Executive summary:

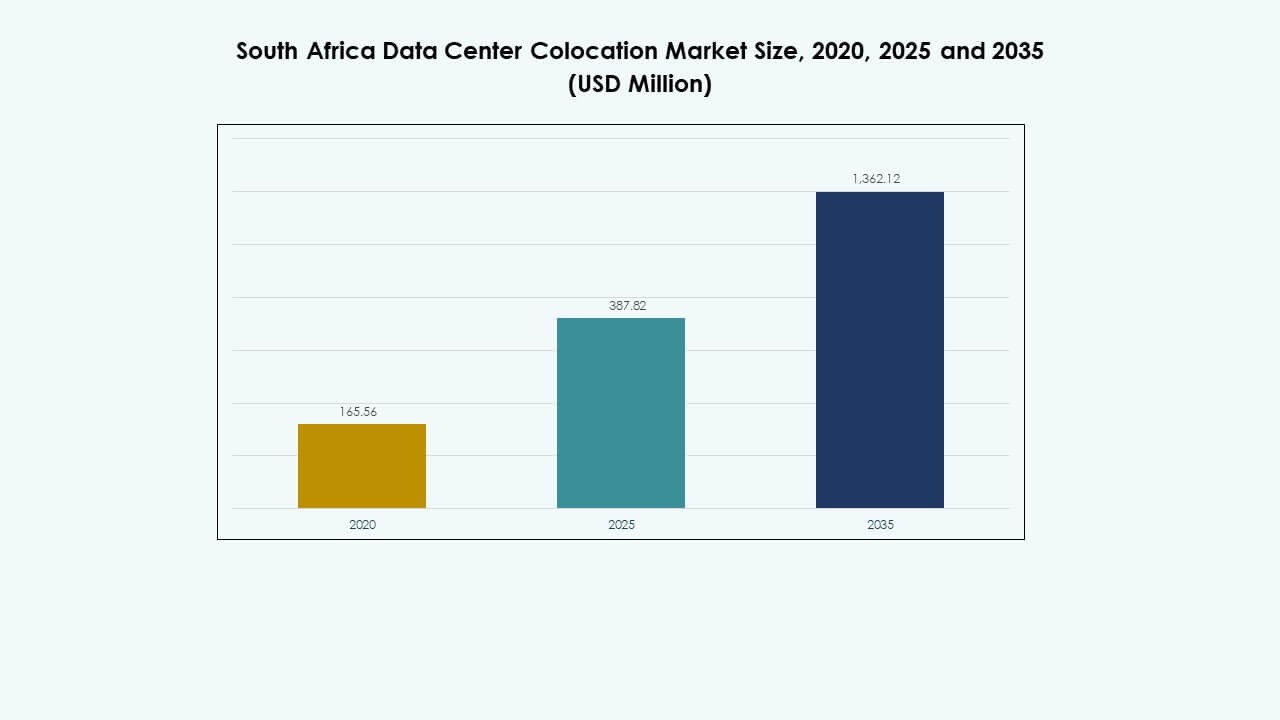

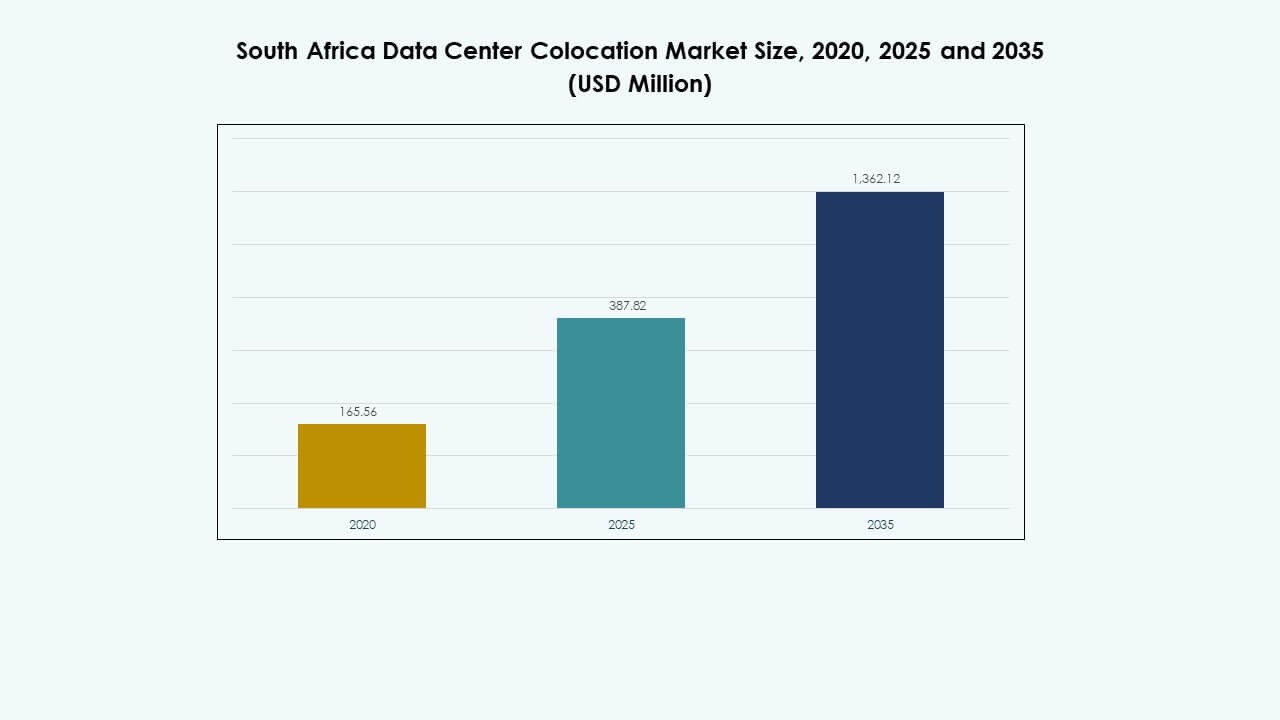

The South Africa Data Center Colocation Market size was valued at USD 165.56 million in 2020, increased to USD 387.82 million in 2025, and is anticipated to reach USD 1,362.12 million by 2035, at a CAGR of 13.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| South Africa Data Center Colocation Market Size 2025 |

USD 387.82 Million |

| South Africa Data Center Colocation Market, CAGR |

13.29% |

| South Africa Data Center Colocation Market Size 2035 |

USD 1,362.12 Million |

Growing cloud adoption, AI-driven workloads, and increased investment in advanced IT infrastructure are driving the market forward. Enterprises are shifting to scalable colocation facilities to manage rising data volumes and improve connectivity. Expansion of subsea cable systems and edge computing capabilities supports faster, more secure data exchange. The market holds strategic significance for businesses and investors seeking long-term digital infrastructure growth and competitive advantage.

Gauteng leads the market with strong connectivity and a concentration of enterprise activity. Western Cape is emerging as a key hub supported by renewable energy potential and coastal subsea landings. Other regions are gaining traction through expanding fiber networks, strategic investments, and favorable government initiatives focused on digital transformation.

Market Drivers

Growing Cloud Adoption and Expanding Digital Ecosystems Accelerate Colocation Demand

The South Africa Data Center Colocation Market benefits from rapid cloud adoption and enterprise digital transformation. Large corporations are moving critical workloads to hybrid and multi-cloud environments to increase flexibility. Government programs and private sector investments support digital infrastructure development. Subsea cable projects improve latency and boost international connectivity. Rising data consumption drives demand for scalable, secure colocation facilities. The market plays a strategic role for businesses seeking cost efficiency and global integration. Investors view this expansion as a foundation for long-term regional growth.

Rising AI, IoT, and Edge Computing Adoption Strengthens Infrastructure Modernization

AI, IoT, and edge computing technologies reshape enterprise infrastructure strategies. Companies require low-latency connectivity to support intelligent applications and analytics. This need fuels demand for colocation facilities offering robust power, cooling, and interconnection. Telecom operators upgrade networks to handle higher traffic volumes. Modernization aligns with enterprise efforts to improve operational agility and cost optimization. It creates new opportunities for colocation service providers to expand capacity. The market acts as a critical backbone for innovation-led industries.

- For instance, Teraco (Digital Realty) opened the JB5 data center at its Isando campus in Johannesburg in June 2025, adding 30 MW of IT load capacity. The facility uses a closed-loop chilled water system with 100% free-air cooling, enabling zero ongoing water usage for cooling.

Increasing Investment From Global Hyperscalers Enhances Market Competitiveness

Global hyperscalers are investing in colocation infrastructure to establish regional hubs. These investments improve connectivity standards and accelerate technology transfer. International players bring operational expertise that elevates facility reliability and scalability. Their presence also drives competition, encouraging local providers to enhance services. Regulatory clarity and stable power supply zones make the environment favorable. This activity increases investor confidence and accelerates ecosystem development. It strengthens South Africa’s position in the continental data landscape.

- For instance, Microsoft announced in March 2025 an investment of approximately $297 million (R5.4 billion) to strengthen South Africa’s cloud and AI infrastructure, including initiatives to train 50,000 people in digital and AI skills.

Strategic Location and Renewable Energy Integration Strengthen Long-Term Market Potential

South Africa’s geographic position between major global internet routes creates unique advantages. Renewable energy integration supports sustainable expansion, meeting enterprise ESG goals. Growing interest in green data centers attracts global enterprises focused on carbon reduction. Power availability in strategic zones supports Tier III and Tier IV developments. Emerging technology corridors attract both domestic and foreign investors. Businesses view colocation as a reliable solution for cost-effective scaling. It positions the country as a preferred digital gateway for Africa.

Market Trends

Market Trends

Emerging Hybrid Colocation Models Shape Enterprise Infrastructure Strategies

The South Africa Data Center Colocation Market is witnessing a shift toward hybrid colocation models. Enterprises combine private and public cloud environments to balance cost, security, and flexibility. Hybrid solutions support multi-region workloads and enable better disaster recovery. Service providers integrate advanced orchestration tools for smooth deployment. This approach enhances agility and supports rapid innovation cycles. Companies increasingly prefer flexible contracts to match evolving capacity needs. It encourages data center operators to build modular, future-ready facilities.

Rise of Edge Data Centers Enhances Network Efficiency and Low-Latency Performance

Edge data centers are gaining traction in response to growing demand for real-time data processing. Enterprises deploy applications closer to users to reduce latency and improve service delivery. Telecom companies expand edge infrastructure to support 5G and AI applications. This trend accelerates investment in distributed, smaller-scale colocation facilities. Industries like gaming, fintech, and healthcare drive adoption of edge architecture. It creates new regional data exchange points and strengthens national connectivity. The ecosystem grows more resilient and responsive.

Sustainability and Green Data Center Initiatives Drive Market Differentiation

Sustainability is becoming a key competitive factor for operators. Companies integrate renewable power sources to reduce operational emissions. Green certifications enhance trust and attract international clients. Investments in efficient cooling, energy management, and power backup solutions support low-carbon operations. Enterprises prefer providers with clear sustainability roadmaps. It aligns with global environmental reporting frameworks and ESG mandates. This shift pushes the industry toward long-term responsible growth.

Growth of Interconnection Hubs and Carrier-Neutral Facilities Expands Ecosystem

Carrier-neutral colocation sites are transforming connectivity patterns. Enterprises leverage these facilities for direct interconnection with multiple networks and cloud providers. Interconnection hubs increase routing efficiency and lower costs for high-traffic applications. This infrastructure supports content delivery, fintech, and manufacturing sectors. Global networks establish presence points to strengthen continental coverage. It drives ecosystem maturity and enhances business continuity strategies. Strategic placement of hubs accelerates digital trade and cross-border communication.

Market Challenges

Power Supply Instability and High Energy Costs Affect Facility Operations

The South Africa Data Center Colocation Market faces power instability and rising energy costs. Frequent load shedding affects uptime reliability and increases operational risks. Operators must invest heavily in backup generation, raising costs. Energy prices influence colocation pricing models and profit margins. Sustainable power sourcing remains limited in some regions. These factors discourage smaller providers from scaling infrastructure. It creates an uneven playing field between large hyperscalers and local operators. Reliable power remains a critical challenge for expansion.

Regulatory Complexity and Infrastructure Gaps Slow Market Scalability

Regulatory frameworks vary across regions and complicate expansion planning. Lengthy approval processes delay construction and increase capital costs. Limited infrastructure outside major hubs restricts network reach and edge deployment. Investors require predictable regulations to commit to large-scale projects. Workforce skill gaps slow technology integration and facility management. High import costs for specialized equipment add further constraints. It affects deployment speed and operational flexibility.

Market Opportunities

Rising Demand From Enterprises Seeking Scalable Digital Infrastructure

The South Africa Data Center Colocation Market offers strong potential for enterprises modernizing IT infrastructure. Rising cloud workloads and data localization needs increase colocation adoption. Flexible contracts and modular deployments attract both large and mid-sized businesses. Digital-first industries view colocation as a strategic growth enabler. It creates room for managed services, security enhancements, and interconnection offerings.

Strategic Positioning as a Continental Digital Hub Enhances Investment Appeal

South Africa’s location provides a gateway to African digital markets. Subsea cable expansions improve international connectivity and latency. Global players view the country as a regional anchor for infrastructure development. Renewable energy potential supports sustainable data center expansion. It encourages long-term foreign direct investment and ecosystem partnerships.

Market Segmentation

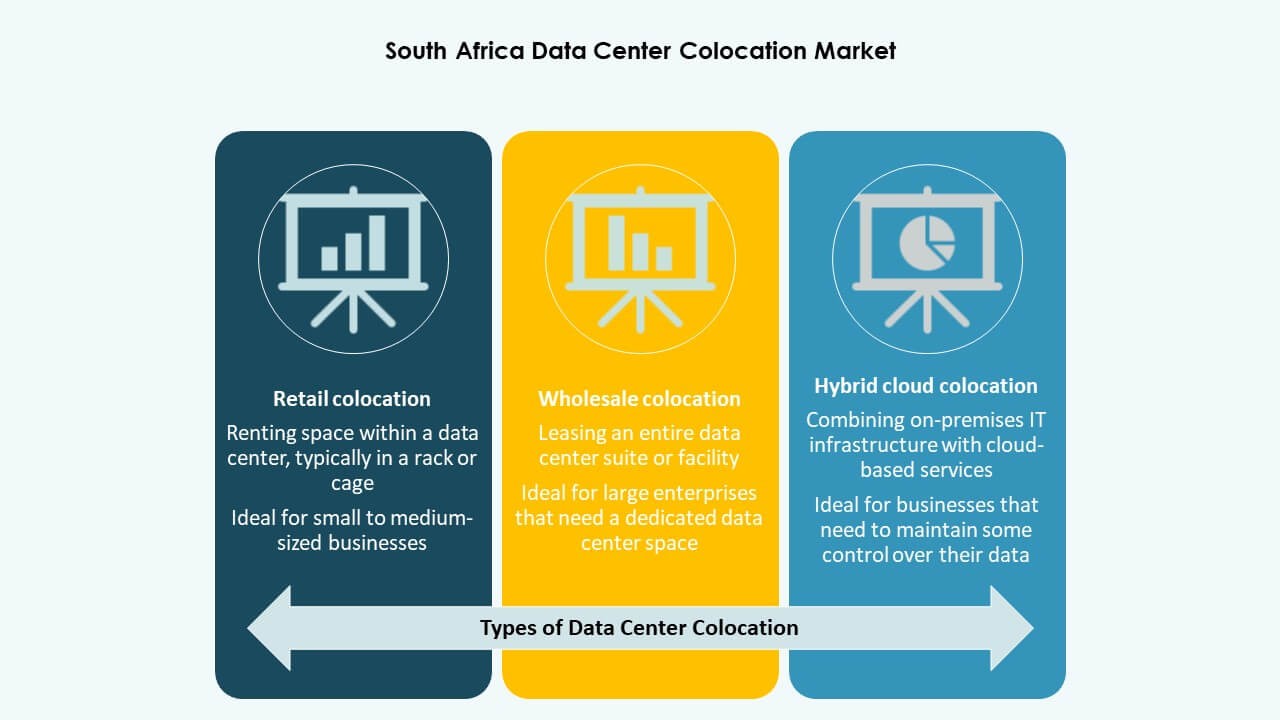

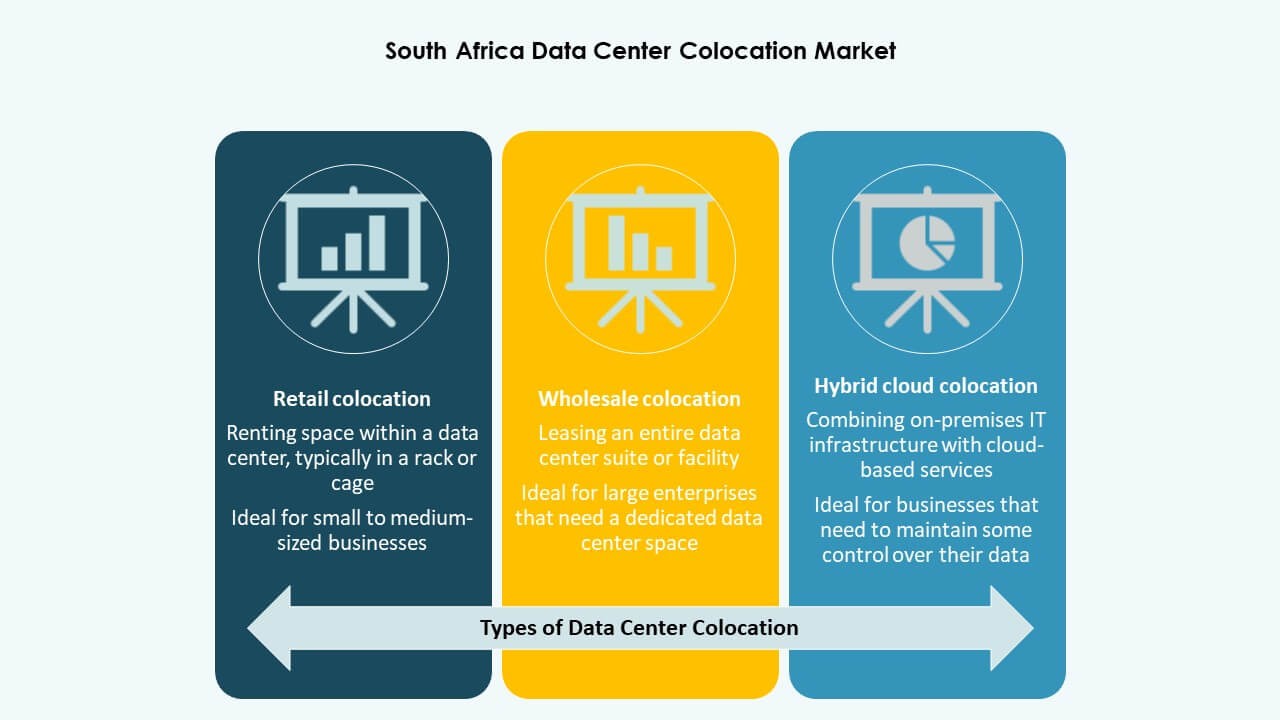

By Type

Retail colocation holds a dominant share in the South Africa Data Center Colocation Market. Enterprises prefer retail models for flexibility, scalability, and lower upfront investment. Wholesale colocation gains traction among hyperscalers seeking dedicated capacity. Hybrid cloud colocation grows steadily due to multi-cloud integration needs. Retail solutions remain the preferred choice for businesses needing fast deployment and managed services.

By Tier Level

Tier III dominates the South Africa Data Center Colocation Market, driven by demand for reliable uptime and efficient redundancy. Tier IV sees growing investment for mission-critical workloads requiring advanced fault tolerance. Tier I and II remain relevant for edge and smaller enterprise deployments. Strong demand for Tier III aligns with enterprises’ preference for performance, security, and cost balance.

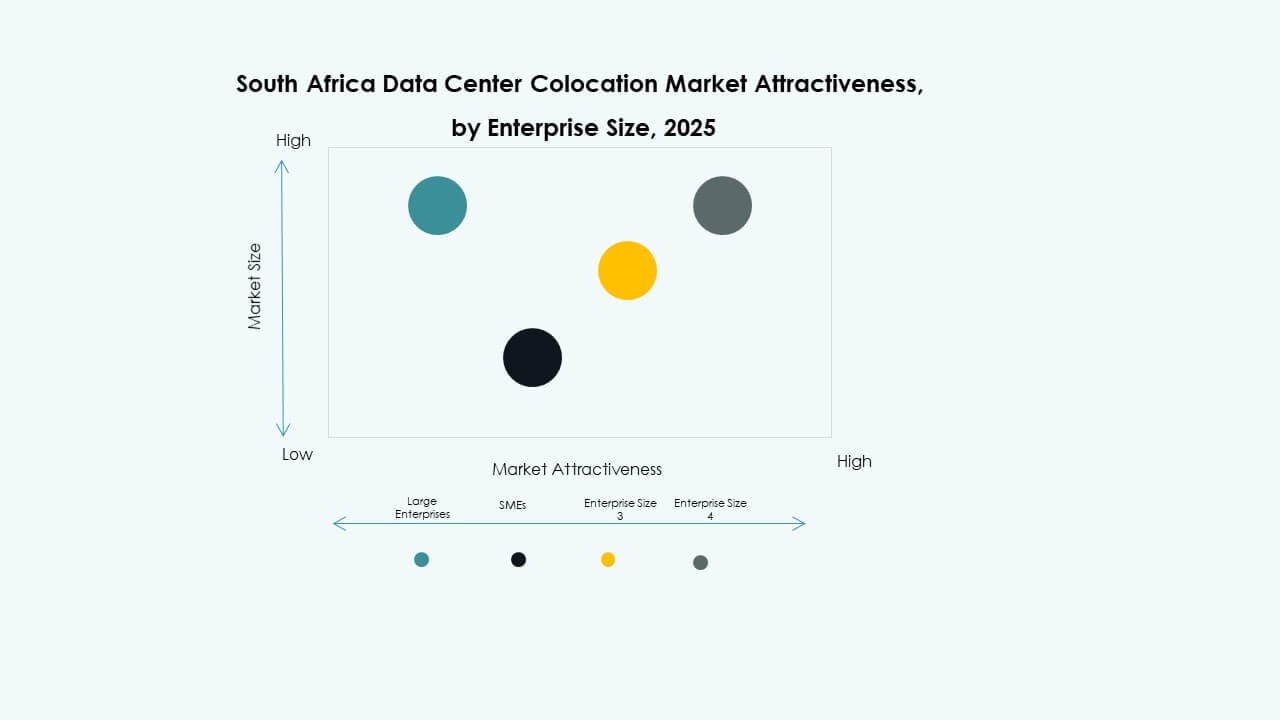

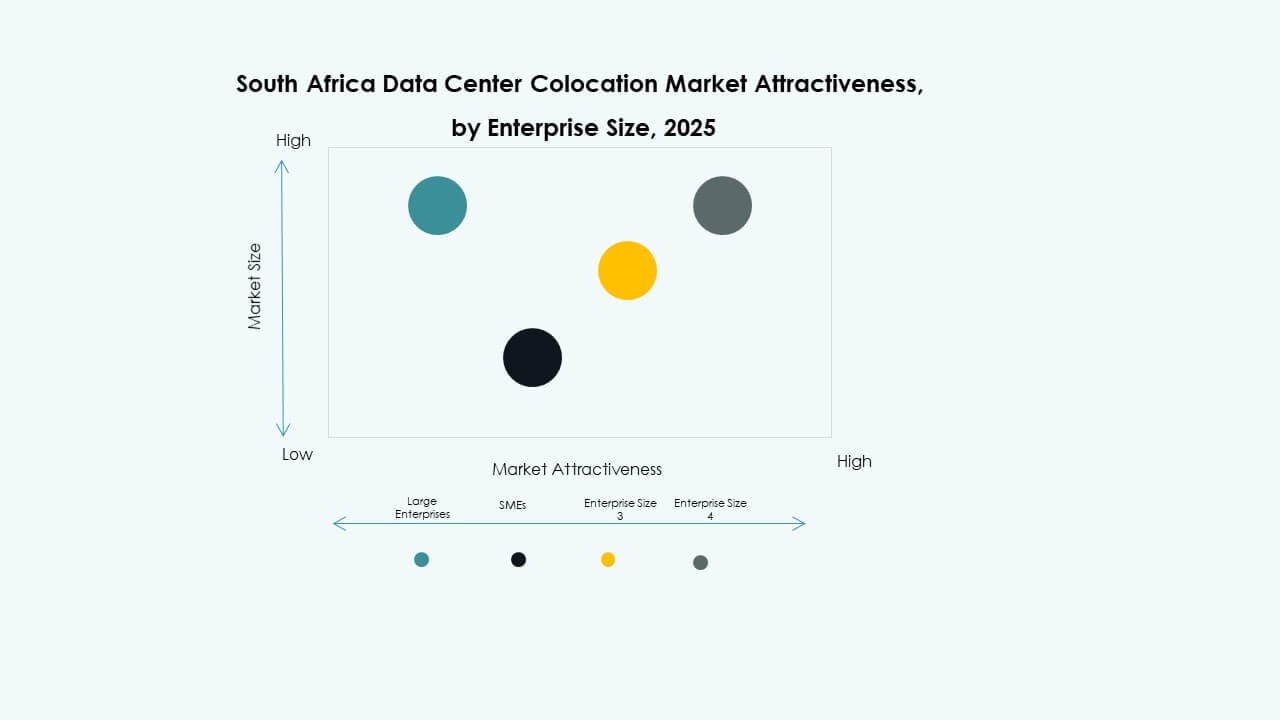

By Enterprise Size

Large enterprises lead the South Africa Data Center Colocation Market, supported by expanding data needs and compliance requirements. SMEs show rising interest due to cost-efficient access to advanced infrastructure. Flexible colocation contracts and managed services encourage SME participation. The demand from large organizations sets high infrastructure standards and drives innovation.

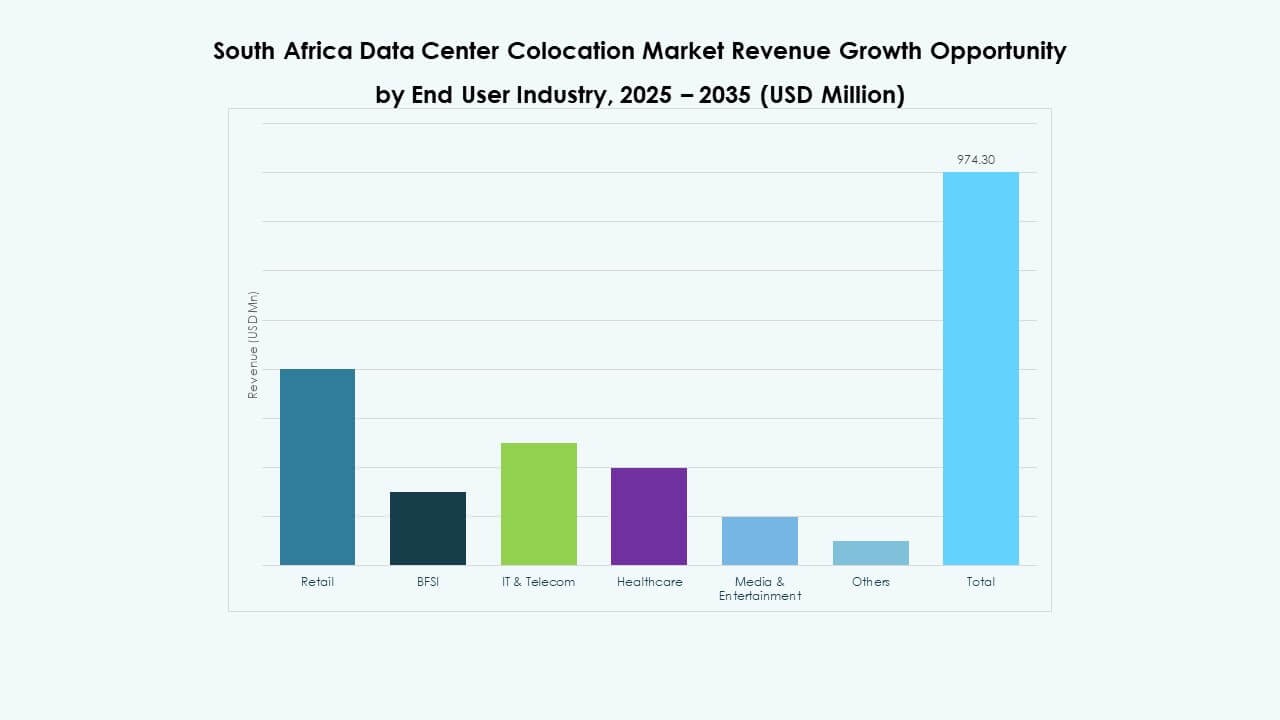

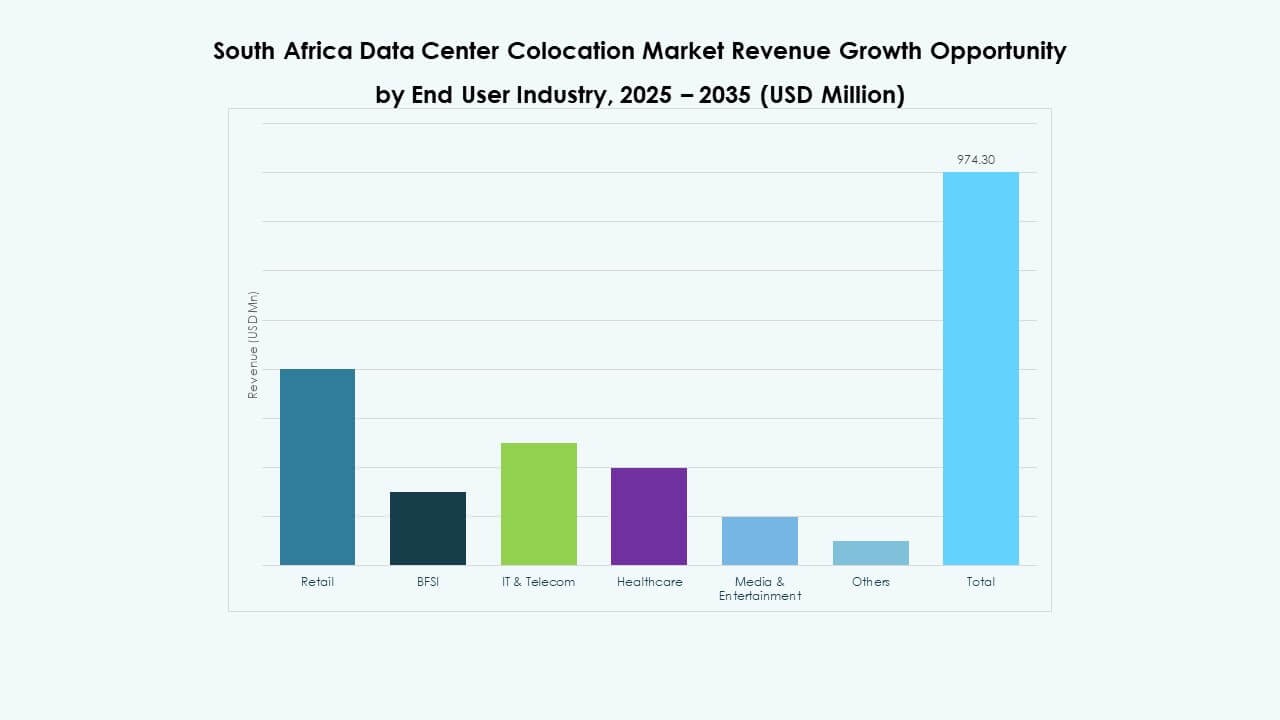

By End User Industry

IT & Telecom dominates the South Africa Data Center Colocation Market, driven by cloud integration, 5G deployment, and high data processing needs. BFSI and healthcare sectors adopt colocation for data compliance and security. Media and entertainment leverage it for streaming and content distribution. Retail and other industries contribute to a broad customer base, strengthening market resilience.

Regional Insights

Gauteng Region Holds the Largest Market Share

Gauteng leads the South Africa Data Center Colocation Market with 43.5% share. Johannesburg serves as the primary connectivity hub with multiple Tier III and Tier IV facilities. Strong enterprise presence and dense network infrastructure drive adoption. Subsea cable backhaul routes converge here, supporting low-latency operations. The region attracts hyperscalers, cloud providers, and financial institutions. Its strong digital ecosystem strengthens national competitiveness.

Western Cape Region Shows Steady Expansion

The Western Cape holds 31.2% share, supported by Cape Town’s strategic coastal location. The city acts as a landing point for major subsea cable systems, boosting international connectivity. Green energy initiatives enhance its appeal for sustainable operations. Increasing tech startups and digital businesses push colocation demand. Its infrastructure supports scalable deployments for global firms seeking coastal redundancy.

- For instance, in July 2024, Africa Data Centres expanded its CPT1 facility in Cape Town, adding three new data halls and 6 MW of IT load. The expansion was supported by a 20-year solar Power Purchase Agreement with Distributed Power Africa, marking a major step in integrating renewable energy into large-scale data center operations.

Emerging Regions Show Growing Potential

Emerging regions, including KwaZulu-Natal and Eastern Cape, collectively account for 25.3% share. These areas benefit from expanding fiber networks and government-led digitalization programs. Land availability and lower costs encourage greenfield development. Edge deployments in secondary cities improve national coverage. Growing enterprise adoption strengthens regional diversity and decentralizes infrastructure concentration.

- For instance, in November 2023, Teraco completed the expansion of its DB1 facility in Durban, doubling capacity to 2.2 MW with a 5,800 m² building footprint and over 700 racks, strengthening KwaZulu-Natal’s role as an important interconnection hub on Africa’s east coast.

Competitive Insights:

- Dimension Data

- Vox Telecom

- RSAWEB

- Teraco

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- CoreSite

- CyrusOne

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The South Africa Data Center Colocation Market features strong competition among global hyperscalers and leading regional providers. It is shaped by infrastructure expansion, power resilience, and interconnection capabilities. Global players such as AWS, Google Cloud, and Equinix strengthen their presence through scalable capacity and advanced security standards. Regional operators like Teraco and Dimension Data focus on strategic partnerships and edge connectivity. Investment in Tier III and Tier IV facilities remains a key competitive factor. Providers aim to differentiate through green data center strategies, carrier-neutral ecosystems, and service integration. Market leaders emphasize network density, uptime reliability, and flexible colocation models to capture enterprise demand. This mix of global and local competition creates a balanced and evolving ecosystem.

Recent Developments:

- In September 2025, Amazon Web Services (AWS) strengthened its South African data center ecosystem through a deeper infrastructure integration supporting AI and analytics workloads. The move, tied to its long-term collaboration with Snowflake, saw the expansion of AWS’s Cape Town region capacity, enabling advanced cloud-native services that meet local data residency requirements under the Protection of Personal Information Act (POPIA).

- In September 2025, MTN Group began discussions with American and European technology companies to develop AI-dedicated data centers across Africa, with a significant focus on South Africa. The initiative underscores MTN’s strategy to diversify into advanced data solutions and aims to position South Africa as a continental hub for AI workloads and digital infrastructure.

- In June 2025, Africa Data Centres entered into a strategic partnership with Blue Turtle Technologies to enhance the country’s digital infrastructure and cloud transformation capabilities. This collaboration is expected to bolster South Africa’s data center ecosystem by expanding secure colocation and cloud-ready infrastructure services. The partnership aims to scale enterprise cloud solutions, facilitate edge computing, and support AI-enabled infrastructure deployments across the region, positioning South Africa as a leading digital hub in Africa.

- In January 2024, Google Cloud launched its first African cloud region in Johannesburg, marking a milestone for the continent’s digital transformation. This launch, operational from March 16, 2025, is expected to add $2.1 billion to South Africa’s GDP and create over 40,000 jobs by 2030. The Johannesburg region now delivers low-latency services for African businesses using Google Cloud’s AI and data analytics platforms.

Market Trends

Market Trends