Executive summary:

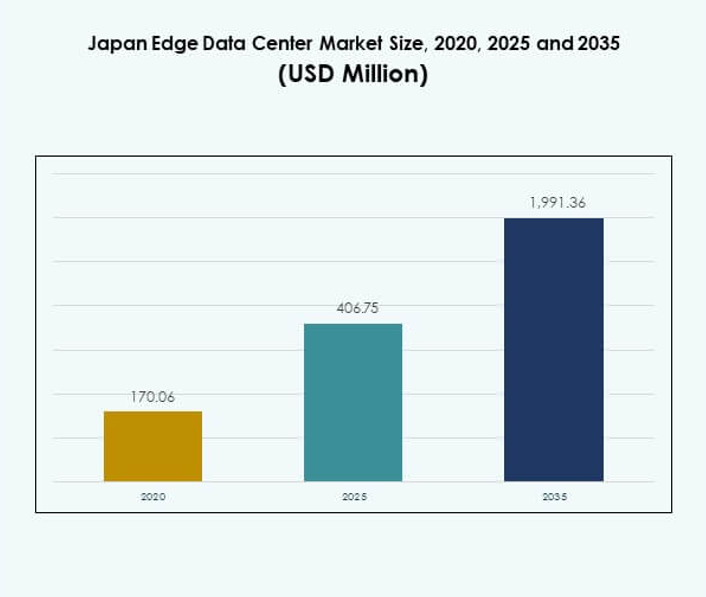

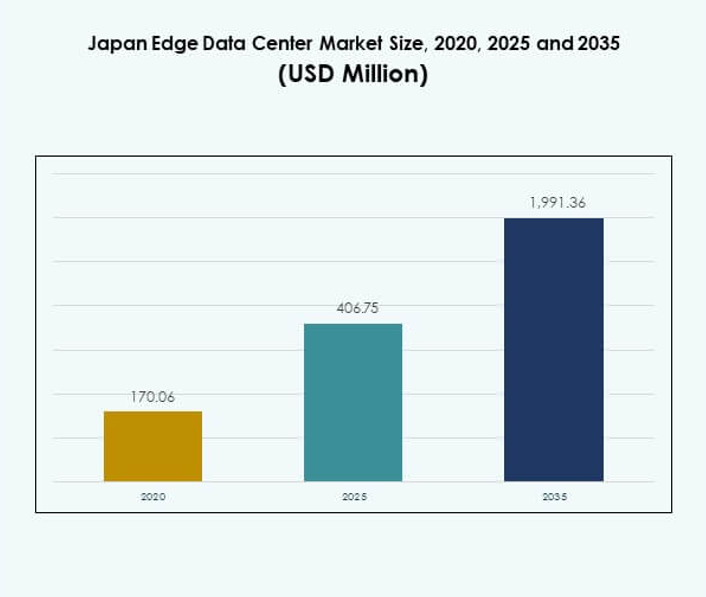

The Japan Edge Data Center Market size was valued at USD 170.06 million in 2020, reaching USD 406.75 million in 2025, and is anticipated to reach USD 1,991.36 million by 2035, at a CAGR of 17.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Japan Edge Data Center Market Size 2025 |

USD 406.75 Million |

| Japan Edge Data Center Market, CAGR |

17.05% |

| Japan Edge Data Center Market Size 2035 |

USD 1,991.36 Million |

The market is driven by Japan’s accelerating 5G expansion, IoT adoption, and rapid digital transformation across industries. Innovation in AI-powered edge infrastructure, data localization, and sustainable operations is enhancing network efficiency and scalability. The Japan Edge Data Center Market holds strategic importance for enterprises and investors seeking secure, low-latency computing to support automation, smart cities, and real-time analytics.

Tokyo and Osaka lead the regional landscape with high-density connectivity and advanced data infrastructure. These hubs attract hyperscale investments and enterprise deployments, while regions such as Fukuoka and Hokkaido are emerging due to growing renewable energy use and government incentives. This balanced development strengthens Japan’s nationwide digital ecosystem.

Market Drivers

Expanding 5G Infrastructure and Rising Edge Computing Demand

Japan’s rapid 5G rollout is fueling strong growth in the Japan Edge Data Center Market. Telecom operators and cloud service providers are investing in localized data infrastructure to minimize latency and enhance service quality. The expansion of smart manufacturing and autonomous vehicles is driving demand for real-time data processing at the edge. It supports mission-critical applications by enabling faster decision-making and seamless connectivity. The integration of multi-access edge computing (MEC) is optimizing bandwidth use and network resilience. Government initiatives promoting 5G and Industry 4.0 are accelerating investments. These developments are transforming Japan’s digital backbone and attracting high-value investors. The market plays a key role in enabling Japan’s transition toward a connected digital economy.

- For example, NTT DOCOMO and NTT Corporation successfully demonstrated In-Network Computing (INC) for advancing AI utilization in the 6G era with coordinated edge resources. In March 2025, their test integrated GSMA Open Gateway/CAMARA APIs and proved quality control for real-time video and AI analysis, reaching 90% inference accuracy for the deployed models.

Adoption of IoT Devices and Real-Time Data Processing Needs

The surge in connected devices across industries is boosting edge data infrastructure. Enterprises need localized processing to handle vast IoT-generated data and reduce network congestion. The Japan Edge Data Center Market supports this transition through scalable, energy-efficient facilities. It enhances operational efficiency in logistics, healthcare, and manufacturing sectors. Increasing AI integration in industrial systems requires data processing closer to endpoints. Edge centers help businesses maintain data sovereignty and improve compliance with Japan’s privacy regulations. Growing enterprise digitalization is reinforcing the shift from centralized to distributed computing. This evolution is aligning national infrastructure with Japan’s Smart City and digital economy goals.

- For example, SoftBank Corp. operates Japan’s largest NVIDIA DGX SuperPOD, deployed in July 2025, with over 4,000 NVIDIA Blackwell GPUs powering a national AI and edge platform. The new infrastructure delivers 13.7 exaflops for Japanese-language large models, providing distributed AI computing and high-throughput real-time analytics for smart factories, healthcare, and telecom customers.

Technological Innovation and Sustainable Infrastructure Development

Japan’s edge data centers are advancing through modular designs, renewable energy use, and liquid cooling systems. The Japan Edge Data Center Market is witnessing innovation in AI-driven monitoring and automation technologies. It ensures uptime efficiency and sustainability by reducing energy consumption and operational costs. Firms are deploying modular data units to expand faster in urban and rural regions. Investments from global players like Equinix and Digital Edge demonstrate confidence in Japan’s green infrastructure roadmap. Smart grids and hydrogen-based power systems are emerging as critical enablers for sustainable operations. The adoption of these technologies enhances system reliability and resilience. Investors view Japan as a technology leader driving sustainable data center transformation.

Rising Enterprise Adoption and Strategic Digital Investments

Japanese enterprises are accelerating digital adoption through cloud migration and edge deployment. The Japan Edge Data Center Market benefits from increasing corporate demand for hybrid and private network solutions. It helps organizations enhance data security, efficiency, and scalability. Financial institutions and e-commerce firms are leveraging edge computing to process transactions and analytics in real time. Strategic partnerships between data center operators and telecom firms are improving nationwide connectivity. AI and analytics integration are enabling predictive maintenance and dynamic resource allocation. This transformation is reshaping enterprise IT strategies across sectors. Investors recognize Japan’s edge infrastructure as a foundation for long-term digital competitiveness.

Market Trends

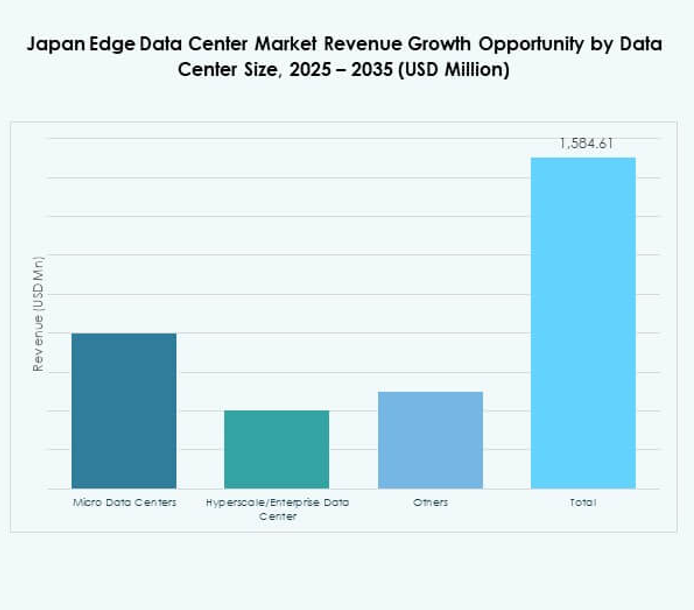

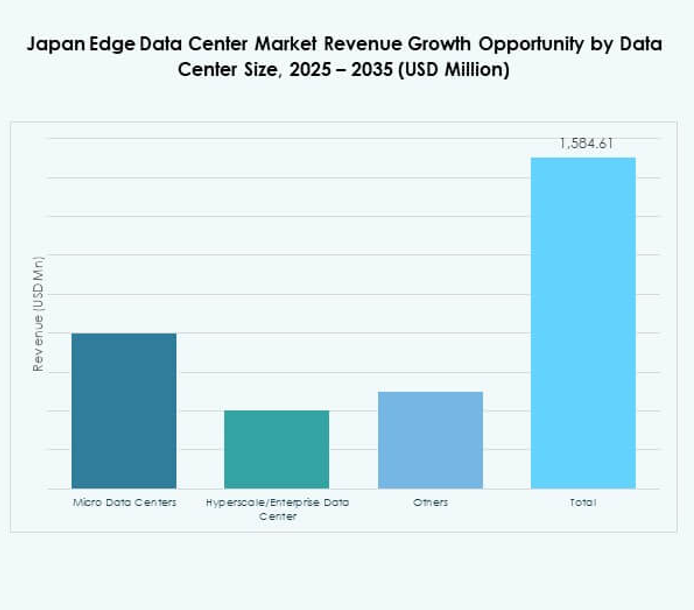

Growth of Modular and Micro Edge Data Centers Across Urban Hubs

Micro and modular data centers are reshaping Japan’s infrastructure strategy. The Japan Edge Data Center Market is witnessing deployment of compact, prefabricated facilities in urban areas. It provides scalability and flexibility to support diverse digital applications. Telecom and cloud providers prefer these designs for faster deployment and cost control. Modular construction allows adaptability for changing workloads. Businesses value this setup for supporting decentralized computing in smart factories and retail. The demand is increasing due to rising data volume near population centers. Japan’s focus on efficiency and urban optimization strengthens modular data center adoption.

Shift Toward AI-Optimized Edge Networks and Smart Infrastructure

Artificial intelligence is becoming integral to Japan’s edge infrastructure. The Japan Edge Data Center Market is experiencing adoption of AI-powered tools for resource allocation and cooling management. It enhances performance efficiency and reduces operational risks. Data centers use predictive analytics to balance workloads and optimize energy use. Integration of machine learning in monitoring systems is improving uptime and reducing outages. Telecom firms deploy AI at the network edge for faster analytics and automation. Enterprises view AI-enabled infrastructure as critical for competitive advantage. This transformation supports advanced applications in robotics, healthcare, and finance.

Increased Focus on Renewable Energy and Low-Carbon Operations

Sustainability remains a major trend across Japan’s technology landscape. The Japan Edge Data Center Market is transitioning toward low-carbon energy models using solar and hydrogen power. It supports the national commitment to carbon neutrality by 2050. Operators are integrating renewable grids and heat reuse systems to lower emissions. Facilities near renewable-rich regions are favored for sustainable operations. Companies are adopting energy-efficient cooling and advanced power usage monitoring. Green certification initiatives are also rising among operators to attract eco-conscious clients. The trend enhances Japan’s global reputation for sustainable infrastructure leadership.

Expansion of Edge Infrastructure Beyond Metropolitan Corridors

Japan’s secondary regions are emerging as strategic zones for data infrastructure. The Japan Edge Data Center Market is expanding into areas like Fukuoka and Hokkaido for redundancy and resilience. It reduces network load on Tokyo and Osaka while supporting disaster recovery. Local governments are offering incentives for rural digital investments. Companies deploy regional data hubs to serve industrial and public service needs. Energy availability and land cost advantages drive edge expansions outside cities. The regional diversification ensures stable national data distribution. This trend strengthens the country’s digital continuity and network reliability.

Market Challenges

High Energy Consumption and Rising Operational Costs

Sustaining energy efficiency remains a persistent challenge in Japan’s data center ecosystem. The Japan Edge Data Center Market faces increasing operational costs due to high power prices and limited renewable integration in some regions. It must address efficiency through advanced cooling systems and automation. Growing data traffic from IoT and AI applications intensifies power demand. Operators face pressure to balance expansion with environmental responsibility. Compliance with Japan’s energy regulations adds complexity to large-scale facility operations. Managing thermal loads in dense urban environments also poses technical hurdles. The industry continues to seek cost-effective solutions that balance performance and sustainability.

Regulatory Complexity and Land Availability Constraints

Japan’s stringent data protection laws and limited land supply complicate market expansion. The Japan Edge Data Center Market experiences constraints in urban zones with zoning restrictions and high property costs. It must navigate complex approval processes and sustainability standards. Regulatory compliance increases project lead times and cost structures. Operators require collaboration with local authorities for construction and grid integration. Data localization rules further influence investment decisions and operational frameworks. Rural expansion faces logistical and infrastructure challenges. These barriers limit the speed of deployment and require strategic planning to achieve scalability.

Market Opportunities

Rising Cloud Migration and Enterprise Digital Transformation Projects

The shift toward hybrid cloud and digital transformation offers strong growth opportunities. The Japan Edge Data Center Market is positioned to support enterprise workloads across manufacturing, BFSI, and e-commerce. It provides low-latency computing and improved data sovereignty. Cloud-native applications demand distributed architectures that edge facilities enable effectively. Increasing investment from hyperscalers enhances service diversity. Enterprises are leveraging these data centers for secure and localized operations. This transition presents lucrative prospects for infrastructure providers and technology investors seeking long-term value creation.

Expansion into Renewable-Powered and AI-Enabled Edge Facilities

Sustainability goals are pushing operators toward green and AI-integrated infrastructure. The Japan Edge Data Center Market benefits from government incentives promoting hydrogen-based and solar-driven facilities. It supports Japan’s decarbonization roadmap and innovation goals. Operators integrating AI for predictive maintenance and cooling automation achieve efficiency advantages. The trend attracts ESG-focused investments seeking environmentally responsible assets. Growth in AI and IoT adoption will continue driving green infrastructure expansion. This opportunity enhances Japan’s position as a regional leader in sustainable data operations.

Market Segmentation

By Component

Solutions hold the dominant share in the Japan Edge Data Center Market due to high demand for integrated hardware and software platforms. It supports efficient network connectivity and performance optimization. Services such as maintenance and consulting are also growing rapidly. The rise in managed IT infrastructure and automation drives solution adoption. Service providers are expanding portfolios to include security and monitoring. Demand for modular deployment and smart management further strengthens solution dominance. Enterprises rely on advanced integration for flexibility and scalability.

By Data Center Type

Colocation edge data centers dominate the Japan Edge Data Center Market with the largest market share. It provides scalability and reduces capital expenditure for enterprises. Managed and cloud edge centers are also growing due to hybrid IT adoption. The flexibility of colocation facilities supports telecom and financial sectors seeking agility. Enterprises prefer shared infrastructure for faster deployment and data proximity. Cloud-native applications and IoT are fueling colocation demand. The trend reflects the country’s focus on efficient and distributed digital infrastructure.

By Deployment Model

Hybrid deployment leads the Japan Edge Data Center Market owing to its flexibility and resilience. It allows enterprises to integrate on-premises systems with cloud environments. The model enhances scalability while maintaining control over sensitive data. Cloud-based deployment is gaining pace among SMEs for cost efficiency. On-premises setups serve regulated sectors like BFSI and defense. Hybrid infrastructure supports seamless workload distribution and data synchronization. The growing reliance on hybrid models strengthens business continuity strategies.

By Enterprise Size

Large enterprises dominate the Japan Edge Data Center Market with higher infrastructure investments and complex IT needs. It helps them deploy customized and secure edge solutions. SMEs are increasingly adopting modular and cloud-based data centers for scalability. The accessibility of pay-as-you-go models enables smaller firms to adopt digital solutions efficiently. Edge infrastructure supports operational efficiency in diverse industries. Large corporations lead innovation through automation and smart analytics. The segment’s growth aligns with Japan’s enterprise modernization trend.

By Application / Use Case

Power monitoring and capacity management hold significant shares in the Japan Edge Data Center Market. It ensures energy optimization and real-time resource allocation. Environmental monitoring and BI analytics are expanding due to growing ESG and data-driven demands. Asset management tools enhance uptime and reduce maintenance costs. Edge data centers integrate AI for dynamic load balancing and fault detection. These applications strengthen performance reliability and decision-making accuracy. Demand for multi-function platforms continues to grow across industries.

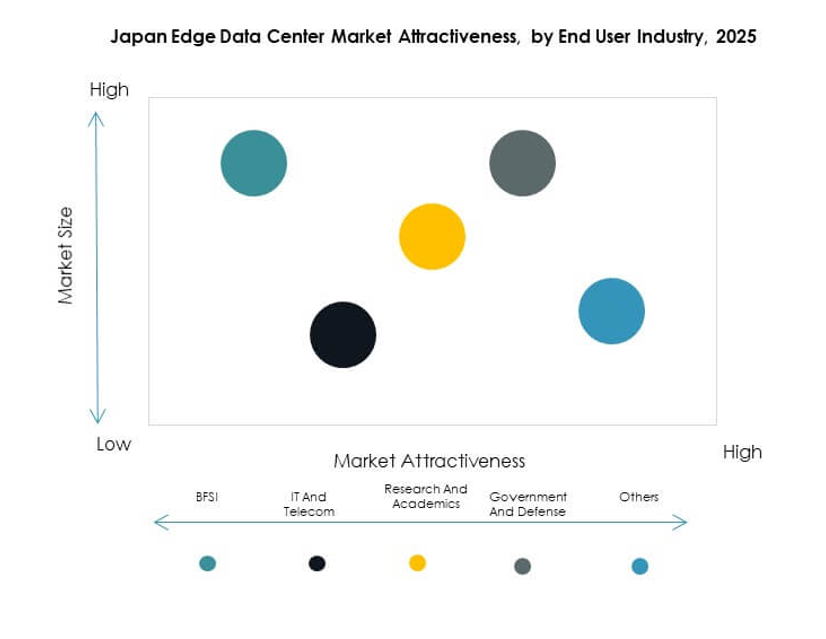

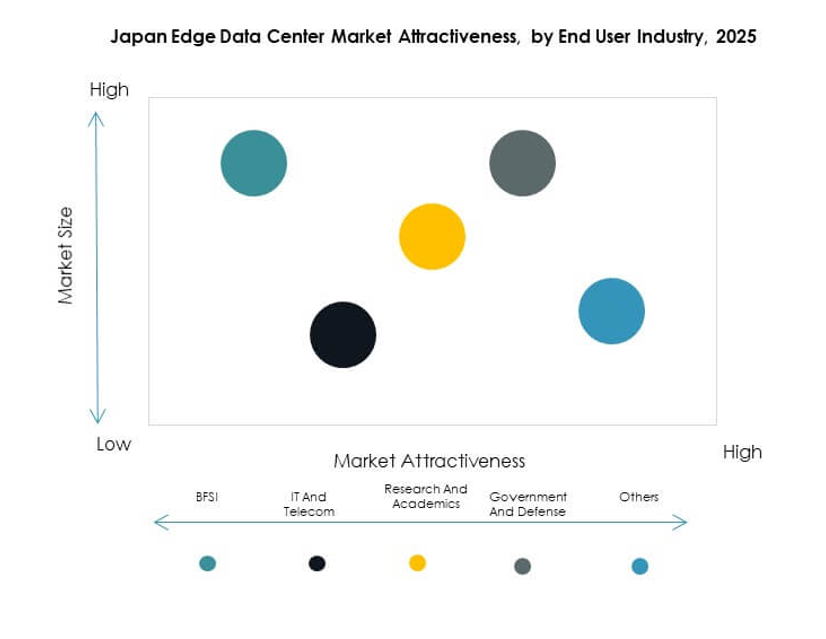

By End User Industry

The IT and telecommunications sector leads the Japan Edge Data Center Market with the highest adoption rate. It enables 5G deployment, IoT connectivity, and content delivery optimization. BFSI and retail sectors follow due to data security and transaction processing needs. Healthcare and energy firms are investing in localized computing for real-time analytics. E-commerce companies benefit from low-latency networks supporting seamless user experiences. The diverse adoption across industries ensures sustained market expansion.

Regional Insights

Kanto Region (Tokyo Metropolitan Area) – 45% Market Share

The Kanto region dominates the Japan Edge Data Center Market, accounting for 45% of the total share. Tokyo’s dense population, advanced connectivity, and cloud ecosystem attract large-scale investments. It hosts hyperscale facilities from global operators ensuring low latency and high reliability. The presence of telecom headquarters enhances integration between edge and core systems. Government digital initiatives also support infrastructure modernization. The region remains the central hub for Japan’s enterprise and digital service operations.

- Equinix Tokyo’s TY11, opened in 2019 in Koto-ku, is Japan’s largest IBX data center with over 14,300 square meters of space and 3,500 cabinet capacity. It connects 835+ companies and offers sub-2 millisecond latency across Tokyo, showcasing the Kanto region’s advanced connectivity and data infrastructure.

Kansai Region (Osaka and Kyoto) – 30% Market Share

The Kansai region holds 30% of the Japan Edge Data Center Market share, driven by industrial automation and manufacturing. Osaka’s proximity to major logistics routes supports distributed data networks. The region attracts investors seeking geographic redundancy and disaster resilience. Local enterprises prefer edge deployments to optimize AI and IoT-based operations. Advanced renewable integration improves sustainability of data center facilities. Kansai’s infrastructure expansion complements Tokyo’s digital ecosystem effectively.

- For example, MC Digital Realty, a joint venture between Mitsubishi Corporation and Digital Realty, operates the Osaka data center campus, which includes KIX10, KIX11, and KIX12. The KIX12 facility, launched in August 2021, offers 20 MW of power and 18,334 square meters (197,300 sq ft) of space. The Osaka campus totals 53 MW IT capacity and features liquid cooling and renewable integration, confirmed through official company and industry reports.

Other Regions (Fukuoka, Hokkaido, Nagoya) – 25% Market Share

Other regions collectively account for 25% of the Japan Edge Data Center Market. Fukuoka is emerging as a technology hub supporting western Japan’s industries. Hokkaido offers favorable conditions for green and renewable-powered facilities. Nagoya’s manufacturing base drives regional data processing needs. These areas provide land availability and energy cost advantages. It strengthens the national digital network and ensures balanced growth. The government’s incentives are accelerating private sector participation in these regions.

Competitive Insights:

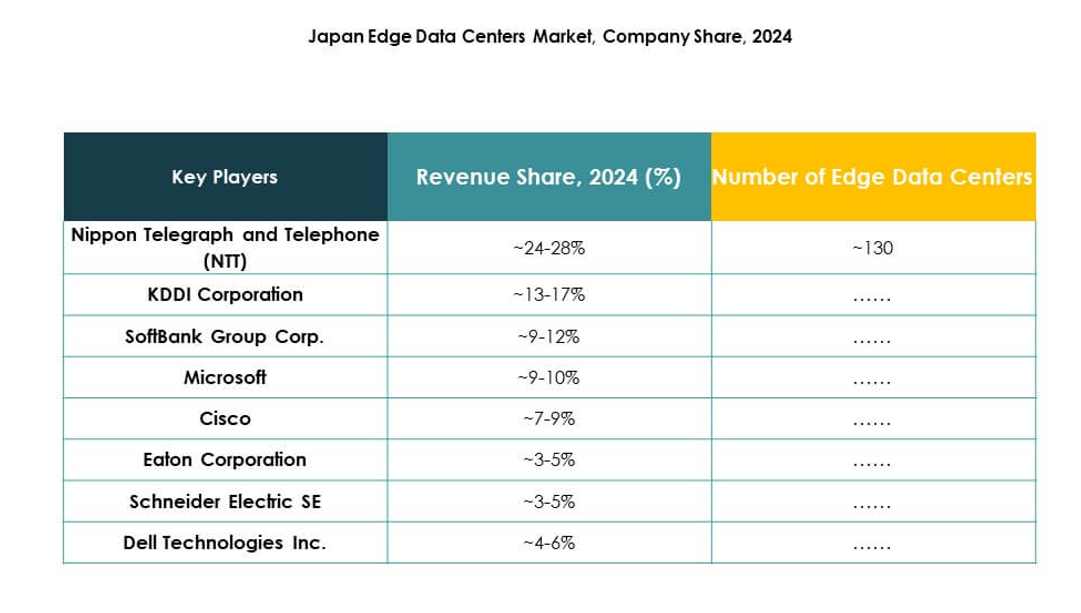

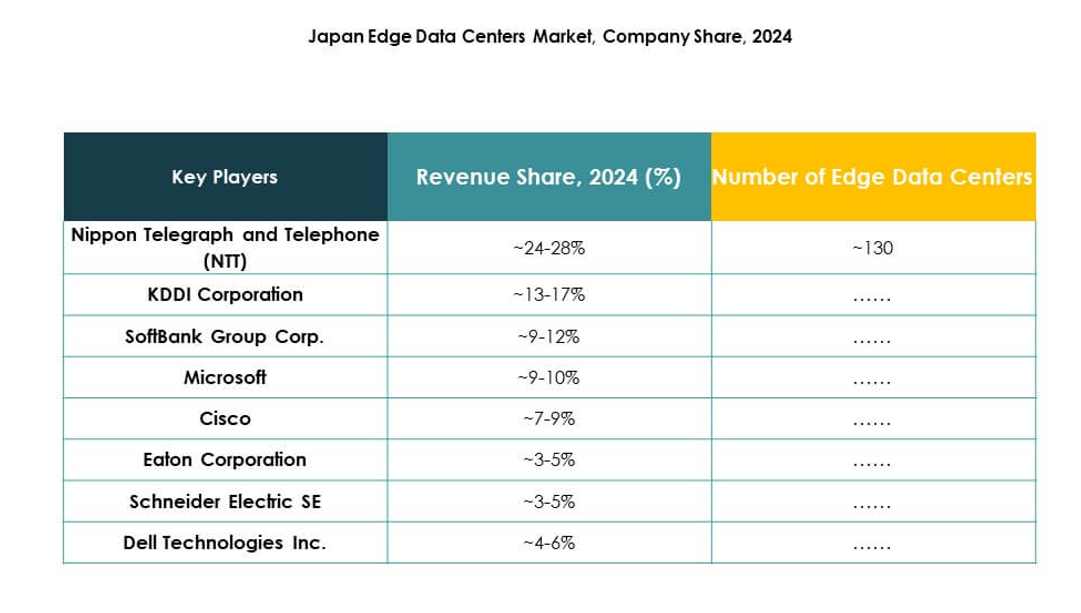

- Nippon Telegraph and Telephone (NTT)

- KDDI Corporation

- SoftBank Group Corp.

- Rakuten Mobile, Inc.

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. KG

The Japan Edge Data Center Market features a strong mix of domestic telecom leaders and global technology innovators. NTT, KDDI, and SoftBank dominate through extensive 5G integration and national connectivity networks. It benefits from strategic collaborations between global players like Microsoft, Schneider Electric, and Dell, who supply advanced digital infrastructure and automation systems. EdgeConneX and SixSq strengthen localized computing capacity with modular and AI-driven deployments. Fujitsu and Cisco focus on energy efficiency, cybersecurity, and hybrid cloud integration. Competition is centered on service differentiation, sustainability, and low-latency solutions, driving continuous infrastructure modernization across Japan’s edge ecosystem.

Recent Developments:

- In October 2025, SoftBank and Oracle entered into a strategic partnership to deliver sovereign cloud and AI services in Japan. This collaboration is set to launch its first phase in SoftBank’s eastern Japan edge data center in April 2026, followed by its western Japan edge data center in October 2026. The partnership aims to provide secure, compliant, and scalable solutions that support Japanese companies’ growing need for data localization and advanced AI capabilities.

- In September 2025, Digital Edge and Hulic Co., Ltd. launched the TYO7 data center, a next-generation, carrier-neutral facility in central Tokyo. TYO7 marks Digital Edge’s seventh Tokyo location and ninth in Japan, strategically situated one kilometer from Japan’s central network hub at Otemachi and within 300 meters of an existing Digital Edge site. This product launch enhances connectivity options for the Tokyo metropolitan area and supports the city’s cloud and AI ecosystem with high-density, energy-efficient infrastructure.

- In August 2025, EdgeConneX acquired its second data center site in the Greater Osaka and Yawata regions of Japan, expanding its total planned platform capacity in the country to 350MW. The new site will eventually add 150MW of power and is designed to handle workloads exceeding 600kW per rack, supporting deployments for advanced AI technologies by Nvidia, AMD, and Intel.