Executive summary:

The Romania Data Center Colocation Market size was valued at USD 84.93 million in 2020 to USD 162.08 million in 2025 and is anticipated to reach USD 531.01 million by 2035, at a CAGR of 12.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Romania Data Center Colocation Market Size 2025 |

USD 162.08 Million |

| Romania Data Center Colocation Market, CAGR |

12.53% |

| Romania Data Center Colocation Market Size 2035 |

USD 531.01 Million |

The market is driven by increasing enterprise cloud adoption, rising demand for scalable infrastructure, and growing investments in energy-efficient facilities. Companies are integrating advanced technologies like AI, edge computing, and hybrid cloud platforms to improve performance and connectivity. Strategic positioning within Eastern Europe makes Romania attractive for businesses and investors seeking low-latency operations, improved data security, and flexible colocation solutions.

Western Europe leads the regional landscape with established infrastructure and advanced connectivity networks. Romania is emerging as a key growth hub due to its expanding fiber backbone and favorable investment conditions. Central and Eastern European countries are scaling capacity rapidly, enhancing cross-border data exchange and reinforcing Romania’s position as a strategic digital gateway.

Market Drivers

Growing Demand for Scalable and Energy-Efficient Colocation Facilities

The Romania Data Center Colocation Market is expanding due to a surge in cloud adoption and enterprise digital transformation. Businesses are migrating workloads from on-premises setups to scalable colocation environments for better performance and security. The demand for energy-efficient infrastructure is pushing operators to adopt modular designs and advanced cooling technologies. Romania’s reliable power grid and renewable integration enhance operational sustainability. Enterprises are investing in Tier III and Tier IV facilities to meet uptime expectations. It attracts technology firms seeking flexibility, reliability, and long-term value from modern colocation ecosystems.

- For instance, NXDATA operates carrier-neutral colocation facilities in Bucharest, serving a broad mix of domestic and international clients. Its data centers host major global networks such as Netflix and Akamai and hold ISO 27001 and ISO 9001 certifications, reinforcing their operational reliability and security standards.

Advancement in Cloud Connectivity and Edge Infrastructure Deployment

Enterprises are driving significant investment in interconnected hybrid cloud ecosystems to enhance latency and service performance. The adoption of edge infrastructure supports real-time applications such as IoT analytics and AI workloads. Telecom operators and hyperscalers are developing interconnect solutions that improve data transmission between public and private clouds. The Romania Data Center Colocation Market benefits from these deployments by enabling faster local data access. It enhances the nation’s capacity to handle bandwidth-intensive applications and high-performance computing requirements efficiently.

Rising Government Support and Digital Transformation Initiatives

Government programs focused on smart city development, e-governance, and digital economy expansion are fueling market growth. Public-private partnerships are boosting infrastructure upgrades in fiber networks and IT modernization. Incentives for renewable energy adoption make Romania an attractive location for sustainable colocation investments. The Romania Data Center Colocation Market gains from policies promoting cross-border connectivity and foreign capital inflow. It reinforces the country’s reputation as a regional technology hub supporting digital innovation. Businesses benefit from lower latency and improved compliance capabilities under EU digital frameworks.

- For instance, in February 2025, the Authority for Digitalization of Romania (ADR) launched the procurement process to migrate at least 30 government IT systems and applications to the Government Private Cloud. The project is funded through Romania’s National Recovery and Resilience Plan (NRRP) and targets completion by June 2026.

Strategic Investment by Global and Regional Data Center Operators

Global and regional providers are expanding their presence through acquisitions and greenfield investments. These firms are building advanced facilities to cater to hyperscale clients, cloud service providers, and fintech enterprises. The Romania Data Center Colocation Market attracts investors due to its cost efficiency, skilled workforce, and strategic Eastern European location. It provides gateway access to neighboring markets, improving service delivery across Central and Eastern Europe. Continuous upgrades in power and network infrastructure enhance the reliability and scalability of these investments.

Market Trends

Integration of Artificial Intelligence and Automation in Operations

Operators are increasingly implementing AI and automation for data center monitoring, predictive maintenance, and power optimization. These technologies minimize downtime and enhance operational visibility across multiple sites. The Romania Data Center Colocation Market is witnessing automation adoption for energy efficiency and workload balancing. It strengthens the reliability of data centers by improving resource utilization. AI-driven analytics help predict system failures and manage dynamic workloads. The trend aligns with global movements toward intelligent infrastructure management in colocation environments.

Growing Adoption of Modular and Prefabricated Data Center Designs

Prefabricated designs are gaining traction for their scalability, rapid deployment, and cost efficiency. Data center providers are using modular architectures to meet fluctuating enterprise demands and reduce construction time. The Romania Data Center Colocation Market leverages modular solutions for flexibility in expansion and energy savings. It helps operators scale capacity quickly to serve dynamic market needs. These modular setups allow easier integration of advanced cooling and energy management systems. The trend supports sustainability targets and enhances return on investment for operators.

Expansion of 5G Networks Driving Edge and Micro Data Center Growth

The rollout of 5G networks is creating demand for low-latency data processing closer to end-users. Edge and micro data centers are being deployed across Romania to support real-time applications. The Romania Data Center Colocation Market benefits from this expansion by attracting investments from telecom and cloud providers. It enhances connectivity for industries such as gaming, logistics, and manufacturing. The trend strengthens Romania’s digital infrastructure footprint and regional competitiveness. Localized computing supports seamless delivery of high-speed digital services.

Emphasis on Renewable Energy and Carbon-Neutral Operations

Sustainability has become a critical priority among operators seeking to meet global environmental standards. Companies are integrating renewable energy sources, including solar and wind, to power colocation facilities. The Romania Data Center Colocation Market is transitioning toward carbon-neutral operations through efficient cooling systems and waste heat recovery. It aligns with EU green data center initiatives promoting environmental responsibility. Green energy partnerships reduce operational costs while meeting corporate sustainability goals. The trend enhances Romania’s reputation as an eco-friendly digital hub.

Market Challenges

Limited Power Availability and High Energy Costs Impacting Scalability

Energy infrastructure limitations and rising electricity prices present obstacles for colocation expansion. Romania’s power grid, though improving, faces regional disparities that affect uptime reliability in remote zones. The Romania Data Center Colocation Market encounters challenges in securing continuous energy supply for hyperscale operations. It forces operators to explore renewable sources and backup generation systems, increasing capital costs. Maintaining energy efficiency while meeting growing IT loads remains difficult. Investors face delays in project execution due to regulatory hurdles and energy procurement constraints.

Shortage of Skilled Technical Workforce and Infrastructure Standardization Gaps

The shortage of skilled IT and engineering professionals slows the deployment of advanced colocation facilities. Training programs for cloud architecture and data center management remain limited, affecting workforce readiness. The Romania Data Center Colocation Market experiences uneven adherence to global standards such as Uptime Institute certifications. It impacts investor confidence and operational benchmarking. Variability in infrastructure design and safety compliance complicates interoperability among providers. Addressing these gaps is crucial to achieving sustainable long-term growth.

Market Opportunities

Expansion of Cloud Ecosystem and Strategic Foreign Investment Potential

Foreign investors view Romania as a favorable location for new colocation ventures due to its growing digital ecosystem. Global tech companies are exploring joint ventures and hyperscale partnerships to expand capacity. The Romania Data Center Colocation Market benefits from increased foreign direct investment aimed at improving connectivity. It strengthens Romania’s integration into the European cloud and data exchange framework. The opportunity supports job creation and technological innovation within local industries.

Emerging Demand from AI, IoT, and Fintech Sectors

The surge in AI, IoT, and fintech adoption across industries drives new colocation requirements. Enterprises seek secure, scalable environments for data-intensive applications and real-time analytics. The Romania Data Center Colocation Market supports these needs through high-performance infrastructure and network resilience. It creates growth opportunities for specialized colocation services tailored to evolving digital business models.

Market Segmentation

By Type

Retail colocation dominates the Romania Data Center Colocation Market with a strong share due to rising demand from SMEs and startups seeking scalable yet cost-effective solutions. Wholesale colocation attracts large cloud and telecom providers requiring dedicated space. Hybrid cloud colocation is gaining traction as enterprises combine public and private cloud capabilities for data flexibility and compliance. The segment’s growth is fueled by diverse enterprise requirements for agility and secure infrastructure.

By Tier Level

Tier III facilities lead the Romania Data Center Colocation Market with the highest share, offering reliable uptime and redundancy. These centers are preferred for mission-critical workloads by enterprises across finance and IT sectors. Tier IV facilities are emerging in response to global clients demanding higher resilience and fault tolerance. Tier I and II facilities serve smaller enterprises with moderate capacity needs. Continuous upgrades ensure balanced performance and energy optimization across tier categories.

By Enterprise Size

Large enterprises dominate the Romania Data Center Colocation Market due to their extensive IT infrastructure and security needs. These organizations prefer colocation for better scalability, control, and cost optimization. SMEs are steadily increasing their adoption, leveraging retail colocation for operational flexibility. It helps smaller firms manage workloads efficiently without heavy capital investment. The trend reflects growing awareness of data security and digital transformation benefits among mid-sized businesses.

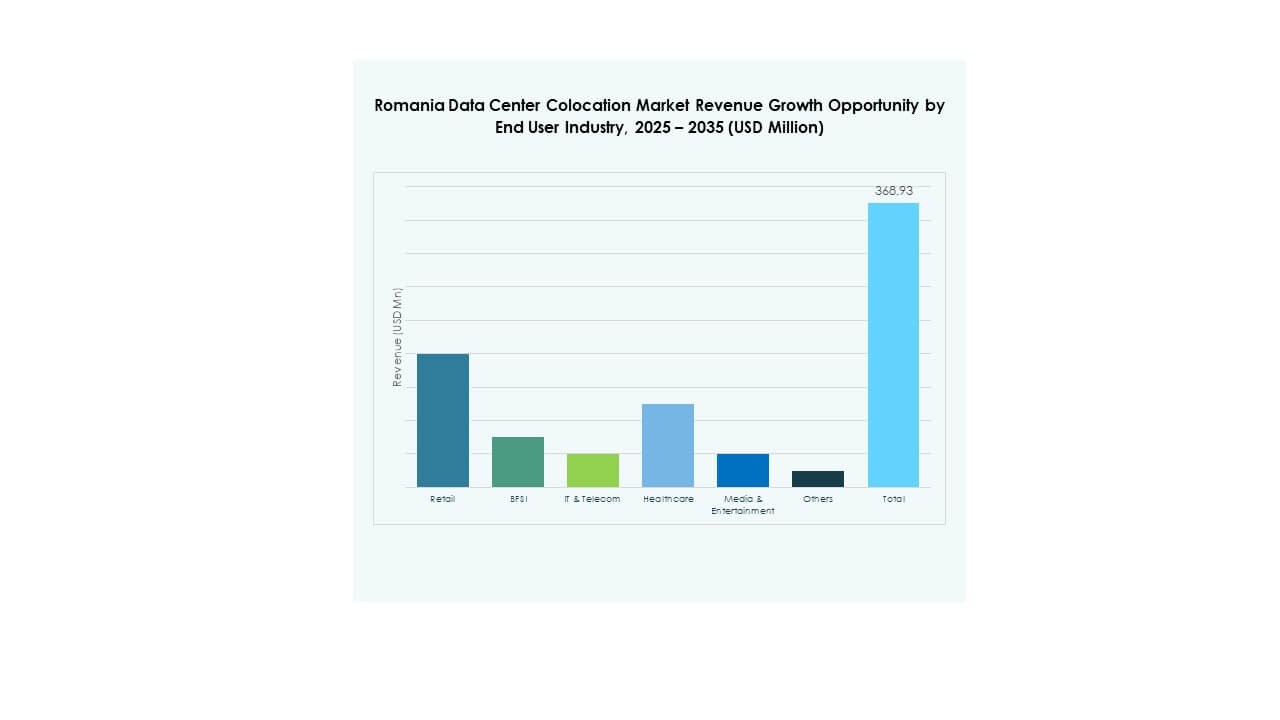

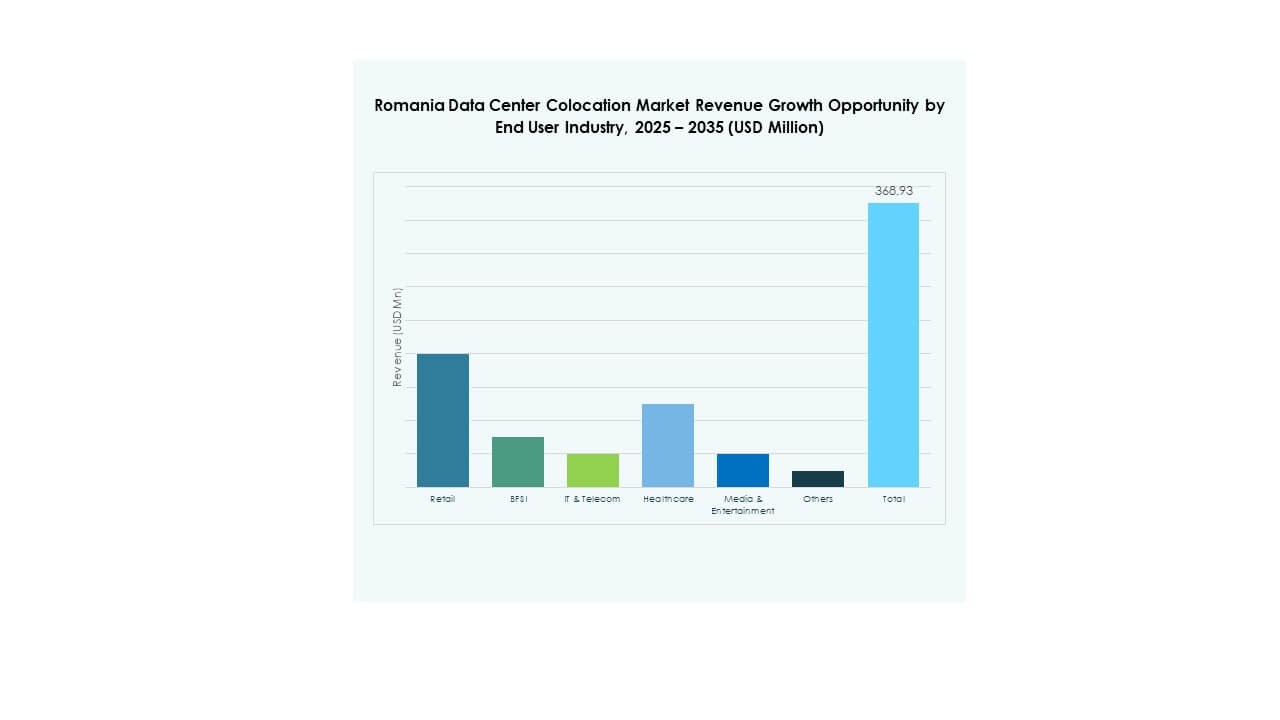

By End User Industry

The IT & Telecom segment holds the largest share in the Romania Data Center Colocation Market, driven by the expanding cloud, edge, and 5G ecosystem. BFSI firms follow closely, requiring high-security infrastructure for financial transactions. Healthcare and media industries are adopting colocation to manage digital records and content distribution. Retail and other industries use colocation for analytics and e-commerce growth. Strong digital adoption across verticals supports sustained market expansion.

Regional Insights

Western and Central Romania Holding the Largest Market Share (34%)

Western and Central regions lead the Romania Data Center Colocation Market with 34% share due to dense fiber networks, reliable power supply, and concentration of business hubs. Cities such as Bucharest and Cluj-Napoca attract hyperscale providers and multinational clients. It benefits from advanced telecom infrastructure and proximity to Western Europe. Growing data exchange between Romania and regional economies further strengthens this area’s dominance.

Eastern Romania Emerging as a Fast-Growing Subregion (28%)

Eastern Romania records a 28% share, witnessing strong development in connectivity and colocation infrastructure. Strategic investments in network modernization and renewable power capacity enhance its appeal. The Romania Data Center Colocation Market grows here due to government-backed digital inclusion programs. It supports SMEs and regional enterprises focusing on e-commerce and technology services. Lower operational costs and untapped demand make it a key emerging subregion.

- For instance, in July 2025, NEPI Rockcastle launched a 54.1 MW solar park at Chișineu‑Criș (Arad County) as part of a €110 million renewable program totaling 159 MW capacity across 28 projects. The installation uses 84,000 LONGi Hi‑MO 9 BC modules achieving 24.8% efficiency, supporting cleaner electricity for hyperscale and retail‑linked data facilities.

Southern Romania Expanding Through Industrial and Government Projects (22%)

Southern Romania holds a 22% share, supported by infrastructure projects and industrial development. Public and private initiatives are improving connectivity and ICT capacity in this region. The Romania Data Center Colocation Market sees increasing deployment of energy-efficient and modular facilities. It connects major transport corridors that facilitate cross-border data flow with neighboring countries. The region’s progress positions it as a strong contributor to national digital growth.

- For instance, ClusterPower’s Technology Campus in Mischii (Dolj County) is Romania’s largest hyperscale complex, planned to reach 200 MW total capacity across five Tier III data centers. The site is designed for high energy efficiency, with a targeted PUE of 1.1 and infrastructure aimed at supporting large-scale enterprise workloads.

Competitive Insights:

- Data Center Nord

- Interlink

- EvoSwitch

- Global Tech

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

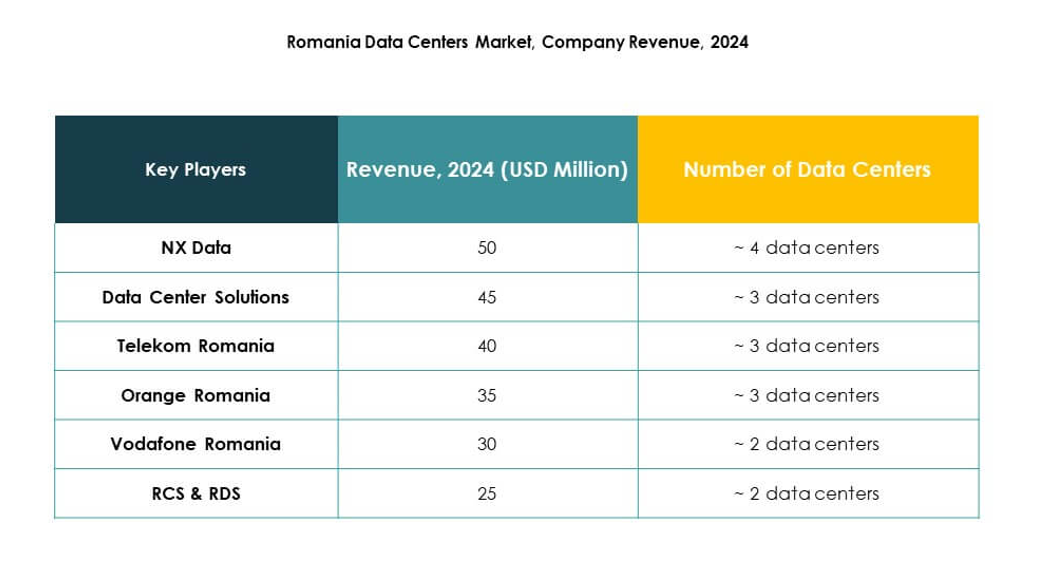

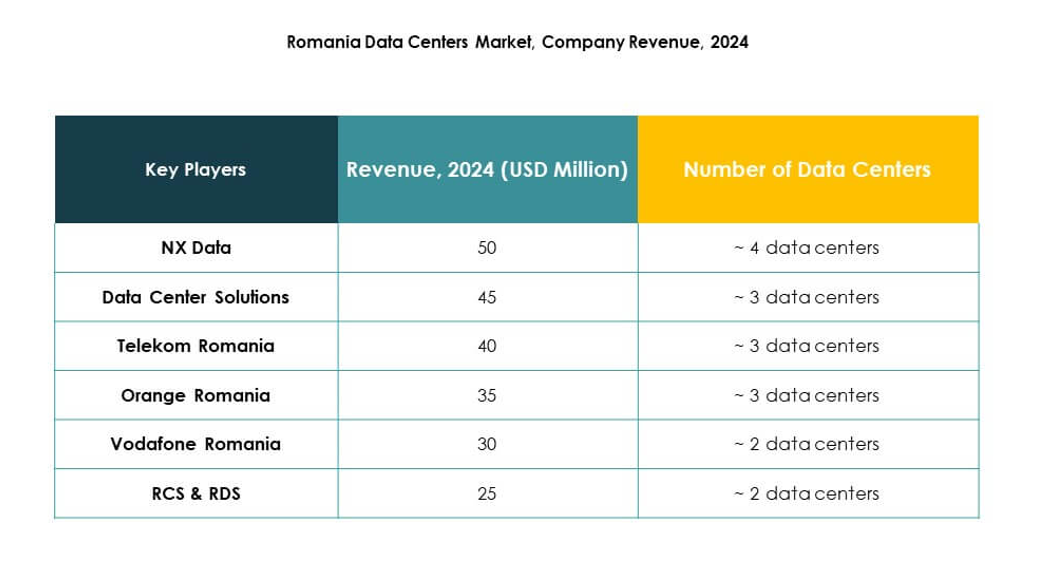

The Romania Data Center Colocation Market features a mix of global hyperscale operators and strong regional providers. Global firms such as Equinix, Digital Realty, AWS, and Google Cloud are expanding their network reach to capture enterprise clients seeking high-performance infrastructure. Regional players like Data Center Nord and Interlink strengthen local connectivity and offer flexible colocation services. It benefits from strategic partnerships that enhance service integration across telecom, cloud, and IT segments. Companies compete on energy efficiency, uptime reliability, and interconnection capabilities. Mergers, acquisitions, and strategic alliances drive service innovation and broader market coverage. Competitive differentiation depends on technological investments, sustainable design, and compliance with European standards.

Recent Developments:

Recent Developments:

- In May 2025, Tema Energy announced a major industry partnership during the DataCenter Forum 2025 in Bucharest, Romania. The event, organized by Tema Energy—a prominent local leader in data center design and construction—highlighted expanding collaborations with major technology and infrastructure players such as Orange Romania, Rittal, and Digital Realty. The forum revealed that Tema Energy is actively working with public institutions like the Romanian Police to build modular, container-type data centers to enhance national IT infrastructure resilience.

Recent Developments:

Recent Developments: