Executive summary:

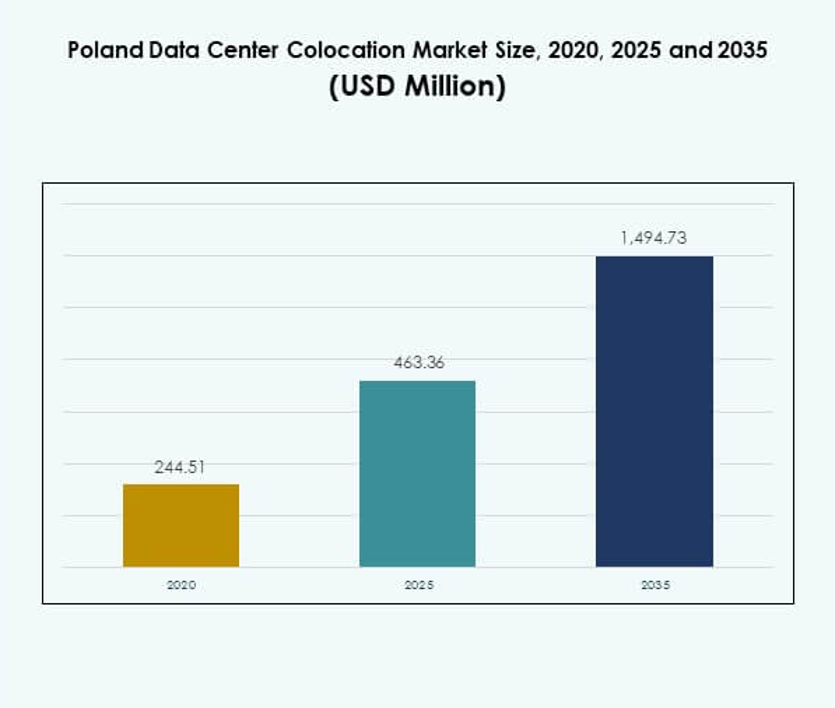

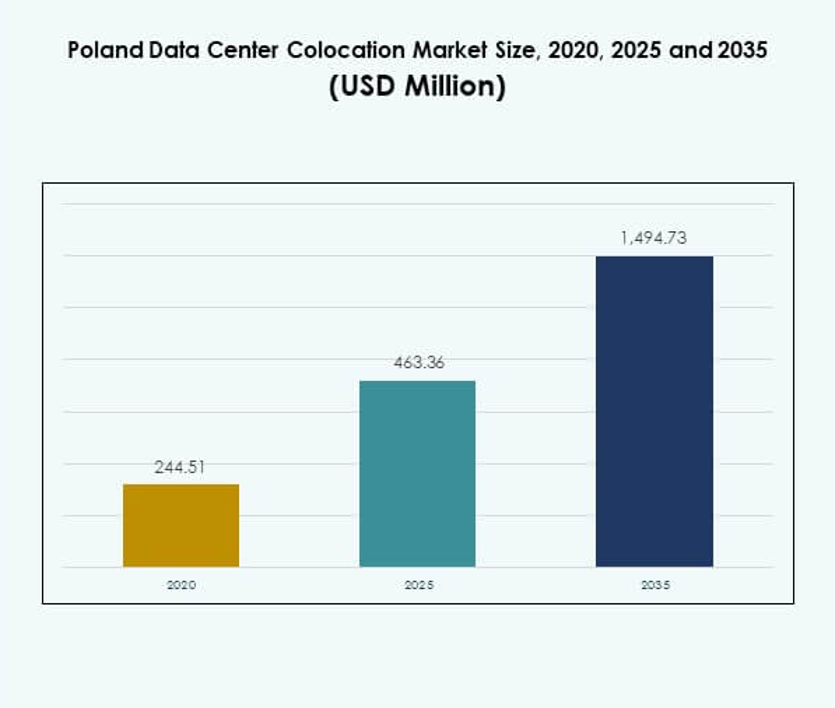

The Poland Data Center Colocation Market size was valued at USD 244.51 million in 2020, reached USD 463.36 million in 2025, and is anticipated to attain USD 1,494.73 million by 2035, growing at a CAGR of 12.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Poland Data Center Colocation Market Size 2025 |

USD 463.36 Million |

| Poland Data Center Colocation Market, CAGR |

12.36% |

| Poland Data Center Colocation Market Size 2035 |

USD 1,494.73 Million |

The market is driven by rising enterprise cloud adoption, hyperscale investments, and increasing demand for secure digital infrastructure. Companies are focusing on advanced cooling, renewable energy use, and automation to improve operational efficiency. Edge computing and hybrid IT models are becoming key enablers for AI workloads and real-time data processing. The Poland Data Center Colocation Market plays a strategic role in supporting business continuity, scalability, and sustainable growth for both domestic and global enterprises.

Warsaw dominates the market as the primary data center hub due to strong connectivity and advanced infrastructure. Cities such as Poznań, Kraków, and Wrocław are emerging as secondary hubs, attracting investments from operators expanding their footprint. Poland’s geographic position in Central Europe strengthens its appeal as a key digital gateway, supporting low-latency interconnections across the continent and reinforcing its importance in regional infrastructure growth.

Market Drivers

Rising Enterprise Cloud Adoption and Digital Infrastructure Expansion

Rapid digital transformation across sectors is driving large-scale investment in advanced infrastructure. Enterprises are adopting hybrid and multi-cloud models to enhance operational flexibility and minimize downtime. Cloud service providers are expanding regional availability zones to meet growing enterprise demand. Edge computing deployment is increasing to support low-latency workloads across retail, banking, and manufacturing. Government digitalization programs are further accelerating adoption rates. The Poland Data Center Colocation Market benefits from strong enterprise migration toward flexible IT infrastructure. It supports strategic business continuity plans for both domestic and international organizations.

Advancement in Renewable Energy and Sustainable Data Center Operations

Growing emphasis on energy efficiency is reshaping the structure of modern facilities. Operators are integrating renewable power sources to reduce operational costs and meet ESG goals. Advanced cooling systems and waste heat recovery solutions are improving power usage effectiveness. Green building certifications are becoming a key factor for attracting enterprise customers. This shift aligns infrastructure with EU climate policies and energy transition targets. It strengthens Poland’s positioning in the regional colocation landscape. It also encourages investors to prioritize sustainable infrastructure developments that align with regulatory goals and customer demand.

- For instance, Beyond.pl (a leading data center operator in Poland) powers its Poznań and Warsaw campuses entirely with renewable energy, is committed to an annual PUE below 1.2, and was the first operator in Poland to confirm full renewable energy sourcing for its campus, as reported in September 2024 and regularly cited in innovation leadership statements from their management.

Strategic Positioning as a Central European Connectivity Hub

Poland’s geographic location provides strategic access to major European data routes. It enables low-latency connectivity to Western Europe and Baltic regions. Hyperscale operators are expanding investments to strengthen Poland’s role as a regional hub. Strong fiber infrastructure and submarine cable expansion are improving connectivity reliability. Warsaw remains a primary gateway, while secondary cities attract capacity expansion. The Poland Data Center Colocation Market gains competitive strength from this geographic advantage. It enables enterprises to reduce latency, improve network performance, and expand service coverage effectively.

- For instance, Equinix’s WA3 data center in Warsaw offers direct access to key European fiber backbones, supporting carrier-neutral peering and interconnection to the DE-CIX exchange, which enhances low-latency multinational connectivity for clients and strengthens Poland’s role as a digital gateway in Central Europe.

Growing Demand for Colocation Services from Digital Native Industries

Digital-first enterprises are driving a shift toward scalable and secure colocation facilities. E-commerce, fintech, and media industries are expanding their infrastructure footprints rapidly. AI and big data workloads require high compute capacity and secure hosting environments. Colocation enables these industries to scale without heavy upfront capital investment. This demand is boosting investments in advanced facilities with higher power density. The Poland Data Center Colocation Market leverages this surge to attract both domestic and international businesses. It enhances long-term infrastructure resilience and supports regional digital economy growth.

Market Trends

Expansion of Edge Computing to Support Low-Latency Applications

Edge computing deployment is growing in tandem with real-time service requirements. Enterprises in logistics, e-commerce, and manufacturing are adopting distributed edge nodes to process data closer to end users. Operators are deploying micro data centers to reduce latency and improve service efficiency. Integration with IoT networks is enabling faster and more accurate analytics. The Poland Data Center Colocation Market reflects this shift toward decentralized infrastructure. It supports modern use cases such as smart cities and automated production systems. It also creates new revenue streams for colocation providers targeting niche industries.

Increased Investment in Hyperscale and Interconnection Facilities

Hyperscale operators are expanding capacity to meet rising data traffic across enterprise segments. Interconnection hubs are being upgraded to support multi-cloud connectivity and high network performance. Enterprises are seeking flexible colocation solutions integrated with cloud platforms. Direct interconnects to global cloud providers are enhancing service resilience. High-capacity fiber networks and carrier-neutral facilities are becoming strategic investment targets. The Poland Data Center Colocation Market benefits from this growing hyperscale presence. It reinforces the country’s role in supporting mission-critical digital workloads and regional connectivity.

Integration of AI and Automation for Data Center Optimization

AI-based energy management and predictive maintenance solutions are becoming mainstream. Operators are implementing intelligent control systems to reduce downtime and operational costs. AI algorithms are improving resource allocation and load balancing efficiency. Automation enhances security monitoring, performance tracking, and incident response capabilities. Facilities are evolving to deliver autonomous, self-optimizing environments for enterprises. The Poland Data Center Colocation Market reflects this shift toward intelligent infrastructure operations. It strengthens the competitiveness of regional operators and attracts enterprise clients with advanced performance needs.

Shift Toward Modular and Scalable Facility Designs

Modular design is enabling faster deployment of high-capacity facilities at lower costs. Operators are adopting prefabricated modules to improve construction timelines and operational flexibility. This design trend supports customized capacity expansion without full rebuilds. Scalable configurations are aligning with fluctuating enterprise demand. Operators can optimize power and cooling based on workload distribution. The Poland Data Center Colocation Market is embracing modular infrastructure to meet rapid capacity growth. It improves time-to-market for new deployments and enhances adaptability to evolving digital needs.

Market Challenges

High Energy Demand and Power Grid Constraints Affecting Expansion Plans

Rising energy consumption is creating pressure on Poland’s national power grid. Data center operations require stable electricity supply with minimal interruptions. Limited availability of renewable power capacity complicates sustainability goals. Operators are facing longer timelines to secure reliable energy sources for new projects. Power grid upgrades remain uneven across regions, slowing capacity expansion outside Warsaw. The Poland Data Center Colocation Market faces higher operational risks due to energy constraints. It pushes operators to explore advanced energy management solutions and long-term power purchase agreements.

Regulatory Complexity and Delays in Infrastructure Development Approvals

Strict environmental and building regulations are increasing compliance costs for operators. Delays in permitting processes are affecting project timelines and investment decisions. Uncertainty around tax incentives and zoning laws creates planning challenges. Complex reporting requirements related to energy consumption and emissions increase administrative burdens. Smaller players find it difficult to compete with hyperscale operators under these regulatory conditions. The Poland Data Center Colocation Market faces slower facility rollout timelines in regions with limited administrative capacity. It encourages consolidation among larger providers that can navigate regulatory frameworks more effectively.

Market Opportunities

Expansion of AI, 5G, and IoT-Driven Infrastructure Demand

Next-generation technologies are creating strong demand for localized computing power. 5G deployments are enabling low-latency services that require regional infrastructure. AI applications need high-performance compute hosted in secure and scalable facilities. Colocation operators can capture this growing segment through strategic investments. The Poland Data Center Colocation Market benefits from enterprises seeking hybrid hosting environments. It supports a broader ecosystem of digital applications driving long-term infrastructure expansion.

Strong Investor Interest in Sustainable and Green Data Centers

Investors are prioritizing low-carbon and energy-efficient facilities across Europe. Poland’s renewable energy integration plans align with green investment trends. Developers adopting advanced cooling and heat recovery technologies attract strong funding. Green-certified colocation facilities offer cost advantages over legacy systems. The Poland Data Center Colocation Market stands to gain from ESG-focused financing. It strengthens investor confidence and accelerates long-term infrastructure modernization.

Market Segmentation

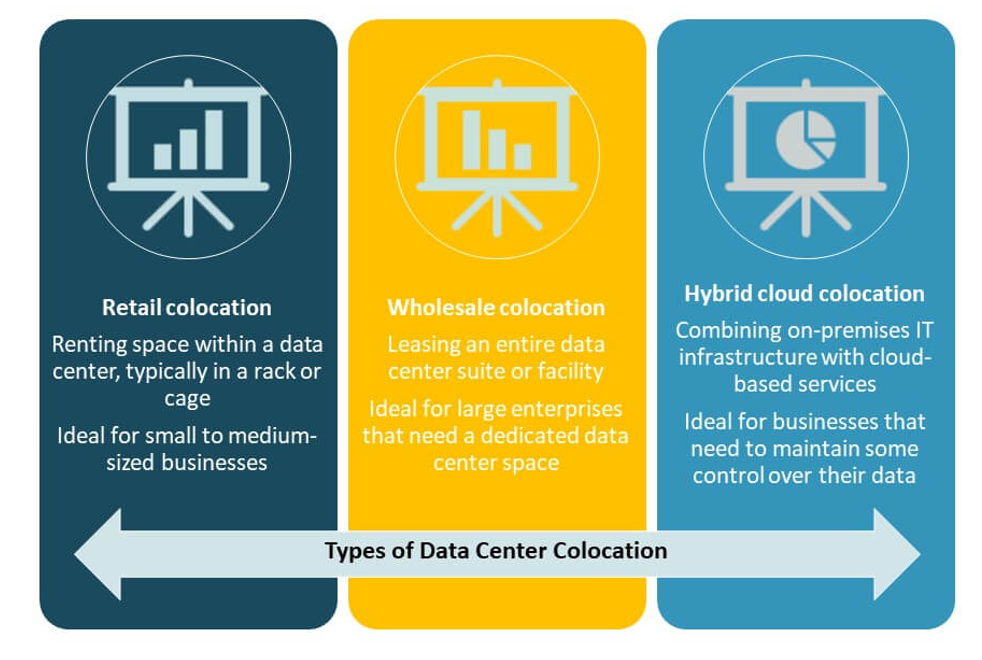

By Type

Retail colocation dominates the segment with strong demand from SMEs and digital-first enterprises. Its flexibility and cost efficiency make it attractive for businesses needing scalable capacity. Wholesale colocation is gaining traction with cloud providers expanding regional availability. Hybrid cloud colocation is growing steadily due to enterprise adoption of mixed infrastructure models. The Poland Data Center Colocation Market benefits from this diversified structure that supports various operational scales and business models.

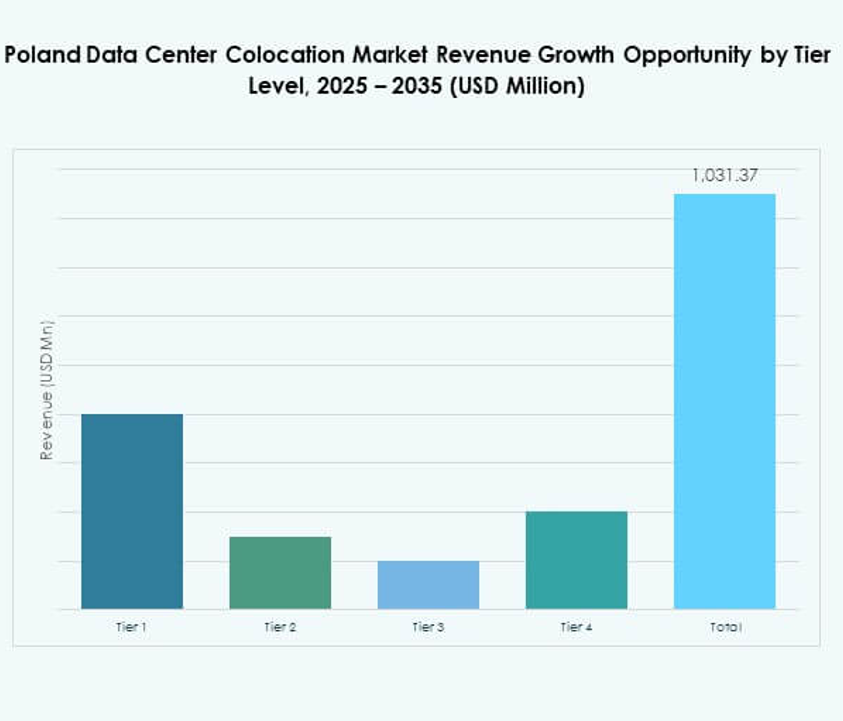

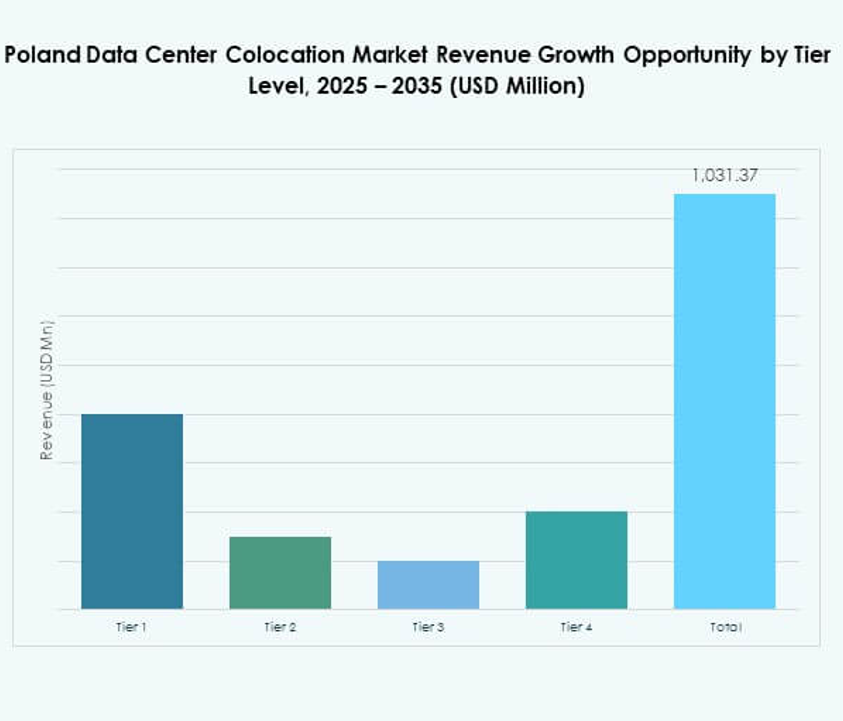

By Tier Level

Tier 3 facilities lead the segment with the highest share, driven by their high reliability and uptime capabilities. Tier 4 facilities are expanding in urban hubs to meet hyperscale requirements. Tier 1 and Tier 2 facilities maintain a smaller presence, serving edge deployments and local enterprises. Operators are focusing on higher-tier certifications to meet SLA commitments. The Poland Data Center Colocation Market aligns with global standards through these tier investments, ensuring robust service delivery.

By Enterprise Size

Large enterprises dominate the segment due to their heavy investment in IT infrastructure and compliance-driven operations. SMEs are increasing adoption rates with demand for flexible and affordable colocation services. Enterprises across industries prefer facilities offering hybrid IT integration options. It strengthens their operational resilience and scalability. The Poland Data Center Colocation Market reflects this dual demand structure, supporting both global corporations and local business growth.

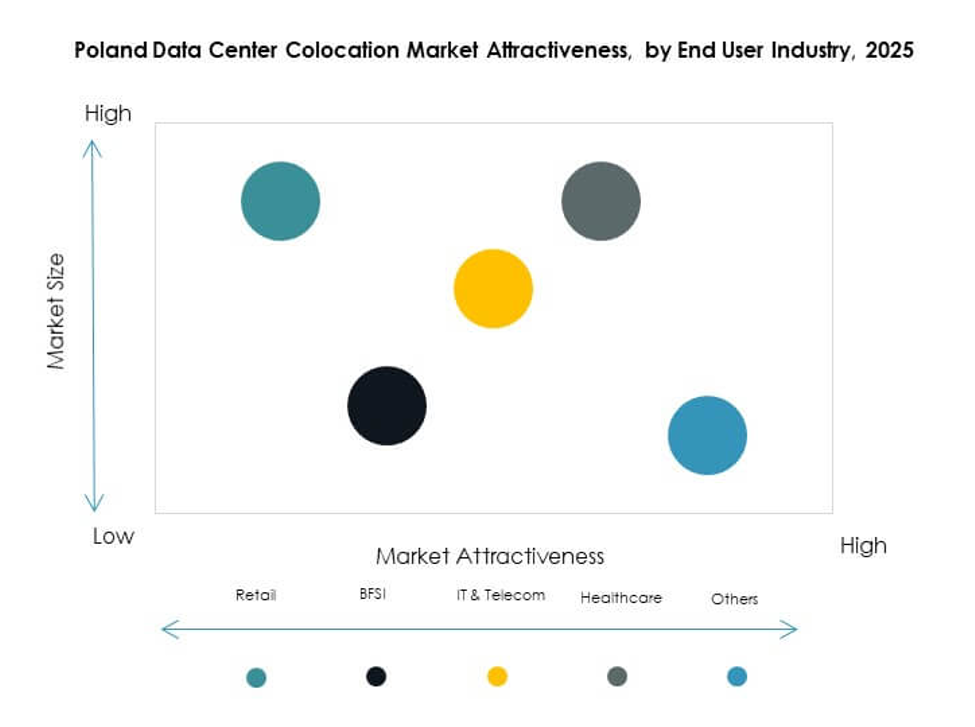

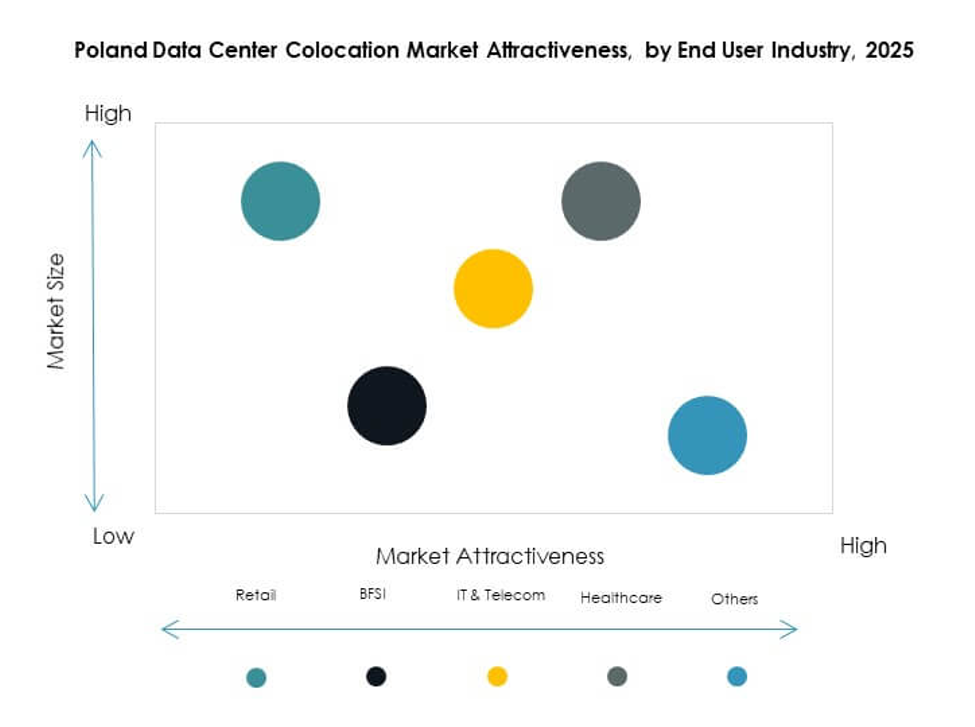

By End User Industry

IT and telecom hold the largest share, driven by strong cloud adoption and network service expansion. BFSI follows closely, requiring secure, low-latency infrastructure for critical workloads. Healthcare is gaining importance with digital health record hosting and telemedicine support. Media and entertainment demand is rising with content streaming and gaming services. Retail and other industries contribute through e-commerce and logistics expansion. The Poland Data Center Colocation Market leverages this broad sectoral demand to sustain capacity growth.

Regional Insights

Warsaw as the Core Colocation Hub with 62% Market Share

Warsaw leads the regional market due to its advanced connectivity, data exchange infrastructure, and proximity to major financial and cloud institutions. Its fiber networks and interconnection density attract hyperscale operators and enterprises. Strong energy infrastructure ensures stable facility operations. The Poland Data Center Colocation Market uses Warsaw as its strategic base for cross-border data flow. It reinforces Poland’s position as a major digital node within Central and Eastern Europe.

- For instance, Atman opened its flagship WAW-3 data center campus near Warsaw in September 2025, launching the first colocation building with 14.4 MW IT power capacity, 50 kW per rack density, and 6,324 sq m of IT floor space. The facility is powered entirely by 100% renewable energy and designed for high-density workloads. It sets a new benchmark for scalable, high-performance colocation and supports direct express routes to global cloud providers and hyperscale partners.

Secondary Growth in Kraków, Wrocław, and Gdańsk with 25% Market Share

These cities are emerging as strong alternatives to Warsaw due to lower land and energy costs. Investments from regional operators and international developers are increasing capacity expansion. Their proximity to academic and research centers supports innovation-driven industries. Improved power grid capacity is enhancing reliability for large-scale facilities. The Poland Data Center Colocation Market gains geographic diversification from these emerging hubs. It reduces dependence on the capital and attracts new enterprise segments.

- For instance, 1911 Data Centres announced a PLN 2 billion ($552 million) investment in a new 46 MW modular data center in Wałbrzych, located approximately 70 km from Wrocław, with initial construction phases starting in Q4 2025 and 16 MW expected to be operational by Q1 2027.

Other Regions Including Poznań and Łódź with 13% Market Share

Smaller regions are developing edge colocation facilities supporting regional enterprises and logistics networks. These deployments are designed to enhance coverage for low-latency applications. Infrastructure upgrades and renewable energy integration are improving regional attractiveness. Local government incentives are encouraging new investments in strategic zones. The Poland Data Center Colocation Market benefits from distributed facility placement, supporting balanced national infrastructure development and network resilience.

Competitive Insights:

- Beyond.pl

- ATM

- Oktawave

- Atman

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Poland Data Center Colocation Market features strong competition between local providers and global hyperscale operators. Leading domestic firms such as Beyond.pl, Atman, and Oktawave focus on localized service delivery, low-latency connectivity, and sustainable energy use. Global players like Equinix, Digital Realty, and AWS are scaling capacity and interconnection services to capture cloud-driven enterprise demand. Strategic partnerships and green infrastructure investments are shaping competitive positioning. Operators are expanding Tier 3 and Tier 4 facilities to attract financial services, telecom, and technology clients. It demonstrates a clear shift toward high-density, energy-efficient data center models with advanced interconnection capabilities.

Recent Developments:

- In September 2025, Atman opened the first phase of its WAW-3 data center campus in Warsaw, delivering 14.4MW of IT power and marking the largest facility of its kind in Poland. Designed to support high-density and AI workloads, this expansion reinforces Warsaw’s position as a key European data hub. Atman also joined the American Chamber of Commerce in Poland in November 2024, further deepening its strategic connections.

- In September 2025, the Polish government revealed a collaboration with the IRIS² initiative, committing around USD 548 million to develop six satellites, a ground station, and a new data center facility. This strategic partnership aims to advance the country’s space, digital, and colocation infrastructure, reinforcing Poland’s role as a critical European data hub.

- In May 2025, Beyond.pl launched an AI Factory at its 100MW data center campus in Poznan, Poland. Powered by Nvidia DGX B200 SuperPOD infrastructure and Pure Storage FlashBlade, this innovation positions Beyond.pl as a pioneer in Central and Eastern Europe for providing GPU-as-a-Service and sovereign high-performance computing for AI development.

- In February 2025, Microsoft announced a significant investment of around USD 740 million to expand its hyperscale cloud data center operations in Poland. This expansion is tailored to enhance local cloud capacity and colocation offerings, supporting the country’s continued digital transformation and surge in cloud computing and AI-driven technologies.