Executive summary:

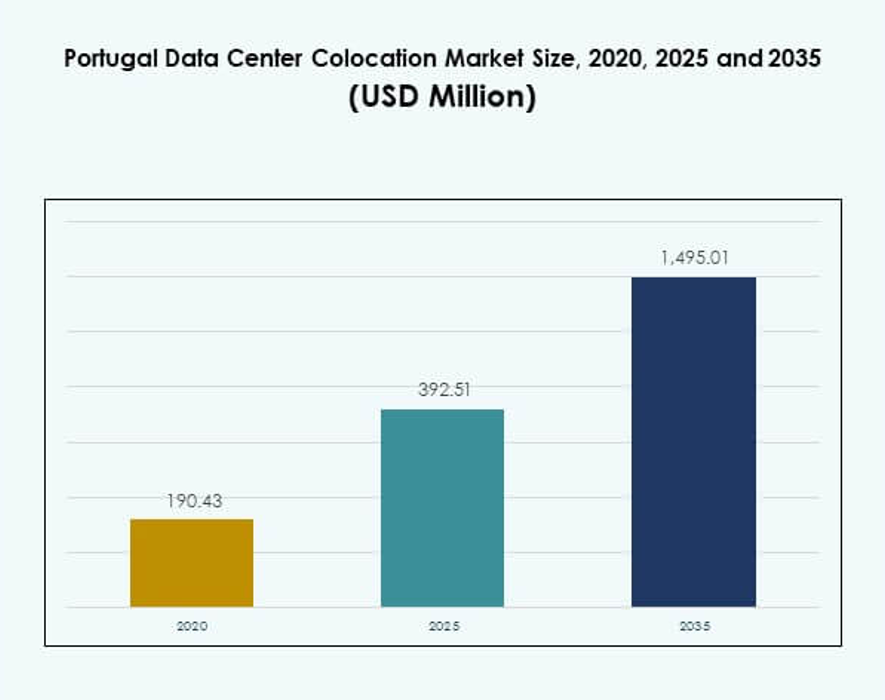

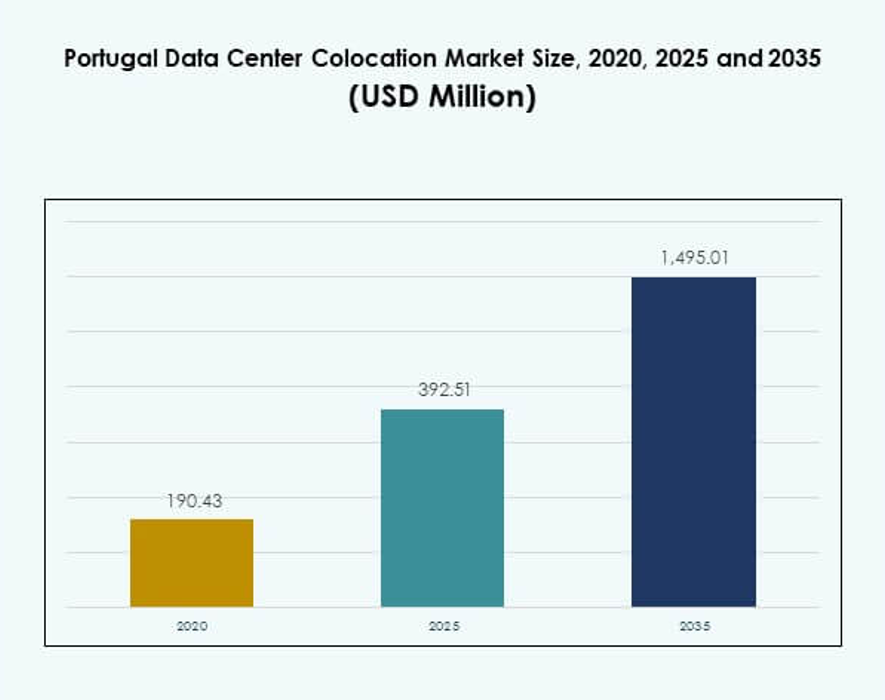

The Portugal Data Center Colocation Market size was valued at USD 190.43 million in 2020 to USD 392.51 million in 2025 and is anticipated to reach USD 1,495.01 million by 2035, at a CAGR of 14.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Portugal Data Center Colocation Market Size 2025 |

USD 392.51 Million |

| Portugal Data Center Colocation Market, CAGR |

6.87% |

| Portugal Data Center Colocation Market Size 2035 |

USD 1,495.01 Million |

Strong cloud adoption, AI integration, and submarine cable deployments are driving market growth. Hyperscale and enterprise operators are investing in high-density, energy-efficient facilities to meet rising connectivity needs. The Portugal Data Center Colocation Market plays a strategic role for investors and businesses seeking resilient digital infrastructure, low-latency access, and hybrid cloud solutions. Innovation in renewable-powered operations and edge computing strengthens its position in the European data landscape.

Lisbon leads the market due to strong connectivity and hyperscale investments. Porto is an emerging hub supported by growing enterprise activity and expanding fiber networks. Sines is gaining relevance with its strategic location near cable landing stations and renewable energy sources. These regional developments strengthen Portugal’s position as a key interconnection and hosting gateway.

Market Drivers

Strong Acceleration of Cloud Integration and AI Workloads Creating Demand for Advanced Colocation Facilities

Portugal is witnessing rapid cloud adoption and AI integration across multiple industries, creating strong momentum for advanced data center infrastructure. Enterprises are shifting workloads from on-premises facilities to flexible colocation environments to achieve lower latency and better scalability. Hyperscale and edge deployments are rising as organizations modernize IT infrastructure. The Portugal Data Center Colocation Market is strategically positioned to support hybrid cloud and AI inference needs. Its expanding colocation capacity improves workload flexibility for businesses entering high-performance computing segments. Major cloud providers are also expanding availability zones, strengthening Portugal’s position in Europe’s digital landscape. Investors view this trend as a key opportunity for long-term revenue generation.

- For instance, Equinix launched its second Lisbon data center, LS2, in June 2025 with an investment of approximately €50 million. The facility adds 2,050 sqm of colocation space and supports 625 racks, expanding capacity to meet rising enterprise, cloud, and AI workload demand.

Strategic Submarine Cable Deployments and International Connectivity Boosting Market Growth

Portugal’s location on key transatlantic and intra-European routes positions it as a prime connectivity hub. Strategic submarine cable projects link Portugal directly to North America, Africa, and other European countries. These routes reduce latency and improve cross-border data flow, attracting hyperscale operators seeking stable infrastructure. It creates an ecosystem that supports financial services, content delivery, and digital commerce. The Portugal Data Center Colocation Market benefits from this connectivity expansion, making the country a preferred site for mission-critical workloads. Operators are aligning new data center builds near cable landing stations to maximize efficiency. Businesses benefit from improved network reach, resilience, and cost-effective operations. This connectivity surge enhances investor confidence in the country’s digital ecosystem.

- For example, the EllaLink submarine cable system, connecting Sines (Portugal) and Fortaleza (Brazil), delivers less than 60 milliseconds round-trip delay (RTD), providing Europe and Latin America’s lowest-latency dedicated data route as of 2024. This cable enables direct high-capacity and low-latency connectivity crucial for financial services, real-time AI processing, and mission-critical cloud workloads

Energy Transition and Sustainable Cooling Systems Driving Data Center Modernization

Growing emphasis on renewable energy is transforming data center development in Portugal. Colocation providers are integrating clean energy sources such as hydropower and solar to reduce operational costs and carbon footprint. Energy efficiency goals align with EU sustainability mandates, pushing operators to adopt advanced cooling and heat reuse systems. The Portugal Data Center Colocation Market leverages these transitions to enhance energy security and meet corporate ESG goals. Green certifications and power usage effectiveness improvements attract clients prioritizing sustainable operations. Large operators are deploying liquid cooling and modular power systems to handle AI-intensive workloads. These innovations support environmentally responsible growth and reinforce Portugal’s role as a green data hub.

Regulatory Stability and Strategic Policy Frameworks Encouraging Infrastructure Investment

Stable regulations and favorable tax policies are encouraging strong foreign and domestic investment in digital infrastructure. National digital strategies emphasize connectivity, cybersecurity, and cloud integration, providing a predictable investment climate. The Portugal Data Center Colocation Market benefits from this policy clarity, making infrastructure planning more efficient. Government support for renewable integration further strengthens operational resilience for operators. Investors prioritize countries with transparent energy markets and strong network infrastructure, which enhances Portugal’s competitive position. Strategic partnerships with international tech companies are expanding capacity and service diversity. This policy environment creates long-term advantages for both hyperscale and enterprise colocation providers.

Market Trends

Rising Edge Data Center Deployments Supporting Latency-Sensitive Applications Across the Country

Portugal is seeing a clear shift toward edge infrastructure to support AI, IoT, and real-time analytics. Enterprises demand low-latency connections for workloads like autonomous systems, smart cities, and immersive content. Edge colocation facilities closer to urban centers are enabling high-performance compute distribution. The Portugal Data Center Colocation Market is expanding edge capacity to strengthen domestic and regional data flow. Telcos are partnering with colocation providers to establish micro-data hubs. This trend helps operators improve service quality while reducing network congestion. Edge deployments also allow flexible capacity scaling, making infrastructure more resilient to traffic surges.

Adoption of High-Density Rack Solutions Optimizing Power Utilization and Performance

Demand for high-density computing is rising due to GPU-driven AI and machine learning applications. Operators are designing facilities with advanced liquid cooling systems and rack densities exceeding traditional levels. These solutions support greater workloads within compact footprints, optimizing power and space. The Portugal Data Center Colocation Market aligns with these shifts by enabling better resource utilization and improved energy efficiency. Data center providers are adopting modular designs to accommodate variable power loads. This trend supports both hyperscale operators and enterprise customers aiming for performance gains. Rack-level optimization helps lower operational costs and accelerates digital transformation timelines.

Growing Interconnection Ecosystems Enhancing Cross-Border Digital Exchange and Cloud Access

Strong interconnection growth is shaping the competitive positioning of Portugal’s colocation sector. Data centers are evolving into network-rich hubs that support hybrid and multi-cloud environments. Peering and cloud on-ramps are expanding, enabling faster and more secure traffic routing. The Portugal Data Center Colocation Market benefits from the growing ecosystem of IXPs and telcos. Increased network density enables enterprises to simplify their IT architecture and lower latency. Colocation providers are enhancing connectivity diversity to attract regional and international customers. This trend creates more value for businesses seeking resilient digital backbones.

AI Automation and Infrastructure Orchestration Driving Operational Efficiency Gains

Data center operators are adopting AI-driven orchestration tools to improve resource allocation, workload scheduling, and predictive maintenance. Automation helps reduce downtime and energy waste while improving service reliability. The Portugal Data Center Colocation Market reflects this shift toward intelligent infrastructure, allowing operators to maintain competitive service levels. AI-based management platforms optimize cooling, energy use, and asset tracking. Automation also improves capacity planning for colocation customers. This operational evolution is key to supporting rapid workload scaling and ensuring predictable performance across distributed infrastructure.

Market Challenges

Power Supply Constraints and Energy Cost Volatility Impacting Operational Planning and Scalability

The energy transition in Portugal creates opportunities but also introduces operational complexity. Rapid capacity expansion increases pressure on existing grid infrastructure, particularly in high-demand urban hubs. Power supply reliability remains a critical factor for large-scale colocation builds. The Portugal Data Center Colocation Market faces planning difficulties when integrating renewable sources with variable outputs. Operators are forced to adopt advanced energy storage and grid-balancing solutions to maintain uptime guarantees. Rising energy costs increase operational expenses and affect competitive pricing. These challenges demand high capital expenditure and advanced power management strategies from operators. Infrastructure investments in energy flexibility will determine long-term scalability.

Regulatory Compliance and Talent Constraints Slowing Deployment Timelines

Data center operators must meet strict environmental, construction, and cybersecurity regulations, which extend project timelines. Regulatory complexity makes capacity delivery less predictable, creating hurdles for hyperscale and edge deployment. The Portugal Data Center Colocation Market experiences delays when skilled technical labor is limited in key regions. Talent shortages in power systems, cooling, and cloud integration affect project execution quality. Regulatory bottlenecks also create barriers for smaller players entering the market. These factors make strategic partnerships and automation critical for overcoming operational delays. Maintaining compliance while accelerating build cycles remains a key industry challenge.

Market Opportunities

Emerging Role as a Digital Gateway Strengthening Cross-Regional Connectivity and Trade

Portugal’s geographic advantage offers a strong foundation for developing new interconnection routes and digital trade corridors. The Portugal Data Center Colocation Market stands to gain from growing transatlantic data flows and increasing demand from hyperscalers. Submarine cable expansions and favorable policy conditions create attractive investment prospects. New facility clusters near cable landing points enable low-latency connectivity. Enterprises and cloud providers view Portugal as a stable entry point into European and global markets.

Expansion of AI and Edge Infrastructure Unlocking New Enterprise and Public Sector Applications

The rise of AI and edge use cases is opening new application areas in healthcare, finance, manufacturing, and public services. The Portugal Data Center Colocation Market supports this transformation through scalable, distributed infrastructure. Edge computing enables localized processing, improving efficiency for real-time workloads. AI adoption drives demand for specialized colocation capacity with advanced cooling and network resilience. This creates new opportunities for investors and operators targeting vertical expansion strategies.

Market Segmentation

By Type

Retail colocation holds a dominant share, supported by strong adoption among enterprises seeking flexible capacity. It provides predictable pricing, secure hosting, and scalable services for mid-market and large organizations. Wholesale colocation is expanding through hyperscale investments focused on cable landing points. Hybrid cloud colocation is gaining traction as enterprises seek integrated on-premises and cloud strategies. The Portugal Data Center Colocation Market benefits from this layered demand across customer segments.

By Tier Level

Tier 3 facilities lead the market with a strong focus on reliability, scalability, and compliance with industry standards. Tier 4 facilities are expanding gradually to meet hyperscale and AI infrastructure needs. Tier 1 and Tier 2 sites support edge deployments in emerging hubs. The Portugal Data Center Colocation Market aligns with these trends to enhance operational resilience. Tier 3’s balance of cost and uptime performance drives most enterprise demand.

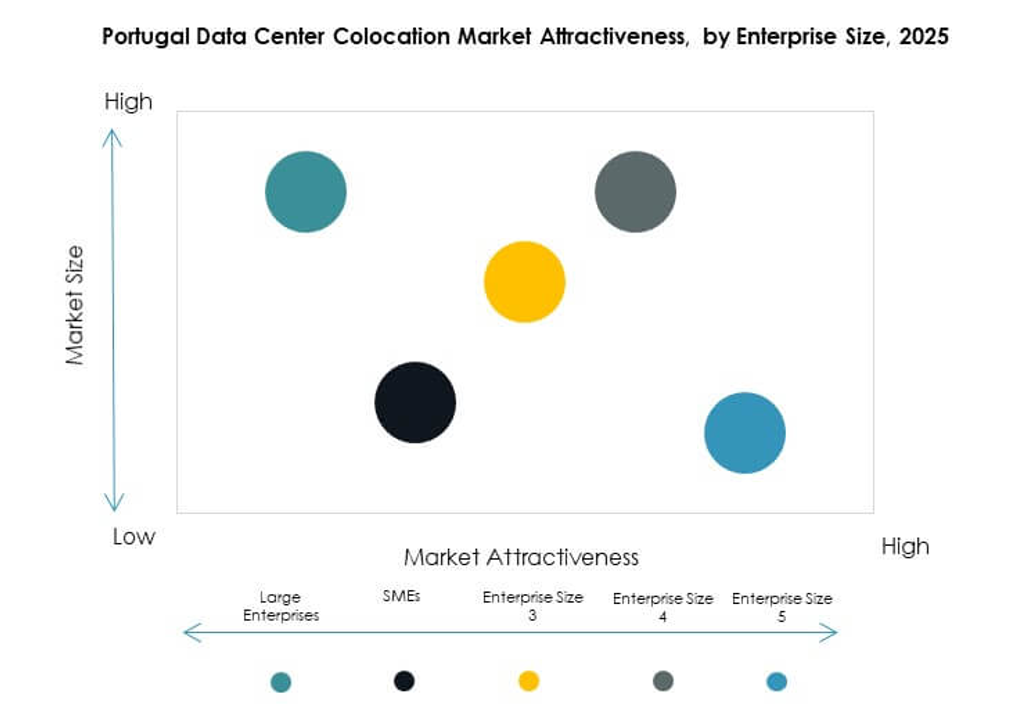

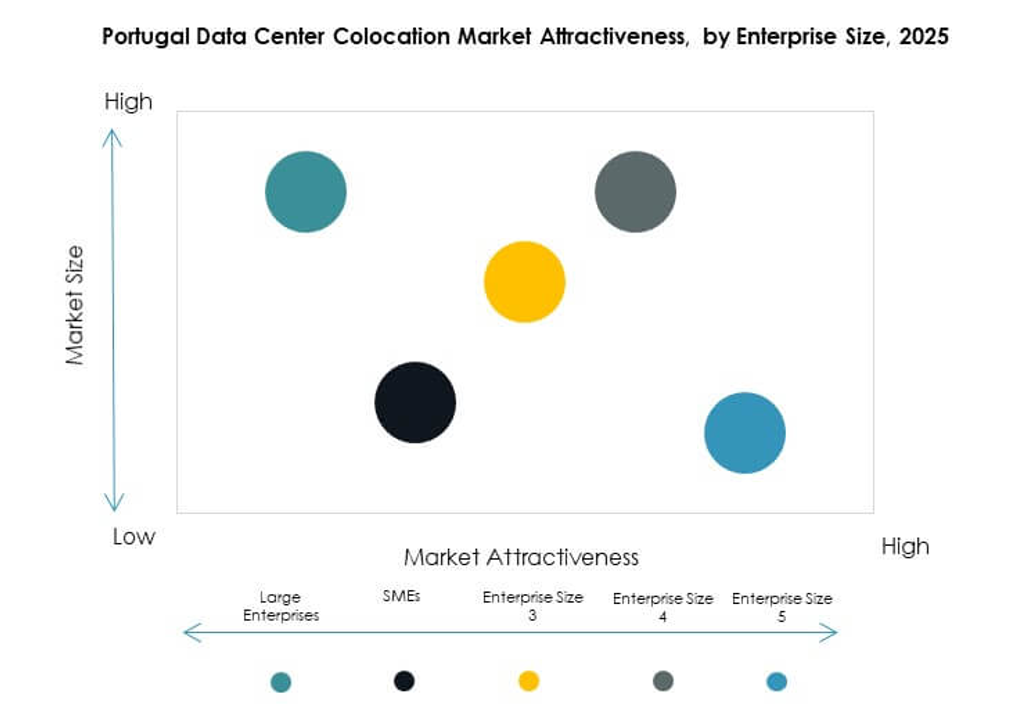

By Enterprise Size

Large enterprises dominate the market, leveraging colocation for high-performance workloads, secure hosting, and compliance requirements. SMEs are adopting retail colocation for cost-effective IT modernization and hybrid strategies. The Portugal Data Center Colocation Market benefits from balanced growth across both segments, with larger firms driving capacity investments and SMEs fueling edge expansion.

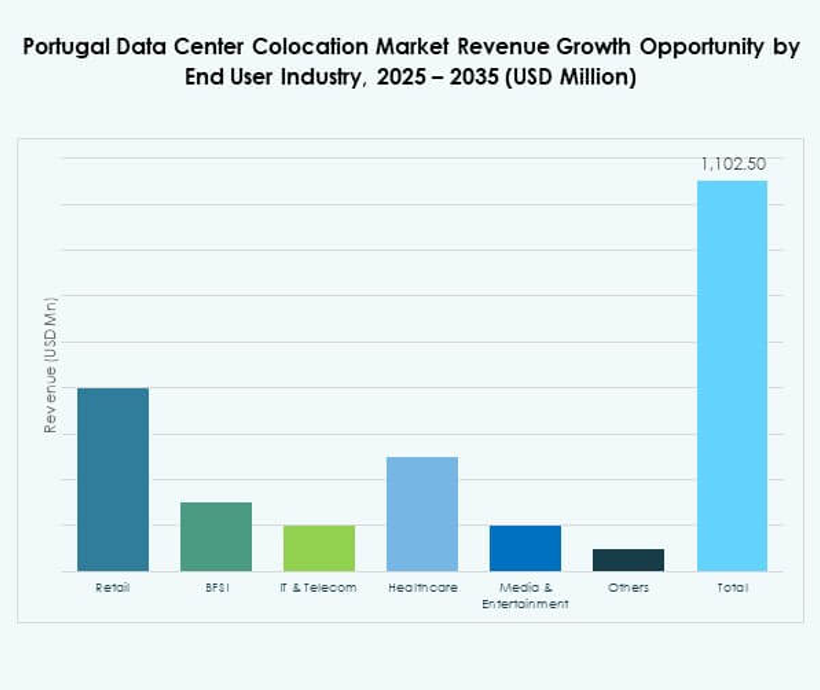

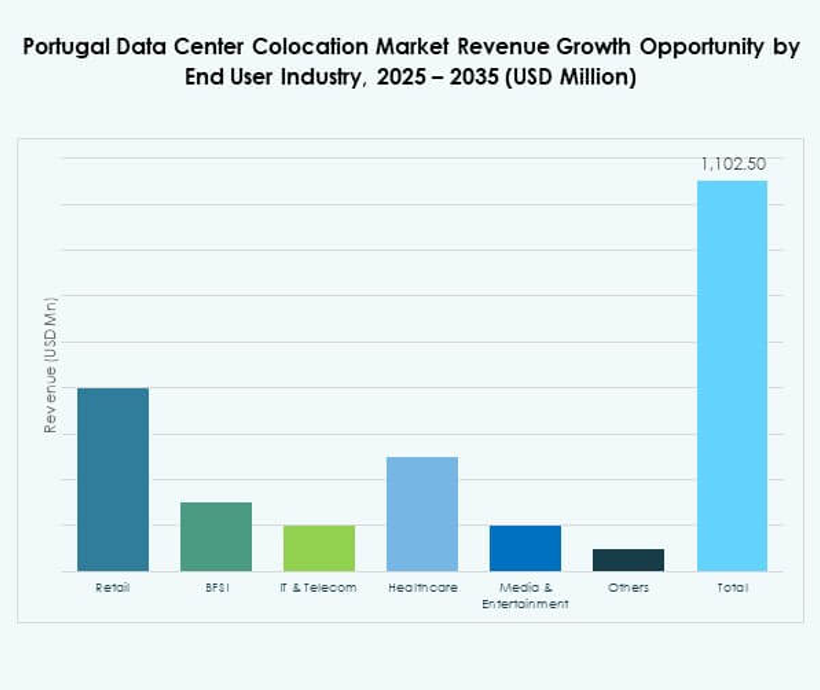

By End User Industry

IT and telecom is the leading segment, driven by high interconnection demand and cloud transformation projects. BFSI and healthcare are increasing colocation adoption to meet data residency and regulatory standards. Media and entertainment rely on colocation to support content delivery and streaming performance. The Portugal Data Center Colocation Market benefits from this diverse demand, ensuring sustained infrastructure development across sectors.

Regional Insights

Lisbon Region Leading with Strong Connectivity and Hyperscale Investment Share of 51.2%

Lisbon dominates the Portugal Data Center Colocation Market due to its strategic location, network infrastructure, and hyperscale ecosystem. Multiple submarine cable landings connect Lisbon to major international hubs. Strong investments in green power and network densification attract global operators. The city supports edge, retail, and hyperscale deployments, creating a mature market environment. Government-backed digital infrastructure strategies further reinforce Lisbon’s leadership position.

- For instance, Equinix opened its second Lisbon data center (LS2) in June 2025 with an initial investment of €50 million, supporting expansion for hyperscale and enterprise customers through new international submarine cable connectivity and direct access to more than 75 network service providers on its platform.

Porto Region Emerging as a Secondary Colocation Hub with a Share of 29.5%

Porto is becoming an attractive secondary hub for colocation growth. Expanding fiber networks and increasing enterprise activity support this momentum. The region attracts both retail and wholesale colocation projects, enabling regional load distribution. The Portugal Data Center Colocation Market benefits from Porto’s growing role in serving northern businesses. Infrastructure diversification strengthens resilience and reduces pressure on Lisbon’s data infrastructure.

Sines and Other Strategic Hubs Strengthening Future Edge and Subsea Infrastructure with 19.3% Share

Sines and other emerging hubs are gaining strategic relevance through their proximity to future cable projects and renewable power sources. These locations offer room for large-scale builds, making them attractive for hyperscale operators. The Portugal Data Center Colocation Market sees these hubs as critical for edge deployments and international routing. Infrastructure expansion in these areas will enhance national data flow resilience and connectivity competitiveness.

- For instance, Start Campus inaugurated its SIN01 data center in Sines in late 2024, marking the first operational phase of its planned 1.2 GW campus. The facility is designed to support hyperscale expansion and integrates renewable power with advanced cooling infrastructure.

Competitive Insights:

- Claranet

- Nos Data Centers

- AR Telecom

- Porto Data Center

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The Portugal Data Center Colocation Market features a balanced mix of domestic operators and global hyperscale providers. It reflects a competitive structure driven by infrastructure scalability, network reach, and energy-efficient designs. Local firms like Claranet and Nos Data Centers strengthen regional presence through strategic colocation expansions, while hyperscale leaders such as Equinix, Digital Realty, and AWS focus on high-density deployments and interconnection ecosystems. Global players introduce advanced automation, hybrid cloud services, and AI-ready infrastructure. Domestic operators prioritize regional connectivity and energy security, creating differentiated value propositions. Strategic alliances, renewable integration, and cable landing proximity play a key role in shaping competitive advantages. This competitive landscape supports rapid digital infrastructure growth and diversified service offerings across enterprise and hyperscale segments.

Recent Developments:

- In May 2025, Start Campus also partnered with Schneider Electric to deliver the SIN01 facility, a 26MW data center in Sines. This partnership underscores Portugal’s growing reputation for robust digital infrastructure and enhances the market’s capability to support enterprise and hyperscale operations with resilient, renewable-powered backup systems for uninterrupted services.

- In March 2025, AWS launched its first AWS Direct Connect location in Portugal, hosted at the Equinix LS1 data center in Lisbon. This provides private, high-speed connections for enterprises needing secure access to AWS’s global cloud infrastructure, and marks a significant step in integrating Portugal into the global cloud ecosystem.

- In March 2025, Colt Technology Services partnered with AtlasEdge to deliver high-performance, sustainable connectivity at AtlasEdge’s renewable-powered Lisbon data center campus, leveraging Colt’s robust fiber network for enterprise clients across Portugal.