Executive summary:

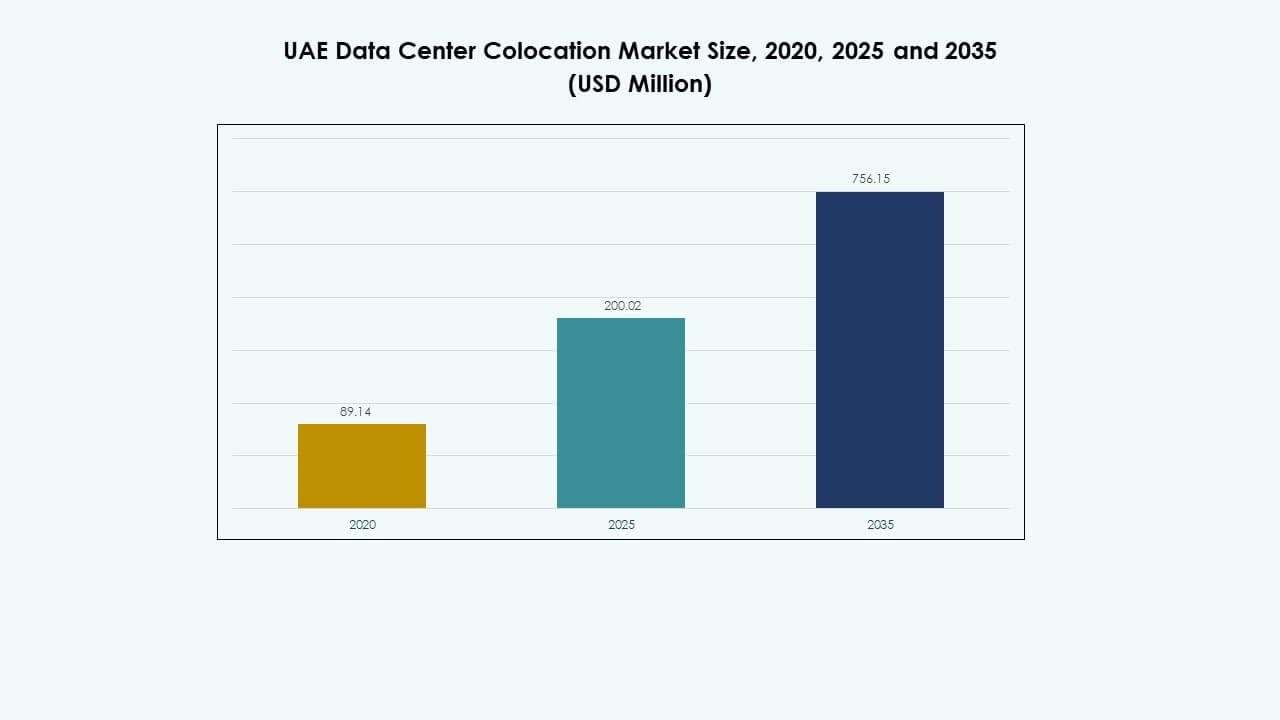

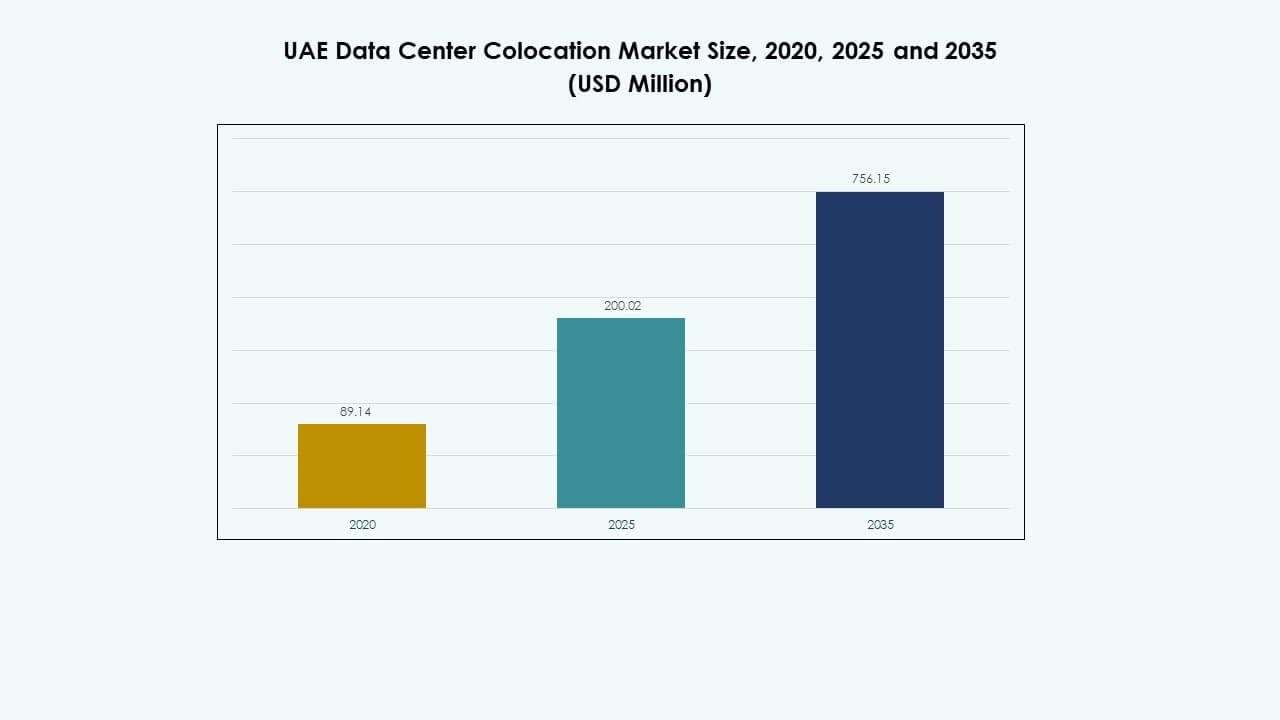

The UAE Data Center Colocation Market size was valued at USD 89.14 million in 2020 to USD 200.02 million in 2025 and is anticipated to reach USD 756.15 million by 2035, at a CAGR of 14.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UAE Data Center Colocation Market Size 2025 |

USD 200.02 Million |

| UAE Data Center Colocation Market, CAGR |

14.15% |

| UAE Data Center Colocation Market Size 2035 |

USD 756.15 Million |

Rising technology adoption, cloud integration, and AI-driven solutions are fueling strong demand across industries. Companies are shifting toward scalable infrastructure to enhance efficiency and security. It enables enterprises to lower capital expenditure and improve operational resilience. Strategic investments from both domestic and global providers strengthen infrastructure capacity and innovation. The UAE Data Center Colocation Market plays a crucial role in supporting digital transformation and regional economic diversification.

Dubai leads the market due to its advanced connectivity, robust infrastructure, and favorable investment climate. Abu Dhabi is gaining momentum with strong government support and enterprise adoption. Other emirates are emerging as secondary hubs due to their growing digital initiatives. This regional distribution creates a balanced and scalable colocation ecosystem across the UAE.

Market Drivers

Strong Technology Adoption Driving Digital Infrastructure Expansion

Rapid technology adoption across industries boosts the need for advanced colocation services. Cloud computing, edge computing, and AI are redefining infrastructure requirements. Enterprises prefer scalable and secure solutions to support expanding digital workloads. Government-led digital transformation accelerates investments in modern facilities. The UAE Data Center Colocation Market plays a critical role in supporting this shift. It enables businesses to enhance data security and ensure operational continuity. Investors view the sector as a stable and high-growth segment. The focus on smart infrastructure drives long-term strategic value.

- For example, Equinix officially launched its third Dubai data center (DX3) in May 2023, offering 1,800 cabinets and 12,000 m² of space. The facility is planned to be powered by 100% renewable energy and is the largest Equinix site in the Middle East, according to the company’s official press release and corporate blog.

Rising Cloud Adoption and Hybrid Infrastructure Deployment

Cloud adoption continues to reshape enterprise IT strategies across sectors. Organizations choose colocation facilities to combine public and private cloud environments. Hybrid setups offer better performance, security, and flexibility. This approach strengthens operational efficiency and business continuity. The UAE Data Center Colocation Market benefits from this structural change. It provides enterprises with reliable and cost-efficient infrastructure. Colocation providers focus on energy-efficient designs and modular data centers. Investors consider hybrid cloud growth a strong indicator of market resilience.

Increased Strategic Investment from Global Technology Providers

Global technology providers are expanding their footprint in the UAE through partnerships and data center development. Large-scale projects strengthen the region’s digital ecosystem and support enterprise transformation. These investments ensure better connectivity, capacity, and redundancy. The UAE Data Center Colocation Market gains from strong investor confidence. It supports cross-border business operations and digital trade. Global partnerships create a competitive environment, improving service quality and infrastructure standards. Businesses see this as an opportunity to scale faster with lower capital investment. The steady flow of foreign investment enhances market maturity.

Government Policies and Economic Diversification Supporting Market Growth

Government initiatives promote digital infrastructure development and attract international players. National strategies focus on digital transformation, smart cities, and economic diversification. This supportive environment accelerates new data center deployments. The UAE Data Center Colocation Market aligns with national goals to create a resilient digital economy. It supports critical sectors like banking, healthcare, and telecom with advanced hosting capabilities. Businesses rely on these facilities to meet regulatory and operational demands. Investors benefit from transparent policies, tax benefits, and stable returns. These factors build a strong foundation for sustainable growth.

- For instance, Khazna Data Centers announced during GITEX Global 2025 its plan to expand operational capacity by over 1 gigawatt across the UAE and international markets by 2030. The initiative focuses on building sovereign-grade digital infrastructure aligned with the UAE’s national AI and digital economy strategy, according to Khazna’s official press release dated October 14, 2025.

Market Trends

Shift Toward High-Density and Energy-Efficient Infrastructure

The trend toward high-density computing drives demand for energy-efficient colocation solutions. Enterprises require advanced cooling and power optimization systems. Providers invest in modern infrastructure to meet sustainability targets. It enhances operational efficiency while reducing carbon footprints. The UAE Data Center Colocation Market reflects this transition clearly. Green energy integration and advanced monitoring systems are becoming standard. Operators focus on long-term cost optimization and compliance. This trend improves competitiveness and attracts environmentally conscious clients.

Rapid Growth of Edge Computing and Latency Reduction Strategies

Edge computing adoption accelerates across multiple industries, including telecom, retail, and BFSI. Low-latency connectivity drives demand for regional colocation centers. Providers build edge-focused facilities near urban hubs. This strengthens network resilience and improves user experiences. The UAE Data Center Colocation Market benefits from this localized approach. It allows companies to process and store data closer to end users. Investments in edge infrastructure enhance agility. The trend supports new applications like IoT and real-time analytics.

Integration of Advanced Security and Compliance Frameworks

Data protection and regulatory compliance are driving stronger security measures in colocation facilities. Operators deploy AI-based monitoring, encryption, and zero-trust architectures. Businesses value facilities that meet international compliance standards. The UAE Data Center Colocation Market integrates these technologies to ensure operational reliability. It strengthens trust among global enterprises and public institutions. Enhanced compliance frameworks support expansion into regulated sectors. This trend elevates the market’s reputation for secure hosting. It also improves long-term customer retention.

Growing Partnerships Between Telecom Operators and Hyperscalers

Strategic collaborations between telecom companies and hyperscalers shape the market landscape. Joint infrastructure development increases capacity and connectivity. Telecom networks enable hyperscalers to reach more enterprises. The UAE Data Center Colocation Market gains strategic strength from these alliances. It supports faster digital service deployment and improved performance. These partnerships encourage ecosystem integration and innovation. Enterprises benefit from improved availability and reduced costs. The trend reinforces the country’s position as a regional data hub.

Market Challenges

High Capital Requirements and Infrastructure Cost Pressures

The establishment and operation of colocation facilities involve heavy upfront investments. Power, cooling, and connectivity infrastructure require significant capital. Small and mid-sized providers find it difficult to match hyperscaler capabilities. The UAE Data Center Colocation Market faces intense price competition. It pushes operators to balance profitability with technological advancement. Investors seek long-term returns, which require careful cost optimization. The challenge lies in maintaining high-quality service while controlling operating expenses. This capital intensity slows market entry for new players.

Talent Gaps and Operational Skill Shortages in Advanced Facilities

Managing modern colocation centers requires specialized expertise. Skilled personnel in cybersecurity, power management, and cloud integration remain limited. Operators face rising labor costs and slower deployment cycles. The UAE Data Center Colocation Market encounters operational gaps that impact service scalability. It leads to reliance on external service providers for critical functions. Training programs and talent development lag behind infrastructure growth. This shortage reduces operational efficiency and increases security risks. Addressing the talent gap is essential for sustainable market expansion.

Market Opportunities

Rising Demand for Multi-Cloud and AI-Driven Infrastructure Solutions

The increasing reliance on AI and multi-cloud environments creates strong growth opportunities. Enterprises need flexible infrastructure that supports complex workloads. The UAE Data Center Colocation Market is well positioned to address this demand. It offers secure, scalable, and hybrid-ready environments. AI integration allows better resource utilization and predictive maintenance. This improves efficiency and strengthens business continuity. Providers that offer integrated AI capabilities can capture larger market shares. This shift opens a profitable segment for both operators and investors.

Expansion of Regional Digital Hubs to Support Global Connectivity

Strategic location and government support make the UAE a prime regional hub. Enterprises expand their global footprint through colocation facilities in the region. The UAE Data Center Colocation Market supports this expansion through advanced interconnectivity and strategic partnerships. It attracts international businesses seeking stable and secure infrastructure. The growing role of the UAE in global data flows enhances its strategic appeal. These developments create new revenue opportunities for providers. This position strengthens the market’s competitive edge.

Market Segmentation

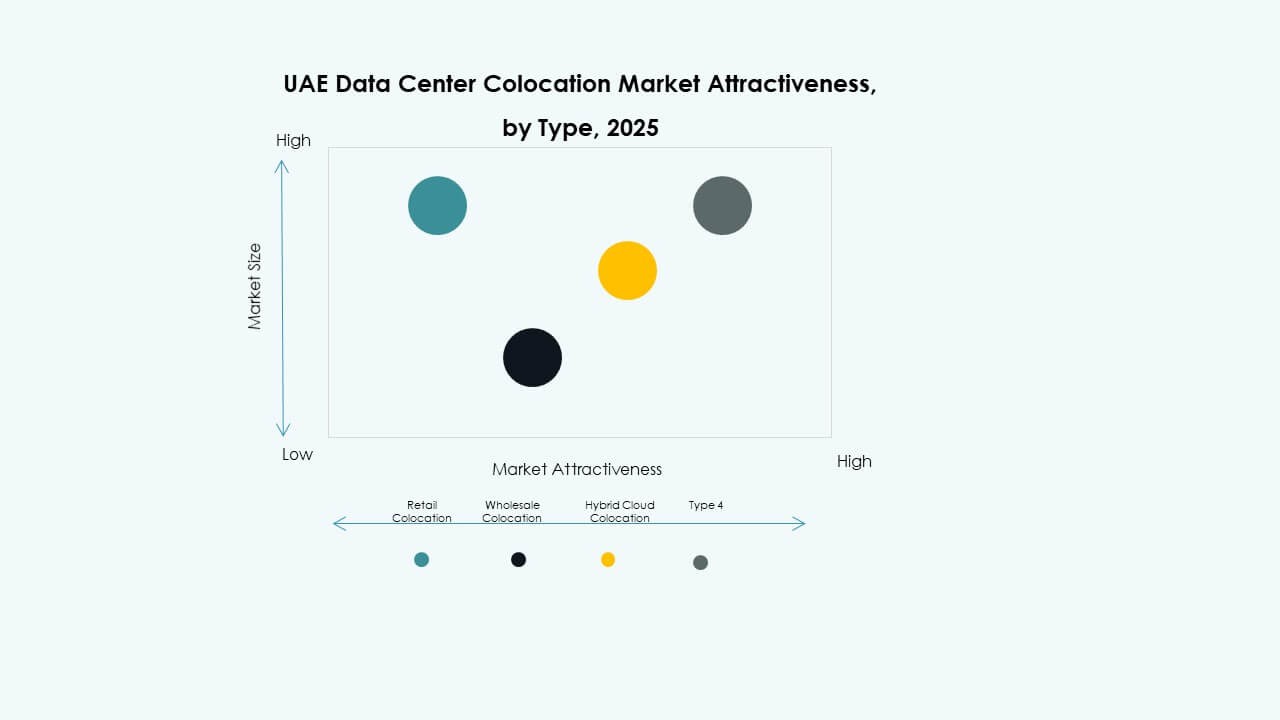

By Type

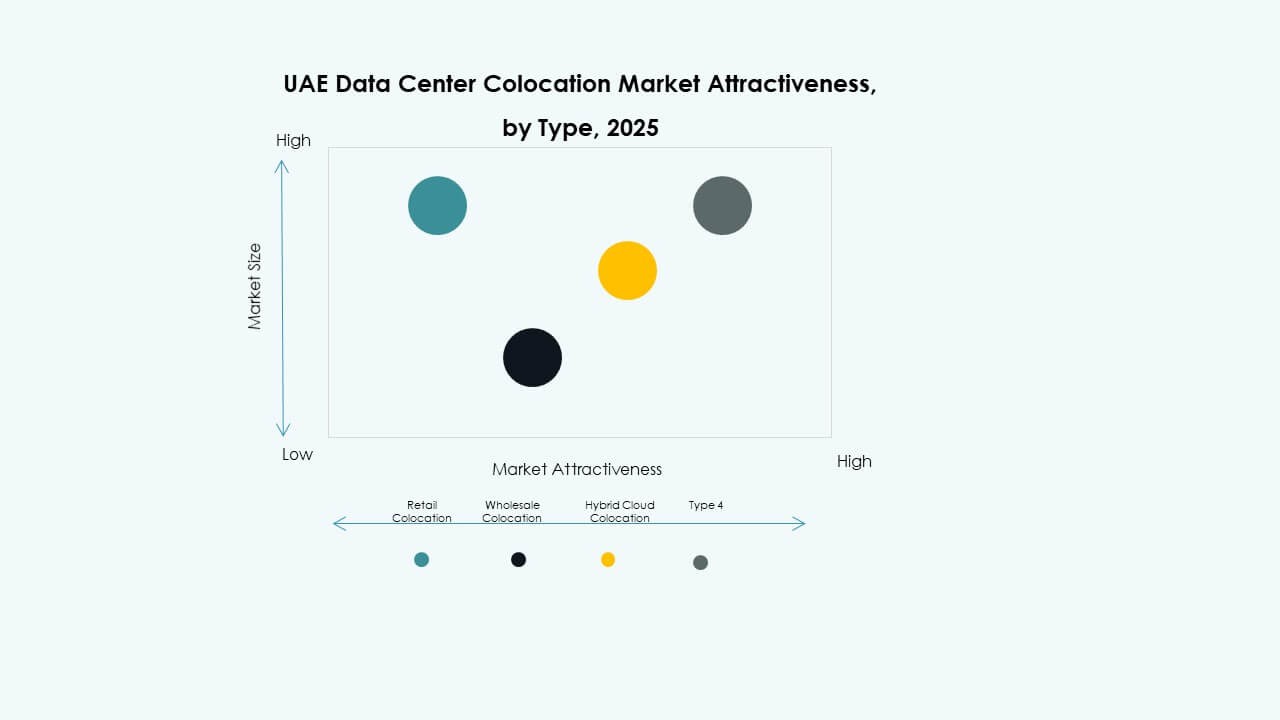

Retail colocation dominates the segment, driven by rising enterprise demand for flexible and secure hosting. Small and mid-sized businesses prefer shared infrastructure to lower costs. Wholesale colocation sees strong adoption among hyperscalers and telecom providers. Hybrid cloud colocation grows rapidly with increased cloud integration needs. The UAE Data Center Colocation Market benefits from these diverse models, meeting different capacity and control requirements. Retail colocation leads the market share due to its scalability and cost benefits. Wholesale demand aligns with strategic expansion by global providers. Hybrid adoption accelerates digital transformation efforts.

By Tier Level

Tier 3 facilities lead the segment due to their strong balance between reliability and cost efficiency. Enterprises choose Tier 3 for guaranteed uptime and operational security. Tier 4 facilities grow steadily with demand from hyperscalers and critical sectors. Tier 1 and Tier 2 serve smaller workloads and less sensitive applications. The UAE Data Center Colocation Market reflects this structured tier demand. Tier 3 offers advanced redundancy and remains the preferred choice. Tier 4 expands gradually with high-performance computing demand. Tier 1 and 2 remain niche but relevant for budget-conscious users.

By Enterprise Size

Large enterprises hold a major share of the market due to their heavy IT infrastructure needs. These organizations depend on colocation for security, scalability, and compliance. SMEs adopt colocation to reduce capital costs and improve digital capabilities. The UAE Data Center Colocation Market supports both segments with tailored service models. Large enterprises drive high-capacity deployments and premium service demand. SMEs contribute to market diversity and long-term growth. This mix ensures stable revenue streams for providers. It also strengthens ecosystem resilience.

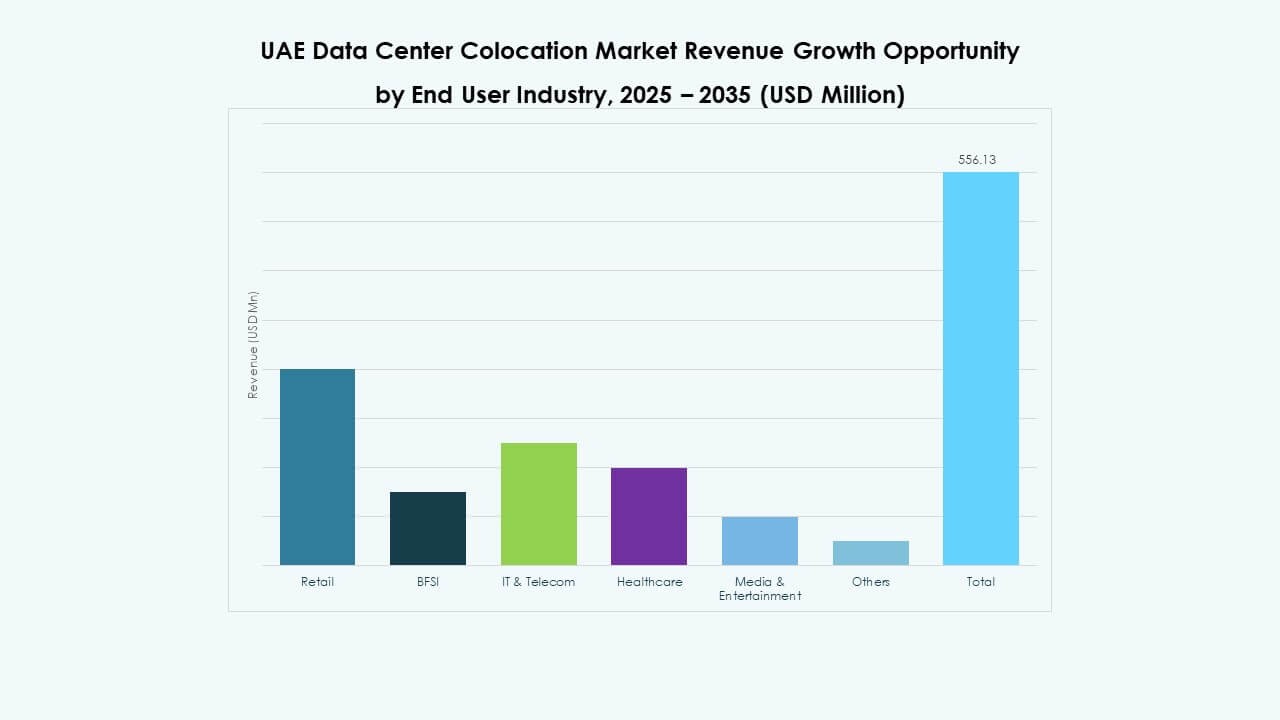

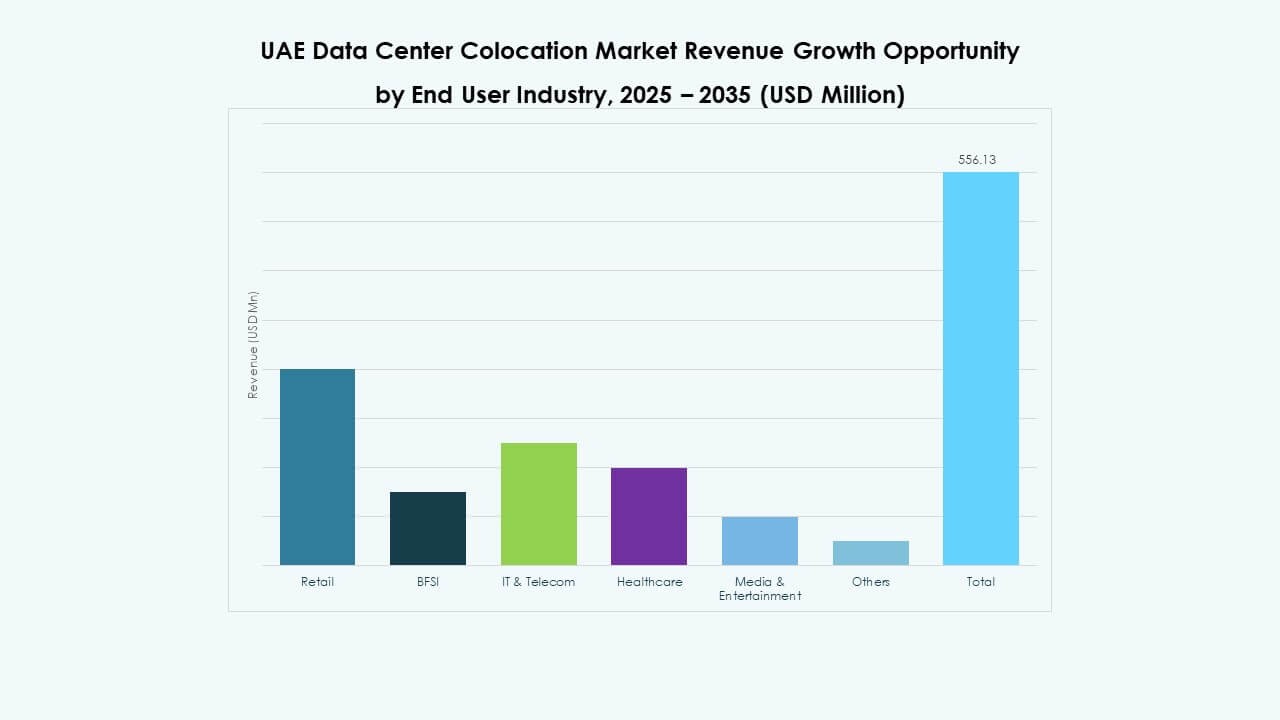

By End User Industry

IT and Telecom lead the segment due to high cloud adoption and digital service delivery. BFSI follows closely, driven by strict security and compliance needs. Retail, healthcare, and media and entertainment also expand their usage rapidly. The UAE Data Center Colocation Market supports these industries with sector-specific solutions. IT and Telecom maintain leadership through connectivity and innovation. BFSI relies on trusted facilities for data security and operational uptime. Other industries use colocation to modernize infrastructure without heavy investments. This broad demand base strengthens market stability.

Regional Insights

Dubai: Leading Regional Hub with Strong Market Share of 54.2%

Dubai remains the largest regional hub for colocation services. Strategic location, advanced infrastructure, and strong connectivity make it a preferred choice. Global providers establish large facilities to meet growing demand. The UAE Data Center Colocation Market benefits from Dubai’s business ecosystem. The city supports multiple industries with low-latency connections. High investment activity sustains infrastructure growth. Dubai maintains its leadership through continuous innovation and regulatory clarity.

- For instance, Moro Hub, a subsidiary of Digital DEWA (Dubai Electricity and Water Authority), inaugurated the world’s largest solar-powered data center in February 2023 at the Mohammed bin Rashid Al Maktoum Solar Park. The facility, jointly built with Huawei, delivers a 100 MW capacity and spans 33,311 square meters, fully powered by renewable energy.

Abu Dhabi: Expanding Strategic Base with 32.6% Market Share

Abu Dhabi strengthens its role as a strategic data infrastructure base. The region attracts investments from both domestic and global technology providers. High energy availability supports large-scale facility deployments. The UAE Data Center Colocation Market gains scale from Abu Dhabi’s focus on digital transformation. The city serves critical sectors like government, defense, and finance. Its supportive regulatory environment encourages long-term commitments. This steady growth positions it as a key national data hub.

Other Emirates: Emerging Market with 13.2% Market Share

Other emirates show growing interest in colocation investments. Regional governments prioritize digital infrastructure development to support economic growth. Smaller hubs offer strategic advantages in cost and scalability. The UAE Data Center Colocation Market benefits from this diversification. It enables broader geographic coverage and network resilience. These locations attract niche industries and regional service providers. Their steady expansion supports balanced national market growth.

- For instance, in September 2025, Khazna Data Centers secured a USD 2.62 billion financing facility from Abu Dhabi Commercial Bank and First Abu Dhabi Bank. The funding supports the company’s data center infrastructure expansion across the UAE and MENA region, marking one of the largest financing deals in the sector.

Competitive Insights:

- eHosting DataFort

- Injazat Data Systems

- Khazna Data Centers

- Etisalat

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- CoreSite

- CyrusOne

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The UAE Data Center Colocation Market is shaped by strong competition among global and regional players. It reflects a mix of telecom operators, hyperscalers, and specialized colocation providers. Companies focus on expanding capacity, enhancing energy efficiency, and improving connectivity to meet rising enterprise demand. Strategic partnerships strengthen network infrastructure and support hybrid cloud deployments. Leading providers invest in advanced security frameworks and automation to gain a competitive edge. Local firms benefit from strong government support, while global players leverage scale and technical expertise. Market leaders differentiate through service reliability, compliance strength, and ecosystem integration. Continuous infrastructure investment reinforces market maturity and positions top operators for long-term growth.

Recent Developments:

- In September 2025, Khazna Data Centersannounced securing a $2.62 billion financing facility in partnership with Abu Dhabi Commercial Bank (ADCB) and First Abu Dhabi Bank (FAB). The funding, one of the largest in the region, will support Khazna’s hyperscale digital infrastructure expansion across the Middle East and North Africa (MENA).

- In July 2025, Sophos announced the launch of its new data center in the United Arab Emirates, marking a significant expansion to bolster the region’s digital security ecosystem. Hosted on Amazon Web Services (AWS) infrastructure within the UAE, the facility aims to enhance data sovereignty, reduce latency, and strengthen compliance for sectors including government, healthcare, and finance.