Executive summary:

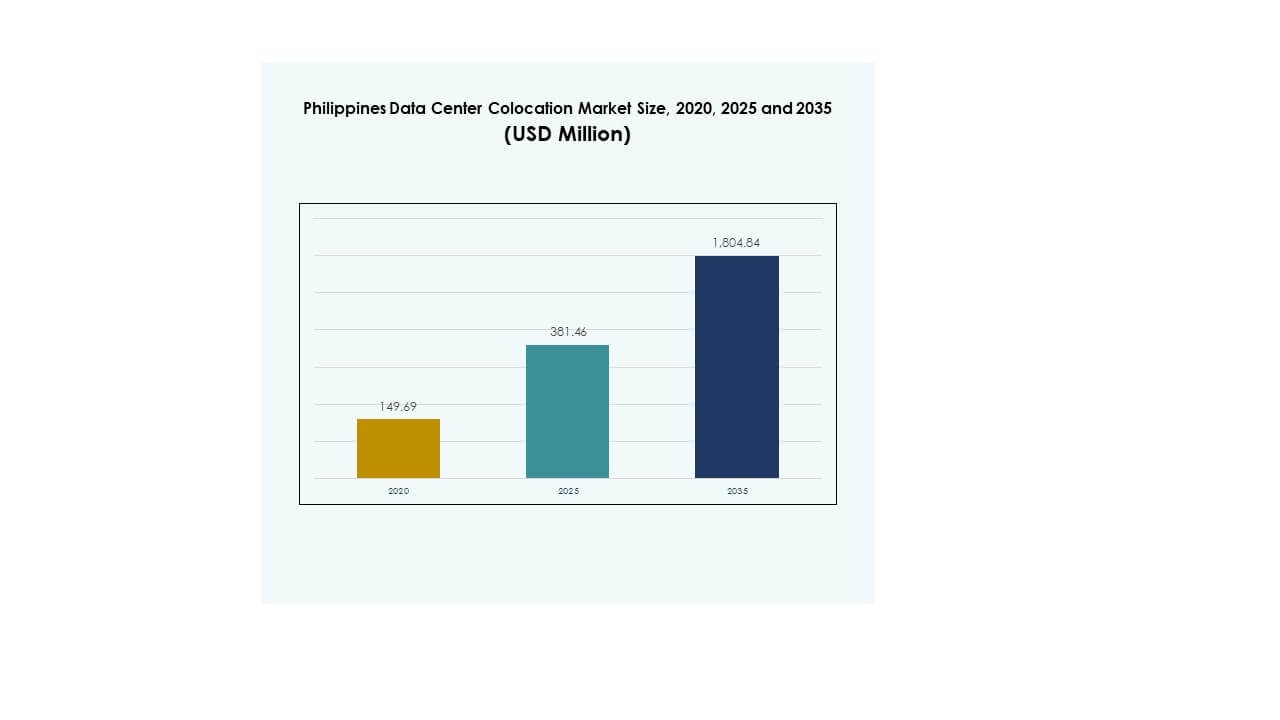

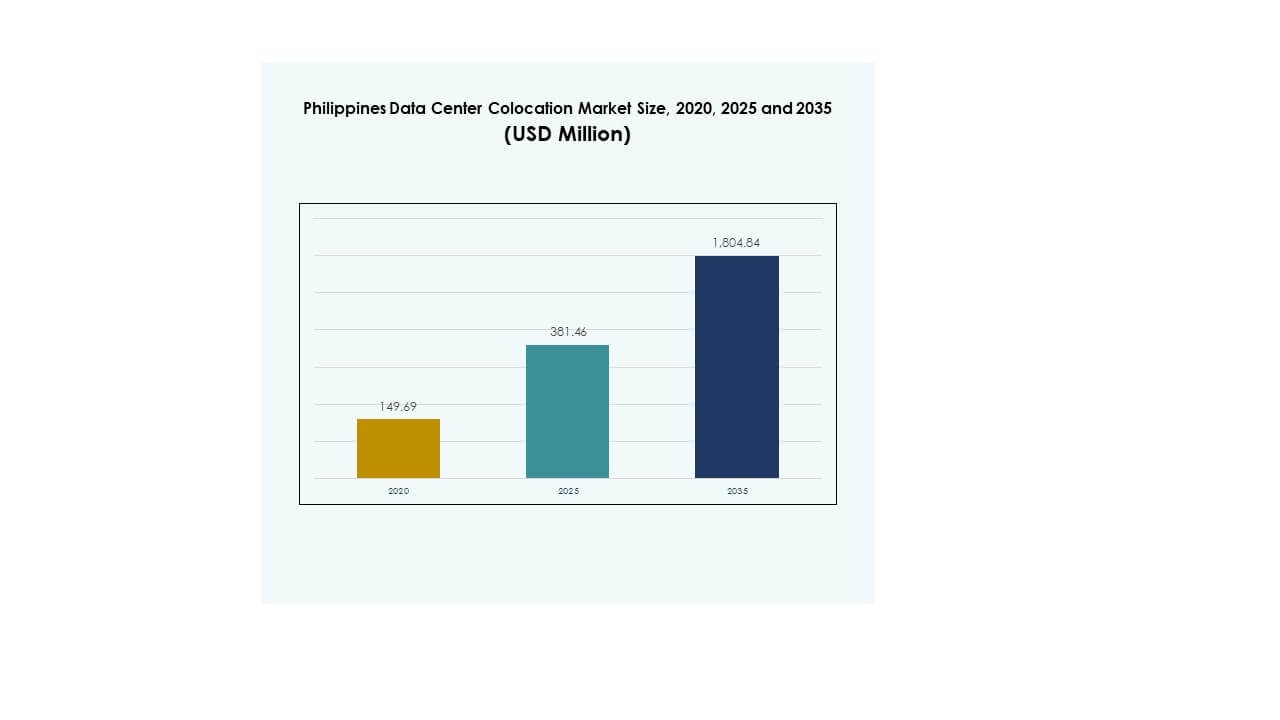

The Philippines Data Center Colocation Market size was valued at USD 149.69 million in 2020 to USD 381.46 million in 2025 and is anticipated to reach USD 1,804.84 million by 2035, at a CAGR of 16.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Philippines Data Center Colocation Market Size 2025 |

USD 381.46 Million |

| Philippines Data Center Colocation Market, CAGR |

16.72% |

| Philippines Data Center Colocation Market Size 2035 |

USD 1,804.84 Million |

Strong technology adoption, growing cloud infrastructure, and rising enterprise digitalization are fueling market expansion. Companies are shifting workloads to colocation facilities to reduce capital costs and gain scalable IT capacity. Innovation in high-density racks, hybrid cloud models, and energy-efficient infrastructure strengthens operational performance. It holds strategic importance for businesses and investors seeking improved data resilience, compliance, and connectivity across sectors.

Metro Manila leads the market due to advanced infrastructure, power availability, and fiber connectivity. Cebu is emerging with expanding enterprise demand and strategic network positioning. Davao and other regional hubs are gaining traction through new edge deployments and government-backed infrastructure programs. This regional expansion strengthens national digital capabilities.

Market Drivers

Rising Digital Transformation and Increasing Enterprise Adoption of Cloud Infrastructure

The Philippines Data Center Colocation Market benefits from the strong pace of digital transformation across industries. Enterprises are shifting workloads to colocation facilities to reduce capital costs and ensure scalable IT infrastructure. Investments in high-speed connectivity and cloud-native solutions accelerate this migration. Digital banking, e-commerce, and government services drive demand for secure and high-availability environments. Edge computing and AI integration further enhance operational agility. It supports digital expansion strategies and strengthens service delivery. Businesses view this market as a critical enabler for data resiliency and performance.

- For instance, Beeinfotech PH launched the HIVE Hybrid Data Center in Manila in March 2025. The facility offers over 3,600 racks, is built to Tier 3+ standards, and holds LEED certification. It is a telco-neutral site designed to support AI, cloud, and enterprise workloads.

Growing Investments in High-Density and Energy-Efficient Infrastructure

A major driver is the growing investment in high-density racks, modular systems, and energy-efficient designs. Colocation operators deploy advanced power and cooling solutions to meet increasing data volumes and processing demands. Energy optimization ensures cost efficiency and aligns with sustainability goals. Green data centers are gaining traction, supported by renewable power initiatives and compliance standards. Hybrid cloud adoption also accelerates infrastructure modernization. It allows enterprises to optimize workloads and achieve better uptime. This shift boosts competitiveness and positions the market as a strategic hub.

Regulatory Support and Expansion of the Digital Economy

Government initiatives supporting digital infrastructure development are strengthening market growth. The introduction of policies for data sovereignty, security, and compliance encourages investments. The digital economy is expanding rapidly with increased adoption of fintech, e-government services, and digital identity platforms. Colocation providers are aligning infrastructure to meet regulatory and security requirements. International investors are attracted by favorable policies and strategic location. It builds confidence for hyperscale operators seeking regional expansion. This alignment of regulation and infrastructure fuels long-term demand.

Strategic Importance of Colocation in Enabling Business Continuity and Scalability

Enterprises depend on colocation facilities to maintain operational continuity and scalability. Colocation infrastructure ensures high availability, disaster recovery capabilities, and lower latency connections. Businesses can expand without major upfront capital investments. The demand from BFSI, telecom, and healthcare sectors drives continuous upgrades. Advanced connectivity through submarine cable networks and fiber backbones improves service reliability. It enables businesses to expand digital services at scale while ensuring compliance. The strategic role of colocation makes it an essential part of digital strategies for investors and operators.

- For instance, ENDECGROUP is developing a 300 MW hyperscale data center campus at Narra Technology Park in New Clark City, Tarlac. The project spans 47 hectares and is planned in three 100 MW phases, with the first phase targeted for late 2025. This development strengthens the country’s position in Asia’s hyperscale ecosystem.

Market Trends

Surge in Hyperscale Deployments and AI-Ready Infrastructure Development

The Philippines Data Center Colocation Market is witnessing rapid expansion of hyperscale facilities. Global cloud providers and telecom operators are establishing large-scale campuses to serve enterprise and government clients. These sites support advanced AI workloads, content delivery, and high-performance computing applications. Operators are deploying liquid cooling, modular construction, and automation technologies. This trend aligns with increasing demand for low-latency services. It strengthens the country’s role in regional data routing and hosting. The move toward hyperscale investments signals strong market maturity.

Expansion of Edge Data Centers to Support Latency-Sensitive Applications

The growing use of 5G, IoT, and streaming platforms is fueling edge deployments. Smaller, strategically located data centers improve latency and performance for enterprise users. These facilities support real-time processing for fintech, gaming, and e-health services. Colocation operators are integrating edge infrastructure with cloud backbones for seamless connectivity. It enhances service availability and user experience. Telecom carriers are investing in multi-access edge solutions to capture this demand. The edge expansion trend creates new growth clusters outside traditional hubs.

Integration of Automation and Software-Defined Infrastructure

Operators are embracing automation to improve service efficiency and flexibility. Software-defined infrastructure enables real-time monitoring, predictive maintenance, and intelligent resource allocation. Automation reduces downtime and improves energy efficiency. AI and machine learning integration allow dynamic load balancing and enhanced security. It improves cost control and operational reliability for enterprises. The trend toward automation supports future-ready colocation environments. This shift helps service providers deliver more scalable and adaptive solutions.

Growing Focus on Renewable Energy and Sustainable Operations

Sustainability has become a core trend shaping infrastructure strategies. Colocation operators are integrating solar and wind energy sources to reduce carbon footprints. Energy-efficient cooling technologies are adopted to lower power usage effectiveness. Green certifications enhance the market’s appeal to multinational clients. Governments support sustainability through incentives and regulatory frameworks. It improves energy security and aligns with global ESG goals. This sustainability push positions the country as an attractive hub for responsible digital investments.

Market Challenges

High Energy Costs and Power Reliability Concerns Affecting Operational Economics

The Philippines Data Center Colocation Market faces power-related challenges that impact cost structures. Energy expenses represent a major share of operational costs. Frequent supply fluctuations and dependence on traditional energy sources create uncertainty for operators. Backup power systems and redundant infrastructure increase capital expenditure. Power availability outside major urban hubs remains limited. It complicates regional expansion strategies and affects site selection. High costs can deter smaller operators and reduce competitiveness. These factors require long-term investment in energy diversification and grid modernization.

Skilled Workforce Gap and Supply Chain Constraints Impacting Scalability

A shortage of skilled professionals and supply chain constraints slow down infrastructure deployment. Specialized skills are required for managing advanced cooling systems, cybersecurity protocols, and AI-driven operations. Delays in importing critical components also impact construction timelines. Regulatory processes can extend project completion periods. It increases operational risks and discourages foreign investments in some regions. Limited availability of technical talent restricts service expansion. The challenge requires targeted workforce development and stronger ecosystem support.

Market Opportunities

Strong Government Push for Digital Infrastructure and Strategic Location Advantage

The Philippines Data Center Colocation Market benefits from its location as a key connectivity hub in Southeast Asia. Government initiatives encourage investment through digital infrastructure policies and tax incentives. Submarine cable expansions improve regional connectivity and network resilience. It creates strong potential for attracting hyperscale operators and global cloud providers. Strategic positioning strengthens the country’s role in data transit and service delivery across the region. This provides investors with long-term scalability opportunities.

Accelerating Demand from Enterprise Cloud and AI Deployments

Enterprises are rapidly shifting to hybrid cloud models and AI-driven applications. Colocation facilities provide secure and flexible environments for these workloads. Demand for data-intensive applications in BFSI, healthcare, and telecom sectors is rising. Operators are offering AI-ready, high-density environments to support next-generation workloads. It gives investors room to expand value-added services and capture a growing client base. This creates strong opportunities for both domestic and international operators.

Market Segmentation

By Type

Retail colocation dominates the Philippines Data Center Colocation Market due to its flexibility and cost advantages. Enterprises prefer retail models to scale IT infrastructure without large capital investments. It supports growing demand from SMEs and regional businesses. Wholesale colocation gains traction from hyperscale players building large campuses. Hybrid cloud colocation grows with increased demand for workload flexibility. Retail holds the largest share due to its adaptability and lower entry barriers.

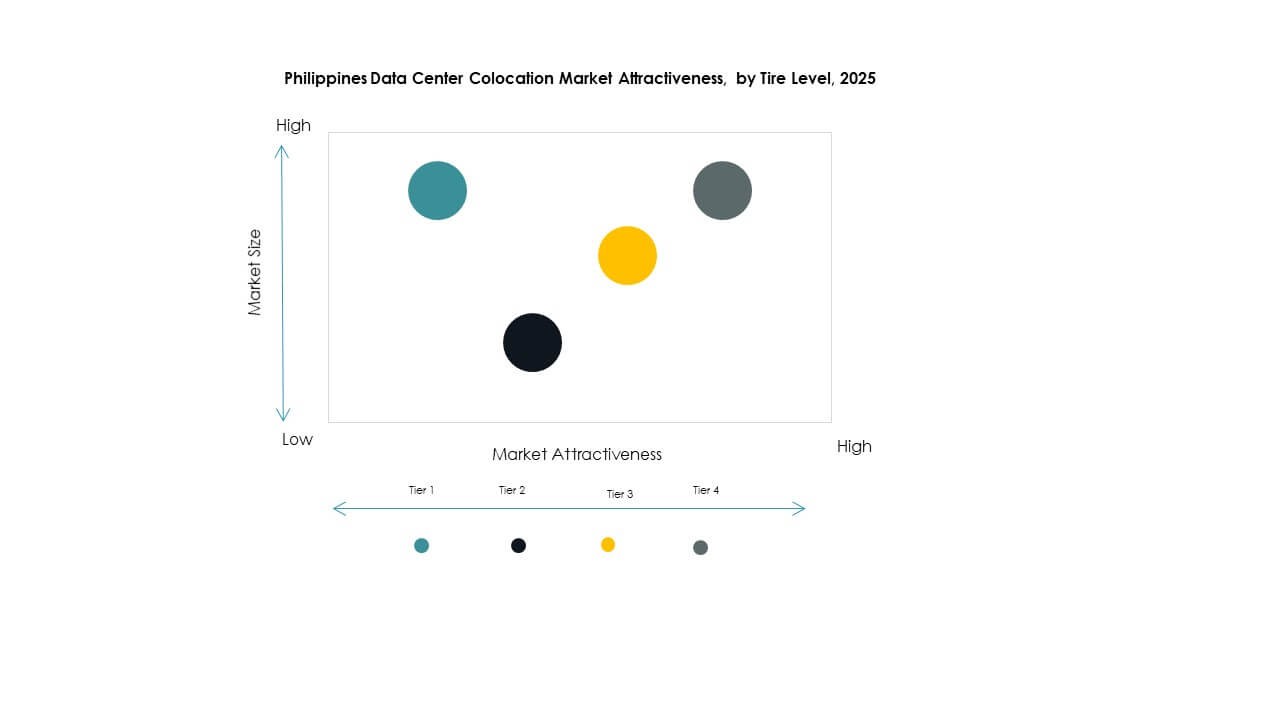

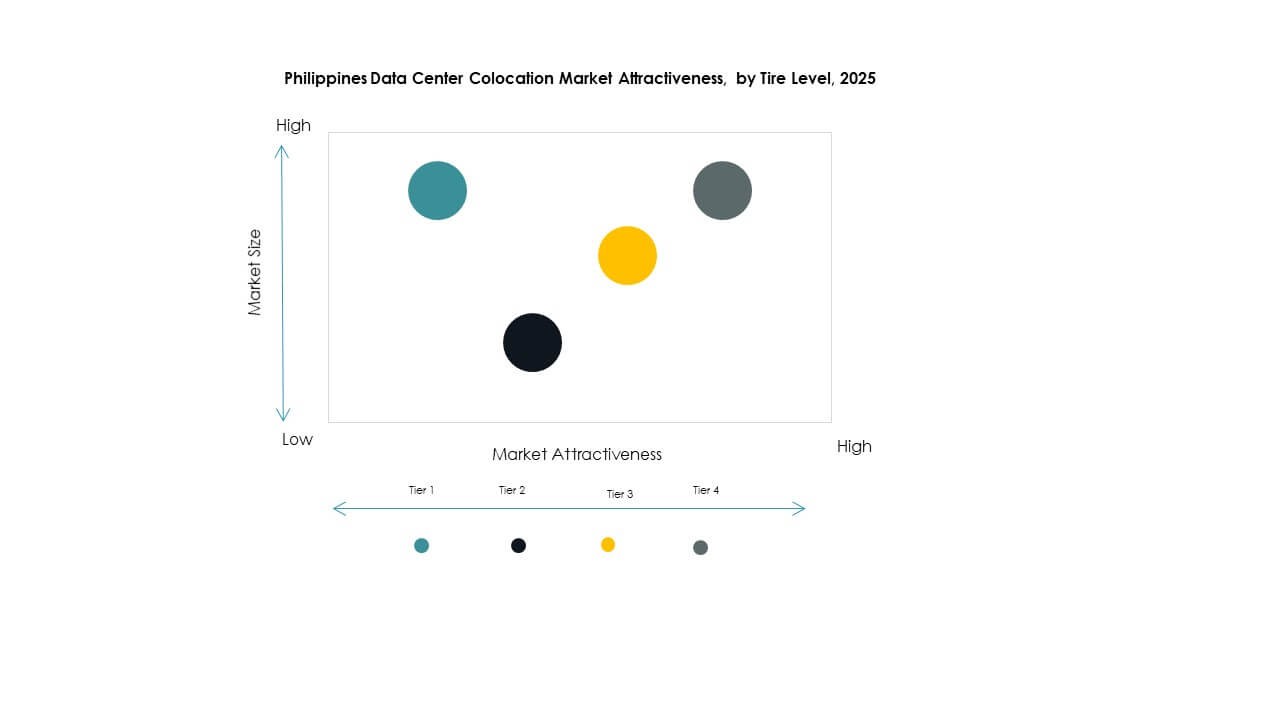

By Tier Level

Tier 3 facilities lead the Philippines Data Center Colocation Market with the highest market share. Their strong uptime, redundancy, and cost balance make them attractive for enterprises. Tier 4 adoption is increasing due to demand from BFSI and hyperscale operators. Tier 1 and Tier 2 sites serve SMEs and smaller businesses seeking cost-efficient hosting. The dominance of Tier 3 reflects a preference for reliability and operational efficiency in core markets.

By Enterprise Size

Large enterprises dominate the Philippines Data Center Colocation Market due to their complex workload demands and security requirements. These enterprises adopt colocation to achieve scalability, compliance, and cost optimization. SMEs are expanding their presence as cloud adoption grows. They use colocation to avoid infrastructure investments while maintaining control over IT assets. Large enterprises continue to drive revenue growth through high-capacity deployments.

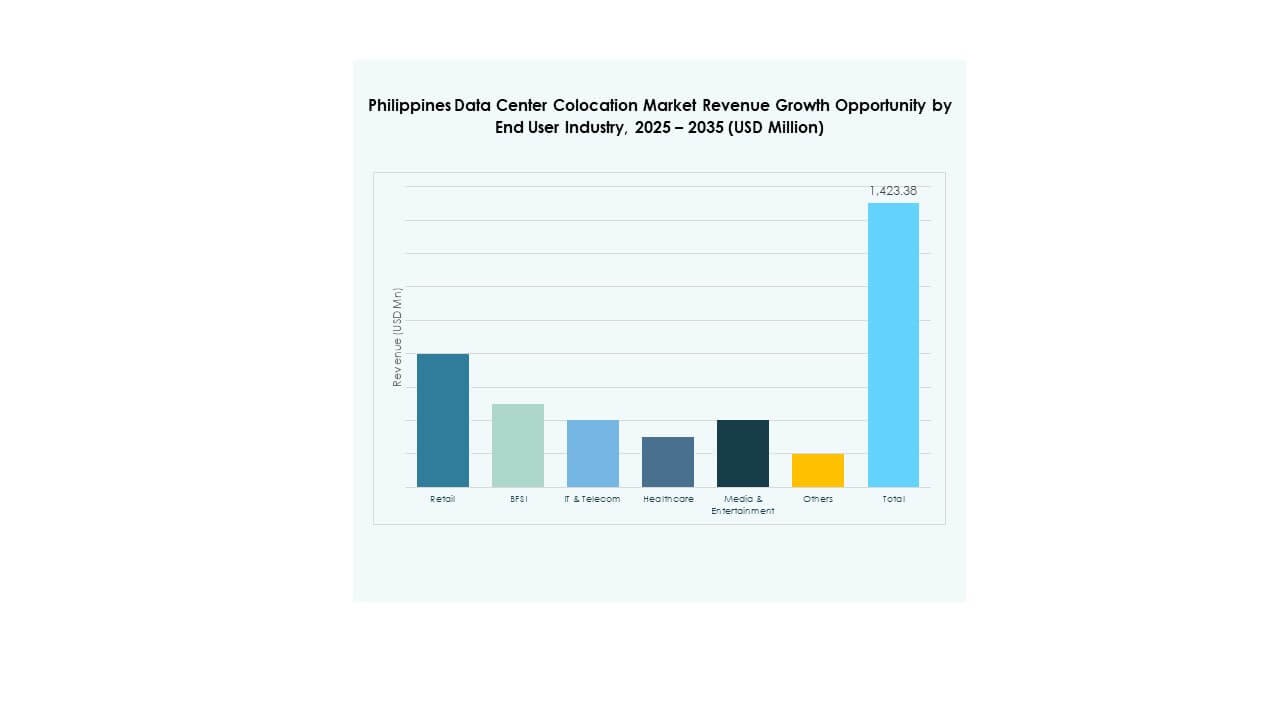

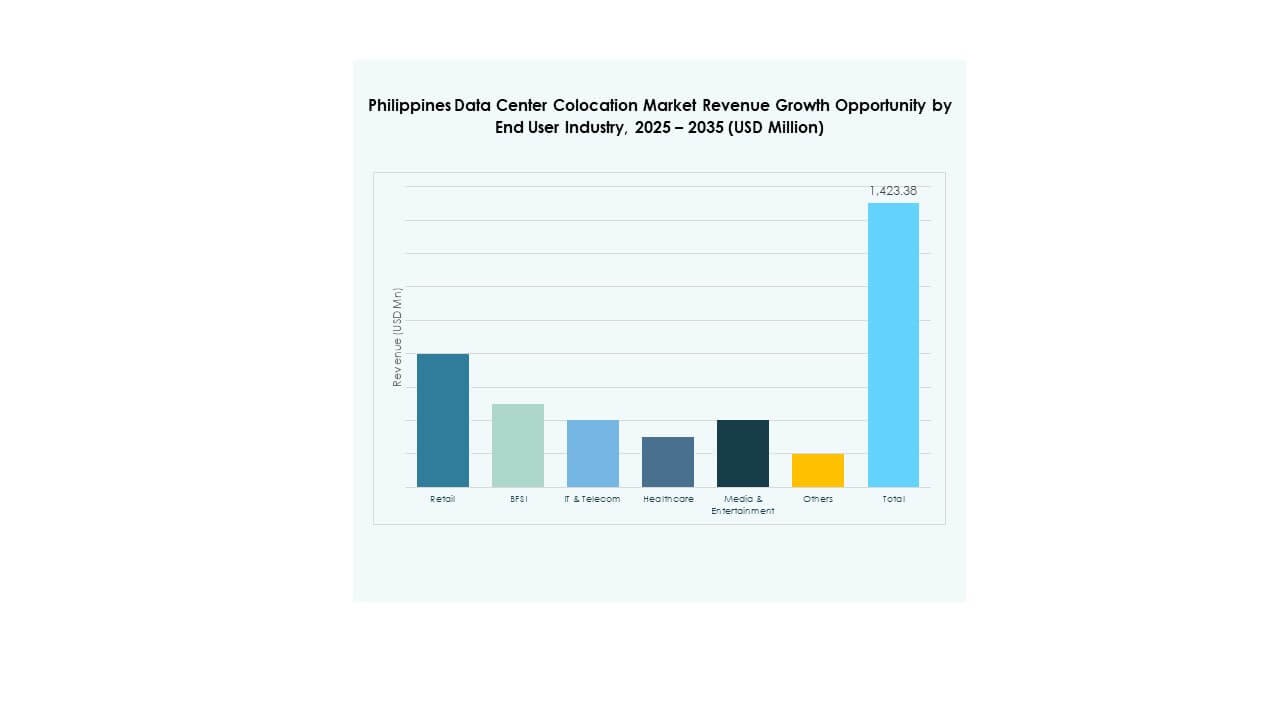

By End User Industry

IT & Telecom holds the largest share in the Philippines Data Center Colocation Market due to its high data processing and network requirements. BFSI drives demand for secure and compliant infrastructure. Healthcare and media sectors are expanding with the rise of digital services. Retail adoption is growing through omnichannel strategies and e-commerce. Other sectors like manufacturing and logistics are gradually increasing their participation. IT & Telecom remains the primary demand driver.

Regional Insights

Metro Manila: Core Hub Driving 67% Market Share

Metro Manila leads the Philippines Data Center Colocation Market with 67% share due to its advanced infrastructure and strong connectivity. The region hosts most hyperscale and enterprise data center deployments. Reliable power availability, fiber density, and proximity to business districts strengthen its dominance. International connectivity through submarine cable landing points enhances network resilience. It attracts multinational clients seeking low-latency services. The capital’s concentration of enterprises drives sustained growth in this subregion.

- For instance, ST Telemedia Global Data Centres (STT GDC) Philippines is developing the largest data center campus in the country STT Fairview campus with a planned IT capacity of 124 MW, set for full operations starting Q2 2025. This campus is billed as the largest AI-ready, carrier-neutral data center facility in the Philippines, already onboarding multiple connectivity partners to strengthen its ecosystem.

Cebu: Emerging Secondary Hub with 21% Market Share

Cebu accounts for 21% share and is emerging as a strong secondary hub. The city benefits from improving infrastructure, fiber network expansion, and growing enterprise demand. Local governments support digital investments through business incentives and streamlined approvals. Its strategic location supports disaster recovery and business continuity strategies. It attracts both domestic and international operators expanding outside Metro Manila. This growth strengthens the overall market ecosystem.

- For instance, ePLDT’s VITRO Cebu 2 is the biggest purpose-built data center outside Luzon. It is located in Mandaue City and holds an ANSI/TIA-942 Rated-3 certification for mission-critical operations. The facility is also Seismic Zone 4 compliant, strengthening its disaster resilience.

Davao and Other Regions: Strategic Growth Clusters with 12% Market Share

Davao and other regions hold 12% share and are positioned as future growth clusters. These areas offer strategic advantages for edge deployments and regional connectivity. Fiber expansion and infrastructure investments are improving readiness. They provide alternative locations for disaster recovery and service diversification. Supportive local policies and stable power supply encourage new investments. These regions will play a key role in decentralizing capacity and supporting national digital goals.

Competitive Insights:

- ePLDT / VITRO Data Centers

- Globe Business

- Eastern Communications

- DITO Telecommunity

- Google Cloud

- Philippines Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The competitive landscape of the Philippines Data Center Colocation Market is shaped by strong local operators and global hyperscale providers. ePLDT and Globe Business lead through extensive local infrastructure and enterprise partnerships. Global players such as Equinix, NTT, and Digital Realty strengthen their positions through high-density colocation and interconnection services. Google Cloud enhances the ecosystem with hyperscale capacity and cloud integration capabilities. Local telecom firms expand reach by upgrading Tier 3 and Tier 4 facilities. International firms focus on scalability, connectivity, and advanced sustainability standards. It drives healthy competition and pushes providers to invest in edge computing, renewable energy, and network expansion to meet rising enterprise demand.

Recent Developments:

- In September 2025, Eastern Communications entered into a strategic cybersecurity partnership with Nexusguard, a global leader in DDoS mitigation technologies. This collaboration, unveiled in Manila, will combine Nexusguard’s expertise in cloud-based protection with Eastern Communications’ infrastructure to deliver advanced cybersecurity solutions for Philippine enterprises and government agencies.

- In June 2025, Equinix made a significant move to strengthen its presence in the Philippines through the acquisition of three data centers MN1, MN2, and MN3 from Total Information Management, a local technology solutions provider. This acquisition was part of a broader regional expansion strategy within the APAC data center colocation market. The facilities, located in Manila, add more than 1,000 cabinets of capacity and include land for future development.

- In May 2025, Bridge Data Centres (BDC)entered a Memorandum of Understanding (MoU) with EcoCeres, a Hong Kong-based biofuels company, to develop hydrotreated vegetable oil (HVO) as a renewable alternative to diesel fuel for backup power systems in colocation data centers. While the initial focus is on Singapore, the sustainability-first strategy aligns with BDC’s ongoing expansion in the Philippines, where operators are actively seeking eco-efficient energy solutions.