Executive summary:

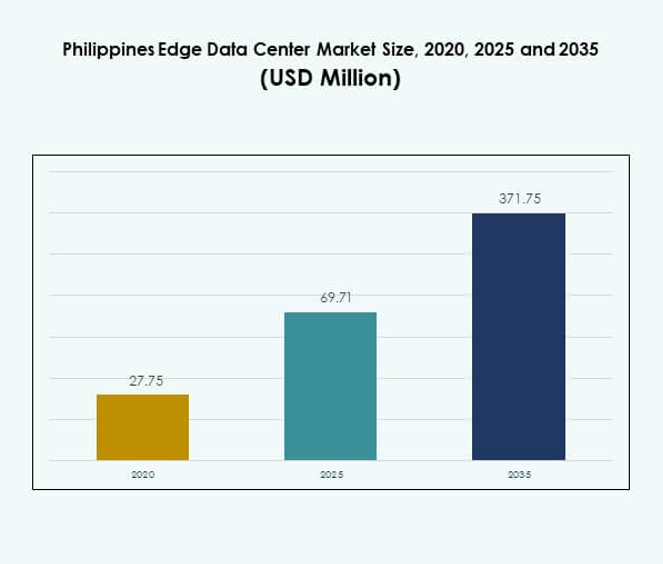

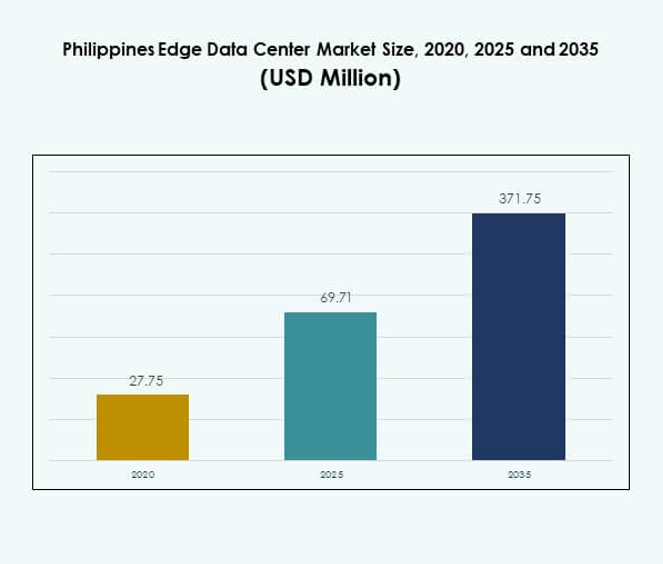

The Philippines Edge Data Center Market size was valued at USD 27.75 million in 2020 to USD 69.71 million in 2025 and is anticipated to reach USD 371.75 million by 2035, at a CAGR of 18.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Philippines Edge Data Center Market Size 2025 |

USD 69.71 Million |

| Philippines Edge Data Center Market, CAGR |

18.05% |

| Philippines Edge Data Center Market Size 2035 |

USD 371.75 Million |

The market is experiencing strong growth driven by rapid digital transformation, rising 5G adoption, and increasing deployment of AI-powered applications. Telecom operators, cloud service providers, and global hyperscalers are investing in localized infrastructure to meet low-latency and data compliance requirements. These shifts make the market strategically important for businesses and investors looking to capitalize on emerging digital infrastructure and service opportunities.

Metro Manila leads the market due to strong connectivity, enterprise presence, and hyperscale facility development. Cebu is emerging as a key secondary hub, supported by investments in logistics, commerce, and IT-BPM sectors. Davao and other cities are gaining traction for regional edge deployments, reflecting a broader strategy to build nationwide coverage and improve digital resilience.

Market Drivers

Rapid 5G Deployment and Rising Need for Low-Latency Infrastructure

The growing rollout of 5G networks is driving large-scale investments in localized data processing. Enterprises are prioritizing infrastructure that reduces latency and improves application performance. The Philippines Edge Data Center Market benefits from growing use of IoT devices and real-time data analytics. It strengthens the digital backbone required for autonomous systems, connected vehicles, and smart city projects. Telecom operators are partnering with hyperscalers to improve connectivity coverage. Companies view edge infrastructure as critical to delivering seamless digital experiences. This shift supports operational efficiency and data sovereignty compliance. Investors are capitalizing on these developments to secure early market positions.

Expanding Enterprise Cloud Adoption and Digital Transformation Strategies

More enterprises are migrating workloads from traditional infrastructure to hybrid and cloud-based models. Digital transformation strategies are prioritizing edge computing for faster data access and better security. The Philippines Edge Data Center Market is supported by cloud-first policies from public and private organizations. It enables faster deployment of critical business applications across industries. Demand from sectors such as BFSI, healthcare, and e-commerce is rising quickly. This adoption improves business agility and reduces dependence on centralized data centers. Local edge capacity helps enterprises optimize cost structures while improving resilience. Strategic investments are aligning with long-term digital ecosystem expansion.

Growing Demand for Real-Time Processing Across Key Industries

Industries such as retail, energy, and telecommunications are demanding faster processing closer to end users. Localized computing supports continuous service availability without network delays. The Philippines Edge Data Center Market addresses this growing demand by enabling distributed computing. It enhances performance for AI workloads, sensor networks, and immersive experiences. The integration of AI and machine learning at the edge boosts service personalization. Large enterprises are integrating edge with cloud to handle data bursts efficiently. Government digitalization initiatives are also accelerating investments in local infrastructure. These developments create a scalable foundation for technology innovation and business expansion.

- For instance, Ayala Corporation’s energy unit ACEN is raising up to 30 billion pesos ($530 million) in 2025 to triple its renewable energy capacity to 20 gigawatts, supporting new solar and wind farms. These infrastructure upgrades enable distribution and real-time management of energy resources, leveraging data analytics platforms for improved forecasting and operational efficiency across the Philippines.

Rising Strategic Interest from Global and Regional Investors

Foreign and domestic investors are increasing funding in infrastructure projects to meet demand. Data center operators are building hyperscale-ready edge nodes in strategic locations. The Philippines Edge Data Center Market is gaining importance as a regional connectivity hub. It offers long-term opportunities for investors seeking exposure to the digital infrastructure sector. Real estate developers and telcos are collaborating to build flexible and scalable facilities. This trend supports high-value use cases like AI inference, predictive analytics, and advanced monitoring. Increased capital flow improves competitiveness and accelerates innovation cycles. These factors establish a strong base for market expansion and revenue growth.

- For instance, Digital Edge (Singapore) Holdings Pte. Ltd. announced the launch of NARRA1 its first 10MW data center in Manila, operational since March 2023, designed with 2,200 cabinets, state-of-the art power, reliability, and security features. This facility is the largest carrier-neutral data center in the market, serving cloud, network, digital media, and enterprise customers, and marks a significant development in making the Philippines a regional connectivity hub.

Market Trends

Increased Deployment of Modular and Scalable Edge Infrastructure

Companies are adopting modular data center designs to accelerate deployment timelines. These flexible systems enable fast scaling to meet varying workloads. The Philippines Edge Data Center Market reflects strong demand for compact, energy-efficient facilities. It helps enterprises reduce deployment complexity and cost per rack. Containerized solutions are growing in popularity among telecom operators and enterprises. These systems support rapid rollouts in remote and urban sites. Vendors are focusing on pre-fabricated and automated designs to ensure operational reliability. This trend strengthens business continuity strategies and supports multi-site deployments.

Rising Integration of Renewable Energy and Sustainable Designs

Sustainability goals are influencing infrastructure development strategies. Edge operators are adopting renewable energy sources to minimize environmental impact. The Philippines Edge Data Center Market is observing a shift toward green building standards. It aligns with investor priorities for ESG-compliant assets. Companies are exploring solar and hybrid systems to reduce operational costs. Efficient cooling, intelligent power management, and energy optimization are gaining attention. Sustainable facilities appeal to international investors seeking long-term value. These developments position the sector for responsible growth.

Adoption of AI-Driven Monitoring and Automation Tools

Automation is transforming infrastructure management and operations. AI and predictive analytics tools enhance monitoring efficiency and uptime reliability. The Philippines Edge Data Center Market is adopting intelligent platforms for power, cooling, and security control. It enables proactive maintenance and improved risk mitigation. Operators are using digital twins to optimize infrastructure performance. Real-time monitoring reduces human errors and improves resource allocation. This shift increases operational resilience and ensures service continuity. Vendors are offering AI-enabled solutions to differentiate their services.

Strengthening Regional Connectivity and Cross-Border Network Integration

Geographic location is positioning the country as a digital gateway for regional connectivity. Major network providers are expanding submarine cable systems and terrestrial links. The Philippines Edge Data Center Market benefits from these high-capacity networks. It enhances latency-sensitive services like video streaming, cloud gaming, and AR applications. Global companies are establishing partnerships with local operators to expand capacity. These collaborations improve international connectivity and reliability. This trend supports enterprise expansion plans and strengthens regional economic links. Strong connectivity ecosystems attract strategic investments from hyperscalers.

Market Challenges

High Energy Costs and Infrastructure Reliability Constraints

High operational energy costs create pressure on data center margins. Power availability varies across regions, leading to potential downtime risks. The Philippines Edge Data Center Market faces rising energy tariffs that affect scalability and cost efficiency. It requires robust backup systems to maintain service continuity. Legacy grid infrastructure in some areas slows expansion plans. Power stability issues increase the cost of deploying redundant systems. Meeting uptime expectations requires significant capital investment. These constraints limit smaller operators and slow competitive entry.

Regulatory Complexity and Delayed Permitting Processes

Complex regulatory frameworks increase project timelines and operational uncertainties. Operators face multiple clearances before construction begins. The Philippines Edge Data Center Market is affected by fragmented permitting and inconsistent zoning rules. It limits the speed of infrastructure deployment in key growth corridors. Delays impact investor confidence and capital allocation. Compliance with data localization and cybersecurity laws adds complexity. Businesses must manage evolving regulations to sustain operations. Streamlining these processes is essential to support faster market growth.

Market Opportunities

Growing Demand for Regional Edge Nodes from Global Cloud Providers

Rising demand from hyperscalers creates opportunities for new facilities and service models. Global players are looking for strategic regional nodes to reduce latency and enhance user experience. The Philippines Edge Data Center Market is well positioned to support this expansion. It enables cloud and AI workloads to operate closer to end users. This opportunity supports new partnerships between telcos and global infrastructure providers. Localized capacity also encourages ecosystem development around applications and managed services. Investors can benefit from early participation in this growth cycle.

Expansion of Edge Infrastructure into Emerging Urban and Industrial Zones

Urban expansion is driving the need for distributed infrastructure beyond Metro Manila. Emerging cities offer untapped potential for data center development. The Philippines Edge Data Center Market supports localized solutions for industrial parks, logistics hubs, and manufacturing clusters. It helps enterprises deploy digital infrastructure faster and at lower cost. Edge nodes in regional cities reduce dependence on centralized hubs. These developments create opportunities for partnerships and localized services. Regional expansion strengthens national coverage and supports inclusive digital growth.

Market Segmentation

By Component

Solution dominates the segment with a significant share driven by rising enterprise investment in edge computing platforms. The Philippines Edge Data Center Market is witnessing strong adoption of integrated IT systems, cooling solutions, and power management tools. It enables companies to deploy scalable and efficient edge nodes across multiple locations. Service offerings such as managed hosting and monitoring are expanding but remain complementary to core solutions. Large enterprises prefer end-to-end solutions for faster deployment and control.

By Data Center Type

Colocation edge data centers hold the leading share, driven by flexible leasing models and cost-efficient capacity. The Philippines Edge Data Center Market benefits from demand among enterprises avoiding heavy upfront capital. Managed and cloud edge data centers are gaining momentum due to integration with hyperscale networks. Enterprises are adopting multi-tenant facilities for better scalability. These models support dynamic workloads and lower operational complexity. This approach drives rapid network expansion and business agility.

By Deployment Model

Hybrid deployment holds the largest share as enterprises seek balance between control and flexibility. The Philippines Edge Data Center Market is leveraging hybrid models to support mission-critical workloads. Enterprises use on-premises for sensitive data and cloud for scalable capacity. This structure enhances resilience and reduces latency issues. Cloud-based models are expanding quickly among SMEs seeking cost efficiency. The combination supports varied use cases across industries, enabling reliable and secure operations.

By Enterprise Size

Large enterprises dominate the segment due to their capacity to invest in high-performance infrastructure. The Philippines Edge Data Center Market benefits from demand across telecommunications, BFSI, and technology sectors. These organizations require advanced edge platforms to manage complex workloads and user demands. SMEs are increasing adoption gradually with cloud-based and managed service models. This segmentation reflects distinct spending patterns and infrastructure priorities between enterprise sizes.

By Application / Use Case

Power monitoring leads this segment, driven by the need for real-time energy optimization and uptime reliability. The Philippines Edge Data Center Market is supporting advanced monitoring platforms to improve operational efficiency. Capacity management and asset tracking are gaining traction for better resource utilization. Enterprises prioritize intelligent control systems to reduce downtime and maintenance costs. BI and analytics use cases are expanding with increased adoption of AI-driven operations.

By End User Industry

IT and telecommunications hold the highest share due to continuous network expansion and 5G investments. The Philippines Edge Data Center Market is supporting critical functions for telecom operators, cloud providers, and digital platforms. BFSI and retail sectors are growing segments driven by digital payment ecosystems. Healthcare and energy utilities are adopting edge infrastructure to improve operational response and service delivery. This broad industry base ensures stable long-term market demand.

Regional Insights

Metro Manila – 64% Market Share

Metro Manila dominates the market due to strong connectivity infrastructure and concentration of enterprise customers. The Philippines Edge Data Center Market benefits from proximity to financial institutions, cloud hubs, and hyperscale providers. It supports high data traffic from telecom networks and enterprise applications. The region is the primary landing point for major subsea cables, ensuring low-latency connections. Most new edge developments and partnerships are concentrated here. This leadership makes it a strategic hub for international operators and investors.

- For example, in June 2025, global digital infrastructure firm Equinix completed the acquisition of three carrier-neutral data centers in Manila, adding a combined capacity of over 1,000 cabinets and integrating four internet exchanges, reinforcing Metro Manila’s status as a regional hub.

Cebu – 21% Market Share

Cebu is emerging as a secondary hub for edge infrastructure expansion. The Philippines Edge Data Center Market benefits from growing investments in commercial zones, logistics, and BPO sectors. It offers connectivity redundancy and lower disaster risk compared to Manila. Enterprises are exploring Cebu for distributed deployments to support nationwide service coverage. Infrastructure modernization and government support strengthen its appeal to international players. This development helps diversify network capacity beyond the capital.

Davao and Other Regions – 15% Market Share

Davao and other urban centers are gradually attracting investment for edge deployment. The Philippines Edge Data Center Market is expanding coverage in these regions to meet growing demand from industrial corridors. These areas offer strategic advantages for distributed workloads, disaster recovery, and latency-sensitive applications. Infrastructure development is improving reliability and power availability. Investors view these regions as key expansion zones to support inclusive connectivity. Regional diversification enhances network resilience and national competitiveness.

- For instance, in August 2025 the Department of Information and Communications Technology (DICT) advanced the National Fiber Backbone, linking Davao via a 1,000 km government-owned high-speed fiber network and injecting an initial 600 Gbps optical spectrum capacity, directly enabling new edge deployments in that region.

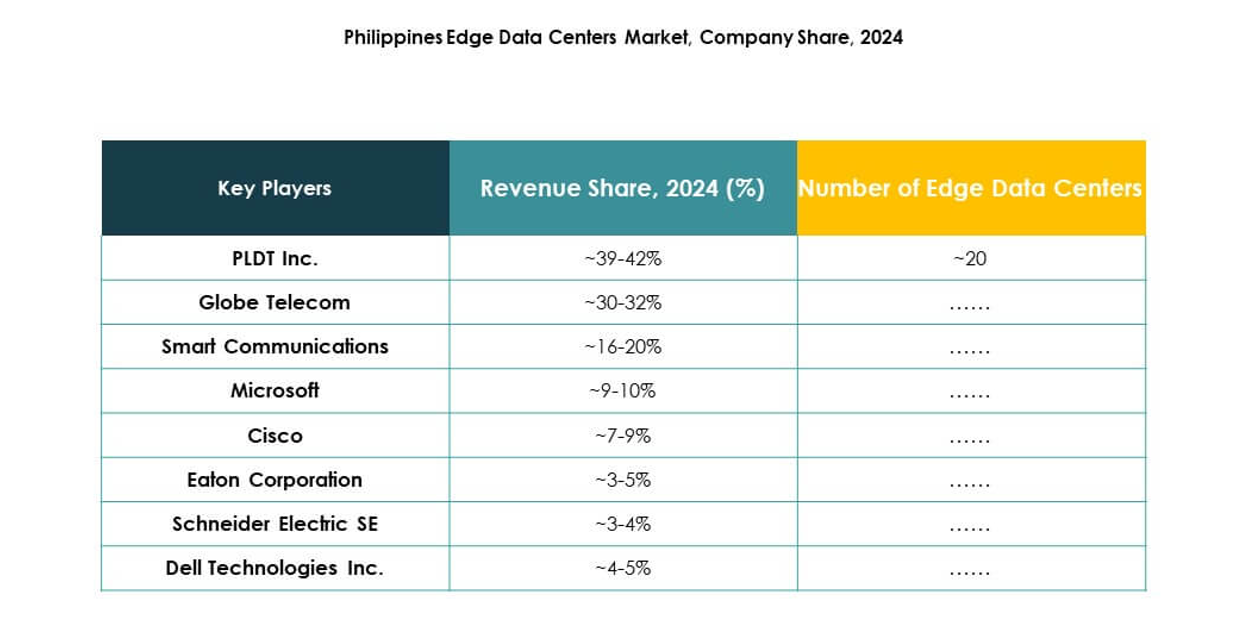

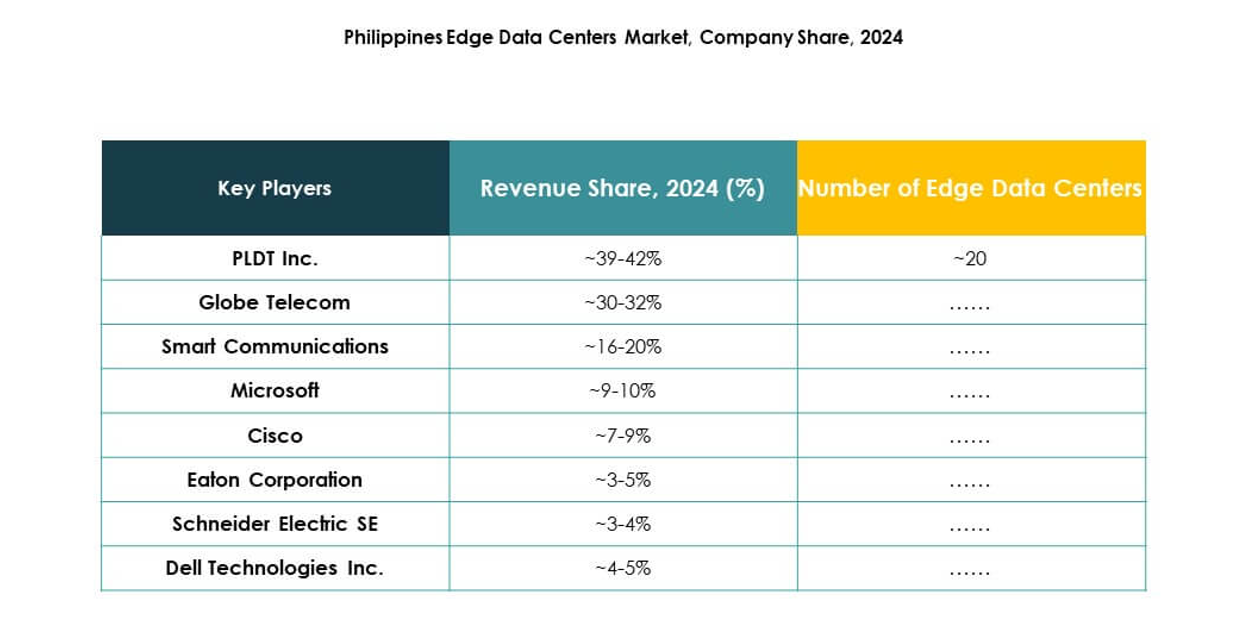

Competitive Insights:

- PLDT Inc.

- Globe Telecom

- Smart Communications

- Converge ICT Solutions

- Dito Telecommunity

- Fujitsu

- Cisco

- Eaton Corporation

- Dell Technologies Inc.

- Microsoft

The competitive landscape of the Philippines Edge Data Center Market features strong participation from telecom operators, global technology providers, and infrastructure specialists. It is characterized by a mix of domestic leaders expanding capacity and international firms supplying advanced edge technologies. Major telecom operators are focusing on expanding regional networks and forming partnerships with hyperscalers to strengthen edge connectivity. Global firms emphasize modular, energy-efficient designs and AI-driven infrastructure solutions. Investments in renewable energy and automation support operational efficiency and cost optimization. Strategic alliances, joint ventures, and acquisitions drive market positioning and technology leadership. Competition is shifting toward integrated solutions that combine connectivity, computing power, and energy resilience.

Recent Developments:

- In September 2025, ePLDT partnered with Dell Technologies and Katonic AI to launch Pilipinas AI, the first locally hosted “sovereign AI” platform in the Philippines. Hosted at the Vitro Sta. Rosa site, Pilipinas AI enables enterprises to build and deploy AI models domestically ensuring local data compliance and boosting AI adoption across industries including finance, public services, and healthcare.

- In June 2025, Equinix completed the acquisition of three data centers in Manila from Total Information Management. This move marks Equinix’s strategic entry into the Philippines’ edge data center market, enabling the company to provide a full suite of global digital services to local enterprises and international clients seeking low-latency connectivity and AI integration. With this acquisition.

- In April 2025, PLDT Inc. and its data center subsidiary, ePLDT, launched the Vitro Sta. Rosa facility in Laguna, marking the Philippines’ first AI-ready hyperscale data center. The 50MW site is designed to serve as the country’s largest data center campus, offering the infrastructure needed for advanced computing and AI workloads while supporting the national goal of making the Philippines a digital hub for Asia.