Executive summary:

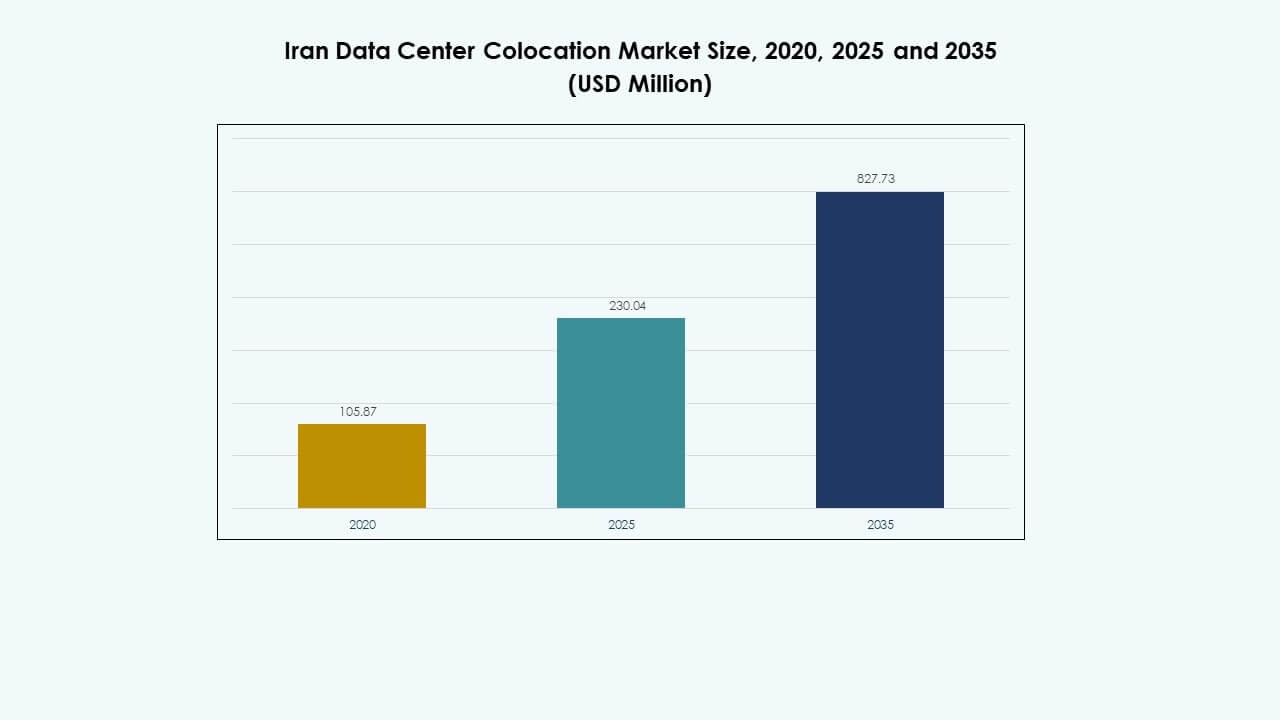

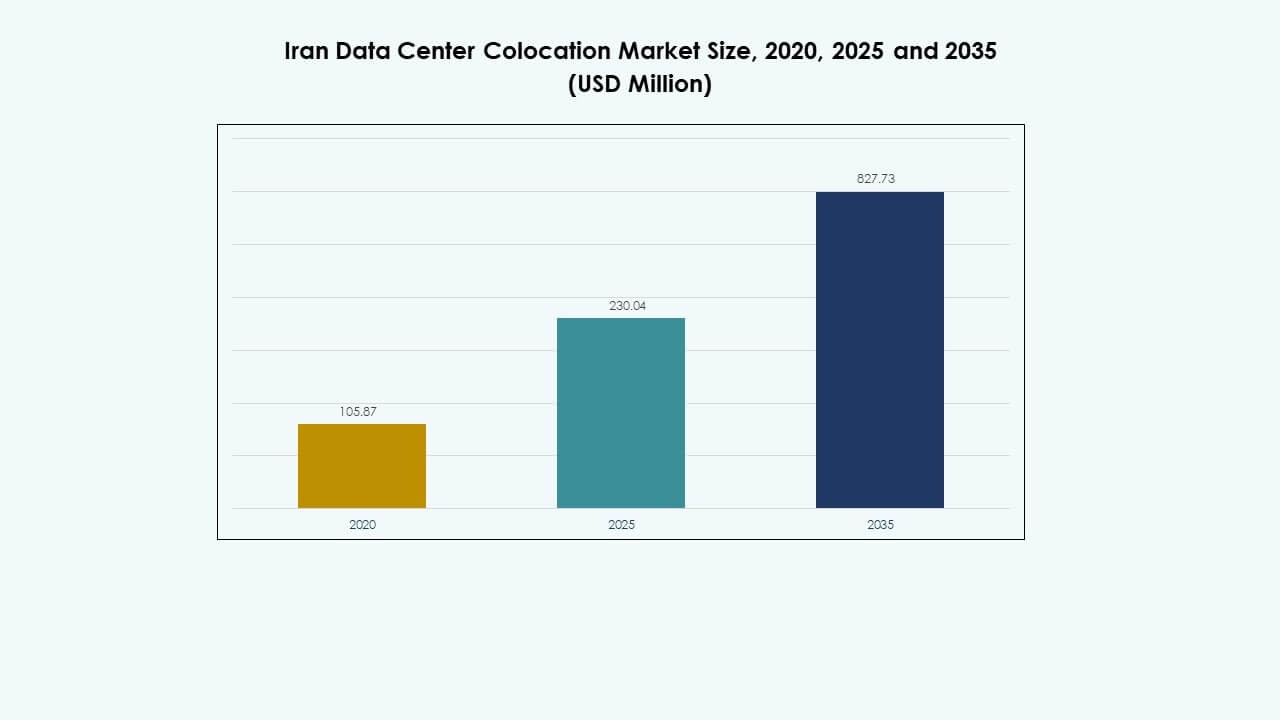

The Iran Data Center Colocation Market size was valued at USD 105.87 million in 2020 to USD 230.04 million in 2025 and is anticipated to reach USD 827.73 million by 2035, at a CAGR of 13.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Iran Data Center Colocation Market Size 2025 |

USD 230.04 Million |

| Iran Data Center Colocation Market, CAGR |

13.60% |

| Iran Data Center Colocation Market Size 2035 |

USD 827.73 Million |

Rising cloud adoption, expanding AI workloads, and growing enterprise connectivity needs are key drivers supporting strong market growth. The market benefits from technology modernization, advanced energy efficiency, and increasing use of hybrid architectures. It plays a strategic role for businesses and investors by enabling faster deployments, reducing operational costs, and improving digital infrastructure capabilities, making it a core pillar of Iran’s digital economy.

Tehran leads the market due to its strong connectivity and enterprise concentration. Mashhad and Isfahan are emerging regions with expanding infrastructure and increasing investment. These locations benefit from reliable power supply and growing local demand, creating a well-distributed ecosystem that strengthens network resilience and supports long-term market growth.

Market Drivers

Rising Demand for Digital Infrastructure and Strategic Expansion of Data Center Ecosystems

Growing reliance on cloud services and digital platforms drives strong demand for modern infrastructure. The Iran Data Center Colocation Market benefits from government-backed digital transformation programs and growing private investments. Companies aim to reduce operational costs and improve efficiency through shared colocation services. It supports faster data transmission, stronger network reliability, and lower latency. Businesses view the market as a core element in their digital strategies. Strategic expansions and infrastructure modernization enhance service capabilities. Investors consider these developments a stable long-term opportunity. Global operators closely watch this emerging ecosystem.

Increased Technology Adoption and Integration of Advanced Cooling and Energy Efficiency Solutions

Rapid adoption of liquid cooling systems and modular designs is improving operational performance. Energy efficiency standards influence new data center builds and upgrades. The Iran Data Center Colocation Market aligns with global sustainability goals, attracting environmentally conscious enterprises. It supports efficient energy use and stable power supply in critical facilities. Operators implement AI-based monitoring tools to optimize resource allocation. Green power integration strengthens business continuity and compliance. These technologies reduce downtime and operational risks. Enterprises view this advancement as essential for reliable digital infrastructure.

- For instance, in May 2025, the Iranian Ministry of ICT launched six national-scale AI megaprojects focused on improving energy balance and efficiency, including the Energy Management AI Program, which uses intelligent algorithms to detect and reduce excessive energy consumption across industrial and digital infrastructure sectors.

Strong Innovation in Edge Computing and Cloud Interconnectivity Solutions

Edge infrastructure is reshaping data traffic management and user experience. The Iran Data Center Colocation Market supports advanced edge deployments, driving lower latency and improved performance. It enables companies to bring applications closer to users, strengthening service quality. Investments in interconnectivity and carrier-neutral facilities boost network diversity. Innovative architectures create new collaboration models for telecoms and enterprises. Cloud-native solutions improve scalability and security. Businesses adopt hybrid strategies to balance flexibility and control. This wave of innovation enhances the market’s strategic relevance for long-term digital expansion.

- For instance, in February 2025 during the Iran Corridor 2025 event, the Telecommunication Infrastructure Company (TIC) signed a tripartite agreement with Omantel and Pishgaman Company. The deal focuses on developing a regional data transit corridor to strengthen Iran’s role as a strategic connectivity hub. This initiative enhances cross-border network reach and regional interconnection.

Strategic Importance for Regional and Global Enterprises in Strengthening Operational Capabilities

Colocation services enable businesses to expand without heavy capital investment. The Iran Data Center Colocation Market offers secure environments for sensitive workloads. It helps enterprises comply with regulatory and security frameworks. Local and international companies depend on these facilities for business continuity. Growing hyperscale interest signals increasing strategic importance. Investors identify strong returns from infrastructure growth and capacity expansion. Large enterprises leverage colocation to scale operations efficiently. These dynamics reinforce the market’s position in the broader digital economy.

Market Trends

Rapid Growth of Hyperscale Deployments and Modular Data Center Construction

Hyperscale investments are accelerating network modernization and capacity building. Modular data centers allow faster deployments with scalable power and cooling capabilities. The Iran Data Center Colocation Market reflects rising demand for flexible infrastructure. It supports rapid service rollouts and strong operational resilience. Enterprises prefer modular builds for lower upfront costs and faster installation. This trend aligns with regional demand for hybrid workloads. Major providers are designing facilities that meet evolving service-level needs. This shift is transforming how data centers are built and expanded.

Increasing Use of Renewable Energy Sources to Support Sustainable Operations

Green energy integration is becoming a defining factor in operational planning. Operators are securing renewable power sources to minimize carbon footprints. The Iran Data Center Colocation Market integrates sustainable solutions to meet global environmental standards. It strengthens energy security and improves power availability. Data centers adopting solar and wind energy improve brand positioning and cost efficiency. Sustainable operations attract environmentally conscious customers. Enterprises see this as a competitive advantage in a carbon-regulated landscape. Green initiatives drive long-term operational stability.

Growing Interconnection Between Cloud Providers and Carrier-Neutral Data Centers

Strong collaboration between cloud providers and colocation operators is shaping network infrastructure. Interconnected ecosystems reduce latency and enhance service reliability. The Iran Data Center Colocation Market supports hybrid cloud strategies and multi-cloud integration. It enables enterprises to connect to multiple platforms through a single location. Carrier-neutral models encourage competition and flexibility. This interconnection trend is reshaping enterprise networking strategies. It strengthens market positioning in regional and international data exchange. Cloud adoption and colocation demand are rising together.

Rising Investments in AI-Based Automation and Advanced Monitoring Capabilities

Automation is transforming data center management and performance monitoring. AI-powered platforms optimize energy consumption, cooling, and security processes. The Iran Data Center Colocation Market is experiencing strong adoption of intelligent tools. It allows operators to detect issues faster and improve uptime. Predictive maintenance helps reduce service disruptions. Real-time monitoring supports better resource allocation and cost control. Enterprises benefit from improved service quality and stronger operational visibility. This trend drives the next phase of infrastructure modernization.

Market Challenges

Regulatory Complexity and Limited Access to Global Network Infrastructure

Complex regulatory environments slow down infrastructure growth and increase compliance costs. The Iran Data Center Colocation Market faces challenges from limited cross-border network integration. It creates hurdles for companies seeking global interconnectivity and cloud expansion. Strict data sovereignty laws restrict certain international partnerships. Operators need to adapt to frequent regulatory updates and approval cycles. Limited global routing access can reduce competitive agility. International service providers weigh these factors before market entry. This challenge impacts overall investment confidence.

Energy Reliability and High Infrastructure Development Costs Affecting Growth

Power reliability and infrastructure costs remain major constraints for large-scale operations. The Iran Data Center Colocation Market depends on stable and uninterrupted power supply. It faces difficulties in ensuring energy security during peak demand. High construction and equipment costs slow down capacity expansion. Operators must balance cost efficiency with performance demands. Backup power and cooling investments raise financial barriers for new entrants. These factors delay service deployment and limit scalability. Sustained investment in energy infrastructure is essential to ease this challenge.

Market Opportunities

Rising Demand from Cloud, AI, and Digital Transformation Initiatives Across Sectors

Cloud adoption, AI integration, and digitalization are creating significant market opportunities. The Iran Data Center Colocation Market supports this transformation with scalable capacity and secure infrastructure. It offers enterprises cost-effective hosting options with high operational efficiency. AI-driven solutions open opportunities for smarter workload management. Digital-first enterprises see colocation as a way to grow without large capital costs. The ecosystem is well-positioned to attract technology-intensive industries.

Expansion Potential Through Regional Network Hubs and Strategic Partnerships

Emerging regional hubs provide a strong base for network expansion. The Iran Data Center Colocation Market enables operators to serve growing enterprise clusters efficiently. It encourages partnerships between telecom providers and infrastructure companies. Strategic alliances strengthen capacity utilization and customer reach. Regional growth enhances investment attractiveness. These opportunities lay a strong foundation for future scalability.

Market Segmentation

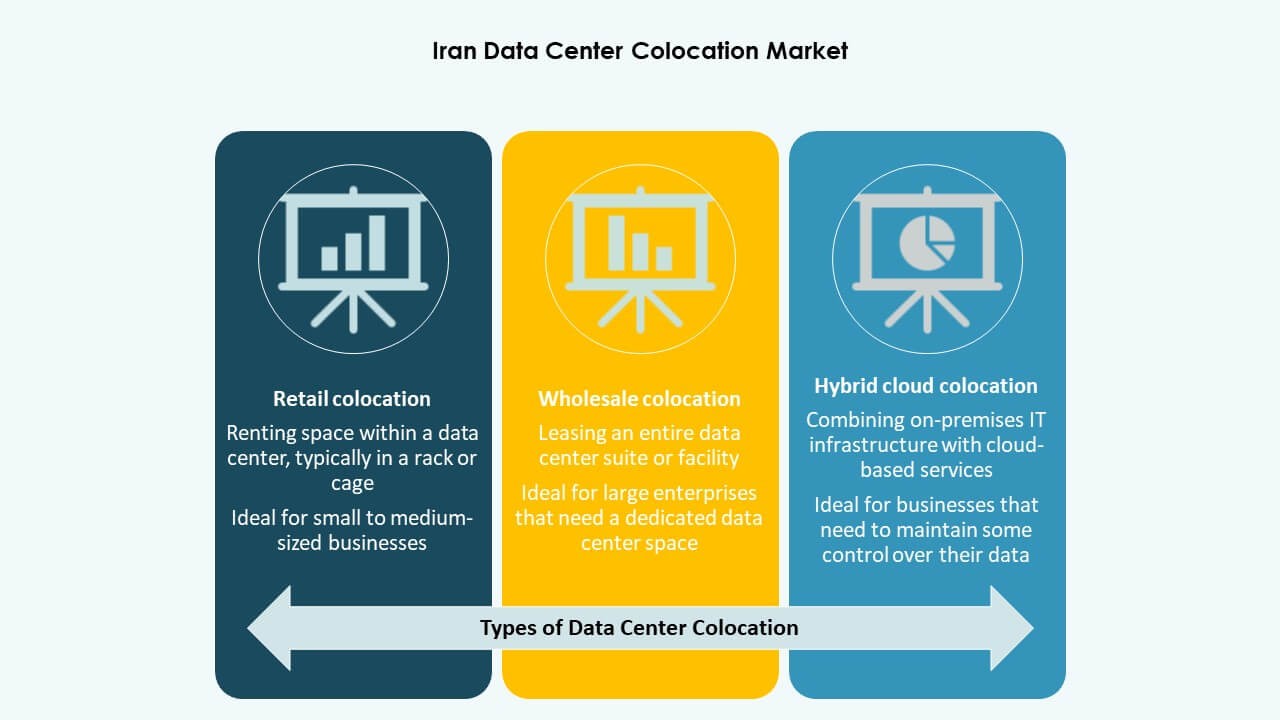

By Type

Retail colocation dominates the Iran Data Center Colocation Market due to its flexibility, lower upfront investment, and strong adoption by enterprises seeking scalable solutions. It provides secure and shared environments with robust connectivity options. Wholesale colocation and hybrid cloud models are growing segments driven by hyperscale interest and cloud adoption. Flexible contracts and customization drive demand for retail facilities among SMEs and large enterprises.

By Tier Level

Tier 3 facilities hold the largest share in the Iran Data Center Colocation Market, supported by their strong reliability and availability standards. These facilities offer multiple power and cooling paths, ensuring high uptime. Tier 4 is gaining traction among enterprises needing advanced redundancy. Tier 1 and Tier 2 are used for less critical applications with lower costs. The shift toward higher tier levels reflects growing enterprise demand for performance and security.

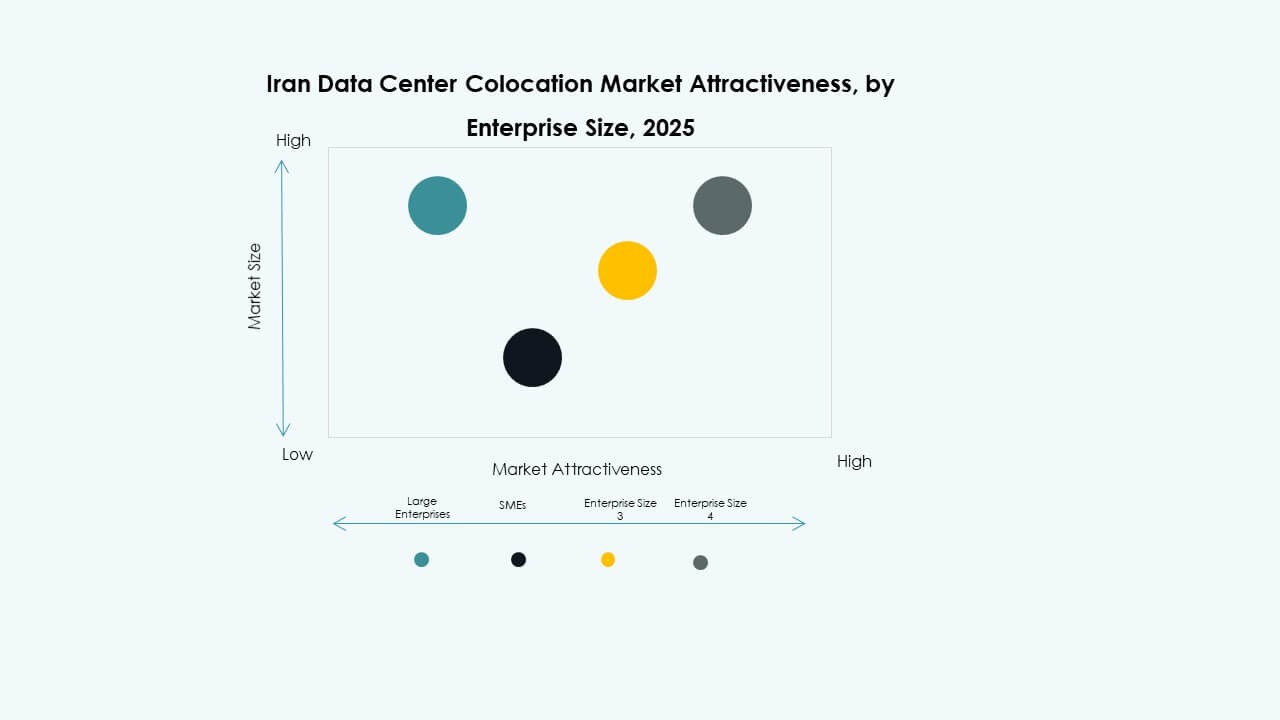

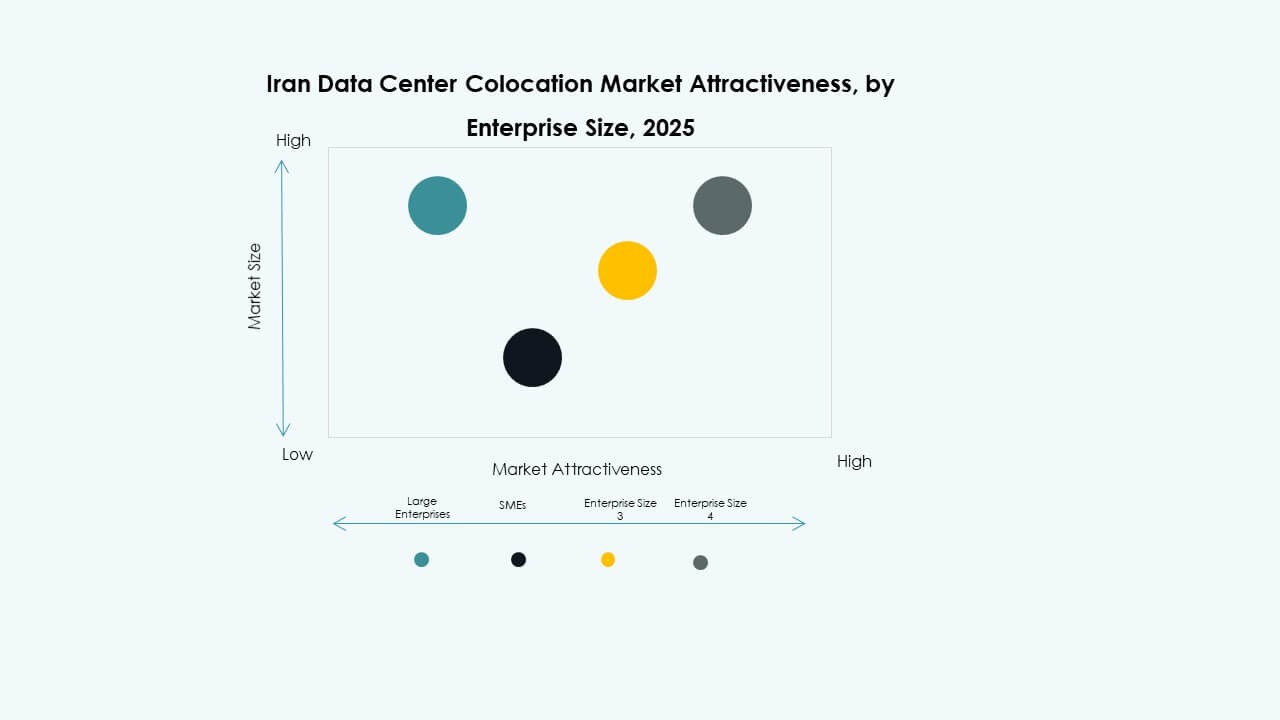

By Enterprise Size

Large enterprises lead the Iran Data Center Colocation Market due to their complex workload requirements and focus on compliance. These organizations prioritize secure, high-capacity, and scalable solutions to support mission-critical operations. SMEs are steadily adopting colocation to minimize infrastructure costs and gain access to advanced technologies. Flexible service models allow smaller businesses to scale operations without owning facilities.

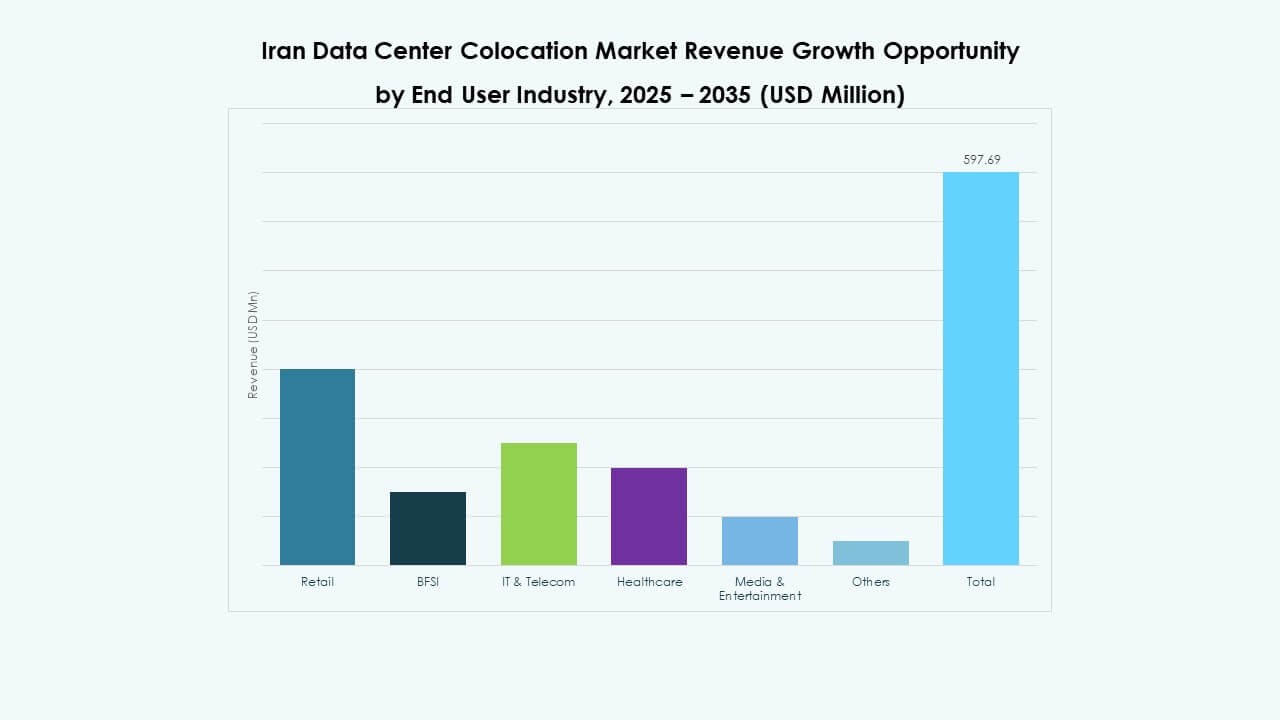

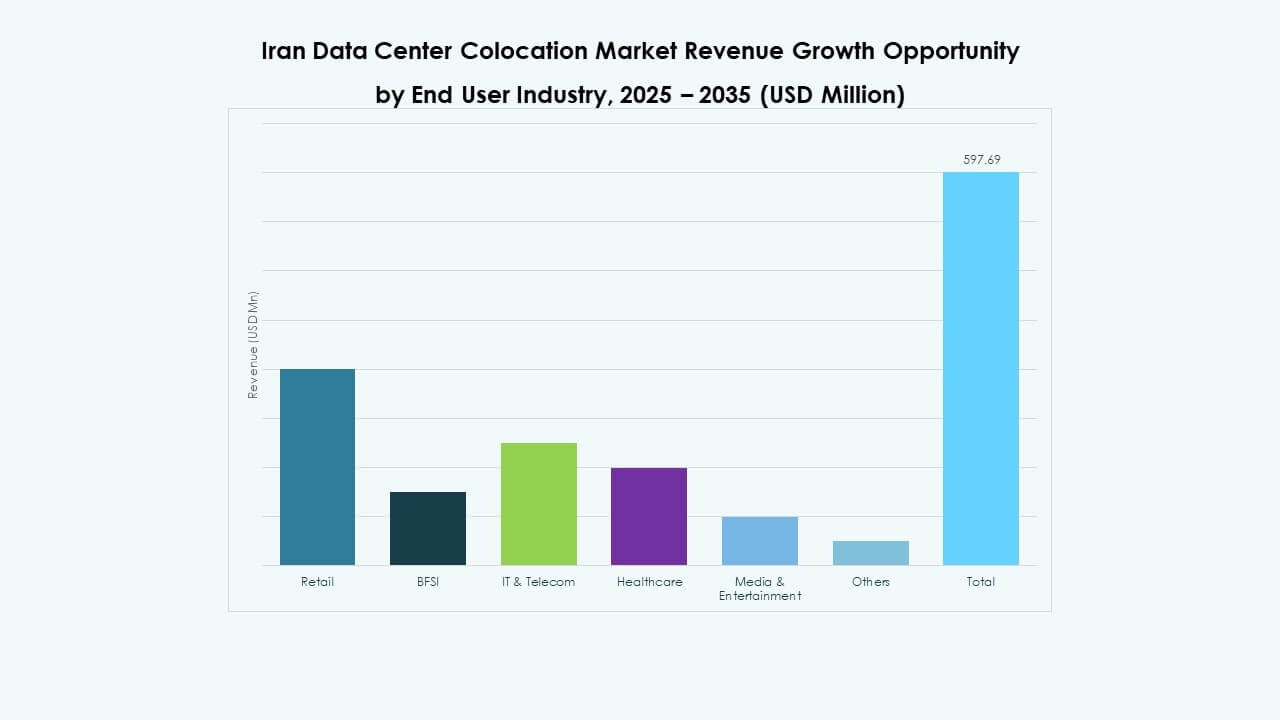

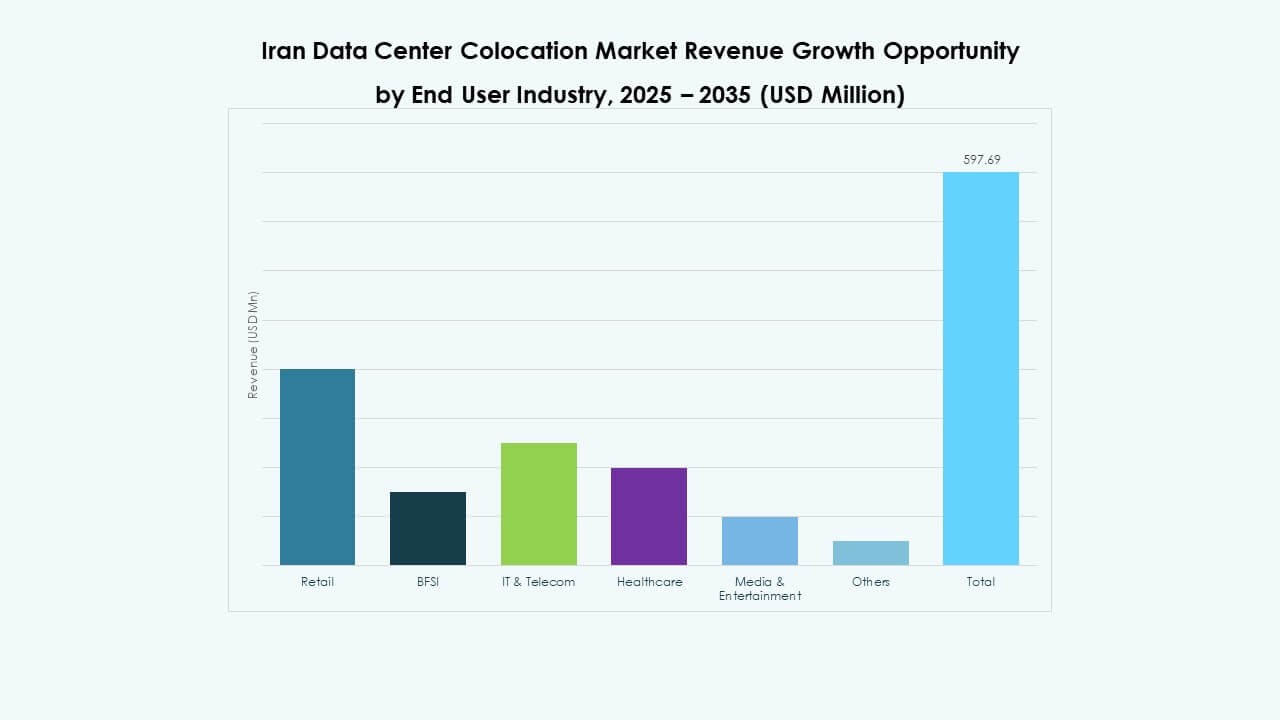

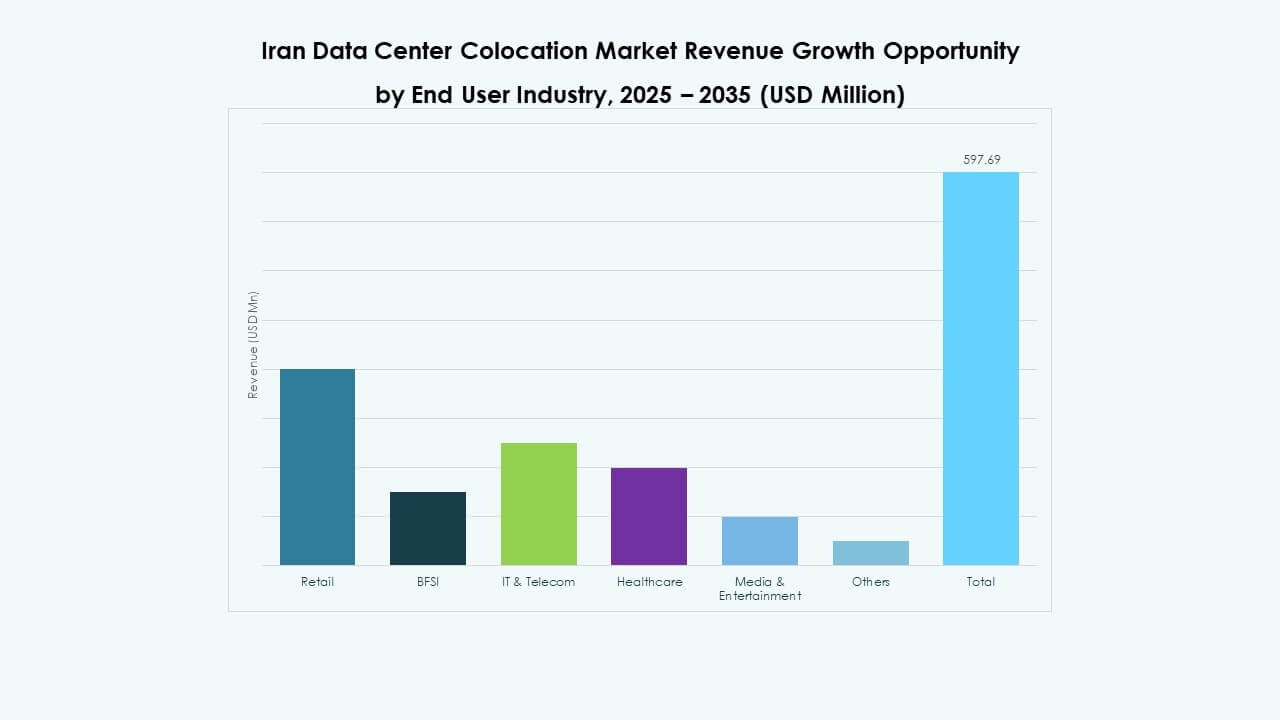

By End User Industry

The IT & Telecom segment dominates the Iran Data Center Colocation Market, driven by growing data traffic and the need for strong network resilience. BFSI and healthcare are emerging segments due to compliance and data protection needs. Media and entertainment demand continues to grow with rising streaming and content delivery services. Retail and other industries adopt colocation to improve operational agility and customer experience.

Regional Insights

Tehran Leading with High Connectivity and Strong Digital Infrastructure — 54.2% Share

Tehran is the dominant region in the Iran Data Center Colocation Market, supported by strong network infrastructure and enterprise concentration. It benefits from advanced fiber connectivity and a skilled workforce. High demand from financial, IT, and public sectors drives steady capacity growth. The region acts as a strategic gateway for digital services. It attracts both domestic and international operators seeking reliable colocation hubs.

- For instance, during World Telecommunication and Information Society Day in May 2025, the Iranian Ministry of ICT and TIC launched three national communication projects, expanding network capacity by 62% from 45,000 to 73,000 Gbps. The upgrade added 28 Tbps of new interconnect capacity across 285 sites in all 31 provinces. This expansion reinforces Tehran’s position as a primary colocation hub with stronger low-latency connectivity across the Middle East.

Mashhad Emerging as a Key Growth Hub with Strategic Infrastructure Expansion — 26.7% Share

Mashhad shows rapid infrastructure development and rising demand for colocation services. The Iran Data Center Colocation Market benefits from regional investments in connectivity and power availability. It serves growing industries and digital businesses seeking cost-effective solutions. The government’s focus on improving digital infrastructure enhances its attractiveness. Enterprises are expanding their presence to reduce latency and diversify operations.

Isfahan Strengthening Regional Capacity and Network Resilience — 19.1% Share

Isfahan holds a growing share in the Iran Data Center Colocation Market through increased investments and network upgrades. It supports critical industries and growing enterprise clusters. Strong local energy availability and lower congestion levels attract operators. It offers strategic benefits for disaster recovery and redundancy planning. This regional diversification supports overall market stability and growth.

- For instance, at the Isfahan International Investment Expo (ISINEX 2025) in September 2025, the city government announced 50 investment projects totaling 2.9 quadrillion rials (around $2.9 billion) across key sectors. In the same month, Iran inaugurated the Aftab Shargh (Eastern Sun) solar power plant in Isfahan with an initial capacity of 120 MW. This project strengthens the region’s clean energy infrastructure and supports digital expansion.

Competitive Insights:

- Fanap Data Company

- Pars Online

- Afranet

- Afranet Data Center

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- CoreSite

- CyrusOne

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The Iran Data Center Colocation Market features a competitive mix of local operators and global technology leaders. It is shaped by strong infrastructure expansion, carrier-neutral strategies, and hybrid cloud adoption. Local firms like Fanap Data Company and Pars Online focus on domestic enterprise solutions with strong regulatory alignment. Global players such as AWS, Google Cloud, and Equinix strengthen network resilience and interconnectivity. Operators are emphasizing modular builds, green power integration, and edge computing capabilities. Strategic partnerships with telecom providers enhance service delivery. Cloud integration and advanced security solutions drive competition intensity. Players differentiate through performance, pricing, and regional reach, creating a dynamic and scalable market environment.

Recent Developments:

- In October 2025, Digital Realty Trust announced multiple strategic partnerships with Dell Technologies, DXC Technology, and Lumen Technologies to create integrated private artificial intelligence (AI) infrastructure solutions on its PlatformDIGITAL ecosystem. These collaborations aim to provide end-to-end implementation and high-speed secure connectivity designed for enterprise AI workloads deployed across its global facilities.

- In October 2025, Google Cloud announced a record-setting $15 billion investment to build an AI and data center hub in Visakhapatnam, India—the company’s first AI-focused facility in the country. The campus, developed in collaboration with AdaniConneX and Airtel, will include gigawatt-scale computing capacity, renewable-energy systems, and high-capacity global fiber connectivity to support its growing AI and cloud business.

- In May 2025, NTT Ltd. announced ongoing expansions of its global data center footprint through the NTT DATA arm, focusing on AI and cloud infrastructure modernization to meet hyperscaler demand in Asia and the Middle East. This aligns with the company’s broader $10 billion global data center growth plan through 2026.

- In April 2025, CoreSite, an American Tower subsidiary, completed the acquisition of the Denver Gas and Electric Building, a network-dense property in Colorado, to bolster its interconnection presence and simplify Google Cloud Onramp connectivity. The move strengthens its Any2Denver Peering Exchange and adds around 100 enterprise customers to its portfolio.