Executive summary:

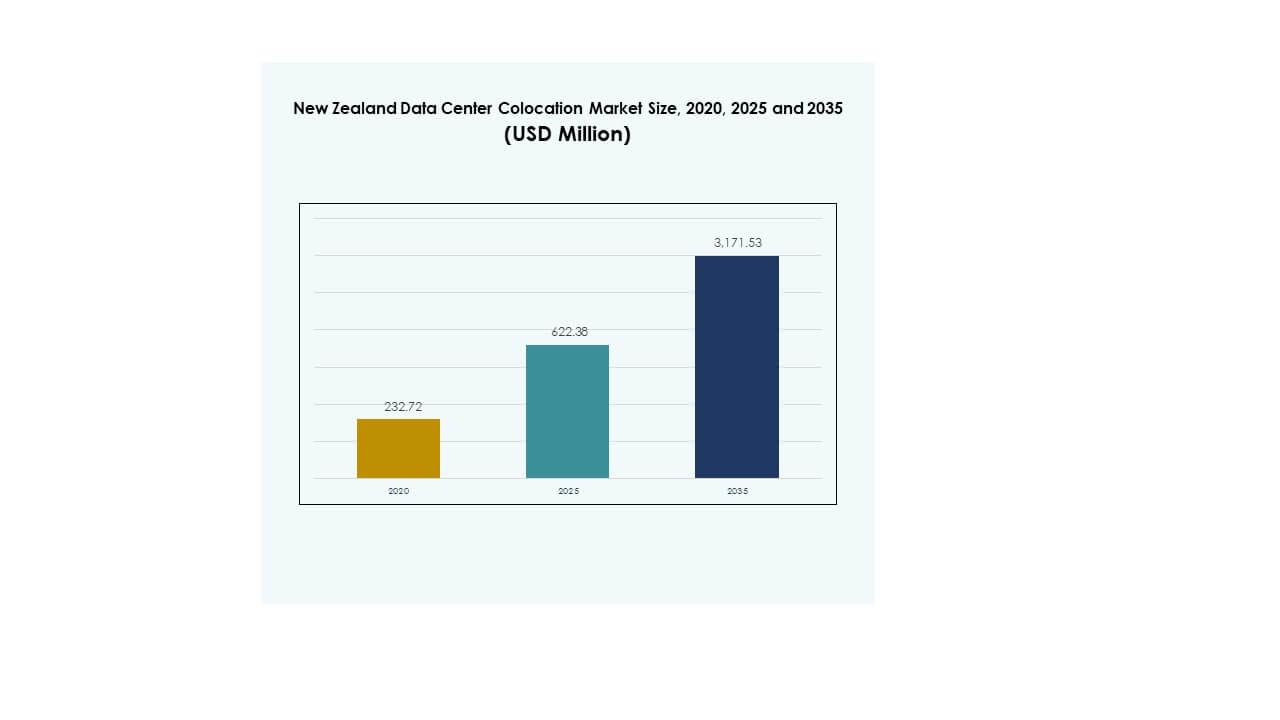

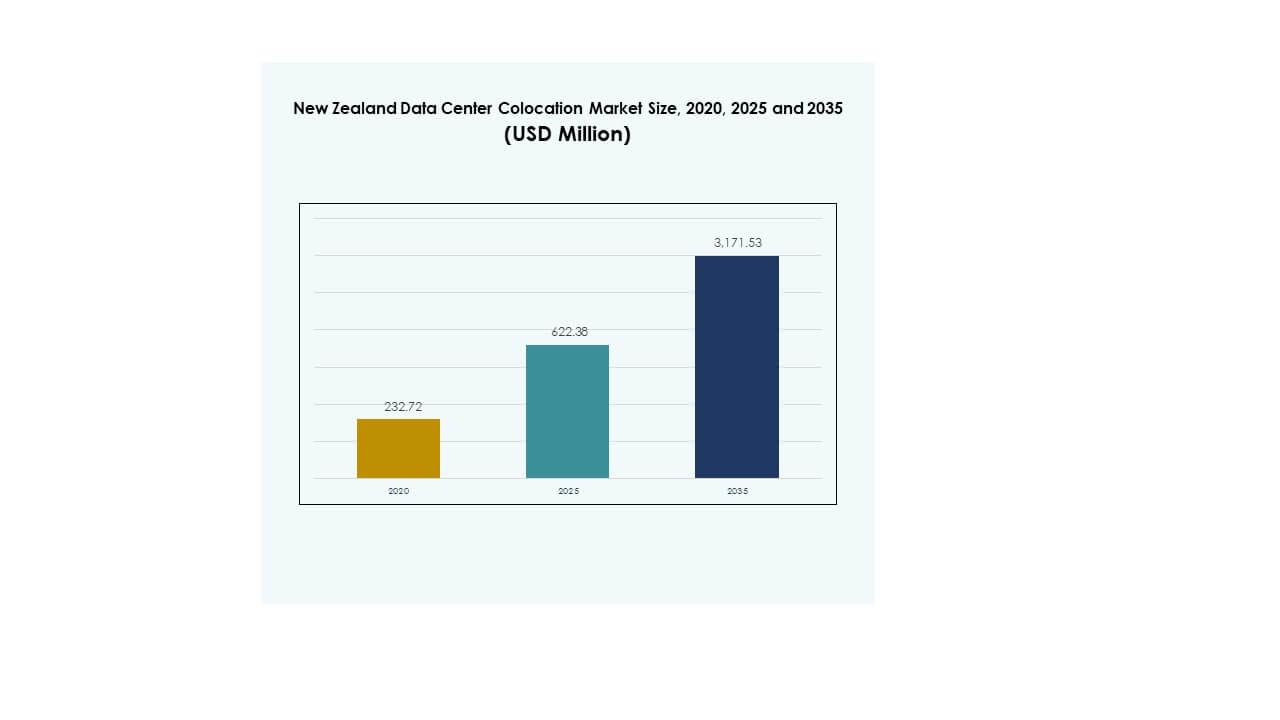

The New Zealand Data Center Colocation Market size was valued at USD 232.72 million in 2020 to USD 622.38 million in 2025 and is anticipated to reach USD 3,171.53 million by 2035, at a CAGR of 17.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| New Zealand Data Center Colocation Market Size 2025 |

USD 622.38 Million |

| New Zealand Data Center Colocation Market, CAGR |

17.58% |

| New Zealand Data Center Colocation Market Size 2035 |

USD 3,171.53 Million |

The market is driven by strong digital transformation, rapid adoption of cloud computing, and increasing integration of AI and edge technologies. Enterprises are prioritizing scalable and sustainable infrastructure to handle rising data volumes. It is strategically important for businesses and investors aiming to strengthen connectivity, improve latency, and secure mission-critical applications.

The regional landscape is dominated by strong infrastructure development in the North Island, supported by strategic locations and submarine cable connectivity. South Island is emerging as a growing hub with renewable energy potential and lower operational impact. Expanding edge deployments in other regions are enhancing national coverage and network resilience.

Market Drivers

Rapid Digital Transformation and Accelerated Adoption of Advanced Cloud Technologies

The New Zealand Data Center Colocation Market is experiencing strong demand due to widespread cloud adoption and digital transformation across industries. Enterprises are modernizing IT infrastructure to support growing workloads and high-performance computing needs. Cloud platforms enable faster deployment and scalability, enhancing operational efficiency. Edge computing integration improves latency and data processing near end-users. It supports real-time analytics, critical workloads, and seamless business continuity. The adoption of hybrid cloud models is expanding the colocation ecosystem. Enterprises view colocation as a cost-effective, secure, and sustainable solution. This growth aligns with rising demand for reliable data storage and management.

- For instance, Datacom confirmed that its New Zealand data centers operate on 100% renewable energy through agreements with Mercury Energy, supporting high-density infrastructure designed for modern workloads including AI and GPU applications. The company highlights its modular design strategy to meet rising enterprise demand.

Rising Focus on Energy Efficiency and Sustainable Infrastructure Development

Colocation providers are investing in sustainable and energy-efficient designs to meet regulatory and customer expectations. Modern facilities integrate renewable energy sources and advanced cooling technologies to reduce carbon footprints. It enhances operational reliability while supporting green data initiatives. Companies are targeting PUE optimization to improve energy performance. Investors are recognizing the strategic value of sustainable data infrastructure. Regulatory incentives are encouraging cleaner energy adoption in colocation. Sustainability commitments are driving long-term investments in efficient power systems. These factors strengthen the country’s position in the digital infrastructure landscape.

Increasing Demand from High-Growth Sectors and Strategic Industry Shifts

High-growth sectors such as banking, healthcare, media, and telecom are fueling demand for secure and scalable infrastructure. Organizations rely on advanced data processing and analytics to support business-critical applications. It allows faster service delivery and improved security compliance. Industry shifts toward AI-driven services and low-latency applications are increasing infrastructure demand. The rise of fintech and telemedicine is accelerating data center investments. Global enterprises are prioritizing New Zealand to strengthen regional connectivity. Partnerships between hyperscale and colocation providers are shaping the next phase of market development. These shifts are making colocation an essential part of digital expansion strategies.

- For instance, in July 2025, Kiwibank confirmed its partnership with Amazon Web Services (AWS) to use the new AWS Asia Pacific (New Zealand) Region, reinforcing its cloud transformation strategy and enhancing access to local cloud services. The partnership was announced during the official AWS Region launch.

Government Support, Submarine Cable Expansion, and Improved Connectivity Ecosystem

The government is supporting data infrastructure growth through favorable policies and digital investment plans. Submarine cable projects are strengthening international connectivity and network resilience. It enhances New Zealand’s capability to host global cloud and enterprise workloads. Strategic infrastructure projects are increasing the country’s competitiveness in the Asia-Pacific market. Businesses are leveraging these capabilities to expand digital services and regional presence. Data sovereignty compliance is attracting regulated industries to local facilities. Connectivity upgrades are creating new opportunities for technology-driven sectors. These developments are shaping the foundation for long-term colocation growth.

Market Trends

Growing Deployment of AI-Ready and High-Density Colocation Infrastructure

The New Zealand Data Center Colocation Market is witnessing increased adoption of AI-ready infrastructure to handle complex workloads. Facilities are deploying liquid cooling systems and advanced power management to support GPU-intensive environments. AI applications require higher compute capacity, driving modernization efforts. It encourages providers to build high-density racks and modular designs. Automation tools improve workload management and resource allocation. This trend is attracting hyperscalers and enterprise clients. Integration of AI enhances operational efficiency and service delivery. The market is shifting toward intelligent, scalable, and performance-optimized facilities.

Strong Expansion of Edge Computing and Low-Latency Service Demand

Edge computing growth is reshaping data center site selection and network design. Enterprises are expanding closer to end-users to reduce latency and improve user experiences. It supports real-time applications like IoT, AR, and content delivery networks. Edge facilities enable faster data processing without depending on distant hubs. Telecom operators and service providers are building distributed infrastructure. This trend aligns with growing demand for smart city solutions and 5G services. The country’s strategic location amplifies its role in regional connectivity. Edge infrastructure deployment is strengthening the national digital backbone.

Shift Toward Automation, Orchestration, and Zero-Touch Operations

Automation is transforming facility management, monitoring, and energy optimization. Colocation operators are integrating AI and ML systems for predictive maintenance. It enhances system uptime and reduces manual intervention. Software-defined infrastructure allows dynamic scaling and better resource utilization. Zero-touch operations minimize operational costs and improve security control. This trend is improving service delivery standards for enterprise clients. Data center orchestration tools are streamlining complex workflows. Digital twins and intelligent management systems are redefining operational models. These advancements are creating a more agile colocation environment.

Rising Integration of Renewable Energy and Advanced Cooling Techniques

Sustainability trends are pushing operators to adopt renewable energy sources and green cooling systems. Renewable integration reduces dependency on traditional power grids. It aligns with corporate decarbonization targets and global ESG goals. Facilities are implementing energy-efficient designs to reduce operational costs. Innovative cooling techniques like liquid immersion are improving thermal performance. This shift supports long-term cost savings and enhances brand credibility. Customers are prioritizing providers with strong sustainability commitments. Colocation growth is increasingly linked to environmental responsibility. These trends are shaping infrastructure investment decisions.

Market Challenges

High Infrastructure Costs and Complexity in Scaling Operations

The New Zealand Data Center Colocation Market faces cost challenges due to high capital investments in land, power, and network upgrades. Infrastructure construction involves strict compliance, increasing development timelines. It becomes complex to scale facilities while maintaining efficiency and uptime. Energy costs impact operational budgets, especially for high-density deployments. Smaller providers struggle to match hyperscale capabilities. Financing remains a key barrier for new entrants. Rising demand requires constant upgrades, adding financial pressure. High build-out costs limit market participation for mid-tier investors.

Regulatory Constraints, Power Limitations, and Environmental Pressures

Regulatory frameworks related to energy usage, environmental impact, and data sovereignty are tightening. Meeting these compliance standards demands advanced infrastructure and planning. It adds complexity to expansion strategies. Power supply availability in certain regions creates constraints on large deployments. Environmental regulations require investments in green technology. Energy grid limitations affect operational reliability during peak demand. Managing these issues requires strategic partnerships and sustainable designs. Colocation providers face pressure to balance growth with environmental responsibility.

Market Opportunities

Expansion of Hyperscale Partnerships and Cross-Border Connectivity Projects

The New Zealand Data Center Colocation Market offers strong opportunities through partnerships with hyperscale providers. Submarine cable expansions are improving regional and global connectivity. It enhances the market’s role as a key infrastructure hub. Enterprises can leverage this connectivity to scale cloud and edge services. Strong connectivity attracts international investors and customers. High availability zones are becoming more critical for service providers. This opens avenues for long-term growth and strategic alliances.

Rising Demand for Green Data Centers and Digital Transformation Acceleration

Sustainability is creating a competitive advantage for providers with energy-efficient designs. Enterprises are prioritizing low-carbon infrastructure to meet ESG goals. It drives investment in renewable energy integration and sustainable design. Digital transformation in critical industries expands colocation demand. Businesses are seeking scalable and secure infrastructure for AI and cloud workloads. This demand encourages providers to innovate and invest strategically. The market is well-positioned to benefit from this shift.

Market Segmentation

By Type

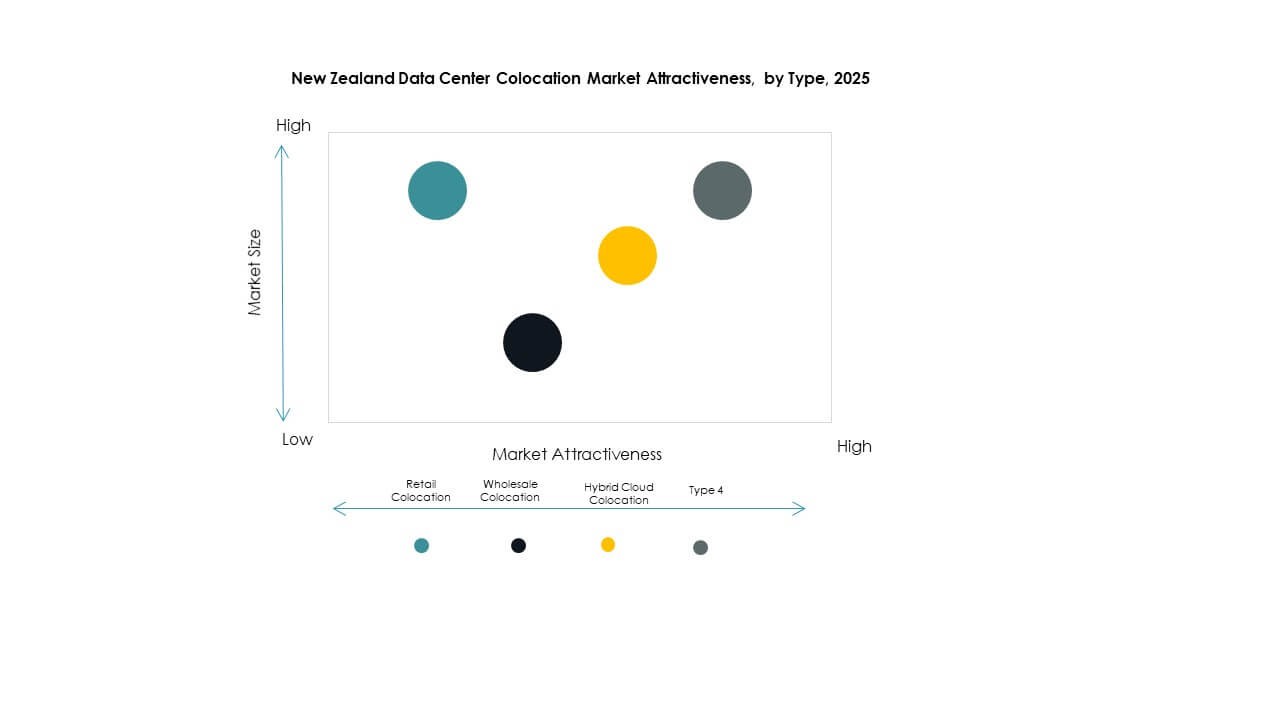

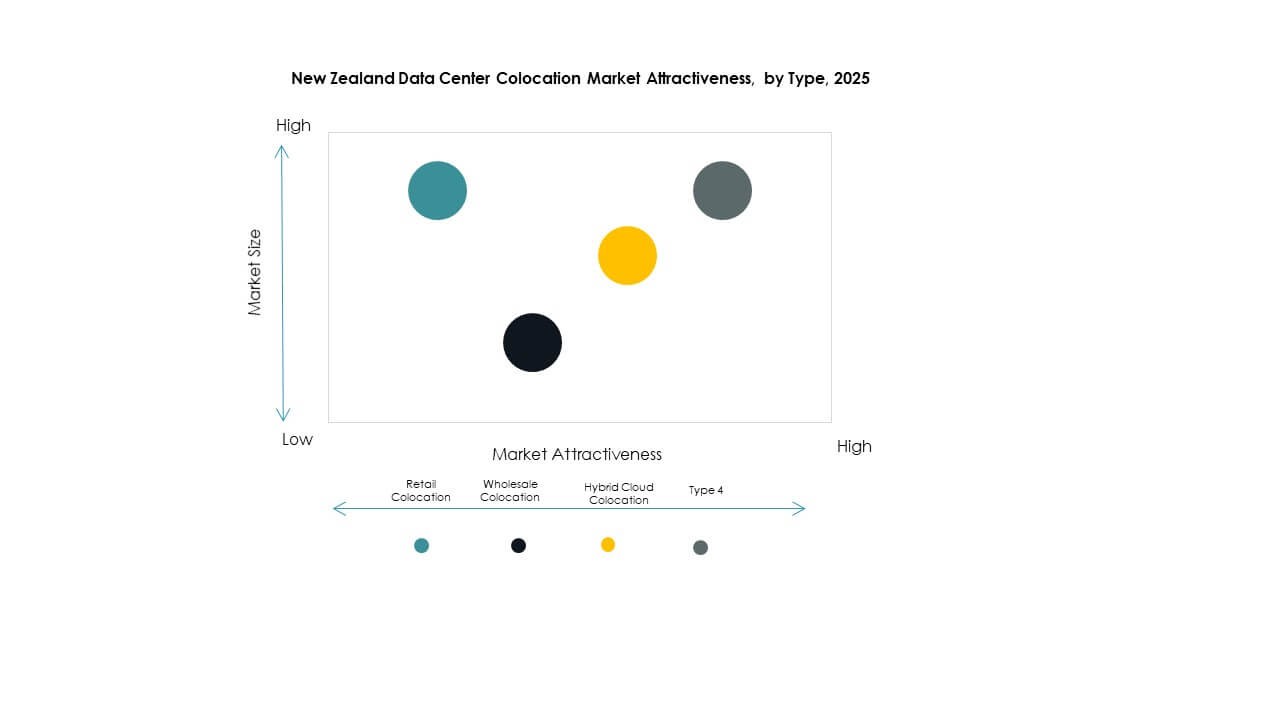

Retail colocation dominates the New Zealand Data Center Colocation Market due to strong demand from small and medium enterprises seeking flexible and cost-effective hosting solutions. It enables rapid deployment and operational control without heavy capital investment. Wholesale colocation attracts large enterprises and cloud providers looking for scalable capacity. Hybrid cloud colocation is gaining traction among organizations aiming to balance control, flexibility, and cost. The retail segment holds a leading share, supported by growing digital adoption and expanding service portfolios.

By Tier Level

Tier 3 holds the largest share in the New Zealand Data Center Colocation Market due to its strong balance between availability, redundancy, and cost efficiency. It ensures high uptime, making it attractive for critical business operations. Tier 4 is growing steadily, driven by increasing hyperscale demand and mission-critical workloads. Tier 2 and Tier 1 serve smaller workloads with moderate redundancy. The dominance of Tier 3 facilities reflects strong enterprise demand for secure and stable infrastructure aligned with service level agreements.

By Enterprise Size

Large enterprises lead the New Zealand Data Center Colocation Market due to their need for advanced infrastructure, strong security, and global connectivity. They rely on colocation to manage AI, big data, and high-performance applications. SMEs are increasingly adopting colocation to reduce IT costs and enhance service reliability. The growing digital economy is encouraging businesses of all sizes to outsource data management. Large enterprise dominance is supported by long-term contracts, higher capacity requirements, and strong cloud integration.

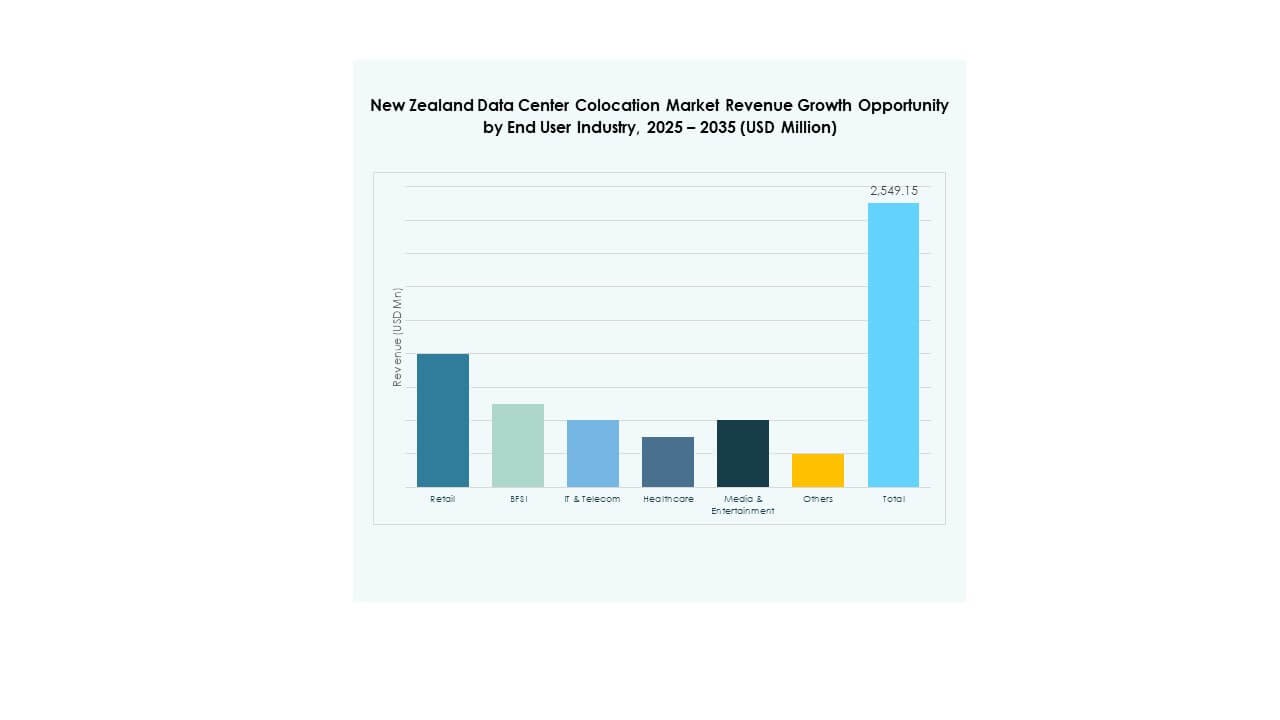

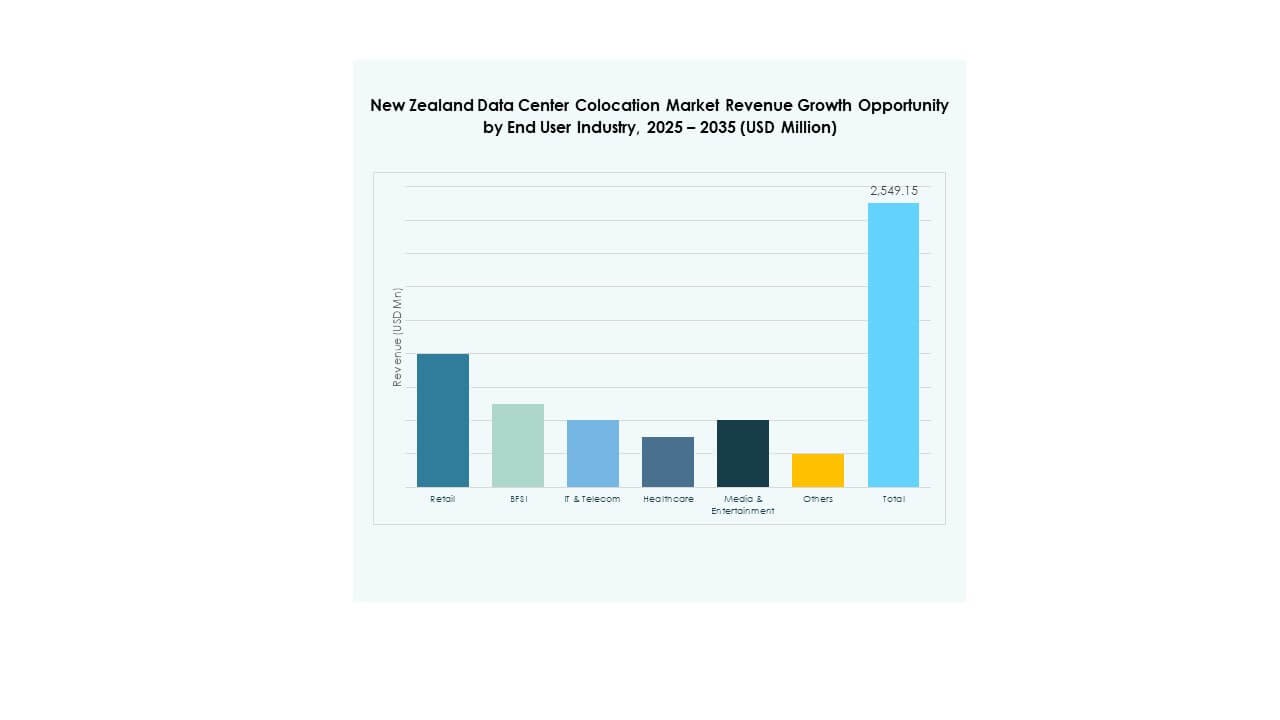

By End User Industry

IT and Telecom dominate the New Zealand Data Center Colocation Market, supported by strong digitalization and cloud adoption. BFSI follows, driven by security and compliance needs. Healthcare is increasing its presence with rising telemedicine and data storage demand. Media and entertainment benefit from streaming growth and content delivery. Retail is shifting to digital commerce models, increasing data needs. The IT and Telecom segment maintains the largest share, fueled by growing connectivity and enterprise transformation strategies.

Regional Insights

North Island Holds the Largest Share Due to Infrastructure and Connectivity Strength

The New Zealand Data Center Colocation Market sees the North Island leading with a 61.2% share, supported by strong infrastructure and dense connectivity networks. Auckland serves as the primary hub for international traffic and enterprise demand. It benefits from submarine cable landings and advanced power availability. Businesses prefer the region for its strategic location and ecosystem maturity. Government support is strengthening its infrastructure resilience. North Island’s dominance reflects its role in shaping the national digital infrastructure landscape.

- For instance, in August 2025, Spark New Zealand completed the sale of a 75% stake in its data center business to Pacific Equity Partners (PEP) in a deal valued at NZ$705 million, supporting plans to expand capacity to 130 MW and develop new sites in Auckland, including Takanini.

South Island Emerging as a Growing Regional Hub for Sustainable Development

The South Island accounts for 28.5% of the market, with strong potential for renewable energy integration. The region leverages hydropower capacity and lower population density to support green data center developments. It offers expansion opportunities for providers seeking sustainable growth. Power availability and lower environmental impact make it attractive for future investments. Its strategic role is expanding due to increased edge deployments. The region is building capabilities to complement North Island’s network strength.

Other Regions Expanding with Targeted Edge Deployments and Connectivity Projects

Other regions hold 10.3% of the New Zealand Data Center Colocation Market and are seeing increased edge deployment. Rural and secondary hubs are improving connectivity through government-led broadband initiatives. It creates opportunities for localized hosting and improved latency. These regions support specific industry clusters, including agriculture and logistics. Infrastructure investments are gradually increasing capacity and reach. The regional ecosystem is diversifying beyond major cities, strengthening national digital coverage. This balanced growth improves overall network resilience.

- For instance, New Zealand’s Rural Broadband Initiative Phase Two (RBI2) and the Mobile Black Spot Fund (MBSF) programs, tracked in Crown Infrastructure Partners (CIP) updates, aimed to expand rural broadband and mobile coverage. By March 2022, official reports confirmed the connection of thousands of rural households and the construction of new mobile towers, supporting the goal of near-universal national broadband coverage.

Competitive Insights:

- Datacom

- Spark Digital

- Vocus Group

- Plan B Limited

- Google Cloud

- New Zealand Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The competitive landscape of the New Zealand Data Center Colocation Market features a mix of domestic operators and global hyperscale providers. It is driven by strategic partnerships, capacity expansion, and advanced technology integration. Major players are focusing on building energy-efficient and AI-ready facilities to meet rising enterprise demand. Global companies such as Equinix, Digital Realty, and NTT Ltd. are investing in scalable infrastructure to strengthen regional connectivity. Local firms like Datacom and Spark Digital are emphasizing low-latency services and regulatory compliance. Competitive differentiation centers on reliability, green energy adoption, and hybrid deployment models. Mergers, acquisitions, and long-term service contracts are increasing market consolidation. This structure strengthens the region’s strategic importance within the Asia-Pacific data center ecosystem.

Recent Developments:

- In October 2025, Datacom announced a significant expansion of its data centre footprint across New Zealand and Australia to meet the surging demand for cloud services, artificial intelligence, and digital transformation. The company emphasized the integration of sustainability initiatives, liquid cooling for AI workloads, and 24/7 onsite support, positioning its new infrastructure to attract global clients seeking energy-efficient colocation solutions.

- In August 2025, Spark New Zealand confirmed the sale of a 75% stake in its data centre business to Pacific Equity Partners (PEP), a deal valued at approximately NZ$705 million (USD 418.6 million). This strategic divestment will enable Spark to accelerate its data centre expansion while maintaining a 25% ownership stake. The new entity, referred to as DC Co, will target next-generation infrastructure, including AI-ready capacity and new sites in Auckland and South Auckland, reflecting Spark’s growth-driven approach despite challenging trading conditions.

- In July 2025, Vocus Group finalized the acquisition of TPG Telecom’s enterprise, government, and wholesale fixed business and associated fibre assets for A$5.25 billion. This acquisition strengthens Vocus’s wholesale fibre offering and network reach across Australia and New Zealand, integrating new fibre assets that support the growing demand for resilient colocation and enterprise connectivity solutions.