Executive summary:

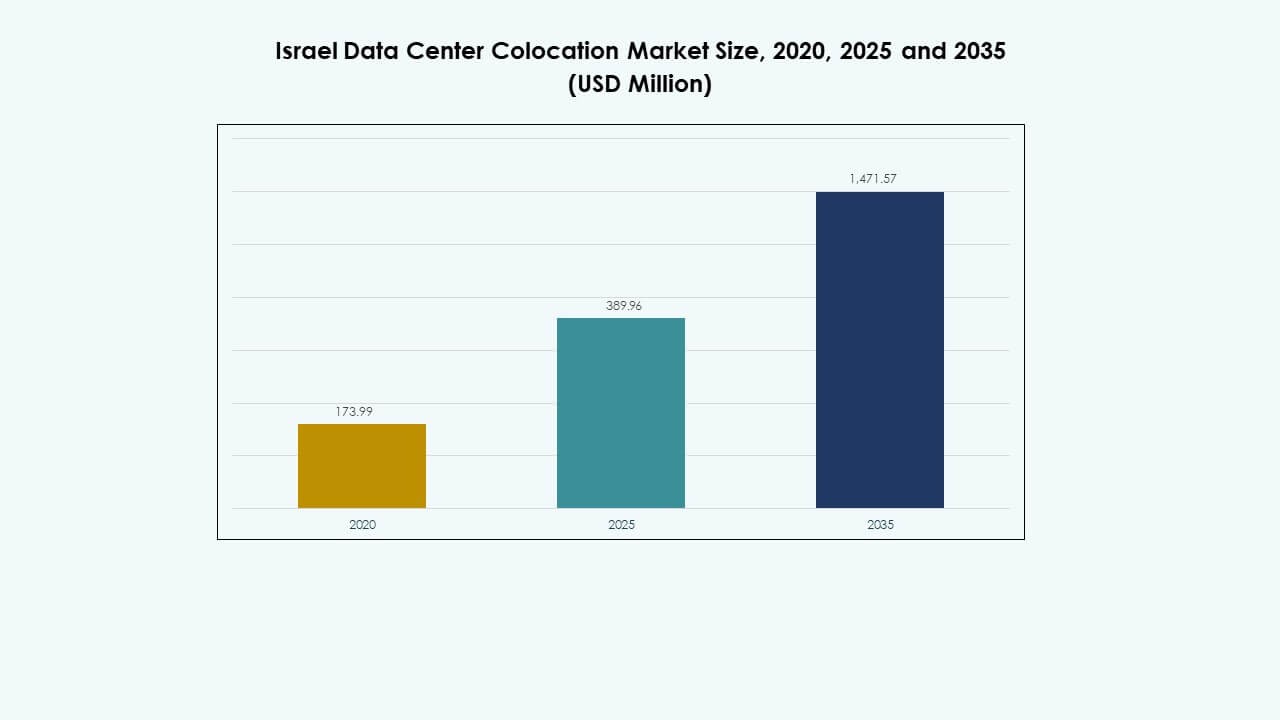

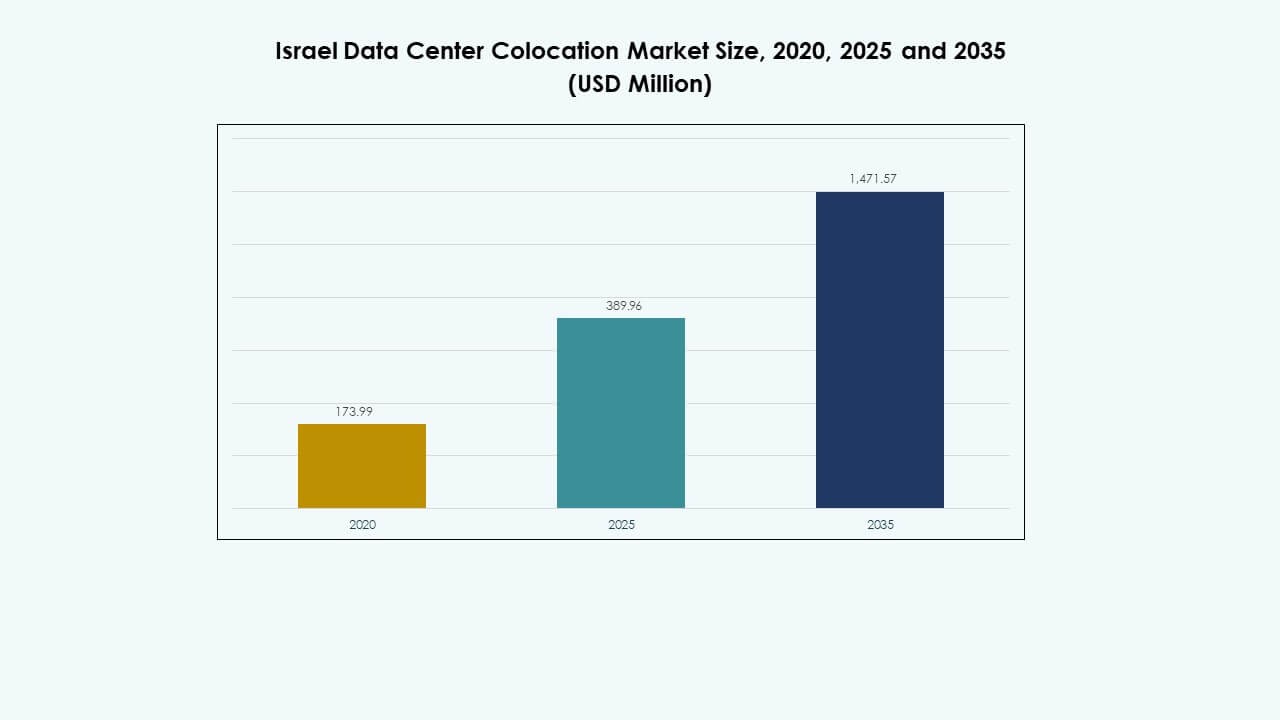

The Israel Data Center Colocation Market size was valued at USD 173.99 million in 2020 to USD 389.96 million in 2025 and is anticipated to reach USD 1,471.57 million by 2035, at a CAGR of 14.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Israel Data Center Colocation Market Size 2025 |

USD 389.96 Million |

| Israel Data Center Colocation Market, CAGR |

14.13% |

| Israel Data Center Colocation Market Size 2035 |

USD 1,471.57 Million |

Strong demand for cloud adoption, AI-driven applications, and low-latency connectivity is driving the market forward. Enterprises are shifting toward scalable infrastructure and secure hosting environments. Hyperscalers are expanding their regional presence to meet rising workload demands. Regulatory support for data localization encourages onshore deployments. Strategic investment in fiber networks and advanced colocation facilities positions the market as a critical hub for digital operations. Investors view this ecosystem as a stable and innovation-driven growth opportunity.

Tel Aviv remains the leading region due to dense connectivity and hyperscale infrastructure. Petah Tikva, Herzliya, and Jerusalem are key emerging hubs supported by enterprise and fintech demand. Haifa and the Northern cluster are gaining traction with research and industrial expansions. The Negev region is emerging with strong development potential, supported by land availability and power readiness. Regional diversification enhances network resilience and supports national infrastructure growth.

Market Drivers

Rising Demand for Cloud Services and Strategic Expansion of Hyperscale Infrastructure

The rapid shift toward digital transformation increases demand for cloud connectivity and hybrid IT solutions. The [Israel Data Center Colocation Market] benefits from enterprises seeking flexible and scalable infrastructure. Hyperscale providers are expanding their footprints to address growing enterprise workloads. The development of low-latency environments supports AI, analytics, and edge applications. It enables organizations to operate critical workloads with improved reliability. Regulatory frameworks focused on data sovereignty encourage onshore hosting. Strong fiber networks and interconnection points further drive colocation investments. Businesses view this infrastructure growth as a foundation for scaling innovation.

Accelerated Technology Adoption Through AI Integration and High-Density Deployment

The integration of AI workloads requires advanced infrastructure with strong compute and cooling capabilities. It supports high-performance computing demands and promotes faster processing speeds. Advanced energy-efficient designs are adopted to manage power usage and reduce costs. Automation streamlines capacity management and improves operational agility. Enterprises prefer modular colocation models for faster deployments and lower upfront investment. It strengthens the value proposition for both operators and tenants. The country’s tech ecosystem provides a competitive edge in infrastructure innovation. Investors see high-density facilities as a long-term value driver.

- For instance, in January 2025, Nvidia announced plans to build an AI data center in Israel’s Mevo Carmel Science and Industry Park. The facility will support advanced GPU infrastructure to strengthen local R&D and AI engineering capabilities. This project marks one of Nvidia’s key strategic investments in Israel’s technology ecosystem.

Strengthening Regulatory Environment and Increased Focus on Cybersecurity Compliance

Tighter regulations on data handling influence colocation growth. Enterprises seek trusted facilities that meet strict security standards. The [Israel Data Center Colocation Market] benefits from heightened compliance requirements, which enhance operational trust. Enhanced cybersecurity frameworks support sectoral growth by attracting regulated industries. It creates opportunities for hosting mission-critical workloads in secure environments. Strategic focus on compliance drives new service offerings. Operators are investing in advanced security infrastructure to maintain competitiveness. Businesses view compliance readiness as a key factor in location selection.

Strategic Positioning of Israel as a Digital Connectivity and Innovation Hub

Israel’s geographic position strengthens its role as a connectivity hub in the Middle East. Strong subsea cable connectivity supports regional traffic exchange and global routing. The innovation ecosystem encourages early adoption of emerging technologies. It attracts international partnerships and foreign direct investment. Enterprises prioritize this market to reach regional customers efficiently. Colocation infrastructure supports startups and multinational firms expanding operations. Strategic collaboration between operators and governments accelerates network modernization. Investors identify the region as a stable, innovation-led growth market.

- For instance, Bezeq International owns the 2,300 km JONAH subsea cable linking Tel Aviv and Bari, Italy. The system uses 100 Gbps interfaces and connects Israel to major European hubs such as London and Frankfurt. It enhances regional low-latency connectivity and supports international data traffic.

Market Trends

Rising Deployment of Modular and Edge-Ready Colocation Facilities

Operators are shifting to modular builds to meet fast-changing demand cycles. The [Israel Data Center Colocation Market] benefits from flexible deployment models that reduce build time. Edge-ready facilities support latency-sensitive applications such as AI, IoT, and AR. It enables enterprises to scale efficiently with less upfront investment. Demand for near-user infrastructure creates opportunities for secondary city expansion. Modular construction supports lower energy use and optimized space utilization. This trend aligns with growing preference for dynamic capacity models. Operators prioritize speed and adaptability over traditional large-scale builds.

Growing Emphasis on Energy Efficiency and Renewable Power Integration

Rising power costs drive strong interest in energy-efficient designs. Operators are adopting advanced cooling and low PUE architectures. The [Israel Data Center Colocation Market] benefits from integrating renewable power to ensure long-term cost savings. It aligns with national sustainability goals and ESG commitments. Data centers with green certifications gain higher investor confidence. High-efficiency equipment reduces operational expenditure and environmental impact. This trend is shaping procurement strategies across leading colocation providers. Enterprises prefer facilities that meet sustainability benchmarks.

Increasing Demand for Interconnection and Carrier-Neutral Facilities

Carrier-neutral colocation is becoming a key factor for enterprise expansion. It supports better network performance and improved routing diversity. The [Israel Data Center Colocation Market] is influenced by rising demand for multi-cloud strategies. It enhances peering efficiency and lowers latency for critical workloads. Interconnection hubs strengthen the position of data centers in the regional ecosystem. These facilities attract global content delivery networks and cloud providers. Enterprises benefit from faster, more resilient connectivity options. It builds a strong foundation for advanced digital applications.

Rapid Evolution of Service Offerings and Value-Added Solutions

Operators are expanding service portfolios beyond basic colocation. The [Israel Data Center Colocation Market] sees rising demand for managed services, security solutions, and hybrid cloud integration. It reflects changing customer expectations for end-to-end digital infrastructure. Edge computing and private cloud offerings increase service differentiation. Enhanced SLAs and AI-based monitoring improve operational quality. Operators are focusing on integrated solutions to attract enterprise clients. These evolving service models help build deeper client relationships. The market is moving toward full-stack digital infrastructure delivery.

Market Challenges

Power Supply Constraints and Rising Infrastructure Modernization Costs

Securing reliable power remains a critical challenge for operators. Energy demand grows faster than grid capacity in key regions. The [Israel Data Center Colocation Market] faces pressure to modernize legacy power systems. It creates added costs and delays in large-scale projects. Limited land availability in metro hubs raises development complexity. Scaling facilities while maintaining efficiency strains operational budgets. Regulatory hurdles can slow expansion timelines. Providers must adopt innovative energy solutions to remain competitive. Maintaining service reliability under these constraints becomes an operational priority.

Talent Shortages and Increasing Complexity of Facility Operations

The demand for specialized skills in advanced data center operations is rising. Shortages in skilled labor create challenges in maintaining uptime and security. The [Israel Data Center Colocation Market] experiences higher competition for technical expertise. It drives up labor costs and affects service delivery quality. Complex systems require continuous training and operational refinement. Talent gaps can limit the speed of technological adoption. Providers must build stronger workforce development programs. Ensuring operational excellence under resource pressure becomes a strategic necessity.

Market Opportunities

Expanding Role in Regional Interconnection and Subsea Connectivity Growth

The country’s position along key fiber routes creates strong interconnection potential. The [Israel Data Center Colocation Market] benefits from being part of major subsea cable systems. It supports regional and international network expansion strategies. Growing enterprise demand for low-latency connectivity strengthens this advantage. Tel Aviv and nearby hubs can serve as gateway nodes for global cloud providers. Operators can tap into this opportunity by scaling neutral facilities. Strategic partnerships with carriers can further enhance regional reach. The market can attract significant foreign investment.

Rising Enterprise Demand for AI and High-Density Workloads

The global surge in AI adoption drives fresh capacity demand. The [Israel Data Center Colocation Market] is well-positioned to support these workloads. It offers a favorable regulatory environment and robust connectivity. Enterprises seek facilities that can support high power densities efficiently. Advanced liquid cooling and power optimization technologies create value-added offerings. This demand opens new service and monetization models for operators. Scaling high-density infrastructure creates a strong competitive edge. Providers can build long-term client relationships through advanced infrastructure solutions.

Market Segmentation

By Type

Retail colocation dominates the [Israel Data Center Colocation Market] due to growing enterprise demand for flexible capacity. This model supports SMEs and startups seeking scalable solutions without high upfront costs. Wholesale colocation attracts hyperscalers requiring large-scale, dedicated space. Hybrid colocation gains traction as organizations integrate private cloud with colocation. The demand for adaptable solutions fuels competitive expansion among providers. Retail remains the largest share contributor, driven by quick deployment and lower entry barriers.

By Tier Level

Tier 3 facilities lead the [Israel Data Center Colocation Market] due to their strong balance between cost efficiency and uptime assurance. Tier 4 is growing steadily, supported by enterprise and hyperscale demand for mission-critical workloads. Tier 2 maintains relevance for edge deployments and smaller operators. Tier 1 has minimal presence due to limited redundancy. The market is gradually moving toward higher-tier investments to meet compliance and reliability standards. Advanced Tier 3+ designs are becoming a standard for new builds.

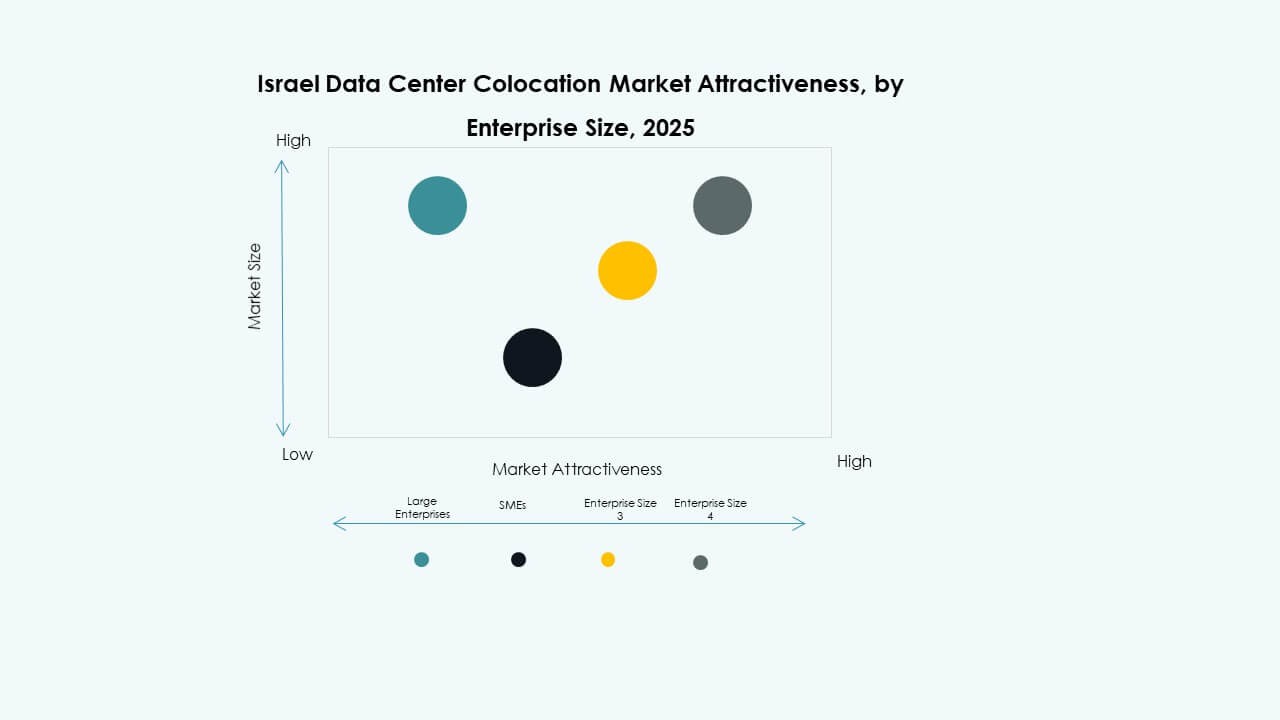

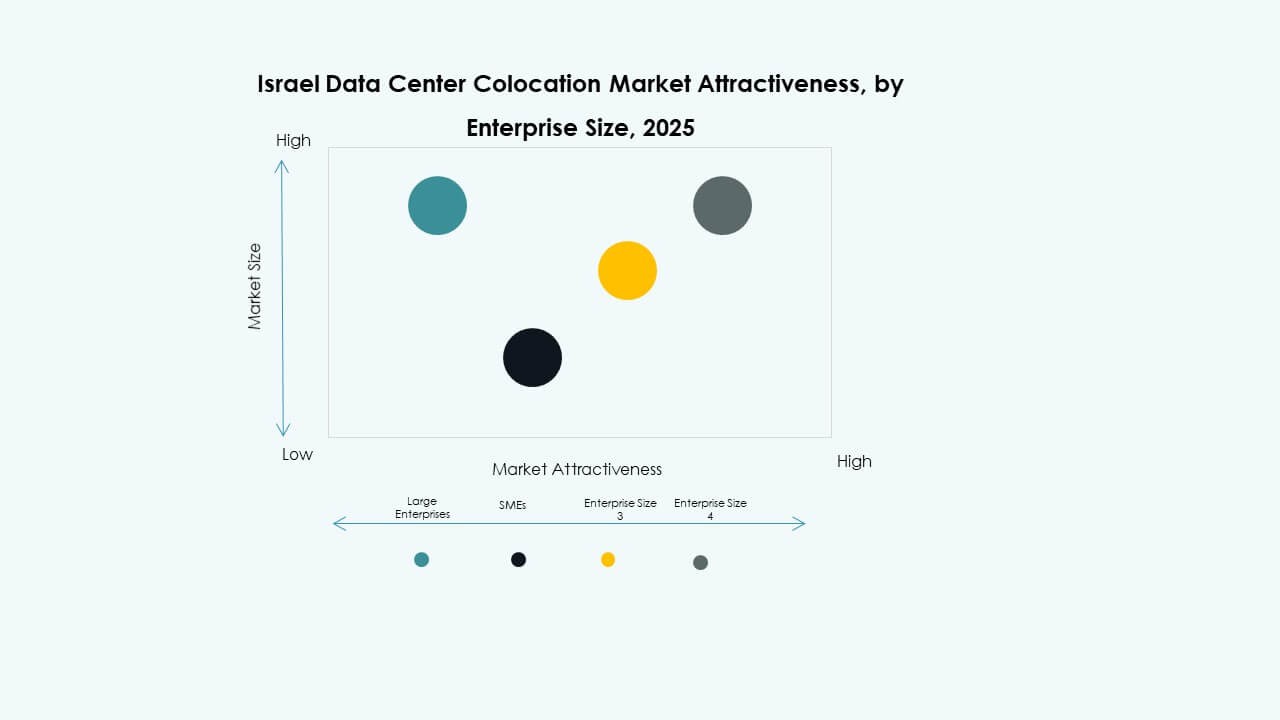

By Enterprise Size

Large enterprises hold the dominant share in the [Israel Data Center Colocation Market] due to their heavy reliance on hybrid IT environments. These organizations prioritize scalability, redundancy, and compliance-ready facilities. SMEs contribute to growing retail demand, especially in technology and service industries. Flexible pricing and modular offerings encourage smaller firms to adopt colocation. The demand mix strengthens the provider landscape. Large enterprises continue to drive the core growth momentum with multi-site strategies.

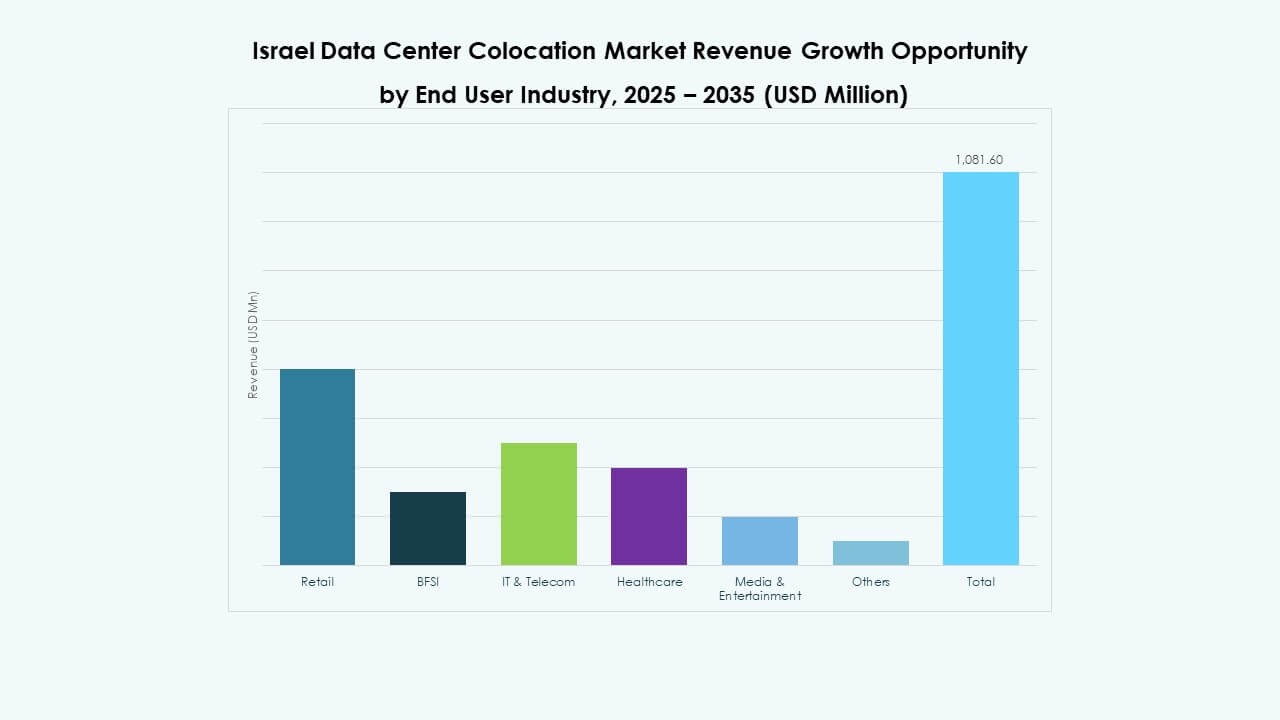

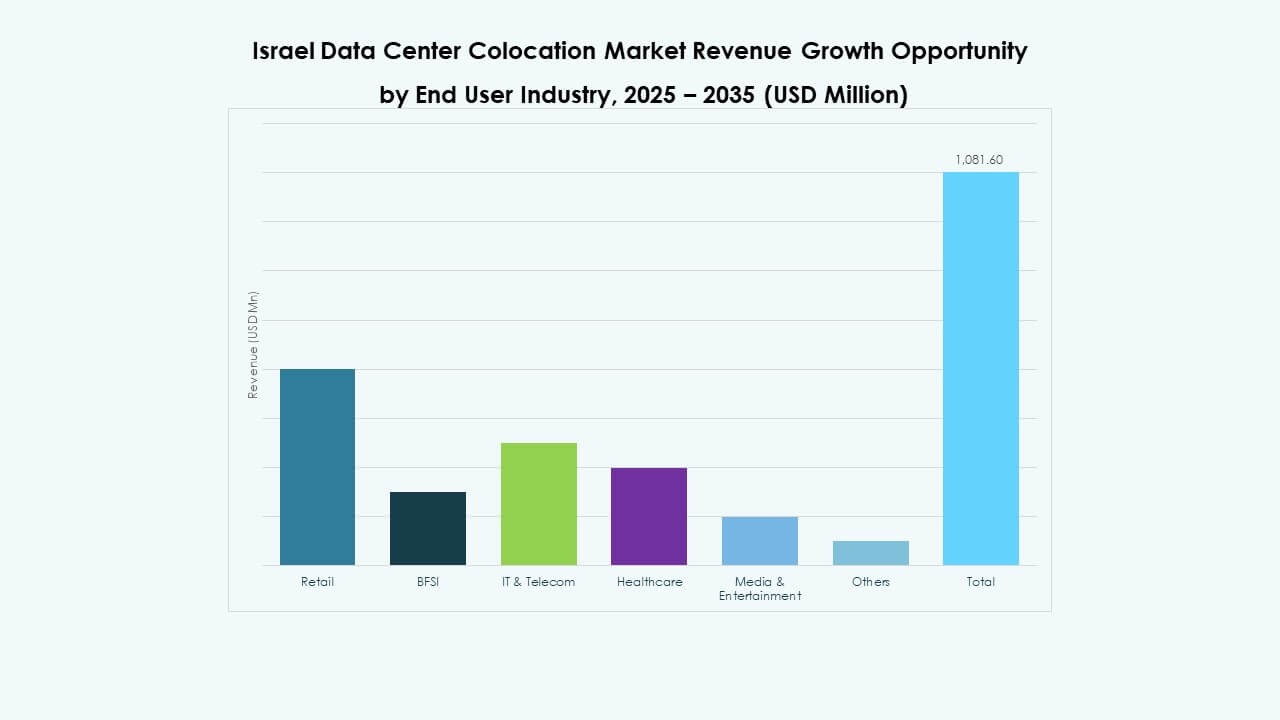

By End User Industry

The IT & telecom sector leads the [Israel Data Center Colocation Market] due to continuous network modernization and cloud expansion. BFSI drives steady demand for secure colocation environments. Healthcare adoption grows with increasing digital health investments. Media and entertainment companies rely on low-latency delivery for streaming and content services. Retail and other industries leverage colocation for scalable digital operations. IT & telecom remain the key growth engine, driving infrastructure innovation.

Regional Insights

Tel Aviv Metropolitan Area Leads with Dense Connectivity and Strong Hyperscale Presence

Tel Aviv accounts for 41.2% share of the [Israel Data Center Colocation Market]. Its strong fiber networks and multiple carrier hotels support dense interconnection. Hyperscale operators and cloud providers prefer this region for strategic expansion. It offers low latency and proximity to financial, healthcare, and technology clusters. Strong infrastructure attracts global content providers and AI workloads. This region acts as the primary gateway for international traffic. Continuous investment in network modernization enhances its dominance.

Petah Tikva, Herzliya, and Jerusalem Corridor Drive Enterprise Expansion

Petah Tikva holds 28.5% share of the [Israel Data Center Colocation Market]. Its carrier-neutral facilities support enterprise and fintech demand. Herzliya strengthens the ecosystem through innovation-led development. The Jerusalem corridor grows rapidly with rising government, defense, and financial workloads. These regions benefit from their strategic location and infrastructure readiness. It positions them as complementary hubs to Tel Aviv. Strong enterprise presence sustains stable long-term growth momentum.

- For instance, EdgeConneX operates a colocation facility in Petah Tikva with a power capacity of around 6.5 MW. The company also has a Herzliya site with a capacity of about 3 MW. These facilities support enterprise connectivity and strengthen Israel’s growing data center ecosystem.

Haifa, Northern Cluster, and Negev Region Show Emerging Potential

Haifa and the Northern cluster hold 19.7% share of the [Israel Data Center Colocation Market]. Their growth links to research institutions, industrial zones, and logistics. The Negev region holds 10.6% share and emerges as a key location for future expansion. It offers land availability and power grid headroom for large builds. Strategic development initiatives aim to diversify geographic distribution. This growth broadens national resilience and reduces concentration risks. Secondary hubs will play a bigger role in capacity planning.

- For instance, in March 2025, Enlight Renewable Energy announced a $1.1 billion investment to develop a large-scale data center and renewable energy complex in southern Israel. The project includes a 50-acre site with up to 100 MW capacity, integrating solar generation and energy storage. This initiative aims to strengthen infrastructure and support future hyperscale developments.

Competitive Insights:

- Bezeq International

- HOT Telecommunication

- Cellcom

- Equinix, Inc.

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- NTT Ltd. (NTT DATA)

- CoreSite

- CyrusOne

The Israel Data Center Colocation Marketfeatures a mix of carrier, cloud, and neutral specialists. Equinix and Digital Realty compete on interconnection density and global reach. AWS and Google Cloud shape demand through hybrid adoption and private connectivity. Bezeq International, HOT, and Cellcom leverage fiber control and enterprise ties. NTT brings design depth and managed services. CoreSite and CyrusOne target high-density, SLA-driven tenants. Operators pursue low PUE builds and certified security to win regulated workloads. It rewards providers that deliver latency, resilience, and multi-cloud routing. Pricing stays disciplined, with value stacked through cross-connects, managed security, and remote hands. M&A and joint ventures remain likely where power access and land banks unlock faster scale.

Recent Developments:

- In May 2025, Nebius Group, backed by Yandex’s cloud spinout, secured a funding package worth NIS 500 million (USD 135 million) to construct Israel’s national AI supercomputer. The infrastructure, expected to go live by early 2026, will utilize colocation spaces within Israel’s emerging hyperscale campuses and provide computational resources for large-scale AI training workloads.

- In April 2025, Partner Communications launched its global business division to expand international IoT connectivity, dark-fiber partnerships, and cross-border telecommunications solutions. This initiative aligns with Partner’s strategy to service colocation clients needing global network interconnectivity and supports the country’s growing demand for integrated data infrastructure services.

- In March 2025, Google Cloud’s parent company Alphabet signed a definitive agreement to acquire Israeli-founded cybersecurity company Wiz for $32 billion. This major acquisition, set to close in 2026 pending regulatory approval, is designed to significantly strengthen Google Cloud’s security offerings and competitive position in the global cloud colocation and cybersecurity landscape, including activities in Israel.