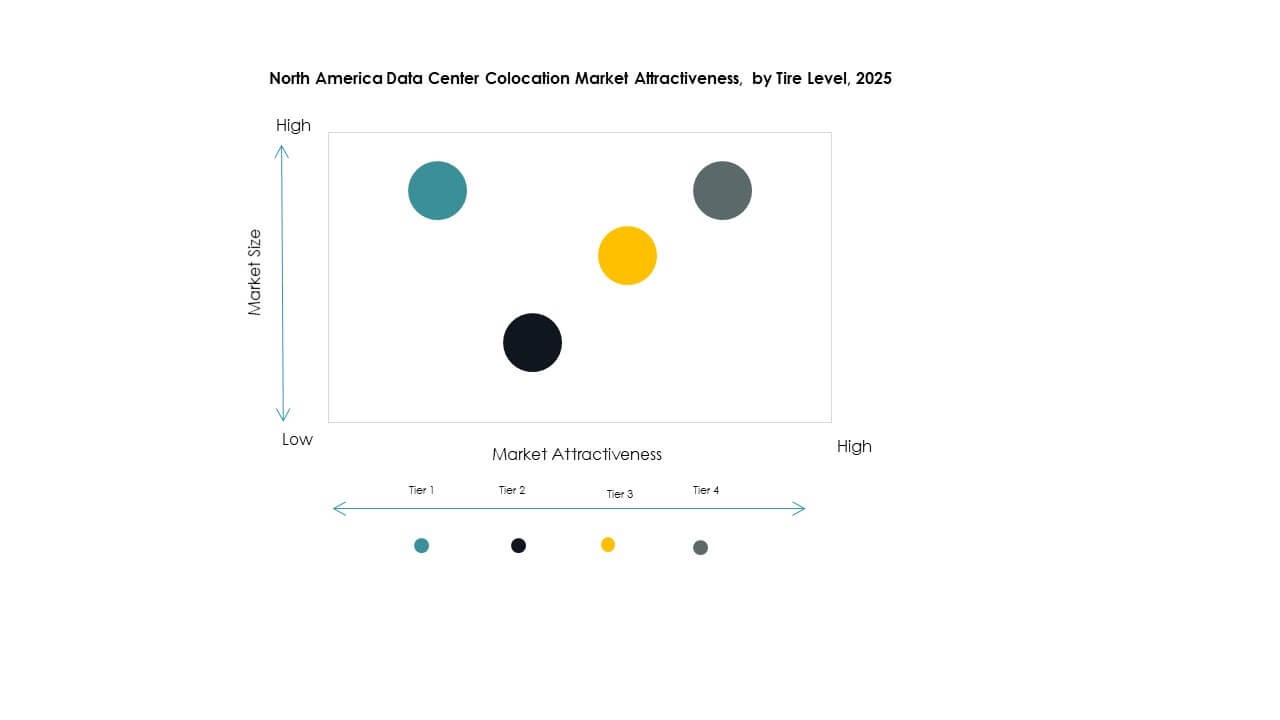

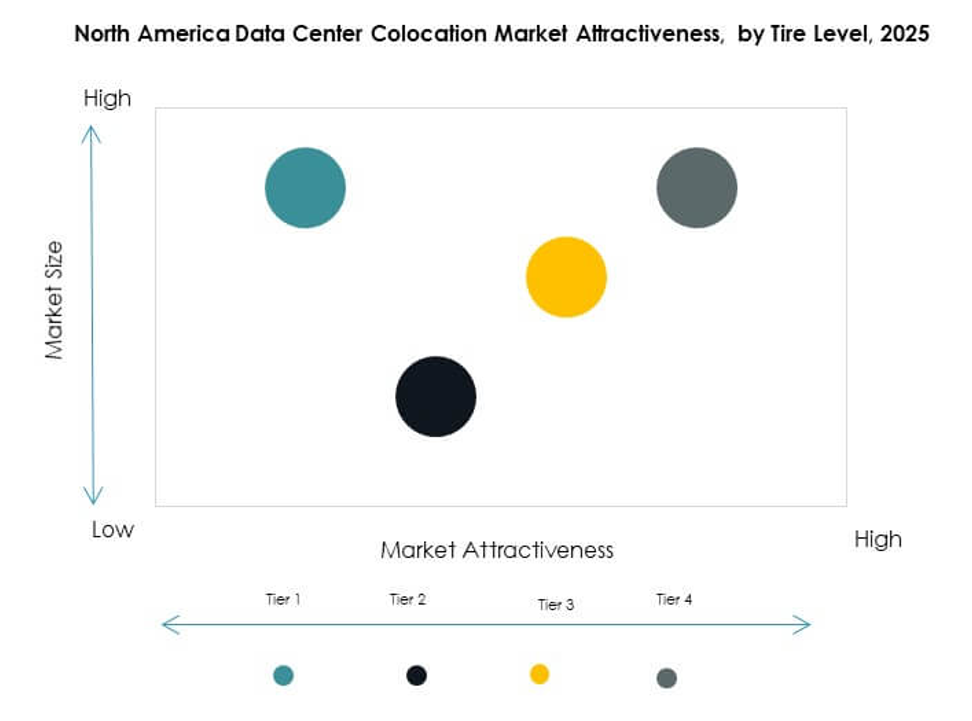

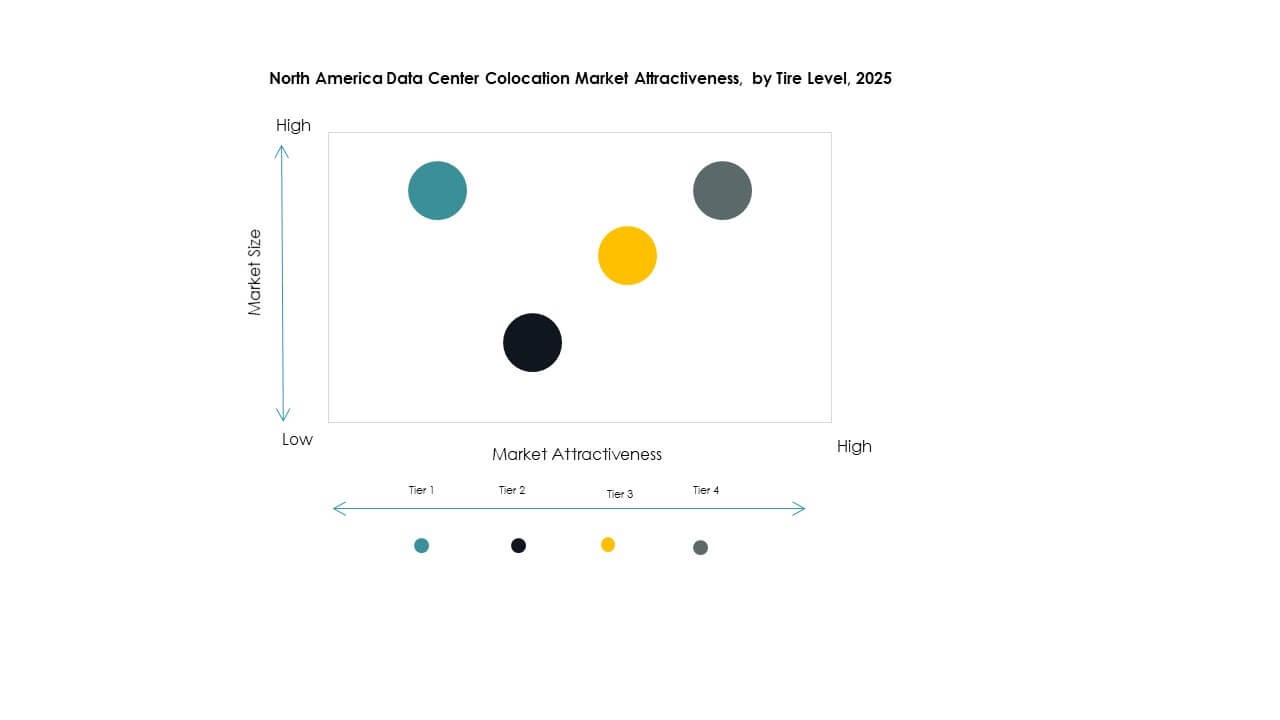

By Tier Level

Tier 3 facilities dominate the North America Data Center Colocation Market with a significant market share. They offer high availability and cost efficiency for most enterprise applications. Tier 4 facilities are growing rapidly due to hyperscale demand for mission-critical workloads. Tier 2 serves smaller deployments requiring moderate redundancy, while Tier 1 remains limited. Growing investment in reliable power backup and cooling enhances Tier 3 competitiveness. Tier 4 attracts investment from cloud providers seeking advanced resilience.

By Enterprise Size

Large enterprises lead the North America Data Center Colocation Market with the highest market share. They depend on colocation for high-performance computing and secure data storage. SMEs are expanding adoption as flexible leasing models reduce infrastructure burden. Growing digital transformation across industries boosts SME participation. Large enterprises maintain preference for Tier 3 and Tier 4 sites. SMEs focus on retail colocation for cost-effective and scalable solutions. Strategic alliances between operators and mid-sized firms support this growth.

By End User Industry

The IT & Telecom sector dominates the North America Data Center Colocation Market with strong infrastructure demand. BFSI follows closely, driven by compliance needs and secure transactions. Healthcare is expanding its presence with growing telehealth and digital records. Retail, media, and entertainment sectors adopt colocation to support e-commerce and streaming services. Edge computing and low-latency delivery accelerate sector growth. Emerging industries like education and public sector are increasing participation.

Regional Insights

United States – 67.5% Market Share

The U.S. holds the largest share of the North America Data Center Colocation Market due to its advanced digital ecosystem. Strong hyperscale activity, cloud adoption, and data localization drive investment. It benefits from a mature power grid, skilled workforce, and strategic connectivity hubs. Major cities like Ashburn, Dallas, and Chicago serve as primary colocation clusters. Edge deployments in secondary cities expand capacity. Hyperscalers and enterprises strengthen infrastructure footprints to support high-density workloads.

Canada – 20.2% Market Share

Canada shows strong momentum in colocation adoption due to its clean energy availability. Enterprises leverage renewable power to meet sustainability targets. It benefits from regulatory stability and attractive energy pricing structures. Montreal and Toronto lead deployments, attracting both domestic and foreign investments. Edge infrastructure projects enhance national connectivity. Government incentives accelerate infrastructure modernization and colocation growth. Investors view Canada as a stable and sustainable colocation market.

- For instance, Cologix’s TOR3 data center in Toronto offers 2 megawatts of power with 2N redundancy and access to over 160 network providers. It is built to Tier III standards and provides direct connectivity to more than 50 cloud platforms.

Mexico – 12.3% Market Share

Mexico emerges as a fast-growing subregion in the North America Data Center Colocation Market. Urban hubs like Mexico City and Querétaro lead adoption, supported by telecom expansion. Competitive power costs and improving connectivity strengthen investment potential. Colocation demand grows among cloud providers and regional enterprises. Government-backed digitalization programs accelerate infrastructure upgrades. Expanding edge infrastructure supports cross-border connectivity. Market players focus on strategic partnerships to enhance regional presence.

- For example, KIO Networks’ QRO2 in Querétaro’s El Marqués Industrial Park is designed to deliver 12 MW of IT power with concurrently maintainable N+1 infrastructure. It offers carrier-neutral access via more than 20 providers and includes two diverse underground service entry routes.

Competitive Insights:

- China Telecom Corporation Limited

- Cologix

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Centersquare

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- Iron Mountain, Inc.

- NTT Ltd. (NTT DATA)

- QTS Realty Trust, LLC

- Rackspace Technology

- Telehouse (KDDI CORPORATION)

- Zayo Group, LLC

The North America Data Center Colocation Market is shaped by aggressive expansion strategies, hyperscale investments, and strategic acquisitions. It reflects rising competition among large operators seeking stronger regional footprints and advanced capacity. Leading companies focus on scaling high-density and energy-efficient infrastructure to support AI, cloud, and edge workloads. Centersquare’s acquisition of 10 data centers, Cologix’s Toronto expansion, CoreSite’s facility launches in New Jersey and Denver, and CyrusOne’s Texas hyperscale project highlight this shift. Competitive advantage depends on power availability, network density, interconnection capabilities, and sustainable operations. Operators strengthen market positions through ecosystem integration and long-term enterprise partnerships. Market leaders prioritize operational excellence and rapid deployment to capture growing enterprise and hyperscale demand.

Recent Developments:

- In October 2025, Centersquare completed the acquisition of 10 data centers across the United States and Canada, totaling an enterprise value of $1 billion. The newly acquired facilities bolster Centersquare’s footprint, bringing its portfolio to 80 data centers and reinforcing its strategy to offer high-performance infrastructure for enterprise and hyperscale customers in key North American markets.

- In September 2025, Cologix expanded its Canadian presence by acquiring full ownership of the TOR4 hyperscale data center in Toronto and a strategic facility at 105 Clegg Road (TOR5), both sourced from CIM Group. These additions, now part of Cologix’s Scalelogix portfolio, deliver 14 MW of new capacity and over 90,000 square feet for hyperscale and enterprise customers. The transaction deepens Cologix’s investment in Toronto, providing enhanced support for inference AI and cloud workloads.

- In September 2025, CoreSite launched its NY3 data center in Secaucus, New Jersey, adding over 138,000 square feet of AI-optimized capacity to the New York metro campus, which now exceeds 442,000 square feet in total. In October 2025, CoreSite also reached a milestone in constructing its DE3 data center in Denver, a 180,000-square-foot project that will further expand its high-density digital infrastructure in the region.

- In July 2025, CyrusOne announced a partnership with Calpine Corporation to develop a new hyperscale data center adjacent to the Thad Hill Energy Center in Bosque County, Texas. The state-of-the-art DFW10 facility will benefit from a 190-megawatt deal for power and grid connection, is under construction, and is expected to be operational by Q4 2026. The $1.2 billion project targets climate neutrality, water conservation, and emergency grid responsiveness.