Executive summary:

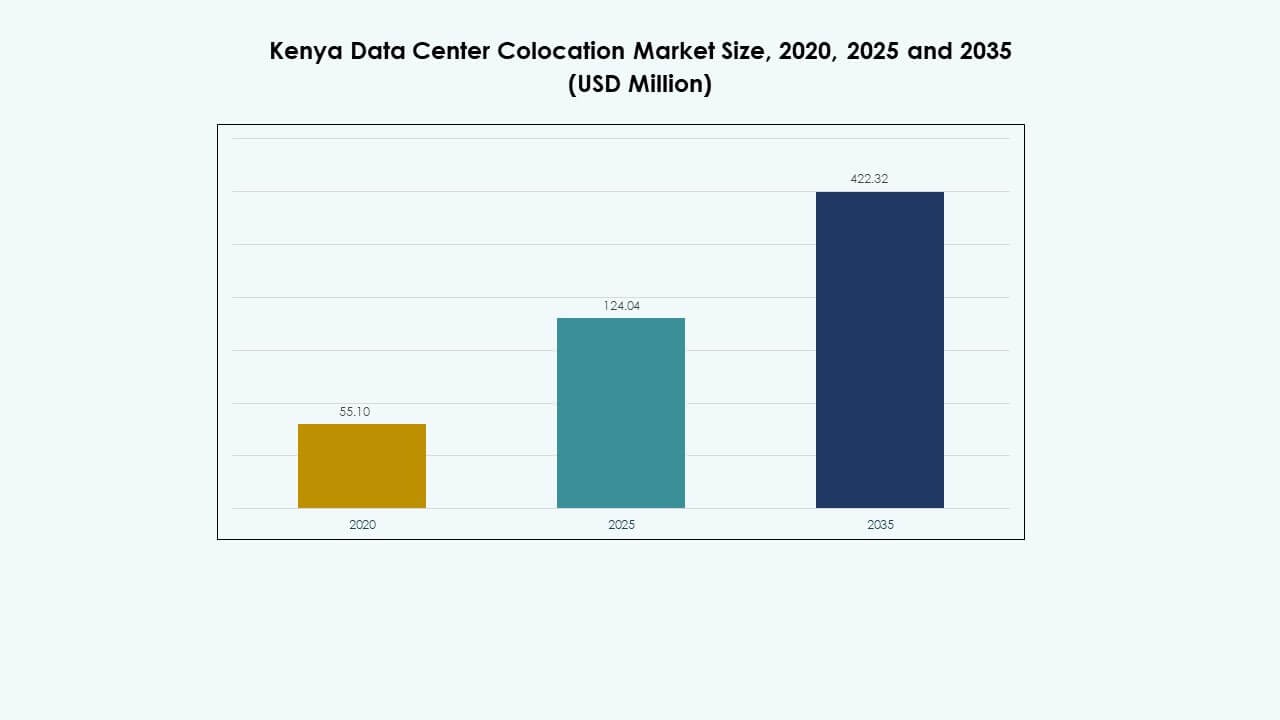

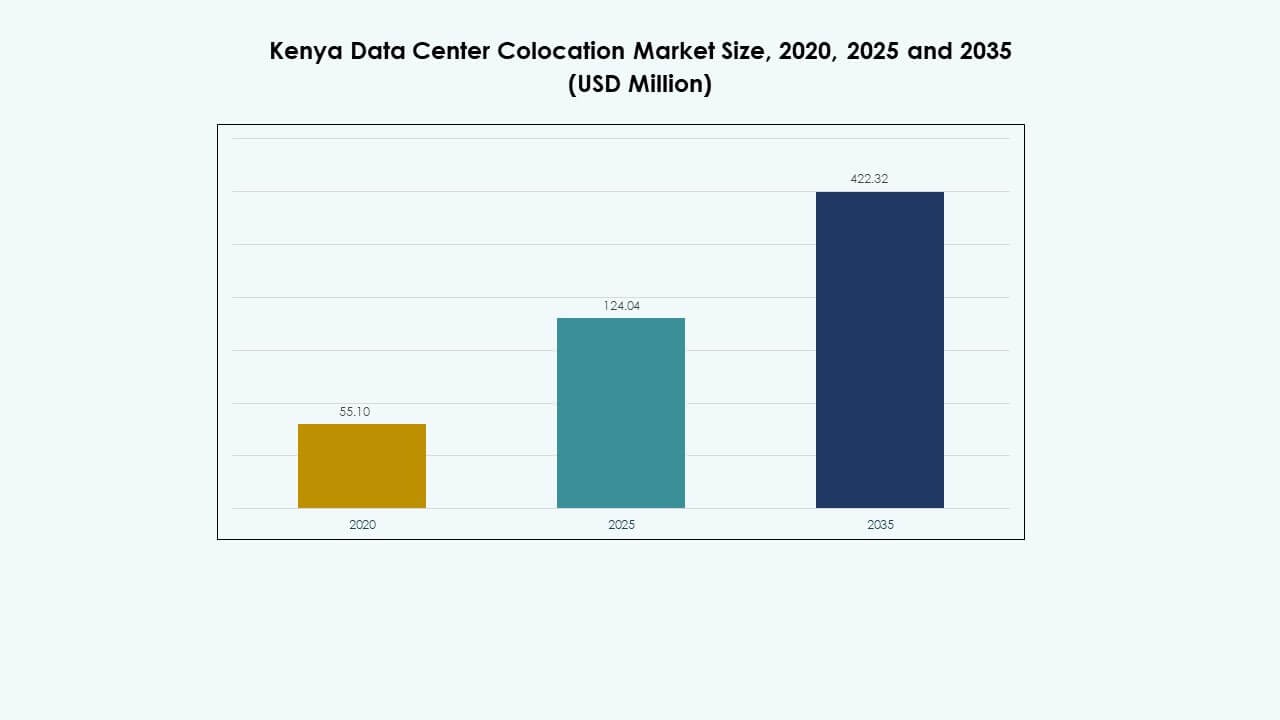

The Kenya Data Center Colocation Market size was valued at USD 55.10 million in 2020, increased to USD 124.04 million in 2025, and is anticipated to reach USD 422.32 million by 2035, at a CAGR of 12.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Kenya Data Center Colocation Market Size 2025 |

USD 124.04 Million |

| Kenya Data Center Colocation Market, CAGR |

12.88% |

| Kenya Data Center Colocation Market Size 2035 |

USD 422.32 Million |

The market is driven by rapid cloud adoption, expanding subsea cable connectivity, and rising enterprise demand for scalable infrastructure. It benefits from growing investment in hyperscale facilities, AI-ready infrastructure, and carrier-neutral ecosystems. Organizations are modernizing their IT operations and shifting to hybrid models that ensure flexibility and cost efficiency. Investors view the sector as strategically important for supporting regional digital transformation and driving long-term economic growth.

Nairobi leads the market with its advanced connectivity, stable power availability, and presence of major data center operators. Mombasa is emerging as a strategic interconnection hub due to its subsea cable landings and growing infrastructure ecosystem. Kenya’s position as a digital gateway to East and Central Africa strengthens its role in regional connectivity expansion.

Market Drivers

Rising Demand for Digital Infrastructure and Cloud Integration

The rapid increase in digital transformation across enterprises drives the demand for scalable infrastructure. It supports a growing ecosystem of cloud-native applications, enterprise resource systems, and AI platforms. Organizations require colocation to reduce capital expenditure and improve operational agility. This shift accelerates hybrid cloud adoption, enabling faster service delivery. Businesses prefer colocation to meet strict uptime standards and data security needs. Investors see strong potential in supporting digital-first models. The Kenya Data Center Colocation Market benefits from expanding multi-tenant facilities. The rising enterprise focus on automation strengthens its strategic role in the regional ICT landscape.

Expanding Subsea Cable Connectivity and Edge Computing Deployment

Subsea cable investments strengthen international bandwidth capacity and improve network reliability. It enhances connectivity for hyperscalers, telcos, and cloud providers. This infrastructure enables low-latency data flows across global networks. Edge computing deployments increase regional traffic handling capacity, driving colocation expansion. Enterprises leverage this infrastructure to support IoT ecosystems and content delivery platforms. The presence of major landing stations positions the region as a critical digital hub. The Kenya Data Center Colocation Market gains importance for hyperscale and enterprise networks. Strategic connectivity advantages attract both local and international investments.

- For instance, in September 2025, SEACOM Ltd. announced the launch of its SEACOM 2.0 subsea cable system at Submarine Networks World in Singapore. The 48-fibre-pair system connects Africa with the Middle East, Mediterranean, and Southern Europe. It is engineered to deliver high-capacity, low-latency connectivity and support AI-driven network demand.

Growing Regulatory Support and Data Sovereignty Initiatives

Government policies promoting ICT infrastructure expansion drive strong market momentum. It ensures a stable regulatory framework for colocation operators and cloud service providers. Local data residency laws encourage businesses to host workloads within national borders. Strong compliance incentives increase trust among global partners and investors. Enterprises use colocation facilities to align with cybersecurity and governance requirements. Regulatory clarity attracts foreign direct investment in infrastructure projects. The Kenya Data Center Colocation Market aligns with national digital economy goals. Data protection laws improve resilience and operational reliability for mission-critical workloads.

Rising Enterprise Focus on Cost Optimization and Resilience

Enterprises prioritize colocation to reduce costs linked to in-house data centers. It supports scalable capacity planning and predictable operational expenditure. Colocation facilities deliver advanced cooling and power efficiency standards, lowering total costs. Businesses seek resilient infrastructure to ensure service continuity during outages. Demand for disaster recovery and backup services continues to rise. The move toward flexible infrastructure models create long-term growth avenues. The Kenya Data Center Colocation Market plays a critical role in enterprise risk strategies. Investors view the sector as a stable asset class in the digital economy.

- For instance, on 13 May 2025, Safaricom PLC and iXAfrica Data Centres launched the NBOX1 hyperscale campus in Nairobi. Phase One included 5 MW of IT capacity and 780 racks, with a design target of 22.5 MW. The facility supports AI and enterprise workloads, marking a major technological advancement for the region.

Market Trends

Accelerating Hyperscale Data Center Investments and Strategic Partnerships

The entry of hyperscale operators transforms the competitive landscape. It pushes facility operators to adopt advanced designs and modular builds. Large-scale projects encourage strategic partnerships between telecom operators and global tech firms. This collaboration strengthens operational efficiency and sustainability goals. Local operators benefit from shared expertise and funding access. Investors prioritize regions with hyperscale-ready connectivity and energy supply. The Kenya Data Center Colocation Market experiences a wave of capital inflows. Strategic alliances position the market as a hub for East Africa’s digital expansion.

Growing Use of Renewable Energy and Sustainable Infrastructure Models

Data center operators are adopting renewable energy sources to address energy security and ESG goals. It drives the deployment of solar, wind, and hybrid energy systems for colocation facilities. Operators focus on optimizing cooling systems to reduce power usage effectiveness. Green data centers gain higher preference among enterprises and hyperscalers. Energy-efficient designs reduce operational costs and carbon emissions. Investors prefer assets that align with global sustainability frameworks. The Kenya Data Center Colocation Market benefits from a rising shift toward clean energy. Sustainability adoption strengthens its competitive position in the region.

Increasing Role of Automation and Software-Defined Infrastructure

Data center operators integrate AI, ML, and automation tools into facility operations. It enables predictive maintenance, power optimization, and intelligent resource allocation. Software-defined systems improve workload distribution and reduce downtime risks. Enterprises prefer facilities that provide operational transparency and advanced monitoring tools. Automation enhances security management and incident response efficiency. Digital twins and real-time analytics increase overall infrastructure resilience. The Kenya Data Center Colocation Market witnesses rapid modernization of infrastructure. Automation enhances service quality and scalability for multi-tenant environments.

Rising Demand for Interconnection and Carrier-Neutral Facilities

Interconnection ecosystems become a key differentiator in colocation strategies. It enables customers to access multiple carriers and cloud providers seamlessly. Enterprises seek high-speed, redundant connectivity options to support mission-critical workloads. Carrier-neutral data centers drive innovation and competitive pricing models. This trend creates an open environment for cloud on-ramps and edge deployments. Network diversity improves regional performance for global platforms. The Kenya Data Center Colocation Market benefits from expanded interconnection strategies. Its growth aligns with the broader digital corridor vision for Africa.

Market Challenges

Limited Power Infrastructure and Energy Reliability Concerns

Power availability remains a critical factor affecting facility expansion plans. It limits the ability of operators to deploy large-scale, energy-intensive workloads. Grid instability creates operational risks and increases reliance on backup generation. High energy costs reduce margins and delay ROI for infrastructure investors. It pushes operators to adopt alternative energy strategies. Securing reliable energy sources requires long-term planning and significant capital. The Kenya Data Center Colocation Market faces constraints that affect deployment speed. Infrastructure gaps must be addressed to sustain hyperscale and enterprise growth.

High Capital Expenditure and Skilled Workforce Shortages

The high cost of building and maintaining Tier 3 and Tier 4 facilities affects market scalability. It requires advanced engineering, equipment procurement, and regulatory approvals. Operators face funding delays, affecting their ability to meet growing demand. Limited availability of skilled professionals restricts operational excellence and service delivery. It slows down innovation and digital infrastructure development. Training programs and capacity-building initiatives remain underdeveloped. The Kenya Data Center Colocation Market faces operational limitations tied to capital and talent. Overcoming these barriers is essential for competitive positioning.

Market Opportunities

Strategic Positioning as a Regional Digital Gateway

Kenya’s coastal connectivity creates a strong foundation for international traffic routing. It enhances the region’s role as a digital hub for East and Central Africa. Colocation providers can leverage this position to attract hyperscalers and global enterprises. The market offers favorable conditions for cloud expansion strategies. It supports regional data exchange and content delivery acceleration. The Kenya Data Center Colocation Market stands to benefit from increased strategic investment. Strong infrastructure positioning builds long-term commercial resilience and competitiveness.

Emerging Focus on AI, IoT, and Industry Cloud Solutions

AI-driven workloads, IoT deployments, and vertical-specific cloud solutions drive new service models. It opens revenue streams for providers offering secure and scalable infrastructure. Industry-tailored solutions support healthcare, finance, and telecom applications. Enterprises prefer reliable facilities with compliance-ready infrastructure. This trend aligns with the region’s digital transformation roadmap. The Kenya Data Center Colocation Market creates opportunities for specialized service providers. Growth in edge, AI, and cloud verticals enhances overall market potential.

Market Segmentation

By Type

Retail colocation dominates due to its flexibility and lower capital requirement for enterprises. It offers scalable rack space and shared infrastructure suited for SMEs and large businesses. Wholesale colocation gains traction from hyperscalers seeking dedicated capacity. Hybrid cloud colocation supports enterprises balancing on-premise and cloud workloads. The Kenya Data Center Colocation Market benefits from strong retail adoption trends. Scalability and cost control remain key factors for customer choice.

By Tier Level

Tier 3 facilities hold the largest market share due to their strong uptime reliability. Tier 4 facilities attract hyperscalers requiring advanced redundancy and power availability. Tier 2 and Tier 1 segments cater to smaller workloads with limited redundancy needs. Enterprises prefer Tier 3 due to its balance between cost and operational assurance. The Kenya Data Center Colocation Market reflects growing investment in advanced tier levels. Robust power systems and cooling efficiency strengthen customer trust.

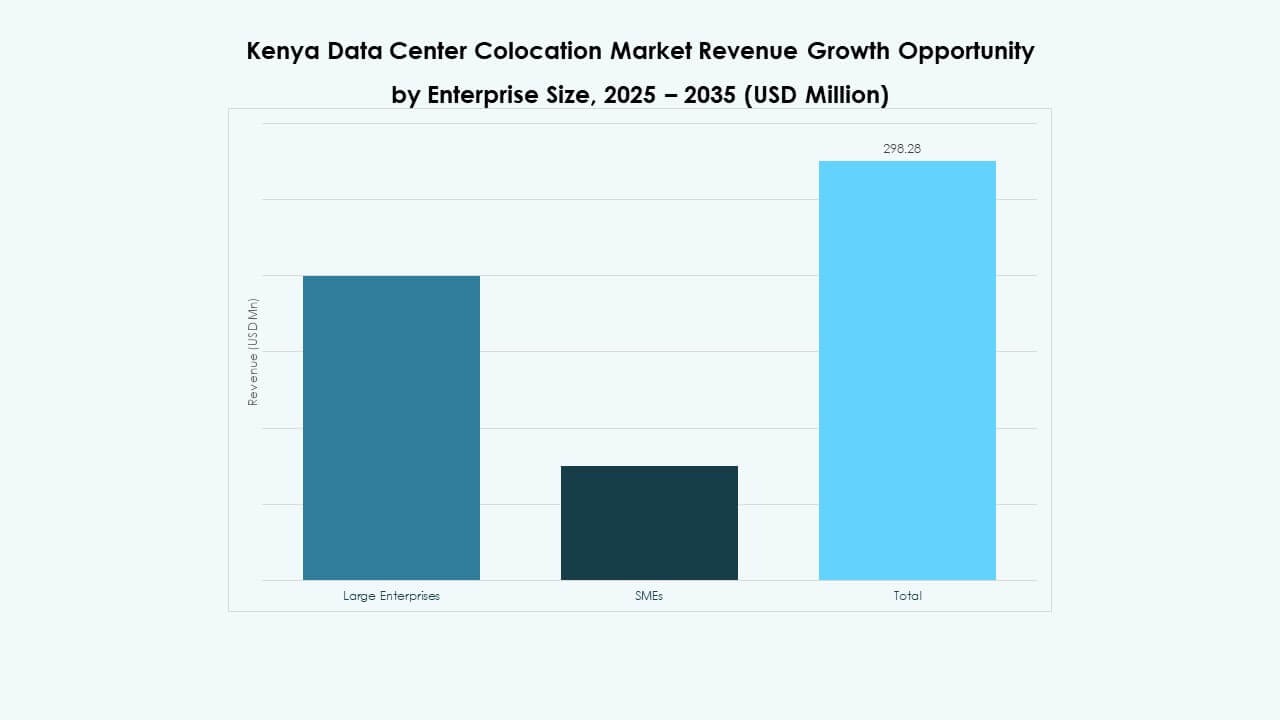

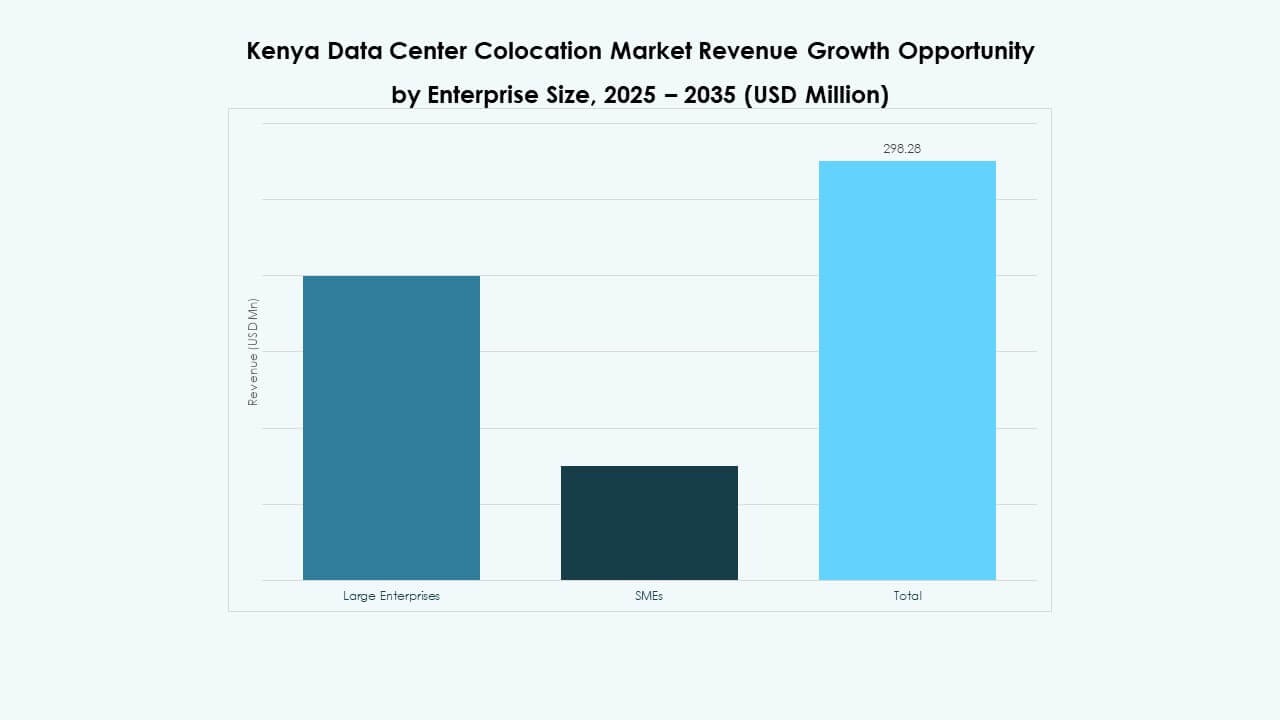

By Enterprise Size

Large enterprises dominate demand due to complex workloads and compliance priorities. SMEs adopt colocation to reduce IT costs and focus on core operations. It offers them flexibility without heavy capital investment. Colocation also provides scalable options for rapid business expansion. The Kenya Data Center Colocation Market sees strong participation from both enterprise segments. Larger organizations set demand trends, while SMEs drive volume growth.

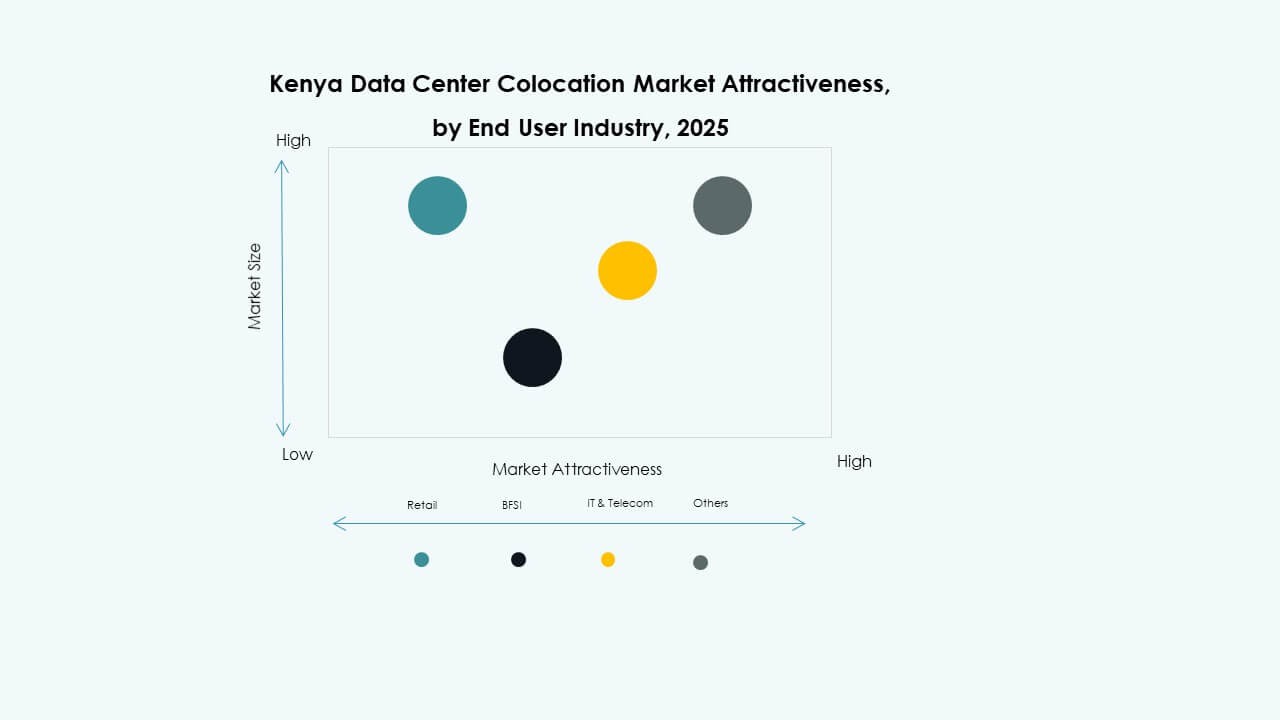

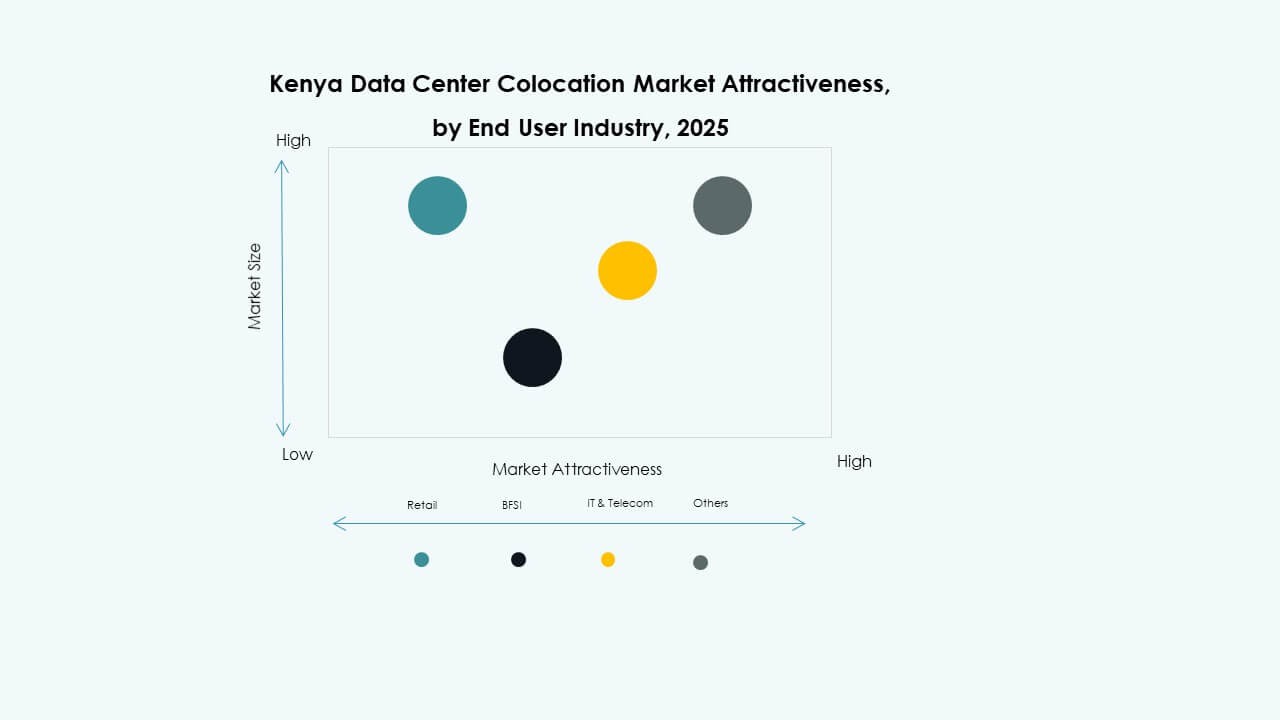

By End User Industry

IT and telecom lead the market due to rising data traffic and cloud integration. BFSI relies on colocation to ensure data security and regulatory compliance. Healthcare uses it for patient data hosting and telehealth platform support. Media and entertainment adopt colocation for streaming and content distribution. Retail leverages it for omnichannel operations and customer analytics. The Kenya Data Center Colocation Market shows strong vertical demand diversity. Industry-specific requirements drive facility expansion and technology adoption.

Regional Analysis

Nairobi: Leading Hub with 62.5% Market Share

Nairobi holds the largest share of the Kenya Data Center Colocation Market at 62.5%, driven by its advanced connectivity and strong presence of global and local operators. It benefits from stable power infrastructure, multiple carrier networks, and proximity to key enterprise clusters. Investors prioritize Nairobi due to its role as the national technology and financial center. The city hosts several Tier 3 and Tier 4 facilities supporting cloud, AI, and enterprise workloads. It serves as a primary location for hyperscalers and carriers expanding their regional footprint. Nairobi’s infrastructure maturity and access to subsea cable backhaul make it the core colocation hub of the country.

- For instance, in September 2025, Nxtra by Airtel broke ground on a 44 MW hyperscale data center at Tatu City SEZ in Kenya. The facility is being developed in two 22 MW phases, targets 999% uptime, and uses over 95% renewable energy. It features GPU-ready high-density racks to support AI and cloud workloads.

Mombasa: Emerging Interconnection Gateway with 27.5% Market Share

Mombasa commands 27.5% of the Kenya Data Center Colocation Market, driven by its strategic coastal position and growing subsea cable ecosystem. The city hosts major landing stations connecting Africa to global networks, enabling low-latency routing and regional data exchange. Its infrastructure expansion focuses on building high-capacity edge-ready facilities. Operators target Mombasa to strengthen interconnection services and boost resilience. The city attracts investment from carriers, hyperscalers, and peering platforms. Mombasa is evolving into a critical interconnection gateway that complements Nairobi’s data center ecosystem.

- For instance, in September 2025, Meta Platforms and Safaricom PLC announced the USD 2.9 billion Daraja Fibre Optic Cable, a 4,100 km subsea system linking Oman to Mombasa. Developed with Alcatel Submarine Networks, the cable features 24 fiber pairs, exceeding traditional 16-pair systems, and is scheduled for completion in 2026.

Other Regions: Supporting Network Expansion with 10% Market Share

Other regions collectively account for 10% of the Kenya Data Center Colocation Market, reflecting early-stage development and infrastructure investments. These areas serve as secondary deployment zones for edge and enterprise facilities. Operators aim to bring services closer to inland enterprise clusters, improving latency and network reliability. Infrastructure projects are gradually expanding to cities with growing industrial activity. Power availability and fiber expansion remain key enablers for these markets. The increasing focus on distributed architectures and localized services supports steady future growth in secondary hubs.

Competitive Insights:

- Safaricom

- Liquid Telecom Kenya

- iColo

- Internet Solutions Kenya

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- CoreSite

- CyrusOne

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The Kenya Data Center Colocation Market features a strong mix of local and global operators driving infrastructure modernization. It is shaped by strategic investments, partnerships, and network expansions targeting hyperscale and enterprise demand. Local players like iColo, Safaricom, and Liquid Telecom Kenya focus on regional connectivity and edge-ready capacity. Global operators such as Equinix, AWS, and Google Cloud target cloud on-ramp services and carrier-neutral models. Their strategies strengthen competitive intensity and service differentiation. Operators emphasize renewable energy adoption, automation, and Tier 3–4 facility deployments to secure high-value clients. The increasing entry of hyperscale providers boosts competition for strategic locations, energy capacity, and enterprise contracts. This dynamic landscape supports long-term ecosystem maturity.

Recent Developments:

- In October 2025, Airtel Africa entered into a strategic partnership with Vertiv to expand its data center infrastructure across African markets, including Kenya. Announced on October 16, 2025, this partnership aims to bolster Airtel’s Nxtra initiative by leveraging Vertiv’s advanced power, cooling, and infrastructure management technologies.

- In August 2025, iColo, a subsidiary of Digital Realty, announced an expansion of its Mombasa peering ecosystem through a partnership with the Kenya Internet Exchange Point (KIXP), which established a new Point of Presence at iColo’s MBA2 data center. The project aims to enhance Kenya’s internet infrastructure by reducing latency, boosting redundancy, and enabling more efficient routing of regional data traffic solidifying iColo’s position as a key interconnection hub in East Africa.

- In May 2025, Safaricom entered a strategic partnership with iXAfrica Data Centres to launch East Africa’s first AI-ready data center services, marking a major technological advancement for Kenya’s colocation market. The collaboration leverages iXAfrica’s newly launched NBOX1 hyperscale data center in Nairobi featuring 780 racks and 4.5MW of IT capacity to deliver scalable, secure, and sustainable infrastructure for cloud, AI, and enterprise clients across the region.