Executive summary:

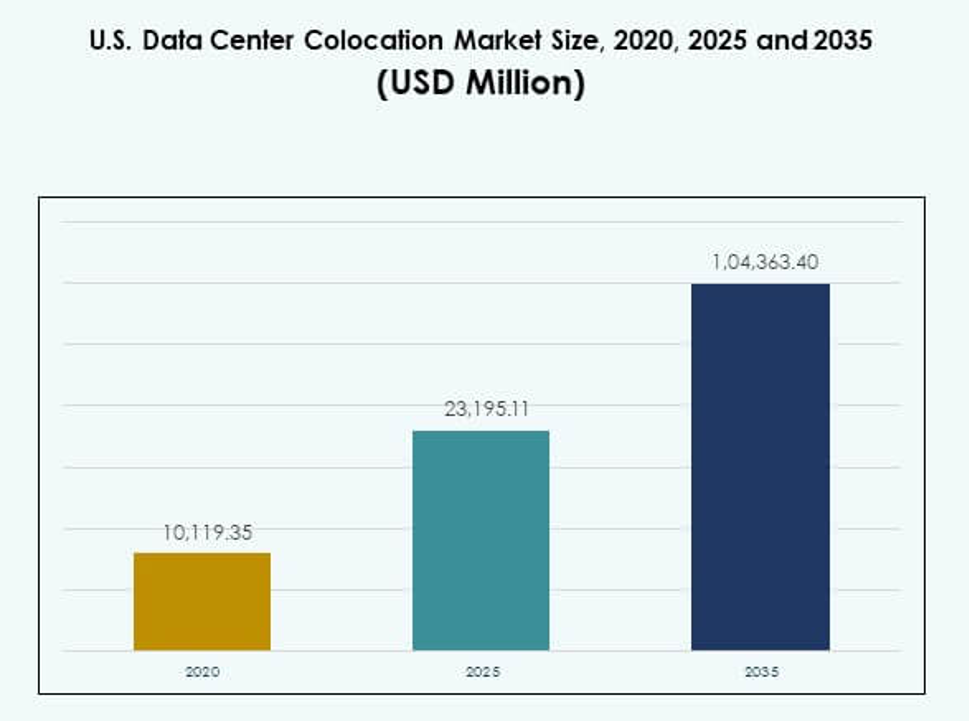

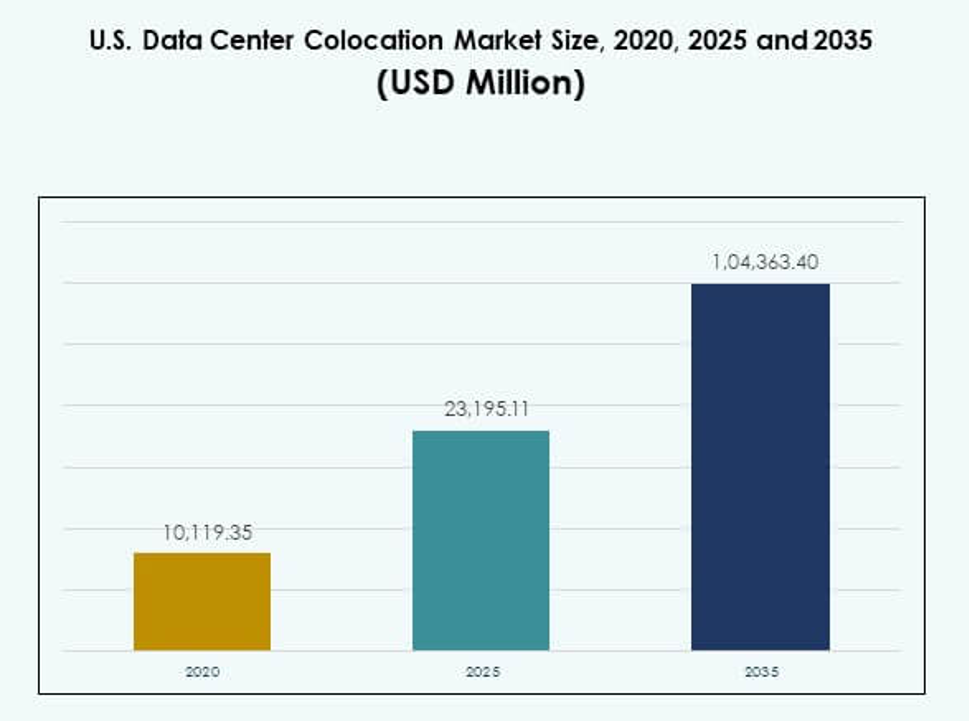

The U.S. Data Center Colocation Market size was valued at USD 10,119.35 million in 2020, reached USD 23,195.11 million in 2025, and is anticipated to reach USD 104,363.40 million by 2035, at a CAGR of 16.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| U.S. Data Center Colocation Market Size 2025 |

USD 23,195.11 Million |

| U.S. Data Center Colocation Market, CAGR |

16.15% |

| U.S. Data Center Colocation Market Size 2035 |

USD 104,363.40 Million |

Technology adoption and innovation are driving strong demand for advanced colocation services. Enterprises are shifting from on-premises setups to shared facilities that offer flexibility, speed, and operational efficiency. Modern facilities integrate AI-ready infrastructure, sustainable power systems, and strong interconnection ecosystems. For businesses and investors, it represents a strategic backbone supporting digital transformation, cost optimization, and future-ready growth across sectors like finance, healthcare, and telecom.

The Northeast leads the market due to its dense network ecosystem and hyperscale presence. Regions in the South and West are rapidly emerging with strong infrastructure investments, renewable energy access, and favorable regulatory environments. Secondary markets in the Midwest are expanding, driven by lower real estate costs and strategic edge deployments. This regional diversification strengthens national colocation capacity and ensures balanced digital infrastructure growth.

Market Drivers

Rising Enterprise Demand for Flexible and Scalable Infrastructure

The U.S. Data Center Colocation Market is witnessing strong growth driven by the shift from on-premises setups to scalable shared infrastructure. Large enterprises are choosing colocation facilities to reduce capital expenditure and improve IT agility. This approach enables faster deployment of workloads and improved disaster recovery capabilities. It also supports digital transformation goals across multiple industries. The availability of secure, redundant, and high-bandwidth environments strengthens operational efficiency. Investors view these facilities as long-term strategic assets with strong demand visibility. It enhances cost optimization while ensuring business continuity. Enterprises benefit from reliable infrastructure without complex ownership responsibilities.

Growing Role of Edge Computing and Low-Latency Network Needs

Edge computing is transforming how businesses manage data processing and distribution. Colocation providers are expanding edge-ready facilities to support latency-sensitive applications like AI, IoT, and AR/VR. Enterprises gain closer proximity to end users, improving response times and user experience. It enables industries such as finance, healthcare, and e-commerce to run real-time analytics more efficiently. Network densification is also accelerating, driving demand for interconnected hubs. These hubs act as a backbone for mission-critical applications. The need for ultra-fast connectivity makes colocation sites a key digital infrastructure. Investors see stable, recurring revenue from such deployments.

Rapid Integration of Sustainable Infrastructure and Energy Efficiency

Sustainability is becoming a central focus across infrastructure planning. Colocation operators are adopting advanced cooling systems, renewable power sources, and modular designs to lower energy footprints. Enterprises prefer facilities with energy-efficient certifications to meet ESG commitments. It strengthens the long-term viability of infrastructure investments. Sustainability strategies are also reducing operational costs through improved power usage effectiveness. Regulatory pressure and customer expectations are pushing this shift further. Green technologies also attract investment from funds with environmental mandates. The drive toward energy efficiency strengthens both competitiveness and operational resilience.

- For instance, Digital Realty matched 185 of its facilities with 100% renewable energy by mid-2025, reaching 1.5 gigawatts (GW) of renewable energy capacity under contract, and achieved ENERGY STAR certifications for 69% of its U.S. portfolio. This milestone is independently documented in Digital Realty’s 2024 Impact Report and widely covered in industry sustainability reports.

Accelerating Cloud and AI Workload Deployments Across Industries

The rapid expansion of AI workloads and cloud adoption is increasing demand for colocation services. Enterprises need high-performance computing environments without building new facilities. It supports seamless workload migration, hybrid cloud models, and multicloud strategies. AI training and inference rely on dense compute and high network capacity. Colocation hubs offer the required power, cooling, and interconnection for such workloads. Tech companies, banks, and healthcare systems are leading this adoption wave. Investors see strong growth potential in facilities serving AI ecosystems. The strategic value lies in delivering reliable infrastructure at scale.

- For instance, in 2025, CyrusOne operated 13 data centers in Northern Virginia and Texas, hosting 98 tenants under a securitization structure. These facilities form part of its core U.S. portfolio, supporting large-scale enterprise and cloud infrastructure demand in key regional hubs.

Market Trends

Expansion of Hyperscale-Ready Colocation Campuses Across Strategic Hubs

The U.S. Data Center Colocation Market is seeing rapid development of hyperscale campuses. Operators are building larger, more efficient facilities to support massive cloud and AI deployments. It allows enterprises to scale without building independent data centers. Major metros like Northern Virginia, Dallas, and Chicago are evolving into hyperscale clusters. These campuses offer multiple megawatts of IT power and carrier diversity. Developers are also integrating automation tools to streamline operations. The growing demand for interconnected ecosystems supports continued expansion. Hyperscale adoption is shaping long-term industry structure and competition.

Integration of Software-Defined Interconnection Platforms and Automation

Software-defined interconnection is reshaping how data center networks operate. Colocation providers are integrating orchestration platforms that enable dynamic connectivity between cloud services. It improves agility for enterprise IT environments. Businesses can easily manage traffic between multicloud and edge deployments. The shift toward automation lowers latency and simplifies network operations. It also improves security by enabling more granular control. Providers are investing in platforms that offer real-time visibility and scalability. This trend creates new competitive advantages for operators adopting programmable infrastructure.

Adoption of Modular and Prefabricated Designs for Faster Deployment

Modular construction methods are reducing deployment timelines for colocation facilities. Prefabricated components allow faster installation of power and cooling systems. It supports scalability and improves design standardization. This trend allows operators to meet rising demand with greater efficiency. The U.S. Data Center Colocation Market benefits from predictable construction schedules and lower capital risk. Modular designs also enable phased expansions aligned with customer needs. Operators use these designs to quickly enter emerging regional markets. It increases deployment speed and operational flexibility for investors and tenants.

Focus on Renewable Energy Procurement and Green Power Integration

Sustainability is becoming a major trend across data center operations. Operators are signing power purchase agreements to secure renewable energy sources. It reduces carbon emissions and supports environmental commitments. Colocation facilities are integrating solar, wind, and hydro energy sources into their grids. Green energy enhances brand reputation and attracts environmentally conscious clients. Operators also gain cost stability through long-term energy contracts. The emphasis on renewable energy aligns with global ESG goals. This trend strengthens long-term competitiveness and investment appeal.

Market Challenges

Power Supply Constraints and Infrastructure Strain in High-Demand Regions

The U.S. Data Center Colocation Market faces growing power availability challenges in several major hubs. Rapid hyperscale and enterprise deployments are increasing strain on utility grids. Limited power capacity can delay new facility launches and expansions. It creates competitive bottlenecks for operators and tenants. Local infrastructure also faces pressure from environmental regulations and planning delays. Rising energy prices further increase operational costs. It pushes operators to seek new strategies for power procurement. Meeting rising demand requires close coordination with utilities and regulators. Power constraints remain a critical risk factor for expansion plans.

Regulatory Complexity, Cybersecurity Concerns, and Skilled Workforce Gaps

Operators must navigate complex regulatory frameworks governing data security, sustainability, and land use. This environment increases project timelines and compliance costs. Cybersecurity risks also pose serious operational and reputational threats. It demands significant investment in security infrastructure and protocols. The shortage of skilled technical personnel adds another layer of difficulty. Recruiting and retaining talent is becoming more challenging for operators. Regulatory shifts can also impact site selection and operating models. These challenges require coordinated strategies to maintain competitiveness and service reliability.

Market Opportunities

Rising Investments in Edge Deployments and Secondary Market Expansion

The U.S. Data Center Colocation Market offers growth potential through edge expansion. Secondary markets are becoming attractive for operators due to lower costs and available power. It enables improved coverage for low-latency applications. Enterprises benefit from distributing workloads across multiple sites. Operators gain strategic positioning outside overcrowded metros. Edge deployments also align with the expansion of 5G networks. This creates new opportunities for investors seeking early market entry.

Growing Demand for AI Infrastructure and Sustainable Data Centers

AI workloads are driving significant demand for advanced colocation environments. Facilities with high power density and efficient cooling are attracting enterprise clients. It also increases investor interest in energy-optimized sites. Companies are targeting facilities designed for GPU clusters and high-speed connectivity. Sustainability commitments further enhance investment appeal. Green data centers with renewable energy integration hold strong growth potential. This shift is creating new revenue streams across multiple industries.

Market Segmentation

By Type

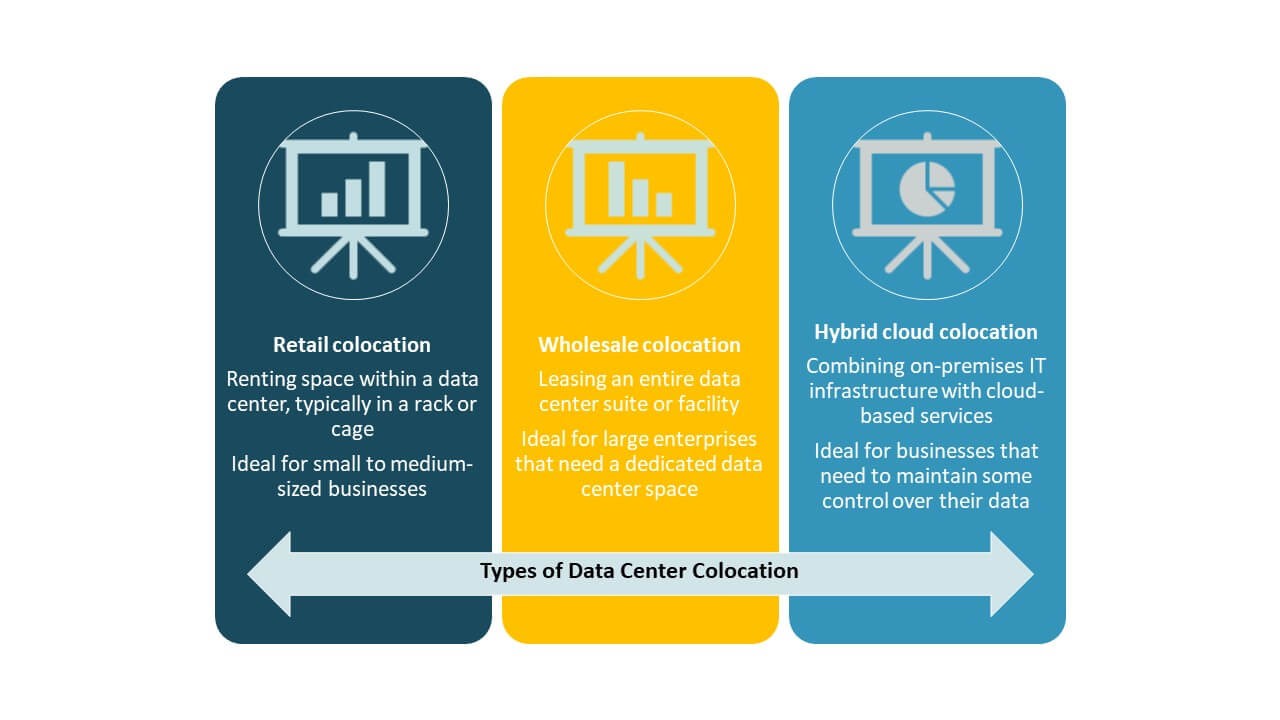

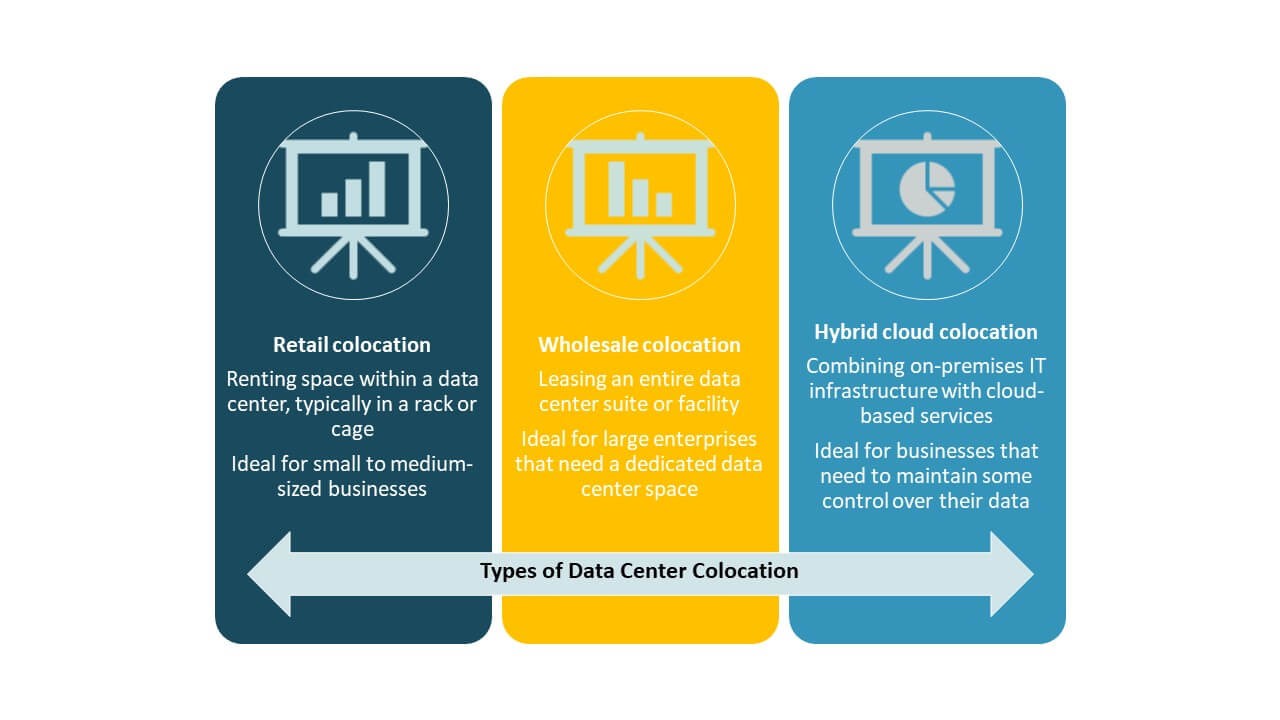

Retail colocation dominates the U.S. Data Center Colocation Market with a strong share driven by flexibility and cost control. It allows enterprises to lease smaller space with shared infrastructure and robust connectivity. Wholesale colocation is gaining traction among hyperscale clients for larger power and space needs. Hybrid colocation is expanding with the rise of hybrid cloud strategies. The mix of these segments reflects diverse enterprise IT requirements and strategic priorities across industries.

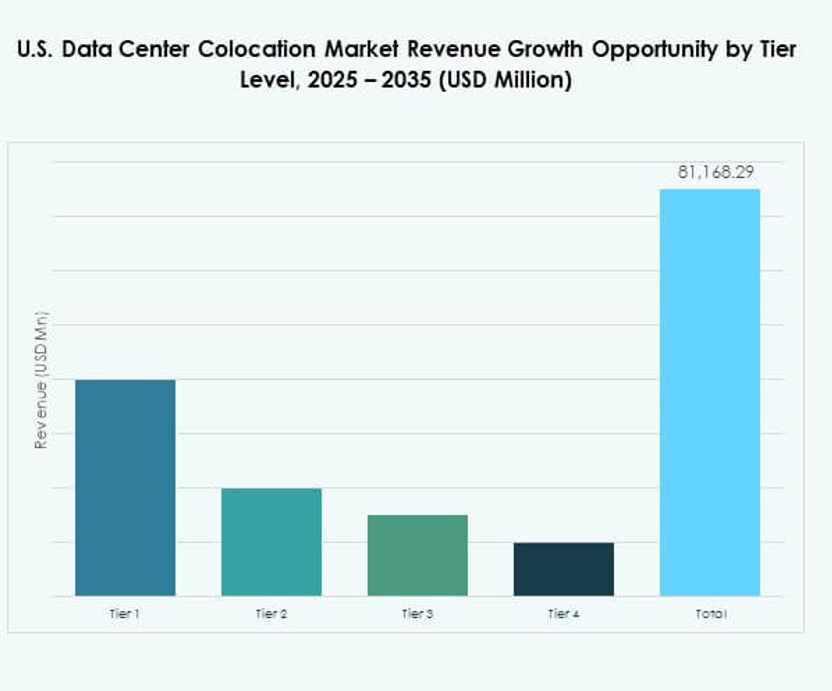

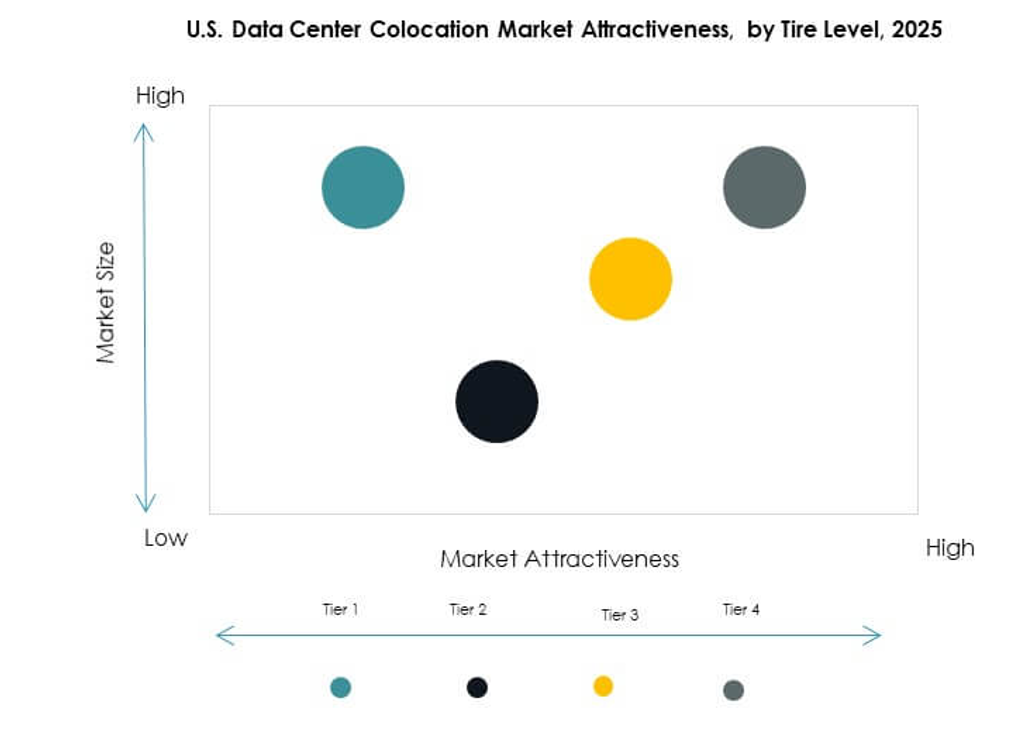

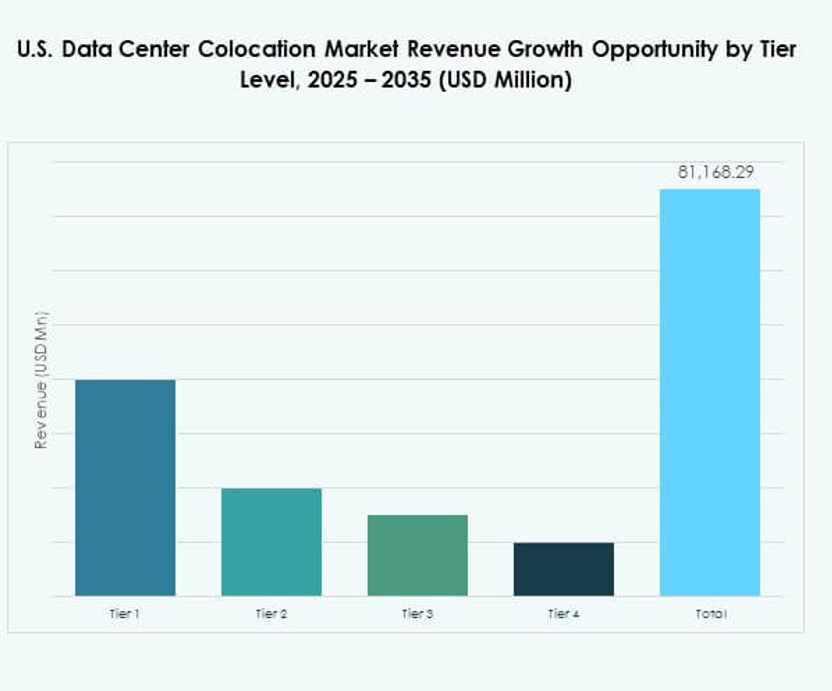

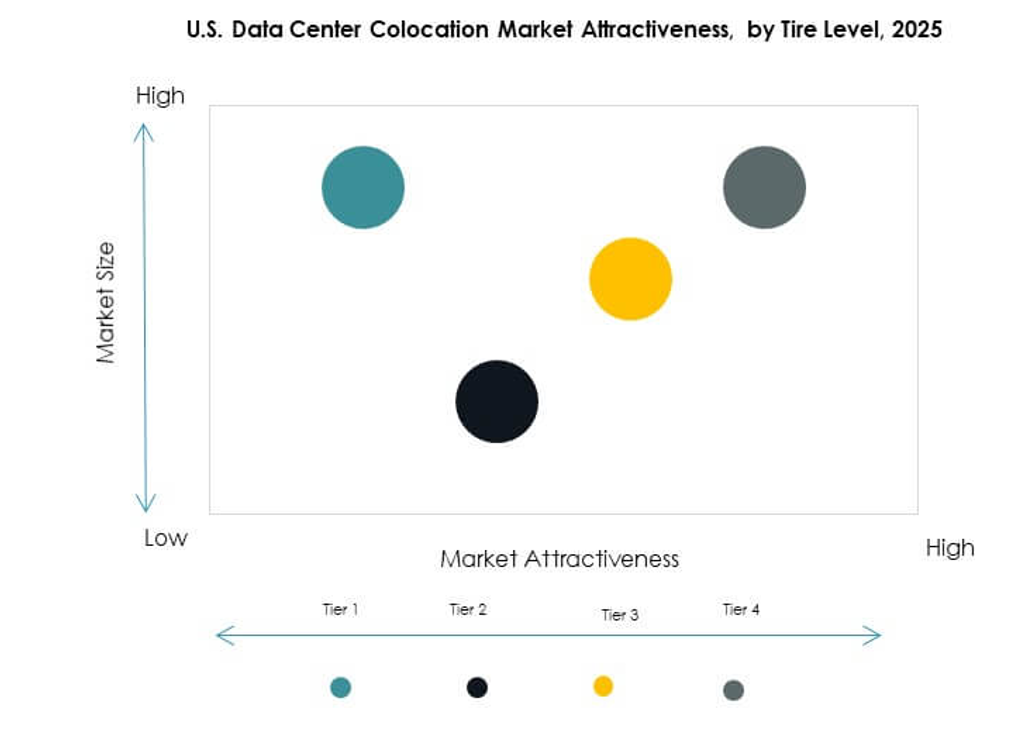

By Tier Level

Tier 3 facilities hold the largest market share due to their high reliability and redundancy features. Enterprises prefer Tier 3 for mission-critical workloads and compliance assurance. Tier 4 is growing steadily with advanced fault tolerance and high uptime standards. Tier 1 and Tier 2 cater to smaller deployments with less critical workloads. The focus on Tier 3 and Tier 4 reflects strong demand for secure and continuous operations. It drives infrastructure investment and site development strategies.

By Enterprise Size

Large enterprises dominate the market due to their significant workload requirements and cloud adoption strategies. They prefer colocation to reduce capital costs and enhance operational flexibility. SMEs are increasingly adopting colocation for scalable growth and better connectivity access. Their entry supports market diversification and broadens customer base. The ability to support multiple enterprise sizes strengthens the value proposition. It drives sustained demand for flexible colocation models.

By End User Industry

IT & Telecom leads the market with the largest share due to strong data traffic and cloud service demands. BFSI follows with high-security requirements and compliance priorities. Healthcare and media industries are also increasing adoption to support digital transformation. Retail and others contribute to steady demand growth across distributed networks. Each vertical brings unique requirements, shaping facility design and service models. The strong demand across sectors reflects the strategic role of colocation in the digital economy.

Regional Insights

Northeast Region – 34.5% Market Share

The Northeast holds the largest share of the U.S. Data Center Colocation Market due to the strong presence of cloud providers and hyperscale operators. Northern Virginia leads as the country’s primary data hub with extensive network density. High fiber availability and strategic proximity to government agencies boost demand. It attracts both domestic and international investors seeking low-latency interconnections. The region benefits from advanced infrastructure and regulatory support. Energy availability and strategic land positions reinforce its dominance.

- For instance, Equinix operates over 620,000 square feet of data center space on its Ashburn campus, which serves as one of the internet’s busiest intersections and hosts interconnections with nearly 200 network service providers. This site plays a critical role in supporting high-capacity, low-latency digital infrastructure.

South and West Regions – 33.8% Market Share

The South and West regions are rapidly expanding due to strong enterprise growth and lower energy costs. Texas, Arizona, and California are emerging as major data center clusters. The availability of renewable energy and large development sites makes them attractive for hyperscale projects. It supports rising AI, edge, and cloud workloads. Investors favor these states for their business-friendly environments and infrastructure readiness. Strong connectivity to global networks boosts their strategic value in long-term growth.

Midwest and Emerging Secondary Markets – 31.7% Market Share

The Midwest and other secondary markets are becoming important growth areas. States such as Ohio, Illinois, and Colorado offer stable energy costs and untapped capacity. Edge deployments are driving activity outside crowded metros. It allows enterprises to build distributed architectures that improve service reach. Lower real estate costs and local incentives attract new operators. These regions are developing into strong alternatives to traditional hubs. Their growth enhances the geographic balance of national colocation capacity.

- For instance, in 2025, Stack Infrastructure announced a new multi-story data center facility in Chicago with at least 20MW of additional critical capacity, bringing the site’s total to a minimum of 33MW, further reinforcing Chicago’s position as a leading secondary colocation hub.

Competitive Insights:

- China Telecom Corporation Limited

- Cologix

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Centersquare

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- Iron Mountain, Inc.

- NTT Ltd. (NTT DATA)

- QTS Realty Trust, LLC

- Rackspace Technology

- Telehouse (KDDI CORPORATION)

- Zayo Group, LLC

The competitive landscape of the U.S. Data Center Colocation Market is shaped by large global operators and strong domestic providers. It reflects intense competition focused on capacity expansion, network interconnection, and sustainable infrastructure. Leading players such as Equinix and Digital Realty are investing heavily in hyperscale campuses and advanced interconnection platforms. Mid-sized operators like Cologix and Flexential strengthen their regional presence through targeted facility upgrades. Strategic partnerships and renewable energy sourcing are key competitive levers. Companies also focus on edge deployments and service differentiation to attract enterprise clients. The emphasis on security, uptime, and multicloud flexibility drives aggressive infrastructure investments. Strong market presence depends on network reach, service reliability, and customer trust.

Recent Developments:

- In October 2025, Centersquare, a Dallas-based colocation provider, completed a series of acquisitions involving ten data centers across the United States and Canada, totaling $1 billion in value. This move raises Centersquare’s portfolio to 80 data center facilities, further strengthening its capacity to serve high-density workloads and emerging AI-driven requirements in strategic U.S. markets.

- In September 2025, Flexential acquired a prime property in Hillsboro, Oregon, to build its sixth data center in the city, Hillsboro 6, a two-story facility expected to provide 27 MW of new colocation capacity. This expansion is designed to fill supply gaps in one of the nation’s densest and fastest-growing colocation markets, aiming to support cloud, AI, and enterprise workloads through high-performance and flexible infrastructure.

- In September 2025, OpenAI, Oracle, and SoftBank jointly announced five new AI-focused data center sites in the United States as part of the Stargate platform. These facilities, spread across Texas, New Mexico, Ohio, and the Midwest, represent a partnership that will expand AI infrastructure, add thousands of jobs, and increase colocation capacity for advanced computing workloads over the next three years.

- In July 2025, Cologix secured $525 million in financing through an asset-backed securitization to expand its AI and cloud data center infrastructure, bolstering its edge capacity for U.S. hyperscale and enterprise clients, and enabling enhanced support for inference AI and cloud workloads. This investment directly addresses growing U.S. demand for edge computing in the colocation sector.