Executive summary:

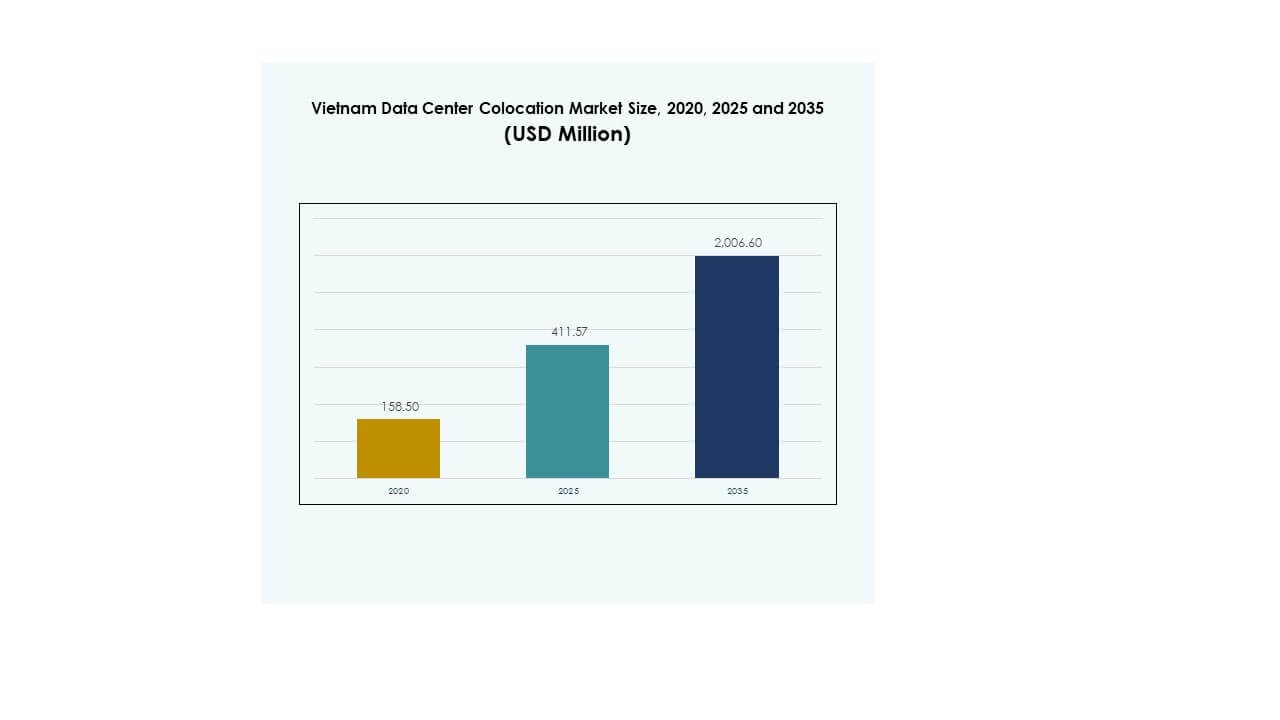

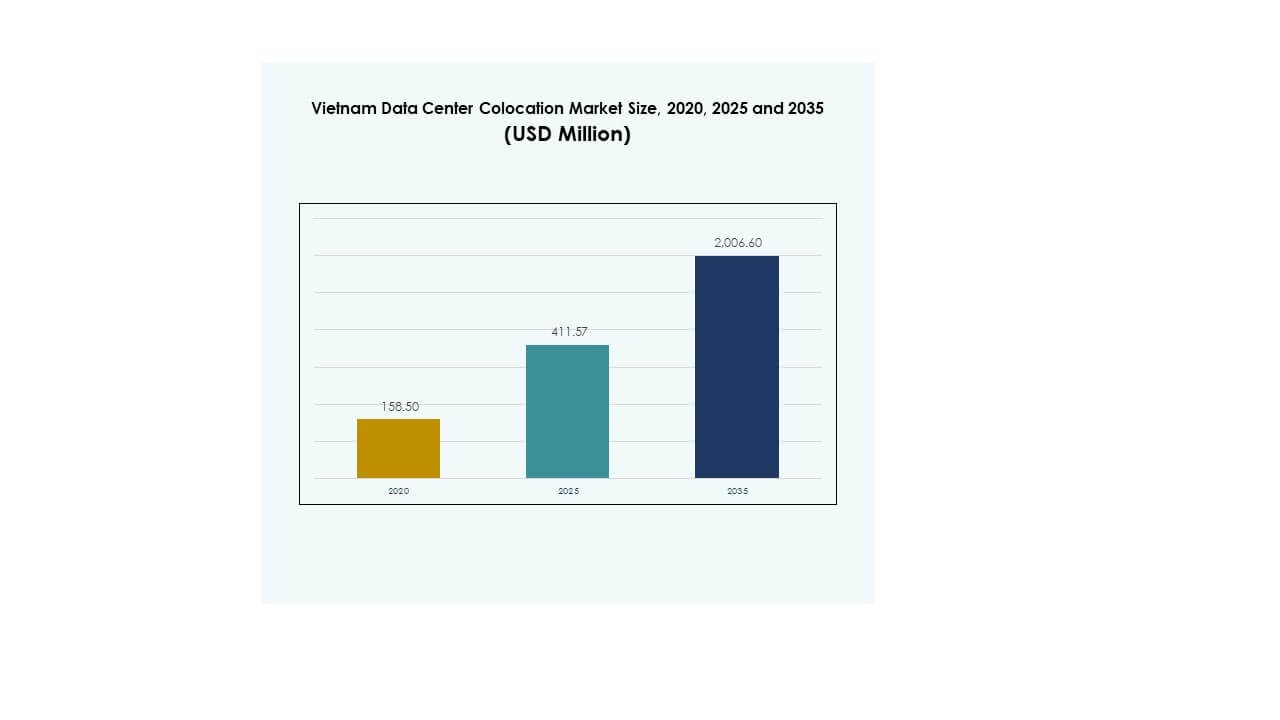

The Vietnam Data Center Colocation Market size was valued at USD 158.50 million in 2020 to USD 411.57 million in 2025 and is anticipated to reach USD 2,006.60 million by 2035, at a CAGR of 17.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Vietnam Data Center Colocation Market Size 2025 |

USD 411.57 Million |

| Vietnam Data Center Colocation Market, CAGR |

17.07% |

| Vietnam Data Center Colocation Market Size 2035 |

USD 2,006.60 Million |

Rising digital transformation, rapid cloud adoption, and increasing edge computing deployments are driving demand across industries. Enterprises are shifting workloads to colocation facilities to improve operational efficiency, scalability, and network performance. Innovation in AI-driven infrastructure and green technologies is reshaping investment priorities. The Vietnam Data Center Colocation Market plays a strategic role for businesses and investors seeking stable, secure, and future-ready data ecosystems.

Hanoi leads the market due to its advanced telecom backbone, enterprise activity, and strong government support. Ho Chi Minh City is rapidly expanding with hyperscale developments, making it a key growth hub. Central and southern provinces are emerging due to industrial corridor expansion and improved connectivity, reinforcing Vietnam’s position as a regional digital gateway.

Market Drivers

Accelerating Digital Transformation Across Enterprises

Rapid enterprise digitalization is driving sustained demand for scalable and secure colocation services. Businesses are modernizing their IT infrastructure to support cloud-first strategies and hybrid models. It enables faster application delivery, improved security, and lower operational costs. Organizations in banking, e-commerce, and manufacturing are increasing investment in advanced IT ecosystems. The Vietnam Data Center Colocation Market benefits from this shift as more enterprises migrate workloads to colocation facilities. This demand strengthens connectivity, boosts data processing capacity, and supports innovation. The market aligns with the government’s digital agenda and enterprise modernization goals.

- For instance, in April 2025, Viettel IDC launched construction of its 140 MW Tan Phu Trung Data Center in Ho Chi Minh City, designed to host up to 10,000 racks with a PUE below 1.4, supporting financial services, AI, and e-commerce clients. The facility targets Tier III certification and contributes to Vietnam’s digital modernization strategy

Rising Cloud and Edge Computing Deployment

Edge computing and cloud adoption are creating strong infrastructure needs across industries. Many enterprises prefer colocation to reduce latency and ensure data compliance. The strategy improves performance for mission-critical applications and advanced analytics. Telecom operators and hyperscalers are expanding their footprint through colocation facilities. It helps businesses gain flexibility, speed, and reliability without building their own centers. The Vietnam Data Center Colocation Market gains traction from the rapid adoption of IoT, AI, and automation. This transformation also strengthens operational continuity and network efficiency.

- For instance, in July 2025, CMC Technology Group received government approval to build a USD 250 million hyperscale data center at Saigon Hi-Tech Park in Ho Chi Minh City. The facility will start with 30 MW of IT capacity, scalable to 120 MW, and integrate 800 Gbps optical links with Digital Twin technology to enhance operational performance.

Strengthening Renewable and Green Infrastructure Adoption

Sustainability is becoming central to IT infrastructure investments. Operators are integrating renewable energy and energy-efficient cooling systems into new facilities. This shift lowers energy costs and reduces environmental impact. Green data center certifications and stricter carbon regulations are reinforcing the trend. It attracts global cloud providers that prioritize low PUE and green standards. The Vietnam Data Center Colocation Market reflects these shifts with growing green investment pipelines. It enhances competitiveness and aligns with regional net-zero strategies.

Strategic Investments by Telecom and Hyperscale Providers

Telecom operators and hyperscalers are accelerating investments in advanced colocation hubs. The growing demand for 5G, AI, and digital services requires high-capacity, low-latency networks. New partnerships and strategic expansions are transforming data infrastructure at scale. These investments strengthen Vietnam’s position as a digital hub in Southeast Asia. It also creates stable revenue streams for operators and service providers. The Vietnam Data Center Colocation Market benefits from rising hyperscale demand, improved network resilience, and foreign direct investment inflows.

Market Trends

Emergence of High-Density and Modular Data Center Designs

Operators are shifting to modular and high-density colocation facilities to meet growing workloads. Modular designs offer faster deployment, scalability, and operational flexibility. High-density racks support advanced applications like AI, IoT, and machine learning. It enables operators to serve enterprise customers more efficiently. The Vietnam Data Center Colocation Market is adapting to new architecture standards and optimized cooling systems. This trend enhances energy efficiency and allows rapid capacity expansion. It also aligns with global best practices in infrastructure design.

Integration of Software-Defined Infrastructure and Automation

Automation and software-defined solutions are transforming colocation operations. These technologies optimize resource allocation, enhance monitoring, and reduce downtime. It also supports dynamic workload management and cost efficiency. Data center operators are deploying intelligent management systems for better control and agility. The Vietnam Data Center Colocation Market is embracing AI-driven monitoring to enhance reliability and service uptime. These trends reduce operational complexity and improve energy performance. They position providers for strong competitiveness in the regional market.

Expansion of Carrier-Neutral and Interconnected Ecosystems

Carrier-neutral colocation ecosystems are gaining preference among enterprises. The design allows multiple network providers and cloud services to interconnect seamlessly. It boosts flexibility and enhances traffic management. Many data centers are integrating direct cloud on-ramps to support multi-cloud strategies. The Vietnam Data Center Colocation Market is witnessing a rise in interconnected facilities and cross-border peering. This trend increases market attractiveness for global operators and accelerates cloud migration. It also creates stronger ecosystem partnerships.

Rise of Edge Data Centers in Emerging Industrial Zones

Edge facilities are expanding beyond urban hubs to industrial corridors. This growth supports real-time processing needs for smart manufacturing, logistics, and smart city projects. Edge deployments improve latency and enable localized data storage. It allows businesses to comply with data residency and privacy rules. The Vietnam Data Center Colocation Market benefits from government incentives and enterprise adoption. These edge deployments strengthen regional digital infrastructure and attract hyperscale collaboration. It reinforces Vietnam’s role as a connectivity hub.

Market Challenges

Regulatory Complexity and Infrastructure Limitations

Regulatory frameworks around data security and privacy remain fragmented. Multiple approvals, evolving compliance requirements, and limited clarity increase project timelines. Power grid limitations and uneven energy distribution across provinces pose infrastructure risks. High dependency on imported equipment increases operational costs and lead times. It creates complexity for foreign investors planning large-scale deployments. The Vietnam Data Center Colocation Market faces delays in project execution and integration. Addressing regulatory gaps and power stability remains a strategic priority.

Skilled Workforce Shortage and Supply Chain Constraints

The shortage of skilled IT and data center professionals slows deployment efficiency. Limited availability of experienced technicians impacts operational reliability. Supply chain delays for critical hardware like cooling systems and power equipment affect capacity expansion plans. These constraints reduce speed-to-market for operators. It also increases dependency on external vendors and technology partners. The Vietnam Data Center Colocation Market must strengthen local skills development and vendor diversification. This challenge requires coordinated investment in talent and infrastructure resilience.

Market Opportunities

Growing Hyperscale Partnerships and AI Infrastructure Demand

Rising adoption of AI, 5G, and cloud creates strong opportunities for hyperscale partnerships. Global cloud and content providers are exploring Vietnam for edge and regional hubs. It enhances the country’s role in the regional digital ecosystem. The Vietnam Data Center Colocation Market gains from expanding hyperscale partnerships and strategic alliances. These partnerships improve infrastructure resilience and global connectivity.

Strategic Advantage as a Regional Connectivity Hub

Vietnam’s location and trade routes offer a unique advantage for digital traffic exchange. Submarine cable expansions and peering facilities enhance cross-border capacity. The government’s digital strategy attracts investment from regional telecom operators. The Vietnam Data Center Colocation Market can leverage its position to serve Southeast Asia. This opportunity strengthens foreign direct investment inflows and global integration.

Market Segmentation

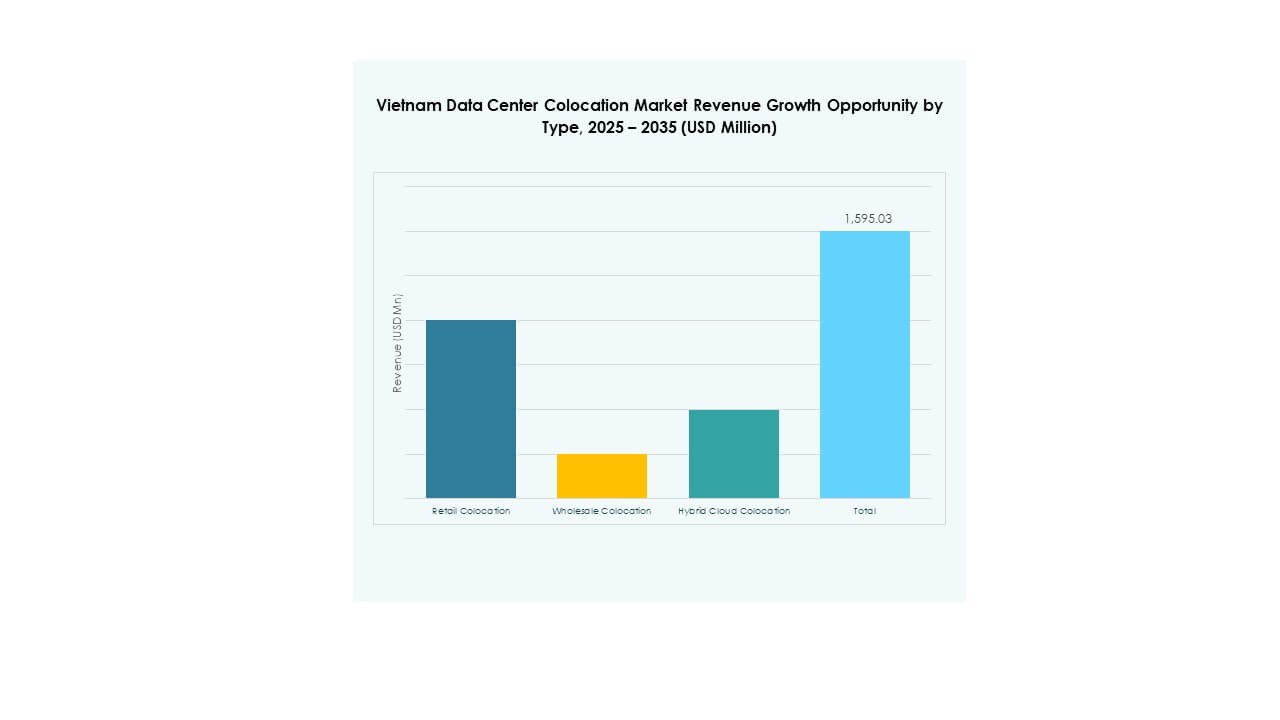

By Type

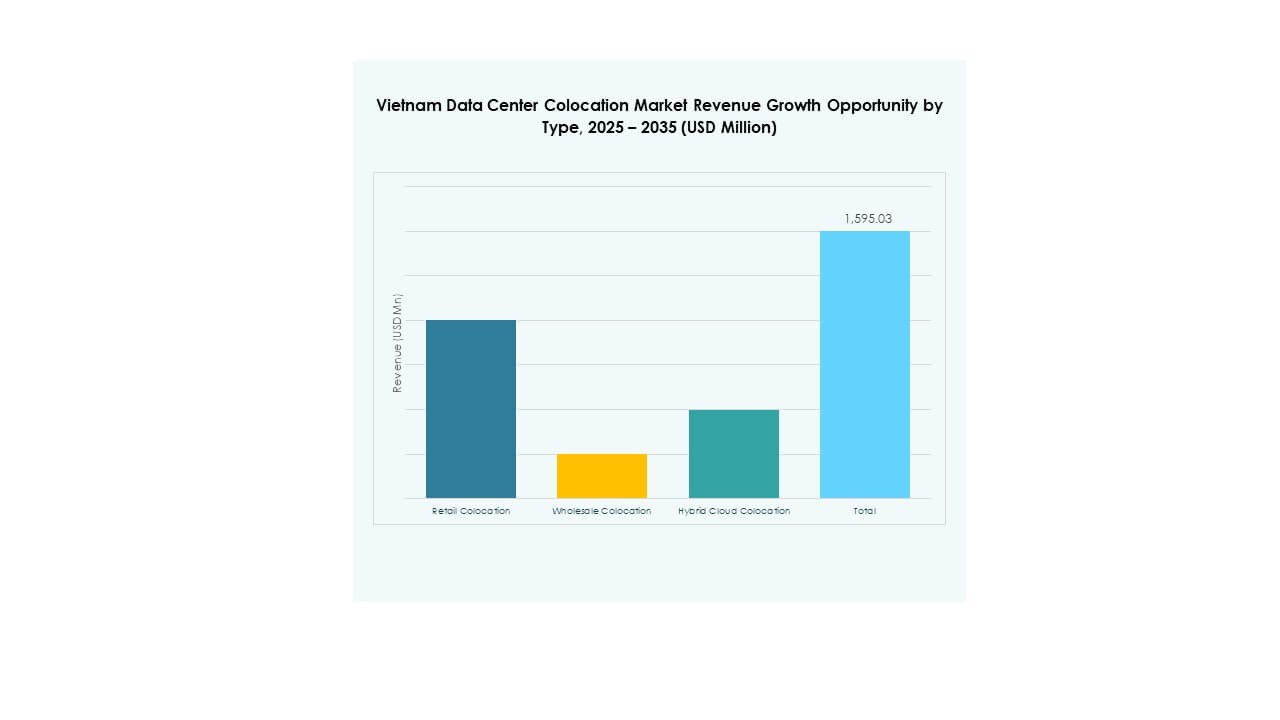

Retail colocation holds a dominant market share due to its flexibility and cost benefits for enterprises. It supports scalable solutions, making it attractive for mid-sized and large businesses. Wholesale colocation gains traction among hyperscalers needing dedicated capacity. Hybrid cloud colocation is expanding as firms adopt mixed deployment models. The Vietnam Data Center Colocation Market benefits from a rising preference for scalable and hybrid models. Retail colocation leads adoption, while hybrid models show the fastest growth.

By Tier Level

Tier 3 facilities dominate the market with a significant share, supported by high availability and reliability. Enterprises prefer Tier 3 due to its balance between cost and performance. Tier 4 facilities are emerging in critical infrastructure projects requiring maximum uptime. Tier 1 and Tier 2 serve smaller workloads and localized needs. The Vietnam Data Center Colocation Market reflects strong demand for Tier 3 as the preferred standard. This segment drives infrastructure expansion and enterprise adoption.

By Enterprise Size

Large enterprises lead market adoption due to their demand for advanced security and network redundancy. They prefer colocation to scale efficiently without high capital investment. SMEs are expanding adoption driven by cloud migration and cost-effective solutions. Many smaller firms are moving workloads to shared infrastructure to improve efficiency. The Vietnam Data Center Colocation Market sees strong growth from SMEs adopting flexible pricing models. Large enterprises, however, remain the core revenue drivers.

By End User Industry

IT & Telecom dominates with a large share due to network expansion and 5G growth. BFSI follows with rising compliance and data security needs. Retail, healthcare, and media sectors are increasing investment in digital infrastructure. The Vietnam Data Center Colocation Market reflects the rapid digitalization across multiple sectors. IT & Telecom sets the pace, supported by rapid innovation and network growth. BFSI and healthcare segments show strong potential for future expansion.

Regional Insights

Hanoi and Northern Vietnam Leading with Strong Digital Infrastructure

Hanoi leads the Vietnam Data Center Colocation Market with 41% share. The region benefits from strong connectivity, government support, and telecom presence. High enterprise concentration and proximity to industrial hubs boost colocation demand. The region attracts both domestic and foreign investments in Tier 3 and Tier 4 facilities. It also serves as a core connectivity node for northern provinces.

- For instance, in August 2025, Vietnam’s Ministry of Public Security inaugurated National Data Center No. 1 at Hoa Lac Hi-Tech Park in Hanoi. The 20-hectare facility houses around 1,300 server racks and is among the largest national-level data centers in Southeast Asia, designed to strengthen Vietnam’s digital infrastructure and data security.

Ho Chi Minh City Driving Growth with Hyperscale and Cloud Expansion

Ho Chi Minh City holds 36% share, supported by its dynamic business ecosystem. The presence of global telecom operators and hyperscalers accelerates capacity development. Colocation providers are expanding new facilities to meet growing enterprise demand. Strategic connectivity routes and urbanization support further growth. The region is becoming a hub for edge computing and AI infrastructure.

Emerging Central and Southern Industrial Corridors Gaining Traction

Central and southern provinces contribute 23% of the market share. Industrial corridors in Binh Duong, Da Nang, and neighboring areas are expanding infrastructure. These areas support edge deployments to serve manufacturing and logistics sectors. The region attracts investments from both local and regional operators. The Vietnam Data Center Colocation Market benefits from these emerging zones that extend capacity beyond major cities. These subregions are expected to grow steadily in the next decade.

- For instance, VNPT IDC operates a data center in Da Nang to support regional enterprise and industrial demand. Viettel is also expanding infrastructure in Da Nang and Binh Duong as part of its broader digital network development strategy.

Competitive Insights:

- Vietnam Posts and Telecommunications (VNPT)

- FPT Telecom

- CMC Telecom

- Viettel IDC

- Amazon Web Services (AWS)

- Google Cloud

- Vietnam Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Vietnam Data Center Colocation Market features a mix of strong domestic operators and global hyperscale leaders. VNPT, Viettel IDC, FPT Telecom, and CMC Telecom dominate local infrastructure through extensive network coverage and government partnerships. Global players such as AWS, Google Cloud, Equinix, and Digital Realty strengthen the market with advanced cloud integration, high-capacity facilities, and interconnection services. It is witnessing rising strategic alliances, mergers, and capacity expansions. Hyperscalers focus on edge deployments, while domestic firms invest in energy efficiency and compliance. The competition drives infrastructure upgrades, improved service reliability, and broader geographic reach.

Recent Developments:

- In September 2025, VNPT entered a strategic partnership with Japan’s KDDI Corporation to expand digital infrastructure and data services across Vietnam. The Memorandum of Understanding focuses on co-developing secure cloud and colocation facilities to support enterprise digital transformation, marking VNPT’s push into next-generation connectivity and AI-driven colocation solutions.

- In September 2025, FPT signed an MoU valued at up to USD 30 million with Konica Minolta and the Vietnam National Innovation Center to launch a multi-year AI transformation program. This partnership will include AI-focused cloud integration within FPT’s colocation data centers, enhancing computing efficiency and creating enterprise-ready cloud infrastructure for Vietnam’s rapidly growing digital ecosystem.

- In April 2025, Viettel IDC initiated construction of a 140 MW hyperscale data center in Ho Chi Minh City’s Tan Phu Trung Industrial Park. The new site—Vietnam’s largest green facility—will host 10,000 racks using energy‑efficient cooling, AI processing, and scalable colocation capabilities. Completion is scheduled for 2030, reinforcing Viettel’s leadership in the Vietnamese data center industry.