Executive summary:

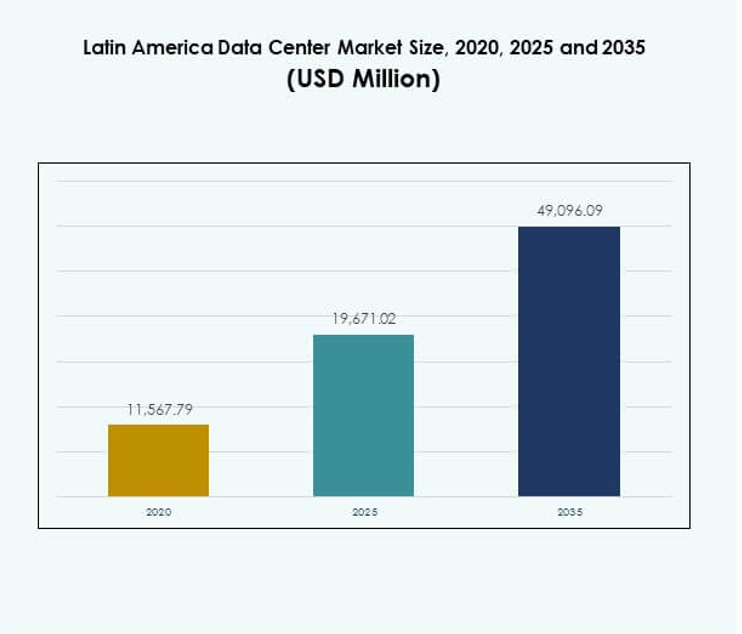

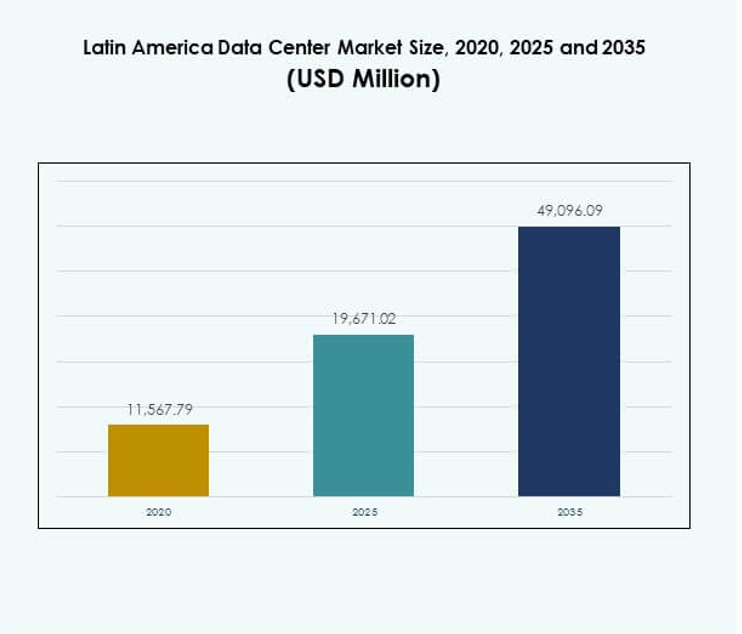

The Latin America Data Center Market size was valued at USD 11,567.79 million in 2020 to USD 19,671.02 million in 2025 and is anticipated to reach USD 49,096.09 million by 2035, at a CAGR of 9.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Latin America Data Center Market Size 2025 |

USD 19,671.02 Million |

| Latin America Data Center Market, CAGR |

9.53% |

| Latin America Data Center Market Size 2035 |

USD 49,096.09 Million |

Growth in the market is driven by rapid digital transformation, expansion of cloud computing, and the surge in e-commerce platforms. Enterprises adopt colocation and hyperscale solutions to manage growing workloads, while governments support digital policies and regulatory frameworks. Innovation in automation, AI, and energy-efficient technologies strengthens competitiveness. The Latin America Data Center Market has become strategically important for businesses and investors seeking sustainable, scalable, and technologically advanced infrastructure.

Brazil leads the region with strong connectivity, a robust IT ecosystem, and large-scale investments in hyperscale facilities. Mexico and Chile are emerging as critical hubs, supported by favorable regulations and renewable energy adoption. Colombia, Argentina, and Peru are expanding their presence through new facilities and infrastructure upgrades. Together, these regions strengthen the Latin America Data Center Market by diversifying its footprint and ensuring long-term digital growth.

Market Drivers

Growing Digital Transformation and Rising Demand for Cloud-Enabled Infrastructure

The Latin America Data Center Market is driven by accelerated digital adoption across industries. Enterprises expand operations through cloud platforms to enhance scalability and efficiency. Demand for colocation and hyperscale facilities rises as firms seek advanced infrastructure. Governments promote digital economies by supporting cloud-first policies and data localization requirements. Investments in broadband expansion strengthen the region’s ability to manage increasing digital workloads. Businesses adopt data-driven strategies to remain competitive in fast-evolving markets. Cloud computing integration provides flexibility for diverse enterprise applications. It positions the market as a hub for regional and international investments.

Increased Technology Adoption and Integration of Artificial Intelligence in Operations

The market benefits from rapid adoption of artificial intelligence and automation across operations. Enterprises deploy AI-driven tools to optimize energy efficiency and workload management. Automated monitoring reduces downtime and enhances service reliability. Edge computing strengthens demand for low-latency infrastructure across high-density urban areas. Adoption of digital twin technology supports predictive maintenance for data centers. The rise of Industry 4.0 initiatives further increases data processing requirements. Automation lowers operational costs and strengthens long-term sustainability. The Latin America Data Center Market attracts investments from global operators focused on innovation.

- For instance, in July 2025, Scala Data Centers secured $254 million in funding for three new hyperscale data centers and a power substation in Chile, dedicated to supporting AI workloads and committed to operating using 100% certified renewable energy and best-in-class energy efficiency metrics.

Surge in E-Commerce, Online Services, and Connected Devices Across the Region

The rise of e-commerce platforms and digital services boosts demand for large-scale data processing. Online streaming and gaming accelerate requirements for high-performance servers. Growth in IoT devices adds complexity to data traffic management. Edge infrastructure supports real-time applications such as telemedicine and financial services. Enterprises leverage colocation to handle unpredictable traffic spikes during seasonal peaks. This demand drives rapid expansion of hyperscale and modular facilities. The market addresses consumer expectations for seamless digital experiences. It solidifies the Latin America Data Center Market as a strategic growth engine.

Government Initiatives, Renewable Energy Adoption, and Investor Confidence

Public policies promoting renewable power supply support long-term sustainability of data centers. Tax incentives and regulatory reforms attract foreign and domestic investors. Growing renewable adoption ensures compliance with global ESG requirements. Energy-efficient cooling and power distribution gain importance for large-scale facilities. Regional governments invest in digital infrastructure to close connectivity gaps. Investor confidence grows as more operators announce expansion plans across key countries. Enterprises prioritize compliance with data sovereignty regulations to protect consumer trust. The market demonstrates its strategic relevance for building resilient and future-ready digital economies.

- For instance, in September 2025, ODATA secured $1.02 billion in green financing, the largest sustainable funding ever for Latin American data centers, to expand energy-efficient and renewable-powered facilities across Brazil, Mexico, Chile, and Colombia in line with tightening sustainability requirements and government energy regulations.

Market Trends

Adoption of Modular and Edge Data Centers for Flexible Expansion

The Latin America Data Center Market observes rising interest in modular and edge facilities. Operators deploy modular units to reduce setup times and achieve faster scalability. Edge centers support decentralized processing, crucial for latency-sensitive applications. Telecommunications growth boosts demand for smaller yet efficient facilities closer to users. Modular designs enable energy-efficient operations while reducing real estate requirements. Enterprises adopt edge solutions for autonomous vehicles, healthcare, and retail sectors. Flexibility in expansion helps operators serve evolving digital workloads. It strengthens the market’s ability to support next-generation services.

Emphasis on Green Data Centers and Renewable Energy Integration

Sustainability trends dominate strategic investments in regional data centers. Operators transition toward renewable energy sources such as solar, wind, and hydroelectric power. Energy-efficient designs like liquid cooling and AI-based energy monitoring gain traction. Investors prioritize facilities that comply with international sustainability certifications. Enterprises demand carbon-neutral services to align with corporate ESG targets. Green data centers improve long-term cost efficiency while enhancing brand reputation. Renewable integration secures power availability and reduces reliance on fossil fuels. It positions the Latin America Data Center Market as a leader in sustainable infrastructure.

Rising Importance of Interconnectivity and Strategic Partnerships

The market experiences growth through partnerships among cloud providers, telecom firms, and colocation operators. Interconnectivity strengthens cross-border data flow and enhances redundancy across facilities. Collaboration with undersea cable projects improves international connectivity for global clients. Carriers expand internet exchange points to boost regional digital performance. Partnerships accelerate market entry for global technology companies into new territories. Interconnected hubs attract multinational firms looking for seamless infrastructure integration. This collaborative environment fosters innovation and competitive advantage. It increases the attractiveness of the Latin America Data Center Market for global enterprises.

Growth of AI-Driven Data Center Management and Smart Operations

Smart operations powered by artificial intelligence transform data center efficiency. AI tools optimize cooling systems and reduce electricity costs for large facilities. Predictive analytics improve capacity planning and help operators avoid downtime. Data centers integrate machine learning for real-time threat detection and security. Automation enhances workforce efficiency by minimizing manual intervention. Demand for software-defined infrastructure supports dynamic workload allocation. Enterprises seek AI-driven data centers to meet modern digital needs. It makes the Latin America Data Center Market a frontrunner in operational innovation.

Market Challenges

Energy Constraints, High Operational Costs, and Infrastructure Gaps Across the Region

The Latin America Data Center Market faces challenges due to uneven energy infrastructure. Rising electricity costs pressure operators to balance efficiency with profitability. Limited renewable capacity in some countries hinders adoption of sustainable practices. Inconsistent power grids increase operational risks and require heavy investments in backup systems. Regional disparities in connectivity slow uniform market expansion. Building large-scale facilities demands high capital investment, making entry difficult for smaller firms. Compliance with evolving regulations creates uncertainty for investors. It continues to test long-term resilience of the market.

Skilled Workforce Shortages, Regulatory Complexities, and Security Concerns

Shortages of skilled professionals delay deployment of advanced technologies. Lack of training programs limits availability of data center specialists in smaller economies. Complex regulatory frameworks around data sovereignty create operational challenges. Cybersecurity threats increase with rising digital traffic, requiring continuous investment. Cross-border data flow regulations restrict scalability for multinational operators. Physical security risks also demand strict safety protocols and monitoring systems. Balancing innovation with compliance remains a core challenge. The Latin America Data Center Market must address these barriers to sustain momentum.

Market Opportunities

Expansion of Hyperscale Facilities and Rise of Regional Cloud Adoption

The market presents strong opportunities in hyperscale expansion to meet enterprise demand. Cloud adoption across industries accelerates the need for scalable, flexible infrastructure. Global providers invest in building regional hubs to support growing workloads. Hyperscale facilities enable cost efficiency and ensure reliable service for global clients. SMEs increasingly migrate to cloud-based services, creating further demand. Edge integration enhances adoption of hybrid models in urban centers. It strengthens the Latin America Data Center Market as a key global hub.

Emergence of AI, IoT, and Next-Generation Applications Driving Investments

Investments in AI, IoT, and 5G services generate new opportunities for infrastructure growth. Data centers capable of processing real-time data gain importance in healthcare and retail. Smart city initiatives boost demand for edge and modular deployments. Investors identify rising demand for green facilities as a competitive edge. International players enter partnerships with local firms to expand regional reach. The market provides significant prospects for long-term digital transformation. It positions the Latin America Data Center Market as a strategic growth destination.

Market Segmentation

By Component

Hardware dominates the Latin America Data Center Market due to high demand for servers, networking, and cooling systems. Operators invest in energy-efficient cooling and advanced storage solutions to support data growth. Software such as DCIM and automation tools gain traction for monitoring and management. Services including consulting and managed operations strengthen long-term adoption. Hardware continues to hold the largest share as data processing needs increase.

By Data Center Type

Hyperscale data centers dominate due to rising demand from cloud service providers and global enterprises. Colocation facilities also expand rapidly to serve SMEs and regional operators. Modular and edge facilities gain popularity for their flexible, cost-efficient deployment models. Enterprise data centers remain relevant for private workloads with strict compliance needs. The Latin America Data Center Market shows hyperscale holding the largest share.

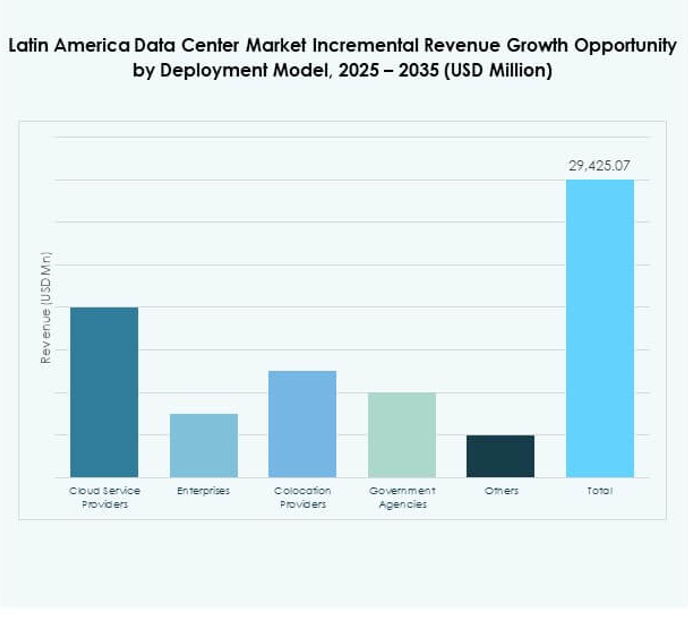

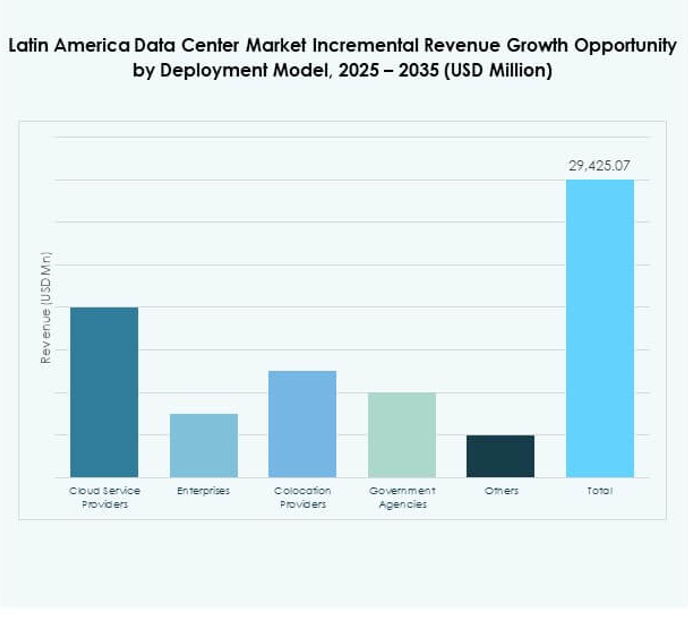

By Deployment Model

Cloud-based deployment leads due to growing enterprise adoption of SaaS, IaaS, and PaaS models. Hybrid models gain strength as firms balance flexibility with regulatory compliance. On-premises deployment continues in industries requiring high security, such as defense and healthcare. Enterprises adopt hybrid for better scalability and control. Cloud holds the largest share, reinforcing regional cloud-first strategies.

By Enterprise Size

Large enterprises dominate with strong investment capacity and demand for global-scale facilities. SMEs adopt cloud and colocation services to reduce upfront infrastructure costs. Rising digital transformation among SMEs boosts managed service adoption. Large enterprises maintain higher demand for hyperscale facilities. The Latin America Data Center Market reflects strong adoption across both segments, with large enterprises leading.

By Application / Use Case

IT & Telecom leads demand due to rapid digital connectivity growth across the region. BFSI follows closely, driven by digital banking and online financial services expansion. Retail and e-commerce push demand for scalable infrastructure to handle traffic surges. Healthcare adopts cloud and edge solutions to support telemedicine and research. Media and entertainment drive streaming workloads. IT & Telecom holds the largest share in the market.

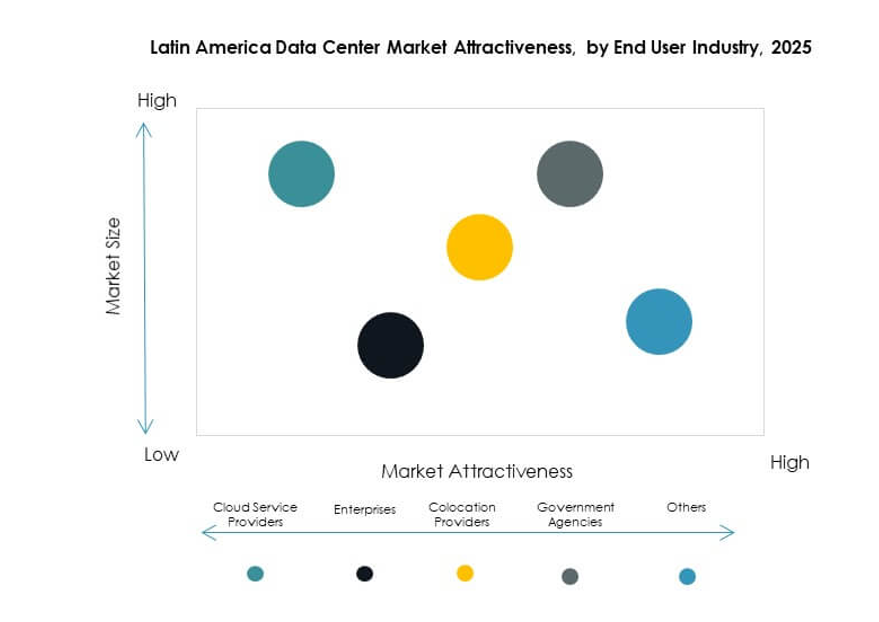

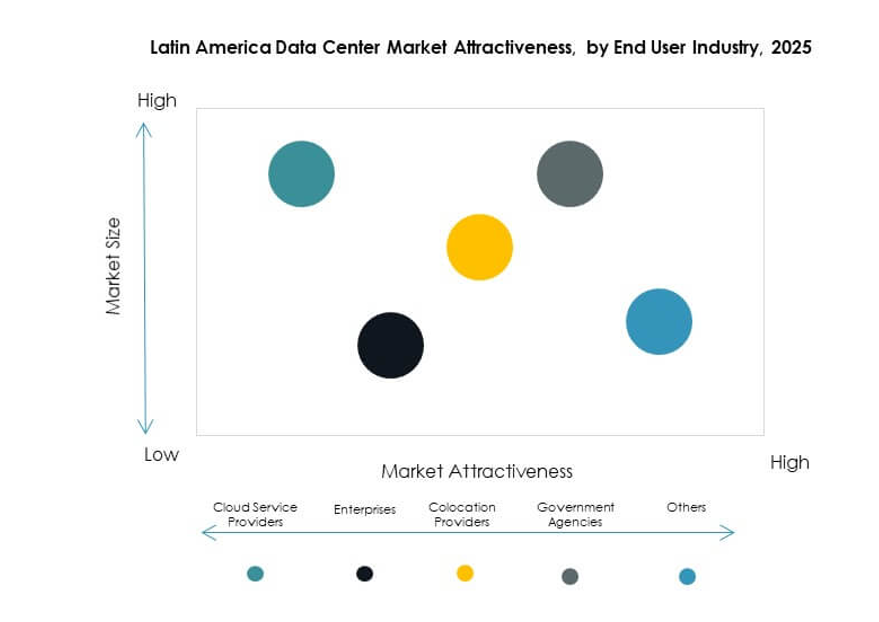

By End User Industry

Cloud service providers dominate demand for hyperscale and colocation facilities. Enterprises increasingly rely on colocation for cost-effective infrastructure solutions. Government agencies expand investment in data localization and digital sovereignty. Colocation providers strengthen regional infrastructure to support SME adoption. The Latin America Data Center Market reflects cloud service providers as the leading end user.

Regional Insights

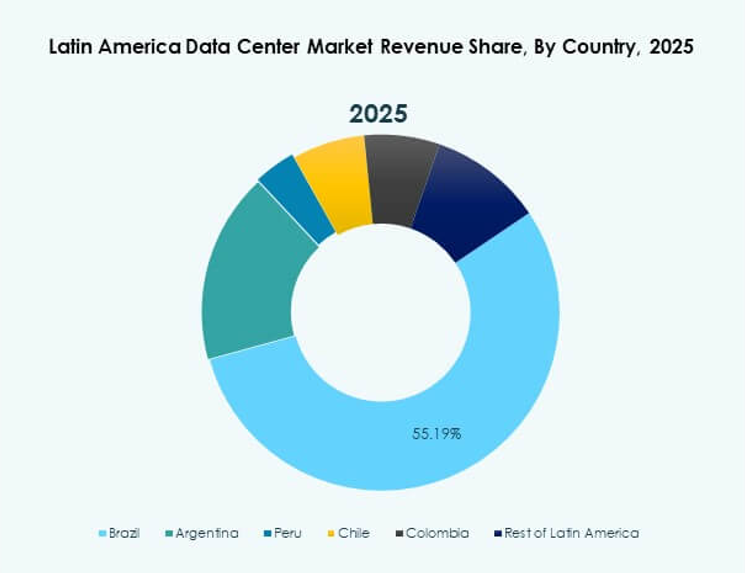

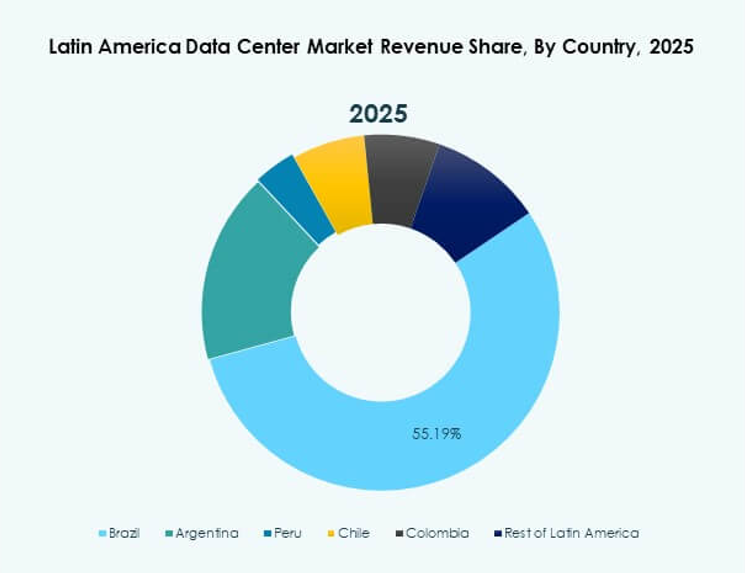

Brazil as the Leading Subregion with Strong Ecosystem and 38% Share

Brazil dominates the Latin America Data Center Market with 38% share. Its strong IT ecosystem, population size, and government support attract global investors. Renewable energy potential and undersea cable projects enhance connectivity. Hyperscale facilities continue to expand across São Paulo and Rio de Janeiro. Enterprises in financial and telecom sectors drive demand for infrastructure. It remains the largest and most influential regional hub.

- For instance, in 2025, Brazil is scheduled to add 550 megawatts of new data center power capacity with over $1.5 billion in new investments, mostly concentrated around São Paulo, further strengthening its ecosystem and maintaining its dominance in regional infrastructure expansion.

Mexico and Chile as Emerging Hubs with Combined 27% Share

Mexico holds 15% share, supported by favorable regulations and growing e-commerce sector. Chile contributes 12% share, driven by renewable energy adoption and international cable networks. Both nations attract hyperscale investments from global cloud providers. Edge facilities expand in urban centers to meet low-latency demand. Mexico and Chile strengthen their presence as competitive alternatives to Brazil. The Latin America Data Center Market expands with their rising importance.

- For instance, in September 2025, CloudHQ unveiled plans for a hyperscale data center campus in Querétaro, Mexico, with an investment of $4.8 billion and up to 900 megawatts of capacity, making it one of the largest tech infrastructure developments in the country.

Other Regional Markets Including Colombia, Argentina, and Peru with 35% Share

Colombia emerges with 14% share due to investments in Bogotá and Medellín. Argentina accounts for 11% share, supported by digital transformation programs and strong enterprise demand. Peru contributes 10% share with infrastructure expansion in Lima. These countries attract growing investment from regional and global players. They strengthen market diversity across South America. It reinforces the long-term resilience of the Latin America Data Center Market.

Competitive Insights:

- ODATA (Aligned Data Centers)

- Scala Data Centers

- Elea Digital Data Center

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Latin America Data Center Market is highly competitive with strong participation from global hyperscale players and regional operators. ODATA and Scala Data Centers lead regional expansions through large-scale facilities and energy-efficient projects. Elea Digital strengthens presence with strategic acquisitions across key cities. Equinix and Digital Realty enhance interconnectivity and global integration, while NTT brings international expertise in colocation and managed services. Cloud giants Microsoft, AWS, and Google dominate demand through hyperscale investments and partnerships with local firms. It demonstrates a balance between local specialization and global capacity, creating a dynamic environment where innovation, renewable integration, and customer-centric services define competitive advantage.

Recent Developments:

- In September 2025, ODATA, an Aligned Data Centers company, secured a landmark US $1.02 billion green financing package aimed at expanding sustainable data center infrastructure across Latin America, including key markets such as Brazil, Mexico, Chile, and Colombia. This financing is the largest of its kind for the region and will be used to accelerate projects that focus on energy efficiency, renewable energy, and low-carbon construction methods.

- In August 2025, Elea Digital Data Centers signed a Memorandum of Understanding (MoU) with Oracle and the City of Rio de Janeiro to advance the Rio AI City project. This partnership aims to transform Rio’s Olympic Park into the largest data center hub in Latin America, with a planned initial capacity of 1.5 GW and potential expansion to 3.2 GW, all powered by clean energy and designed for high-density cloud and AI deployments.

- In July 2025, US-based RT-One announced the purchase of land in Uberlândia, Minas Gerais, Brazil, with plans to install a new 400 MW data center facility, highlighting its commitment to investing in newer regional infrastructure to support intensified cloud adoption across the Latin American market.

- In October 2024, ODATA (Aligned Data Centers) signed a significant supply agreement with Casa dos Ventos in Brazil to expand its sustainable data center footprint, underscoring the focus on renewable energy integration within the region’s data center growth strategy.