Executive summary:

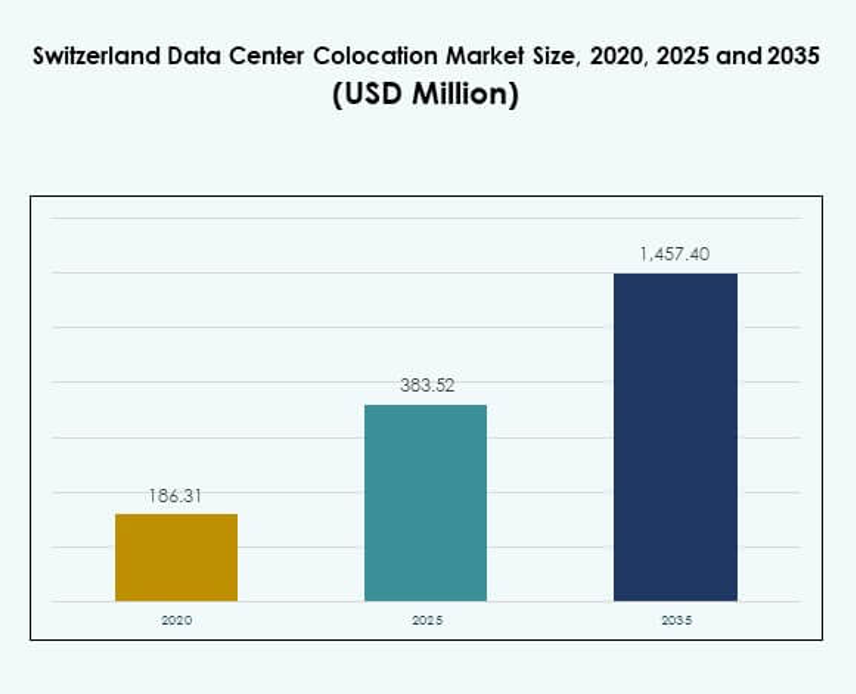

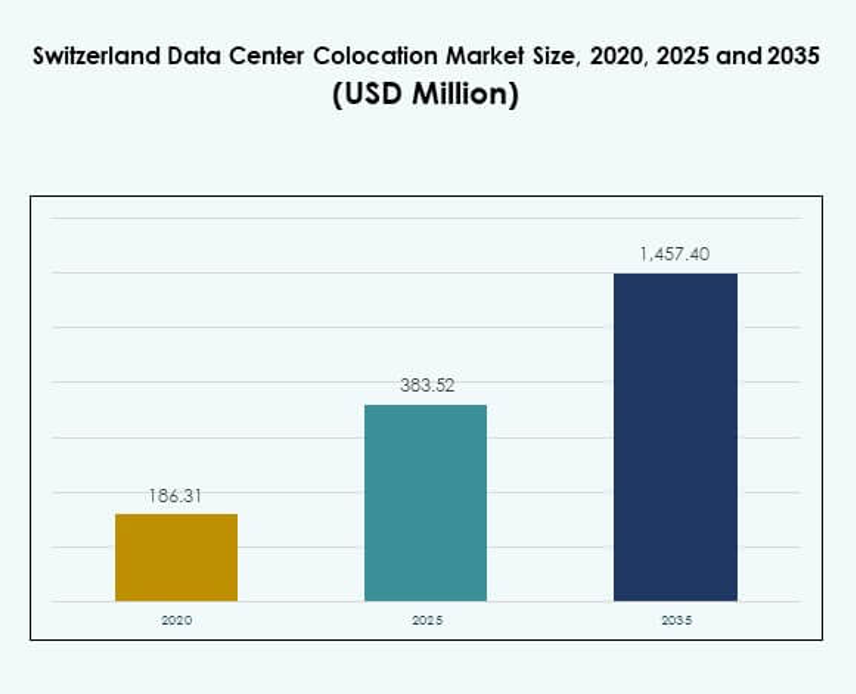

The Switzerland Data Center Colocation Market size was valued at USD 186.31 million in 2020, increased to USD 383.52 million in 2025, and is anticipated to reach USD 1,457.40 million by 2035, at a CAGR of 14.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Switzerland Data Center Colocation Market Size 2025 |

USD 383.52 Million |

| Switzerland Data Center Colocation Market, CAGR |

14.22% |

| Switzerland Data Center Colocation Market Size 2035 |

USD 1,457.40 Million |

Strong demand for secure, high-performance infrastructure and advanced cloud services drives rapid adoption of colocation in the country. The Switzerland Data Center Colocation Market benefits from growing AI and IoT integration, strong renewable energy availability, and scalable infrastructure. These factors create favorable conditions for hyperscalers and enterprise clients. Its strategic importance for investors lies in its stable regulatory environment, reliable energy supply, and direct connectivity to major European hubs. Zurich leads the market due to its dense network infrastructure, hyperscale presence, and strong fiber connectivity. Geneva is emerging as a secondary hub supported by renewable energy integration and cross-border financial activity. Bern and other regions are growing through modular expansions and strategic infrastructure investments. These geographic dynamics make Switzerland a critical node in Europe’s digital infrastructure ecosystem.

Market Drivers

Rising Demand for High-Performance Infrastructure Supporting Cloud and AI Adoption

Switzerland’s strong digital ecosystem is driving large-scale investments in advanced colocation facilities. Global enterprises are adopting AI workloads, IoT applications, and data-intensive processes, which increase demand for reliable compute capacity. The Switzerland Data Center Colocation Market benefits from its robust fiber backbone and direct cloud connectivity to hyperscalers. Zurich plays a key role in enabling low-latency access across Europe. Enterprises prioritize uptime and scalable architecture to meet fast-evolving IT needs. Colocation providers focus on high-density deployments and efficient energy use. Investors view this infrastructure as critical for digital growth. This shift reinforces Switzerland’s position as a strategic digital hub.

- For instance, Equinix has announced liquid cooling deployments across its global facilities, supporting AI workloads with power densities scaling up to 100 kW per rack through direct-to-chip cooling technology. This capability enables efficient handling of high-performance compute clusters and GPU-intensive applications.

Expanding Renewable Energy Integration Enhancing Operational Efficiency

Strong renewable energy availability strengthens the sustainability profile of Swiss data centers. Colocation operators actively deploy energy-efficient cooling, power management, and heat recovery solutions. The Switzerland Data Center Colocation Market benefits from hydropower availability, ensuring stable and clean energy supply. Operators align operations with carbon neutrality goals to meet enterprise sustainability targets. Efficient energy integration also improves operational cost control for tenants. Investors favor locations with stable power grids and environmental compliance. This alignment supports long-term returns and ESG strategies. Renewable energy integration enhances both reliability and global competitiveness of Swiss colocation assets.

- For instance, Green Datacenter AG launched its Metro-Campus Zurich Datacenter M in January 2023, a facility built with energy-efficient design in Dielsdorf and powered by renewable energy and free-cooling strategies.

Regulatory Stability and Data Protection Strengthening Investor Confidence

Switzerland’s data protection framework and political stability create a secure operating environment. Enterprises value strict privacy regulations that align with EU standards while preserving independence. The Switzerland Data Center Colocation Market gains strategic advantage through its robust compliance structure. Colocation operators attract global clients seeking GDPR-aligned but sovereign data hosting. Regulatory certainty lowers risk for large-scale infrastructure investments. Stability supports long-term lease agreements and international partnerships. This advantage appeals to financial services, healthcare, and government clients. Strong governance reinforces Switzerland’s reputation as a trusted hosting destination.

Edge Deployments and Hyperscale Expansion Creating New Growth Corridors

Hyperscale players are expanding presence in Zurich and surrounding zones to meet rising demand. Edge deployments enable ultra-low latency and distributed processing capabilities. The Switzerland Data Center Colocation Market benefits from growing proximity hosting strategies. Telecom operators and enterprises deploy edge nodes to support 5G, IoT, and smart industry applications. This infrastructure accelerates network responsiveness and business agility. Strategic geographic positioning supports connectivity to major EU cities. Operators expand footprint with modular and scalable builds. Edge and hyperscale investments increase market competitiveness and attract global capital flows.

Market Trends

Heat Recovery and Circular Energy Models Transforming Data Center Operations

Circular energy practices are shaping future energy strategies in Swiss colocation facilities. Colocation providers export waste heat from server operations to district heating systems. The Switzerland Data Center Colocation Market benefits from these advanced sustainability initiatives. This reduces environmental impact and enhances energy efficiency ratings. Zurich leads this shift with several operators integrating urban heating grids. Such practices create value streams while improving ESG performance. Regulatory incentives and public-private partnerships support wider adoption. Circular models strengthen Switzerland’s position as a leader in green data infrastructure.

AI-Powered Automation Enhancing Efficiency and Reliability Across Facilities

Operators deploy AI-driven monitoring, predictive maintenance, and dynamic cooling to optimize operations. AI enables real-time power management and workload distribution for improved performance. The Switzerland Data Center Colocation Market leverages automation to boost energy savings and reliability. AI tools help operators manage capacity and respond quickly to demand shifts. Predictive analytics reduces downtime and enhances service delivery. This improves customer experience and strengthens service-level compliance. Automation also supports modular scalability for future capacity expansions. AI integration is becoming a standard competitive differentiator.

Growing Interconnection Hubs Strengthening International Connectivity

Switzerland is becoming a key interconnection hub for Central and Western Europe. High-speed fiber routes link Zurich with Frankfurt, Milan, Paris, and London. The Switzerland Data Center Colocation Market benefits from this dense network integration. Enterprises use these hubs to enable secure, low-latency traffic exchange. Carrier-neutral facilities increase cloud access flexibility for customers. Interconnection growth enhances Switzerland’s attractiveness to content providers and hyperscalers. This drives network densification and boosts digital trade flows. Strong connectivity reinforces the country’s role as a European digital bridge.

Increased Focus on Modular and Scalable Data Center Architectures

Modular infrastructure design enables faster deployments and flexible capacity expansion. Colocation operators adopt pre-fabricated modules to meet client demands quickly. The Switzerland Data Center Colocation Market gains from shorter construction timelines and efficient land use. Modular builds align with changing power and space requirements of enterprises. This trend supports both hyperscale and edge strategies. It also allows providers to respond to regulatory and market changes more effectively. Scalability ensures better cost optimization and faster ROI cycles. Modular adoption enhances market agility and competitiveness.

Market Challenges

Power Availability Constraints and High Energy Pricing Pressure

Limited grid capacity and rising energy costs pose serious concerns for operators. Hydropower remains stable but growing demand strains overall availability. The Switzerland Data Center Colocation Market faces operational complexity in securing sustainable and affordable energy. Rising power costs pressure colocation pricing models and customer margins. Providers need to balance ESG goals with cost control strategies. Expanding renewable capacity takes time, increasing short-term risk. Power constraints also limit rapid capacity additions for hyperscale projects. Energy security remains a critical factor influencing investment strategies.

Complex Regulatory Compliance and Land Use Restrictions Slowing Expansions

Strict zoning, construction, and environmental regulations create hurdles for new facility developments. The Switzerland Data Center Colocation Market operates under layered compliance frameworks at national and municipal levels. Obtaining permits often involves lengthy review cycles and infrastructure commitments. Land scarcity near urban connectivity hubs intensifies competitive bidding. These factors slow down expansion timelines for both retail and wholesale providers. Investors face additional costs tied to regulatory approvals. Operators must navigate complex rules while maintaining project profitability. These constraints affect market scalability and operational flexibility.

Market Opportunities

Expansion of Hyperscale and Edge Deployments Strengthening Market Growth

Hyperscale providers are increasing investments in Zurich and surrounding regions. Edge infrastructure supports industries requiring real-time processing, such as manufacturing and autonomous systems. The Switzerland Data Center Colocation Market benefits from this multi-layered infrastructure growth. Local enterprises gain improved access to scalable and secure compute capacity. This attracts international players seeking low-latency European connectivity. Investment momentum creates strong opportunities for co-location operators. Strategic positioning around key fiber routes maximizes growth potential.

Green Technology Adoption Driving Competitive Advantage for Colocation Providers

Sustainability leadership enhances Switzerland’s global appeal in the colocation landscape. Operators invest in liquid cooling, heat reuse, and zero-carbon energy sourcing. The Switzerland Data Center Colocation Market gains strategic visibility through these innovations. Enterprises prefer hosting in environmentally compliant facilities to meet ESG mandates. Providers can access green financing and long-term partnerships. Green practices align with corporate climate goals and strengthen branding. This creates strong investment and market differentiation opportunities.

Market Segmentation

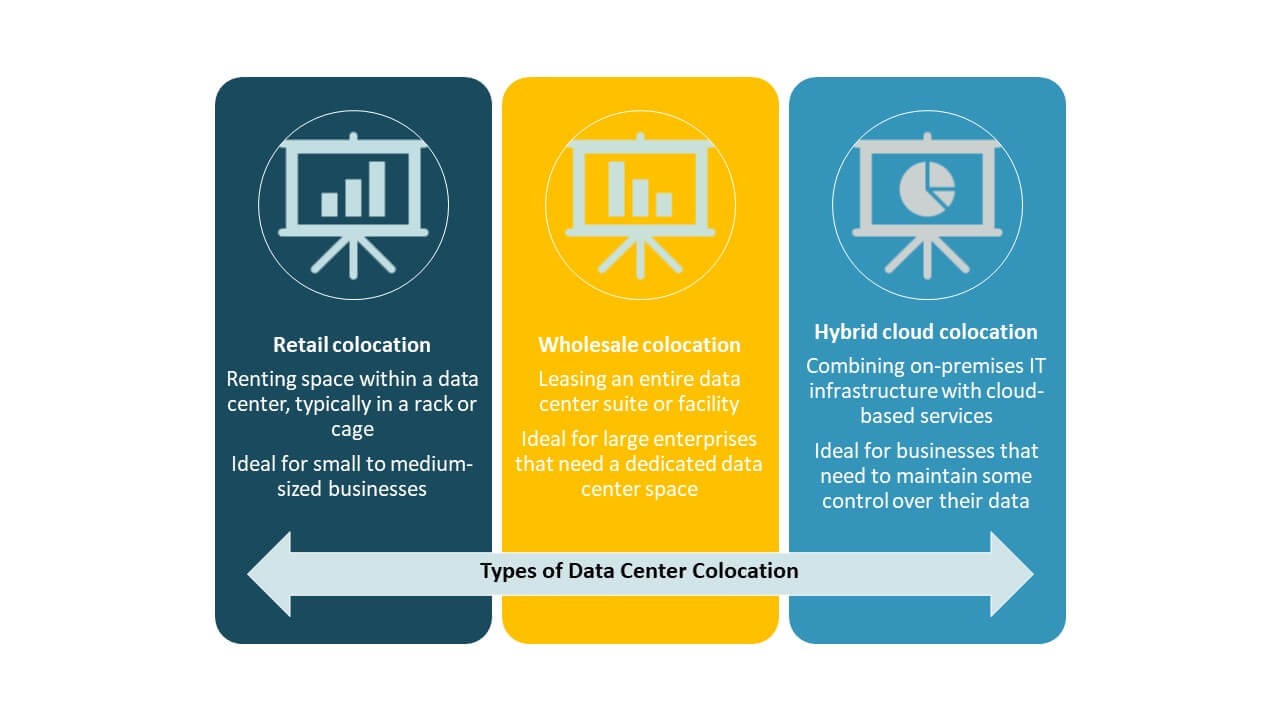

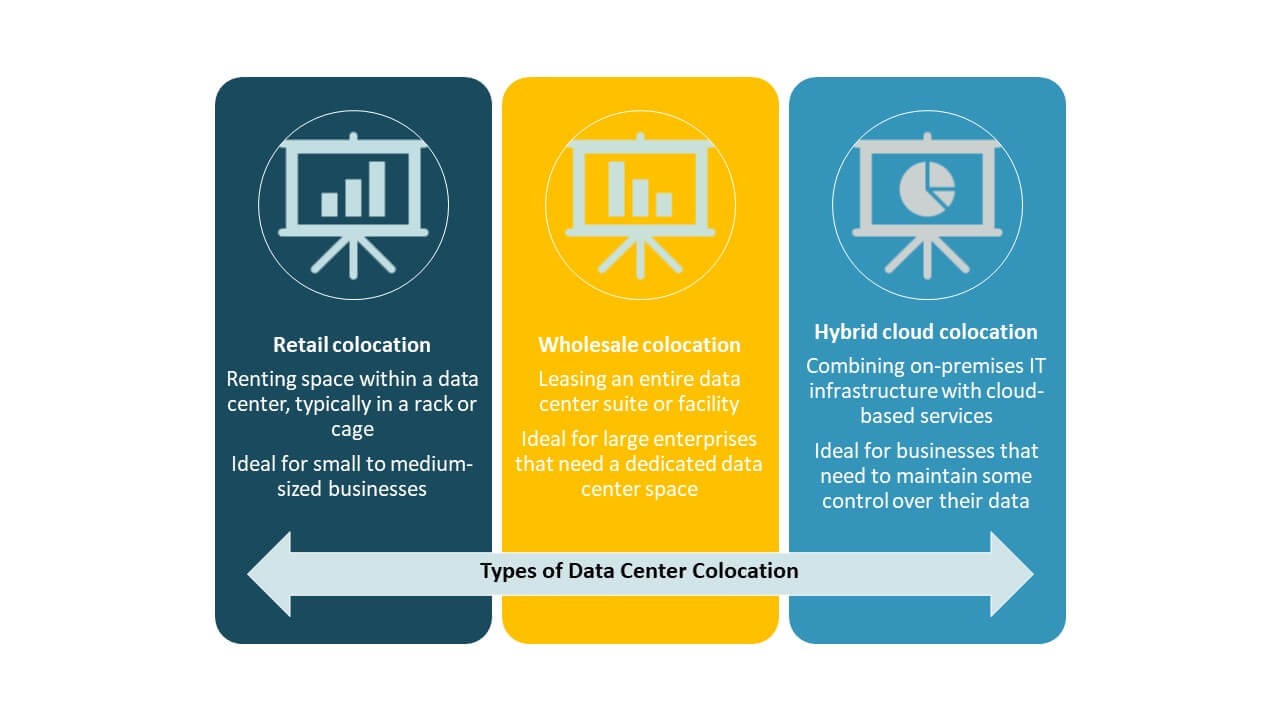

By Type

Retail colocation holds the largest share of the Switzerland Data Center Colocation Market due to its flexibility for small and mid-sized enterprises. It allows customers to lease rack space with managed power and connectivity. Wholesale colocation supports hyperscale needs but faces longer deployment cycles. Hybrid cloud colocation is growing quickly as enterprises combine on-premise and cloud workloads. The retail model remains dominant because of ease of scaling and lower capital needs.

By Tier Level

Tier 3 dominates the Switzerland Data Center Colocation Market due to its balance of cost and reliability. It provides redundant components and 99.982% uptime, meeting critical enterprise needs. Tier 4 is growing in hyperscale segments but involves higher costs. Tier 1 and Tier 2 serve smaller workloads with less redundancy. Most international enterprises prefer Tier 3 for mission-critical hosting. Regulatory compliance and energy efficiency strengthen its position in the Swiss market.

By Enterprise Size

Large enterprises hold the majority share of the Switzerland Data Center Colocation Market. They demand high security, scalable infrastructure, and dedicated power capacity. SMEs are increasing adoption through retail colocation models that reduce capital expenditure. Large enterprises drive demand through hybrid cloud integration and disaster recovery setups. They also leverage colocation for compliance with data residency laws. SME growth is expected to accelerate with expanding digital transformation initiatives.

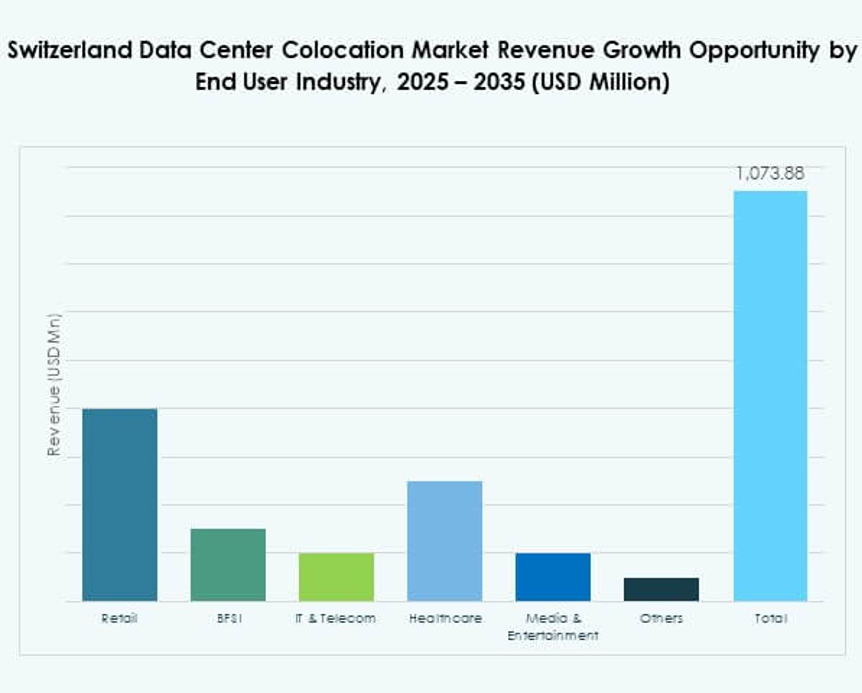

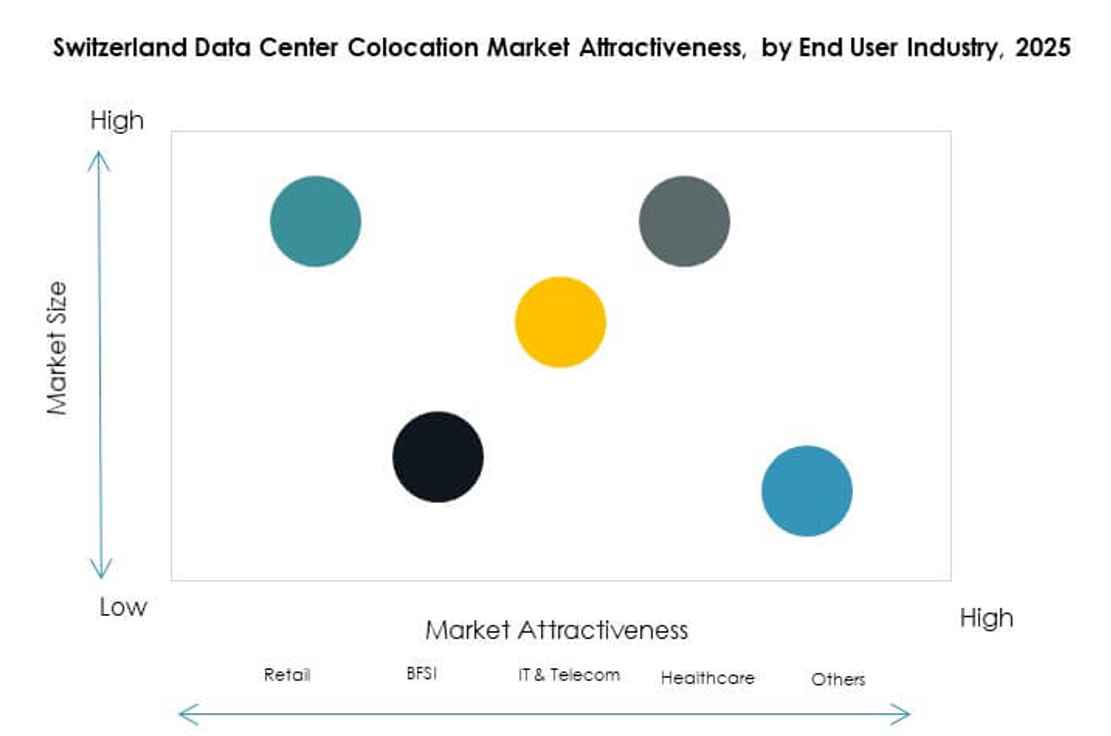

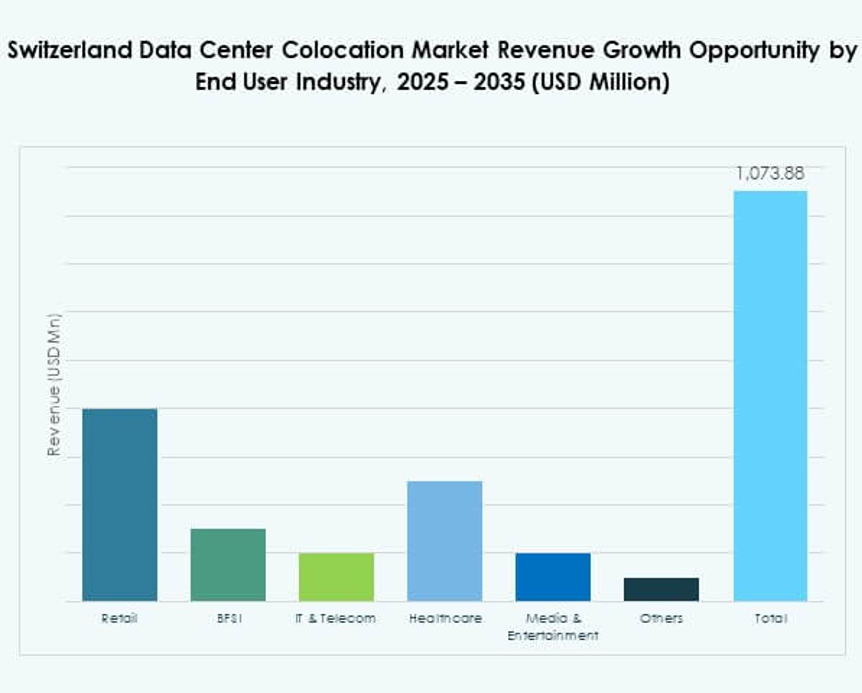

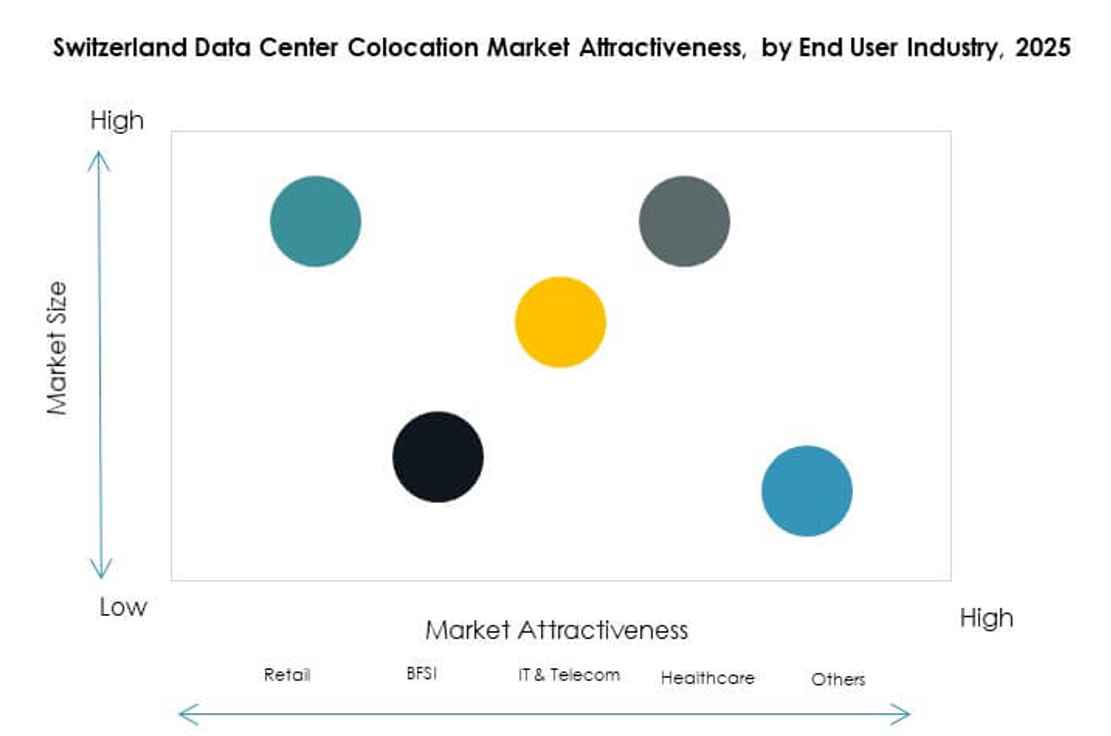

By End User Industry

The IT and Telecom sector leads the Switzerland Data Center Colocation Market, driven by cloud computing, 5G deployment, and AI workloads. BFSI follows due to strict data security and compliance needs. Healthcare and media sectors are adopting colocation to support secure and scalable storage. Retail uses colocation for e-commerce and supply chain digitalization. Other industries are shifting workloads off-premises to reduce operational complexity. IT and Telecom remain the anchor industry segment for market growth.

Regional Insights

Zurich Leading the Market with Strong Connectivity and Hyperscale Presence (67.3%)

Zurich dominates the Switzerland Data Center Colocation Market with a 67.3% share. Its dense connectivity infrastructure and proximity to major EU fiber routes make it the primary hub. Most hyperscale and enterprise colocation deployments concentrate here. Zurich’s energy reliability and skilled workforce further strengthen its strategic role. Colocation operators expand capacity around Zurich to support growing demand from international cloud providers. Its geographic advantage enables low-latency connections to Frankfurt, Milan, and Paris.

- For instance, Equinix operates its ZH5 facility in Zurich, featuring more than 6,670 m² of colocation space with a capacity of up to 2,600 cabinet equivalents, and providing connectivity to major cloud platforms including Microsoft Azure and Google Cloud.

Geneva Emerging as a Secondary Hub with Sustainable Infrastructure (20.6%)

Geneva accounts for 20.6% share of the Switzerland Data Center Colocation Market. It benefits from strong renewable power integration and international business presence. Colocation facilities in this region support cross-border financial services and government workloads. Its sustainable power supply makes it attractive to green investment funds. Geneva’s growing interconnection ecosystem enhances its role as a secondary hub. Operators focus on scalable builds to support emerging demand from edge deployments.

- For example, STACK Infrastructure’s GEN01A campus in Geneva is powered by 100% hydro-generated electricity and offers commissioned capacity around 4 MW, with carrier-neutral interconnection and access to Geneva’s wider ecosystem, including peering available at CERN/Equinix Geneva via CIXP.

Bern and Other Regions Showing Steady Growth through Strategic Expansions (12.1%)

Bern and other regions collectively hold 12.1% share of the Switzerland Data Center Colocation Market. They are gaining importance through regional edge deployments and modular data center builds. Lower land costs and supportive municipal policies encourage new investments. These regions provide alternative hosting options to relieve Zurich’s capacity pressure. Local governments promote infrastructure development to support industrial digitalization. Steady growth across these regions enhances overall market resilience and diversity.

Competitive Insights:

- Green.ch

- Safe Host

- Exoscale

- Nine Internet Solutions

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The competitive landscape of the Switzerland Data Center Colocation Market features a mix of domestic operators and global hyperscale players. Green.ch, Safe Host, and Exoscale strengthen local presence through sustainability-focused infrastructure and regional connectivity. Global companies such as Equinix, Digital Realty, and AWS offer hyperscale capabilities, advanced interconnection services, and direct cloud access. It encourages strong competition based on scalability, energy efficiency, and service reliability. Strategic investments, acquisitions, and green energy integration shape market positions. Local providers differentiate through regulatory expertise and proximity services, while global leaders expand capacity to serve enterprise demand. This balanced competition drives innovation and service modernization across key hubs like Zurich and Geneva.

Recent Developments:

- In October 2025, Switzerland’s Green Datacenter continued its European expansion by officially entering the German market. On September 11, Green Datacenter successfully established its subsidiary, Green Datacenter Germany GmbH, and completed evaluations for new data center locations near Frankfurt. This strategic move allowed Green Datacenter, primarily known for servicing enterprise customers and cloud providers, to further extend its footprint across Europe.

- In September 2025, NorthC announced the construction of a new regional data center in Basel, Switzerland. The contract signing for the facility took place at the uptownBasel Innovation Campus in Arlesheim. The development project illustrated NorthC’s continued commitment to boosting its local footprint and empowering regional cloud and enterprise clients with enhanced colocation solutions and direct connectivity options.