Executive summary:

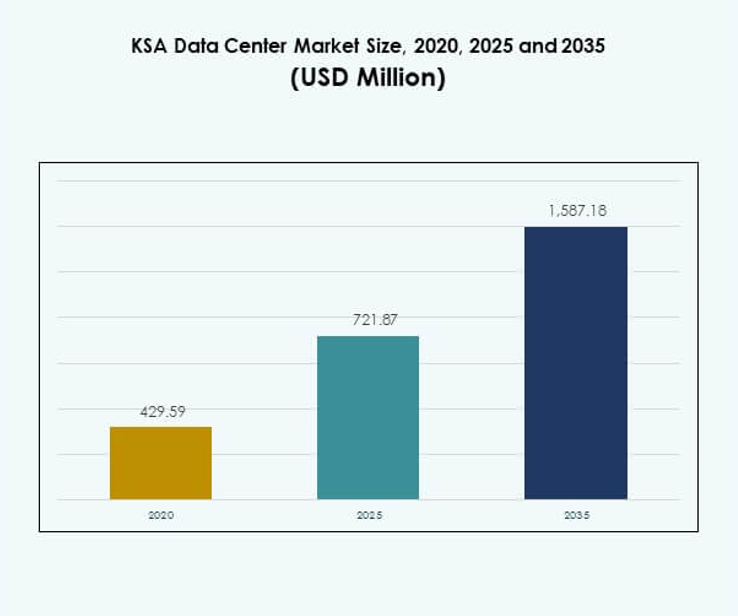

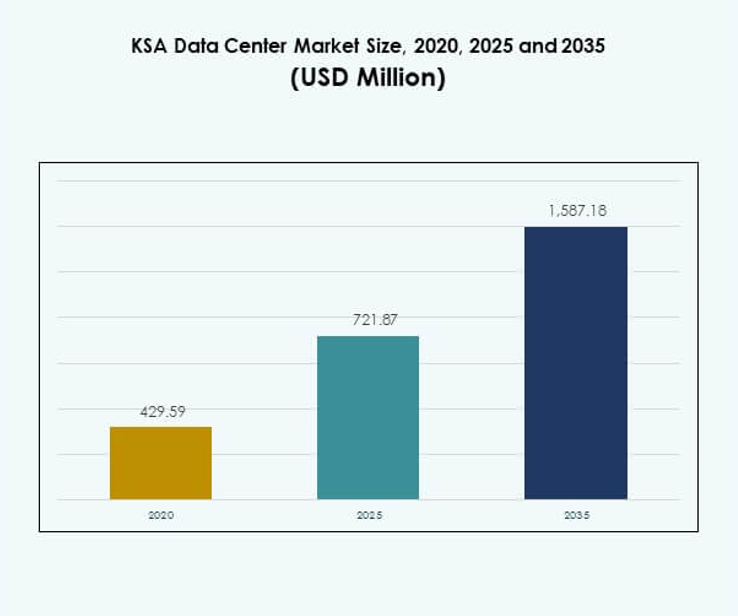

The KSA Data Center Market size was valued at USD 429.59 million in 2020 to USD 721.87 million in 2025 and is anticipated to reach USD 1,587.18 million by 2035, at a CAGR of 8.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| KSA Data Center Market Size 2025 |

USD 721.87 Million |

| KSA Data Center Market, CAGR |

8.15% |

| KSA Data Center Market Size 2035 |

USD 1,587.18 Million |

The market is expanding due to cloud adoption, AI integration, and widespread digital transformation across industries. Strong government backing under Vision 2030 encourages modernization of IT infrastructure. Growing demand for 5G, IoT, and big data analytics increases the need for hyperscale and colocation centers. It is creating opportunities for global providers and local telecom firms to strengthen their footprints. The sector is seen as strategically vital for businesses and investors seeking long-term digital resilience.

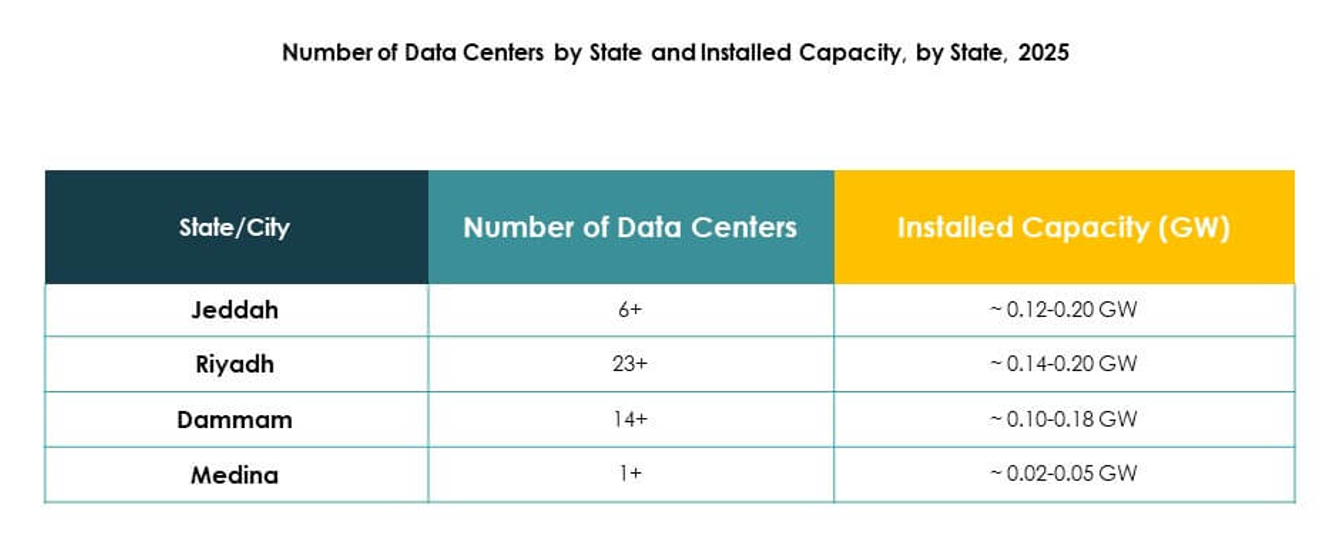

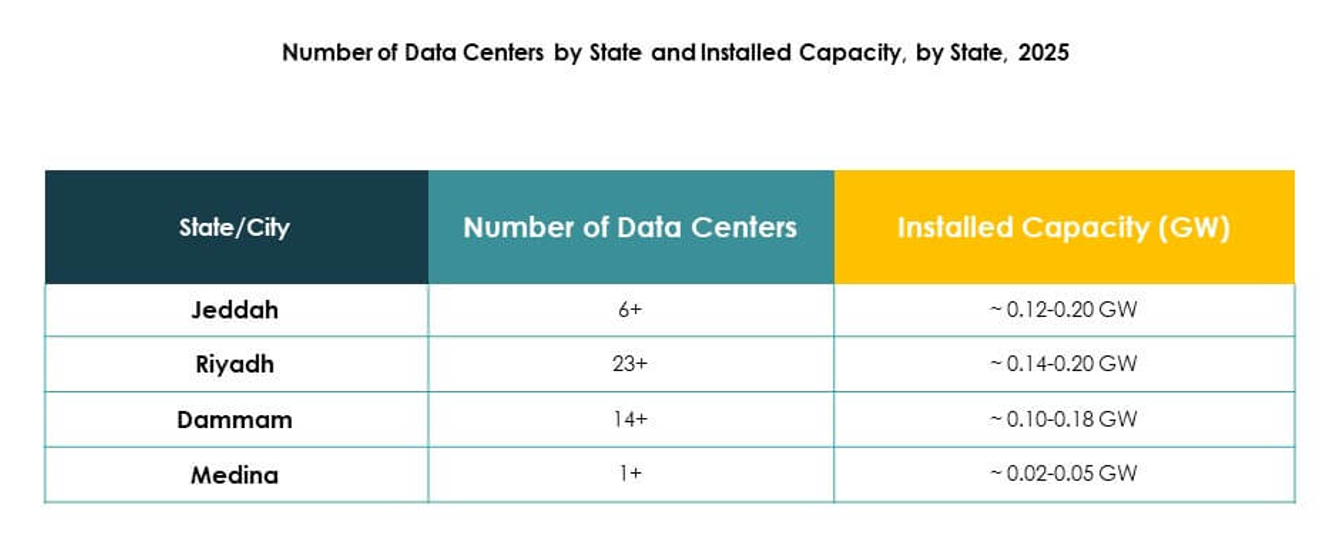

Regionally, the central part of Saudi Arabia leads due to Riyadh’s role as a government and enterprise hub. The western region is emerging as a strong contender, supported by mega projects like NEOM and new smart city initiatives. The eastern region shows steady growth, driven by demand from energy and industrial enterprises. It is ensuring balanced expansion across the Kingdom, making the market a cornerstone for regional digital leadership.

Market Drivers

Rapid Adoption of Cloud Computing and Digital Infrastructure Modernization

The KSA Data Center Market is experiencing growth through rapid adoption of cloud services and digital transformation. Businesses are investing in scalable infrastructure to support cloud-native applications and advanced workloads. It is driving large-scale investments in servers, virtualization platforms, and high-density storage solutions. Government initiatives under Vision 2030 are pushing organizations to upgrade digital capabilities. Enterprises are moving away from legacy systems to adopt flexible cloud-based platforms. Strong demand for digital services across industries makes cloud adoption critical. Global providers are entering partnerships with local players to meet demand. This shift is creating long-term growth opportunities.

Integration of Artificial Intelligence, Big Data, and Advanced Analytics

Artificial intelligence and big data are transforming operations across industries in Saudi Arabia. The KSA Data Center Market benefits from the need for advanced infrastructure to handle complex workloads. AI-driven applications require high-performance computing and massive storage capacity. It is fueling demand for efficient cooling systems and high-speed networking. Businesses view AI integration as essential for competitiveness and decision-making. Data analytics tools are becoming central to operations in finance, retail, and healthcare. Local firms and multinationals are establishing AI-ready data centers. The trend secures a stronger role for Saudi Arabia in regional technology leadership.

- For instance, AWS announced a USD 5.3 billion investment to launch a new Saudi Arabia region, building on its UAE region that already operates three Availability Zones to support cloud scalability.

Expansion of Smart Cities and 5G Network Infrastructure in the Kingdom

Saudi Arabia is heavily investing in smart cities and nationwide 5G rollouts. The KSA Data Center Market gains importance by enabling seamless connectivity and real-time data processing. Smart city projects such as NEOM require high-performance computing infrastructure. It is creating rising demand for edge data centers that reduce latency. 5G adoption supports IoT devices across transportation, utilities, and healthcare. Telecom operators are building advanced facilities to support the surge in mobile data traffic. The alignment of data centers with 5G enhances digital services. This development strengthens competitiveness for businesses and investors in multiple industries.

- For example, Center3, a subsidiary of stc, is one of Saudi Arabia’s largest data center operators and has announced plans to expand its capacity to 1 GW by 2030, reinforcing its role in hyperscale and colocation services.

Government Support, Regulatory Frameworks, and Foreign Investment Inflow

The government is actively promoting foreign investments in the digital economy. The KSA Data Center Market benefits from favorable policies that encourage infrastructure development. Tax reforms, simplified regulations, and strategic partnerships attract global hyperscale operators. It is encouraging international players to establish cloud regions in the Kingdom. Local firms are expanding managed services to align with global standards. Regulatory measures on data sovereignty create confidence for enterprises. Government-backed projects ensure sustained demand for secure data storage and processing. This policy-driven support makes Saudi Arabia a regional hub for technology and digital transformation.

Market Trends

Rise of Sustainable and Green Data Center Infrastructure Development

Sustainability is shaping long-term investment strategies across the Kingdom. The KSA Data Center Market is witnessing a shift toward energy-efficient designs and renewable-powered facilities. Enterprises are adopting modular cooling systems and advanced airflow management solutions. It is reducing operating costs while meeting environmental goals. Investors are prioritizing data centers with green certifications. Integration of solar and wind resources into operations supports energy diversification. Demand for eco-friendly data centers is increasing among multinational corporations. This trend aligns with global ESG standards and Vision 2030 sustainability targets.

Growing Focus on Edge Computing for Decentralized Data Processing Needs

Decentralized data processing is gaining importance across industries such as telecom and retail. The KSA Data Center Market is adopting edge computing to reduce latency and improve real-time services. Edge facilities support IoT devices in transport, manufacturing, and healthcare. It is driving demand for smaller but strategically located data centers. Telecom operators are investing in micro and modular infrastructure. The adoption enhances the efficiency of 5G-enabled applications. Enterprises see edge as essential for localized workloads. This focus strengthens innovation capacity across digital platforms and service ecosystems.

Expansion of Hybrid and Multi-Cloud Strategies Across Enterprises

Hybrid and multi-cloud approaches are becoming essential for enterprise flexibility. The KSA Data Center Market is seeing higher adoption of cloud-based deployments combined with on-premises control. Hybrid strategies support scalability while ensuring data security compliance. It is making businesses more resilient to disruptions. Multi-cloud models allow organizations to avoid vendor lock-in. Enterprises are increasingly using orchestration and monitoring tools. The expansion enables cost optimization and performance management. This trend creates a balanced ecosystem of cloud-native and legacy systems.

Rising Investments in Cybersecurity Infrastructure and Resilience Models

Cybersecurity is a critical concern for businesses handling sensitive data. The KSA Data Center Market is expanding its cybersecurity infrastructure to address risks from digitalization. Operators are implementing AI-driven security frameworks and encryption systems. It is ensuring compliance with national data protection regulations. Enterprises in finance and healthcare require enhanced security layers. Investments in intrusion detection and threat intelligence platforms are growing. Partnerships with global cybersecurity providers strengthen local defense capabilities. This focus on resilience supports trust in data center operations and encourages adoption across industries.

Market Challenges

High Energy Consumption, Operational Costs, and Infrastructure Sustainability

Data centers require vast amounts of electricity for cooling and uninterrupted operations. The KSA Data Center Market faces challenges in managing energy demand and cost structures. Power-intensive infrastructure increases reliance on renewable resources. It is pressuring operators to adopt sustainable cooling and energy-saving technologies. Operational costs remain a barrier for smaller enterprises. The gap between rising demand and efficient infrastructure creates long-term risks. Balancing performance and sustainability is a complex task. These factors slow adoption for certain sectors and require targeted solutions.

Data Sovereignty, Security Regulations, and Skilled Workforce Shortages

Stringent regulations on data sovereignty demand local storage and compliance. The KSA Data Center Market must address strict frameworks while balancing international business needs. It is creating challenges for global firms seeking seamless operations. Cybersecurity risks further add to compliance pressures. Shortage of skilled professionals in advanced IT and data management compounds the problem. Operators face difficulties in training and retaining talent. Dependence on foreign expertise raises operational costs. These hurdles limit scalability and delay the pace of technological adoption.

Market Opportunities

Strategic Expansion of Hyperscale and Cloud Regions with Investor Support

The KSA Data Center Market offers opportunities through hyperscale development and cloud regions expansion. Government initiatives and global partnerships encourage investments in large-scale infrastructure. It is attracting multinational providers to build advanced facilities. Enterprises are leveraging these centers to expand digital services. Growth in e-commerce, fintech, and healthcare creates strong demand. The opportunity positions Saudi Arabia as a regional cloud hub. Favorable policies and rising digital adoption strengthen the appeal for foreign investors.

Rising Potential for AI-Enabled, IoT-Driven, and Industry-Specific Solutions

AI and IoT integration is creating sector-specific opportunities in Saudi Arabia. The KSA Data Center Market is evolving to support real-time analytics, smart manufacturing, and connected healthcare. It is increasing demand for edge data centers and modular systems. Local enterprises are embracing AI-ready infrastructure for competitiveness. Growth is visible in government services and smart city projects. IoT applications in transport and energy require scalable platforms. The opportunity enhances innovation and makes data centers vital for future industries.

Market Segmentation

By Component

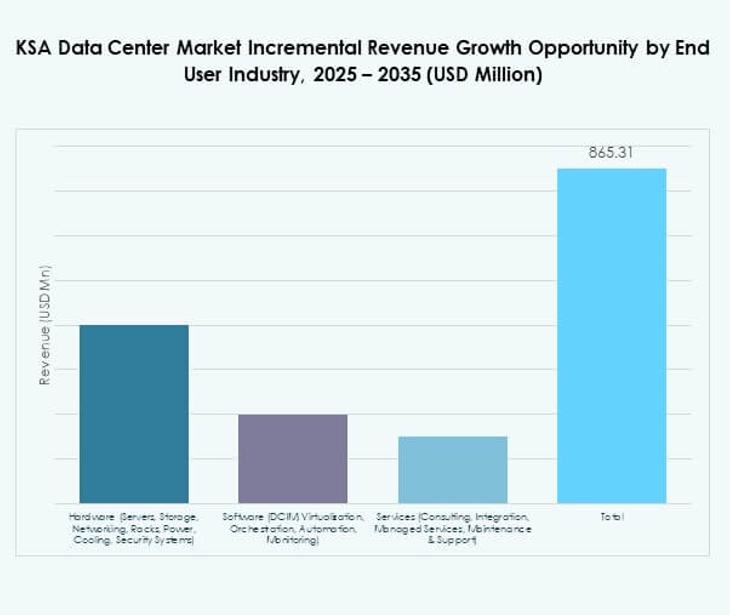

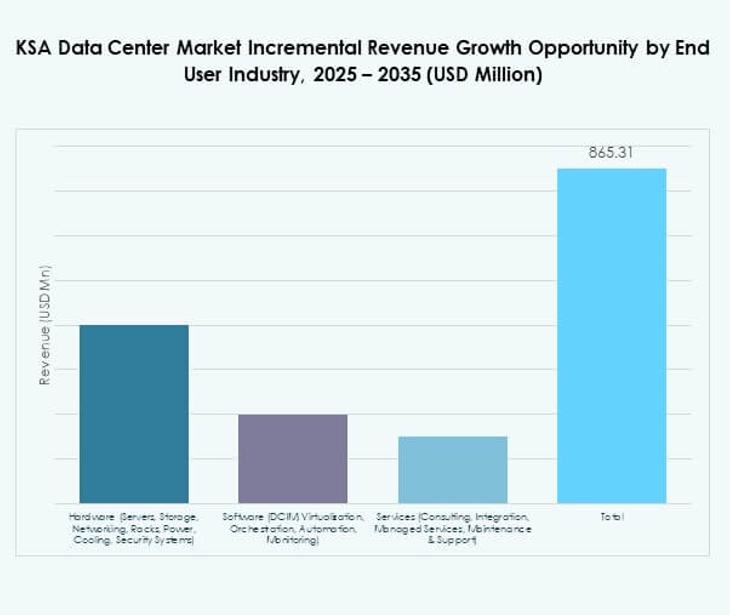

Hardware dominates the KSA Data Center Market with the largest share, driven by rising demand for servers, racks, and cooling solutions. It is supported by large-scale investments in scalable computing infrastructure. Software adoption is growing, with DCIM and virtualization tools enhancing efficiency and automation. Services remain important, as consulting, integration, and managed services attract enterprises seeking operational expertise. The component landscape reflects strong momentum for hardware while software and services show steady acceleration.

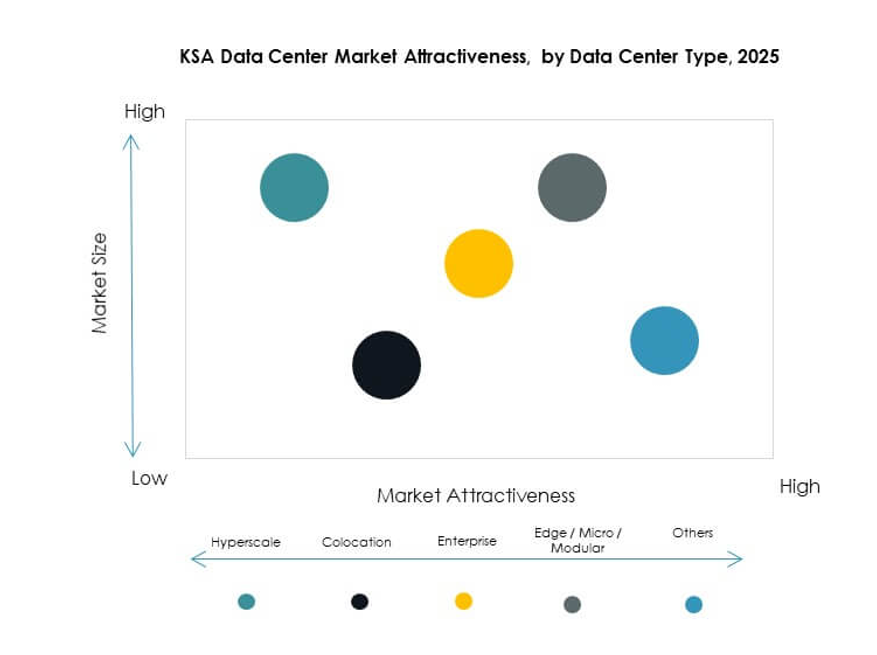

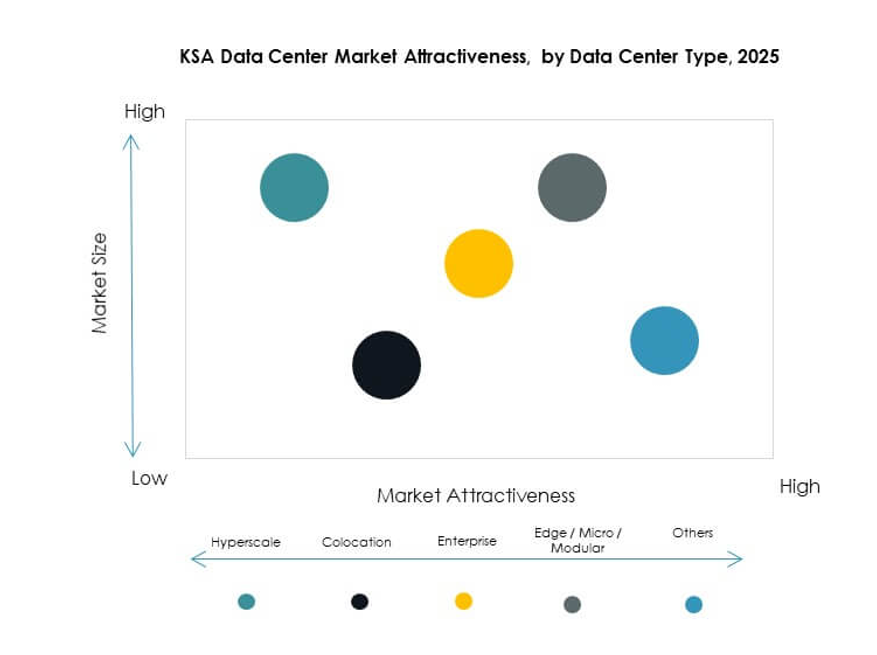

By Data Center Type

Hyperscale data centers hold a dominant share due to their ability to support large enterprises and cloud providers. The KSA Data Center Market is witnessing rising investments in hyperscale facilities by global players. Colocation centers are gaining traction for SMEs and startups. Enterprise data centers continue to serve internal IT needs but face pressure from cloud adoption. Edge and modular facilities are emerging for real-time applications in smart cities. Mega centers and internet data centers add capacity for expanding demand.

By Deployment Model

Cloud-based deployment leads adoption trends due to scalability and flexibility advantages. The KSA Data Center Market shows strong interest in hybrid models that combine on-premises control with cloud scalability. Hybrid platforms support regulatory compliance while enabling cost optimization. On-premises models remain significant for sensitive data in government and finance. Enterprises are diversifying deployments to align with workload requirements. The shift reflects balanced demand across models. Cloud and hybrid strategies dominate future growth trajectories.

By Enterprise Size

Large enterprises dominate the KSA Data Center Market due to high IT budgets and demand for advanced infrastructure. It is driving the expansion of hyperscale and hybrid deployments. Small and medium enterprises are increasingly adopting colocation and managed services to reduce costs. SMEs see data centers as a way to access advanced technologies without capital burdens. Growth in the SME sector strengthens demand for flexible and affordable solutions. Both segments contribute to market expansion with varying priorities.

By Application / Use Case

IT and telecom hold the largest share of applications in the KSA Data Center Market, driven by connectivity expansion and 5G rollout. BFSI and government services demand secure and compliant infrastructure. Healthcare is expanding usage with digital records and telemedicine. Retail and e-commerce require scalable platforms for online growth. Media and entertainment depend on high-speed processing for streaming services. Manufacturing and education are emerging applications. This wide use case diversity drives balanced growth across industries.

By End User Industry

Cloud service providers dominate end user demand in the KSA Data Center Market, supported by hyperscale investments. Enterprises continue to expand usage for digital transformation projects. Colocation providers are serving SMEs and startups seeking flexible solutions. Government agencies demand secure infrastructure for public sector operations. Other industries such as utilities and energy are beginning to adopt specialized facilities. The segment shows strong momentum with cloud providers maintaining leadership while others strengthen presence.

Regional Insights

Central Region Driving Largest Market Share with Government and Enterprise Investments

The central region accounts for 45% share of the KSA Data Center Market, supported by Riyadh’s role as the business and administrative hub. It is home to major government projects, corporate headquarters, and ICT clusters. Investments in hyperscale and cloud regions are concentrated here. Enterprises benefit from strong connectivity and infrastructure availability. Central dominance reflects both strategic positioning and national digital policy alignment.

Western Region Expanding Share with Infrastructure Growth in Key Economic Zones

The western region holds 35% share of the KSA Data Center Market, supported by developments in Jeddah and NEOM. It is emerging as a hub for tourism, logistics, and industrial growth. Mega projects in smart cities are driving strong demand for edge and modular facilities. Businesses benefit from international connectivity through Red Sea ports. The region is becoming an attractive base for multinational data center providers.

- For example, DataVolt signed an agreement with NEOM to develop a net-zero AI data center campus in Oxagon, designed to be powered entirely by renewable energy with a planned total capacity of 1.5 GW, starting with an initial 300 MW phase.

Eastern Region Building Capacity with Energy and Industrial Sector Demand

The eastern region holds 20% share of the KSA Data Center Market, anchored by Dammam and Dhahran. It is driven by strong demand from oil, gas, and industrial enterprises. The presence of energy companies creates need for advanced data management. Growth is also visible in cloud adoption across regional enterprises. The eastern region is building capacity to strengthen competitiveness in industrial digitalization.

- For instance, Google Cloud launched its Dammam cloud region in late 2023, comprising three availability zones and offering AI and data sovereignty solutions, supporting Saudi enterprises in sectors such as energy and manufacturing.

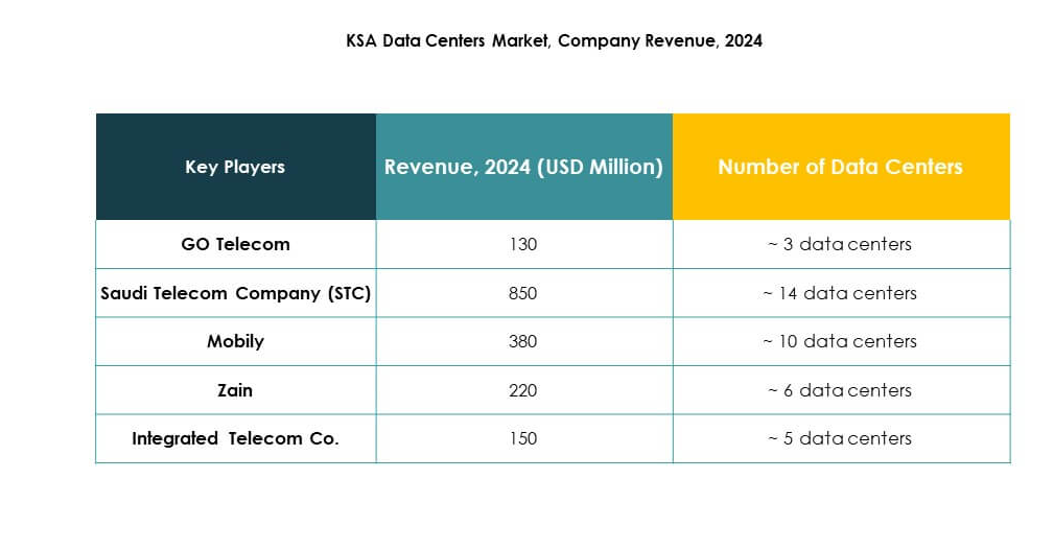

Competitive Insights:

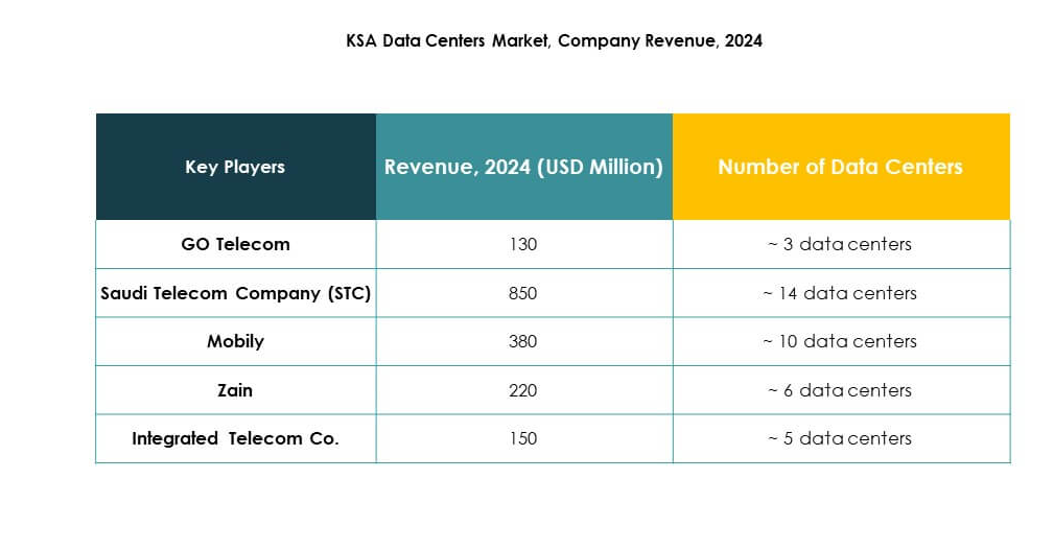

- Saudi Telecom Company (STC)

- Mobily

- Zain

- Integrated Telecom Co.

- Khazna Data Centers

- GO Telecom

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The KSA Data Center Market is highly competitive, with telecom operators, global cloud providers, and specialized colocation firms driving expansion. Local leaders such as STC, Mobily, and Zain invest in large-scale facilities to meet rising enterprise and government demand. It is supported by strong partnerships between domestic firms and hyperscale operators like AWS, Microsoft, and Google. Digital Realty and NTT strengthen their footprint by offering advanced colocation and connectivity services. Khazna and Integrated Telecom Co. enhance regional coverage with modular and managed services. GO Telecom focuses on specialized enterprise solutions. Intense competition centers on cloud adoption, colocation growth, and sustainability, with each player positioning to capture opportunities in government-backed digital transformation and Vision 2030 initiatives.

Recent Developments:

- In September 2025, Saudi Telecom Company (stc) partnered with Arabian Internet and Communications Services Company (Solutions) to sign a SAR 313.39 million contract focused on expanding and upgrading both internal and international networks, replacing outdated equipment, and enhancing 5G services and data center infrastructure in key Saudi regions, including Khamis Mushait, Dammam, Qassim, and north Riyadh. This wide-ranging deal marks a significant investment in the modernization and scaling of digital infrastructure for the Kingdom’s data center landscape.

- In September 2025, LG Electronics advanced its Middle East strategy by partnering with DATAVOLT to provide cooling solutions for a new, AI-driven hyperscale data center under development within Oxagon, part of the NEOM city project in Saudi Arabia. The memorandum of understanding, signed in Riyadh earlier in the month, sees LG delivering advanced thermal management and energy-efficient solutions crucial for large-scale, net-zero ready data centers.

- In September 2025, Zain KSA launched the Zain Great Idea 2025 (ZGI 2025) accelerator program, aiming to cultivate Saudi innovation and promote digital entrepreneurship. This initiative allows local startups to participate in a fully funded international acceleration program in Silicon Valley and is part of Zain KSA’s broader strategy to develop a robust digital economy and advanced business ecosystem aligned with Saudi Vision 2030.

- In February 2025, Khazna Data Centers expanded its cooperation with regional and international partners at the LEAP 2025 tech event by announcing projects intended to increase capacity and enhance cloud service offerings across the Kingdom, thereby supporting evolving enterprise and hyperscale requirements. This move positions Khazna as a key player in Saudi Arabia’s data center expansion drive, though further specifics on financials and individual partner names during this period remain limited.