Executive summary:

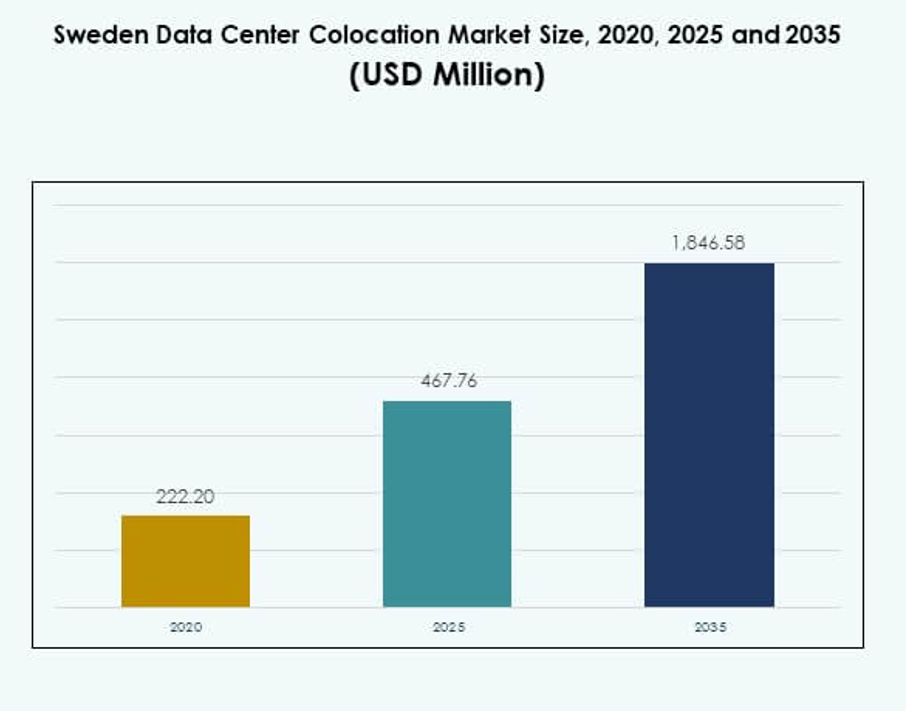

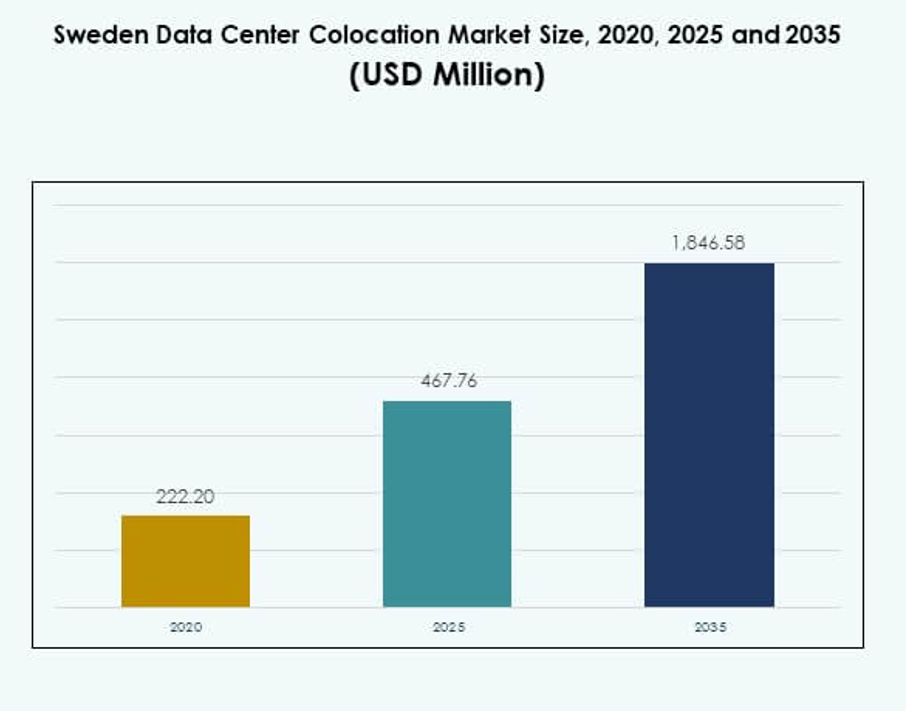

The Sweden Data Center Colocation Market size was valued at USD 222.20 million in 2020 to USD 467.76 million in 2025 and is anticipated to reach USD 1,846.58 million by 2035, at a CAGR of 14.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Sweden Data Center Colocation Market Size 2025 |

USD 467.76 Million |

| Sweden Data Center Colocation Market, CAGR |

14.66% |

| Sweden Data Center Colocation Market Size 2035 |

USD 1,846.58 Million |

The market is expanding through rapid technology adoption, rising cloud migration, and strong demand for AI and edge computing integration. It is strategically important for enterprises and investors seeking reliable, low-latency infrastructure with sustainable energy sources. Companies are focusing on hybrid and multi-cloud environments to optimize performance and reduce operational costs. Sustainability initiatives, advanced connectivity, and interconnection ecosystems strengthen the market’s investment appeal. Northern Sweden leads the market due to its abundant renewable energy and low operational costs. Central Sweden plays a major role, supported by enterprise activity and strong connectivity around Stockholm. Southern Sweden is emerging as a growth hub with infrastructure expansion and proximity to continental Europe. This geographic balance enhances the country’s position as a key Nordic digital infrastructure hub, attracting both regional and global operators.

Market Drivers

Rapid Cloud Migration and Adoption of Next-Generation Digital Infrastructure

The surge in cloud adoption is reshaping enterprise IT infrastructure in the Sweden Data Center Colocation Market. Businesses are transitioning from on-premises facilities to scalable, secure colocation centers to optimize operations. It supports flexibility, enhances network resilience, and reduces capital investment pressure on enterprises. Major hyperscale and enterprise customers are seeking high-availability environments for AI and IoT workloads. Renewable power integration strengthens energy efficiency and aligns with sustainability goals. Strategic location in Northern Europe attracts global investors. Interconnection ecosystems and carrier-neutral facilities boost competitiveness. The shift supports seamless hybrid and multi-cloud integration.

Strategic Advantage from Sweden’s Energy Efficiency and Green Power Initiatives

Sweden’s abundant renewable energy sources, low carbon footprint, and strong grid reliability offer unmatched value for data center operators. The country’s stable energy infrastructure supports large-scale colocation deployments with low operating costs. It encourages enterprises to align digital strategies with net-zero emission goals. Government policies favor energy-efficient construction and modernization, making the region attractive to global cloud and telecom players. Reduced power costs enhance competitiveness in hosting high-performance applications. Renewable power access ensures long-term operational stability. International firms view the market as a strategic hub for sustainable data infrastructure. Strong energy policies reinforce investment confidence.

- For instance, EcoDataCenter certified as climate positive and located in Falun utilizes 100% renewable energy, primarily hydro and solar power. Its Power Usage Effectiveness (PUE) is documented at below 1.15 in official sustainability reports, making it one of the most efficient data centers in Europe as of 2025.

Surging Edge Computing Demand and Network Expansion Driving Market Penetration

The growing need for low-latency services and real-time data processing is pushing enterprises toward colocation infrastructure. Edge computing adoption in Sweden allows operators to support AI, AR/VR, autonomous vehicles, and advanced IoT systems. It ensures enhanced service delivery and supports latency-sensitive applications across industries. Enterprises view colocation as a cost-effective and scalable option for distributed workloads. Telecom network expansion strengthens coverage and improves data flow across Nordic and European regions. Strong backbone connectivity and dark fiber availability enhance service performance. Edge nodes reduce latency for mission-critical applications. This ecosystem accelerates enterprise digital transformation.

Rising Enterprise Digital Transformation and Demand for Secure Infrastructure

A growing number of large enterprises and SMEs are digitizing business processes and integrating hybrid IT models. Colocation facilities offer enhanced security, compliance, and scalability compared to legacy on-premises setups. It provides enterprises with reliable power, climate control, and high network redundancy. Global corporations prefer secure colocation facilities to support mission-critical workloads. Strategic alliances between telecom operators and cloud providers expand service availability. Secure data sovereignty further attracts regulated industries like BFSI and healthcare. Enhanced disaster recovery capabilities make colocation an integral part of business continuity strategies. Advanced security protocols help maintain operational resilience.

- For instance, Interxion (Digital Realty) Stockholm operates data centers certified to ISO 27001 for information security management and provides encrypted colocation services tailored for financial and healthcare sectors. These certifications and sector-specific services are officially listed on Digital Realty’s compliance and data center facility documents.

Market Trends

Widespread Adoption of Modular Data Centers and Scalable Infrastructure Models

Modular data center architecture is emerging as a key trend in the Sweden Data Center Colocation Market. Operators are deploying prefabricated modular units to reduce setup time and improve efficiency. This approach ensures flexible capacity expansion to meet growing enterprise needs. It enables faster deployment of green energy systems and cooling technologies. Companies are investing in containerized power and cooling to reduce operational costs. The modular strategy enhances agility and lowers upfront capital requirements. High energy efficiency further supports net-zero goals. This model is reshaping how colocation providers scale infrastructure to match evolving demand.

Integration of Artificial Intelligence and Automation in Data Center Operations

AI and automation are transforming how colocation facilities manage workloads, energy, and security. AI-based predictive maintenance minimizes downtime and improves asset utilization. It enhances capacity planning and power management for complex workloads. Automated orchestration streamlines workload balancing across multiple environments. Smart energy optimization improves PUE scores and supports ESG goals. Operators are using AI to detect anomalies in real-time, strengthening cyber resilience. Automation reduces manual intervention and operational risk. The integration supports cost optimization and performance enhancement, positioning Sweden as a leader in intelligent data center infrastructure.

Growing Demand for Interconnection Ecosystems and Carrier-Neutral Facilities

Interconnection demand is rising as enterprises require seamless connectivity with multiple cloud and network providers. Carrier-neutral colocation hubs provide flexibility to build hybrid and multi-cloud environments. It enhances scalability and performance while minimizing vendor lock-in risks. Peering ecosystems attract hyperscale operators and content delivery networks. Cross-connect services enable enterprises to scale data transfer efficiently. Rich connectivity options strengthen Sweden’s role in Europe’s digital traffic routes. Strategic geographic location improves latency and data flow. This shift supports growing AI, media, and fintech applications that require robust interconnection infrastructure.

Strengthening Focus on Sustainability, Renewable Energy, and Heat Reuse Systems

Sustainability remains a strong trend shaping the future of colocation infrastructure in Sweden. Operators are adopting renewable energy sources and innovative heat reuse systems to reduce carbon emissions. It improves operational efficiency and aligns with ESG frameworks. Cooling technologies are evolving to use less water and power. Government incentives and environmental policies accelerate sustainable construction. Heat reuse initiatives enable operators to supply district heating networks. This practice strengthens energy circularity and cost efficiency. Green certifications enhance the market’s global reputation. Sustainability integration attracts environmentally conscious investors and enterprise clients.

Market Challenges

High Capital Investment and Cost Pressures in Infrastructure Development

Building and operating large-scale colocation facilities demands significant capital, advanced technology, and skilled resources. The Sweden Data Center Colocation Market faces high upfront costs for power distribution, cooling systems, and modular infrastructure. It requires heavy investment in fiber connectivity and redundancy systems to maintain competitive SLAs. Smaller operators often struggle to match the financial scale of global players. Rising construction costs and technology integration expenses increase market entry barriers. Long ROI timelines may limit participation of mid-sized firms. Strict compliance standards add further cost pressure. Maintaining operational efficiency while scaling capacity remains a key challenge.

Regulatory Compliance, Data Sovereignty, and Skilled Workforce Shortages

Strict regulatory frameworks and data protection rules create complexity for operators managing international workloads. It must ensure compliance with GDPR, national data residency, and environmental mandates. Finding skilled technical talent to manage AI-driven, automated data centers is another major challenge. Workforce shortages can slow operational expansion and innovation. High training costs and limited specialized expertise add to the pressure. Regulatory hurdles can delay new facility approvals and increase project costs. International investors must navigate local legal frameworks carefully. Ensuring compliance while meeting uptime commitments requires strong operational discipline.

Market Opportunities

Strategic Positioning as a Nordic Digital Infrastructure Hub

Sweden holds a central position in Northern Europe’s digital ecosystem, making it a preferred destination for hyperscale and enterprise colocation investments. The Sweden Data Center Colocation Market benefits from abundant renewable power, low-latency connectivity, and proximity to European traffic routes. Its energy efficiency and political stability enhance investor confidence. Demand for AI, IoT, and edge computing services creates strong expansion opportunities. Government support for green energy further strengthens its global competitiveness. This ecosystem positions the country as a strategic interconnection gateway for Europe.

Accelerated Adoption of AI, Edge, and Hybrid IT Solutions

Rising enterprise adoption of AI and edge workloads creates strong growth potential for colocation providers. It supports hosting advanced computing platforms without requiring costly on-premises infrastructure. AI-enabled operations enhance energy efficiency and network reliability. The growing hybrid IT landscape encourages multi-cloud integration within colocation facilities. Strong fiber connectivity and neutral interconnection ecosystems attract new hyperscale operators. This growth trend opens new revenue streams for operators and technology partners. Sustainable and intelligent infrastructure strengthens the market’s long-term investment appeal.

Market Segmentation

By Type

Retail colocation dominates the Sweden Data Center Colocation Market, supported by strong demand from SMEs and mid-sized enterprises. This segment holds the largest share due to its flexibility and cost-efficient infrastructure access. Businesses prefer retail models to deploy smaller workloads without building their own facilities. Wholesale colocation is expanding among hyperscale operators seeking dedicated capacity. Hybrid cloud colocation is gaining momentum through multi-cloud integration strategies. Strong interconnection ecosystems further support retail growth. Strategic location and sustainability policies enhance demand. This structure ensures steady market expansion and investment attractiveness.

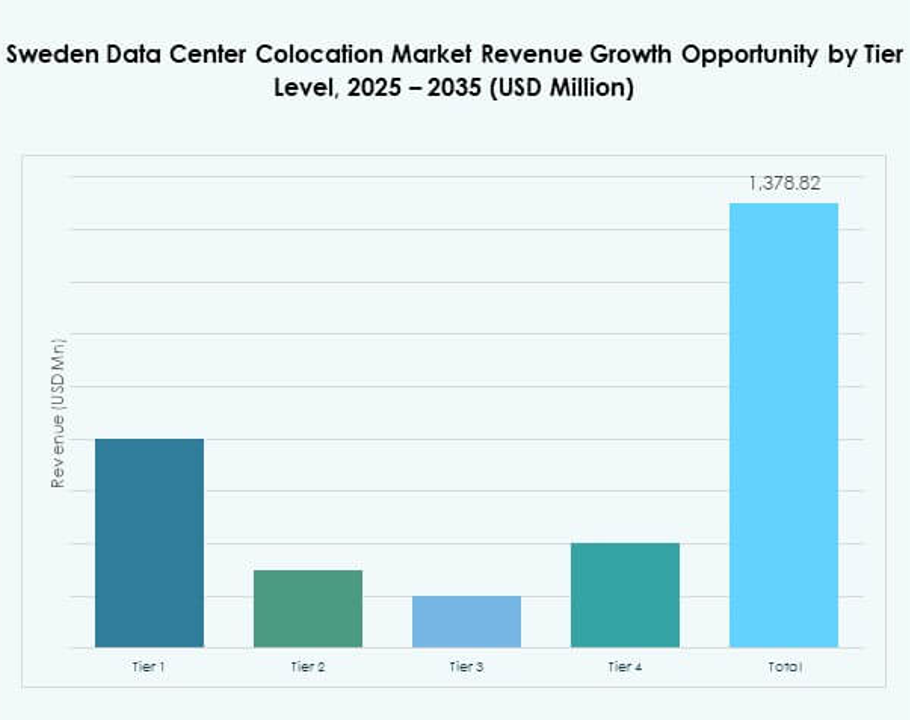

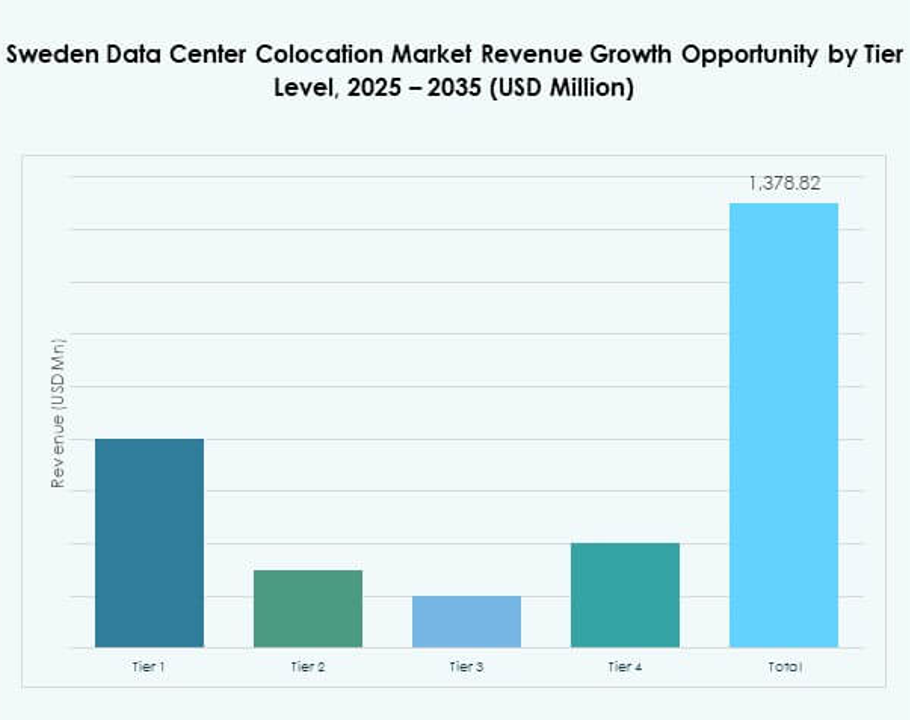

By Tier Level

Tier 3 facilities dominate the Sweden Data Center Colocation Market, reflecting strong enterprise demand for high reliability and uptime. Tier 3 offers advanced redundancy, fault tolerance, and security features. It ensures 99.982% availability, meeting critical application needs. Tier 4 adoption is rising among hyperscale and financial institutions requiring advanced fault tolerance. Tier 1 and Tier 2 remain suitable for non-critical workloads with limited redundancy requirements. High energy efficiency and renewable sourcing strengthen Tier 3 competitiveness. Its balance of cost and resilience drives sustained growth.

By Enterprise Size

Large enterprises lead the Sweden Data Center Colocation Market, driven by demand for secure, scalable, and compliant infrastructure. They use colocation to host AI, IoT, and mission-critical workloads without capital-intensive on-premises builds. Strong SLAs and advanced connectivity support global service delivery. SMEs are rapidly increasing their presence through retail colocation to access affordable, flexible resources. Hybrid cloud adoption is enabling small firms to scale efficiently. Energy efficiency and reliable uptime remain key factors for both segments. The market shows steady diversification of enterprise demand.

By End User Industry

The IT & Telecom sector holds the largest share in the Sweden Data Center Colocation Market due to strong demand for cloud interconnection and edge services. BFSI follows closely, relying on secure, compliant infrastructure to protect sensitive financial data. Healthcare is expanding its presence with digital health applications and patient record systems. Retail and media sectors are growing through e-commerce and content delivery networks. Other industries contribute to demand through AI-driven digitalization. Strong sector diversity enhances market stability and investment potential.

Regional Insights

Northern Sweden: Strategic Leadership with 42% Market Share

Northern Sweden leads the Sweden Data Center Colocation Market with a 42% share due to abundant renewable energy resources and lower operational costs. Its cool climate supports efficient cooling systems and lowers energy usage. Hyperscale operators prefer this region for large-scale deployments. Strong fiber connectivity ensures low-latency interconnection across Europe. Stable political and regulatory conditions enhance investment security. The concentration of green energy facilities strengthens the region’s leadership position in sustainable colocation infrastructure.

- For instance, atNorth announced in December 2024, the acquisition of land in Sollefteå, Northern Sweden, for its new hyperscale data center, which will have an initial planned capacity of 200 MW and is powered entirely by local hydroelectric energy. This facility is part of atNorth’s Nordic expansion and aligns with documented renewable energy integration standards.

Central Sweden: Strong Enterprise Demand with 36% Market Share

Central Sweden holds a 36% share and acts as a major hub for enterprise colocation activity. Its proximity to Stockholm enhances connectivity and accessibility for global cloud service providers. Enterprises prefer this region for hybrid and multi-cloud workloads. Its infrastructure supports fintech, telecom, and digital media industries. Strong presence of carrier-neutral facilities drives interconnection expansion. Strategic location in the heart of the Nordic network enhances its value for hyperscale investments.

Southern Sweden: Emerging Growth Hub with 22% Market Share

Southern Sweden accounts for 22% of the Sweden Data Center Colocation Market, driven by rising demand from SMEs and local enterprises. It benefits from infrastructure expansion, sustainable energy availability, and proximity to continental Europe. The region is attracting emerging colocation providers seeking low-cost expansion zones. Network improvements and renewable energy integration support rapid growth. The region’s position near international fiber routes strengthens its connectivity. Southern Sweden’s rising role enhances the national colocation ecosystem’s balance and reach.

- For instance, European Energy commissioned the Skåramåla hybrid solar-wind park in Kronoberg, Southern Sweden, in September 2025, introducing 39.3 MWp solar PV and 49.6 MW wind capacity directly supporting local grid supply used by new data center developments as confirmed in inaugural press releases and utility grid reports for the region.

Competitive Insights:

- Bahnhof

- GleSYS

- City Network

- Advania

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The competitive landscape of the Sweden Data Center Colocation Market is defined by strong international and regional players investing in advanced infrastructure and sustainable operations. It is marked by strategic expansions, hyperscale partnerships, and energy-efficient facility development. Global operators like Digital Realty, Equinix, AWS, and Google Cloud lead in capacity, connectivity, and innovation. Regional players such as Bahnhof and GleSYS leverage renewable energy and localized service models to strengthen market presence. Companies focus on high-density colocation, hybrid cloud integration, and edge readiness. Strategic alliances with telecom carriers and hyperscale providers further enhance service reach and reliability. Sustainability and interconnection remain critical competitive differentiators.

Recent Developments:

- In October 2025, GlobalConnect announced a major expansion of its Stockholm data center, aiming to boost its colocation capacity and strengthen its services for enterprise clients in Sweden’s fast-growing digital infrastructure sector. This project highlights increasing demand among Swedish businesses for scalable and secure data center solutions driven by cloud adoption and digital transformation.

- In October 2025, GleSYS made headlines by acquiring Verne’s managed private cloud operations and two data center facilities located in Pori and Tampere, Finland. This acquisition represents a critical step for GleSYS in expanding its cloud and IaaS services, further strengthening its footprint and scalable, energy-efficient service capabilities across the Nordic region, including Sweden.