Executive summary:

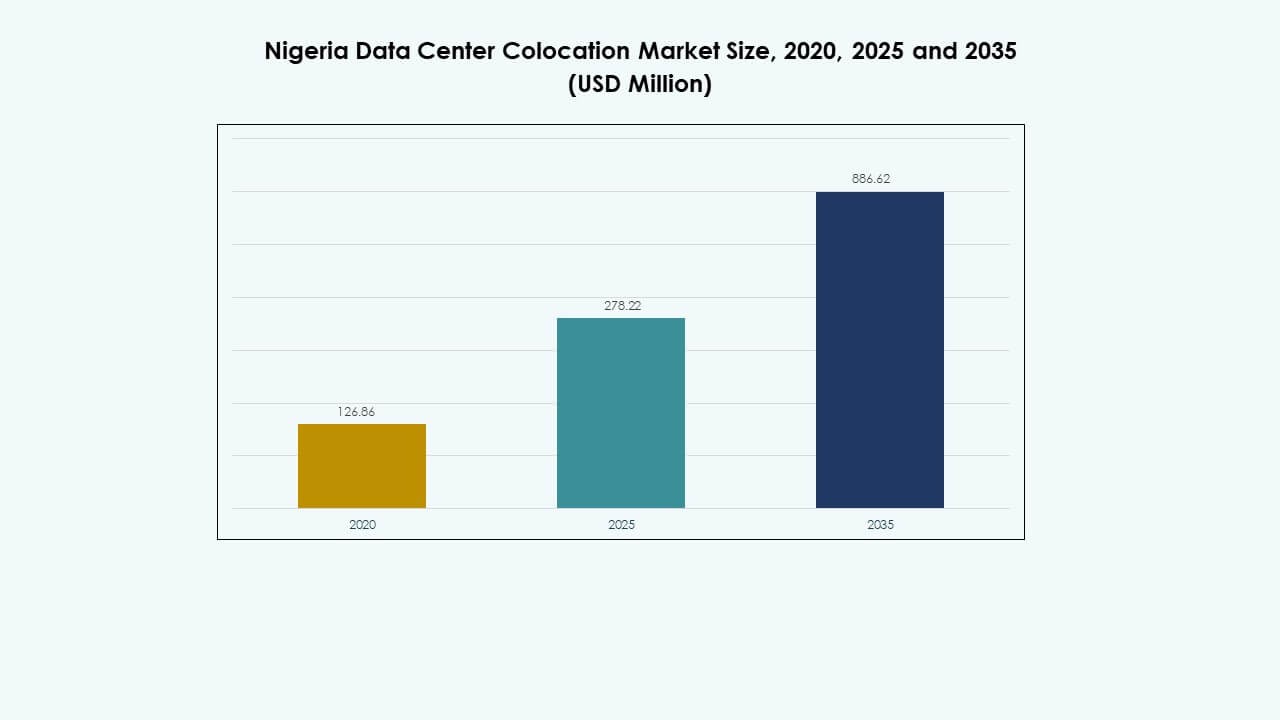

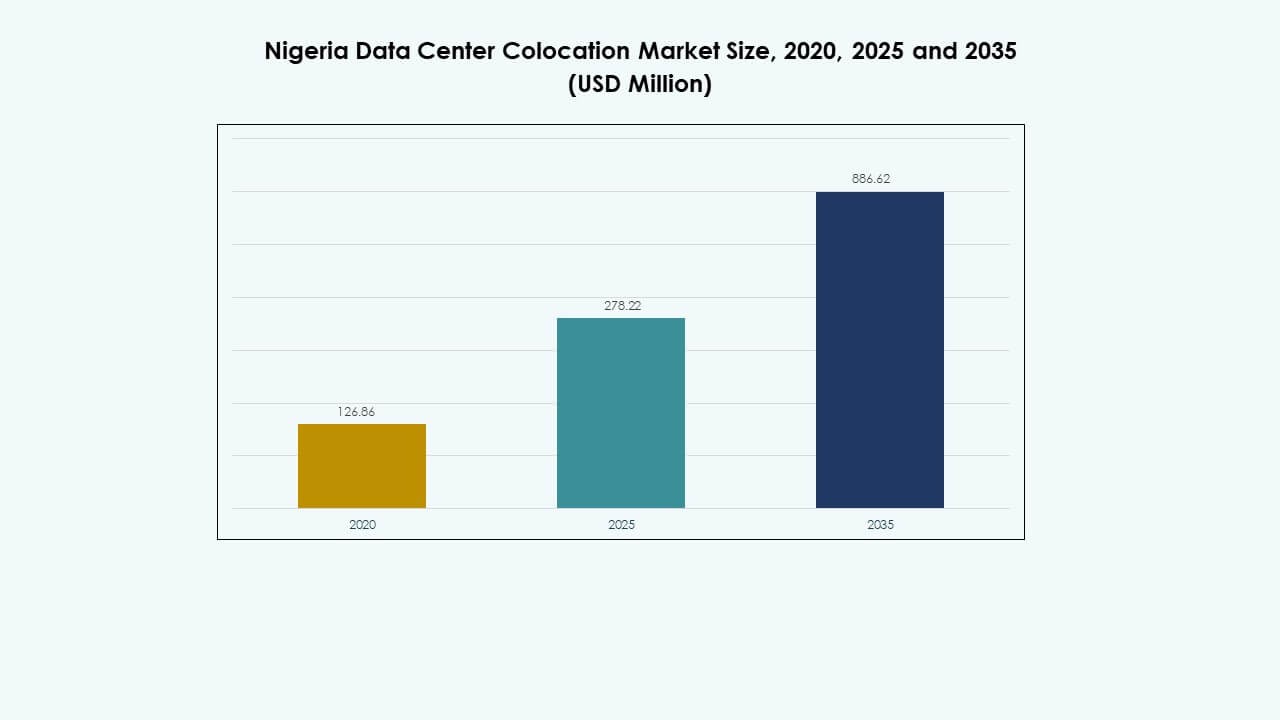

The Nigeria Data Center Colocation Market size was valued at USD 126.86 million in 2020, increased to USD 278.22 million in 2025, and is anticipated to reach USD 886.62 million by 2035, at a CAGR of 12.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Nigeria Data Center Colocation Market Size 2025 |

USD 278.22 Million |

| Nigeria Data Center Colocation Market, CAGR |

12.21% |

| Nigeria Data Center Colocation Market Size 2035 |

USD 886.62 Million |

The Nigeria Data Center Colocation Market is growing due to rapid cloud adoption, rising edge deployments, and increased investment in digital infrastructure. Innovation in modular design, advanced cooling, and energy-efficient operations is improving service reliability. Businesses view colocation as a strategic asset for secure, scalable, and cost-efficient operations. Investors see the market as a high-growth opportunity supported by strong enterprise digital transformation and expanding hyperscaler presence.

Lagos leads the Nigeria Data Center Colocation Market with strong network connectivity, subsea cable access, and power infrastructure. Abuja is emerging as a key hub with growing enterprise adoption and government-led initiatives. Port Harcourt and other secondary cities are gaining importance for edge deployments and regional coverage. These developments are shaping a more distributed and resilient digital infrastructure network across the country.

Market Drivers

Rising Cloud Adoption and Digital Transformation Driving Strategic Infrastructure Investments

Nigeria Data Center Colocation Market is expanding due to rapid enterprise cloud migration and strong digital transformation strategies. Businesses are adopting scalable colocation facilities to improve agility and reduce operational costs. It supports secure, high-performance workloads for critical applications and digital services. Strategic investments by telecom operators and hyperscalers enhance nationwide capacity. Organizations prioritize business continuity, driving demand for tiered infrastructure and strong uptime commitments. Cloud-first strategies are reshaping operational models and supporting advanced digital platforms. Strong power and connectivity investments further enhance operational resilience. This creates an attractive environment for domestic and global investors.

- For instance, in April 2025, Equinix announced a verified US$140 million expansion across southern Nigeria, including the opening of PR1, the country’s first data center in Port Harcourt, and LG3, its third international-grade facility in Lagos. The Port Harcourt site will serve as the first Nigerian landing point for Meta’s 2Africa submarine cable, adding more than 100 Tbps in design capacity and diversifying national connectivity beyond Lagos.

Accelerating Technological Innovation Strengthening Service Capabilities and Efficiency

Growing deployment of AI-driven power management, liquid cooling, and modular design is improving operational efficiency. It helps operators reduce energy costs while meeting sustainability targets. Enterprises are choosing facilities that deliver strong computing power, network performance, and predictable uptime. Emerging automation tools enable efficient management of complex workloads. The market is witnessing stronger partnerships with energy providers and equipment manufacturers. Continuous modernization is allowing operators to keep pace with evolving enterprise needs. Innovation is strengthening competitive positioning and improving customer retention. Investors view these advances as strong enablers of long-term market stability.

- For instance, Rack Centre commissioned its 12MW LGS2 hyperscale facility in Lagos in April 2025, confirmed via the company’s official statement. The facility operates with the lowest designed Power Usage Efficiency (PUE) in Nigeria, using a hybrid energy mix of gas turbines, diesel backup, and solar integration—making it one of West Africa’s most energy-sustainable Tier III carrier-neutral data centers.

Growing Edge Computing Demand Creating Strategic Opportunities for Regional Expansion

Edge computing is transforming how enterprises manage data traffic and latency-sensitive workloads. It pushes critical infrastructure closer to users, improving performance and security. Operators are deploying micro data centers to support growing mobile usage, IoT, and real-time analytics. It allows enterprises to build flexible and distributed architectures. Strong edge infrastructure enhances service delivery and improves operational control. This shift supports national connectivity goals and digital services growth. Key players are pursuing regional deployments to meet increasing demand. Investors view this as a vital growth pillar in a digital-first economy.

Government Initiatives and Policy Reforms Boosting Infrastructure Development

Public sector initiatives are accelerating private investments in colocation capacity. Policy reforms focus on energy supply reliability, data localization, and network infrastructure. It strengthens confidence among global hyperscalers, cloud providers, and telecom operators. National broadband and power development programs are improving market readiness. Regulatory clarity ensures predictable returns for long-term investors. New projects are aligning with digital economy goals and expanding connectivity reach. These developments are supporting new builds and expansion phases. This strong alignment between government and industry drives broader ecosystem growth.

Market Trends

Shift Toward Hyperscale and Modular Data Centers Enhancing Scalability

Operators are increasingly adopting hyperscale and modular data center designs to meet enterprise growth. It enables flexible capacity planning, rapid deployment, and operational efficiency. Modular facilities reduce construction timelines and improve energy use. Hyperscale adoption allows seamless integration with cloud platforms and edge solutions. Telecom operators and international players are scaling infrastructure to serve critical industries. This trend supports both domestic enterprises and multinational corporations. Market entrants are prioritizing fast deployment capabilities to remain competitive. The ecosystem is aligning toward more efficient and scalable models.

Increased Focus on Sustainable and Green Data Center Operations

Sustainability is becoming a central operational priority for leading colocation providers. Operators are investing in renewable energy sourcing and advanced cooling systems. It reduces carbon emissions, improves efficiency, and meets regulatory standards. Companies are adopting PUE optimization technologies to minimize operational costs. Global investors are prioritizing green initiatives when selecting partners and facilities. The trend aligns with international sustainability commitments and local environmental goals. Energy-efficient operations enhance reliability and reduce grid dependency. Green-focused strategies are becoming key market differentiators.

Rising Adoption of High-Density Racks and AI-Powered Infrastructure

High-density computing is driving infrastructure redesign to support AI, ML, and big data workloads. It enables operators to handle complex processing requirements more efficiently. AI-powered infrastructure management tools are improving uptime and optimizing capacity. Automation reduces manual interventions and strengthens SLA delivery. It supports service quality enhancements and operational visibility. Demand for high-performance computing environments is growing across key industries. Advanced infrastructure capabilities are strengthening Nigeria’s role as a digital hub. This trend continues to redefine competitive advantages in the market.

Surge in Interconnection and Cloud On-Ramp Services Supporting Ecosystem Growth

Interconnection growth is enhancing cloud accessibility and enterprise network performance. It supports direct, low-latency connections between service providers and customers. Carriers and hyperscalers are expanding on-ramp services to meet rising demand. It strengthens hybrid and multi-cloud strategies across industries. Improved network architectures enhance disaster recovery and security compliance. These services are critical for financial institutions, healthcare networks, and media platforms. The expanding ecosystem supports cross-border digital flows and global integration. Interconnection is becoming a core component of future growth strategies.

Market Challenges

Power Supply Reliability and Infrastructure Limitations Creating Operational Constraints

Nigeria Data Center Colocation Market faces serious challenges related to unreliable power supply. It increases dependency on diesel generators and raises operational costs. Limited renewable energy availability makes energy transition difficult for operators. Infrastructure gaps in transmission and distribution restrict long-term capacity planning. Frequent outages impact service reliability and uptime guarantees. Energy inefficiencies lead to higher expenses and reduced competitiveness. Power-related risks affect investor confidence in large-scale expansions. Solving these issues is essential for sustainable infrastructure growth.

Regulatory Gaps, Security Risks, and Limited Technical Expertise Hindering Expansion

Regulatory uncertainty and data protection concerns create barriers for international investors. Weak enforcement of cybersecurity frameworks exposes operators to operational risks. It affects trust levels among enterprises handling critical workloads. Limited availability of advanced technical skills slows project execution and maintenance. Regulatory bottlenecks increase approval timelines for new projects. Security compliance gaps create vulnerabilities in multi-tenant environments. Operational risks reduce the attractiveness of large-scale investments. Addressing these structural weaknesses is critical for sustainable growth.

Market Opportunities

Expanding Regional Connectivity and Hyperscaler Interest Driving Growth Potential

Nigeria Data Center Colocation Market holds strong opportunities through growing regional connectivity. Submarine cable landings are strengthening West Africa’s digital infrastructure. It positions the country as a key interconnection hub for global traffic. Hyperscaler interest is creating favorable investment conditions. New data center clusters are emerging in major commercial cities. Edge deployments are extending infrastructure beyond primary hubs. These developments offer operators and investors a scalable expansion path.

Strong Enterprise Digitalization Demand Enabling Strategic Service Differentiation

Enterprise demand for colocation is rising due to rapid digitalization across industries. It creates opportunities for tailored services such as managed hosting and cloud on-ramps. Businesses are prioritizing high availability, compliance, and operational efficiency. Regional players can build differentiated service offerings to attract global partnerships. Demand from BFSI, telecom, and media strengthens long-term revenue visibility. These trends create clear growth pathways for investors and operators.

Market Segmentation

By Type

Retail colocation holds the dominant share in the Nigeria Data Center Colocation Market due to rising demand from SMEs and startups for flexible infrastructure. Wholesale colocation supports larger enterprises and hyperscalers needing scalable capacity. Hybrid cloud colocation is gaining traction as enterprises pursue flexible architectures. Retail colocation offers faster deployment and lower upfront costs, making it ideal for local businesses. Its flexibility and ease of access strengthen its growth outlook.

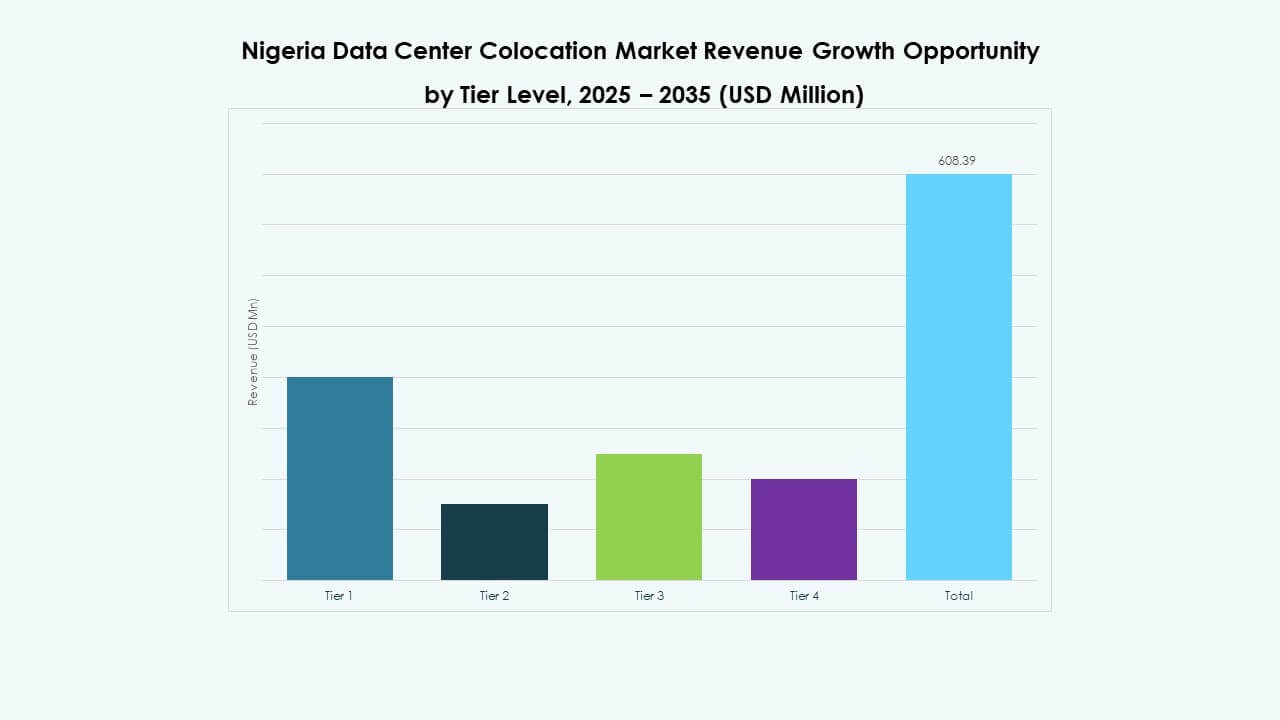

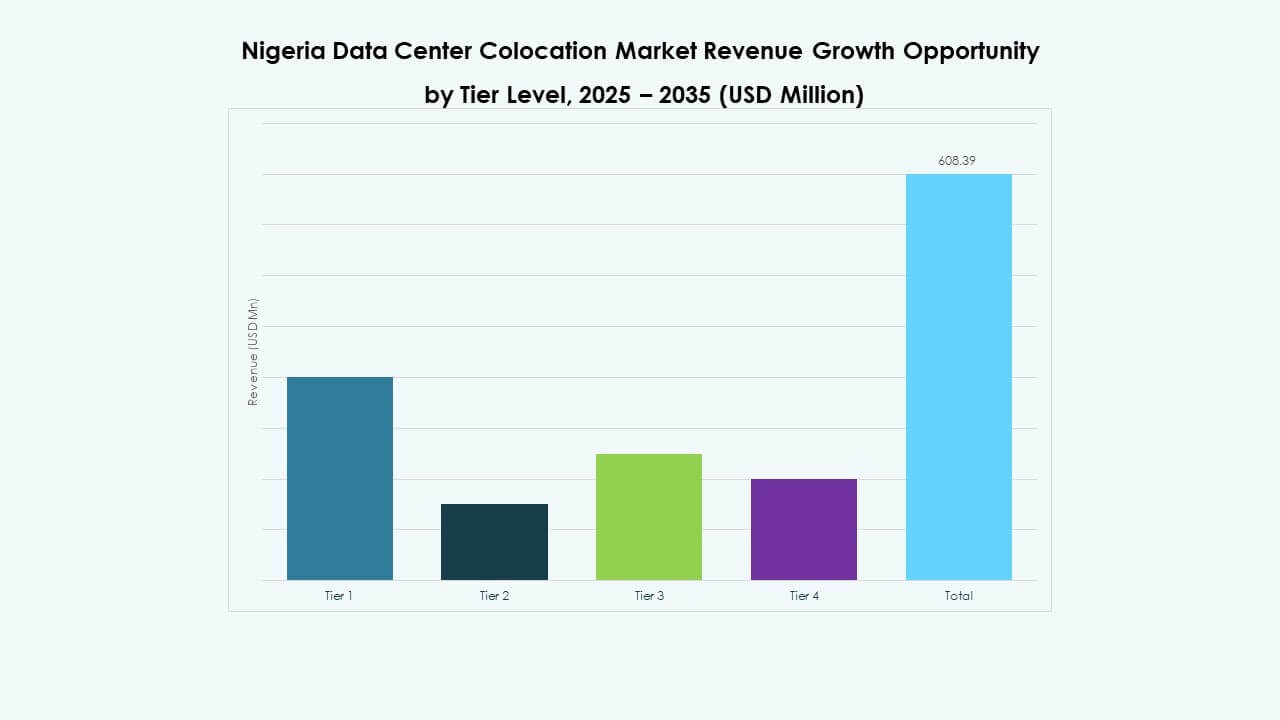

By Tier Level

Tier 3 facilities dominate due to their strong uptime and operational reliability. These data centers meet enterprise requirements for secure and resilient infrastructure. Tier 4 investments are rising among hyperscalers seeking high availability. Tier 1 and Tier 2 facilities serve smaller enterprises but face scalability limitations. Tier 3’s balance of cost efficiency and performance supports its leading position in the Nigeria Data Center Colocation Market. Strong investor interest further strengthens its adoption.

By Enterprise Size

Large enterprises lead the market due to their higher capacity and performance requirements. They prioritize reliability, compliance, and security. SMEs are rapidly increasing adoption due to lower entry costs and better service availability. It allows smaller businesses to access advanced IT infrastructure without major capital investment. Large enterprises dominate in terms of deployed capacity and long-term contracts, driving overall market stability and maturity.

By End User Industry

IT and Telecom is the dominant segment, driven by rising data traffic, 5G expansion, and cloud adoption. BFSI follows with demand for secure, high-availability hosting environments. Retail and healthcare segments are witnessing increased adoption for operational modernization. Media and entertainment rely on colocation for content delivery and streaming. IT and Telecom maintains the largest share in the Nigeria Data Center Colocation Market due to its critical role in digital connectivity.

Regional Insights

Lagos Holding the Largest Market Share Through Strong Infrastructure and Connectivity

Lagos leads the Nigeria Data Center Colocation Market with a 65% share. It benefits from advanced power infrastructure, submarine cable landings, and high enterprise concentration. Strong telecom presence enables reliable interconnection and cloud access. The city’s strategic location supports both domestic and regional traffic. Investments by hyperscalers and international operators enhance capacity. Lagos acts as the primary hub for digital service delivery in West Africa.

- For instance, Open Access Data Centres (OADC), a subsidiary of the WIOCC Group, announced in March 2025 an expansion to scale up its Lagos data center to 24 MW by 2027 through a $240 million investment, making it one of the largest and most advanced facilities in West Africa.

Abuja Emerging as a Strategic Government and Enterprise Growth Hub

Abuja holds a 20% share, supported by public sector digital transformation and enterprise IT modernization. It hosts government-backed projects focusing on data sovereignty and secure hosting. Increasing enterprise adoption is driving infrastructure development. The region is witnessing new colocation builds with advanced tier capabilities. Strong policy support and proximity to decision-making centers enhance investor confidence. Abuja is emerging as a critical node in the national data center network.

Port Harcourt and Secondary Cities Contributing to Distributed Edge Infrastructure

Port Harcourt and secondary cities account for a 15% share. Their growth is driven by oil and gas industry demand and expanding edge deployments. These cities are key for regional connectivity and disaster recovery services. Infrastructure expansion is improving redundancy and load balancing. It supports broader ecosystem resilience and service availability. Edge expansion strategies are strengthening national coverage and improving accessibility for enterprises outside major metros.

- For instance, in September 2025, Nugi Group announced plans to build a Tier IV data center in Calabar, Cross River State. The project aims to expand Nigeria’s digital infrastructure footprint beyond Lagos and Abuja, supporting regional enterprise and government connectivity in the southeast.

Competitive Insights:

- MainOne

- MTN Nigeria

- Layer3

- Smile Communications

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- CoreSite

- CyrusOne

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The Nigeria Data Center Colocation Market features strong competition between local telecom operators, regional service providers, and global hyperscalers. It is characterized by aggressive capacity expansions, partnerships, and strategic technology deployments. Global players such as Equinix, AWS, and Google Cloud focus on scalable infrastructure and cloud integration, while local leaders like MainOne and MTN Nigeria strengthen their edge with network depth and regional expertise. Companies emphasize modular builds, edge connectivity, and green operations to attract enterprise clients. Competitive differentiation is driven by reliability, low latency, and strong interconnection ecosystems. Mergers, acquisitions, and co-location partnerships are increasing, positioning the market for rapid evolution. Strategic alliances continue to shape investment flows and ecosystem maturity.

Recent Developments:

- In October 2025, Airtel Africa entered a strategic partnership with the U.S.-based infrastructure company Vertiv to expand its Nxtra data center operations across the continent, starting in Nigeria.

- In August 2025, Digital Realty declared plans to expand its data center presence in Lagos, Nigeria, reinforcing its strategic commitment to West Africa. The expansion aims to deliver enhanced colocation and interconnection solutions to meet growing regional enterprise and cloud service demands.

- In July 2025, MTN Nigeria inaugurated the first phase of its $235 million Dabengwa Sifiso Data Centre in Ikeja, Lagos. Positioned as Nigeria’s largest prefabricated modular data centre, this facility boasts a 4.5MW IT load, with plans to reach 9MW. Alongside this, MTN has committed an additional $240 million to developing an AI-focused “Genova” data center unit, which will provide AI computing capabilities to local businesses and collaborate with global cloud providers such as Microsoft and Google.

- In April 2025, Equinix, which operates through its MainOne subsidiary in Nigeria, announced a $140 million investment to expand its data center footprint in the country. The initiative includes constructing a new facility in Port Harcourt marking the first data center in southern Nigeria and extending its Lagos-based facilities (LG3).

- In April 2025, MainOne, which is now part of Equinix following a $320 million acquisition finalized previously, completed a major phase of integration, further solidifying Equinix’s ongoing operations in Nigeria’s colocation market. Equinix recently announced a $140 million infrastructure investment in southern Nigeria, including the launch of PR1 the first data center in Port Harcourt and the country’s first landing site for Meta’s 2Africa submarine cable.