Executive summary:

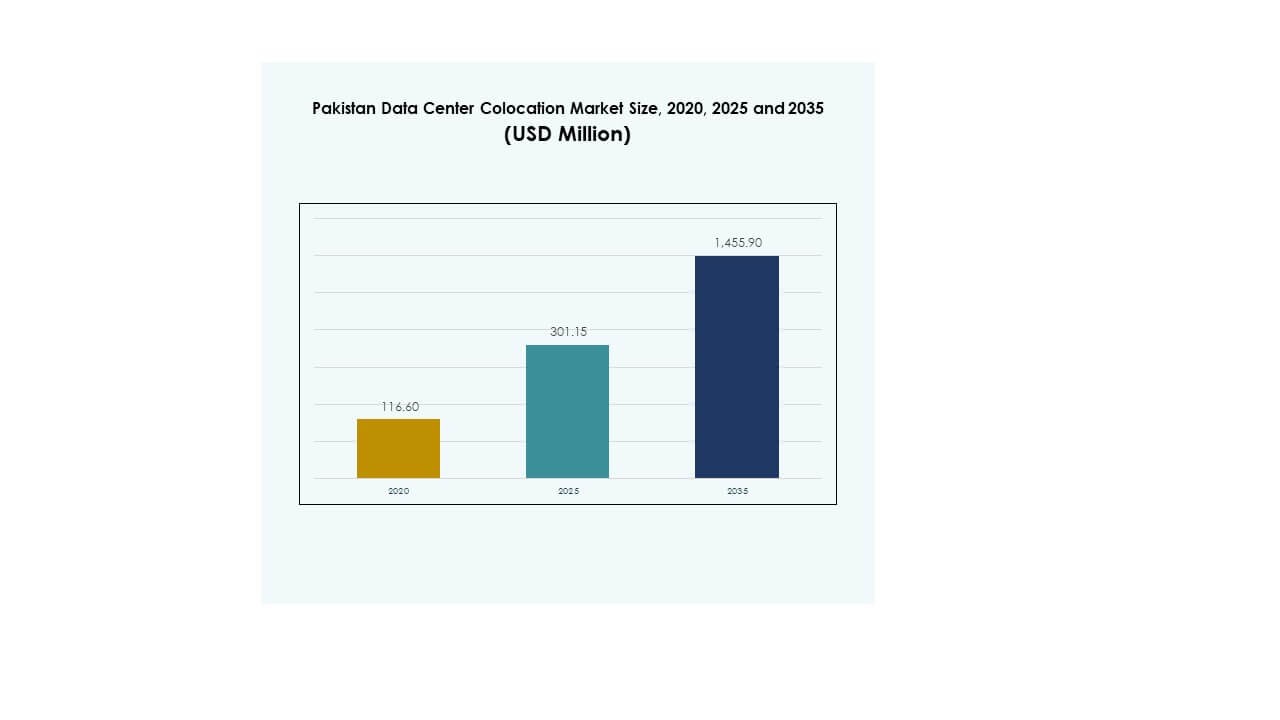

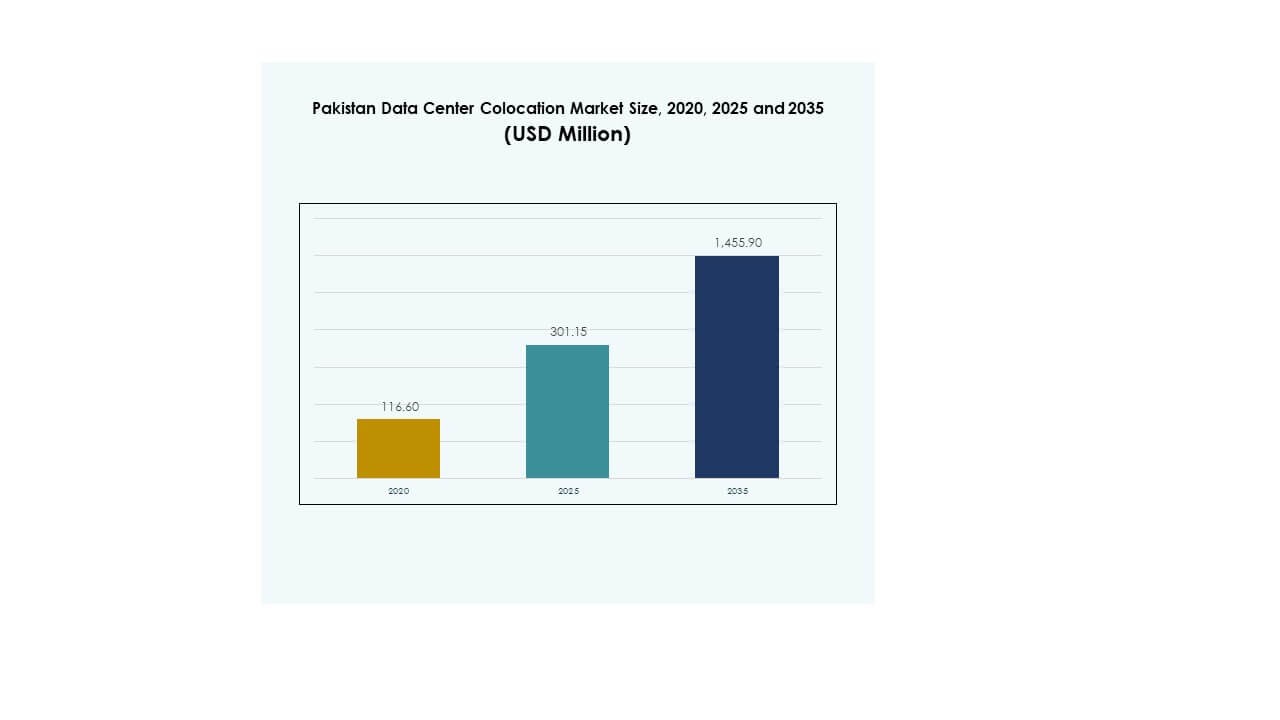

The Pakistan Data Center Colocation Market size was valued at USD 116.60 million in 2020 to USD 301.15 million in 2025 and is anticipated to reach USD 1,455.90 million by 2035, at a CAGR of 16.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Pakistan Data Center Colocation Market Size 2025 |

USD 301.15 Million |

| Pakistan Data Center Colocation Market, CAGR |

16.97% |

| Pakistan Data Center Colocation Market Size 2035 |

USD 1,455.90 Million |

The market is driven by rapid cloud adoption, AI integration, and rising demand for scalable colocation services. Enterprises are moving workloads to advanced facilities to improve operational resilience, lower costs, and enhance service delivery. Strategic government initiatives, AI workloads, and edge computing growth are boosting infrastructure expansion. It is becoming an attractive investment destination for both domestic operators and global cloud providers. The shift toward energy-efficient and modular designs is accelerating digital transformation across sectors, strengthening competitiveness and ecosystem maturity.

Regionally, major cities like Karachi, Lahore, and Islamabad lead due to strong fiber connectivity, subsea cable access, and enterprise concentration. These hubs serve as core gateways for hyperscale and retail colocation. Secondary regions such as Faisalabad and Multan are emerging through improved infrastructure and industrial expansion. Their growth reflects increasing enterprise demand beyond primary hubs. Coastal connectivity corridors offer strategic advantages, enabling faster regional and international data exchange and reinforcing the country’s role as a digital connectivity hub.

Market Drivers

Rising Demand for Digital Infrastructure and Cloud-First Strategies

The Pakistan Data Center Colocation Market is growing due to rapid digital transformation and a surge in cloud-first strategies across industries. Enterprises are shifting mission-critical workloads to secure colocation facilities to lower costs and increase operational resilience. Edge computing adoption is supporting demand for data storage closer to users. Government-led initiatives are accelerating infrastructure deployment and enhancing connectivity nationwide. Investors see clear value in this growing digital economy. It enables organizations to scale efficiently without building costly in-house facilities. Technology-led transformation is creating strong momentum across enterprise and public sectors. Rising data volumes are reinforcing the strategic importance of colocation facilities for regional connectivity and digital inclusion.

Accelerating Adoption of AI, IoT, and Automation Technologies

The growing use of AI, IoT, and automation is driving strong demand for advanced colocation infrastructure. Industries are increasingly using AI workloads that require high-density racks and low-latency connections. This shift is creating a clear need for scalable and modular facilities. It allows businesses to enhance operational efficiency and support smart service delivery. Telecom operators and cloud providers are expanding presence to support these advanced workloads. Policy support is improving energy availability and promoting technological upgrades. AI and IoT workloads are pushing companies to secure reliable hosting environments. The broader ecosystem is becoming more attractive for global technology players.

- For instance, in June 2025, Data Vault inaugurated Pakistan’s first AI-focused data centre in Karachi, enabling local AI startups to access enterprise-grade GPU-as-a-service solutions for accelerated model training and deployment, operationalized with support from the Special Investment Facilitation Council (SIFC).

Strategic Government Support for Digitalization and Data Sovereignty

Public sector investment and regulatory initiatives are encouraging local hosting and data protection. It aligns with national digital policies aimed at fostering secure and resilient infrastructure. Colocation enables businesses to comply with data residency and security frameworks effectively. Government incentives are improving access to land, power, and fiber connectivity. This environment attracts both domestic and international operators. Strategic support for hyperscale and regional data centers is reshaping infrastructure growth. Companies are aligning expansion plans with these favorable policy frameworks. Strengthened regulatory clarity builds investor confidence and ensures long-term ecosystem stability.

Enterprise Shift Toward Cost Efficiency and Energy Optimization

Colocation offers significant cost savings compared to on-premises infrastructure, driving enterprise adoption. Businesses prefer flexible contracts, optimized cooling, and energy-efficient systems to reduce operational burdens. Sustainability goals are also influencing deployment strategies. Energy-optimized facilities are aligning with global ESG commitments. It allows companies to access advanced technology without high capital investments. Enterprises gain predictable pricing models and improved resource utilization. Demand for managed services and hybrid IT models is expanding. These shifts underline the strategic value of colocation for operational resilience and business continuity.

- For instance, in May 2025, Cybernet partnered with Nokia to deploy a 1.2 Tbps-per-wavelength optical backbone, connecting over 25 cities in Pakistan and strengthening its national backbone and data center interconnect capacity.

Market Trends

Expansion of Hyperscale and Edge Infrastructure for Future-Ready Operations

The Pakistan Data Center Colocation Market is witnessing strong growth in hyperscale and edge deployments. Hyperscale operators are building large facilities to meet growing AI and cloud demands. Edge computing growth is pushing capacity closer to end users. It is creating a distributed network architecture that improves latency and performance. Telecom operators are aligning investments with rising mobile and 5G adoption. Enterprises prefer flexible and scalable colocation to handle surging data traffic. Cloud-native applications are increasing demand for reliable infrastructure. These developments reflect a clear shift toward high-capacity, low-latency ecosystems.

Growing Focus on Green Energy Integration and Sustainability Practices

Energy-efficient and green colocation facilities are becoming central to strategic deployments. Investors and operators are integrating renewable energy sources to reduce carbon footprints. It supports global ESG compliance and lowers long-term energy costs. Demand for low PUE designs is driving advanced cooling and power systems. Green certifications are gaining traction among leading operators. Companies are prioritizing sustainability to attract enterprise customers with similar goals. The market is shifting toward smart energy monitoring and AI-powered load management. These steps strengthen operational efficiency and environmental accountability.

Adoption of Advanced Security and Compliance Frameworks

Data privacy and regulatory compliance are shaping operational strategies in the colocation sector. It is prompting operators to implement advanced security frameworks and monitoring solutions. Enterprises prioritize providers with multi-layered protection and certified facilities. Cybersecurity threats are influencing new service models and architectural upgrades. Strict compliance with international standards is creating competitive differentiation. Cloud service integration requires alignment with robust compliance protocols. The focus on secure, compliant operations is attracting high-value enterprise workloads. This trend is strengthening market credibility and investor trust.

Increasing Partnerships Between Telecom, Cloud, and Colocation Providers

Collaborative strategies are becoming key growth drivers across the ecosystem. Telecom carriers and hyperscalers are forming partnerships to expand connectivity footprints. It enhances service delivery through integrated infrastructure models. Cross-border connectivity projects are enabling faster and more reliable data exchange. Strategic alliances are helping optimize capacity utilization and investment planning. This collaboration strengthens market resilience and accelerates adoption. Global partnerships are opening opportunities for advanced network services. This shift supports hybrid deployments and multi-cloud strategies, fueling ecosystem expansion.

Market Challenges

Infrastructure Reliability and Power Supply Constraints Impacting Scalability

The Pakistan Data Center Colocation Market faces notable challenges in ensuring stable infrastructure and energy availability. Power outages and inconsistent grid performance increase operational risks for large facilities. Backup systems raise costs and affect energy efficiency targets. It creates delays in capacity expansion and impacts investor confidence. Rural and semi-urban areas lack robust power and fiber infrastructure, limiting broader deployment. These constraints restrict hyperscale adoption outside urban centers. Upgrading power systems and grid reliability is essential for sustaining long-term growth. The energy gap remains a key challenge for scaling advanced workloads and supporting 24/7 operations.

Regulatory Complexity and Limited Talent Pool Affecting Industry Maturity

The evolving regulatory landscape poses hurdles for seamless market expansion. Varying compliance requirements increase complexity for both domestic and international operators. It slows down project timelines and raises operational costs. Data protection and security mandates require skilled workforce and advanced systems. Limited availability of trained professionals creates operational bottlenecks. It impacts facility management and innovation cycles. Investment in workforce development and streamlined regulation is critical to ease growth barriers. Regulatory predictability and specialized skills will define future scalability and ecosystem strength.

Market Opportunities

Strategic Positioning as a Regional Connectivity and Cloud Hub

The Pakistan Data Center Colocation Market has strong potential to serve as a regional connectivity hub. Its proximity to key digital corridors in Asia and the Middle East enhances this role. It can attract hyperscalers and international cloud providers seeking low-latency access. Subsea cable connectivity strengthens its positioning for global data flow. Government support creates a favorable climate for new investments. It enables the ecosystem to integrate advanced infrastructure solutions. This position can transform the nation into a digital gateway for regional markets.

Rising Demand for Hybrid Cloud, AI, and Edge Deployments

Growing enterprise adoption of hybrid and edge models is opening large-scale opportunities. It allows operators to offer specialized services that meet complex business needs. AI and 5G deployments will increase reliance on secure colocation facilities. High-density racks and modular builds will strengthen operational scalability. Enterprises will look for providers with advanced security and connectivity features. The trend creates space for global partnerships and infrastructure expansion. It aligns well with rising demand for flexible, future-ready colocation solutions across industries.

Market Segmentation

By Type

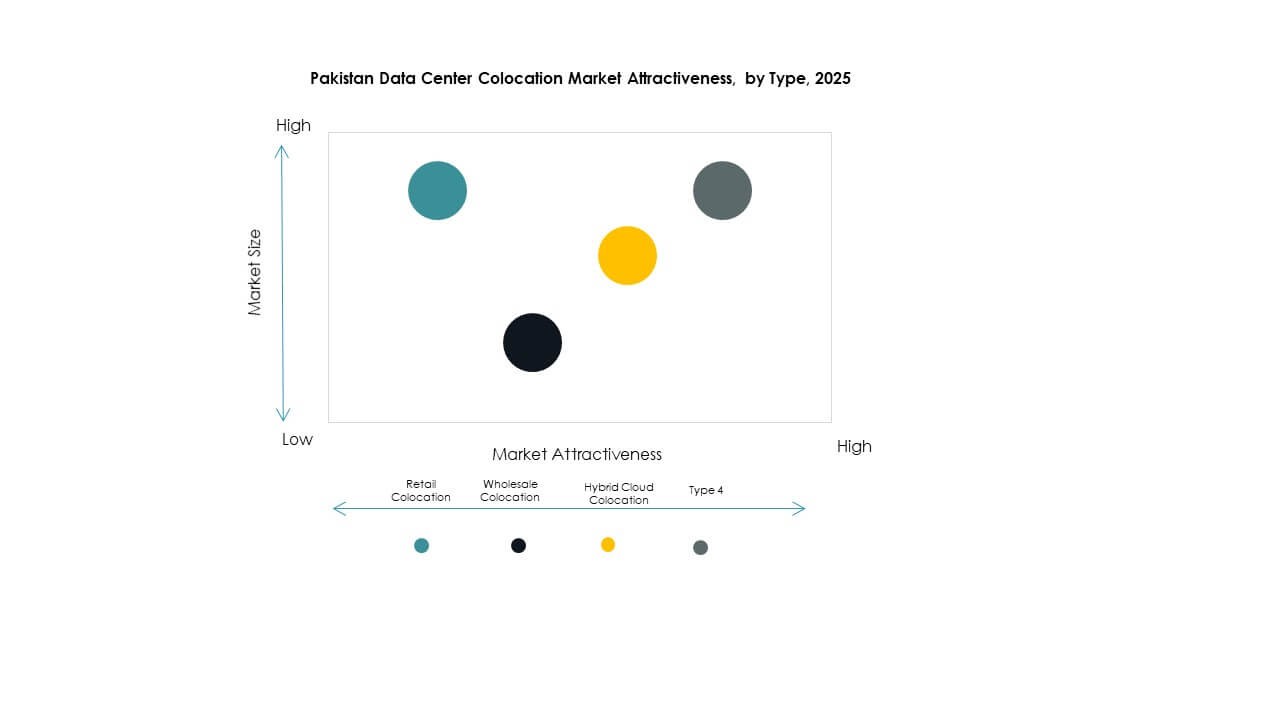

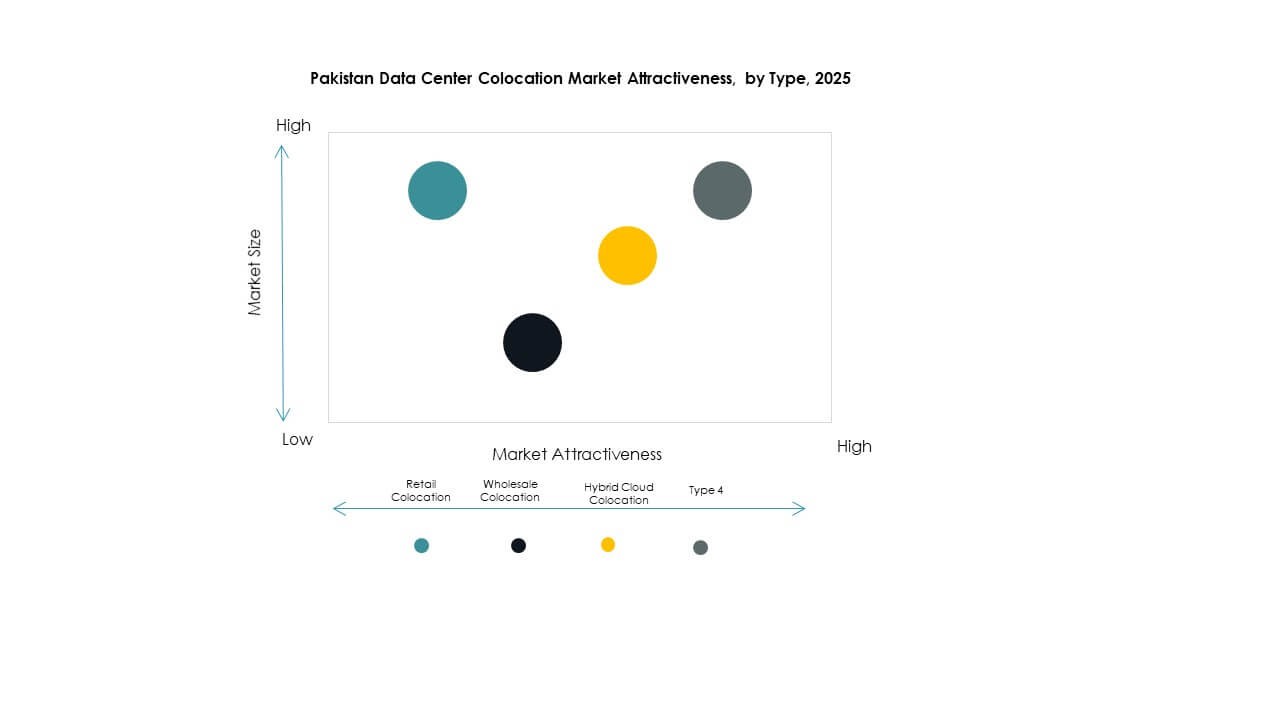

Retail colocation holds the largest share of the Pakistan Data Center Colocation Market due to strong demand from SMEs and mid-sized enterprises. It offers cost-effective, scalable infrastructure without heavy upfront investments. Wholesale colocation is gaining traction among telecom and hyperscale operators focusing on large deployments. Hybrid cloud colocation is growing steadily as companies seek flexibility between on-premises and cloud. Retail colocation remains the dominant segment due to its affordability, operational ease, and suitability for diverse industry needs.

By Tier Level

Tier 3 facilities lead the Pakistan Data Center Colocation Market due to their strong balance of reliability and cost. They support critical workloads with high uptime requirements while remaining energy efficient. Tier 4 facilities are expanding gradually with increasing hyperscale deployments. Tier 1 and Tier 2 are primarily used for non-critical or regional operations. Tier 3 dominance reflects enterprise preference for stable, scalable environments that meet compliance and performance standards. Investments are rising to upgrade Tier 3 to Tier 4 for advanced services.

By Enterprise Size

Large enterprises hold the majority share of the Pakistan Data Center Colocation Market due to their strong digital infrastructure requirements. These enterprises use colocation for cost control, scalability, and operational continuity. SMEs are adopting colocation steadily as cloud migration accelerates across industries. It enables small businesses to access advanced infrastructure without heavy capital investment. Large enterprise dominance reflects their early adoption of hybrid and cloud-first strategies. Demand from SMEs is expected to rise with increasing digital transformation efforts.

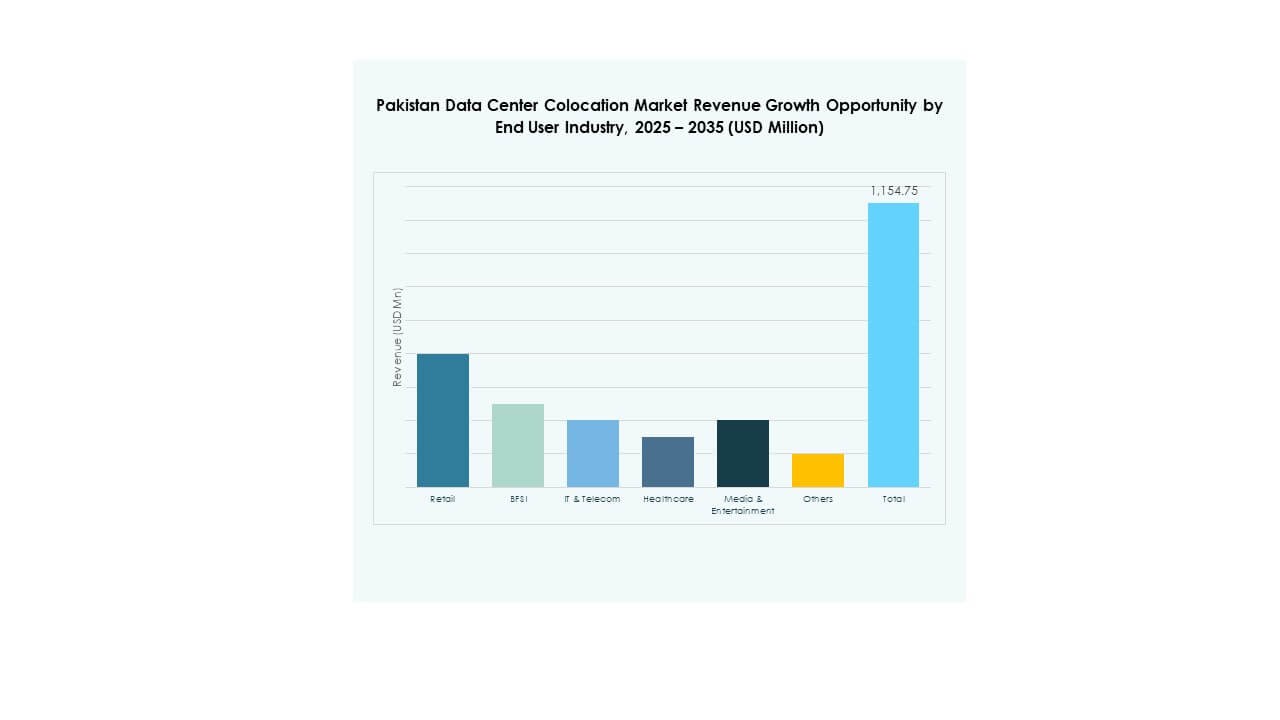

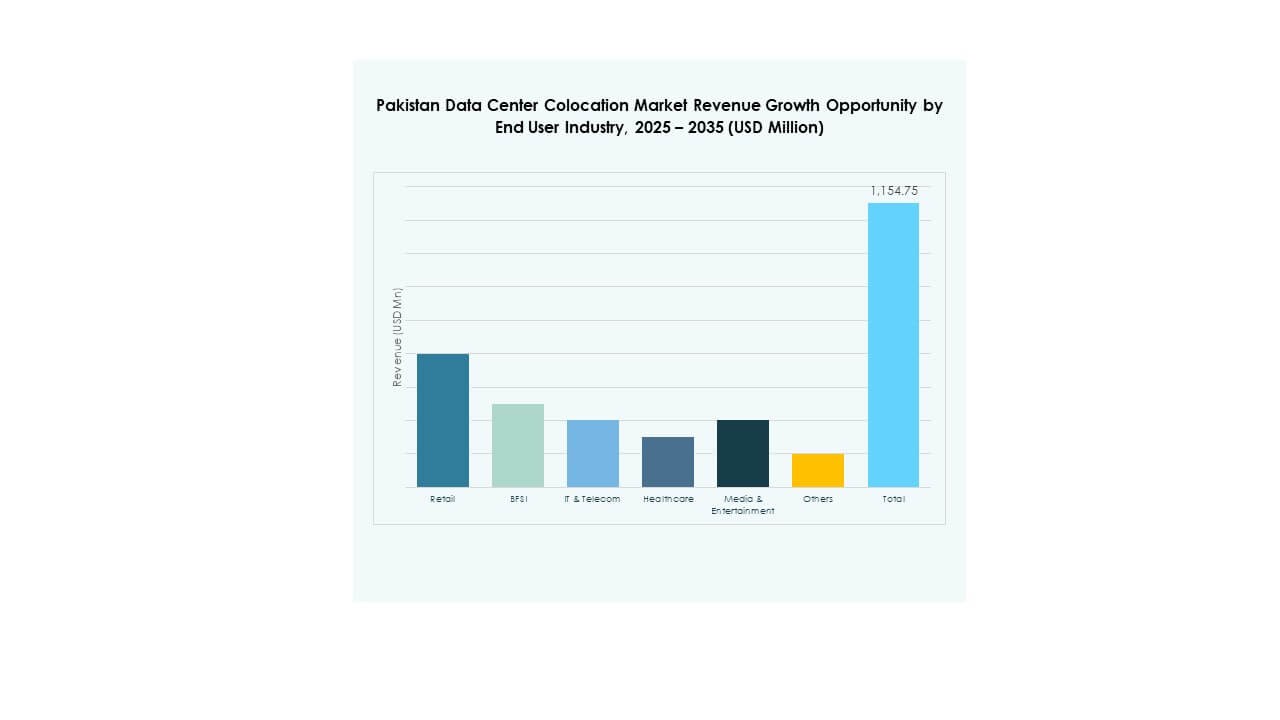

By End User Industry

IT and Telecom lead the Pakistan Data Center Colocation Market due to rapid network expansion and growing digital services. BFSI is adopting colocation for secure data handling and compliance requirements. Healthcare is integrating colocation to support telemedicine, imaging, and patient record management. Retail, media, and entertainment sectors are expanding their presence with rising e-commerce and streaming traffic. Other sectors are also embracing colocation to enhance operational agility. IT and Telecom dominance reflects their central role in driving digital infrastructure growth.

Regional Insights

Dominance of Urban Hubs and Coastal Connectivity Corridors (49.2%)

The Pakistan Data Center Colocation Market sees strong dominance from major urban hubs like Karachi, Lahore, and Islamabad, holding 49.2% market share. These cities offer better power stability, fiber networks, and enterprise demand concentration. Karachi benefits from subsea cable landing stations, making it a key connectivity node. Lahore and Islamabad support strong commercial activity and government projects. It strengthens their role in colocation and cloud infrastructure growth. This concentration is driving further hyperscale and retail facility expansion in metropolitan areas.

- For instance, on February 22 2025, Pakistan Telecommunication Company Limited (PTCL) officially announced the landing of the Africa-1 submarine cable at Sea View Beach, Karachi. The 10,000 km cable connects Pakistan with Saudi Arabia, UAE, Egypt, Sudan, Algeria, France, Kenya, and Djibouti through a consortium including Mobily, e&, G42, Telecom Egypt, Zain Oman International, Algérie Télécom, and TeleYemen.

Emergence of Secondary Regional Clusters (31.5%)

Secondary regions such as Faisalabad, Multan, and Peshawar are emerging with 31.5% market share. Growing fiber connectivity and industrial expansion are fueling this rise. These cities are attracting telecom and cloud operators seeking to extend coverage beyond major metros. It reflects growing enterprise IT adoption and demand for regional hosting. Power grid improvements and smart city projects are improving their attractiveness. This expansion is creating a more balanced infrastructure footprint and reducing over-reliance on primary hubs.

- For instance, Nayatel, Pakistan’s leading fiber-to-the-home operator, confirms on its official website that its FTTH network spans Faisalabad, Gujranwala, and Sialkot. The network supports over 170,000 active customers and is operated by 2,500 professionals. This expansion extends high-speed internet, cloud, and digital-TV services to key secondary industrial cities.

Strategic Positioning Along International Connectivity Routes (19.3%)

Coastal and border regions hold 19.3% market share due to their location near international cable landing points and trade routes. Their strategic positioning enhances low-latency connections with the Middle East and South Asia. It attracts hyperscalers and international operators looking for reliable entry points. Subsea cable investments are boosting capacity and strengthening network resilience. It creates opportunities for international partnerships and infrastructure expansion. These regions are playing a critical role in shaping Pakistan’s long-term digital connectivity landscape.

Competitive Insights:

- PTCL Data Centre

- Nayatel

- Cybernet

- Multinet Data Centers

- Google Cloud

- Pakistan Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Pakistan Data Center Colocation Market features a mix of strong domestic operators and major global providers. It is witnessing increased competition driven by infrastructure expansion, cloud integration, and edge deployments. Local companies focus on network coverage and cost-effective hosting to attract SMEs and government projects. Global players are investing in hyperscale capabilities, sustainability, and hybrid cloud models. Strategic alliances between telecom carriers and cloud providers are strengthening service portfolios. Operators are prioritizing low-latency connectivity and scalable modular builds to meet enterprise needs. Security and compliance leadership remain critical differentiators. This competitive environment is fostering innovation, driving market maturity, and shaping the future of digital infrastructure.

Recent Developments:

- In August 2025, Indus Cloud entered into a strategic partnership with Huawei to jointly develop a state-of-the-art data center in Pakistan. The collaboration aims to enhance local digital infrastructure, providing advanced cloud and colocation services to support enterprises transitioning toward digital transformation.

- In July 2025, Al Baraka Bank Pakistan Limited and Pakistan Telecommunication Company Limited (PTCL) signed an agreement for the provision of primary data center colocation services at PTCL’s Tier-III certified facility. The collaboration enables Al Baraka Bank to leverage PTCL’s robust infrastructure for secure, scalable, and uninterrupted data management operations, underscoring the bank’s focus on digital banking efficiency.

- In June 2025, Data Vault Pakistan launched the country’s first AI-focused data center in Karachi. This pioneering facility, powered by clean solar energy, is specifically designed to cater to artificial intelligence workloads, providing GPU-as-a-service to enterprises, startups, and research institutes.

- In May 2025, Cybernet Pakistan partnered with Nokia to modernize Pakistan’s network infrastructure through advanced optical and IP technologies. The collaboration focuses on deploying Nokia’s latest high-capacity optical transport equipment across Cybernet’s data centers and network routes. This technology upgrade is expected to enhance the backbone for Pakistan’s data center colocation networks, providing ultra-low latency and high reliability for enterprise clients.