Executive summary:

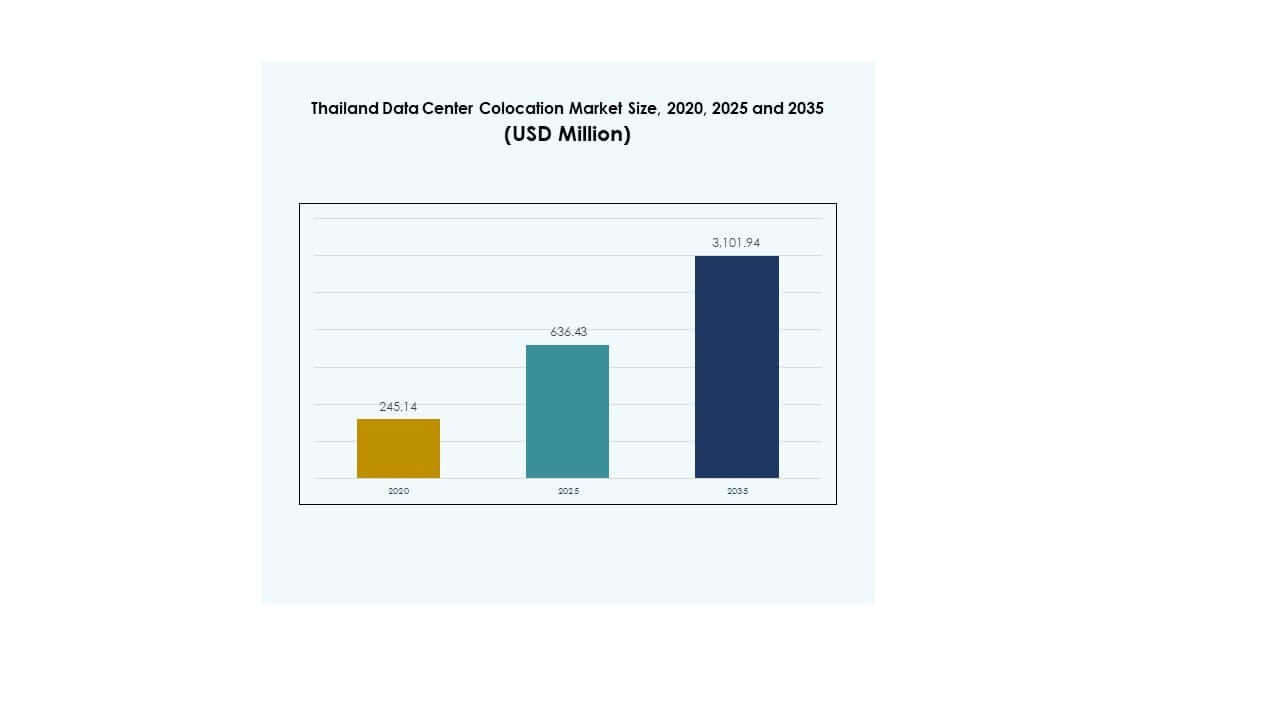

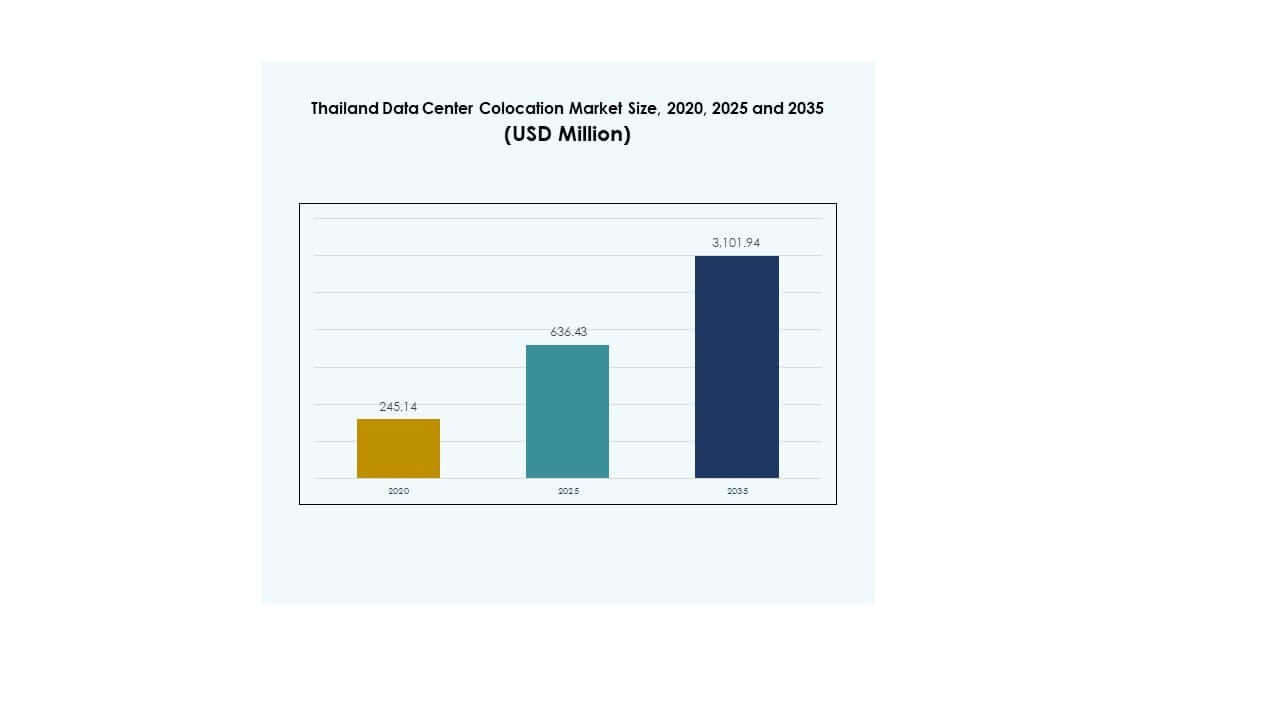

The Thailand Data Center Colocation Market size was valued at USD 245.14 million in 2020 to USD 636.43 million in 2025 and is anticipated to reach USD 3,101.94 million by 2035, at a CAGR of 17.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Thailand Data Center Colocation Market Size 2025 |

USD 636.43 Million |

| Thailand Data Center Colocation Market, CAGR |

17.07% |

| Thailand Data Center Colocation Market Size 2035 |

USD 3,101.94 Million |

Strong enterprise cloud adoption, rapid digital transformation, and expansion of hyperscale facilities are driving demand. Operators are investing in advanced cooling systems, modular designs, and edge infrastructure. It is becoming a strategic backbone for AI, IoT, and high-density computing deployments. Businesses are leveraging colocation to scale infrastructure efficiently, while investors view the sector as a high-growth asset class backed by sustained digital expansion.

Bangkok leads the market, supported by robust fiber connectivity and strong hyperscale presence. The Eastern Economic Corridor is emerging as a key growth zone due to infrastructure development and strategic location advantages. Northern and Southern regions are expanding edge deployments to improve national coverage. These zones together shape Thailand into a regional digital infrastructure hub.

Market Drivers

Growing Cloud Adoption and Rising Demand for Digital Infrastructure Across Enterprises

The surge in enterprise cloud adoption is creating a solid foundation for the Thailand Data Center Colocation Market. Organizations are shifting workloads to hybrid and multi-cloud environments to achieve greater scalability and efficiency. This demand drives hyperscale and retail colocation investments in strategic hubs. Businesses seek flexible capacity to handle rising data volumes and latency-sensitive applications. Strong fiber connectivity and edge deployment support the transformation. It enables enterprises to expand operations with lower capital expenditure. Investors view this growth as a long-term opportunity. Strategic infrastructure development further boosts the country’s competitive positioning in the digital economy.

- For instance, Google announced a USD 1 billion investment on September 30, 2024, to build a data center and cloud region in Bangkok and Chonburi, Thailand. The project will begin in 2025 to strengthen Thailand’s role as a regional digital hub. This information is confirmed through Google’s official press release and industry reports.

Technological Advancements Enhancing Operational Efficiency and Power Optimization

Innovations in power and cooling infrastructure are advancing the operational landscape of colocation facilities. Direct-to-chip liquid cooling and modular power systems help operators support high-density workloads with better energy efficiency. These solutions lower operational costs and enhance uptime performance. It allows operators to deliver reliable services to customers managing AI and IoT applications. Edge nodes and advanced automation platforms optimize performance and resource utilization. Companies align investments with evolving computing needs. The adoption of such solutions strengthens Thailand’s data infrastructure ecosystem. Investors prioritize facilities integrating sustainable and high-performance technologies.

Strategic Investments Driving Regional Competitiveness and Infrastructure Expansion

Major operators and hyperscale providers are increasing investments to expand colocation capacity. The government’s digital programs and foreign direct investments strengthen the country’s position in Southeast Asia. It benefits from favorable regulations, submarine cable connectivity, and energy diversification. These factors attract global and regional players looking to establish large data hubs. New builds and campus expansions in Bangkok and emerging economic zones enhance coverage. Enterprises benefit from enhanced network reliability and reduced latency. Strategic funding creates resilient and scalable ecosystems. This infrastructure expansion improves competitiveness against other digital economies in the region.

- For instance, NTT Ltd. announced an investment of USD 90 million in the Bangkok 3 Data Center (BKK3) with 12 MW IT capacity and around 4,000 m² IT space. The facility is located in Amata City, Chonburi, Thailand, and is planned to begin commercial operations in 2025. This information is officially published in NTT’s global newsroom and industry reports.

Accelerated Industry Shift Toward Edge Computing and AI Workload Enablement

Rapid adoption of AI workloads and edge computing is reshaping the demand curve for colocation. Enterprises require low-latency environments to support AI model training and analytics. It positions Thailand as a key edge hub for global connectivity routes. Infrastructure providers design AI-ready racks and optimized cooling systems to meet demand. High-performance compute deployment encourages partnerships with telecom operators. The expansion of cable landing stations and fiber routes fuels edge infrastructure growth. Businesses benefit from improved application performance and cost predictability. Strategic shifts toward AI readiness open new opportunities for investors.

Market Trends

Increased Focus on Renewable Energy Integration and Sustainability Commitments

Operators are aligning facility designs with renewable energy targets and environmental standards. The Thailand Data Center Colocation Market is witnessing strong demand for green power sourcing and advanced efficiency technologies. Operators are integrating solar and hydro-based energy solutions into infrastructure strategies. The focus on renewable sourcing reduces carbon emissions and ensures long-term operational stability. Energy-efficient cooling and smart automation reduce power usage and operational risks. Green certification programs increase investor and enterprise confidence. Sustainability commitments help facilities meet global corporate ESG goals. This trend drives new partnerships between energy suppliers and data center operators.

Expansion of High-Density Colocation Facilities to Support Advanced Compute Loads

Enterprises deploying AI and HPC workloads are demanding colocation environments with higher power density. Operators are scaling infrastructure with advanced liquid and air-assisted cooling systems to meet these needs. It supports AI training clusters, GPU servers, and latency-sensitive applications. High-density deployments strengthen Thailand’s role as a competitive regional hub. Strong power availability and technical upgrades enable operators to deliver flexible SLAs. Facility expansions include modular and scalable designs to meet changing customer requirements. This trend improves utilization efficiency and long-term value. Investors view high-density facilities as critical assets for future growth.

Rising Demand for Carrier-Neutral Facilities to Enhance Network Resilience

Enterprises are prioritizing carrier-neutral data center facilities to ensure better connectivity and redundancy. Multiple network providers and cable systems support uninterrupted operations. It strengthens Thailand’s digital backbone and positions the market as a connectivity hub. Carrier neutrality gives enterprises flexibility to optimize cost and performance. This trend supports cross-border data exchange and hybrid cloud adoption. Enterprises gain greater control over network routes and peering strategies. Connectivity expansion drives partnerships with global telecom operators. Neutral facilities increase infrastructure resilience and attract hyperscale demand.

Strengthening Ecosystem of Managed Services and Value-Added Offerings

Managed colocation services are gaining traction among enterprises aiming to simplify infrastructure management. The Thailand Data Center Colocation Market is expanding through bundled services including security, disaster recovery, and cloud integration. It reduces operational complexity for enterprises while improving service quality. Providers offer modular service packages tailored to different industry needs. Managed solutions create recurring revenue streams for operators. Advanced monitoring and automation enhance customer experience and operational visibility. This trend supports enterprises seeking faster deployment and lower infrastructure risks. Service differentiation is becoming a key competitive factor.

Market Challenges

Rising Power Constraints and Infrastructure Scalability Limitations in Urban Hubs

High energy demand is straining the existing power infrastructure in major cities like Bangkok. The Thailand Data Center Colocation Market faces growing concerns over power allocation and grid reliability. It impacts expansion timelines and operational cost structures. Limited access to renewable energy sources adds complexity to meeting sustainability goals. Grid upgrades require significant investment and planning coordination. Power availability challenges affect high-density workload deployments. Operators must optimize energy use to maintain service quality. Investors face risks tied to energy capacity and infrastructure development. Addressing these issues is essential to sustain market momentum.

Intensifying Competition and Regulatory Complexity Affecting Market Entry

New market entrants face increasing competition from established colocation providers with strong network ecosystems. Complex compliance standards related to data security, environmental regulations, and operational certifications raise entry barriers. The Thailand Data Center Colocation Market requires operators to meet strict energy and data protection policies. These regulations involve cost-intensive audits and infrastructure alignment. Rising competition pressures pricing strategies and margin structures. Global hyperscalers intensify the race for prime capacity in strategic hubs. Investors evaluate long-term ROI carefully under regulatory uncertainty. Strategic partnerships and compliance strategies become critical for new entrants.

Market Opportunities

Strategic Positioning of Thailand as a Regional Digital Connectivity Gateway

The country’s location and expanding submarine cable network create favorable conditions for growth. The Thailand Data Center Colocation Market benefits from its strategic placement within regional trade and digital routes. It enables operators to cater to increasing traffic between Asia and global destinations. Cross-border cloud and telecom partnerships drive new business opportunities. Investors can capitalize on expanding infrastructure and growing data flows. This geographic advantage enhances competitiveness against other Southeast Asian hubs.

Accelerating Enterprise Digitalization and Edge Deployments Fueling New Investments

Growing digital transformation in sectors such as BFSI, retail, and telecom boosts demand for colocation. It supports enterprise expansion with scalable, secure, and low-latency infrastructure. The Thailand Data Center Colocation Market gains momentum through edge computing strategies and AI deployments. Managed service bundles create attractive entry points for SMEs. Investors benefit from growing industry adoption and modernized infrastructure. Edge expansion strengthens Thailand’s position as an innovation hub in the region.

Market Segmentation

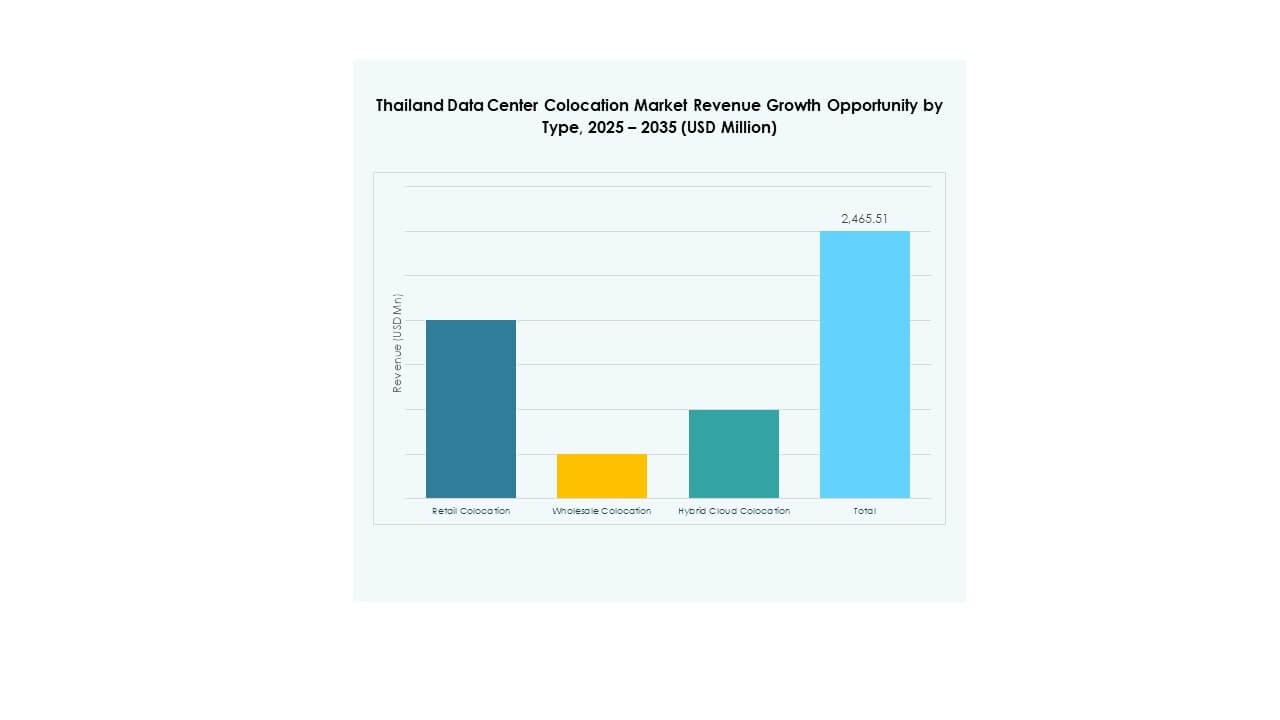

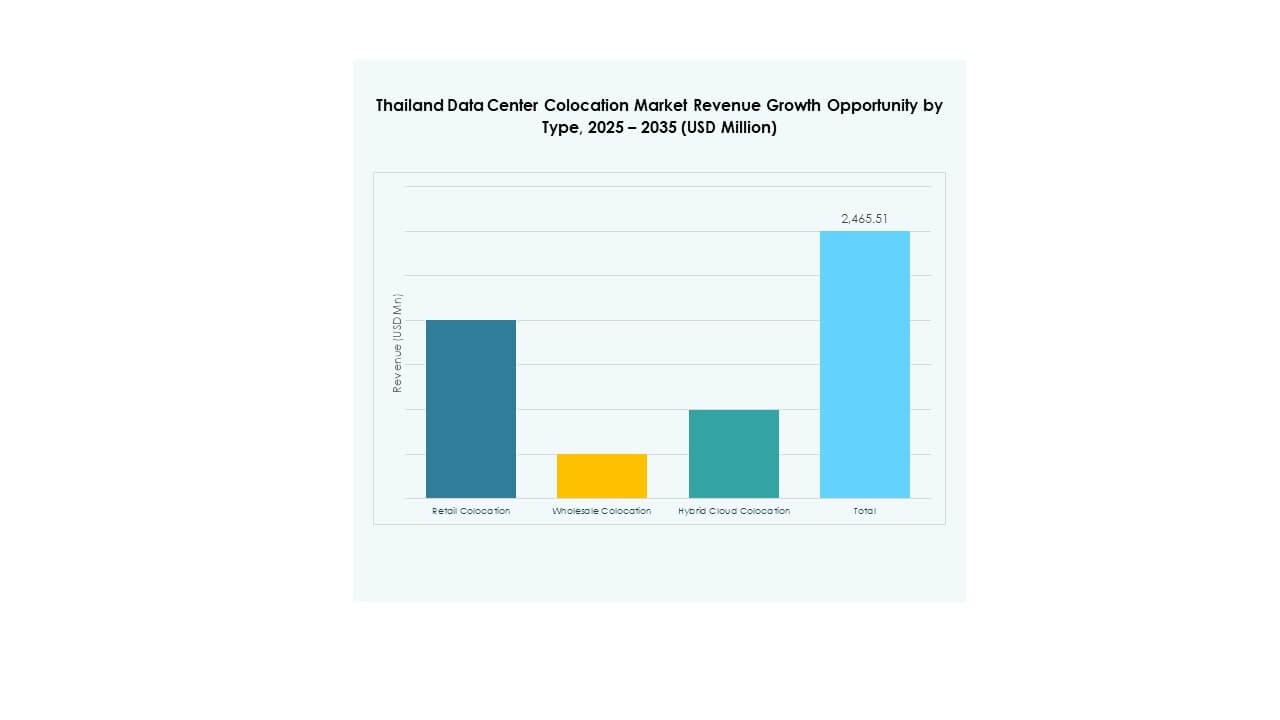

By Type

Retail colocation dominates the Thailand Data Center Colocation Market due to strong demand from SMEs and mid-size enterprises. It offers flexible contracts, scalable capacity, and lower capital investments. Wholesale colocation is gaining traction among hyperscalers expanding regional footprints. Hybrid cloud colocation supports enterprises transitioning to multi-cloud strategies. Retail facilities hold a significant share driven by increased network interconnection needs and cost advantages. Growth is supported by rising digital transformation across multiple industries.

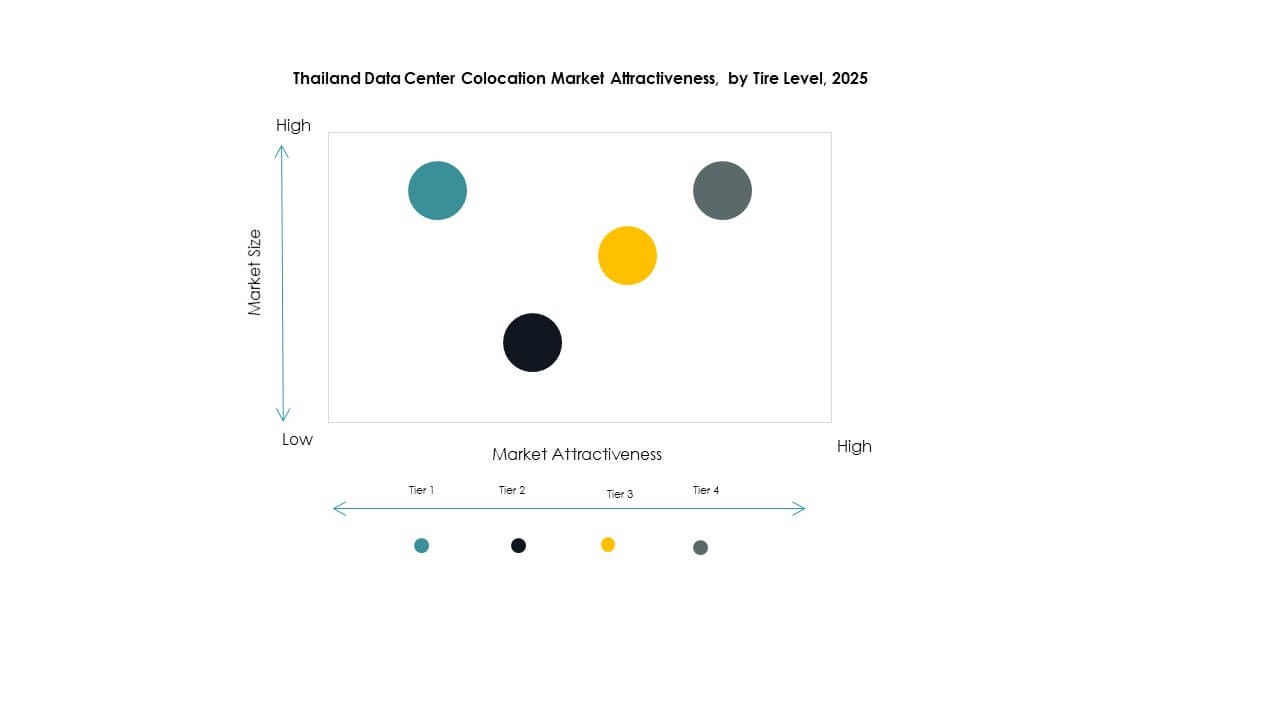

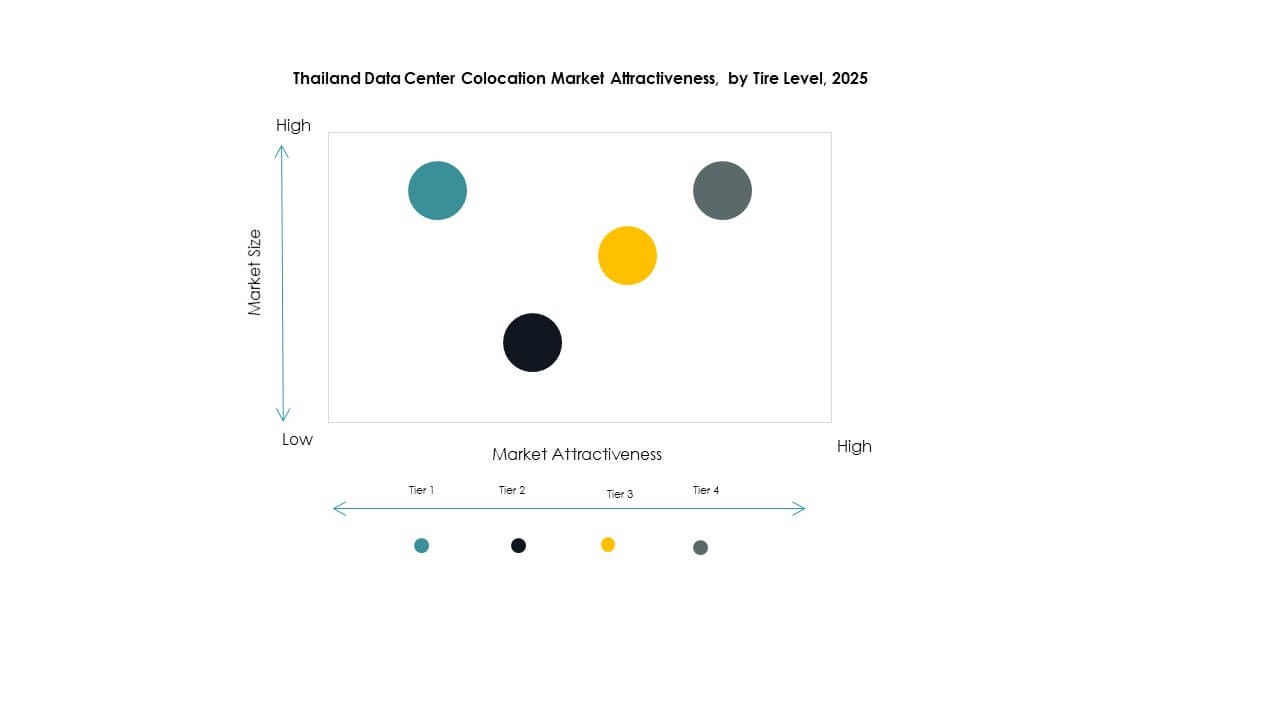

By Tier Level

Tier 3 facilities hold the largest share of the Thailand Data Center Colocation Market due to strong uptime requirements and enterprise demand. These facilities offer robust redundancy and security standards. Tier 4 is emerging, driven by hyperscale expansion and critical workload deployment. Tier 1 and Tier 2 serve smaller, less critical applications with lower cost structures. Tier 3 remains the preferred choice for industries seeking SLA-backed services. Its growth aligns with enterprise resilience strategies and advanced infrastructure adoption.

By Enterprise Size

Large enterprises lead the Thailand Data Center Colocation Market due to higher demand for scalable, secure, and compliant facilities. Their focus on cloud-first strategies drives significant capacity leasing. SMEs are expanding adoption through retail colocation to reduce operational costs. Large enterprises leverage advanced connectivity and managed services to support digital expansion. SMEs contribute to steady market growth through edge adoption and flexible pricing models.

By End User Industry

IT & Telecom dominates the Thailand Data Center Colocation Market due to its high network and compute requirements. BFSI follows, driven by digital banking and secure transaction systems. Retail and healthcare sectors adopt colocation for reliable, scalable operations. Media and entertainment benefit from low-latency delivery for streaming and content management. IT & Telecom maintains leadership due to ongoing 5G expansion and enterprise connectivity demands.

Regional Insights

Bangkok and Central Region: Core Economic and Digital Infrastructure Hub

Bangkok and the Central region hold 52% share of the Thailand Data Center Colocation Market. This region is the primary connectivity hub supported by strong fiber infrastructure and data traffic concentration. Most hyperscale and retail operators are establishing or expanding campuses here. The area’s proximity to enterprises and government agencies accelerates demand. High network density, power access, and advanced connectivity make it the strategic core for colocation investments.

- For instance, True IDC announced in January 2024 an investment of over 10 billion baht to expand its East Bangna and North Muangthong campuses. The project adds 41 MW of capacity and 60,000 m² of service space built under Uptime and TIA-942 standards. This information is confirmed through True IDC’s official press release.

Eastern Economic Corridor (EEC): Emerging Growth Zone for New Infrastructure Projects

The EEC accounts for 31% share of the Thailand Data Center Colocation Market. It is witnessing rapid investment driven by industrial digitization and strategic incentives. The zone benefits from proximity to submarine cable landing stations and industrial clusters. It attracts both local operators and foreign investors building scalable facilities. Strong logistics infrastructure and favorable policy frameworks support growth. This region is emerging as a major alternative to Bangkok for colocation deployment.

- For instance, Digital Edge and B.Grimm Power broke ground in September 2025 on a 100 MW data center campus in Chonburi’s Eastern Economic Corridor. The project is a US$1 billion joint venture structured as a 50–50 partnership. This information is confirmed through official press releases and industry reports.

Northern and Southern Regions: Supporting Regional Expansion and Edge Deployments

Northern and Southern regions together hold 17% share of the Thailand Data Center Colocation Market. These areas are seeing growing interest in edge deployments to improve service coverage. Telecom providers are expanding smaller facilities to reduce latency for regional users. Government programs encourage infrastructure development beyond central hubs. These regions play a supporting role in building a distributed colocation network. Their strategic development enhances nationwide digital resilience.

Competitive Insights:

- CS Loxinfo

- True IDC

- STT GDC Thailand

- SUPERNAP Thailand

- Amazon Web Services (AWS)

- Google Cloud

- Thailand Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Thailand Data Center Colocation Market features a strong mix of domestic and international players competing on infrastructure quality, connectivity, and service differentiation. Local providers such as True IDC, STT GDC Thailand, and SUPERNAP Thailand focus on expanding high-capacity, AI-ready colocation facilities. Global companies including Equinix, Digital Realty Trust, and AWS target hyperscale deployments and carrier-neutral interconnection hubs. It emphasizes sustainability, advanced cooling technologies, and strong cloud integration. Competitive strategies include strategic partnerships, green power sourcing, and service bundling. Companies invest in automation, security, and high-density solutions to secure long-term contracts and strengthen customer loyalty.

Recent Developments:

- In August 2025, Digital Edge announced the groundbreaking of a 100 MW data center campus in Thailand’s Eastern Economic Corridor (EEC). The project is one of the largest hyperscale and AI-ready data centers in the region, signaling Thailand’s growing significance as a hub for digital infrastructure.

- In June 2025, National Telecom (NT), officially known as Thailand Telecom Corporation Limited, entered a partnership with BCPG Public Company Limited, a renewable energy enterprise, to develop new sustainable data centers. This move is part of NT’s strategy to blend renewable energy with digital infrastructure expansion, enhancing government and enterprise cloud capabilities.

- In May 2025, True IDC, a subsidiary of the Charoen Pokphand Group, launched Thailand’s first AI Hyperscale Data Center in Bangkok to advance the nation’s digital infrastructure and position it as a leading ASEAN digital hub. The facility offers over 20MW capacity with advanced liquid cooling and GPU-optimized configurations, marking a milestone in the country’s transition toward AI-era hyperscale computing.

- In March 2025, ST Telemedia Global Data Centres (STT GDC)announced the expansion of its STT Bangkok Campus with the construction of STT Bangkok 2, its second major data center in Thailand. The facility supports high-density workloads and is designed for liquid cooling, focusing on AI-driven operations to meet the country’s growing hyperscale demand.

- In January 2025, Amazon Web Services (AWS)officially launched the AWS Asia Pacific (Thailand) Region, backed by a US$5 billion The project includes three availability zones across Thailand and is projected to contribute about US$10 billion to Thailand’s GDP while supporting over 11,000 jobs annually in sectors linked to the AWS supply chain.