Executive summary:

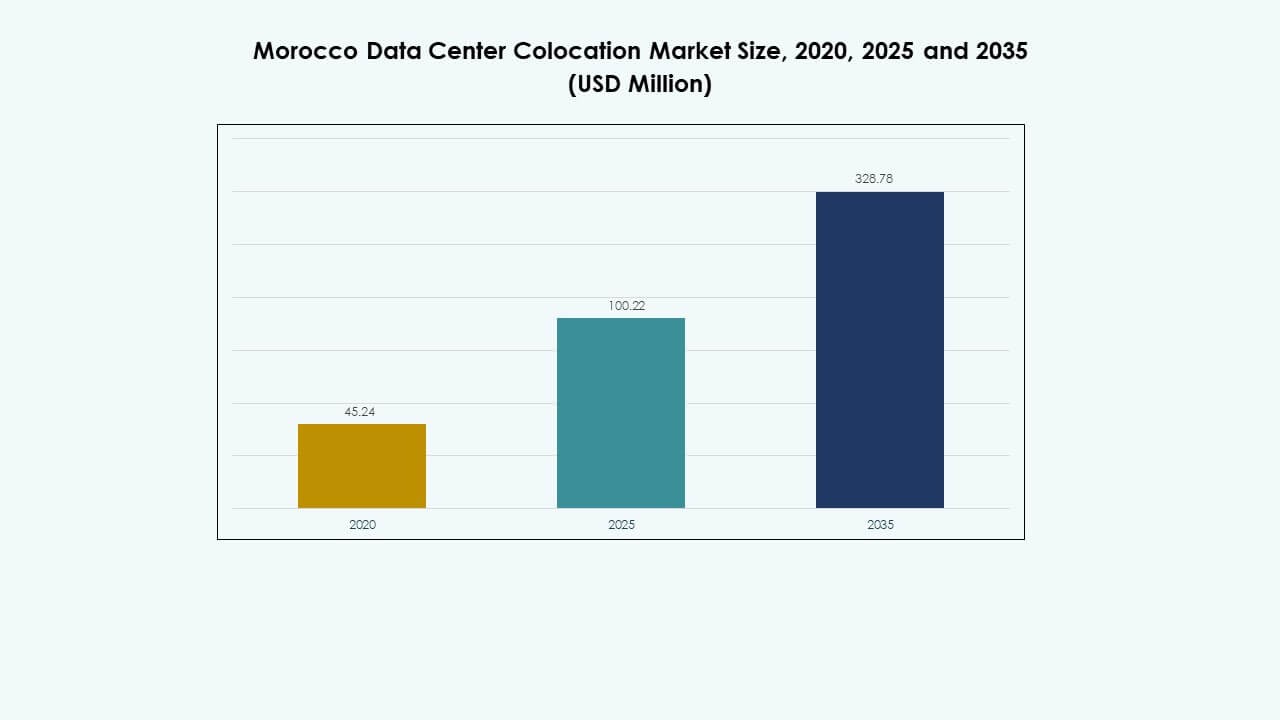

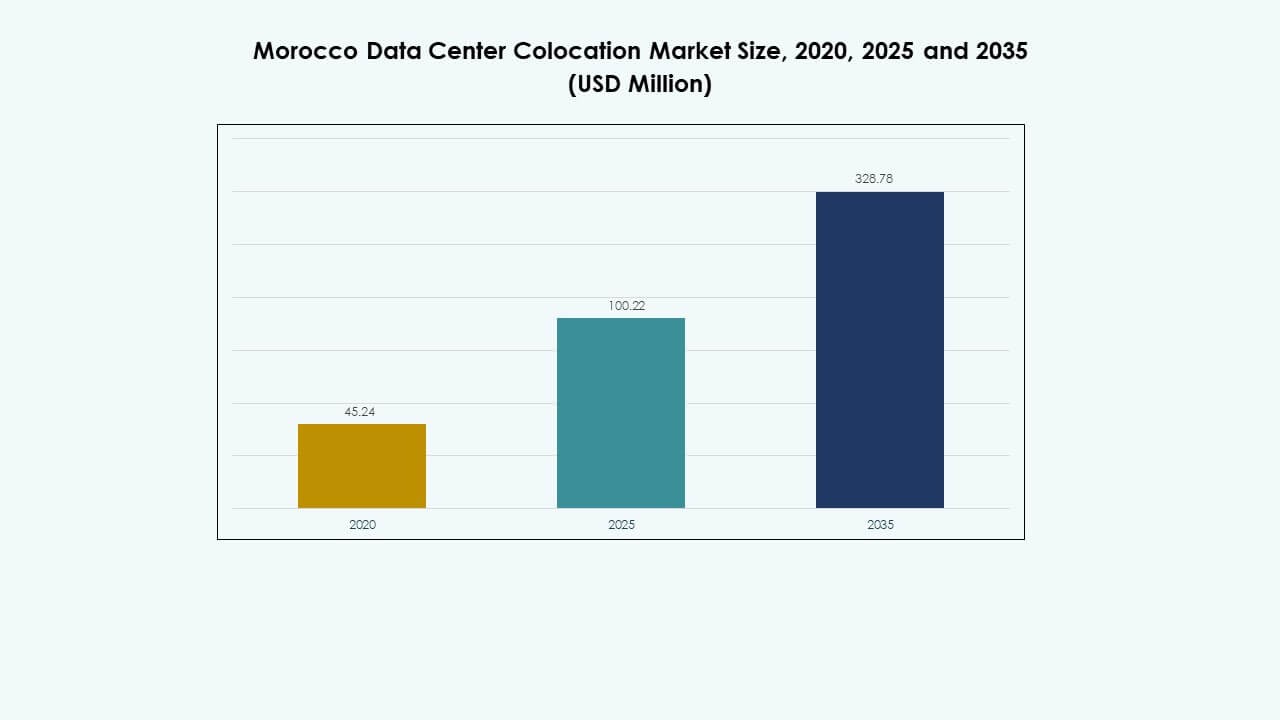

The Morocco Data Center Colocation Market size was valued at USD 45.24 million in 2020 to USD 100.22 million in 2025 and is anticipated to reach USD 328.78 million by 2035, at a CAGR of 12.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Morocco Data Center Colocation Market Size 2025 |

USD 100.22 Million |

| Morocco Data Center Colocation Market, CAGR |

12.50% |

| Morocco Data Center Colocation Market Size 2035 |

USD 328.78 Million |

Strong cloud adoption, renewable-powered infrastructure, and strategic partnerships are driving rapid market growth. Telecom operators and hyperscalers are investing in scalable, energy-efficient colocation facilities to meet rising data demand. Technological innovation, including edge deployments and hybrid cloud solutions, is reshaping the digital infrastructure landscape. The market holds strong strategic value for businesses and investors seeking reliable, low-latency solutions and secure data hosting in North Africa.

The North region leads the market with well-developed connectivity, strong enterprise presence, and robust power infrastructure. The Central region is emerging as a growth hub with modular facility deployments and expanding fiber networks. The South region is developing steadily, supported by regional investments and government-led digital inclusion initiatives.

Market Drivers

Rising Cloud Adoption and Acceleration of Digital Transformation Across Enterprises

The Morocco Data Center Colocation Market is witnessing strong growth due to rising cloud adoption among enterprises. Organizations are shifting critical workloads to colocation facilities to improve scalability, security, and performance. Hybrid and multi-cloud deployments are becoming key strategies to ensure operational agility. Investors view this as a stable infrastructure segment with high potential. Businesses prioritize reliable uptime and lower latency to enhance service delivery. The need for faster access to cloud services drives continuous demand. International hyperscalers and domestic firms contribute to expanding capacity. Strong enterprise digital strategies make colocation a long-term priority.

Strategic Infrastructure Investments to Build a Robust and Energy-Efficient Digital Backbone

Large infrastructure investments play a central role in the sector’s expansion. Colocation providers are building energy-efficient data centers with advanced power and cooling systems. It creates a strong foundation for sustainable digital growth. New investments in fiber connectivity and renewable power enhance network reliability. Businesses gain better operational control through stable infrastructure. The government supports these developments through favorable regulatory frameworks. Strong infrastructure attracts foreign investment and technology partnerships. Investors see this as an opportunity to build resilient digital ecosystems.

- For instance, in June 2025, Naver Cloud, in collaboration with Nvidia and Lloyds Capital, confirmed a consortium project to develop a 500-megawatt AI and renewable-energy-powered hyperscale data center campus in Dakhla, Morocco, aligning with the Digital Morocco 2030 strategy.

Integration of Advanced Technologies Driving Innovation and Enhancing Service Efficiency

The sector benefits from integrating AI, edge computing, and automation. It improves operational efficiency, reduces downtime, and enhances security protocols. AI-driven cooling systems lower energy usage and support sustainability goals. Edge infrastructure improves application performance for industries like telecom, retail, and BFSI. Colocation facilities enable enterprises to deploy advanced analytics at scale. This integration supports high data throughput and improved connectivity. Investors recognize the technological maturity of the market. Technology adoption creates competitive advantages and increases infrastructure value.

Growing Strategic Relevance of Morocco as a Regional Digital Gateway for Investors

Morocco’s geographic position strengthens its role as a North African connectivity hub. It links African networks to Europe through strong subsea and terrestrial fiber routes. This strategic positioning attracts hyperscalers and telecom operators seeking regional entry points. Colocation hubs provide an ideal base for deploying cloud and edge networks. Strong digital infrastructure supports regional expansion strategies. Investors consider this location a stable, scalable, and strategically placed market. The business ecosystem around colocation services continues to mature. Its regional relevance reinforces long-term infrastructure investments.

- For instance, the Xlinks Morocco–UK Power Project planned to lay 4,000 km of HVDC subsea cables connecting Morocco’s renewable energy hubs to the United Kingdom. The project aimed to supply up to 8% of the UK’s electricity demand before UK government support was withdrawn in June 2025.

Market Trends

Increasing Deployment of Edge Data Centers to Support Low-Latency Applications

The Morocco Data Center Colocation Market is seeing growing adoption of edge deployments to enhance network performance. Enterprises require near-user infrastructure to support AI workloads, IoT devices, and real-time analytics. Telecom operators expand their edge networks to meet traffic demands. Colocation providers focus on high-density rack spaces with better cooling solutions. Edge deployment improves service quality for BFSI, retail, and healthcare. Enterprises prefer this model for efficiency and flexibility. The shift toward decentralized architecture boosts local capacity. It also drives strategic partnerships between hyperscalers and carriers.

Shift Toward Renewable Energy Integration and Energy-Efficient Data Center Designs

Sustainability is shaping investment decisions across the sector. Operators are investing in renewable power sources and advanced cooling solutions. Energy efficiency reduces operational costs and supports environmental goals. Investors are prioritizing sustainable infrastructure as part of their expansion strategies. Colocation providers implement modular designs to improve energy use and flexibility. Energy efficiency also aligns with corporate net-zero commitments. It supports the transition to greener digital ecosystems. This trend enhances Morocco’s appeal to environmentally focused investors.

Increased Adoption of AI-Driven Operations to Improve Reliability and Optimize Costs

Operators are embedding AI to automate infrastructure management and enhance performance. The Morocco Data Center Colocation Market benefits from predictive maintenance and real-time monitoring. AI systems improve power allocation, cooling optimization, and security protocols. This enhances reliability and cost efficiency for enterprises. Investors support these innovations to gain operational stability. Automated infrastructure lowers risks and improves service uptime. It strengthens customer trust in colocation providers. AI adoption is now a key trend shaping data center evolution.

Evolving Business Models with Hybrid and Multi-Cloud Integration Strategies

Enterprise demand is shifting toward flexible colocation solutions. Businesses combine public and private clouds to support dynamic workloads. Colocation providers offer interconnected ecosystems for hybrid deployments. This approach improves cost efficiency and workload mobility. Cloud-native strategies are becoming central to business operations. Investors see hybrid integration as a major growth driver. It strengthens Morocco’s position as a key digital hub. Flexible infrastructure models encourage both domestic and international expansion.

Market Challenges

Infrastructure Scalability Constraints and High Operational Cost Pressures

The Morocco Data Center Colocation Market faces scalability limitations due to high capital investment requirements. Infrastructure expansion requires significant funding, technical expertise, and reliable power supply. Smaller operators struggle to compete with larger international providers. High energy costs increase operational expenses and impact pricing strategies. Rapid technological shifts add pressure to upgrade facilities quickly. Power reliability issues create further operational risks. Investors face extended ROI periods due to these challenges. It remains difficult for smaller players to scale efficiently in a competitive landscape.

Regulatory Complexity and Limited Availability of Skilled Technical Workforce

The regulatory environment remains complex and slows infrastructure development timelines. Lengthy approval processes create delays in facility deployment. Limited skilled labor availability impacts operational efficiency and technical maintenance. The Morocco Data Center Colocation Market depends on a workforce trained in specialized infrastructure management. It makes talent acquisition a strategic challenge for operators. Compliance requirements also increase operational costs. Investors need to navigate policy gaps and skill shortages carefully. These challenges can restrict overall growth momentum.

Market Opportunities

Expanding Regional Connectivity and Strengthening Morocco’s Role in Cross-Border Data Exchange

The Morocco Data Center Colocation Market benefits from its strategic location linking Europe and Africa. Expanding subsea and terrestrial fiber networks create strong cross-border opportunities. It enables hyperscalers to establish low-latency regional nodes. Investors view this geographic positioning as a gateway to pan-African expansion. Growing cloud demand in nearby countries increases regional interconnectivity. Telecom carriers leverage Morocco to expand edge services. These factors create a favorable investment environment for long-term infrastructure development.

Rising Enterprise Digitization and Demand for Secure and Scalable Infrastructure Solutions

More enterprises are digitalizing core business functions and migrating workloads to colocation facilities. The market supports flexible and secure data management strategies. It aligns with industry demands for compliance and operational resilience. High adoption across BFSI, healthcare, and telecom enhances market depth. This growth creates opportunities for international and local investors. It strengthens Morocco’s digital economy and service ecosystems. Secure and scalable infrastructure remains a key focus area for business expansion.

Market Segmentation

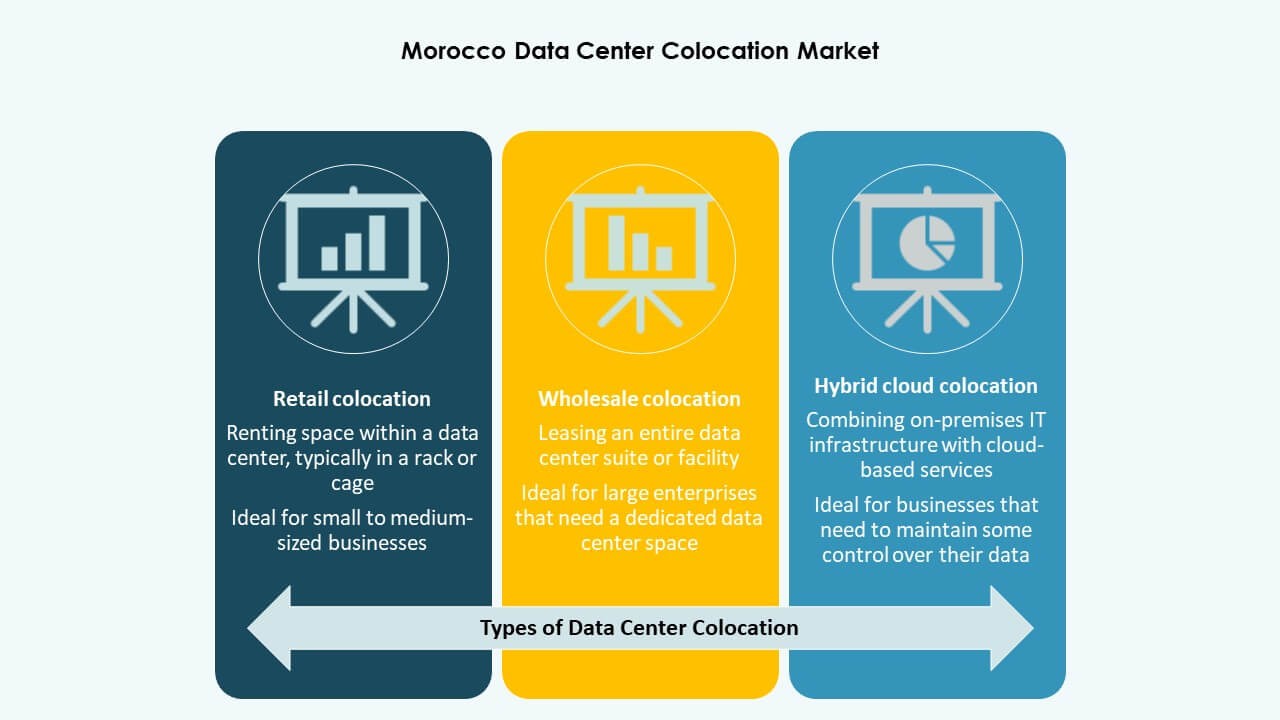

By Type

Retail colocation leads the Morocco Data Center Colocation Market, driven by strong demand from SMEs and mid-size enterprises. It offers flexible space, predictable costs, and faster deployment times. Wholesale colocation supports large hyperscalers requiring dedicated capacity. Hybrid cloud colocation gains traction among enterprises adopting multi-cloud strategies. Retail’s ease of entry and cost structure make it a dominant segment. Its scalability appeals to businesses seeking growth without heavy capital investment.

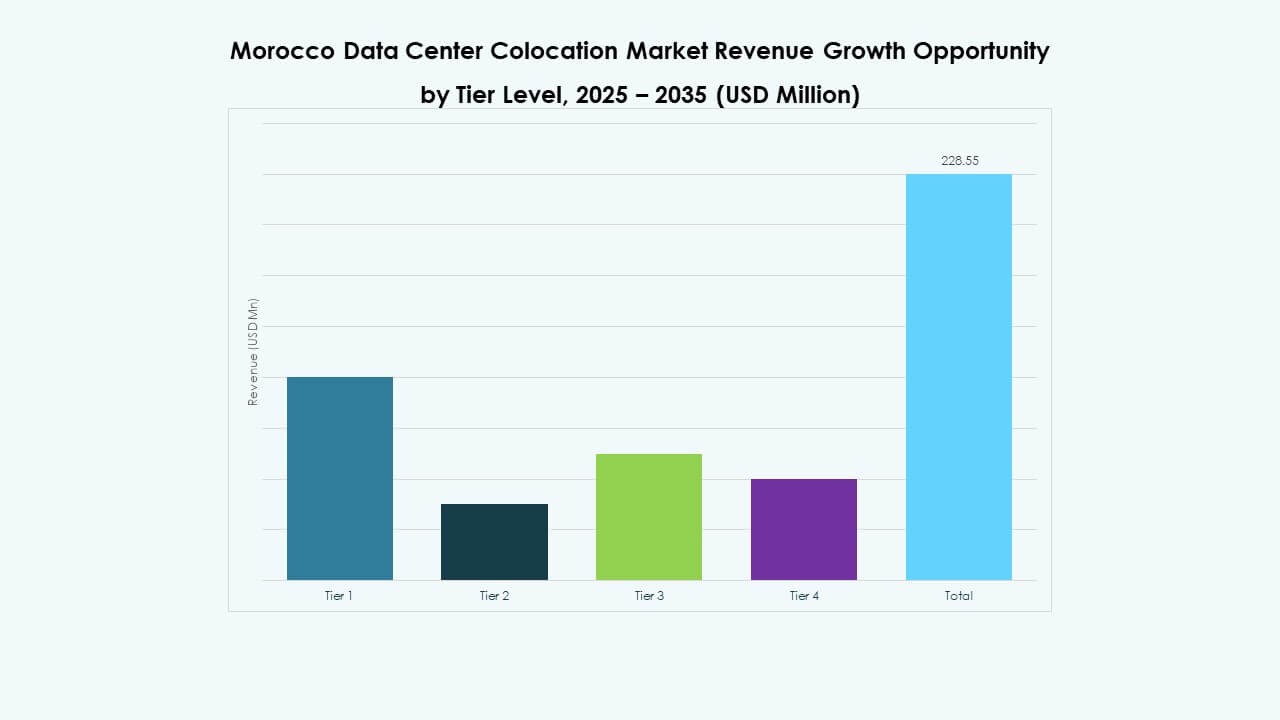

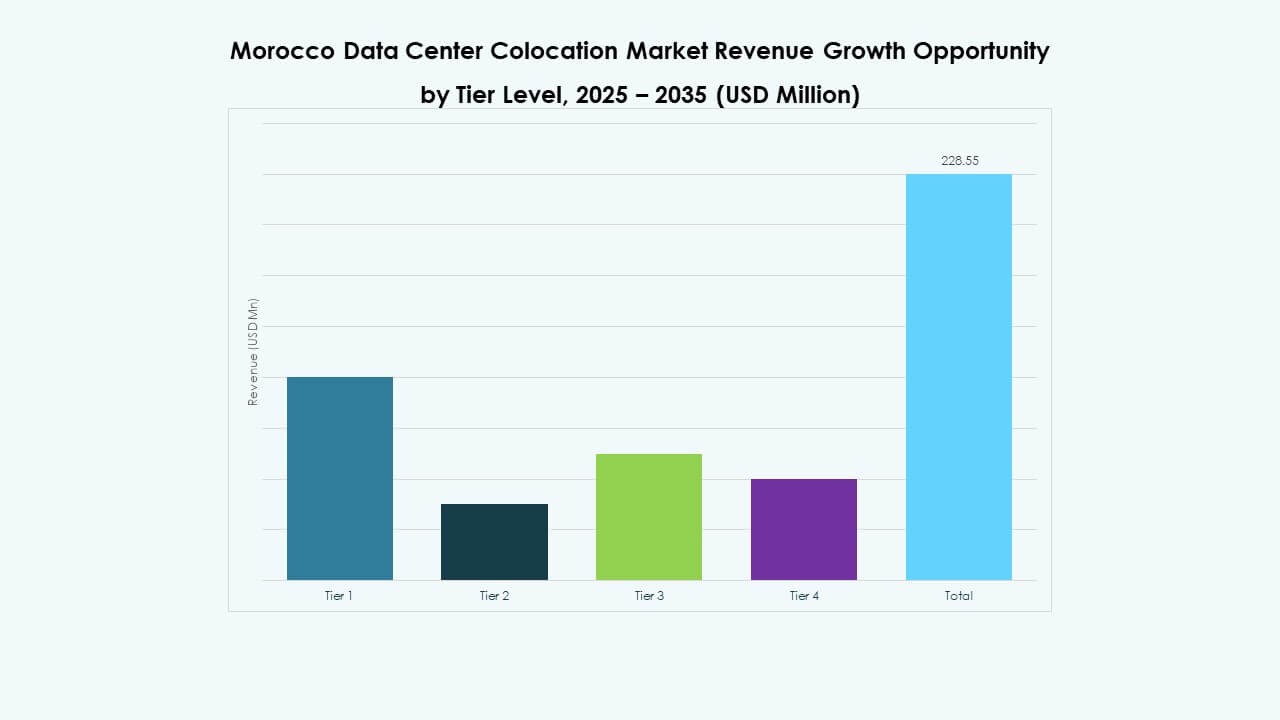

By Tier Level

Tier 3 dominates the Morocco Data Center Colocation Market due to its balanced reliability and cost efficiency. It provides strong uptime guarantees and energy-efficient designs. Tier 4 attracts enterprises requiring maximum resilience for mission-critical workloads. Tier 1 and Tier 2 remain relevant for smaller deployments. Tier 3’s flexible configuration and availability make it the preferred choice. Its popularity grows with increasing enterprise cloud adoption. Investments continue to favor Tier 3 facilities.

By Enterprise Size

Large enterprises lead the Morocco Data Center Colocation Market segment. Their demand for secure, scalable, and compliant infrastructure drives capacity expansion. SMEs rely on retail colocation to reduce operational costs and access advanced technologies. Large companies prioritize reliability and customization for complex IT workloads. SMEs prefer cost-effective and flexible solutions. Both segments support sustained market growth, with large enterprises maintaining the lead. Their investments shape infrastructure development strategies.

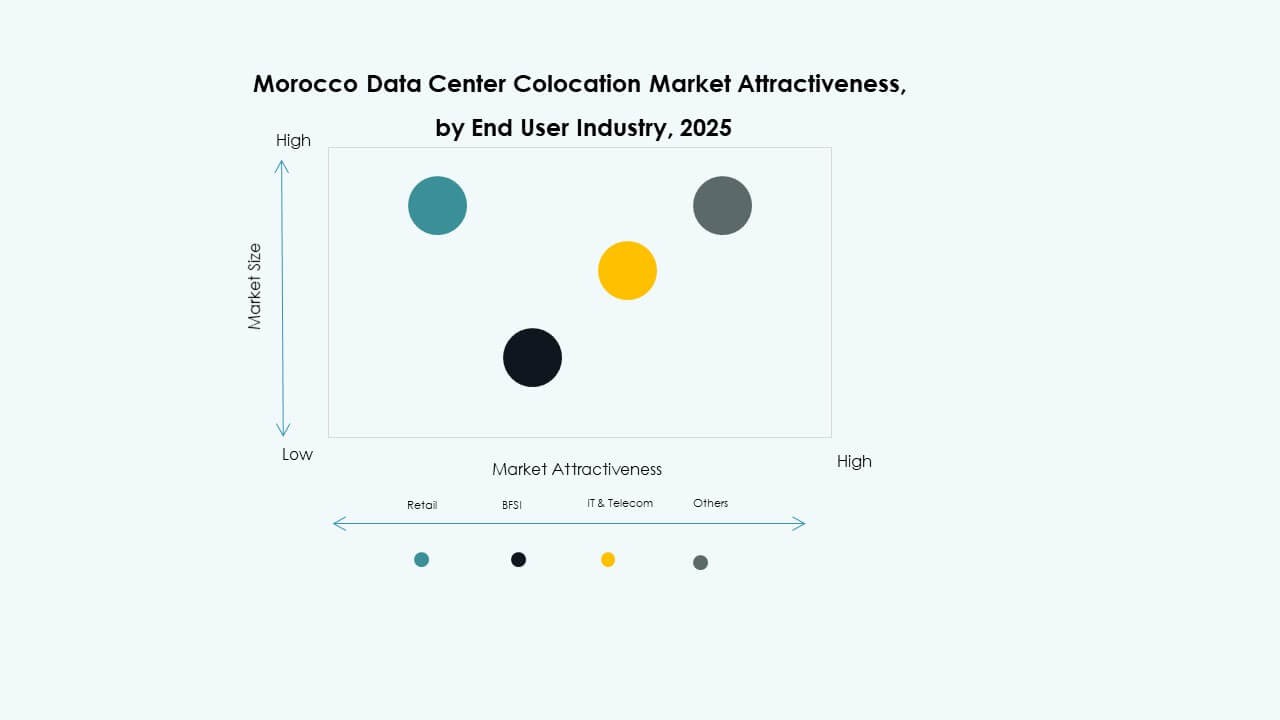

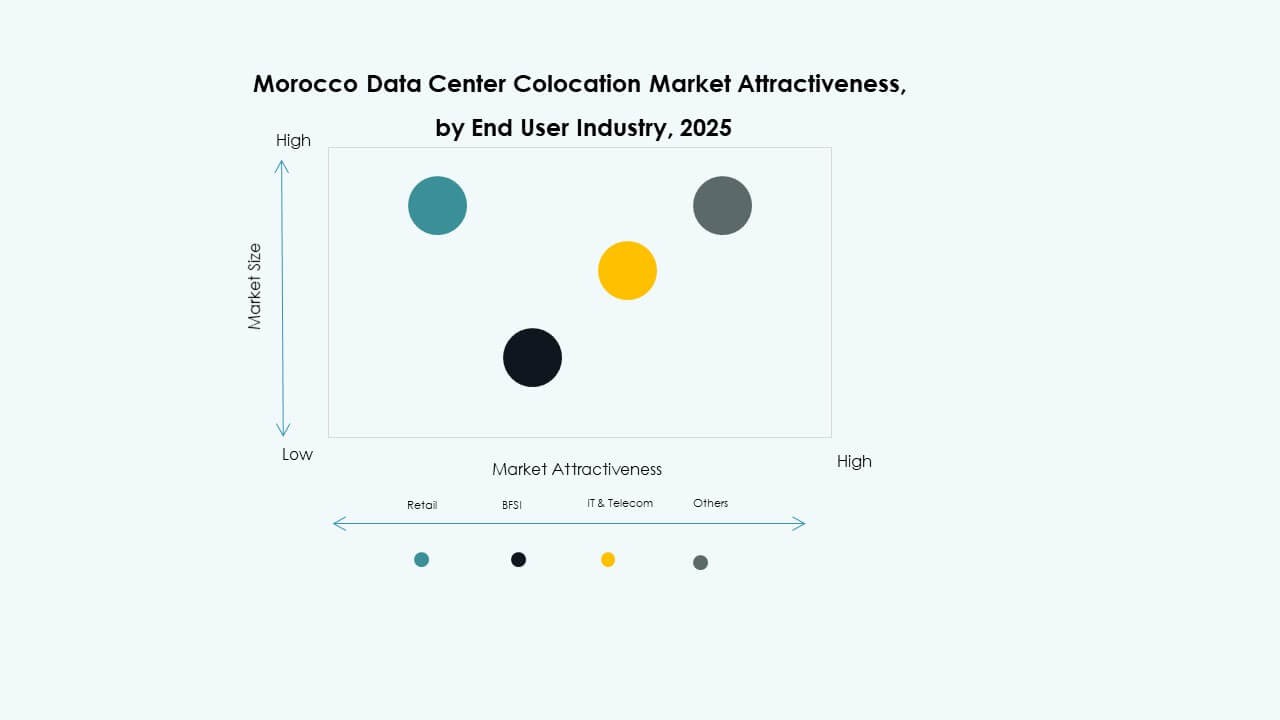

By End User Industry

The IT & Telecom sector dominates the Morocco Data Center Colocation Market. It requires robust connectivity, high-performance infrastructure, and secure hosting environments. BFSI follows closely, driven by strict regulatory and data protection requirements. Healthcare, retail, and media industries adopt colocation to support digital platforms. Demand for low-latency and secure operations supports IT & Telecom leadership. Its critical role in digital transformation makes it a core segment of the market.

Regional Insights

North Region – Leading Hub with Strong Infrastructure Backbone and Market Share of 41.3%

The Morocco Data Center Colocation Market is concentrated in the North region due to its advanced infrastructure and connectivity. Casablanca and Rabat host most colocation facilities, supported by robust power grids and fiber networks. Strong enterprise presence accelerates demand for colocation services. Its proximity to European fiber routes strengthens international connectivity. Investment inflows favor this region for large-scale deployments. It continues to lead in facility development and capacity expansion.

- For instance, N+ONE Datacenters operates Tier III-certified data center facilities in Casablanca, featuring 5,000 sq.m of whitespace. The site provides carrier-neutral connectivity and enterprise-grade infrastructure, supporting advanced colocation and cloud services.

Central Region – Emerging Investment Destination with Market Share of 32.6%

The Central region is becoming a key growth zone for colocation infrastructure. Cities with improving power and network infrastructure attract mid-size enterprises. Strategic location enables better distribution of data traffic. Operators target this region for modular and edge deployments. The Morocco Data Center Colocation Market benefits from improved regional policies. Investors view it as a cost-effective expansion option. It supports balanced infrastructure distribution across the country.

- For instance, Mohammed VI Polytechnic University (UM6P), under the patronage of the OCP Group, operates Africa’s most powerful supercomputing facility at its Benguerir campus, with a processing capacity of 3.15 petaflops—capable of executing over three million billion operations per second, supporting AI, HPC, and industrial research across Africa.

South Region – Developing Ecosystem with Market Share of 26.1%

The South region shows steady progress with new infrastructure projects. Regional governments support data center investments through policy initiatives. Growing enterprise activity boosts local demand for colocation services. It improves digital inclusion in underserved areas. Energy capacity enhancements increase facility viability. The Morocco Data Center Colocation Market gains wider coverage through these developments. This region plays a strategic role in expanding the country’s digital backbone.

Competitive Insights:

- Maroc Telecom

- Inwi

- Orange Maroc

- Meditel

- Wana Corporate

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- CoreSite

- CyrusOne

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The Morocco Data Center Colocation Market features a mix of telecom operators, hyperscalers, and global colocation providers competing to expand their footprint. Telecom leaders like Maroc Telecom, Inwi, and Orange Maroc drive domestic capacity and network integration. Global hyperscalers including AWS and Google Cloud bring advanced infrastructure and cloud connectivity. Major colocation providers such as Equinix, Digital Realty, and NTT focus on scalable facilities and interconnection services. It shows increasing competition in edge deployments, green infrastructure, and hybrid solutions. Strategic alliances, data sovereignty compliance, and capacity expansion remain key competitive strategies. Operators prioritize energy efficiency, connectivity hubs, and service differentiation to gain market share.

Recent Developments:

- In July 2025, Maroc Telecom entered into a strategic partnership with Google Cloud to create a renewable-powered regional data hub in Morocco. The collaboration aims to establish localized data centers that will reduce latency, enhance data sovereignty, and support the nation’s digital transformation. The facilities will run entirely on renewable energy such as solar and wind power, aligning with Morocco’s sustainability goals.

- In May 2025, Maroc Telecom and Inwi jointly sought regulatory approval to collaborate on shared data infrastructure. The goal of this collaboration is to optimize Morocco’s network capacity, reduce operational redundancies, and strengthen national digital resilience. Shared infrastructure initiatives among Moroccan telecoms have become key strategies in accelerating widespread 5G and cloud connectivity.

- In April 2025, Vodafone Business and Maroc Telecom (a subsidiary of e&) announced an extensive digital services partnership focusing on smart city and energy management sectors within Morocco. The cooperation includes the deployment of mobile private networks, cloud computing, cybersecurity, and Software-Defined Wide Area Networks (SD-WAN), targeting both public and private sectors.