Executive summary:

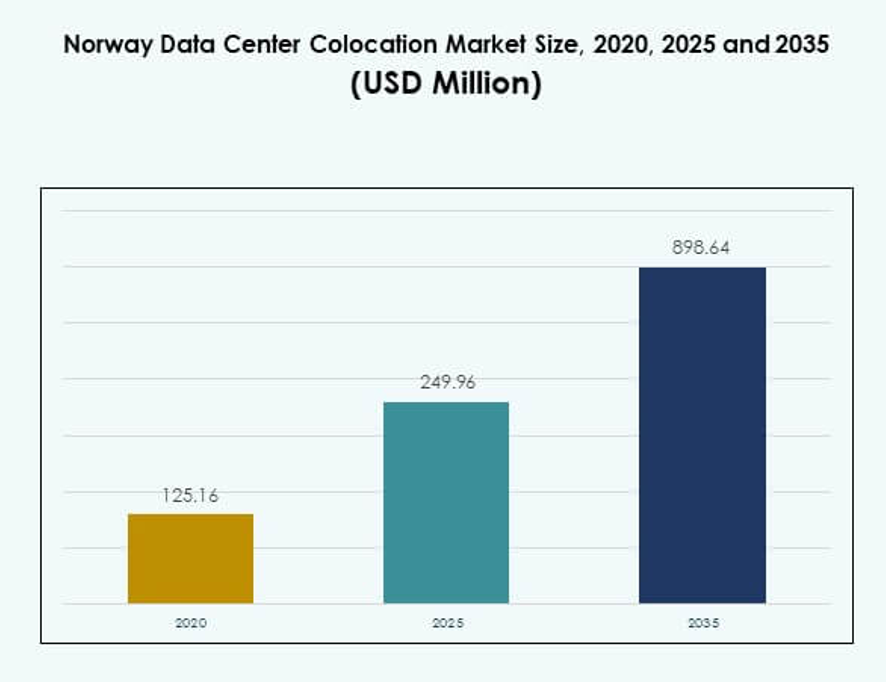

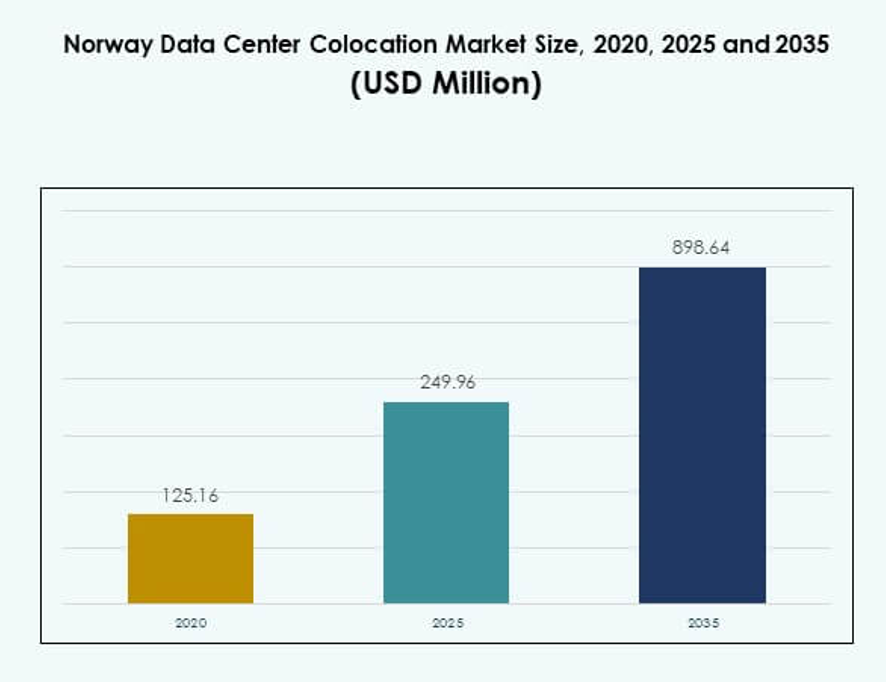

The Norway Data Center Colocation Market size was valued at USD 125.16 million in 2020 to USD 249.96 million in 2025 and is anticipated to reach USD 898.64 million by 2035, at a CAGR of 13.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Norway Data Center Colocation Market Size 2025 |

USD 249.96 Million |

| Norway Data Center Colocation Market, CAGR |

13.59% |

| Norway Data Center Colocation Market Size 2035 |

USD 898.64 Million |

Strong renewable energy availability, growing AI adoption, and advanced network infrastructure are driving rapid expansion. Operators are deploying high-density, energy-efficient facilities to support scalable workloads. Strategic investments in AI infrastructure, liquid cooling, and green energy integration are enhancing competitiveness. Government incentives and stable regulatory frameworks are attracting hyperscalers and enterprises, reinforcing Norway’s position as a sustainable colocation hub for global deployments.

The Oslo region leads the market due to its dense connectivity and proximity to energy sources. Northern Norway is emerging as a key edge hub, leveraging renewable power and efficient cooling. Western Norway is strengthening its position through subsea cable connectivity and sustainable infrastructure. These regions together create a strong national backbone supporting growing colocation capacity.

Market Drivers

Sustainable Energy Integration and Strategic Power Availability Driving Hyperscale Investments

Norway’s abundant renewable energy supply is accelerating the expansion of high-capacity data centers. The country’s extensive hydropower infrastructure ensures low-cost, low-carbon electricity, enabling operators to align with strict sustainability targets. Hyperscalers are prioritizing locations that reduce carbon intensity while offering energy stability. Government support for green technology adoption is strengthening investor confidence. It creates a favorable environment for long-term infrastructure commitments. Energy availability near major hubs supports high-density colocation environments. This reliability encourages migration of global workloads to Norway. The [Norway Data Center Colocation Market] benefits from this strong foundation for energy-efficient operations.

- For instance, in September 2025, Microsoft announced a $6.2 billion investment with Nscale and Aker to provide AI data center infrastructure in Narvik, Norway, powered entirely by renewable energy, advancing Microsoft’s commitment to power all Norwegian data center operations exclusively with renewables.

Growing AI Workload Demands and Advanced Infrastructure Supporting High-Density Deployments

Rapid AI adoption is pushing demand for GPU-optimized infrastructure. Colocation operators are deploying liquid cooling and advanced power management to handle dense compute loads. AI-driven workloads require scalable and secure hosting environments with minimal latency. Strategic investments in high-capacity campuses enhance the country’s competitiveness for global deployments. Technology vendors are enabling efficient infrastructure expansion through modular build-outs. This accelerates time to market and lowers capital risk. Enterprises are shifting critical AI workloads to Norway for better performance and cost control. The [Norway Data Center Colocation Market] is becoming an attractive option for AI-intensive industries.

Strong Connectivity Ecosystem and Proximity to European Data Exchange Hubs

The presence of high-capacity subsea cables is enabling low-latency connections to major European markets. Strategic links to the UK, Denmark, Germany, and the Netherlands enhance Norway’s appeal for latency-sensitive applications. Colocation providers are capitalizing on this connectivity to attract international customers. The ecosystem supports global cloud interconnection strategies and distributed workloads. Carriers and hyperscalers are investing in resilient network routes to ensure uninterrupted services. It reinforces Norway’s position as a key digital gateway in Northern Europe. Advanced connectivity infrastructure is attracting multinational clients seeking redundancy. The [Norway Data Center Colocation Market] is leveraging this advantage for expansion.

- For instance, the NO-UK subsea cable system, operational since late 2021, connects Stavanger, Norway, to Newcastle, UK, offering eight dark fiber pairs and up to 216 Tbps capacity, directly improving Norway’s connectivity for international data traffic.

Government Incentives, Regulatory Stability, and Digitalization Initiatives Strengthening Market Growth

Norwegian authorities are prioritizing the digital economy and promoting green industrial development. Tax incentives, predictable regulations, and fast-track permitting processes support large-scale deployments. The government encourages sustainable design practices and heat reuse initiatives. Digitalization programs are creating demand for colocation services from both enterprises and the public sector. Stable policy frameworks are reassuring investors and accelerating buildouts. Energy-efficient incentives are fostering long-term operational cost reductions. It creates a stable investment environment for hyperscalers and enterprises. The [Norway Data Center Colocation Market] is experiencing steady inflows of capital due to this favorable regulatory setting.

Market Trends

Rising Focus on Heat Reuse and Circular Energy Models Across New Facilities

Operators are integrating district heating solutions to reduce emissions and monetize excess energy. Heat reuse partnerships with municipal networks are expanding across multiple regions. This approach lowers operational costs and supports climate goals. Energy-efficient designs are becoming a competitive differentiator in colocation site selection. Urban areas are prioritizing facilities that contribute to sustainable energy loops. Clients prefer providers that offer measurable environmental benefits. It creates opportunities for long-term energy collaboration with cities. The [Norway Data Center Colocation Market] is setting benchmarks for circular energy innovation in Northern Europe.

Shift Toward Modular and Scalable Data Center Designs for Flexible Expansion

Providers are standardizing modular build models to meet fluctuating demand. Prefabricated infrastructure shortens deployment timelines and optimizes resource use. Scalable designs allow colocation facilities to grow with client requirements. It lowers financial exposure and improves operational agility. Operators can deliver high-capacity environments faster, meeting rapid digitalization needs. This shift aligns with enterprise strategies focused on hybrid cloud adoption. Flexibility is becoming a decisive factor in site selection. The [Norway Data Center Colocation Market] is adapting to this structural transformation in facility design.

Emergence of Edge Data Centers to Serve Remote and Low-Latency Applications

Decentralized edge sites are growing to support 5G, IoT, and content delivery. Smaller facilities near regional users are reducing network congestion and improving response time. Edge computing adoption is strengthening enterprise digital transformation strategies. These deployments are enabling real-time analytics and critical application hosting. Regional connectivity investments are improving access to underserved areas. It helps service providers expand their footprint efficiently. Edge infrastructure is becoming an integral part of national digital planning. The [Norway Data Center Colocation Market] is expanding beyond major metro areas to meet this demand.

Rising Demand for High-Security Infrastructure Meeting Global Compliance Standards

Enterprises are prioritizing colocation facilities with advanced security frameworks. ISO certifications, GDPR alignment, and high physical protection levels are essential for client onboarding. Data sovereignty concerns are driving demand for local hosting solutions. Operators are implementing multi-layered security with automation and monitoring tools. Strategic partnerships with cybersecurity vendors enhance operational resilience. It helps enterprises meet regulatory requirements with reduced risk exposure. High-trust environments are attracting industries like BFSI and healthcare. The [Norway Data Center Colocation Market] is aligning its growth strategy with global compliance standards.

Market Challenges

Limited Land Availability and Environmental Regulations Slowing Large-Scale Expansion

Scarcity of land in strategic urban zones is constraining site development opportunities. Stringent environmental guidelines increase approval timelines for new builds. Energy infrastructure projects face delays due to local impact assessments. Operators must balance expansion goals with environmental commitments. This complexity affects buildout speed and capital planning. Infrastructure availability in remote areas is limited, creating uneven geographic distribution. It challenges providers to balance sustainability and operational efficiency. The [Norway Data Center Colocation Market] faces slower development cycles due to these structural constraints.

Growing Competition and Pricing Pressures from International Hyperscalers

Rising interest from global players is intensifying competition in core colocation markets. Large hyperscalers are leveraging scale advantages to offer competitive pricing. Smaller domestic providers are struggling to maintain margins under these conditions. Differentiation through sustainability and niche services is becoming essential. Price pressure limits flexibility in operational investments and technology upgrades. It increases financial risk for smaller operators. Enterprises are consolidating vendor relationships, reducing market share for smaller firms. The [Norway Data Center Colocation Market] must adapt business models to remain resilient against competitive forces.

Market Opportunities

Accelerating Cloud Migration and AI Workload Expansion Driving Colocation Demand

Digital transformation strategies are accelerating enterprise adoption of hybrid and multi-cloud solutions. AI and HPC workloads are seeking sustainable, low-latency hosting locations. Norway’s renewable energy advantage positions the country favorably in global site selection. Enterprises are expanding their colocation footprint to scale operations efficiently. Advanced infrastructure is attracting industries with critical computing needs. It creates new growth channels for operators offering high-performance solutions. The [Norway Data Center Colocation Market] is well placed to capture this demand surge.

Strategic Energy and Network Collaborations Enhancing Investment Potential

Partnerships between energy utilities, carriers, and operators are unlocking new expansion models. Renewable power agreements strengthen value propositions for international customers. High-capacity networks ensure secure connectivity across European markets. These collaborations reduce project risk and boost operational stability. Investors favor environments with reliable energy and network resilience. It opens opportunities for long-term capital deployment. The [Norway Data Center Colocation Market] benefits from these strategic ecosystem alliances.

Market Segmentation

By Type

Retail colocation dominates the [Norway Data Center Colocation Market] with strong demand from enterprises seeking flexible capacity. Its share remains high due to its lower entry cost and scalability. Wholesale colocation is expanding rapidly as hyperscalers secure large footprints for AI workloads. Hybrid colocation is gaining traction with cloud-driven strategies. Demand from technology firms, BFSI, and healthcare segments drives strong growth. Retail facilities remain critical for distributed workloads and low-latency requirements.

By Tier Level

Tier 3 facilities hold the largest share in the [Norway Data Center Colocation Market] due to their strong balance between redundancy and cost efficiency. Tier 4 centers are expanding with hyperscaler interest in fault-tolerant designs. Tier 1 and Tier 2 deployments serve edge and smaller enterprise applications. High uptime standards and energy-efficient designs strengthen Tier 3 dominance. Government and enterprise workloads favor Tier 3 and Tier 4 facilities for mission-critical operations.

By Enterprise Size

Large enterprises dominate the [Norway Data Center Colocation Market] with demand for high-capacity, secure, and interconnected infrastructure. Their investments drive large-scale campus developments and sustainable designs. SMEs are adopting colocation to reduce infrastructure costs and improve flexibility. Modular options support SMEs in scaling operations efficiently. Cloud-native SMEs are emerging as an important growth segment.

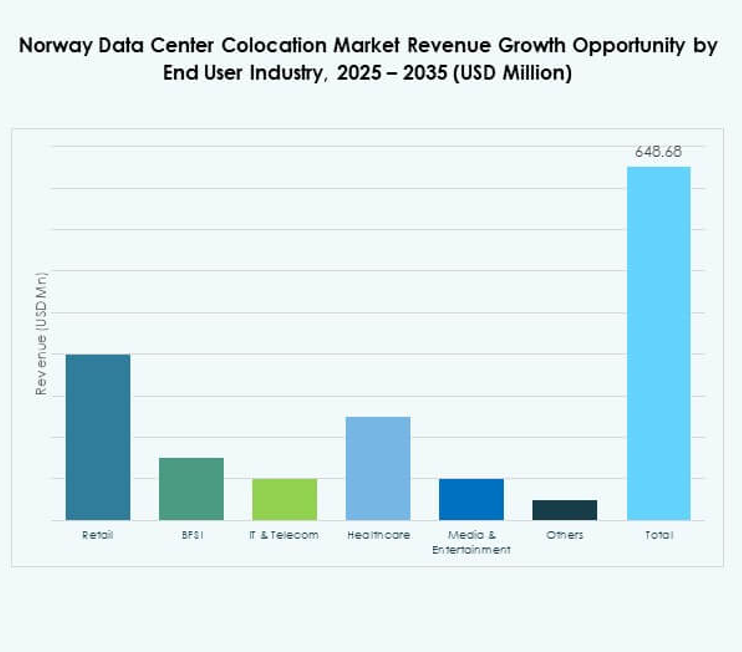

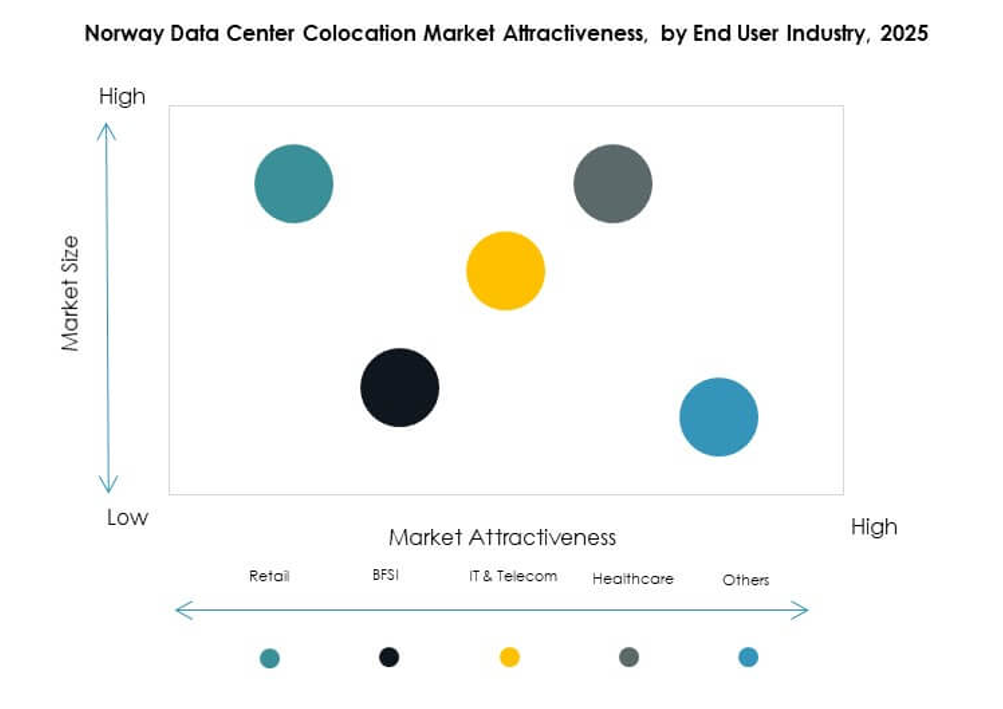

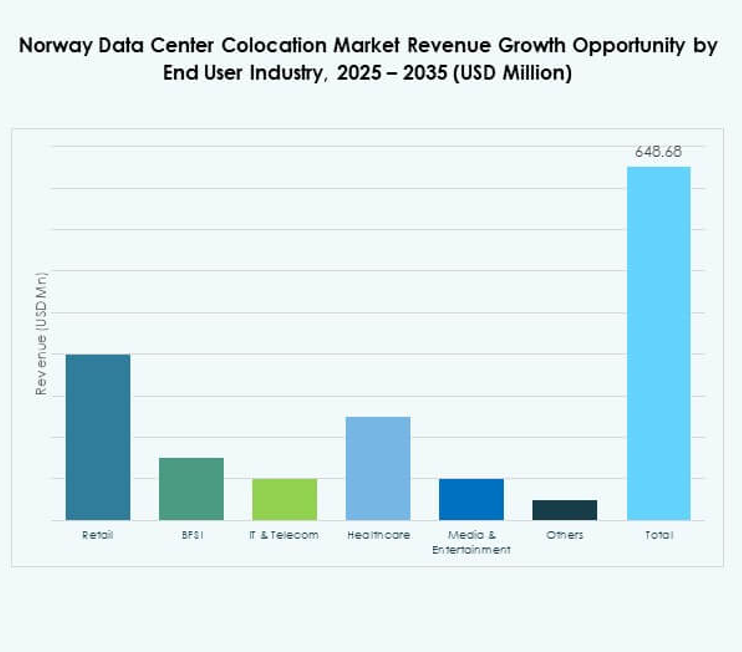

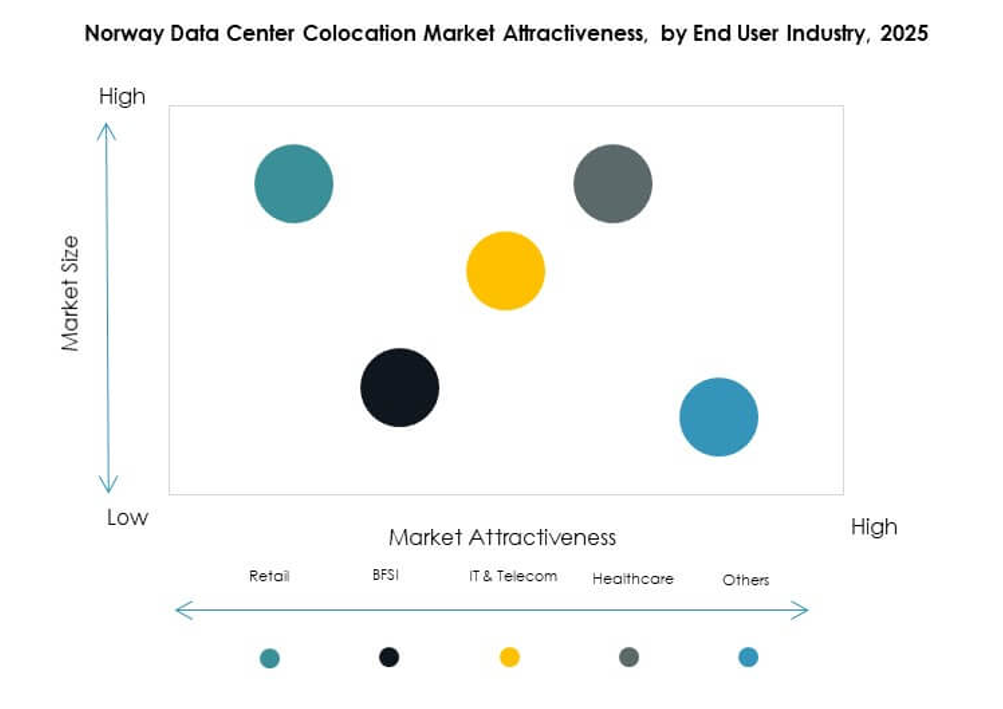

By End User Industry

IT and Telecom lead the [Norway Data Center Colocation Market] with extensive network infrastructure and AI-driven expansion. BFSI remains a critical segment with strict compliance and data sovereignty requirements. Media and entertainment demand is increasing with streaming and content delivery growth. Healthcare deployments are growing, supported by secure hosting needs. Retail and other industries contribute steady demand for distributed infrastructure.

Regional Insights

Oslo Region Leading Market Share with Dense Connectivity and Hyperscale Investments

The Oslo region holds a 48% share of the [Norway Data Center Colocation Market], supported by advanced network infrastructure and reliable power availability. Strong connectivity to European hubs enhances its role in hyperscale strategies. Multiple international operators are expanding in this region to serve AI and cloud demand. Proximity to enterprise clients and energy sources improves operational efficiency. It remains the primary hub for data-intensive industries.

- For instance, Green Mountain’s Oslo and Stavanger data centers are carrier-neutral with multiple fiber providers, dual-path dark fibers, and fully redundant meet-me rooms. The facilities hold Uptime Institute Tier III certification and offer connectivity to London with latency of 14.9 milliseconds.

Northern Norway Emerging as a Strategic Edge Hub with Energy Efficiency Advantages

Northern Norway accounts for 32% of the [Norway Data Center Colocation Market], driven by access to low-cost hydropower and natural cooling. Its location offers excellent conditions for sustainable and high-density data center operations. Edge deployments in this region are expanding to support latency-sensitive applications. Infrastructure investments are improving accessibility and resilience. It plays a crucial role in supporting decentralized computing strategies.

- For instance, Bulk Infrastructure’s data centers in Nordland operate entirely on 100% renewable hydropower, enabling fully emissions-free operation for all clients. The company’s infrastructure is built to maximize sustainability for colocation and edge deployments in the region.

Western Norway Strengthening Position with Green Infrastructure and Subsea Connectivity

Western Norway holds a 20% share of the [Norway Data Center Colocation Market], supported by strong renewable energy capacity and subsea cable landing stations. The region offers strategic links to the UK and mainland Europe. Its favorable energy profile attracts operators building eco-friendly facilities. It complements the northern and Oslo regions in national colocation strategies. It strengthens Norway’s position as a sustainable European data hub.

Competitive Insights:

- Green Mountain

- Basefarm

- City Network

- Bulk Infrastructure

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The [Norway Data Center Colocation Market] features strong competition between local providers and global hyperscale operators. Green Mountain and Bulk Infrastructure lead with large-scale renewable-powered campuses. Equinix, Digital Realty Trust, and NTT Ltd. are expanding their presence to serve AI-driven workloads. AWS and Google Cloud strengthen their footprint through scalable hyperscale infrastructure and cloud integration. City Network and Basefarm provide specialized enterprise services with regional compliance advantages. Colt Technology Services and China Telecom target low-latency interconnectivity and international customer segments. It is experiencing strategic investments, M&A activity, and partnerships focused on energy efficiency, AI readiness, and network resilience, creating a dynamic and highly competitive environment.

Recent Developments:

- In September 2025, ASP Data Center finalized the acquisition of a former factory site just outside Bergen, marking a strategic move aimed at expanding its operational footprint in Norway’s colocation market. This location was previously utilized as a cryptomine, allowing ASP Data Center to leverage existing infrastructure for quick deployment of colocation services in western Norway.

- In August 2025, Terak AS entered into a partnership with Neurophos, a leading AI chip manufacturer, to establish cutting-edge AI infrastructure at its Hellandsbygd facility. This collaboration is set to enhance Norway’s capacity for AI-ready colocation environments, supporting advanced computing and high-density workloads with next-generation technologies.

- In August 2025, Green Mountain completed the construction of three new data center buildings in Hamar, Norway, as part of a major colocation project serving TikTok and supporting regional economic growth. This facility now employs 220 people on site and represents the largest industrial investment in Innlandet county, with more than NOK 9.7 billion invested by Green Mountain and an additional NOK 30 billion invested by TikTok in equipment and services for the project.

- In November 2024, Telenor launched Norway’s inaugural AI factory, powered by Nvidia GPUs, further driving innovation in the country’s colocation sector. This initiative focuses on building secure environments for sensitive AI workloads, demonstrating Telenor’s pivotal role in transforming Norway’s colocation landscape through technology investments.

- In Jan 2024, Bulk Infrastructure launched a new 42MW dedicated colocation facility at their N01 campus in Norway. This site is powered by 100% renewable energy and is designed specifically for high-density GPU and CPU workloads, supporting large-scale AI computing deployments and future data center growth.