Executive summary:

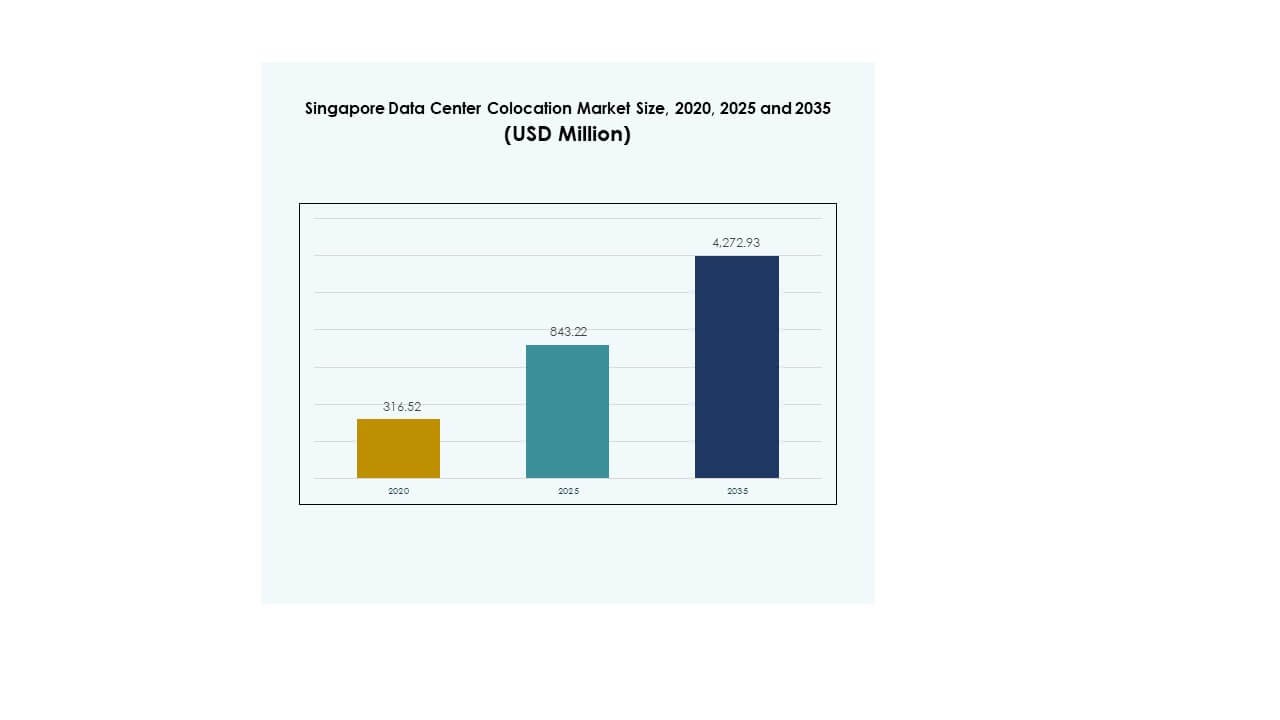

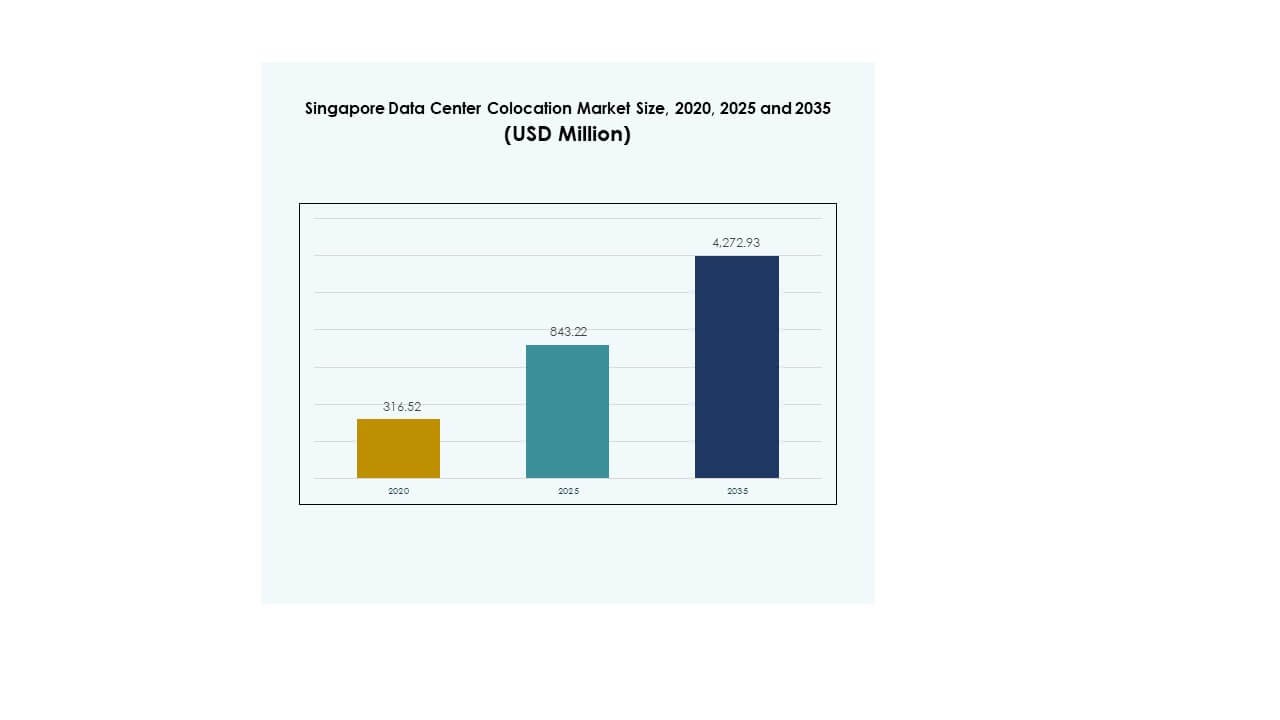

The Singapore Data Center Colocation Market size was valued at USD 316.52 million in 2020 to USD 843.22 million in 2025 and is anticipated to reach USD 4,272.93 million by 2035, at a CAGR of 17.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Singapore Data Center Colocation Market Size 2025 |

USD 843.22 Million |

| Singapore Data Center Colocation Market, CAGR |

17.52% |

| Singapore Data Center Colocation Market Size 2035 |

USD 4,272.93 Million |

Strong cloud adoption, rapid AI integration, and increasing enterprise digital transformation are fueling the market. Advanced connectivity, sustainable design, and modular build strategies are driving infrastructure upgrades. The market holds strategic value for businesses and investors seeking stable, scalable, and secure colocation solutions. Expanding hyperscale demand and regulatory stability further strengthen Singapore’s position as a key digital hub.

Singapore leads the regional market with advanced infrastructure, strong subsea connectivity, and political stability. Neighboring countries such as Malaysia and Indonesia are emerging as competitive hubs through hyperscale expansions and strategic partnerships. Regional integration is deepening through cross-border investments, positioning Singapore as the central node in Southeast Asia’s digital economy.

Market Drivers

Rising Demand for High-Density Infrastructure and Advanced Digital Connectivity

The Singapore Data Center Colocation Market is expanding due to strong demand for high-density infrastructure. Organizations are deploying advanced computing workloads and AI-driven applications, pushing the need for powerful facilities. It supports rapid cloud migration, ensuring businesses access stable and low-latency networks. Singapore’s advanced connectivity and global subsea cable infrastructure strengthen its position as a digital hub. The market benefits from enterprise modernization initiatives across industries. Enterprises rely on colocation to manage scalability and operational efficiency. Strategic investments from hyperscale operators accelerate infrastructure upgrades. This driver enhances Singapore’s role in international digital exchange.

Strong Regulatory Environment and Business-Friendly Policies Driving Investments

Singapore’s strong regulatory environment and stable governance create a favorable business climate. Investors view the country as a secure and transparent destination for digital infrastructure. It supports strict data security and compliance standards, reassuring global enterprises. Government incentives encourage foreign investments and hyperscale expansions. Data protection regulations strengthen trust among multinational companies. This stability attracts leading global players to establish or expand facilities. Strategic initiatives align with sustainability and energy efficiency goals. Investors find a predictable policy framework that supports long-term growth and resilience.

- For example, in June 2025, ST Telemedia Global Data Centres reported achieving 78.5 % renewable energy usage and a 22.9 % year-on-year reduction in carbon emissions across its global portfolio.

Adoption of Hybrid Cloud Strategies and Rising Digital Transformation Initiatives

The adoption of hybrid cloud strategies is reshaping enterprise IT infrastructure. Businesses aim to balance performance, security, and cost efficiency through flexible deployment models. It drives demand for scalable colocation solutions with integrated cloud connectivity. Singapore’s ecosystem supports interconnection and multi-cloud integration across industries. Digital transformation initiatives increase traffic and storage requirements, boosting colocation adoption. Enterprises in finance, healthcare, and technology sectors lead adoption trends. This shift enables faster innovation cycles and optimized resource allocation. Strong infrastructure readiness strengthens the market’s role in supporting enterprise agility.

Strategic Geopolitical Position and Expanding Hyperscale Ecosystem

Singapore’s strategic location at the heart of Southeast Asia supports its role as a digital hub. Hyperscale operators use the country to serve regional and global customers efficiently. It provides advanced infrastructure that meets rising AI, IoT, and cloud demands. Strategic alliances between telecom operators and data center providers expand service capabilities. International enterprises view Singapore as a critical node in global data exchange networks. New technologies like liquid cooling and automation improve efficiency and uptime. The expanding hyperscale ecosystem strengthens cross-border digital trade. This driver positions Singapore as a gateway for high-growth economies.

- For instance, Digital Realty declared in its August 2025 press release a partnership with Vultr to deliver global AI infrastructure across multiple metros including Singapore, integrating 28 cloud regions and deploying liquid‑cooling solutions for GPU‑intensive workloads, strengthening Singapore’s role as a Southeast Asian hyperscale hub.

Market Trends

Growing Adoption of AI-Optimized and Liquid Cooling Infrastructure in Data Centers

The Singapore Data Center Colocation Market is experiencing a shift toward AI-optimized infrastructure. Operators are investing in advanced liquid cooling to support high-power workloads. It enables efficient operation of AI and HPC applications. The focus on energy efficiency aligns with sustainability targets and green building initiatives. Facilities are deploying advanced monitoring systems for real-time optimization. Edge processing is increasing, reducing latency for critical applications. The use of modular systems improves deployment speed and cost control. These trends signal a deeper integration of AI with core infrastructure.

Integration of Renewable Energy Solutions to Support Sustainability Goals

Operators are prioritizing renewable energy to meet carbon neutrality targets. The government’s focus on sustainable development supports green data centers. It encourages the use of solar, wind, and hydro-based energy solutions. Providers are adopting energy-efficient technologies and carbon tracking platforms. Strategic partnerships between energy companies and colocation operators accelerate this transition. Growing investor preference for ESG-compliant infrastructure is shaping capital flows. The shift toward renewables improves operational efficiency and brand value. These trends strengthen Singapore’s reputation as a sustainable digital hub.

Increased Focus on Edge Deployments and Distributed Architectures

The market is shifting toward edge deployments to meet the demand for low-latency services. Edge colocation supports faster delivery of applications in AI, AR/VR, and streaming. It enhances enterprise capabilities in logistics, manufacturing, and financial services. Operators are building distributed data center networks to reach more customers. This approach supports the increasing use of IoT-driven solutions. Advanced interconnection between facilities improves application performance and reliability. Businesses gain flexible scaling options without overburdening centralized infrastructure. These trends reflect a growing preference for decentralized computing.

Expansion of Interconnection Platforms and Cross-Border Data Exchange

The rise of digital trade fuels demand for interconnection services. Enterprises seek reliable infrastructure for secure and fast data exchange. It drives investments in cross-border connectivity and digital gateway facilities. Interconnection platforms support cloud, SaaS, and multi-region deployments. Telecom operators collaborate with data center providers to expand backbone networks. This expansion enables real-time access to services across Asia-Pacific. Enhanced connectivity improves service delivery for enterprises and hyperscale providers. These trends reinforce Singapore’s status as a leading connectivity hub.

Market Challenges

Land Scarcity and Energy Supply Constraints Impacting Capacity Expansion

The Singapore Data Center Colocation Market faces significant challenges linked to limited land availability. Real estate scarcity raises infrastructure costs and slows expansion projects. It forces operators to innovate with vertical builds and modular designs. Energy supply constraints limit large-scale deployments in dense urban zones. Operators must balance capacity growth with environmental regulations. High energy consumption raises operational costs and sustainability concerns. Licensing for new facilities is becoming more selective, adding delays. These factors increase pressure on existing infrastructure to maintain service levels.

Rising Cybersecurity Risks and Stricter Compliance Requirements

The growing volume of data traffic elevates cybersecurity risks for operators and users. Regulatory frameworks demand strict adherence to security standards. It forces providers to invest heavily in advanced cybersecurity solutions. Complex compliance requirements increase operational costs and administrative burdens. Data breaches can undermine investor confidence and client trust. Enterprises expect zero-downtime security measures with fast response times. Rising sophistication of cyberattacks requires constant technology upgrades. These challenges create significant entry barriers for smaller service providers.

Market Opportunities

Emerging Potential in AI and High-Performance Computing Integration

The Singapore Data Center Colocation Market is witnessing strong opportunities in AI integration. Advanced workloads require high-density, low-latency environments to deliver performance. It encourages infrastructure investment in liquid cooling and automation technologies. Colocation providers can attract enterprise clients with specialized AI-ready solutions. This segment supports innovation in healthcare, finance, and manufacturing sectors. Partnerships with chipmakers and cloud platforms create competitive advantages. Growing demand for AI-driven applications strengthens revenue streams and service diversification.

Expansion of Green Infrastructure and Interconnection Ecosystems

Green data center investments are opening new opportunities for sustainable growth. It aligns with Singapore’s national sustainability goals and investor expectations. Renewable integration and energy-efficient operations offer long-term cost benefits. Expansion of interconnection platforms enhances access to regional markets. Strong demand for sustainable solutions attracts hyperscale operators and enterprises. Providers offering carbon-neutral services gain a strategic advantage. These opportunities enable differentiation in an increasingly competitive market landscape.

Market Segmentation

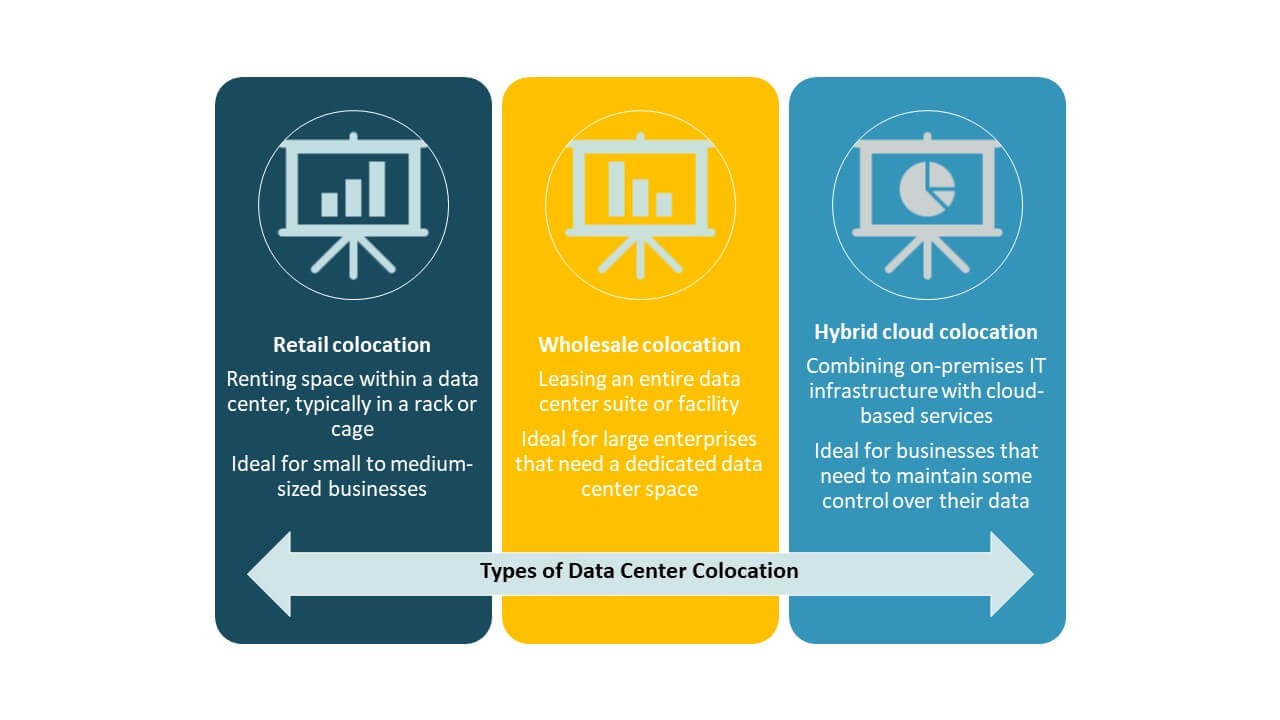

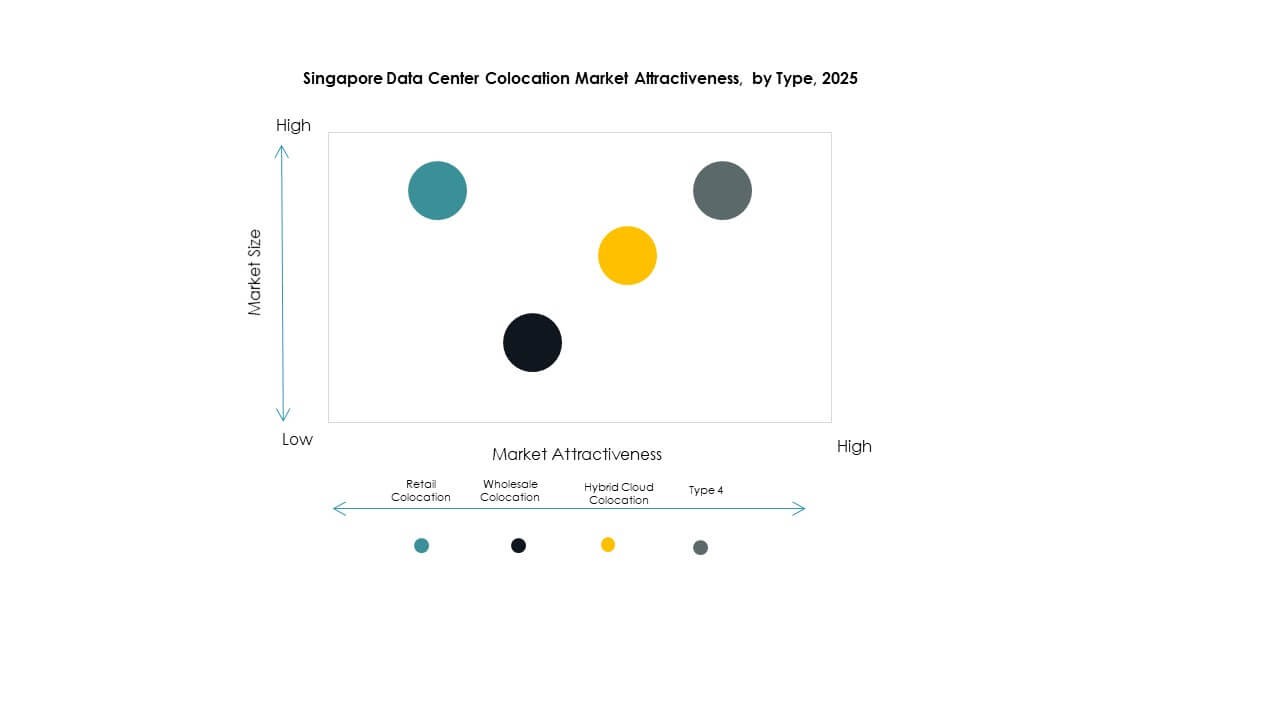

By Type

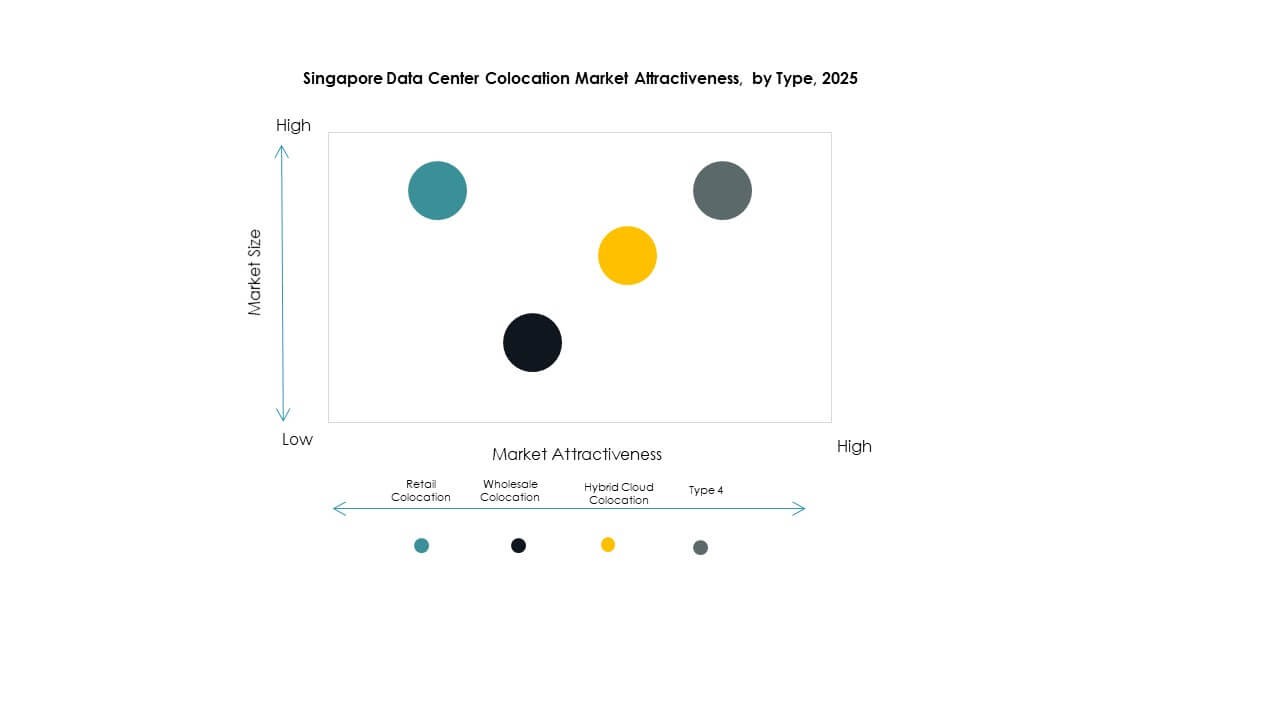

Retail colocation dominates the Singapore Data Center Colocation Market due to strong enterprise demand for flexible and scalable infrastructure. This segment benefits from the growth of SMEs and digital-first enterprises. Wholesale colocation is expanding through hyperscale deployments, while hybrid cloud colocation is rising with multi-cloud strategies. The flexibility of retail solutions makes it the preferred choice for cost-efficient scaling and operational control. Enterprises favor shared infrastructure to manage cost, security, and performance.

By Tier Level

Tier 3 facilities dominate the Singapore Data Center Colocation Market, driven by their strong balance between cost, reliability, and scalability. These facilities provide advanced redundancy and uptime levels suitable for most enterprises. Tier 4 is growing steadily as hyperscalers seek higher resilience for mission-critical workloads. Tier 1 and Tier 2 have limited growth due to low redundancy levels. Strong demand for Tier 3 solutions reflects the strategic focus on high availability and performance.

By Enterprise Size

Large enterprises lead the Singapore Data Center Colocation Market with strong adoption of high-capacity solutions. Their investments focus on operational efficiency, security, and global expansion strategies. SMEs are adopting colocation to reduce infrastructure costs and improve flexibility. The scalability of colocation services enables SMEs to match enterprise-level performance without large capital expenditure. Strong demand from both segments supports a diverse service ecosystem and steady revenue growth.

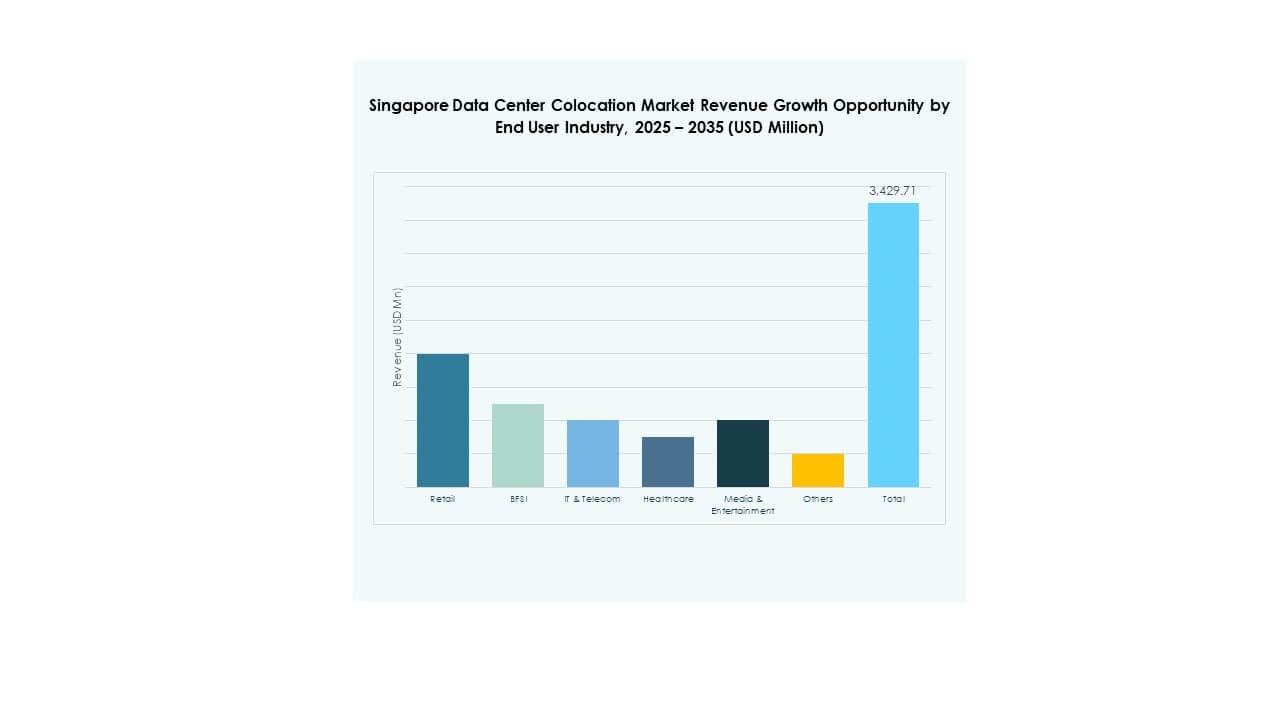

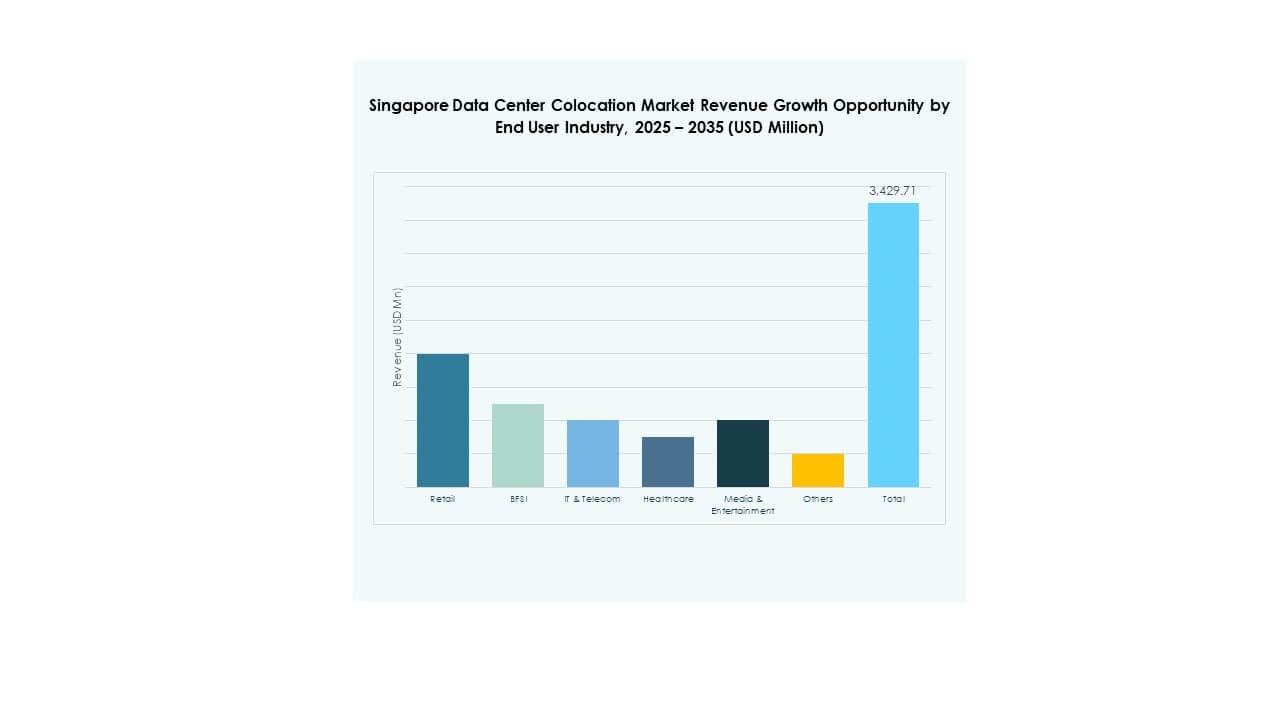

By End User Industry

The IT and telecom sector holds the dominant share in the Singapore Data Center Colocation Market, supported by cloud expansion and AI workloads. BFSI follows closely due to high data security and compliance needs. Healthcare, retail, and media are adopting colocation for operational continuity and digital transformation. Colocation enables these industries to manage growing data volumes efficiently. The rising complexity of digital operations strengthens the role of colocation across sectors.

Regional Insights

Singapore Leading the Regional Landscape with 100% Market Share

The Singapore Data Center Colocation Market holds 100% of the country’s share due to its strategic infrastructure concentration. The country functions as a major digital gateway for Southeast Asia. It benefits from stable political conditions, strong connectivity, and advanced subsea cable systems. The market attracts global hyperscalers seeking low-latency and reliable environments. Government support and regulatory clarity encourage consistent investment. This dominance reinforces Singapore’s leadership in the regional digital economy.

- For instance, in June 2024, Google announced the expansion of its Singapore data center and cloud campus, increasing its total infrastructure investment in the country to USD 5 billion from USD 850 million in 2018. The site employs over 500 staff and features energy-efficient cooling systems, reinforcing Singapore’s role as a key regional hub.

Strong Cross-Border Interconnection with Neighboring Economies

Singapore’s position strengthens through deep interconnection with Malaysia and Indonesia. It provides an ideal platform for enterprises targeting regional expansion. Strong connectivity between data centers supports efficient traffic routing. Neighboring economies are emerging as expansion zones for hyperscale deployments. This regional integration supports trade, digital services, and cloud adoption. Interconnection networks enable seamless service delivery across multiple markets.

- For instance, in May 2025, Equinix announced the interconnection of its KL1 and JH1 data centers in Malaysia with its Singapore campus through Equinix Fabric®. The expansion added 450 cabinets at KL1 and created a cross-border ecosystem of over 1,000 connected companies across cloud, IT, and finance sectors. This development enables low-latency data exchange between Malaysia and Singapore.

Southeast Asia Emerging as a Complementary Growth Region

Southeast Asia is emerging as a critical support region to Singapore’s colocation ecosystem. Malaysia and Indonesia are investing in hyperscale-ready facilities to handle overflow demand. This trend helps balance capacity limitations in Singapore while preserving its hub status. Regional governments support expansion through tax incentives and digital transformation programs. It positions Singapore as the anchor point for multi-country digital strategies. The combined network enhances the overall market’s resilience and reach.

Competitive Insights:

- Keppel Data Centres

- ST Telemedia GDC

- CDC Data Centres

- Singtel

- Google Cloud

- Singapore Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Singapore Data Center Colocation Market features strong competition among global hyperscalers, telecom operators, and specialized infrastructure providers. It is shaped by aggressive capacity expansion, strategic partnerships, and sustainability-focused innovation. Leading players invest in advanced cooling systems, renewable energy integration, and high-density architecture to support enterprise and cloud workloads. Telecom providers strengthen network interconnection capabilities to secure a competitive edge. Hyperscale operators expand service portfolios to meet growing demand for low-latency and high-resilience infrastructure. Strategic alliances enable faster market penetration and improved service diversity. New investments in automation and AI-driven monitoring enhance operational efficiency. This competitive environment pushes providers to deliver greater scalability, security, and energy performance.

Recent Developments:

- In October 2025, CDC Data Centres announced a strategic collaboration with NVIDIA and Firmus Technologies to develop AI Factory capabilities powered by 40MW of capacity across its centers, marking its entry into AI-optimized colocation infrastructure. The project underscores CDC’s rapid growth in meeting emerging AI-driven workloads and reflects its plans to leverage advanced computing ecosystems across the Asia-Pacific region, including Singapore.

- In September 2025, Keppel Ltd. announced a new strategic partnership with Dell Technologies to jointly develop next-generation artificial intelligence (AI) platforms and efficient data centers across key markets in Asia, including Singapore. The collaboration focuses on building advanced, sustainable facilities that integrate Keppel’s renewable energy solutions with Dell’s enterprise cloud technologies.

- In August 2025, Google Cloud reaffirmed its long-term commitment to Singapore’s digital infrastructure through the global rollout of its “Gemini Everywhere” initiative. This program integrates generative AI tools designed for enterprise use within Singapore’s regulatory and cybersecurity framework, expanding Google’s Singapore-based data center capabilities.

- In July 2025, NTT Ltd. announced plans to establish and list a new Data Center Real Estate Investment Trust (NTT DC REIT) on the Singapore Stock Exchange. The REIT will be seeded with six NTT-owned facilities valued at about $1.57 billion, forming a capital recycling model aimed at accelerating investment recovery and data center business expansion. This listing highlights Singapore’s growing appeal as a global data infrastructure and investment hub